5 best business credit cards in Australia: Top picks for 2025

With the wide array of options available in the Australian market, selecting the best business credit card fit is pivotal for any business.

As of 2025, navigating the plethora of options to determine the best business credit card requires a comprehensive level of understanding and analysis.

Factors such as rewards, interest rates, fees, and perks all shape the suitability of a card to individual business needs.

What is a business credit card?

A business credit card serves as a specialized financial instrument expressly crafted for business applications. While resembling personal credit cards in function, it is customized to cater to the diverse needs of businesses, spanning startups, small ventures, and large corporations alike.

By utilizing the best business credit card, enterprises gain the ability to conduct purchases, settle bills, and oversee expenses linked to their daily operations.

These cards frequently come with incentives and bonuses tailored to business expenditures, such as cashback incentives for office supplies or travel rewards for corporate trips. Moreover, they boast comprehensive expense tracking and reporting functionalities, streamlining financial administration and bookkeeping tasks.

How does a business credit card work?

A business credit card functions much like a personal one but is specifically designed for business expenditures. Upon making a purchase, the card issuer provides credit for the transaction, which the cardholder must repay, including any interest, within a set period.

These cards frequently come with advantages such as rewards programs, tools for tracking expenses, and increased credit limits, all of which can aid in managing a company's finances. The best business credit card for your business will come with the perfect balance of tools and rewards that can fit your requirements perfectly.

However, it's vital to exercise responsible card usage to prevent debt accumulation and adverse effects on the business's credit rating. Consistent payments and diligent expense monitoring are key to maximizing the advantages of a business credit card.

What are the different types of business credit cards?

1. Rewards cards

Rewards business credit cards incentivize spending with cashback, points, or miles, redeemable for rewards like travel, gift cards, or statement credits.

They offer businesses tangible benefits for their expenditures, fostering loyalty and maximizing returns on spending.

2. Low-interest cards

Low-interest business credit cards feature reduced annual percentage rates (APRs) on purchases and balance transfers, enabling companies to manage expenses efficiently while minimizing interest costs.

This is the best business credit card for enterprises seeking to maintain financial flexibility and reduce borrowing expenses.

3. Frequent flyer cards

Frequent flyer business credit cards cater to frequent travelers, offering perks such as bonus miles, airport lounge access, and travel insurance.

They assist businesses in saving on travel expenses and enhancing travel experiences, making them valuable tools for companies with significant travel requirements.

5 best business credit cards in Australia to consider in 2025

1. American Express Business Explorer credit card

● Features

-The American Express Business Explorer credit card comes with a generous rewards program where the bank provides 2 points for every $1 spent on business expenses and travel-related purchases.

-Cardholders get access to American Express Membership Rewards Gateway offers for exclusive discounts and promotions on a wide variety of things.

-Complimentary domestic and international travel insurance.

-There is no cap on set on accumulating reward points.

-Mobile wallet for easy and on-the-go account management.

● Interest rate

-This card has a variable purchase rate of 23.99% per annum. Cardholders can't use it for ATM withdrawals or cash advances, so no cash advance rates apply.

-If the cardholder pays the balance in full by the statement due date, then additional costs can be avoided and users get up to 55 interest-free days.

● Annual Fee

One of the best business credit card offerings in the country, the American Express Business Explorer credit card comes with a $0 first-year annual fee, which goes to $149 per annum after that.

● Rewards and limits

-Earn points on every eligible dollar spent using this card, with the opportunity to redeem for travel, gift cards, and other rewards.

-Minimum credit limit of $3000 is applicable on this credit card.

-2 reward points will be given for every dollar worth of purchase made using the card.

2. CommBank Corporate low rate credit card

● Features

-Offers low ongoing interest rates on purchases, suitable for businesses aiming to minimize interest costs. This also makes the CommBank offering arguably the best small business credit card on this list.

-Interest-free period on purchases when the balance is paid in full by the due date.

