Prepaid debit card to manage and simplify employee expenses

Empower your team with business prepaid cards. Top up your cards, assign them to employees, and allow them to access company funds while controlling your business expenses.

With prepaid cards, you can guarantee that your funds are always spent according to your company policy. Start using a prepaid business debit card for more convenient expense management. Bypass long reimbursement processes, track all employee expenses, and easily reconcile all your business spending within minutes. Get both convenience and security hassle-free.

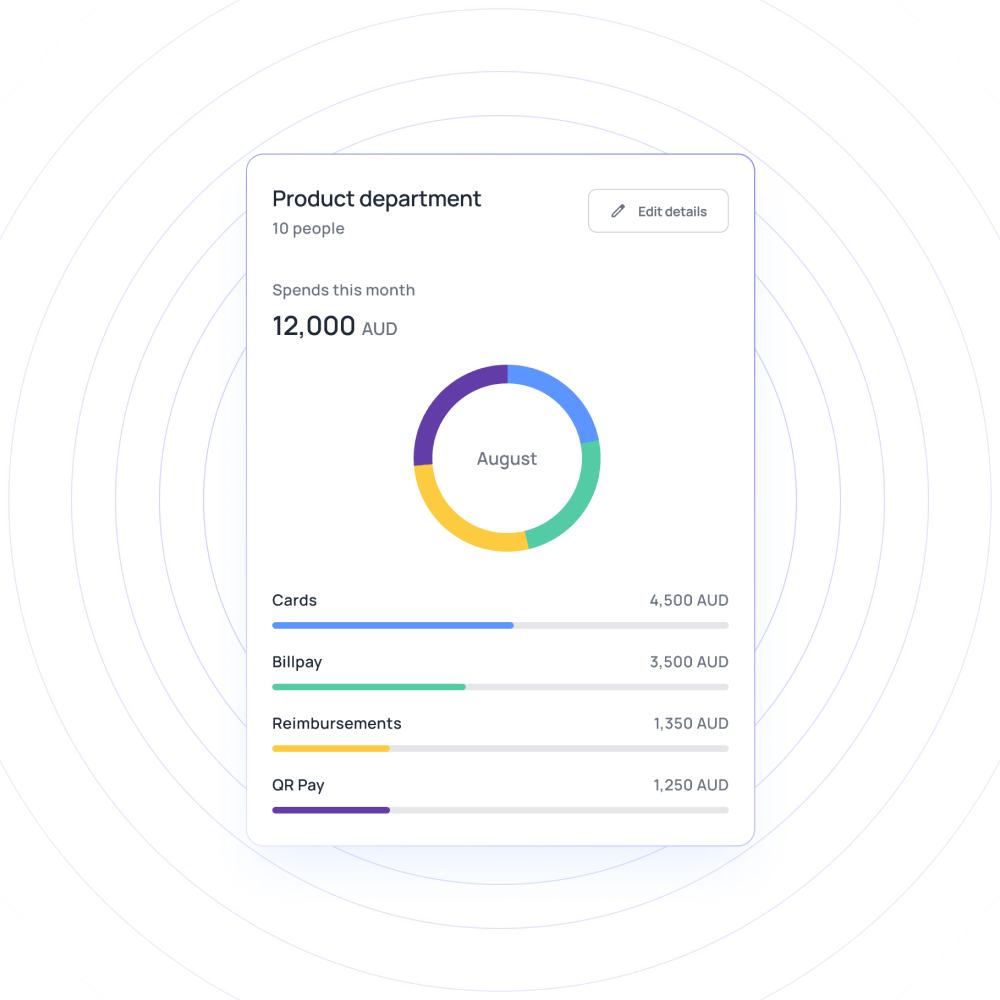

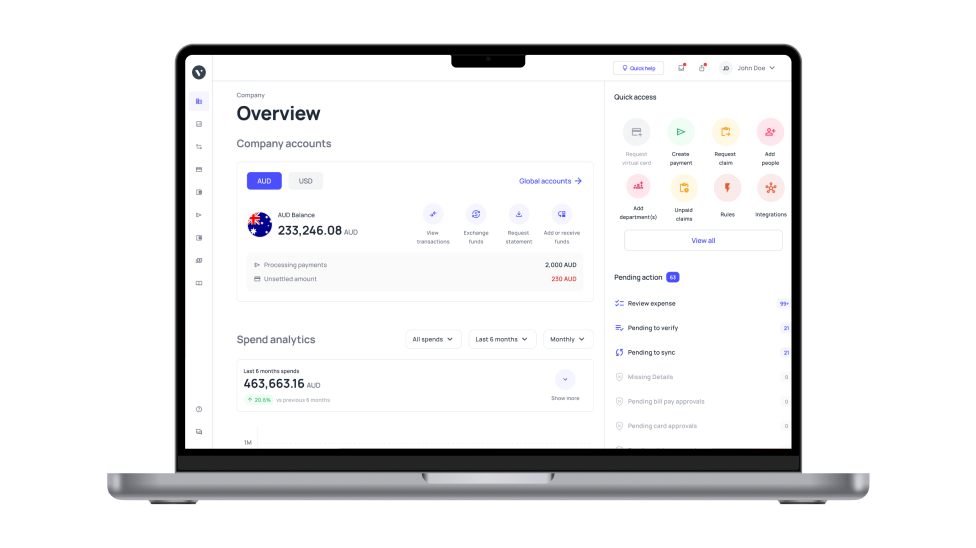

Better visibility of cash flow with prepaid cards

Tracking how your money is used as easy and practical with business prepaid cards. You can simply load the exact amount of money for each purchase you want to authorize.

No more waiting for your end-of-month statements and bills to shock you. Get a better grasp on your cash flow and achieve full visibility with your prepaid cards.

