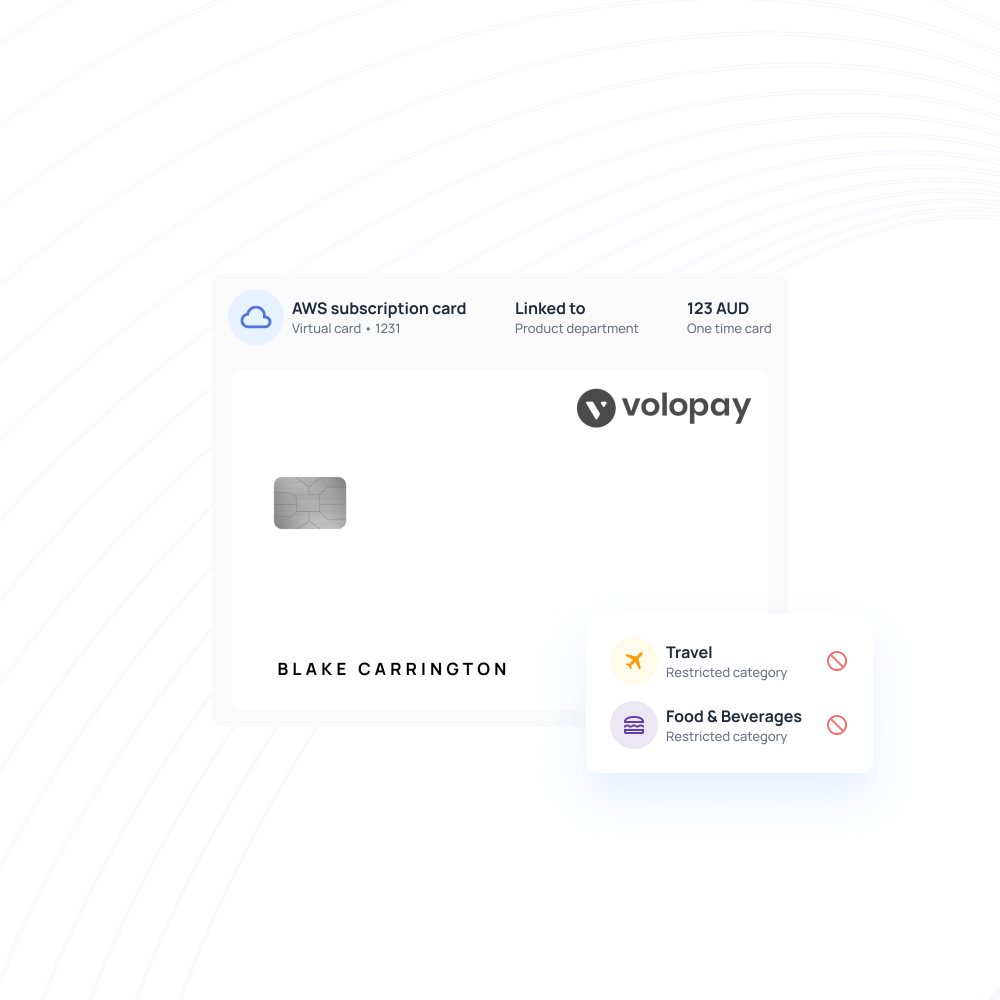

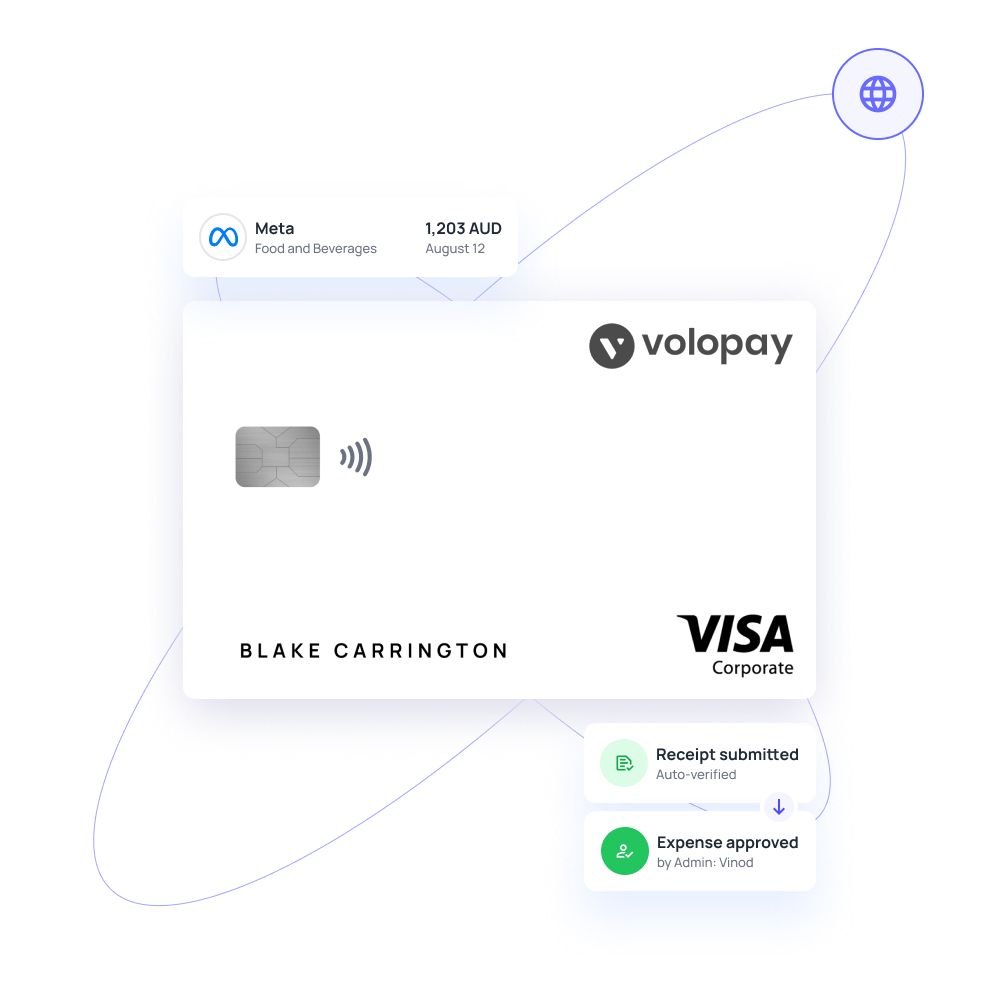

Instant virtual card for smart online payments

Virtual cards for business are the new way to manage payments efficiently, and having a virtual credit card in Australia allows you to complete contactless payments at merchant checkouts, as well as online payments. Volopay’s virtual corporate cards can do that too, if not more!

They’re a great way to empower your employees with financial control, and the ability to make business purchases, without having to dip into their own funds.

