AI in accounts payable: Your complete guide

In simple words, accounts payable is all about making payments for purchased goods. But what happens in an AP department is not at all simple.

Their responsibilities range from capturing invoices, scheduling payments, getting approvals, and many more like this. Though work is the same everywhere, how it’s carried out varies from company to company.

Decades ago, we used laid-back, manual methods and paper documents to process AP. From there, we have evolved so much and moved to spreadsheets and AP software.

From fully manual systems, the gears are shifted to semi-automated and automated workflows. We are now in a place where AI in accounts payable is gaining popularity.

In this state, what does the future of accounts payable look like?

What is the future of accounts payable for business?

The advent of technology has created an impact in almost every industry. Applications developed using cutting-edge technologies can be seen everywhere.

Accounts payable isn’t alone. AI in accounts payable has automated and improvised many critical tasks already.

AI principles like machine learning and RPA are already utilized in many AI applications to capture and analyze real-time data. It’s apparent that it has endless potential to disrupt the finance landscape, shaping the future of accounts payable.

Some tasks that will be replaced by AI in the near future are data analytics, risk assessment and flagging, compliance management, chatbot assistance, and many more.

By leveraging AI, AP teams can find cost-effective solutions and make auto-classifications.

What is AI in accounts payable process?

Before we understand how AI is disrupting the accounting and finance sector, let’s understand the concept and its practical application in accounts payable.

Artificial Intelligence, or AI, is a branch of computer science. It involves developing machines that can think and act like humans. So, this is software or a program that will showcase human intelligence.

They can collect and synthesize information and perform assigned tasks. For example, speech recognition, decision-making, data comparison, and much more. Ex. chatbots like Siri, smart home appliances that work on voice controls, etc.

AI is already a part of many steps in digital invoice processing. Processes that have the involvement of AI in accounts payable are,

Invoice capture

Invoices are received in different formats. AI-powered systems can be used to capture data from emails, hardcopies, or invoice generators. This captured data is automatically matched with the right vendor, and a bill is generated.

Otherwise, accountants will have to look out for invoices in multiple places and manually upload them for payments. The mechanism that facilitates this is OCR (Optical character recognition).

Invoice matching

Before they process an invoice for payment, the details must be verified. To compare with the purchase order and determine accuracy, two-way or three-way matching methods are used.

While cross-checking the information, AI flags and communicates mismatches immediately.

Fraud detection

Fake bills and invoices mostly look original and are created with the ill intent of stealing your money. AI can be employed to capture anomalies in invoices and send them for further review.

It matches patterns and compares with previously processed invoices in the identification process.

Data analysis and prediction

It can analyze a huge amount of data and draw out useful conclusions. It can help the finance team to plan budgets for upcoming months. It can also suggest cost-effective methods and money-saving techniques based on your spending.

How AI in accounts payable systems helps reduce manual intervention?

AI in accounts payable makes many complicated tasks accomplishable. Modern accounting applications make use of them and other state-of-the-art technologies to automate your entire accounting department.

Here is how they reduce manual effort with smart functions.

1. Eliminates labor-intensive tasks

There are countless labor-heavy tasks in accounts payable. Automated accounting applications simplify them and reduce manual labor.

The same task that takes a day to complete can be finished within hours with less effort and more accuracy. It can be draining work for accountants to constantly route, check, authorize, organize, and process repetitively.

AI in accounts payable, along with automation, takes care of it on its own and keeps employees engaged with productive tasks.

2. Automated extraction of data and auto-populating codes

The duties of accounts payable begin when an invoice walks in. Their first task is to extract information from that document (invoice number, amount, vendor description).

In a normal world, an accountant is supposed to enter them in the payment software and/or a spreadsheet for further processing. Their workload accumulates as the number of invoices increases.

The latest accounts payable software is equipped with invoice capture software. This automatically extracts required information, be it in any form of an invoice.

Also, there are payment-related codes they enter, which are unique to each vendor and billable department. It can be programmed to auto-populate instead of manually typing in every time.

3. Automated reminders for approval & payments

Following up with approvers is challenging on its own. Approvers will be busy and have their workload to handle. AP software is the best way to get instant responses from them.

They can sign in and approve on the go. Frequent push notifications are there to remind them of an awaiting approval request. Notifications are not just for approvals but for payments too.