Real-time updates with business prepaid cards

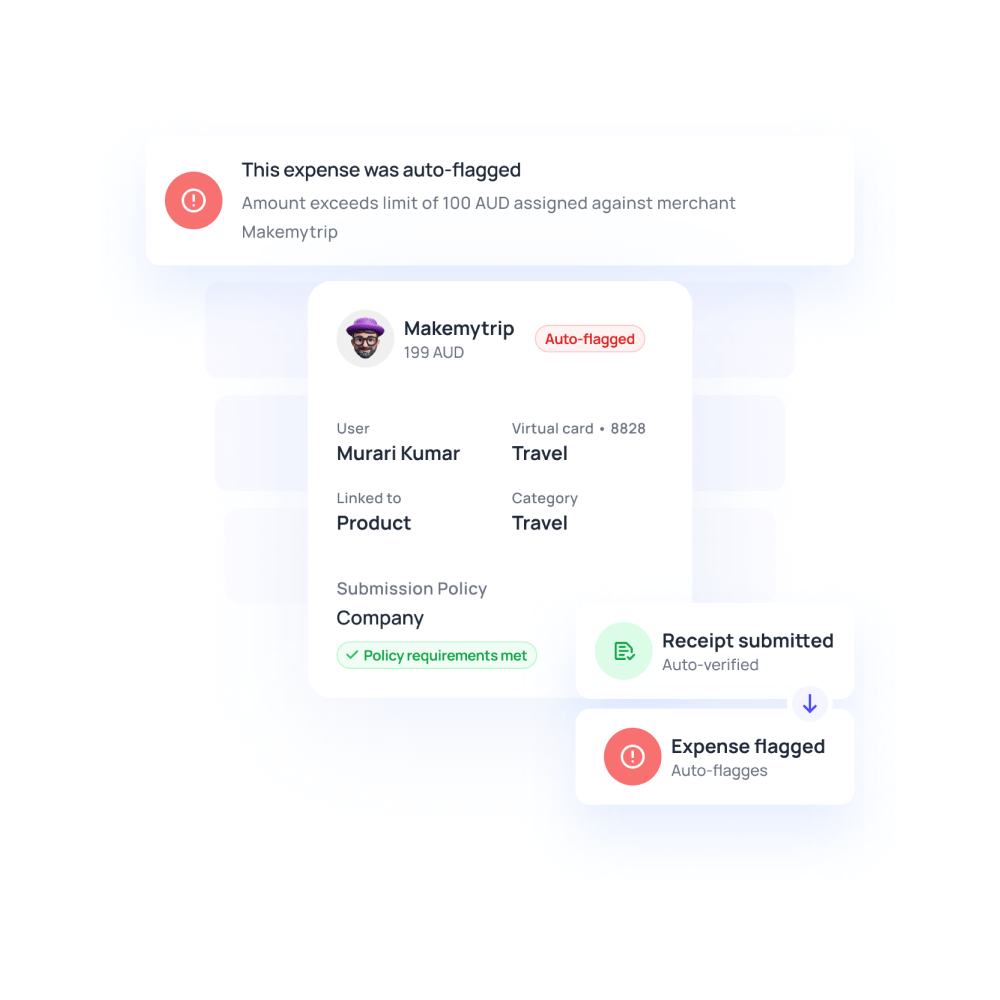

Your card dashboard is updated in real-time for your convenience. Every time an employee uses a business debit card, the transaction will show up immediately on the system.

Monitor the way you and your employees spend your company funds at any time from anywhere. You’ll know when your debit card for employees is low on funds.