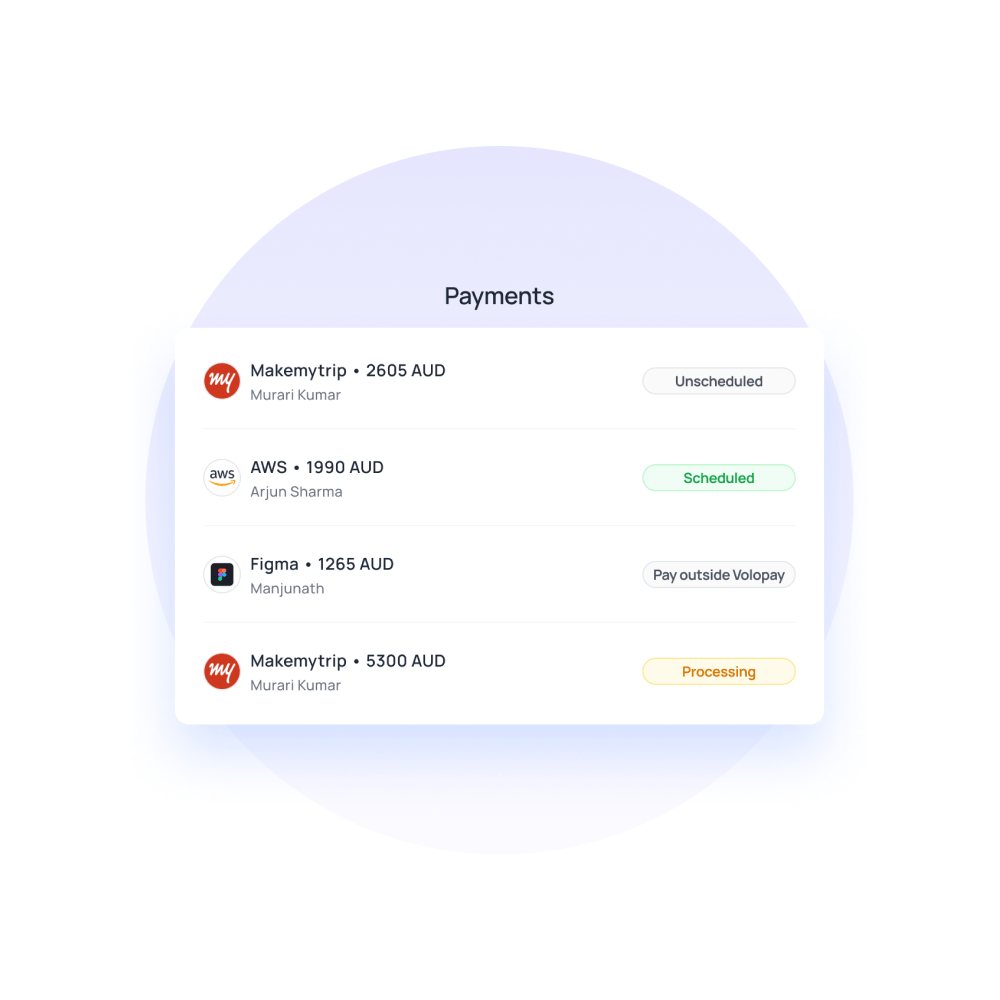

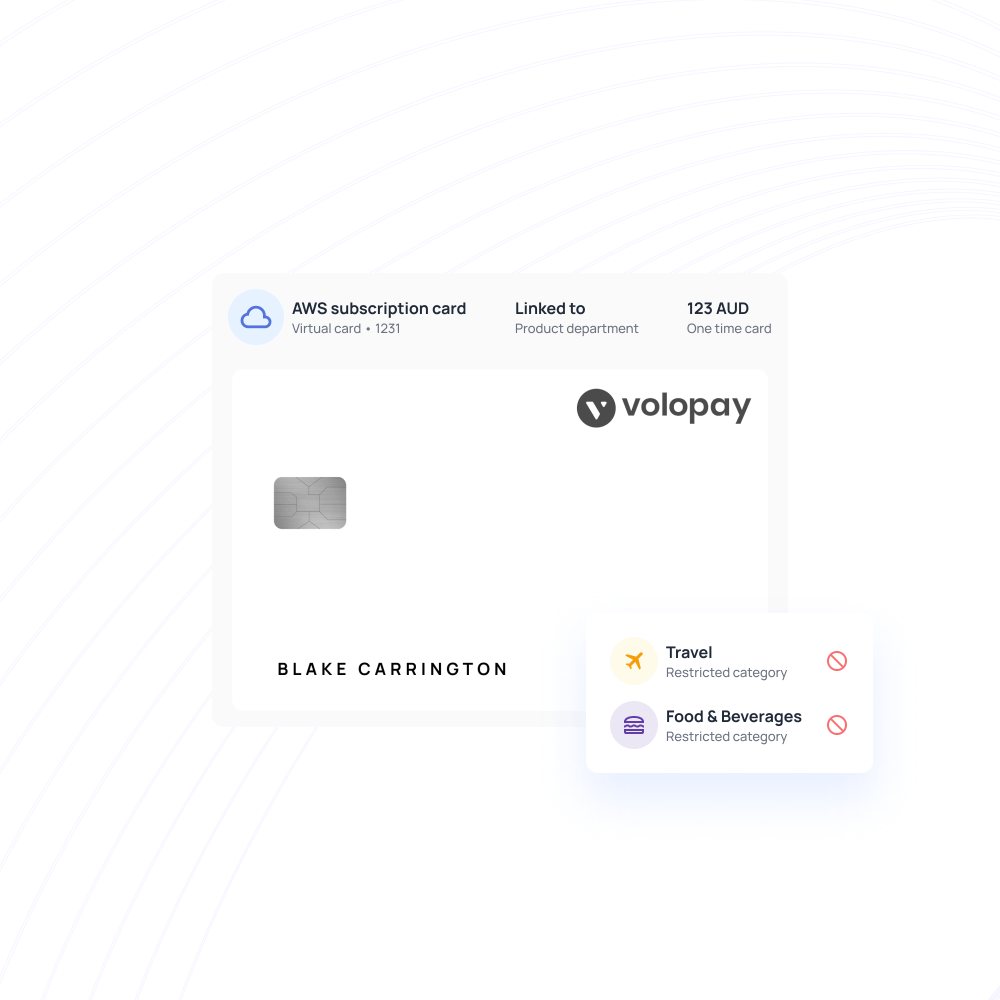

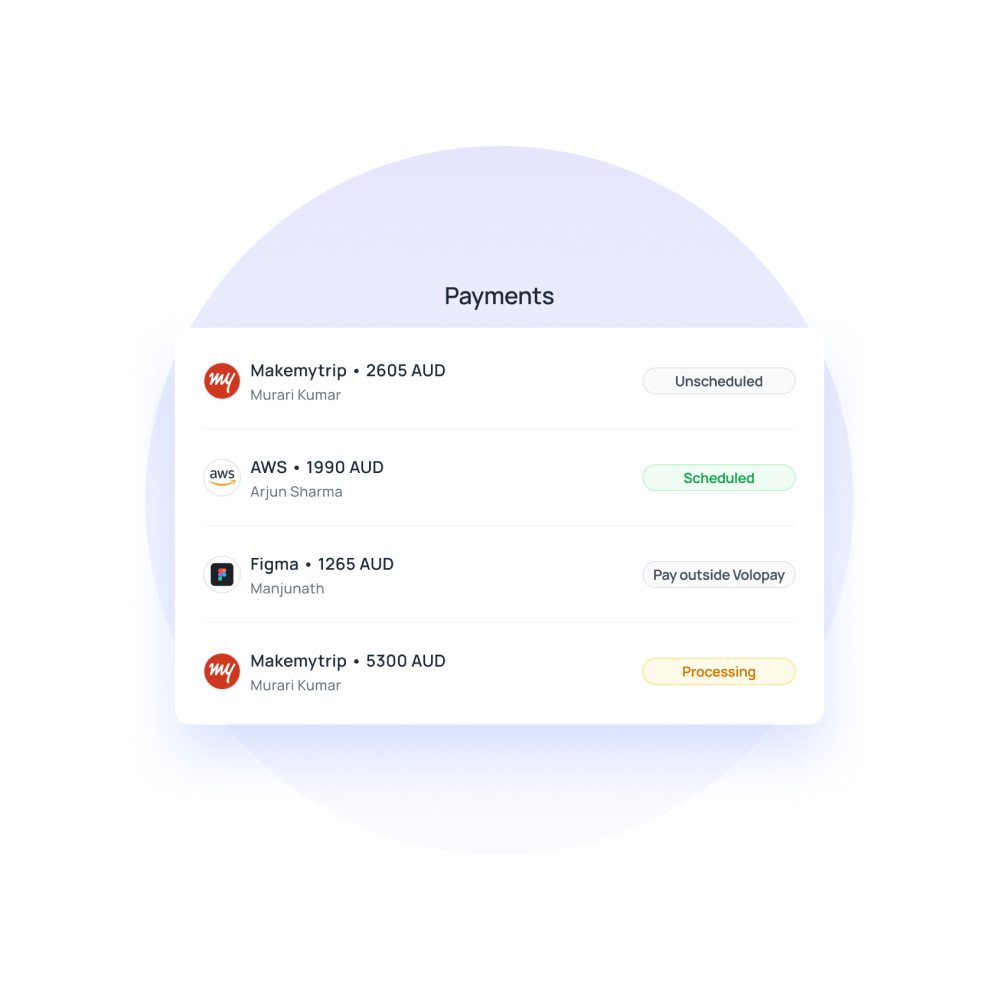

Manage subscriptions with virtual credit card

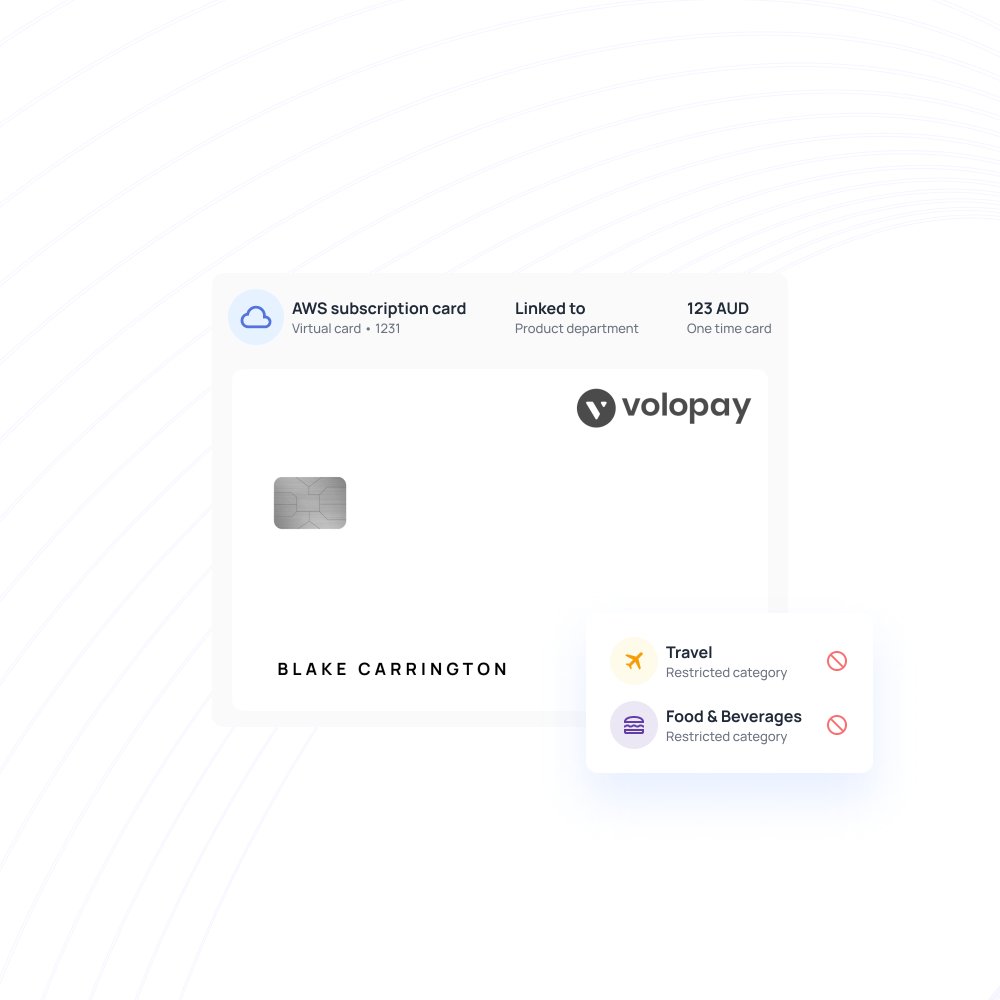

Business virtual prepaid and credit cards are most often used for subscription management. Volopay’s virtual cards work in a similar capacity. They’re an excellent way to keep your SaaS payments in control and to ensure that no multiple or outdated subscriptions get in the way of money management.

Create one-time burner cards for lump-sum payments, or create a vendor-specific card to manage budgets and payouts for each SaaS invoice.

Safe payments with virtual cards

Reliant virtual prepaid and credit cards in Australia are compliant with the ASIC standards of security. Our cards meet the same standards. Issued by VISA, they have the encryption and safety of any bank-grade credit card. The ability to generate unlimited virtual cards means that you no longer have to share cards or worry about data leaks.

