Why Volopay is a flexible AP automation platform?

Accounts payable is very famous for its incessant tasks. They make sure every invoice gets paid when they are supposed to. They also are required to maintain precise records and create audit trails. It’s pretty clear that they keep performing similar tasks time and again. To tackle the challenges of AP, accountants need a state-of-the-art AP automation platform.

But finding the right solution doesn’t come easily. There are plenty of factors and features to consider. The bar is set high in terms of how business owners weigh and choose automated AP software. That’s why it’s essential to explore the best accounts payable automation software in the US, which is designed to streamline these processes, reduce manual work, and enhance overall financial management.

What is AP automation software?

Accounts payable software is a tool that helps companies use a central system to execute and handle all their AP-related tasks. This can include things like processing invoices, making domestic & international money transfers, creating and managing a vendor database, and setting up compliance policies for employees to spend allocated budgets.

Some of the best accounts payable software for small businesses are the ones that also provide some form of automation to help finish AP tasks much faster. Rather than having AP team members in your company do everything manually, automation helps fast-track processes while also reducing the errors that are commonly overlooked or created by humans.

Why Volopay has best AP automation platform?

Maker-checker approvals

Also known as the 4-eyes principle, this is an authorization type that involves two people to make the final decision. This dual-authorization method has its application in expense approval too. There will be a maker and a checker. The maker creates the request and sends it for approval. And the approver ensures that it’s error-free and approves or rejects it.

Employing this method will highly reduce expense fraud and errors. Any error made by the maker will be captured by the checker and rectified. Typically, maker-checker workflows are created manually by the accounting team. But how it gets executed matters the most. That’s how you can decide whether this workflow yields maximum efficiency or not.

You need automated AP software to digitize this whole approval process. That way, the request will be forwarded to approvers instantly once it's created. Volopay allows you to achieve this automation. You can set customized maker-checker workflows for different variety of expenses.

You can either set no approver for a typical payment or have multi-level approval for it. Each approver will be assigned roles and tag them with relevant workflows. Approvers can log in to their dashboard anytime and take a look at pending approvals. It is flexible for any kind of workflow. Whether it’s invoice approval or expense reporting, it yields the same efficiency. Volopay’s automated AP software is also flexible in terms of workflow customization.

Vendor onboarding

Whoever you buy raw materials or services from are your vendors. You need to onboard them into your accounting application to pay them. This is to maintain all vendor-related information in one place and pay them on time. You also get a 360-degree view of your spending with all required documentation lying together.

Typically vendor onboarding takes days and that prolongs the first few payments too. As it snowballs, you won’t be able to match invoices and PO properly nor approve it on time. Every time there is a new invoice, accountants need to go back to your vendor database, match information, and send it for approval. But this can be cut short and automated with Volopay.

AP automation platforms like Volopay have their in-built vendor management tool. Here, you can create vendors, store their invoices, analyze their spending, or link their new invoices. It’s extremely easy and flexible to transfer an invoice into a bill as you already have vendor information in place.

Whether you buy from them regularly or once, it’s easy to update, store, and delete the vendor within the system. There is no limitation on how many vendors you can add to the system. Hence it’s flexible for most SMEs as they deal with many irregular purchases.

Accounting integrations

When an accounts payable system is stand-alone, its functions are limited within itself. Unfortunately, accounts payable cannot act independently and need interactions with other departments too. For a smooth operation between the purchase, payment, and operations teams, the automated AP software must be linked with ERP (Expense Resource Planning).

But end-to-end integration is not common, especially among startups. They might have well-advanced ERP software in place or even have an invoicing system with OCR. without AP integration, their accountants will still be forced to transform data from AP to ERP manually. Also, if you use multiple payment modes like cards, wallets, online banking, etc., it’s even complicated to sync them manually.

