Effortless AP automation for your business

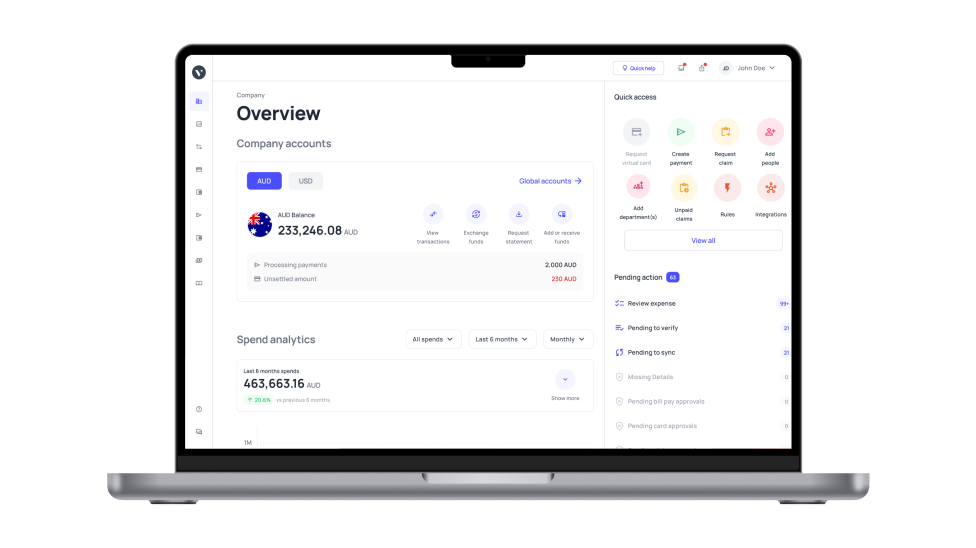

Streamline your accounts payable process – no more hassle involved. Manage and track bill payments, approval processes, vendor management, and invoices in real-time with the best accounts payable automation software Australia has to offer.