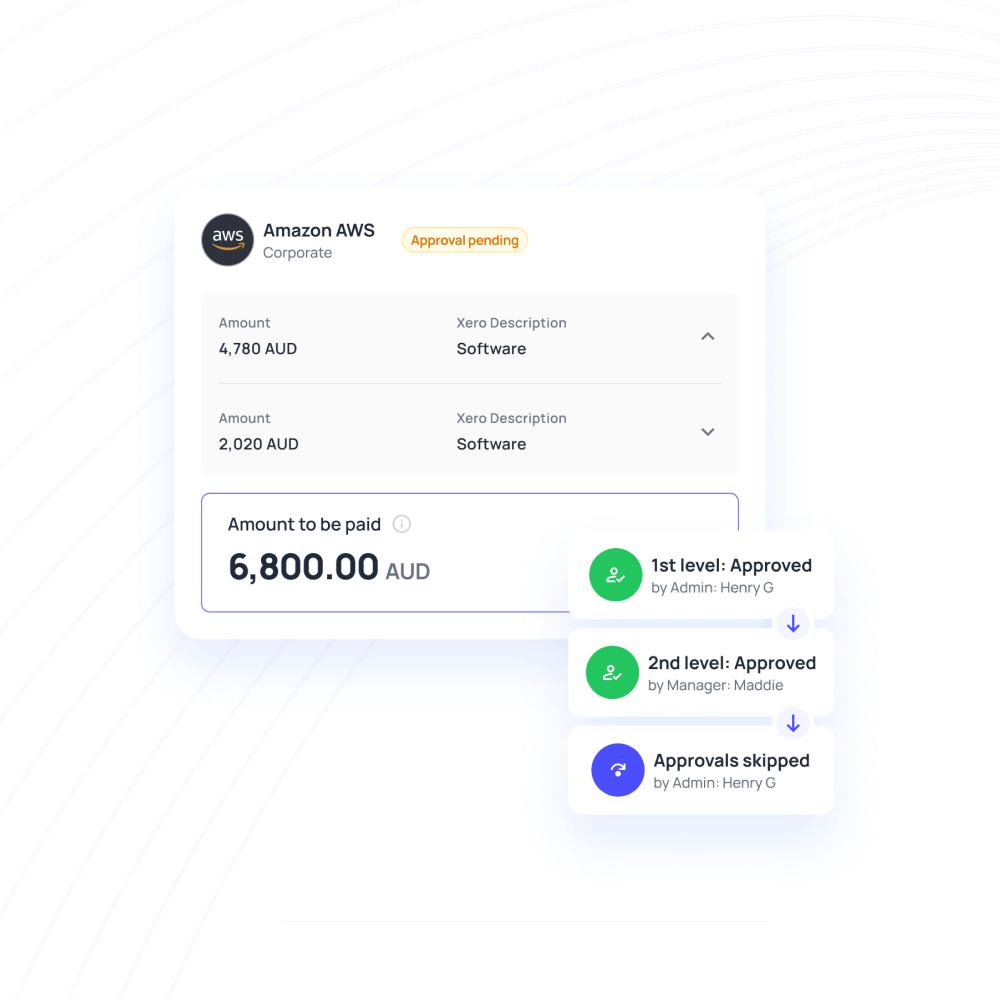

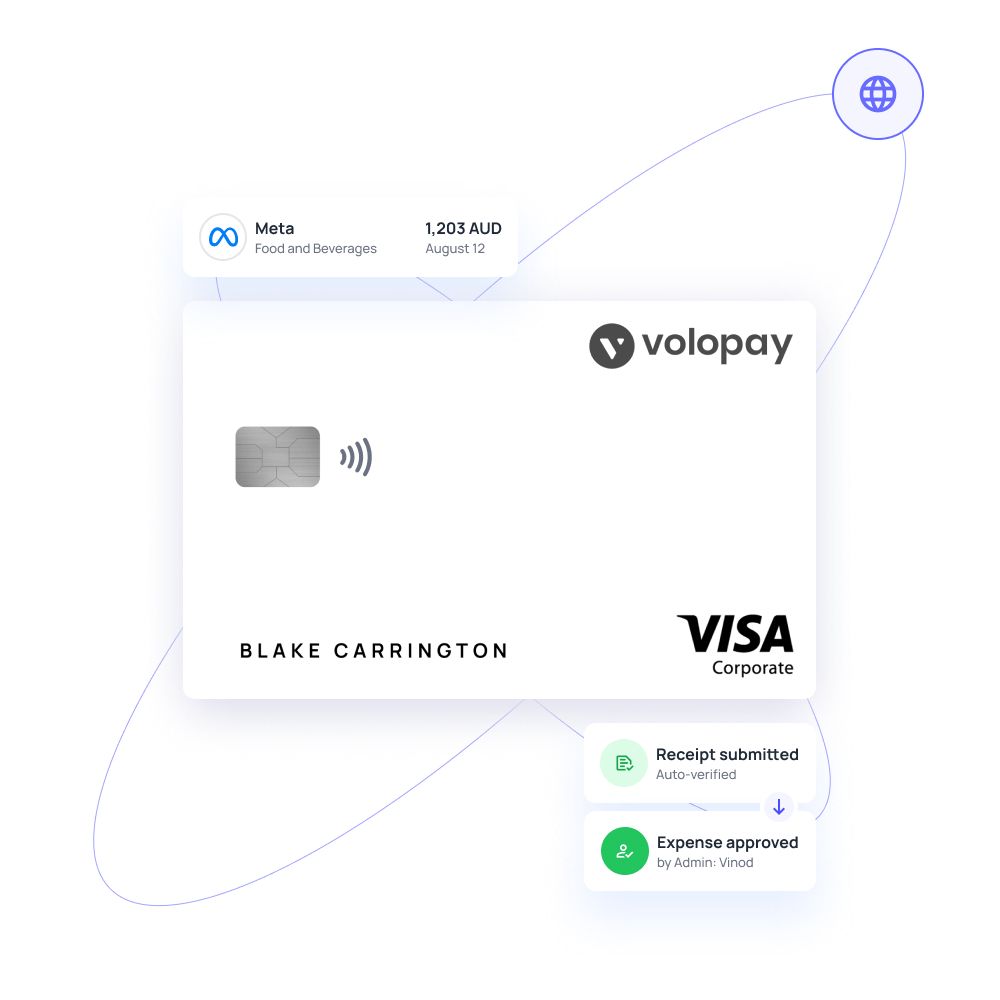

Multi-level approvals with prepaid cards

Say goodbye to long and complicated desk-to-desk approval workflows. Set up multi-level approval workflows through your cards dashboard instead. Link cards to unique projects and budgets so that approvals are streamlined. Comments and discussion sections allow speedier compliance.

When employees use prepaid cards for business expenses and submit reports, approvers can automatically be notified. Create a digital workflow for efficiency and ensure that every expense is monitored, reviewed, and approved correctly. You can also bulk-order personalized cards so that your teams are equipped with physical corporate cards much faster.

