Flexible business credit that is quick and efficient

Your day-to-day expenses shouldn’t be a hassle. Instead of squeezing your funds to their limit, get a quick and easy business line of credit to manage your spends. Spend in a more efficient manner while protecting your capital with our flexible business credit.

Pay with flexible cycles, and become part of one of the quickest credit checks and approval processes.

Trusted by finance teams at startups to enterprises.

A quick approval process

Unlike a bank, Volopay does not take multiple weeks to approve your application. Our approval process and checks take much lesser time, as short as two working days.

You can have access to your approved business line of credit as soon as possible, so that you can start spending immediately.

Customized repayment cycle

When we say flexible credit, we mean it. You can apply for, and get access to, a business line of credit that offers a customized repayment cycles. The cycle is catered to your business needs and to your credit amount.

Feel free to utilize the flexible business credit through our corporate cards, instead of breaking your head over expensive, rigid credit repayments with banks.

Hassle-free credit

No need to drown under the long processes and paperwork of a traditional business loan. Get a high credit limit without any personal guarantees, and by providing the minimal, necessary documents.

Credit checks and approval processes are as quick as possible, and your flexible business credit limit rises as your business expands.

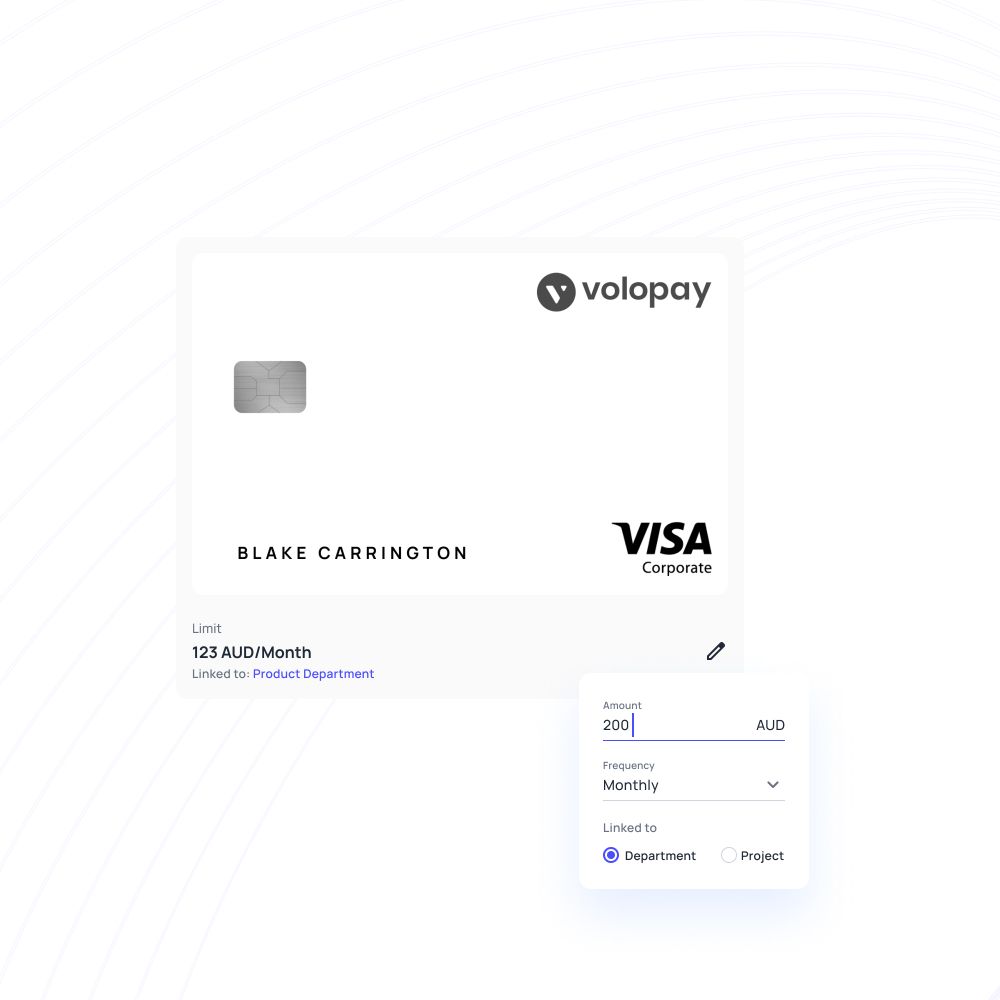

Intuitive corporate credit cards

Your employees are financially empowered with access to company funds. Equip them with corporate credit cards, which have a direct access to the flexible business credit.