Moreover, unlike traditionally issued virtual credit cards, Volopay’s virtual corporate cards are not directly linked to your company bank account. So, there’s no threat of hacks. Keep cards neat and separate, load or freeze as required, and have it all in one place for your peace of mind.

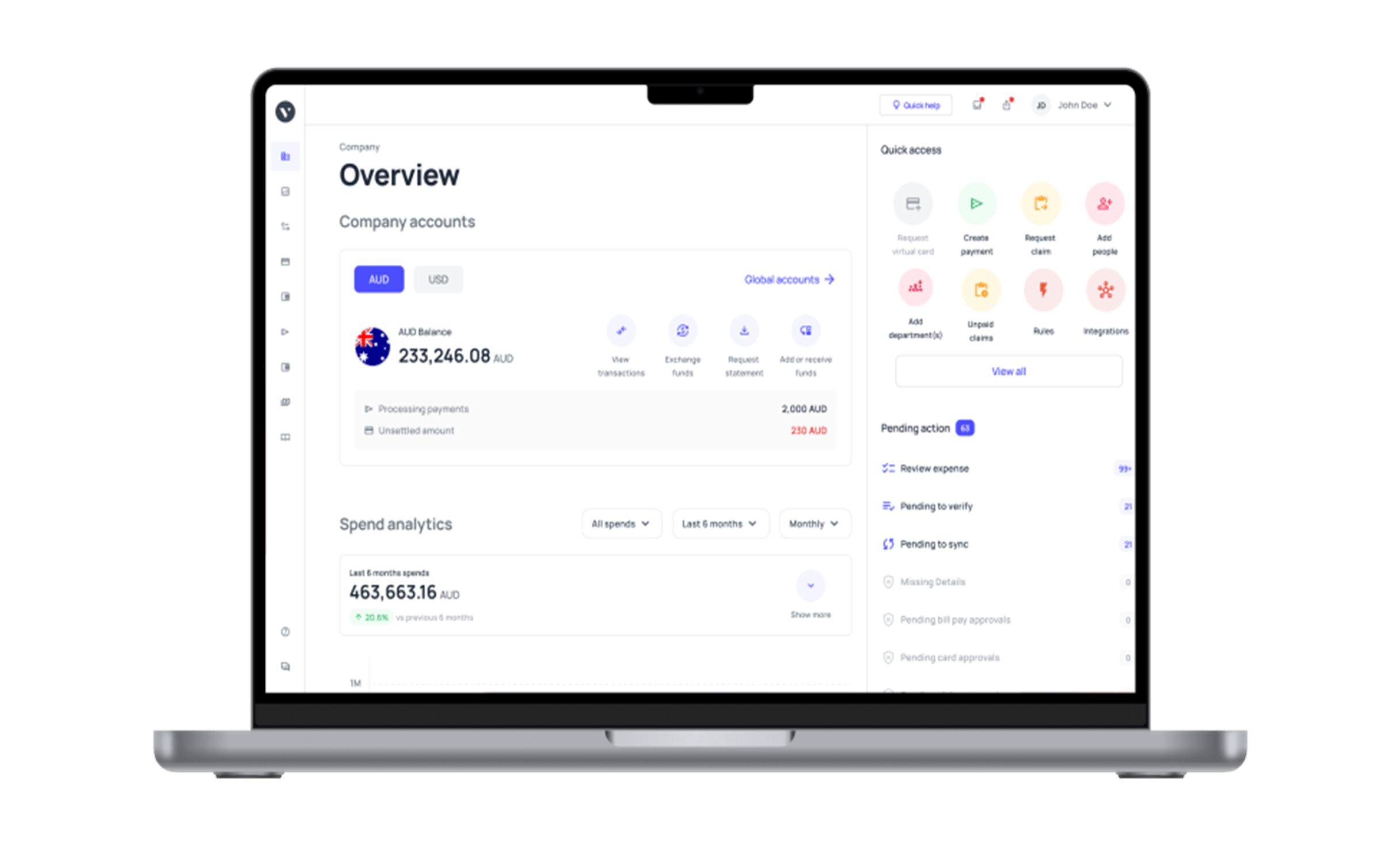

Visible spend metrics in real-time

The beauty of a virtual credit card is the ability to live track its spends. The virtual corporate cards linked to your Volopay account update information in real time. Every swipe, and every transaction gets recorded as soon as it happens.

There is no threat of data loss, and you are always updated on where your money is going. These spend metrics are always available on the mobile app, meaning they’re accessible at all times, from anywhere.