Streamline your business financial management with Volopay cards

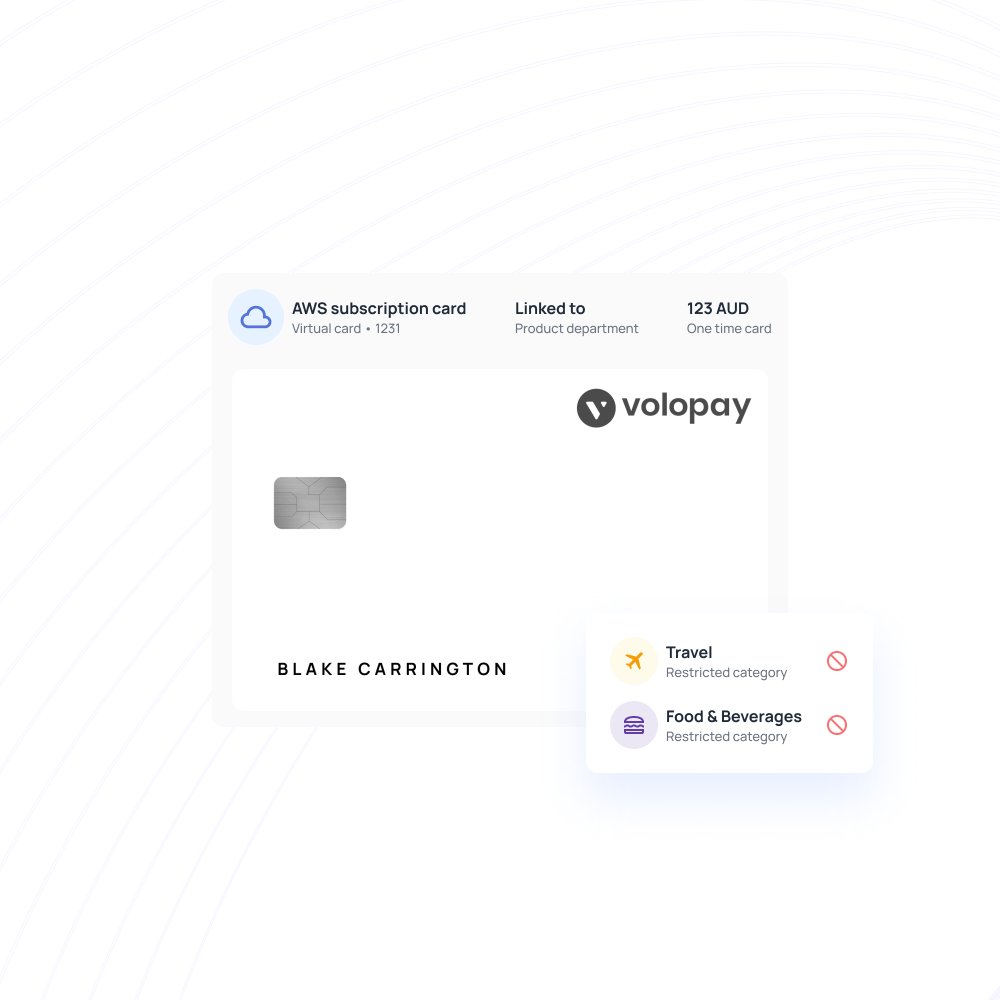

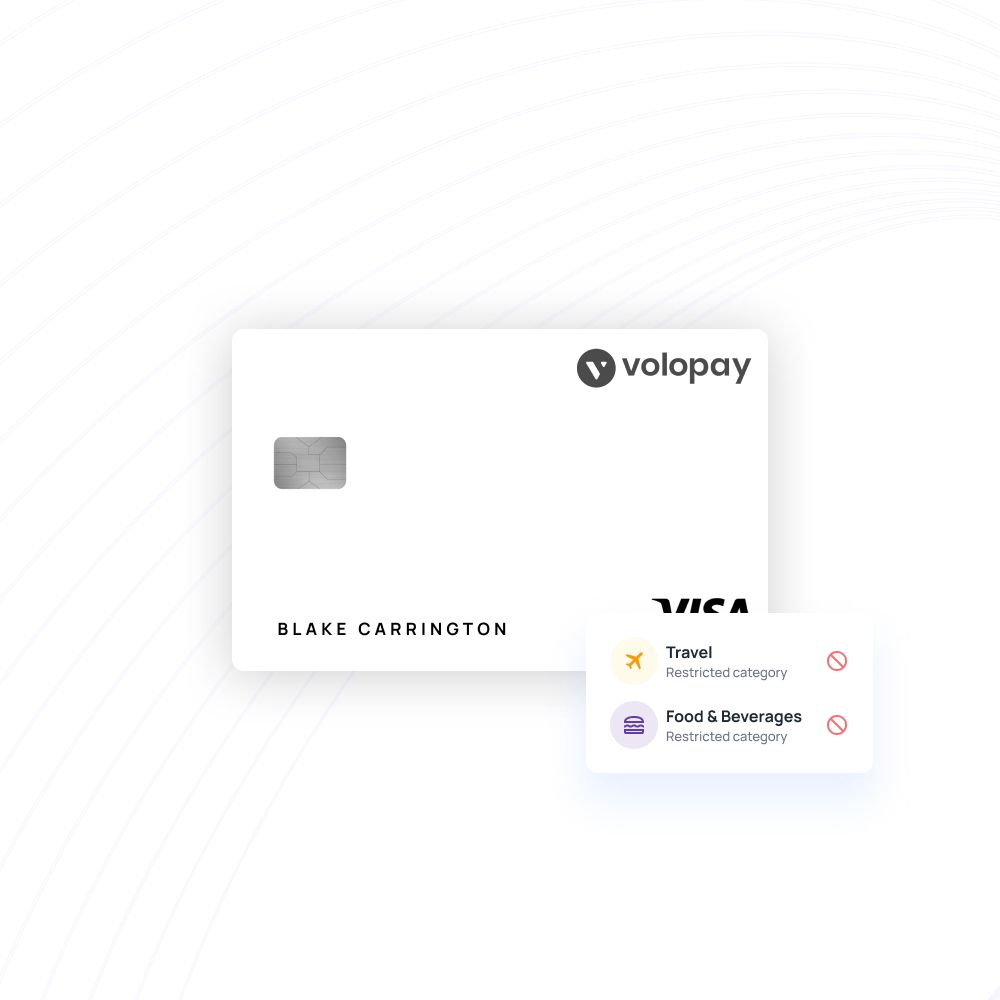

Safer transactions with controlled spending

Get a safe and reliable way for employees to make business expenses using business prepaid cards. Always ensure that employees are only spending the amount you’ve authorized by topping up your cards accordingly.

Toggle online and offline transactions depending on your usage, make it easy for your employees to submit expense reports, and review expenses from anywhere.

Do expense tracking and reporting

Business prepaid cards offer robust expense tracking and reporting features. Transactions made with these cards are automatically recorded and categorized, easing the burden of the employee from manual expense reporting.

Additionally, comprehensive reports provide valuable insights into spending patterns, making budget adjustments and financial planning more data-driven. This will ultimately help the organization make its spending more efficient.

Convenient business transactions

Corporate prepaid cards offer a secure and convenient method for conducting business transactions. By using these cards, employees can make purchases or payments without relying on cash or their personal credit cards.

This reduces the tedious task of filing & processing reimbursements and also reduces the risk of fraud and unauthorized spending, providing peace of mind for both the company and its employees.