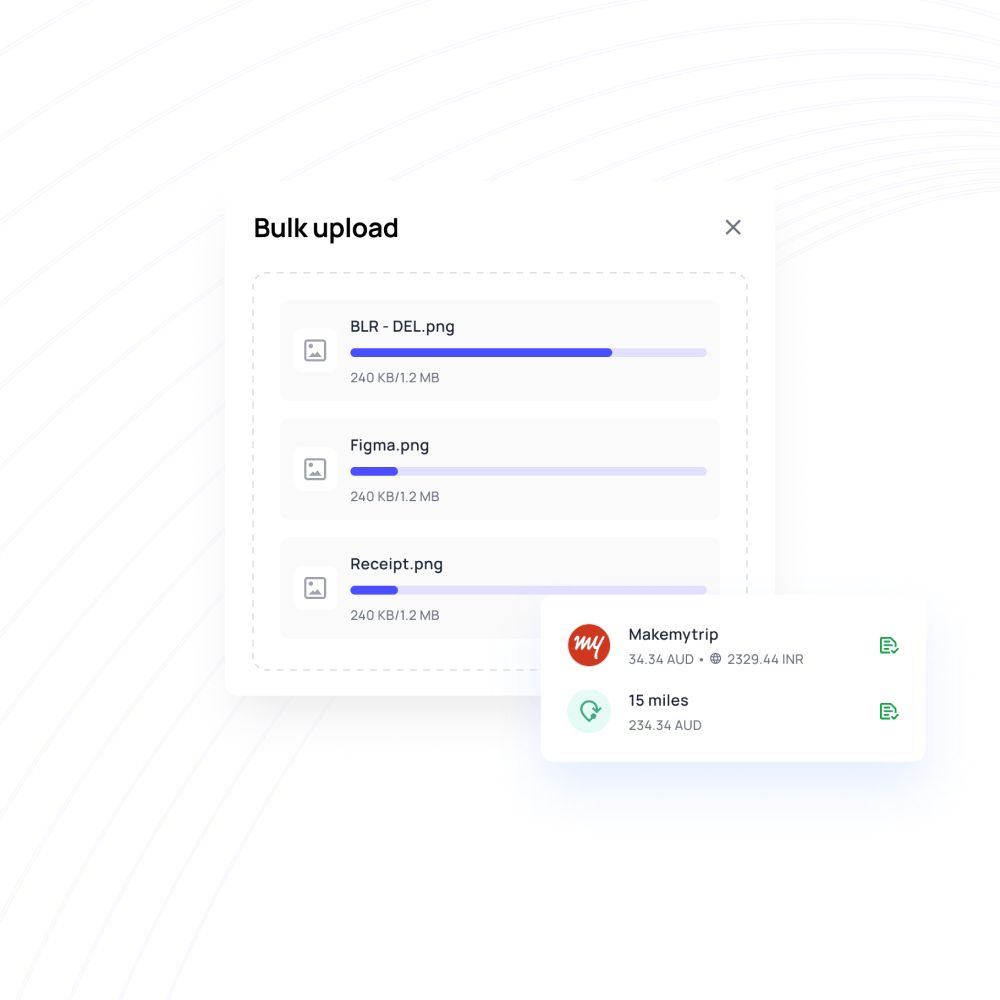

Swift and simplified invoice processing

Stop chasing paper-based invoices or sifting through emails. Use Volopay’s all-in-one accounts payable software to upload, approve, and process invoices in just a few clicks.

Get access to optical character recognition (OCR) technology, powered by AI, to scan invoices and start the process swiftly. If you have multiple invoices, no worries – use our bulk upload feature to quickly sort through your invoices. Splitting invoice bills into multiple line items takes no time at all.