Volopay cards to simplify expense tracking and improve cash flow

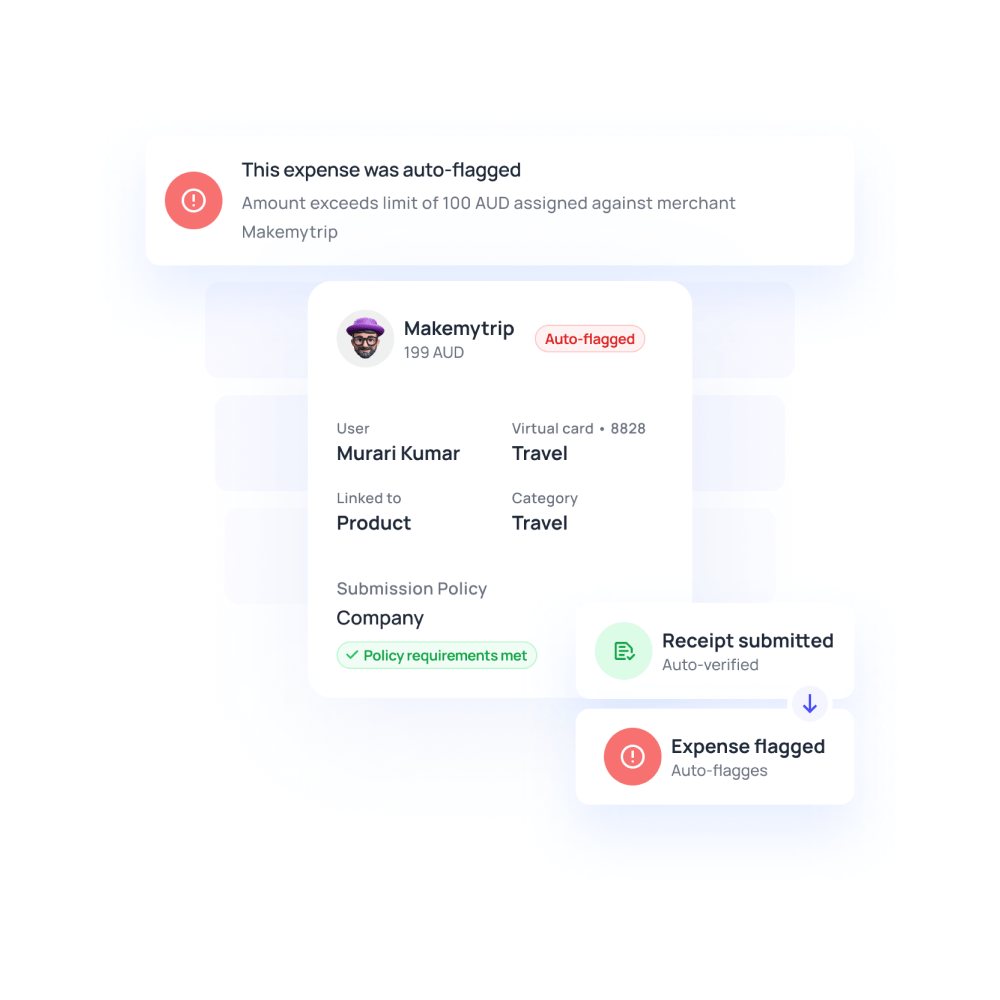

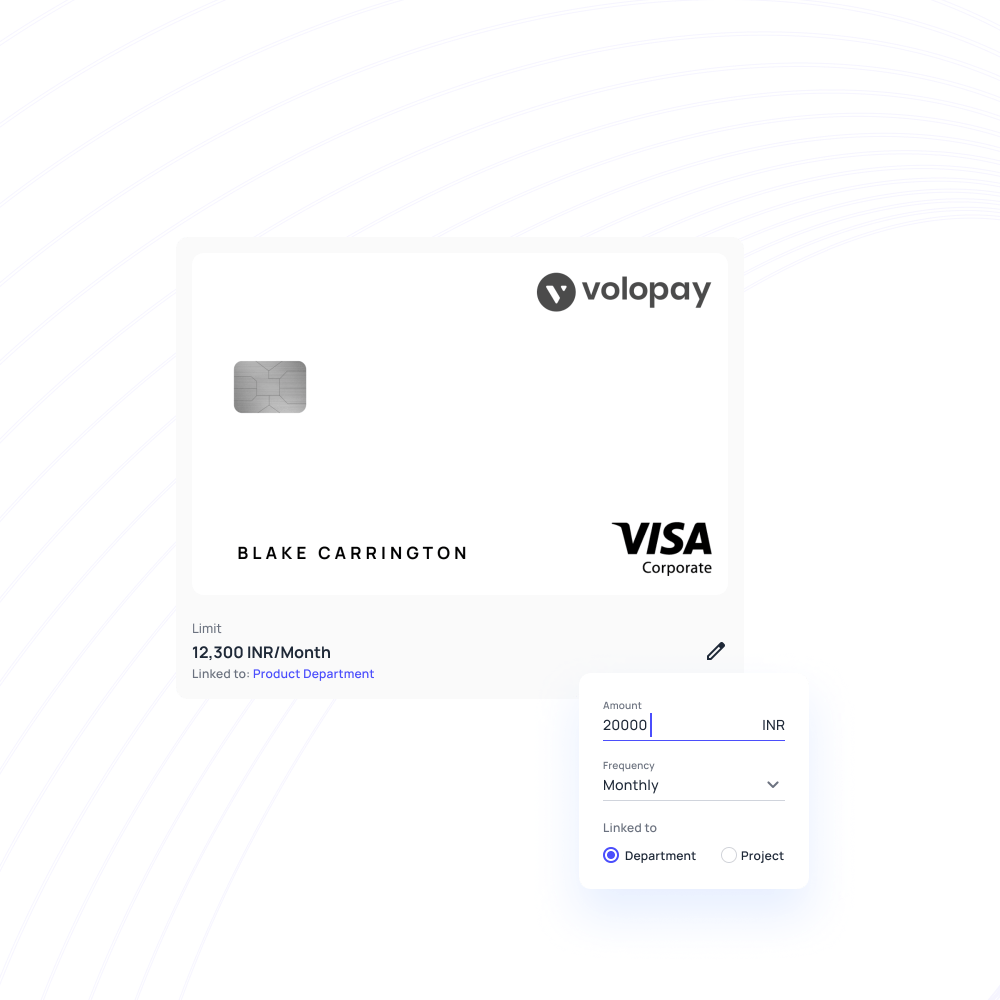

Incorporated spend limits with virtual card

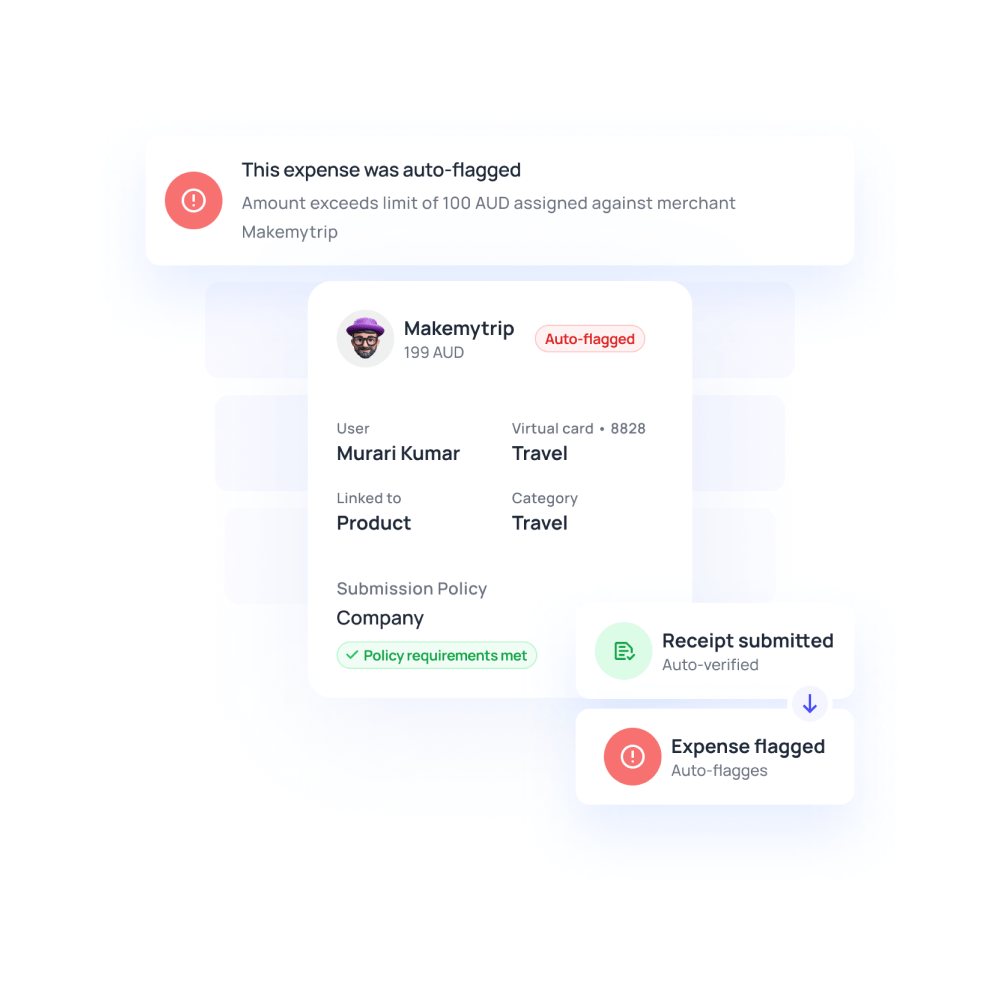

Volopay allows your virtual corporate cards to have very precise spending limits so that you can control how each card is used. Company expense policies are customizable, down to the department and project-level, to ensure that all card swipes are compliant. Specific vendors and transaction limits can also be set up to automatically get flagged.

