How to reduce invoice processing cost with AP automation?

The cost of processing an invoice manually is anywhere between USD 12 to USD 30. With hundreds of invoices to process every month, this price range can be highly damaging for any business.

The invoice processing cost is not just the bill amount but also includes the cost of other materials like paper and storage and labor used in the procedure. Every business constantly searches for areas to cut down costs.

With invoice processing automation, reducing invoice processing costs would become easy. Plus, automation would not only help to reduce the cost of processing an invoice, but it will also bring more efficiency and uniformity to the system.

Hidden costs of manual invoice processing

1. Mail cost

An invoice is either received as a paper document or an email. With manual processing, more and more paper as raw material is used.

With this, while sending your vendor's payments in cheques or cash along with supporting documents, you incur mailing costs. These are inevitable expenses that add up to your overall cost to process an invoice.

2. Per transaction charge for online payments

Along with the charges of manually getting, recording, organizing, reporting, matching, and analyzing an invoice, for every invoice payment you make.

There are certain charges you pay for sending payment, and the amount becomes more prominent when it comes to making international vendor payments.

3. Third-party accountant cost

Another cost often overlooked or not recorded in invoice processing is the cost of hiring/outsourcing your company’s accountants.

The salaries or fees you pay to the third-party accountants to process your business invoices are also considered and raise the overall cost of processing an invoice.

4. Outdated or incomplete technological solutions

Though many companies have adopted AP automation tools, however, there is still a good majority of businesses that still stick to outdated and expensive systems which were built 10-15 years back.

The cost of still using those systems and implementing the workflow can be burdensome. Plus, all the money that it takes to keep that technology running is an additive factor to the invoice processing cost.

5. Manual labor

Another hidden cost that is apparently the most significant is the cost of manual labor. While processing paper invoices, the procedure invoices gathering invoices from emails or posts.

Then enter all the relevant information in the right fields, three-way checking of the invoices for information and amount accuracy, and correcting errors if there are any.

Only after completing all these steps is the invoice sent forward to the managers and the financial team for approval.

The employees dedicated to this work would have to go back and forth in the office to get approvals, gather all requested information, and contact multiple departments.

All this will cost your company wages, salary, or extra compensation. Hence, this gets added to your invoicing cost.

6. Compliance violation risk

Not only is manual invoice processing difficult to conduct it is also enormously tiresome to track and control internal accounts payable challenges with it.

All invoices and related documents or information are required to be stored for a minimum amount of time.

So, with paper invoices, there is no guarantee when of the safety of those invoices, and there is no solid protection of them against fraud or tampering.

How does AP automation help in reducing invoice processing costs?

AP automation solution speeds up all the tasks included in the process and saves the company and its employees time.

The hours which were usually wasted on manually working on paper invoices, making sure that the payments are approved, reaching the suppliers on time, and all the invoices are stored securely

Then are taken over by the AP automation system as it eliminates all the paperwork, extra hidden costs, reduce storage fees and streamlines the entire audit procedure.

AP solutions automatically take invoices from your emails or scan paper invoices and process them immediately by categorizing all the information present on them.

This is done by classifying it correctly and performing the three-way matching and sending all of it for approval to the relevant department managers.

Along with this, the system also helps the business to create vendors or suppliers, using which you can simply just click on the vendor, and the payment to them is automatically made.

Plus, you get amazing transparency into the payment transfer system. Once the payment is made, the system will also notify the vendors and confirm the payment.

Further benefits of AP automation software are that it easily integrates with accounting automation solutions so that every payment made is recorded in the right side of the books.

As it is a machine working on invoices, the chances of any errors or flaws is to the bare minimum, which means the business achieves immovable accuracy and spotless compliance.

Key benefits of AP automation for invoice processing

1. Timely payments

No business would purposely make late payments or willfully wants to incur the late payment charges. In all the business hassle and numerous operations, it just happens.

It becomes hard to manually keep up with all the vendors, accounting, and administration.