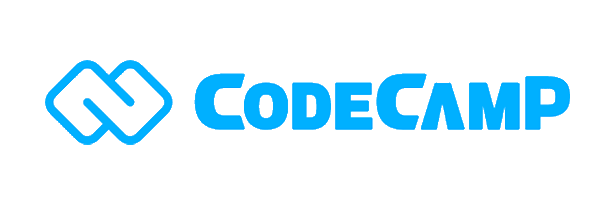

Set controls so that the expenses are tracked in real-time, as well as approval systems to ensure nothing takes place off-board.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

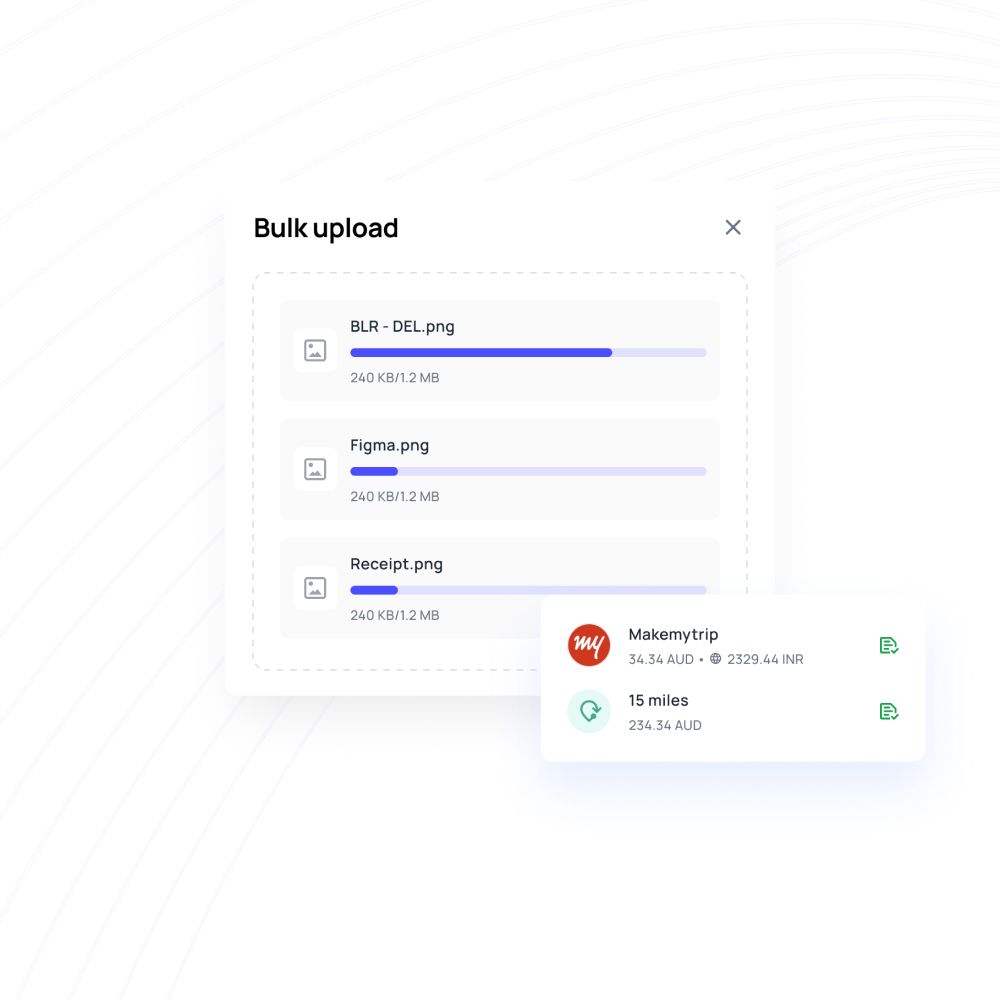

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

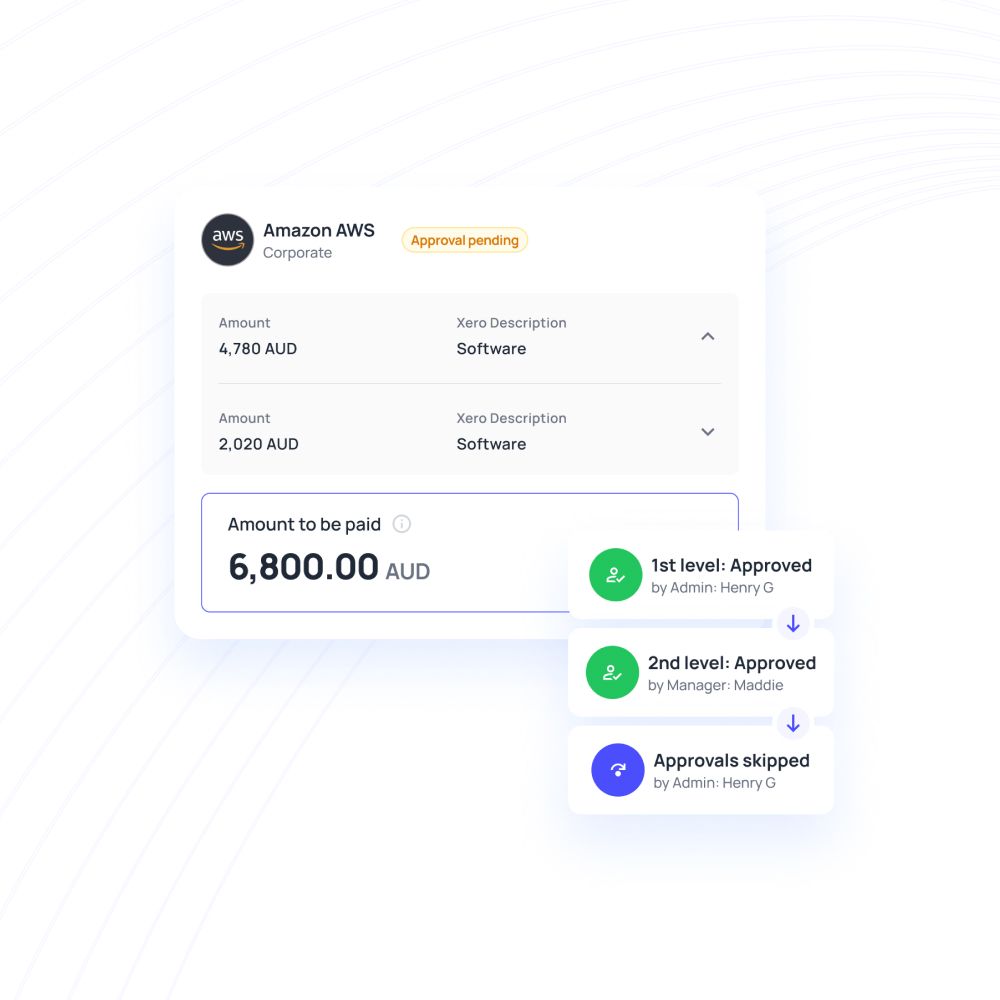

Integrate with the all the tools and software that you use daily

Learn more about our business credit

Volopay offers the unique combination of all your expense management needs on a singular platform. With approvals, corporate cards, bills, reimbursements, and accounting automation in one place, you never have to worry about gathering data together ever again.

Global business accounts

Business bank accounts for global businesses. Instead of juggling your funds in multiple locations, you can open a multi-currency account with Volopay. Hold money in different currencies in different wallets for easier spend tracking across the globe.

Domestic money transfers

Manage all your payments from a single dashboard by using your accounts payable wallet or cards to send money to vendors and employees. Domestic transfers are instantaneous, and reflect in your ledgers as soon as they happen.

International money transfers

Money transfers to other countries are made simpler through our platform. Lower remittance rates and competitive FX costs make it so that you’re not losing big bucks just to pay a vendor in a different country. Instead, your international transfers are quicker, cheaper, and easier to manage.

Accounting automation

A single-click sync with your accounting software ensures that accounting automation is an end-to-end process. From the recorded transaction in the ledger, to reconciliation in your accounting software, everything is handled by the system. We sync with the best in the world – Xero, Quickbooks, Deskera, MYOB, Netsuite, and so many more.

Bring Volopay to your business

Get started now

FAQs on business credit

Your company’s credit limit is determined by your current credit score and business documentation status. However, your personal credit score and statements are not part of this – only your company’s financial history. These documents are requested when you apply for credit.

In order to determine your eligibility for business credit, you can submit your documentation for review with our credit team. They will quickly review your paperwork and let you know your eligibility for a credit line. In general, having your business credit score documents and company’s financial history is important for clearance.

With Volopay, you don’t need to put down any guarantees or collateral for a business credit line. With a regular bank loan, you would have to. But we offer a collateral-free line of credit, provided your other documentation is in order.

Yes, you can request for your credit line limit to be increased at any time. This will depend upon a growth in revenue, spends, or any other factor that exhibits your eligibility for the raise.