Gain better control over your company's finances with Volopay

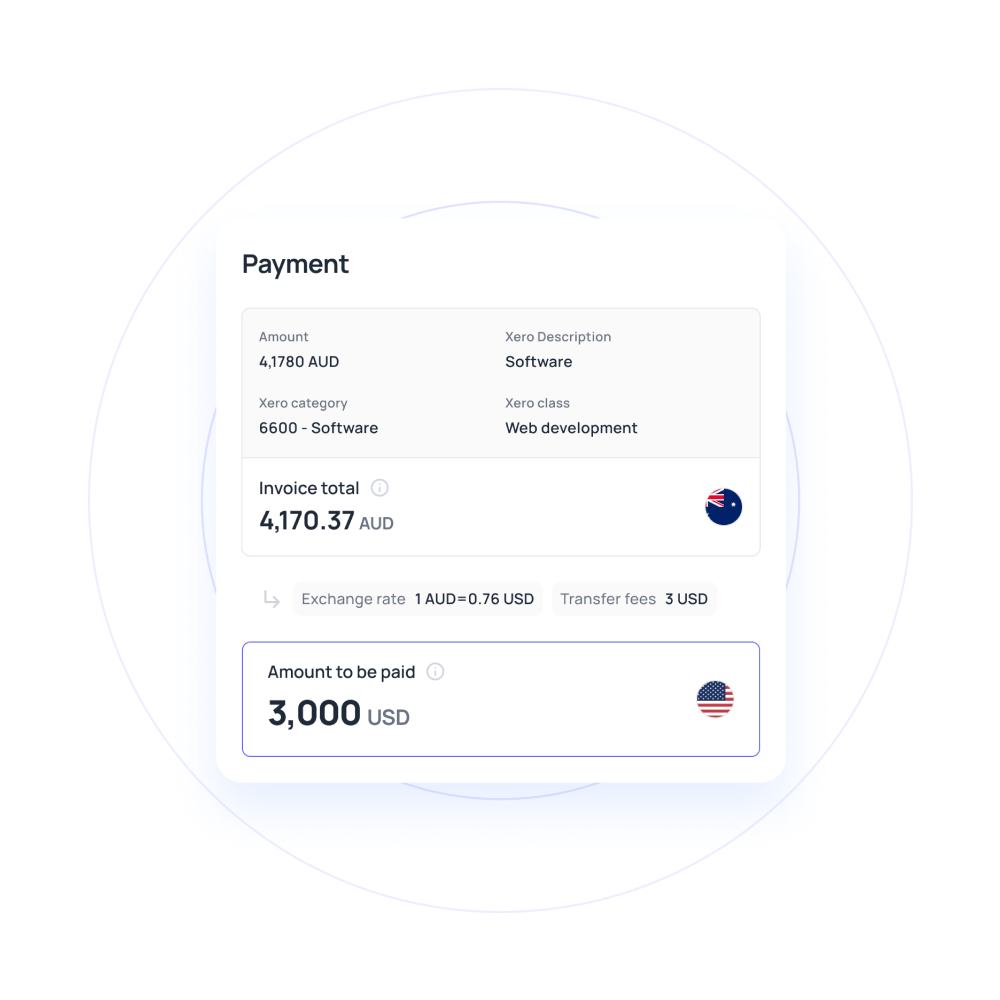

Supports multi-currency transactions

For businesses operating globally or dealing with international clients, multi-currency support is essential. Corporate prepaid cards equipped with this feature allow employees to make transactions in different currencies without incurring hefty conversion fees.

This not only simplifies overseas expenses but also helps manage foreign exchange risks effectively.

All-in-one cards for business subscriptions

Consolidating multiple business subscriptions onto a prepaid card simplifies expense management. Businesses can link various subscriptions, such as software, cloud services, or streaming platforms, to a single prepaid card.

This streamlines payments, reduces administrative burdens, and provides better visibility into subscription expenses. You can also use different prepaid cards to manage different types of subscriptions for each team.