-Option to add additional cardholders with individual spending limits.

● Interest rate

The CommBank Corporate low rate credit card comes with a low variable interest rate of 14.55% per annum, which is advantageous for businesses that may carry a balance and are in need of credit.

● Annual fee

The annual fees required for the CommBank Corporate low rate credit card come at $40 per annum per card for up to 49 cards, $32 per card for 50 to 499 cards, and $24 per card for 500 or more cards.

● Rewards and limits

-There is a minimum monthly repayment costing 2.5% of the closing balance or $75, whichever is greater.

-Additionally, there is a 9,999 limit on number of additional cardholders.

For detailed information on business credit cards offered by Commonwealth Bank, visit our blog on Comparing Commonwealth Bank business credit cards.

3. NAB Qantas Business Signature card

● Features

-Earns Qantas Points on eligible purchases, with bonus points available in specific categories.

-Access to exclusive Qantas offers and discounts.

-Complimentary domestic and international travel insurance.

-Highly lucrative rewards program and points offered.

● Interest rate

The ongoing purchase rate for this card offered by NAB is 18.5% per annum and there is an interest-free period available of up to 44 days on purchases.

● Annual fee

The annual fees applicable for using the NAB Qantas Business Signature card are slightly higher than most competitors, currently set at $295.

● Rewards and limits

-Includes all rewards and offers that are included in the Qantas Business Rewards program, making it one of the best business credit card options for those who have to frequently travel for business purposes.

-150,000 bonus points are provided.

-0.66 reward points are provided per dollar spent on purchases.

-The cap on reward points is set at 33,333. Further, points are also capped at $50,000 spent per card per statement period.

To know more about NAB business credit card, read Card review - NAB business credit cards

4. Westpac Altitude Business Platinum credit card

● Features

-Offers a flexible rewards program with Altitude Points, redeemable for travel, gift cards, and merchandise.

-Complimentary travel insurance and other premium benefits.

-Access to dedicated business support.

● Interest rate

This card offers a competitive ongoing purchase rate of 20.24% per annum and the interest-free period provided is set at up to 55 days on purchases.

● Annual fee

While there is no annual fees required for this card during the first year there is, however, a relatively high annual fee of $200 levied from the second year onwards.

● Rewards and limits

-The number of additional cardholders allowed is 1.

-For every dollar spent using the Westpac Altitude Business Platinum credit card the cardholder earns 1 reward point.

To know in detail about Westpac business credit cards, check out our article on Card Review - Westpac business credit cards

5. ANZ Business Black credit card

● Features

-Earns rewards points on eligible purchases, with the potential for bonus points in specific categories.

-Access to a range of premium services and offers.

-Complimentary travel insurance and Access to the ANZ 24/7 Global Business Concierge service.

● Interest rate

The purchase rate that is currently set for this card is at a moderate 20.24% per annum. The interest-free period provided by ANZ goes up to 55 days on purchases.

● Annual fee

-The ANZ Business Black Card is a premium offering from the ANZ Bank and, thus, also comes at a premium cost.

-The annual fee for this card is set at $300 per annum. However, there is no additional cardholder fee charged.

● Rewards and limits

-Earn rewards points on every dollar spent via the reputed ANZ Rewards Program, redeemable for travel, gift cards, and other perks.

-There is no cap on accumulating reward points.

-Up to 1.5 reward points are earned for every dollar spent using this card.

Are you a small business owner looking for a business credit card? Then, check out our article on best business credit cards for small businesses in Australia and choose the best one for your business.

Looking for business credit cards to manage your expenses?

Why are business credit cards important for businesses?

1. Transferring balances

Business credit cards often offer balance transfer options, allowing companies to consolidate debt from higher-interest accounts onto a single card with more favorable terms, reducing overall interest expenses and simplifying debt management.

2. Enjoying interest-free periods

Many business credit cards offer interest-free grace periods on purchases, providing businesses with an opportunity to defer payment and conserve cash flow without incurring interest charges, enabling better financial planning and management.