But aside from that, you can also have a fixed budget and expiration date on these cards. You choose how much and how often they get reloaded, or if the funds are only for one-time use. Your business virtual cards are powerful and smart.

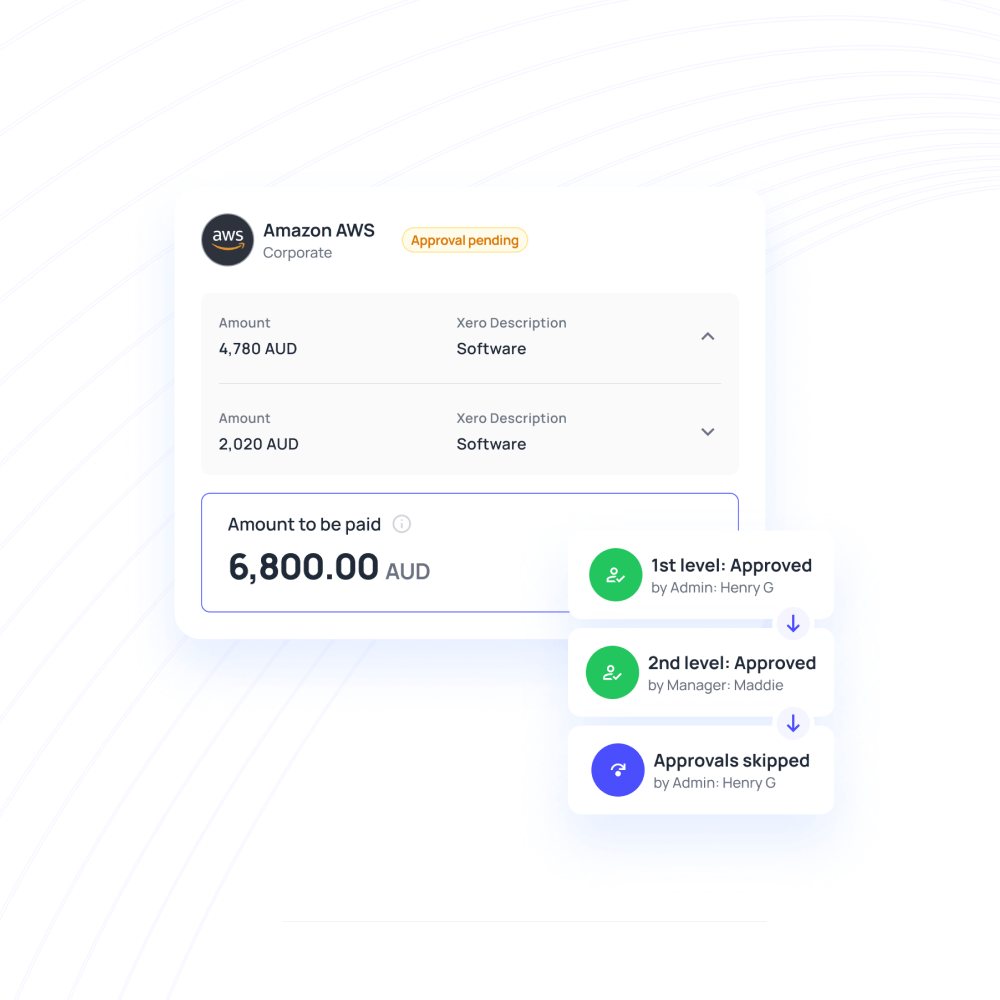

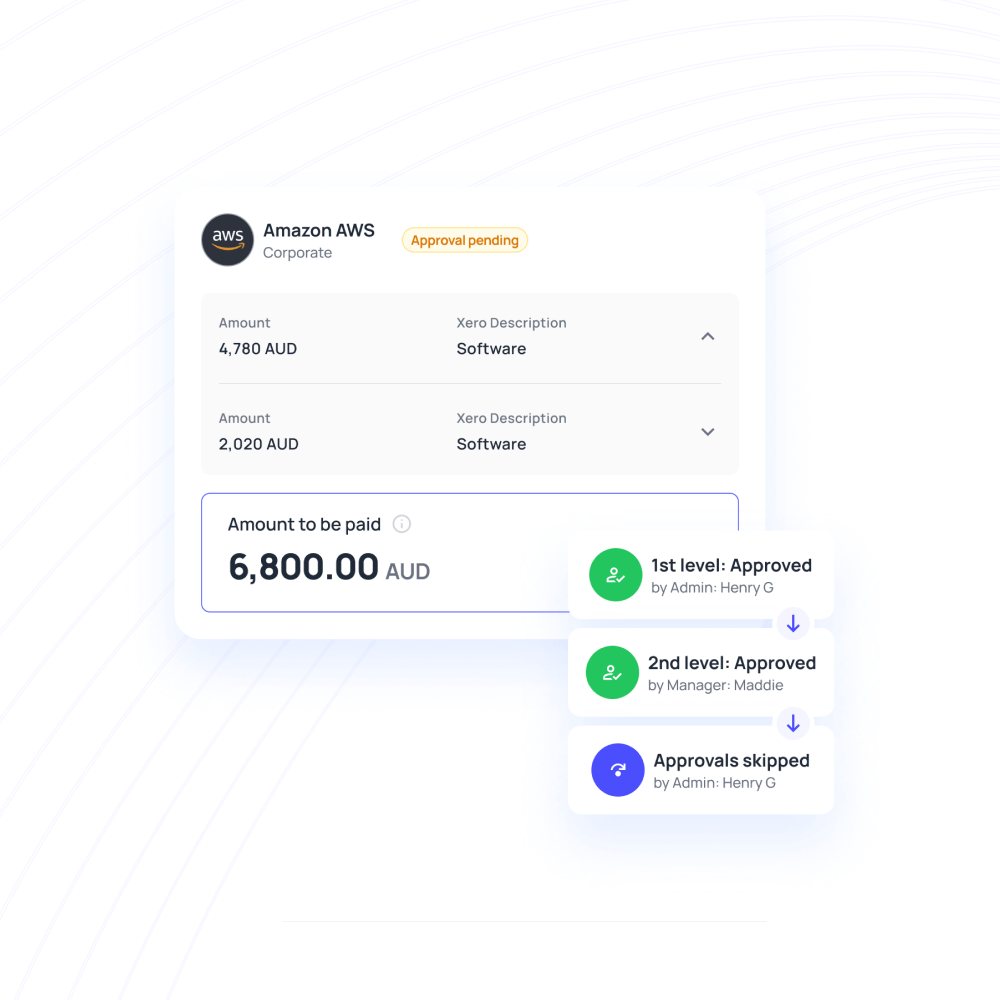

Approval flows with multi-level verification

The security of your cards also comes with multi-level approval systems. You can set up multiple tiers of approvers, all of whom verify expenses and fund requests. This is combined with push notifications and instantaneous payouts to ensure that everything happens with transparency.

Different cards can be linked to a different project so that the relevant approver greenlights a relevant transaction. Any non-compliant transactions on these cards automatically get declined, saving effort for everyone!

Easy employee expense management

Assigning each employee with a virtual card is very easy and you can set custom departments and projects, as well as spending limits, for each one of them. This ensures that the approvers for the transactions are aware of why the money is being spent, preventing delays.

Leveraging the accountability of virtual prepaid and credit cards, all expenses made using our corporate cards are similarly tracked in real time. You can be sure any attempts at internal fraud or non-compliant expenses will be instantly detected.

