Business expense management software for FMCG Companies

According to reports the FMCG industry was valued at $10,020.0 billion in 2017 and is projected to reach $ 15,361.8 billion by 2025. One might say that an industry this big, with revenues in billions of dollars, has its finances all sorted out. But even the biggest companies in the world still find it difficult to manage expenses properly. Every organization precisely knows how much they are earning and expected to earn. But when it comes to spending, the processes lack the same level of management and control.

This happens due to many reasons like standards not being followed because of the vast number of operational outlets and on-field workers across the country. Every employee making small purchases here and there using their personal funds for travel, food, lodging, etc. becomes tough to track and even tougher for the workers to save all the receipts, submit them with their expense reports and then wait for weeks and months to get reimbursed.

There are other costs like sales and marketing expenses which also have leakages due to inefficient utilization. All of this adds up and can cost an FMCG brand a lot of money over time. This is where an employee expense management software like Volopay can help them really cut down on costs by giving complete control and tracking capabilities overall expenses being made from the company budgets. Keep reading to find out the most common expense problems faced by FMCG companies and how a spend management solution can close help close these gaps.

4 challenges that FMCG companies face while managing expenses

Lack of visibility on spending

The biggest con of not using expense management software is the inability to track and monitor expense budgets. A lack of visibility on how your employees are spending their budgets makes it difficult to optimize its usage. When you can see what the budget is being spent on, you can never be sure whether your employees are complying with the expense policies. This might not always be the case, but could certainly lead to people taking advantage of the budget.

Not having updated policies

Company expense policies that are not updated regularly will indefinitely cause compliance issues. Your accountants will come across employees submitting expense reports claiming reimbursements for purchases that the company does not cover. Not only is this a hassle for the finance department but also demotivating and annoying for employees to find out that they won’t be getting back the money they spent thinking that the expense would be covered.

Manual data entry

In the traditional method of expense management, accountants have to enter each business expense submitted to them by all the employees manually. Not only is this process time-intensive but also prone to many errors. Missing receipts, expenses that don’t fall under the expense policy, and false expense claims are just some of the many issues that may arise. All of these problems slow down the accounting process by causing delays in closing the company books, hindering the auditing efforts, and directly affecting the financial wellbeing of the brand.

Unsatisfied employees

When your sales and marketing teams are spending on travel, stay, food, and buying certain services to execute work with their personal funds, it can lead to unsatisfied employees. These out-of-pocket expenses take a long time to be recovered as the employees have to submit their expense reports along with the relevant receipts at the end of each month and wait for the accounts team to process them and reimburse the amount. Factoring in the size of an FMCG company, this process can take months for the money to be reimbursed and finally reflected in the bank account of the team members.