So, last-minute delays or slips are bound to happen. Also, sometimes there isn’t any solid guarantee that the cheque you sent along as a vendor payment would reach the supplier on time; hence delays become a normal thing.

However, this is not what smart businesses can accept. Every business wants to be on top of its game, and reducing invoice processing costs through automation gets them one step closer to the goal.

With the software taking care of all the procedures, you don’t have to worry about any delays in processing.

Along with this, with an automation solution, you would get the option to fix recurring payments, which means that you can just click on the vendor profile and the money would be transferred to them immediately. Plus, you get all real-time updates about the transactions.

2. Improves vendor relationships

Automating invoice processing or your whole accounts payable operations would cause absolutely no harm when it comes to your business’s relationship with its vendors.

In fact, your suppliers would be more than happy to receive early or on-time payments and get a flawless communication channel. You will definitely become their most valued customer.

Once this happens, be ready to benefit from supplier invoice processing improvements like discount offers, cashbacks, and gift cards, and not only this, you can also secure your negotiated price and best quality products.

3. Improves accuracy

Errors are inevitable in manual processes. However, much you try, there is a certain limit of accuracy humans can achieve, and it is not better than software.

Further, if flawed invoices reach down to other business areas like accounting or analytics, the whole process and all conclusions get rigged, and everything has to be done again.

Plus, errors in vendor payments can have an immensely negative effect on your supplier relationships.

This is where AP automation jumps in as the only viable and best solution. It effectively removes errors and eradicates problems from the first step of the process to the last.

Everything is accurate, and all the correct data is forwarded to other parts of the company.

4. Streamlines accounting

Sending cheques or payments in person is not only extremely expensive and time-consuming it is also highly insecure. The huge amount of payment and your financial information all is at risk.

On the other hand, if you adopt an AP automation solution, your company’s vulnerabilities to fraud and theft decrease to almost zero. You can easily pay using virtual cards and also set recurring payments.

There is also an option of one-time-payment/burner cards which expire after the payment is made. You easily sidestep all risks of theft or unauthorized use of money.

5. Insights and spend analytics

Using manual invoice processing, the account payable process isn’t able to collect enough accurate data. There is always tons of paperwork and documents to go through to get a detailed analysis of the account payable portion of the business.

But, to stay on top of the dame, businesses have to use intensive data and make careful, data-driven and empowered decisions.

The case is totally different with automated AP solutions. Using this, a company gets ready to use accurate data about all invoices and payments made to suppliers.

This will help in making on-spot cost-cutting and investment decisions. Along with this, as everything in the system is recorded, it becomes a digital trail which is immensely useful when it comes to business audits and tax payments.

6. Secured payments

Sending cheques or payments in person is not only extremely expensive and time-consuming it is also highly insecure. The huge amount of payment and your financial information all is at risk.

On the other hand, if you adopt an AP automation solution, your company’s vulnerabilities to fraud and theft decrease to almost zero. You can easily pay using virtual cards and also set recurring payments.

There is also an option of one-time-payment/burner cards which expire after the payment is made. You easily sidestep all risks of theft or unauthorized use of money.

How can Volopay help in reducing invoice processing costs?