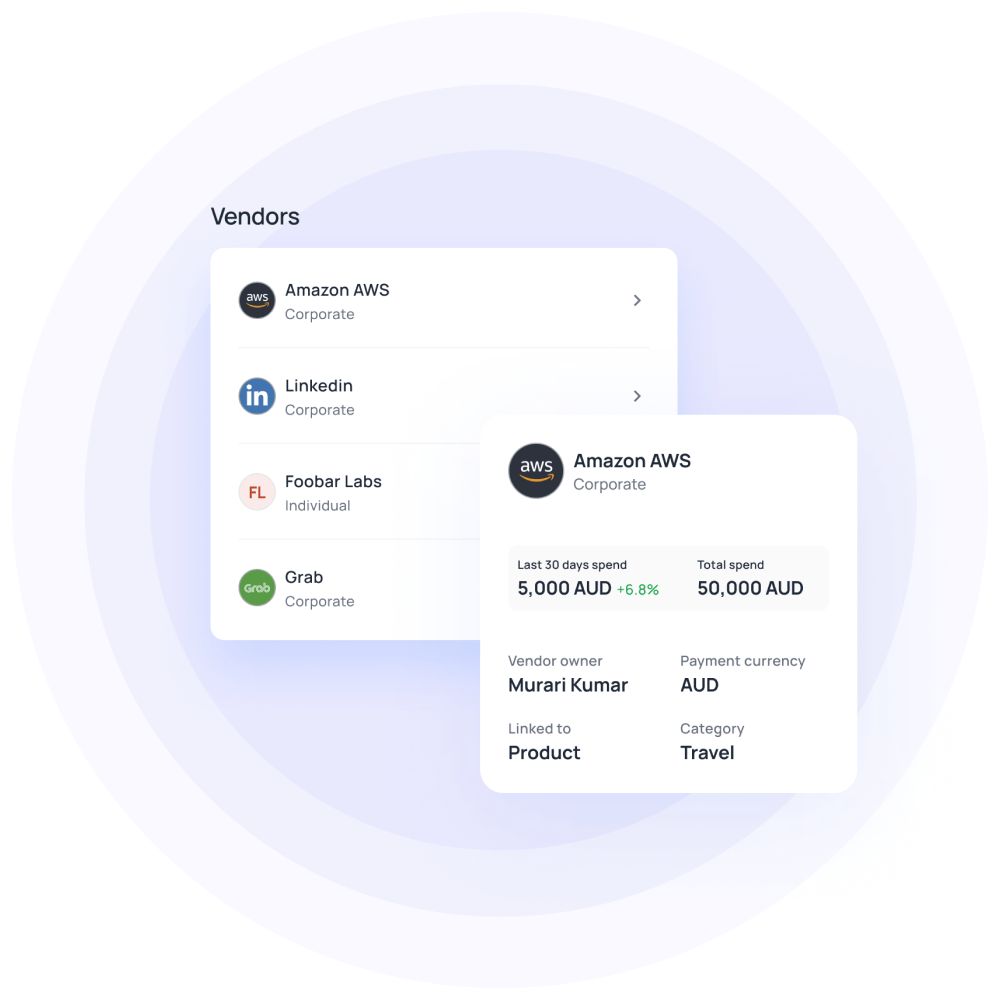

Streamlined vendor management

Everything you need to manage vendors is readily available with Volopay’s best accounts payable software. Easily create vendors, link them to the appropriate department or project, and request vendor details to quickly make payments.

You can appoint a vendor owner to streamline the responsibilities of managing a particular vendor. All payment history is accessible through our platform.

Real-time expense tracking

Automatically track and collate all your purchase orders, vendor invoices, and receipts to their respective transaction, making reconciliation a stress-free process. View the history of when, where, and why each payment is made with Volopay’s Bill Pay module.

Avoid overpayment and automatically flag duplicate payments. Paired with the general ledger sync feature, you can time and simplify the AP process with the best accounts payable software Australia needs.