3. Accessing funds immediately

Business credit cards offer immediate access to funds, providing a convenient source of capital for urgent business needs, such as purchasing inventory, covering unexpected expenses, or seizing time-sensitive opportunities.

4. Managing cash flow

Business credit cards provide a flexible means of managing cash flow by allowing companies to make purchases and cover expenses even when funds are temporarily limited. This flexibility ensures that operations can continue smoothly, even during cash flow fluctuations.

Read our article on cash flow management to know the effective ways to manage and improve your business cash flow in detail.

5. Tracking business expenses

Business credit cards streamline expense tracking by consolidating all business-related transactions onto a single statement.

This simplifies accounting processes, enhances transparency, and facilitates budgeting and financial analysis.

6. Cards designated for employees

Business credit cards allow companies to issue cards to employees with designated spending limits, enabling them to make business-related purchases while ensuring accountability and control over expenses.

This eliminates the need for reimbursement processes and enhances employee convenience.

7. Ensuring fraud protection

Business credit cards often come with robust fraud protection measures, including real-time monitoring, zero-liability policies, and advanced security features such as EMV chips and tokenization.

This safeguards businesses against unauthorized transactions and fraudulent activity, reducing financial risks and liabilities.

What are the eligibility requirements for obtaining a business credit card?

The best business credit card providers in Australia typically offer a straightforward process for obtaining their services.

While the exact criteria may differ from provider to provider, the general eligibility requirements for obtaining a business credit card in Australia are:

● Be at least 18 years old.

● Hold Australian citizenship or permanent residency.

● Serve as a Director or Controller of the business.

● Possess a valid ABN registered for GST.

● Maintain a positive credit history without any payment defaults.

● Meet the lender's specified minimum business turnover criteria.

What is the process for applying for a business credit card?

Once you have chosen the best credit card for business in Australia you must then apply to obtain the services of the card provider. In order to go through this application process you must follow a particular process.

Different providers may have unique steps in the application process but some general steps include the following:

● Provide personal income, business revenue, and expense details

● Provide asset and liability information

● Produce identification such as driver's license or other ID such as passport or Medicare details

● Submit business ownership details as registered with ASIC (for Director and/or Beneficial Owner)

● Contact information for the accountant or company's financial secretary may also be necessary

● For a personal liability business card, provide information on personal income and expenses.

● For cards issued to employees, furnish details of additional cardholders.

Transform your spending with Volopay

Business credit card vs corporate credit card

Ownership

Business credit cards are typically issued to small businesses, startups, or entrepreneurs and are owned by the business owner or partners.

Corporate credit cards, on the other hand, are issued to larger corporations and are owned by the company itself.

Usage

Business credit cards are used by small business owners and authorized employees for business-related expenses. The cardholder is often personally liable for charges.

Corporate credit cards are distributed to employees within larger companies for business expenses, and the corporation is typically responsible for repayment.

Credit limit

Business credit cards generally have moderate credit limits tailored to small or medium-sized enterprises. The best small business credit card is usually the one that offers a suitable credit limit.

Corporate credit cards often offer higher credit limits due to the larger financial scope and purchasing power of corporations.

Rewards and perks

Business credit cards offer rewards such as cashback, points, or miles on business expenses, catering to the needs of small businesses.

Corporate credit cards may offer more customized rewards programs based on corporate spending patterns, including additional perks like travel insurance, expense management tools, and higher-tier rewards.

Business credit card vs charge card

Credit limit

Business credit cards have a defined credit limit, which is the maximum amount a business can borrow.

Charge cards, on the other hand, typically don't have a set spending limit, allowing for more flexibility in purchasing; however, the issuer may still impose some limits based on spending habits and payment history.

Fees and interest rates

Business credit cards may accrue interest on balances left unpaid past the due date and often include fees such as annual or foreign transaction fees.