Easily integrate with expense systems

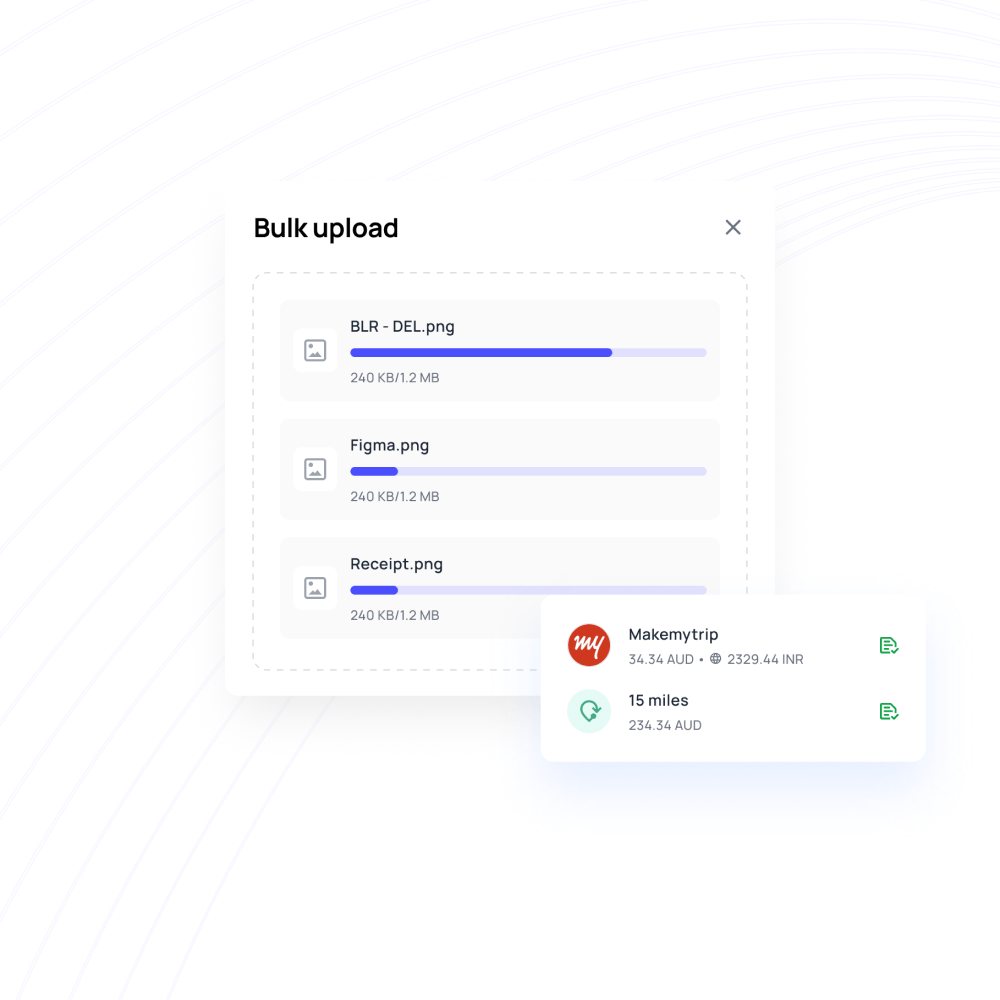

A virtual card is a payment tool that is easy to link with an expense reporting system. Most of the time, the virtual card providers themselves have a capable expense tracking and reporting platform that updates transaction data in real time. Volopay’s expense management dashboard lets you see all transactions for the virtual cards issued for your employees, and managers can view transactions for their assigned departments/projects.

This helps the finance team stay on top of how company funds are being spent by employees who have access to virtual cards. It also allows employees to add documentation to supplement transaction records.