Benefits of using business expense management software for FMCG companies

Real-time tracking on spending

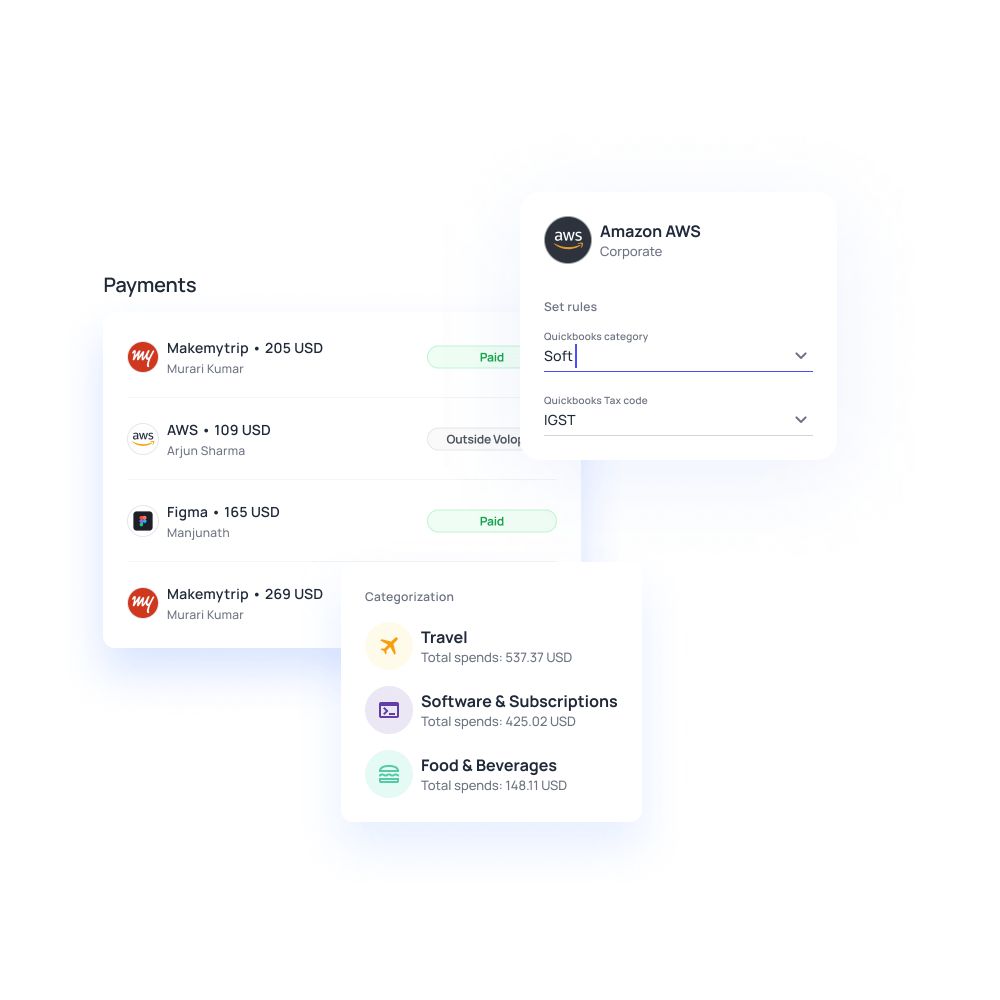

When you manage spending using the business expense management software Volopay, probably one of the biggest benefits you get is that you can see all the transactions happening in real-time. So whenever a team member decides to use a corporate card from Volopay or any other form of payment available on the platform, then the admins will be able to see each expense being recorded on the dashboard.

Avoid fraud and errors

Tracking is just the first part of controlling your budget. Using Volopay, you can actually control who can spend how much by setting limits and creating approval workflows. Our platform allows each registered employee of yours on our platform a physical card and unlimited virtual cards. As an admin on our portal, you can set spending limits for each card of each employee.

You can further control the spending of an employee by creating approval systems for purchases that are above a certain amount. For example, you can create an approval policy where if any employee wants to spend more than $100, then a notification will be sent to a team lead or manager to approve or reject the payment.

Through smart tech optimizations like the ones mentioned above, the expense management software will help you curb any unwanted expenses and fraudulent activities.

Save money and time

It’s needless to say, but we’ll say it. The amount of money and time the accounts department of an FMCG company could save using an expense system software would literally make them rich. Not only do you cut down on costs due to the increased transparency, but it also helps the finance team for better financial planning and forecasting.

Reduce paperwork

Your employees will no longer have to worry about saving all the expense receipts and neither will your finance team have to collect, organize, and store them physically. The Volopay expense management app gives your employees the ability to report an expense directly through their mobile app in real-time by attaching a picture of the receipt to the relevant purchase. This also makes it easier for them to get reimbursed faster.

Improve accuracy

With tons and tons of paperwork involved in the traditional expense management process, you can probably imagine the number of errors that will occur. We all make mistakes and every accountant at the end of the day is human. So there are bound to be expenses that slip through, missing receipts, unaccounted expenses, and so on. You can reduce all of this simply by choosing to opt for an automated expense management system.

Related page: Importance of departmental budget for your business

Get better control of the visibility of your business expenses

How can Volopay help FMCG companies to manage expenses?

To sum it up, here’s a list of all the amazing benefits that you will experience when you use Volopay as your corporate expense management software.

Multi-level approval workflows

Control your budget the way you want to control it by setting approval systems for each payment.

Employee reimbursements

Using our mobile app, employees get to claim expenses instantly and are reimbursed faster. This keeps them happier and performing in the most productive manner.

Spend visibility

With real-time expense reporting, you’ll see all the purchases being made by your employees and keep a track of how the budget is being spent.

Unlimited virtual cards for each online payment

That too at no extra cost. Simply create a card for online payments and use it for enhanced security.

Trusted by finance teams at startups to enterprises.