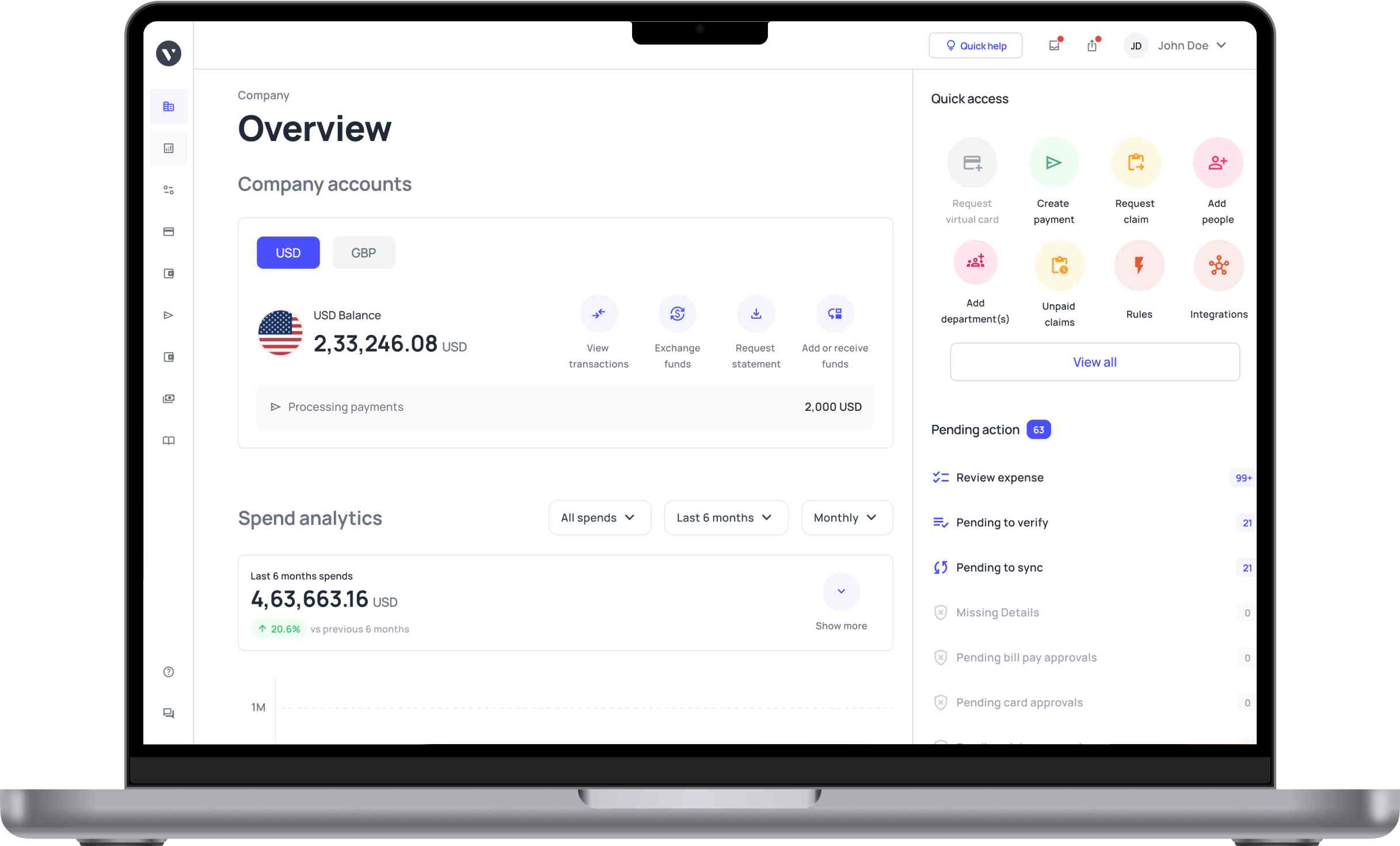

There is no doubt that every business needs a spend management solution in their financial stack. The best one out in the market is Volopay. It is an extremely effective solution for greatly reducing invoice processing costs and streamlining all the processes from start to finish.

With Volopay:

● Submit invoices by simply scanning or uploading them, and a bill is automatically created.

● Set multiple approval levels to avoid any discrepancies or payment errors.

● Efficiently manage vendors by creating an individual account for each so that you don’t have to ask and enter their payment details every time.

● With individual vendor accounts, you can get your hands on early payment discounts and cashback offers.

● Track all payments and expenses in real-time, plus all vendor information is stored together in the system, so you can filter through and get all data you need.

● Create specific virtual cards for each vendor, either burners or recurring payment cards, so you can just use the assigned vendor card to make payments. No hassle between accounts and cards.

● Pay the lowest FX charges available in the market for international payments.