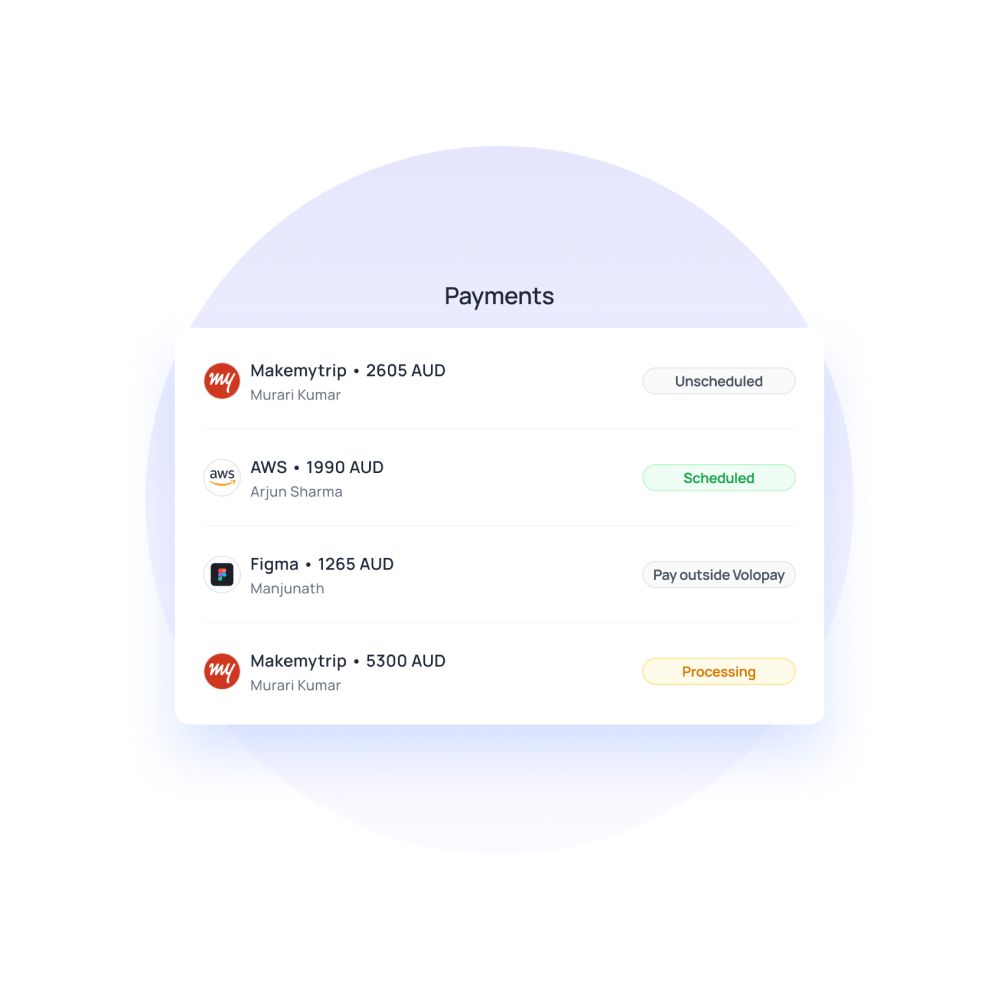

Quick and easy vendor payments

Make domestic vendor payouts hassle-free. Schedule payments in advance and automate recurring bills. Project-specific vendor payments are guaranteed to fall within the specific project or department’s budget.

Monitor all your future payments from a unified dashboard and receive real-time notifications and email alerts whenever a bill is due or processed. If necessary, payments can be made outside of Volopay and synced with your accounting system through Volopay.

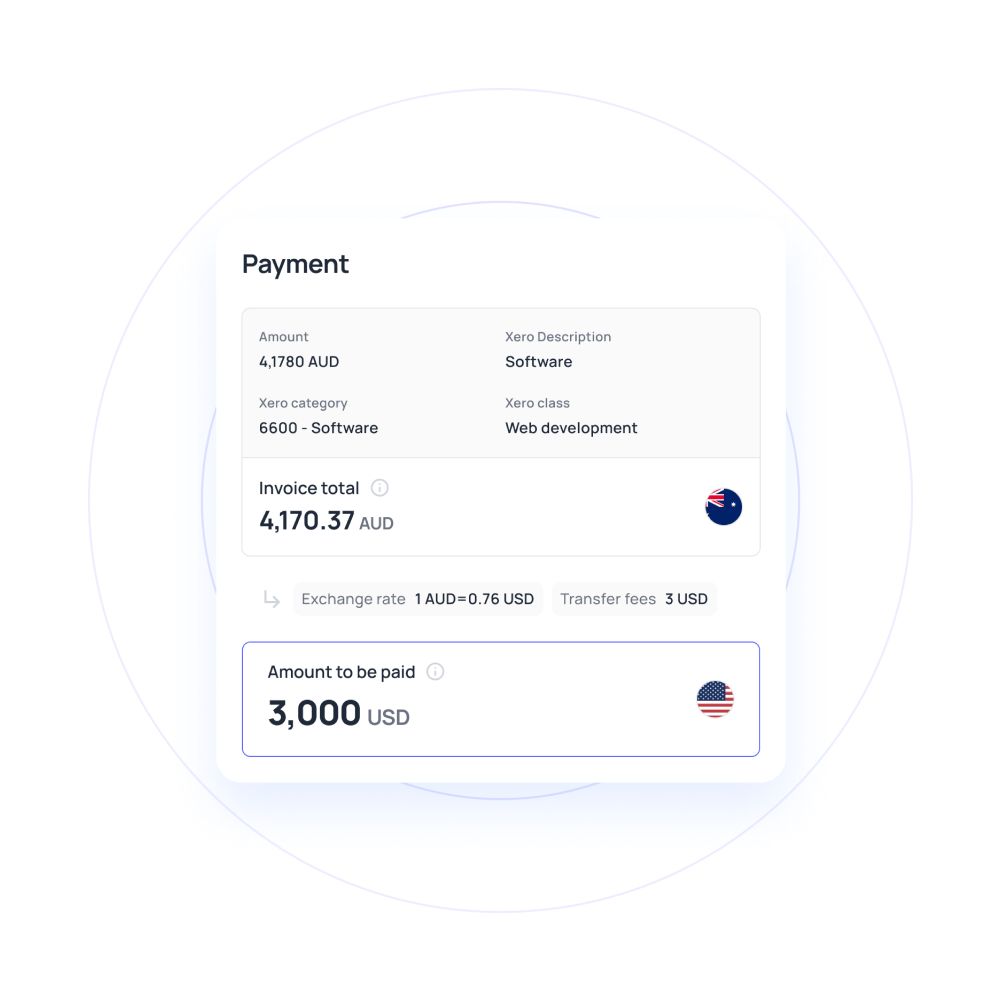

Efficient international remittance with low FX charges

No need to look elsewhere to process international remittance – Volopay does it all for you. Pay foreign vendors through your dashboard with affordable payment fee options.