Experience secure and seamless transactions with virtual cards

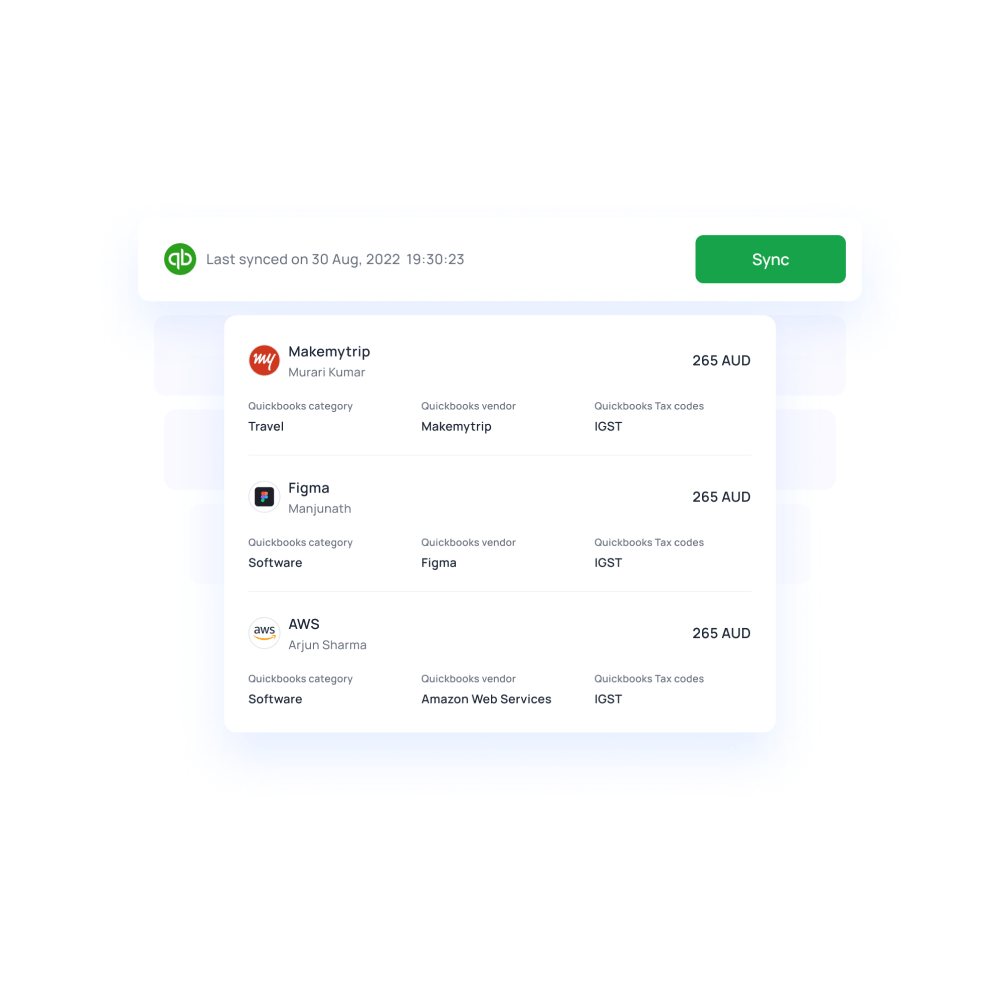

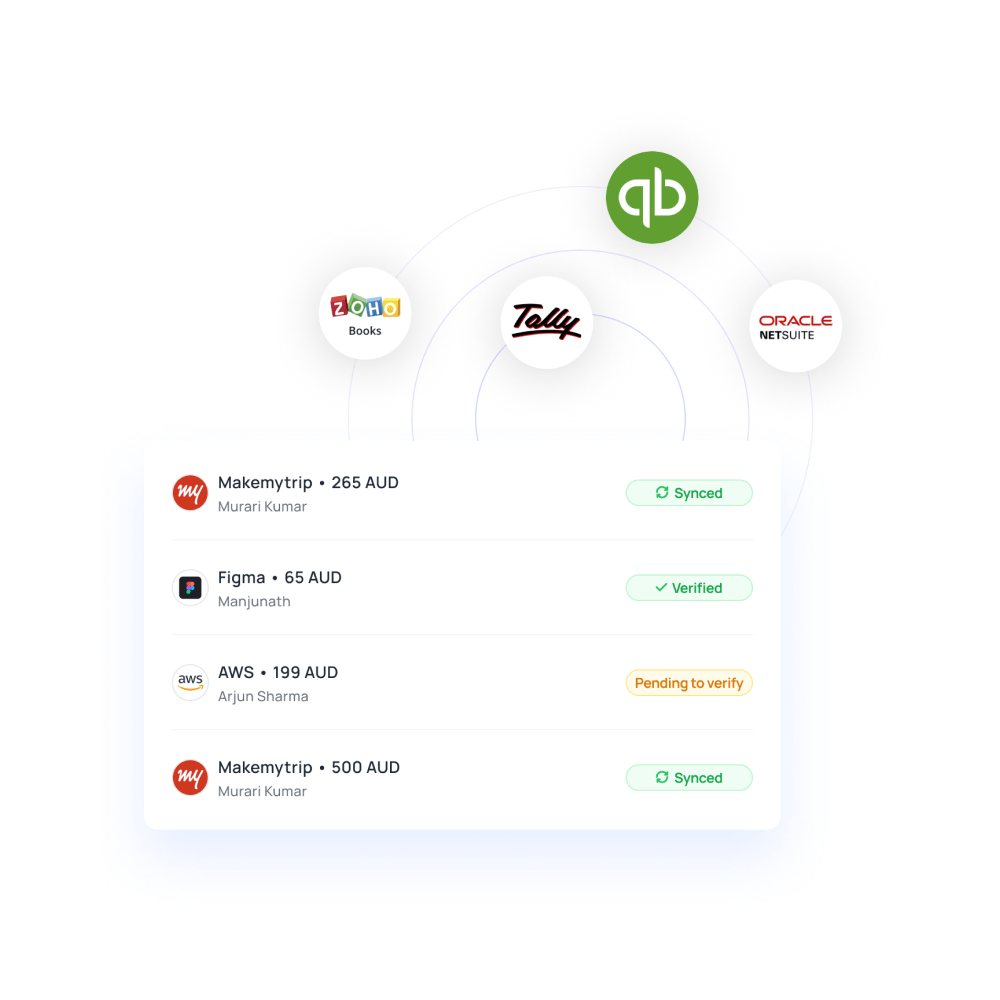

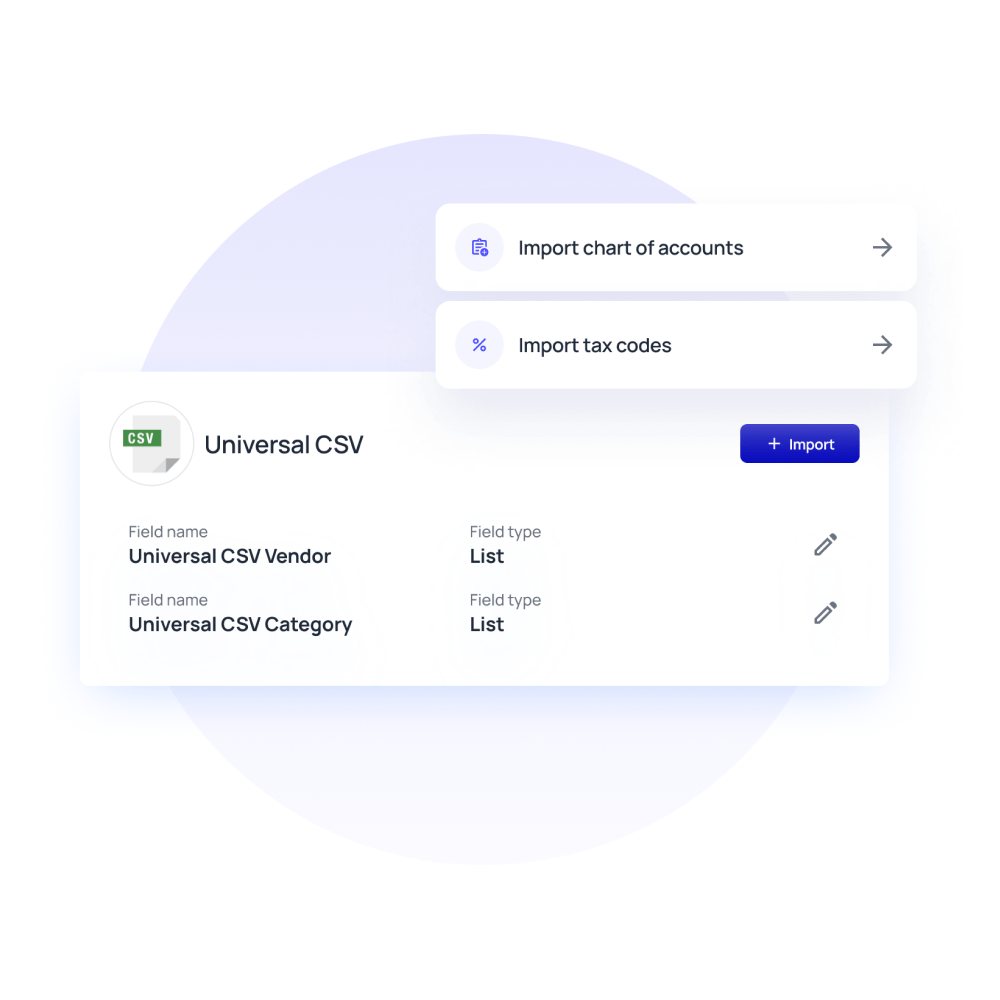

Integrate with accounting systems

Virtual cards often operate using platforms that are capable of integrating with accounting and bookkeeping systems—Volopay does too. This makes it easier for virtual card users to sync and export their expense data seamlessly into their accounting software, without resorting to time-consuming manual data entry.

Volopay allows you to manage expenses using business virtual cards, but it also gives you a chance to make sure the transactions are recorded correctly in your ledgers, and synced with the data in your accounting software through two-way integrations and Universal CSV exports.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

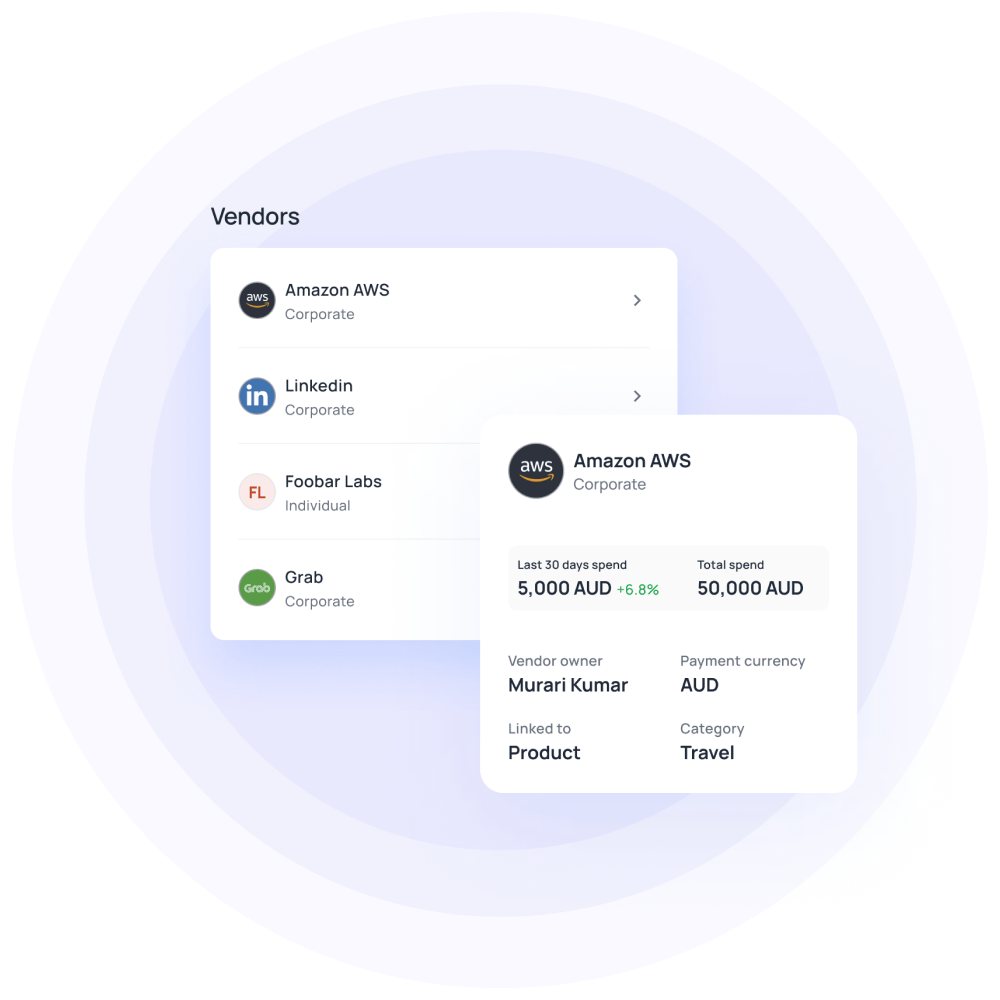

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

How do virtual cards work?

Virtual cards work just like any other payment card (such as a credit or debit card). They have a unique 16-digit number, expiry date, and CVV that you must enter to make payments online. The difference is that you can only use these cards for online payments as they are not tangible in nature and only exist virtually in a digital format (that is to say, on a device like a computer, tablet, or smartphone).

Another unique aspect of prepaid virtual cards (or virtual cards, in general) is that they are made through a method called tokenization. Tokenization is when a card’s details are replaced with a unique code or token, allowing you to make online purchases without revealing sensitive card details.

A great benefit of this is that you can do this as many times as you like and create unlimited virtual prepaid cards for your business to handle different types of expenses in a secure manner.

How does Volopay's card benefit your business?

1. Employee expense management

In a specific company there may be many employees that need access to the company budget on a day-to-day basis. It can become tedious to manually give them approvals to fund requests for each task.

Instead, a company can issue prepaid virtual cards to their employees and give access to funds in this manner.