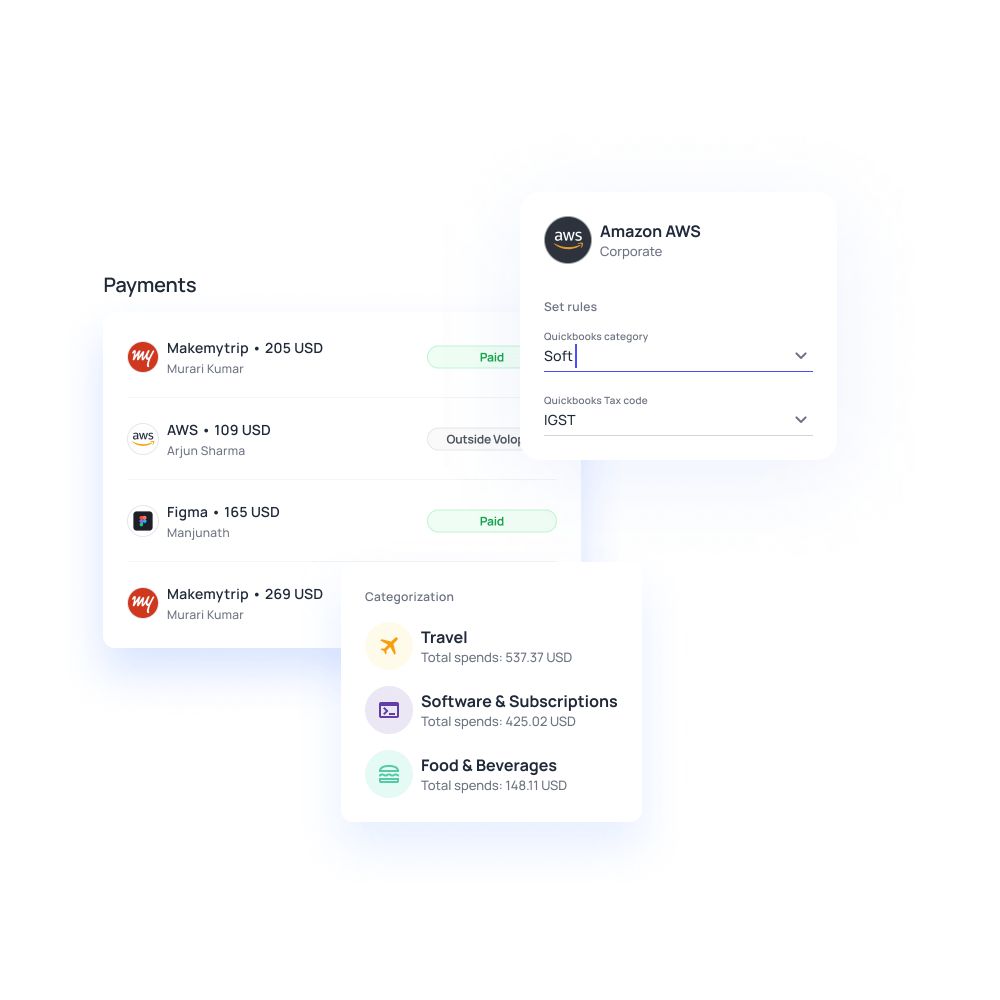

Enter Volopay, an AP automation platform with an integration option. It has an open API and can sync with some of the most common ERPs like Quickbooks and Xero. Even if you use other ERPs, you can still connect and sync your Volopay account with it using open API.

By connecting them, your payment data are instantly fed into your ERP, helping you trace back the payments effectively. Another advantage of Volopay AP integration is that you can choose which payments to sync and see the synchronization status.

Volopay also has an auto-classification of payments option post-syncing, which again shuns manual work. By syncing effectively with ERP, it’s easier to make audit trails. You understand why a payment has been made just by looking at it.

Related read: Benefits of AP automation and seamless ERP integration for your business

Multi-currency wallets

In this digital era, every business somehow gains benefits from the global market. Though they get services/products with international standards, paying them in a non-native currency becomes a challenge. Earlier, there were bank transfers and unions that took five to seven business days to transfer the payment. There were fewer ways to track the payment. On top of that, these options are expensive too.

They are now replaced by wallets, cards, and international payment services. Though they are transparent in operations, one thing hasn’t changed. It’s the price. Spending more on spending is unaffordable for small businesses. Again, you use a separate platform just for international payments, which is a burden for accountants.

Want to bypass both drawbacks in one attempt? Volopay has a solution for this. They are multi-currency wallets. Your Volopay account will have a wallet in your native currency. In addition to that, you can also have wallets in other currencies you regularly use.

Here, you load money in foreign currencies and spend money in the same. With this, you avoid the conversion fee that you pay traditionally when transferring in native currencies. Also, you can track the payment and send it much faster.

Invoice management

A small to medium-sized business receives up to 50 to 100 invoices per month. And an accountant can process up to 10 invoices per day. It also depends on what methods are being followed to process it. Though the shift from paper to digital mediums is happening, there are still vendors who send paper invoices by mail.

When you process them through conventional methods, it can be time-taking. An invoice can take up to 7 to 10 days to get cleared. Also, it’s prone to errors and typos. An AP automation platform is what you need to sharpen this. As invoice processing also involves matching them with PO, it can delay payments further.

Volopay offers you the best solution for invoice processing. It already has a vendor management system. Your invoice can be in any form; scan and upload on Volopay and create a bill instantly by choosing relevant fields. Now, it’s ready for the approval stage. Depending on the workflow chosen, it reaches the relevant approvers and notifies them simultaneously. Once approved, it’s ready for payment. You can schedule payments ahead of time.

You will not be left clueless post-payment. Volopay gives you a real-time view of your payment status. Once the payment is made, receipts can be downloaded right there. And the payment can be synced with your other accounting software. It’s flexible for companies of any size as it allows the smooth processing of any number of invoices.

Get started with AP automation on Volopay

Every small business will have its day of high growth and acceleration. At that point, it needs technical systems that support the excess load too, particularly with accounting and finance. Only flexible automated AP software can do that. That’s why a business owner should look beyond the ‘one size never fits all approach and look for flexible programs.

Volopay can be a part of your growth, by automating accounts payable and every core task of accounting. As it has multi-currency wallets, cards, and bill pay altogether, your entire payment can be made from one place. Your finance managers can make effective and quick decisions with this level of transparency. And that’s how you utilize automation to ease cross-functional workstyle. Try us today for a simplified payment management experience.

Trusted by finance teams at startups to enterprises.

Related reads

Get a deep understanding of accounts payable automation, how it works and how to automate your AP process.

Unlock the full potential of AP automation in this guide tailored for CFOs. Discover the tools and strategies to streamline your AP process.

Gain a thorough understanding of the AP process, from invoicing to payments, and explore effective strategies for managing and optimizing AP workflows.