Seize the most competitive and lowest rates for all your FX transactions offered in Australia. Volopay offers super low FX charges on cross-border B2B payments.

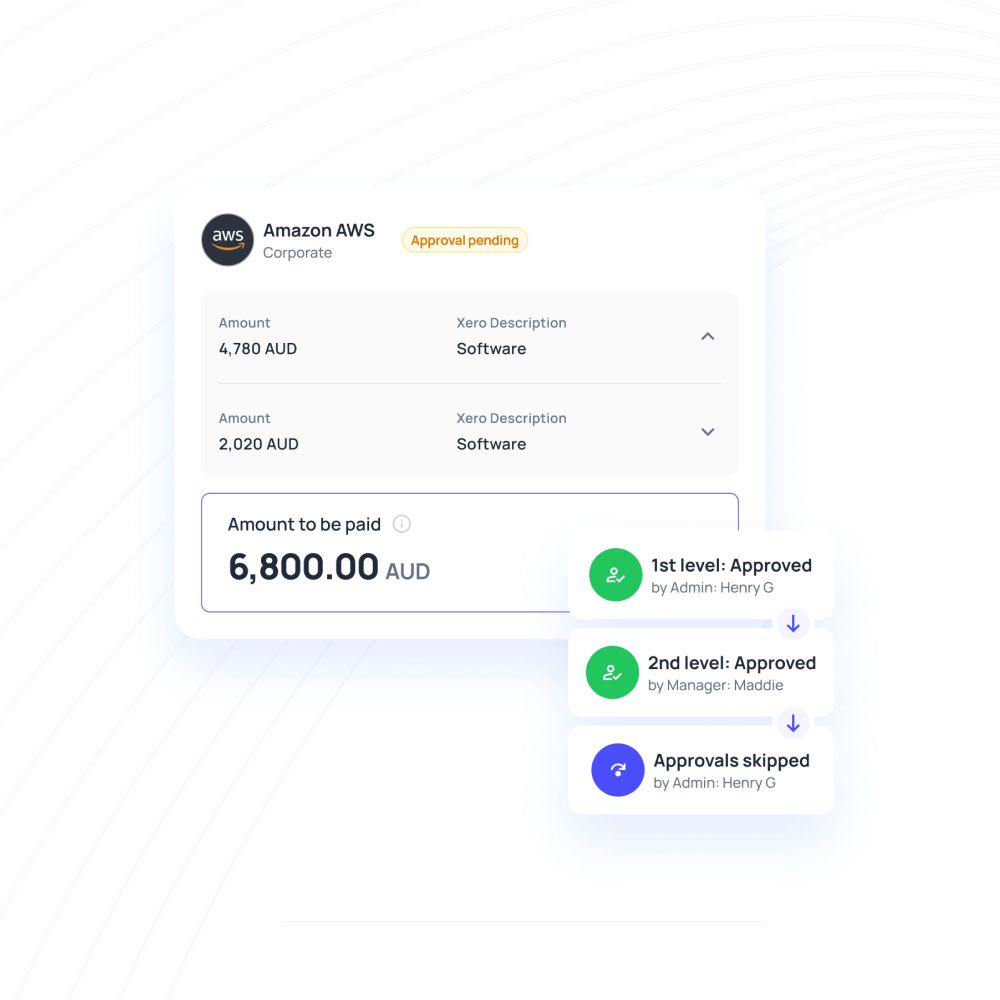

Advanced multi-level approval workflows

Design custom multi-level approvals before processing any payment and assign multiple approvers at each level. Choose from a range of department-specific, spend-centric, and auto-approved policies to enforce compliance.

Approvers receive real-time request updates through our push notifications feature. Initiate discussion threads and make Bill Pay comments to ensure each payment is reviewed thoroughly.