In contrast, charge cards usually require full payment of the balance each month, avoiding interest and emphasizing annual fees.

Billing period

Business credit cards allow for balances to be carried over from one billing cycle to the next if the minimum payment is made, incurring interest on the remaining balance.

Charge cards require full payment of the balance each billing cycle, avoiding any possibility of carrying debt.

Rewards and perks

Both business credit cards and charge cards offer rewards such as cashback, points, or miles on business expenses.

Charge cards, especially premium options, may offer additional perks like travel insurance and concierge services, catering to higher-spending businesses.

When choosing the best credit card in Australia for business it is critical to find the right fit in terms of rewards and perks.

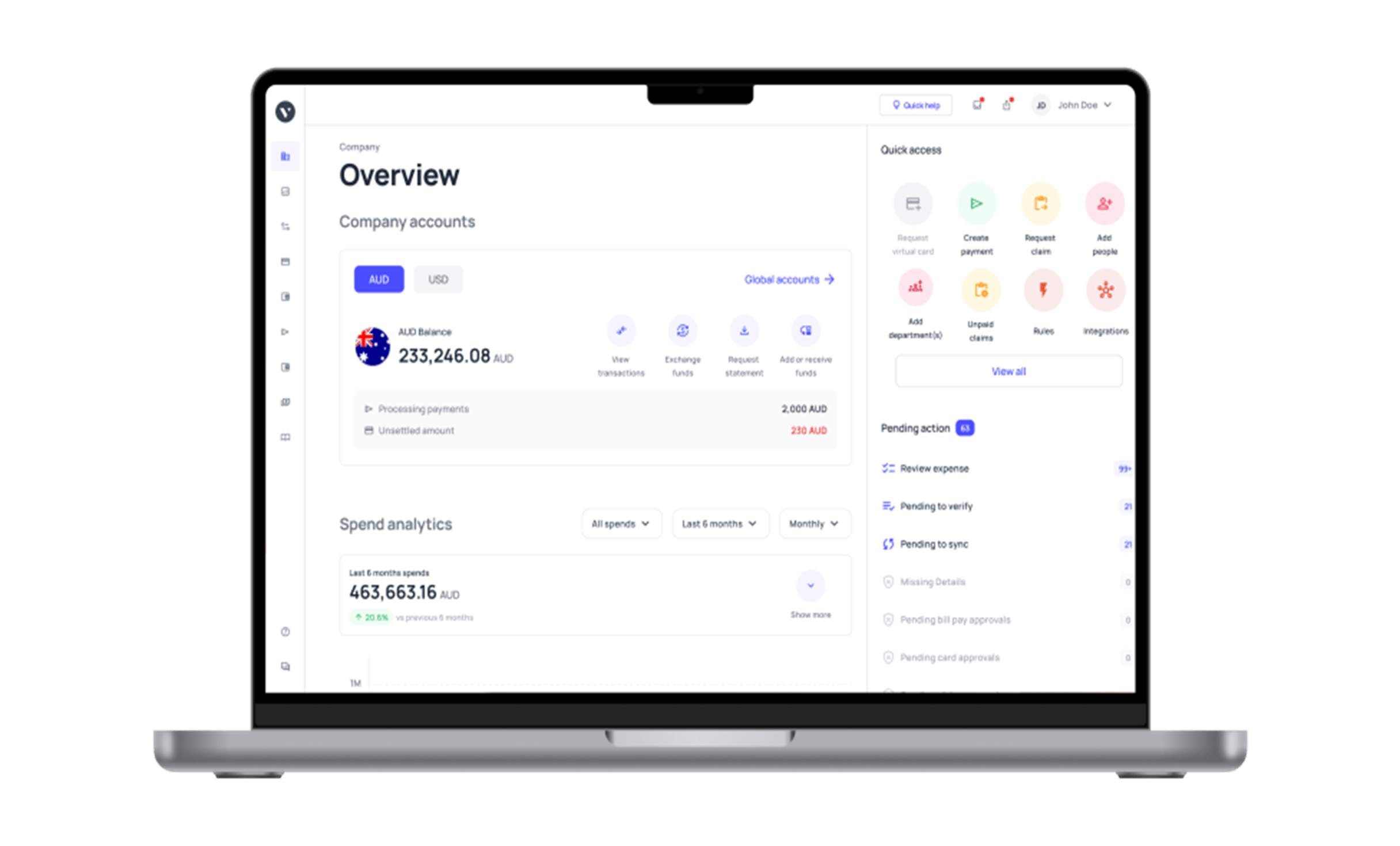

Why choose Volopay corporate cards for your business?

1. User-friendly

Volopay corporate cards offer a platform that is intuitive and easy to use, streamlining the process of expense management for businesses.

The system simplifies tasks such as issuing cards, setting spending limits, and monitoring expenses, with a design that is straightforward to navigate, thus saving time and effort in overseeing your company's financial activities.

2. Instant approval

Volopay corporate cards provide swift and efficient approvals, allowing your business to access funds quickly.

This rapid access aids in managing cash flow and capturing business opportunities without delay.

3. Employee cards

Volopay cards can also be used by businesses as corporate cards for their employees, each with customizable spending limits and controls.

This enables your team to make business purchases conveniently while you maintain control over the budget.

Employee cards also facilitate streamlined expense tracking and reimbursement processes.

4. Integrate with accounting systems

Volopay seamlessly integrates with a wide variety of accounting software such as Quickbooks, Netsuite, Deskera, and MYOB.

Furthermore, with the help of triggers and the Universal CSV feature, this integration reduces the risk of errors and saves significant time on manual data entry.

5. Real-time tracking

With Volopay corporate cards, you gain real-time insights into your business's spending.

Every transaction is instantly updated on the platform, allowing you to monitor expenses as they happen.

This level of transparency helps you stay on top of your business’s financial health and make informed decisions.

6. Secure and reliable