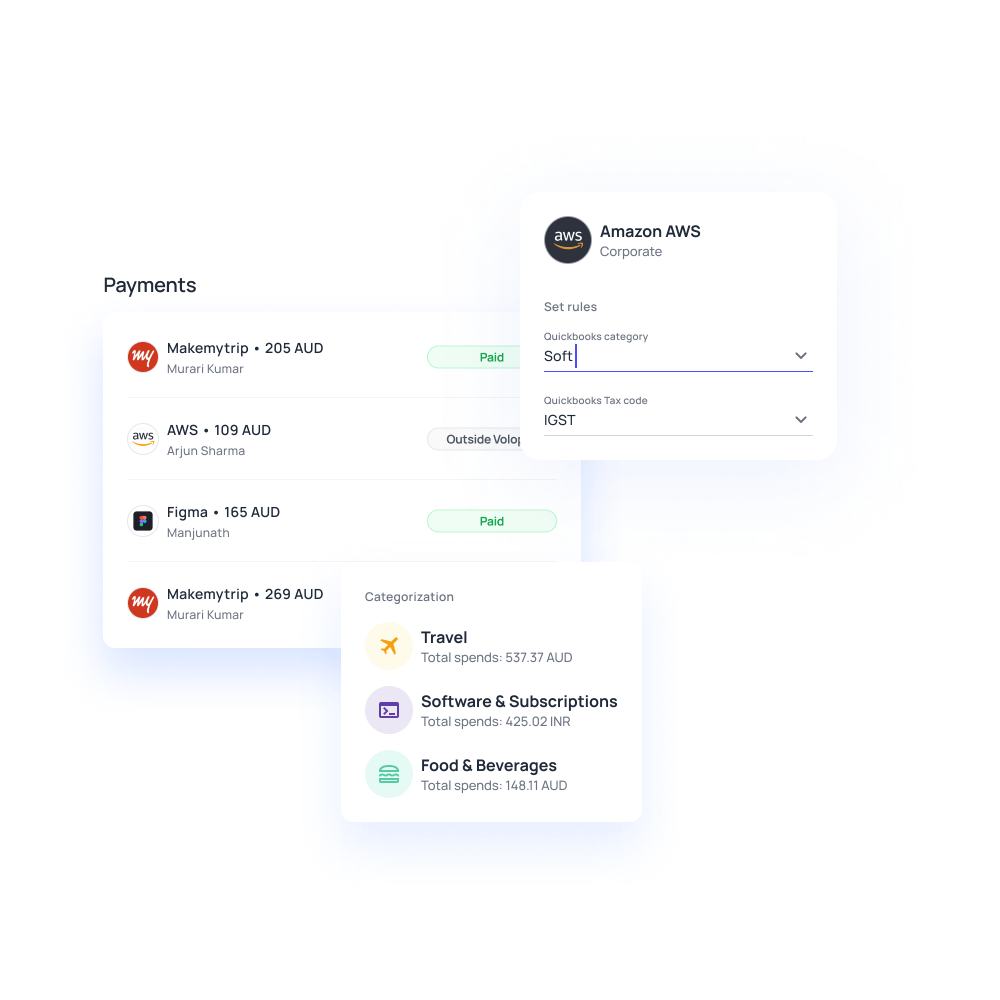

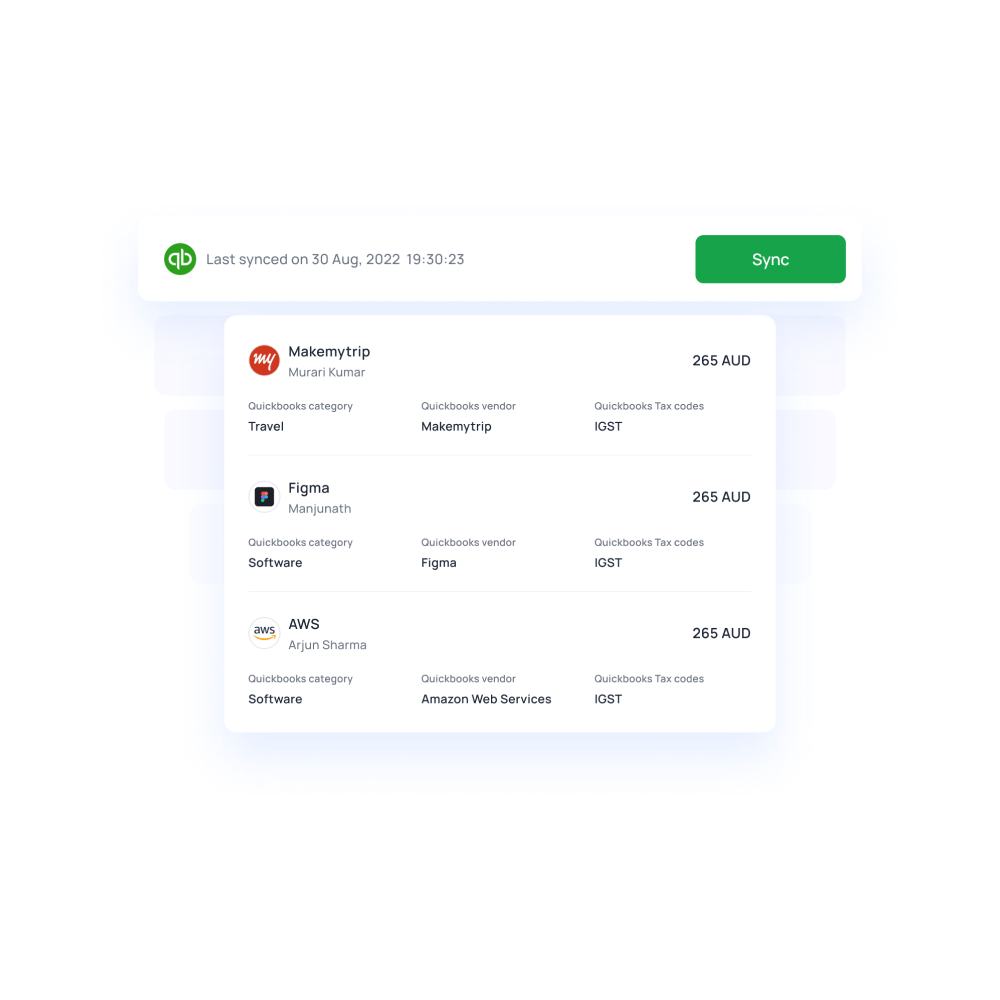

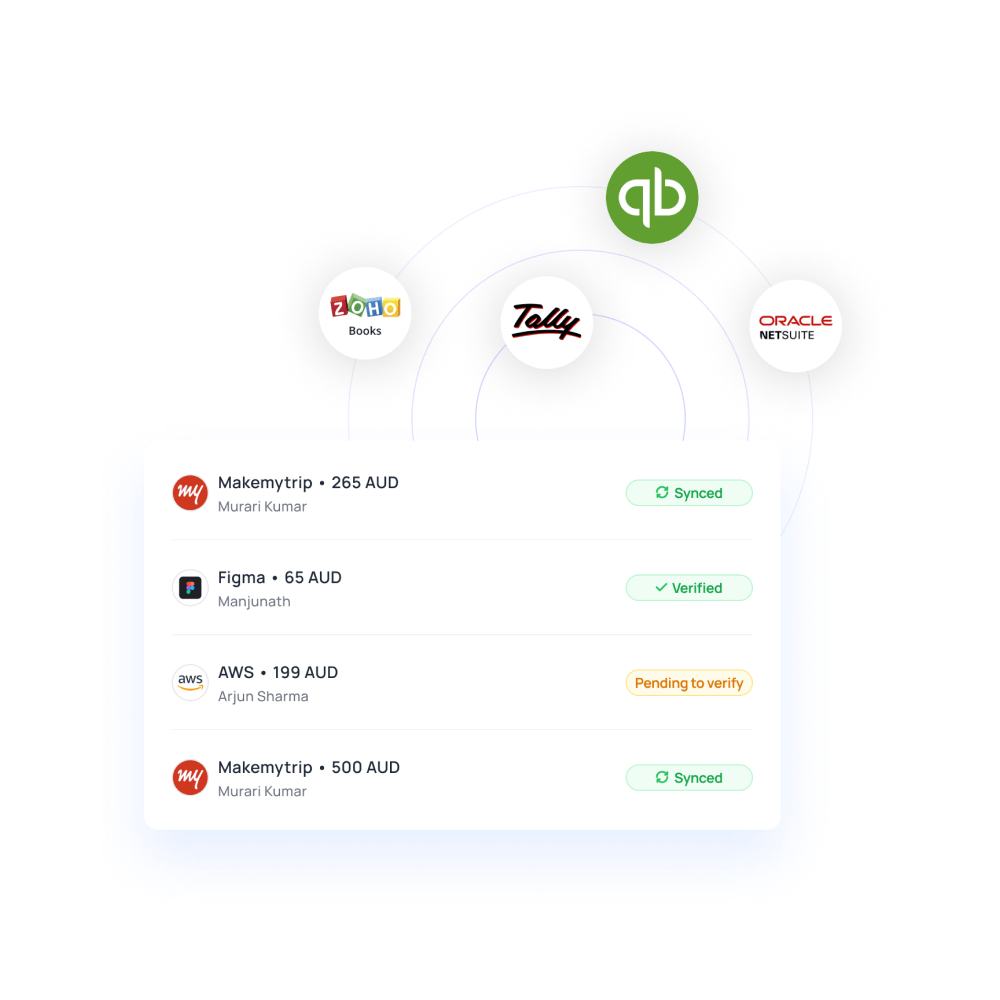

Integrate easily with accounting systems

Skip manually reconciling your card expenses at the end of every month. Volopay’s business debit card integration allows your finance team to reduce their administrative workload and avoid human errors. Advanced rules let you auto-tag and auto-classify card transactions based on which user made the expense, and under what conditions.

Make accounting easy and ensure that you always have the right data in your accounting software. With just a few clicks, you can integrate your system hassle-free and get automated updates.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