2. Supplier and vendor payments

Paying your suppliers and vendors are a critical part of the business to keep operations running smoothly. You can issue virtual cards to make payments to your suppliers and vendors.

These are great payment tools even if your vendors or suppliers are abroad as you can make international payments using your virtual cards.

3. Subscription services and recurring payments

One major area of payments for any modern business is for all the SaaS tools or subscription services that you use. Many teams and employees might be using different subscriptions across the organization.

You can use virtual cards to track and ensure that there is no duplicate purchase of a software service and that all payments are being made with efficient utilization.

4. Online and international transactions

Virtual cards are the perfect tool for making payments online. The reason they are better than using a traditional card is because of the added safety and security that is provided by them.

Because a virtual card is tokenized, it is safer to use it online for domestic and international payments as your actual card details won’t be compromised. Plus you can easily freeze or block the card instantly if the card is compromised.

5. Employee & business travel expenses

While a virtual card cannot be used physically while traveling for business purposes, it can still be used to make bookings for corporate travels online.

Things like booking flights and accommodation is a great way to use the virtual card for business travel while keeping your payment and financial data safe and secure.

Virtual cards for secure and fast payments

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

How to introduce virtual cards in your organization

Defining spending policies and guidelines

Implementing virtual cards for your business might be easy, but if it is not done in a proper way, it can lead to more issues.

You need to ensure that you also establish concrete spending policies and guidelines for how an employee can and cannot use a virtual card that is issued to them.

Monitoring and tracking transactions

Once your organization gets into the flow of using virtual cards for business, the finance team or administrative team must monitor these transactions.

This way you will be able to ensure that the employees are using the payment tool correctly and in an efficient manner.

Training employees on virtual card usage

Once the necessary policies and spending guidelines have been established, the company must also ensure that each employee gets trained on its usage.

Different aspects such as how to request a new card, how to use it online, whether it can be used multiple times or it is a single-use card, etc. must be taught to the employees.

Regularly reviewing expenses

Another reason to regularly monitor and track all transactions is to use this data to analyze the spending behavior of employees, teams, and the organization as a whole.

This will help you get insights regarding the spending patterns and behavior which in turn will help the company make smarter financial decisions and optimize its processes.

Volopay virtual cards—best usage practices

Allocate individual virtual cards

Many employees find expense reporting to be a tedious and time-consuming process, but virtual cards can help streamline business spending.

By creating unlimited cards, each authorized employee can be assigned their own card, which can also assist in tracking and regulating employee and department expenses.

Assign a unique department or project

Each business virtual card can be connected to a department or project for a precise approval cycle, accurate reconciliation, and verifiable spending. Moreover, it also allows for accurate budget tracking.

By routing departmental funds to card payments, you can get a clearer view of how your company's funds are being used and can have more control over their utilization to avoid overspending.

Track your employee spending

Virtual cards can provide employees with the ability to handle their own business expenses without depending on the accounting teams.

At the same time, these cards can also assist accountants in monitoring how employees are spending their money and can be useful for maintaining compliance with expense policies.

Implement spending limits

Giving employees their own cards empowers them to make business purchases on their own, while also putting limits in place to control spending.

For expenses that may be unpredictable, you can create virtual cards with adjustable limits to provide the flexibility.

Set multi-level approvals

If a cardholder needs to go over their assigned spending limit, or change how often the card is reloaded, they can request additional funds and get them approved.

Transactions can also be approved if they’re initially auto-flagged to allow for exceptional situations—this is possible through comment sections where payment initiators can have a record of their supporting documentation.

To ensure compliance with your company's spending policy, you can set up customizable approval processes for these requests.

Automate payments

Subscription payments can be difficult to track, since it’s easy to forget the payment cycle or forget to cancel a transaction. This can result in either an unnecessary loss of funds or loss of access to a service, both of which are inconvenient.

However, virtual cards for businesses can help you to automate these payments, eliminating the need for manual payment. You can use them to set up auto-payments with your SaaS provider for a hassle-free subscription management experience.

Vendor payments made easy and fast

What are the security features of virtual cards?

1. CVV (Card Verification Value)

Generally, payment cards have a 3 or 4-digit CVV code printed on the back to authenticate and execute payments. This allows the user to stay safe from theft and fraud online—even if your card number is compromised, you cannot complete a transaction without the CVV.

2. Time-limited usage

Unlike physical cards, a virtual card can be created according to your specific needs. For example, virtual cards can be single-use or multiple-use in nature.

You can freeze them or block them the moment you don’t need them anymore.

3. Geographical and merchant restrictions

Restrictions based on location or specific vendors can allow fraud prevention. This is not only to avoid the card being used maliciously if the data is ever leaked, but also prevents employee fraud, by declining transactions for vendors outside of company policy.

4. Two-factor authentication

One of the most important and prominent security feature is two-factor authentication. This is a system such as receiving an OTP (one-time password) on a mobile number or email to confirm a payment request. This ensures that even if someone else gets access to your virtual card details, they cannot confirm the payment if they do not get the OTP you received.

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our virtual cards

Volopay brings together the innovation of smart cards and bill payments, combining them with efficient accounting, approvals, and reimbursements. It’s a single place to get all your expense needs met.

Subscription management

Manage your subscriptions with a single click. Create payments and schedule them to avoid any kind of late fees or disruption in services. Real-time tracking lets you avoid multiple payments. And pause options stop you from overpaying for SaaS models you no longer require.

Real-time visibility

Virtual cards for business are most efficient when you can monitor the payments easily. Your expense reporting system is designed for complete transparency and accountability. The details of all your transactions are updated as soon as they happen, allowing you to have an eagle-eye view of all your cash flow.

Whether it’s accounts payable or a quick swipe of a card, all of it gets recorded with accuracy immediately.

Multi level approvals

Bring in a level of responsibility by utilizing maker-checker systems and approval levels. On the platform, you can create up to 5 levels of approvers, all of whom verify and ensure that payments are in order and nothing is done frivolously. Pre-set limits ensure that non-compliant transactions get declined automatically.

Accounting automation

From the first card swipe to the books being closed, your account structure can benefit greatly with the help of accounting automation. The world’s most beloved accounting software list integrates easily with our platform for seamless reconciliation and data analysis.

No need to sync manually. Just integrate and watch two automated systems work in tandem to keep your data updated.

Explore more about virtual cards

Explore our guide on virtual credit cards to learn what they are, how they work, and how they offer enhanced security for online purchases.

Get to know everything about virtual debit cards for business in our guide. Learn how they work, their benefits and how to get one for a safe and secure business transactions.

Explore how virtual cards can simplify employee expense reporting by reducing paperwork, automating expense tracking. Our guide explains how virtual card is a convenient payment option.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Paralleldots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

Bring Volopay to your business

Get started now

FAQs on virtual cards

Yes, it is possible to create virtual cards for business for free in Australia. There are a number of financial institutions and payment service providers like Volopay that offer virtual card services that you can use to make online payments, manage expenses, and track your business transactions.

In Australia most big banks like Commonwealth Bank, Westpac and HSBC provide virtual credit cards while other, more modern financial platforms like Volopay provide virtual corporate cards.

Yes, it is perfectly legal for licensed and compliant banks to issue virtual credit cards in Australia. It is also legal for other compliant providers and financial platforms like Volopay to issue virtual cards in Australia for corporate use.

Setting up a free virtual credit card is dependent on which provider you choose. For example, with Volopay all you need to do, for a virtual corporate card, is create an account, get on the dashboard, click a few buttons, and you'll have your card within seconds.

Providers issue a virtual credit card number as soon as your application for a card is processed. On platforms like Volopay, your card details are generated as soon as your card request is approved. The number of the card created is automatically generated and visible to the owner of the card.

The number of times a virtual credit card can be used depends on the provider you choose as well as card type. For example, with Volopay you can create one-time or monthly recurring virtual credit cards. Users can also choose a custom expiry date for it.

With some digital banks you do get the option to create virtual cards pretty quickly. Better, faster options for creating virtual cards instantly come with setting up an account with platforms like Volopay where all you have to do is click a few buttons to get your card.

A burner or one-time credit card is essentially a single-use card. They mostly come in digital form and are used for online transactions. Using Volopay you can create unlimited burner virtual credit cards for various different online payments.

Yes. Considering that virtual cards don’t have a physical form, it could be argued that they’re even safer than physical cards. You won’t run into the risk of losing your virtual cards.

Not only that, but you can also create virtual cards for one-time purchases, meaning that your virtual card details won’t be tracked after the one-time payment.

Generating a virtual card doesn’t cost you money. They are also generally free to use. However, when used to make a payment, a small service fee might be applied to the receiver of the payment. This would function similarly to a credit or debit card payment in a store.