With Volopay corporate cards, security is paramount. Enhanced security measures, including fraud detection, encryption, and real-time transaction monitoring, safeguard your business against unauthorized transactions and financial losses.

Moreover, the platform is built for utmost reliability, ensuring the safety of your data and the seamless processing of transactions.

Stay ahead of your expenses with our corporate card solutions

FAQs

Yes, businesses can apply for multiple business credit cards to leverage different benefits such as varying rewards programs, interest rates, and perks. This approach can maximize value and optimize spending across different categories, helping businesses tailor their credit card usage to specific needs.

Business credit cards come with a set credit limit, which is determined by the issuer based on the business’s creditworthiness and financial health. The limit can be adjusted over time depending on the business's credit history, payment behavior, and overall financial performance. Regular reviews can lead to credit limit increases or decreases based on the issuer's assessment.

To apply for the best business credit card in Australia, businesses should research available options and compare features. The application process typically involves submitting a form with details such as business structure, revenue, expenses, and personal credit history. Documentation such as identification, business registration, tax ID, and financial statements may be required.

Yes, most business credit cards allow you to add additional cardholders to your account. This enables employees to make authorized purchases for business-related expenses. You can set spending limits and monitor individual spending to maintain control over business finances.

Yes, Volopay's corporate cards are designed to help businesses manage cash flow and expenses effectively. They offer features such as expense tracking, budget controls, and real-time monitoring, allowing businesses to maintain oversight and control over employee spending while streamlining accounting processes.

Volopay cards integrate with popular accounting software like Xero, MYOB, Quickbooks and more. Additionally, the Universal CSV feature allows users to integrate with virtually any accounting software out there.

Yes, Volopay's business cards can be issued to multiple employees within a business. Access is managed through customizable spending limits and controls set by the account administrator. This allows businesses to allocate budgets for different departments or employees while maintaining oversight and control over expenses.