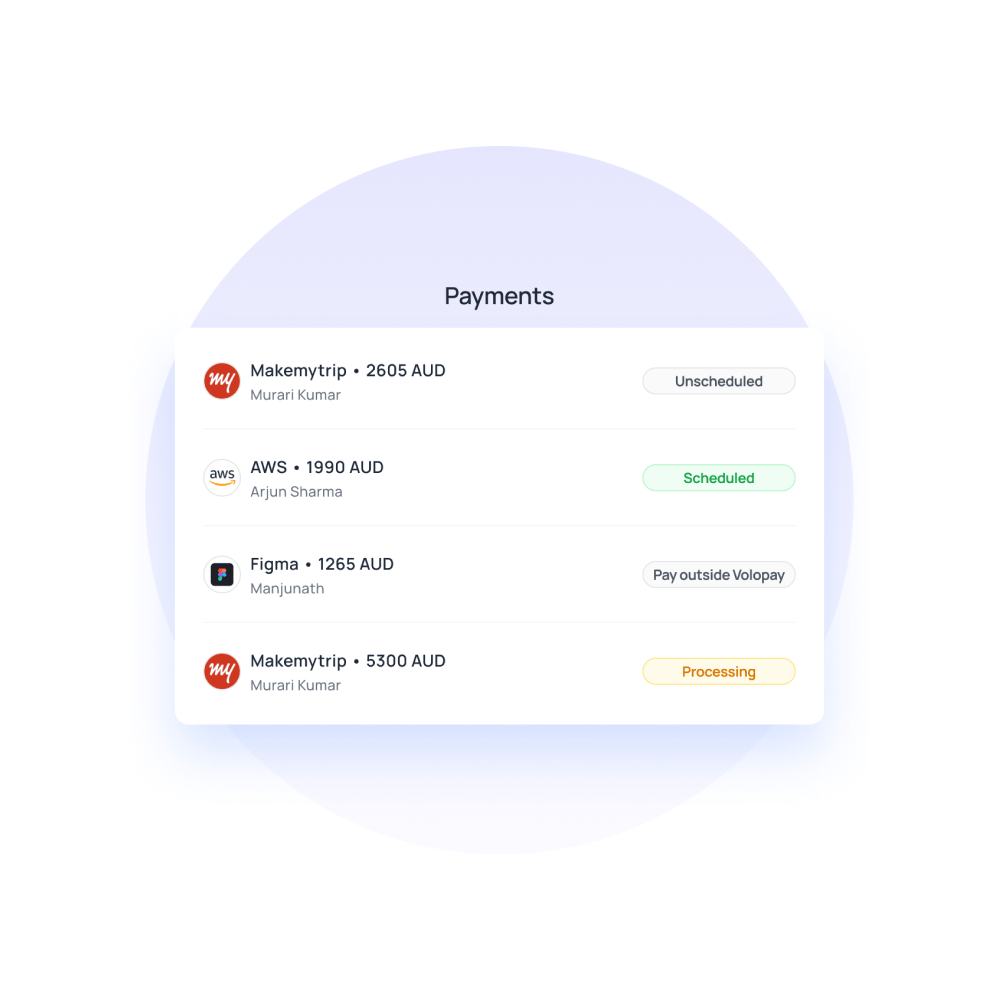

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Use cases of business prepaid cards

Employee expense management

Businesses can issue prepaid cards to employees for their everyday business expenses such as travel, accommodation, and meals. This simplifies the reimbursement process and minimizes the need for employees to use personal funds.

Since the cards are prepaid, the company can be sure that there is no overspending.

Employee & business travel expenses

Prepaid cards are ideal for managing travel expenses. Employers can load cards with specific travel budgets, reducing the risk of overspending and providing a hassle-free experience for employees.