Unlike paper invoices, you have a clear view of when payments should go out with multi-dimensional payment software.

4. Accurate batch processing of invoices

Batch and bulk processing of invoices is a common practice too. Here, the accountant clears out a big load of invoices at the same time.

It’s mostly followed to reduce the workaround time. However, it ends up with missed invoices or duplicate payments.

The good news is that modern AP systems support bulk processing and uploading of invoices. As it happens in an automated fashion, no invoices go out of the destined path and make it to the payment step.

5. Timely payments

All the above steps ensure that the payment goes out on or before scheduled deadlines. It can create unsettling situations if bills are not paid on time.

What if the company has enough funds, but the AP department has delayed it due to processing errors?

The onus, anyway, lies on the AP department to strategically manage cash flow and schedule payments in an orderly manner. And accounts payable software supports this by automating the workflow and reducing inefficient practices.

Enhance accounts payable using automation

How AI supported solutions help manage complex systems & processes

AI-powered automation finds its applications in every corner, helping accountants solve complex issues. Common scenarios and use cases that can be given as examples are.

1. Increased business operational efficiency

When looked at from a business owner’s POV, overall efficiency matters more than anything else. In accounts payable, this efficiency is a measure of how quickly an invoice is cleared out of the system.

It also includes the rate of incorrect invoices to total processed invoices. If you want to shine above the shortcomings and create teams that provide more value, automation is the only choice.

By automating invoice matching and processing, expected efficiency is achievable. Also, accountants are not paid to do copy-paste jobs.

If they should contribute more to the financial well-being of the organization, there should be data extraction tools and integrated ERPs in place.

2. Unified database

Unified accounting systems are the future of accounts payable, where there will be no manual data transfers.

No professional would want to use an endless number of applications for carrying out similar kinds of tasks. They will be required to move data from one application to another in counterproductive ways.

Rather, they can use centralized portals where all accounting functions happen together. Fortunately, new-gen applications come with open interfaces that allow connection with other software.

3. Reduced risk of fraud

Fraud is detectable. But to rectify them and seal the source, real-time fraud detection is required.

AI-based accounting systems promise that. They bring any disparities, mismatches, and anomalies to your attention so that nothing can escape your sight.

To not let duplicate and fake invoices get away, they use multiple checkpoints. AI also remembers patterns and trends, and anything that deviates from what’s regular gets flagged.

4. Increased transparency

Though this pointer is not directly related to AI, it’s still a trait that’s common in recent AP systems.

Accounting cannot be held with secrecy. A transparent and open dashboard gives inputs to departmental managers and finance teams to track payments in real-time.

It gives everyone an understanding of regular and ad-hoc disbursements of the company. This helps a lot in tracking malpractices and preparing monthly budgets.

5. Better financial decisions

The finance team is presented with what they need, and too in a presentable format. As this is also updated data, they don’t have to stay in touch with the accounting department more frequently.

AI can also derive spending insights and share them with relevant departments. This is based on your past spending patterns. AI in accounts payable compares huge chunks of data (way older than months) and helps you compare values.

This kind of calculation is not possible to do manually. They can be used as inputs while forecasting future expenses. The more data it gets access to, the better the outcoming insights are.

Challenges of using AI-driven solutions for better management

Every best solution has its own limitations. AI in accounts payable comes with a set of challenges too. If you are prepared earlier, you can combat better.

Limited knowledge and training

Present day workforce has general knowledge about how AI works but are not trained to operate them, especially basic-level accountants.

It takes organizations to allocate time for training and testing before implementing it full-time. Though human efforts are minimum with AI, expertise is required to get the most out of it.

Where to implement AI

Automation solutions for AP are a handful. But, the application of AI is different. If you plan to implement AI, you must decide which area needs it and why. Is it OCR to capture invoice data or RPA for data entry, or ML to make data-driven decisions?

Non-availability of off-the-shelf software

The reason why decision-makers are hesitant to apply AI in accounting is that they are not available with fully-developed software.

Rather these solutions are sold for separate use cases as niche-based software. In order to avoid confusion and chaos by including one more software, they prefer to stick with basic ERPs.