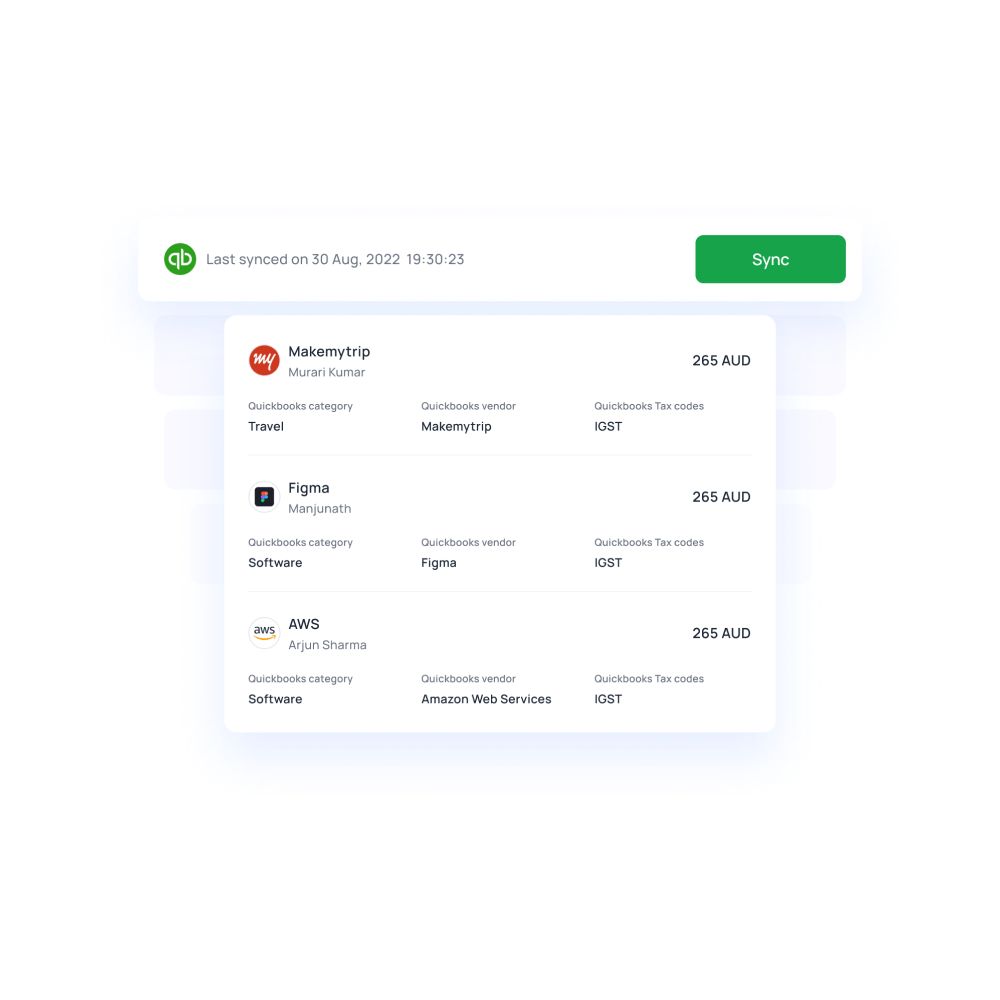

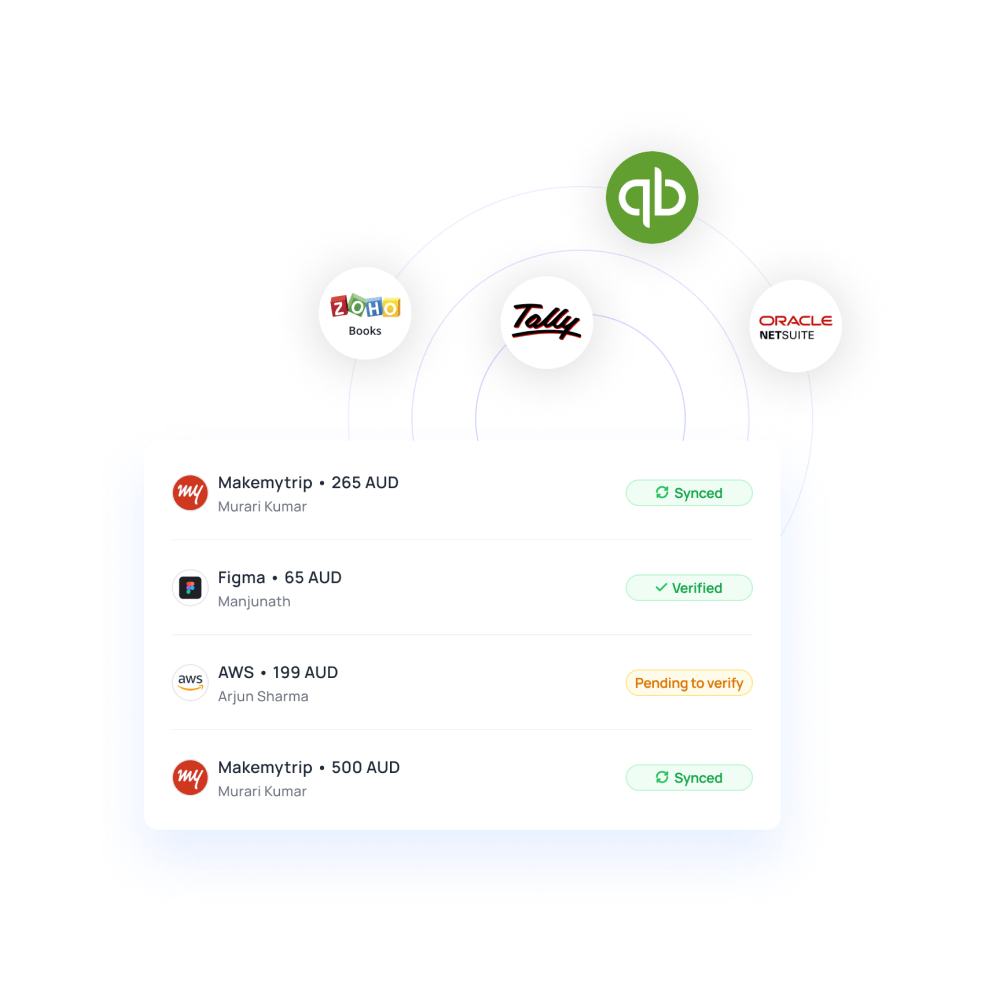

Automated accounts payable accounting

Integrate Volopay with your accounting software of choice and instantly and continuously sync all accounts payable activities.

With advanced rules, you can enable expense categorization and set up automated accounting triggers, guaranteed to save time on AP accounting processes. Volopay also allows easy receipt attachments for documentation purposes.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Paralleldots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

Bring Volopay to your business

Get started now

FAQs on accounts payable

Volopay offers two-way and three-way matching verification techniques for AP process to eliminate fraud and maintain proper records for a smoother auditing process. In the Volopay app, you can match the bills generated and the attached invoices to ensure the transaction details are in order. For three-way matching, you can reconcile bills, invoices, and receipts for even further accuracy.

Xero, MYOB, Quickbooks, Netsuite, and Deskera are all accounting systems that Volopay can link with. Our accounting software integration is a one-click process that takes only a few seconds. The accounting fields are retrieved from the accounting program.

Now, when submitting an expense for review, we can allocate it to a certain chart of accounts or tracking category. These accounting fields can be declared essential for an expense to be completed, so they are pre-filled during expense verification and sync.

Volopay streamlines your AP process by managing invoices, designing customized approval workflows, and paying local and international vendors – all from one single platform.

Invoice capture is the processing of extracting data from scanned invoices, such as supplier name, invoice number, amount, and more. It uses Optical Character Recognition (OCR) technology to scan invoices and convert them into bills on the Volopay platform. Simply upload invoices to our portal, where it gets scanned and categorized into a bill to be paid later.

Vendor payment through Volopay is simple, fast, and reliable. Volopay helps companies in processing local as well as international cross-border B2B vendor payouts. All our non-SWIFT/local payments take minutes to be generated and are completely processed within a few hours. International SWIFT payments may take up to two days to reflect in your vendor’s bank account.

Volopay is your go-to spend management solution that provides seamless payment options for international vendors. Send money to over 130+ countries on super low FX charges, or hold money in our multi-currency wallet to skip paying exchange fees.