The employees can use these cards to book their flights and accommodation online and also use them for on-ground expenses like commuting and dining.

Employee perks and incentives

Companies can reward employees with prepaid cards as incentives or bonuses.

Corporate prepaid cards as an incentive are great to make the employee feel valued for their efforts. This not only motivates the workforce but also gives employees the freedom to choose how they want to use the rewards.

Department budgeting

Prepaid cards can be allocated to specific projects or departments, allowing for better budget management and cost allocation. There are many cases where a specific project might come up that requires a separate budget.

Issuing a prepaid card specifically for it is a great way to manage all the expenses for that project.

Temporary or contractual workers

There might be instances where your team needs to hire or work with a freelancer. The payment set up for such an individual or agency will not be the same as an employee.

For temporary or contractual workers, prepaid cards offer a convenient way to provide necessary funds without the complexities of a traditional payroll setup.

Online purchases and subscriptions

Prepaid cards are suitable for managing online purchases, subscriptions, and recurring expenses, making it easier to track and control costs.

You can simply set up the card just like any other payment card. An added benefit is that you will never overspend as there is only a limited budget on the card.

Petty cash management

Prepaid cards can replace petty cash systems, minimizing the risk of loss or misuse and simplifying record-keeping.

It is much harder to keep track of cash and the change that you get when you complete transactions as compared to simply making payments through cards.

Business event expenses

This is also a type of project that can come up in a business. When organizing business events or conferences, prepaid cards can be used to manage the various expenses for speakers, attendees, and logistics.

It may also come in handy for food and dining expenses for the organizers.

Controlling vendor payments

Businesses can use prepaid cards for vendor payments, ensuring timely and controlled disbursement of funds.

You can set up monthly recurring funds to ensure that no extra payments are made to a vendor by accident or intentionally.

Experience flexible and safe payment with Volopay cards

Why should you choose Volopay cards?

Easy to get

Getting prepaid cards doesn’t have to be difficult. Apply for Volopay easily online. Within the week, you can get started with Volopay and immediately order your cards.

No hidden fee

Every cost to your business debit card is accounted for. You won’t run into any hidden fees that will surprise you. No need to fear hidden fees that’ll pile up!

Easy accounting

Sync your Volopay account with the accounting software of your choice, allowing you to reconcile physical card transactions with a click of a button.

Monitor spends easily

With Volopay’s card dashboard, you’ll know when, where, and how your money is being spent at all times. Every time a card is swiped, your ledger will be updated.

Unlimited virtual cards

Utilizing virtual cards will streamline your expense management and give you better visibility into your spending. Assign each Volopay virtual card to a vendor and never miss recurring payments.

Safe and enhanced security

Volopay has industry-standard ISO and PCI DSS certifications that ensure the safety of all your data. All your Volopay cards are guaranteed to have enhanced security for your comfort.

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Consistently rated at the top

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our prepaid cards

Volopay is a single platform that incorporates approvals, corporate cards, bill payments, cost reimbursements, and accounting automation. All of these are available from any device, at any given time.

Real-time expense reporting

Create an expenditure reporting system that allows you to see where, when, and why each item was made. The report can be created using custom filters, so that your reports only show the information relevant to analysis and data capture. Forecasting and proactive financial decisions are much swifter.

Business credit

Get a quick credit line for your day-to-day business expenses, without jumping the hoops required of a traditional business loan. Instead, use the credit line, loaded into corporate credit cards for all your employees to use. Start spending more efficiently with flexible cycles of payments and lower rates.

Multi-level approvals

5-tiers of approvals to make sure that no transaction is missed, or occurs outside of company policies. In order to handle all staff spending and payments, all fund requests are directed to the company policy and approval algorithms.

Accounting automation

Accounting automation just got better. The world’s most beloved account software options integrate with our system, letting you sync your information in real time. From card swipe to closed books, you can plug and play your expenses with software like Xero, Quickbooks, Netsuite, Deskera, and more.

Explore more about business prepaid cards

Discover our guide on the benefits of prepaid debit cards for your business, and learn how they can streamline expense management and improve cash flow control.

Check out our our detailed guide on business debit cards—what they are, how they work, and the steps to obtain one for your business.

Get to know the best prepaid travel cards in Australia. Learn how these cards can help you manage travel expenses and ensure a hassle-free experience.

Bring Volopay to your business

Get started now

FAQs on physical cards

Yes, getting a prepaid business debit cards is perfectly possible and very easy, depending on the provider. Several banks, financial institutions, and FinTech firms offer this facility to their clientele.

Yes, business debit cards technically function exactly like normal debit cards and so are also limited to the balance that is available in the bank account linked to them.

With prepaid cards, you never have to worry about overspending. You can top up your cards with the exact amount of money you want to spend.

Employees can have easy access to company funds while you’ll be able to maintain control over how much money is being spent. It’s a faster and more convenient payment method compared to reimbursements.

Yes. Similar to other card counterparts like credit cards, you can get business prepaid cards for your company expenses. Having a prepaid card that is specifically designed for your business needs helps you separate between personal and business expenses and is strongly recommended.

Business cards and commercial cards function exactly the same. They both are cards given by banks or other financial institutions to businesses to make expenses, which can be issued to the company’s employees.

The biggest difference between the two is that business cards typically denote smaller companies, while commercial cards refer to cards given to corporations and enterprises. The latter sometimes will have higher requirements than the former.

Whether or not you can withdraw money from business prepaid cards depend on your provider. Make sure that what you choose fits what your business needs.

Keep in mind both the advantages and disadvantages of withdrawing money from prepaid cards as well before you choose what you go with.

You can get started with Volopay in less than a week. Once you have onboarded, you can immediately order and start using your prepaid cards. For physical cards, you’ll be able to activate them as soon as they arrive in the mail.

The cost of business prepaid cards will depend on the card provider. You want to be sure that you know all the fees that you will be paying before you choose a provider. These fees can include the admin fee, card order fee, as well as any top-up fees.