Stay ahead and choose the right AP solution for your business

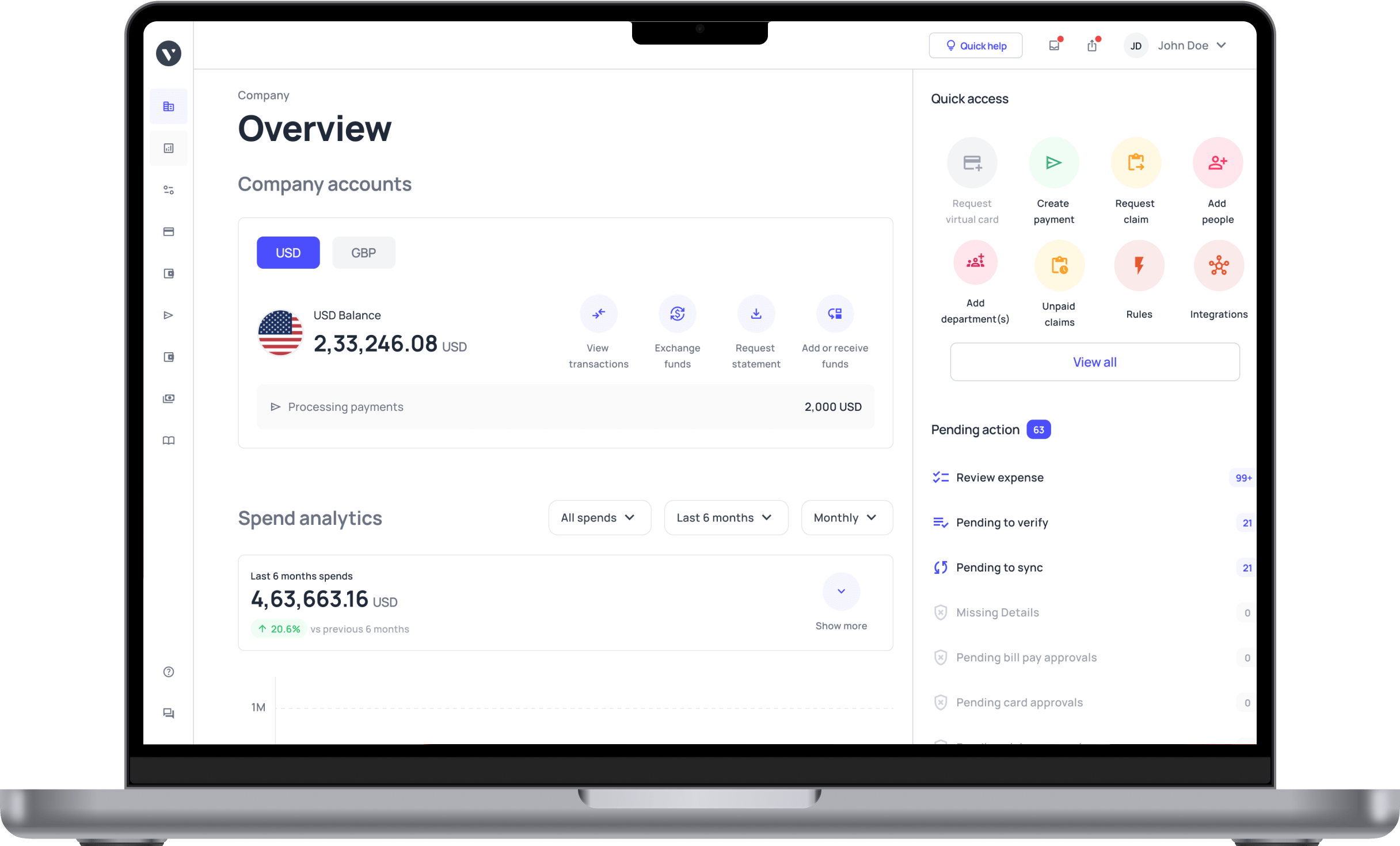

Volopay is an expense management tool that helps in both making and strategizing expenses. It gives endless opportunities to your finance team to create budgets, analyze accounting information, and run reports, all in an instant.

Your accounting team can spend half their actual working hours scheduling payments and processing bills. With automated controls and transparent reporting, your accounting team will end up saving money for you.

Looking for automated accounts payable software with AI functionalities? Take a look at Volopay and automate your entire accounts payable today.