Streamline your accounting with Volopay's QuickBooks integration

Volopay’s native integrations include a QuickBooks integration to connect your accounts. This two-way integration helps ensure that real-time transactions are recorded in your accounting system, thereby reducing the need for manual intervention and reducing the chances of errors.

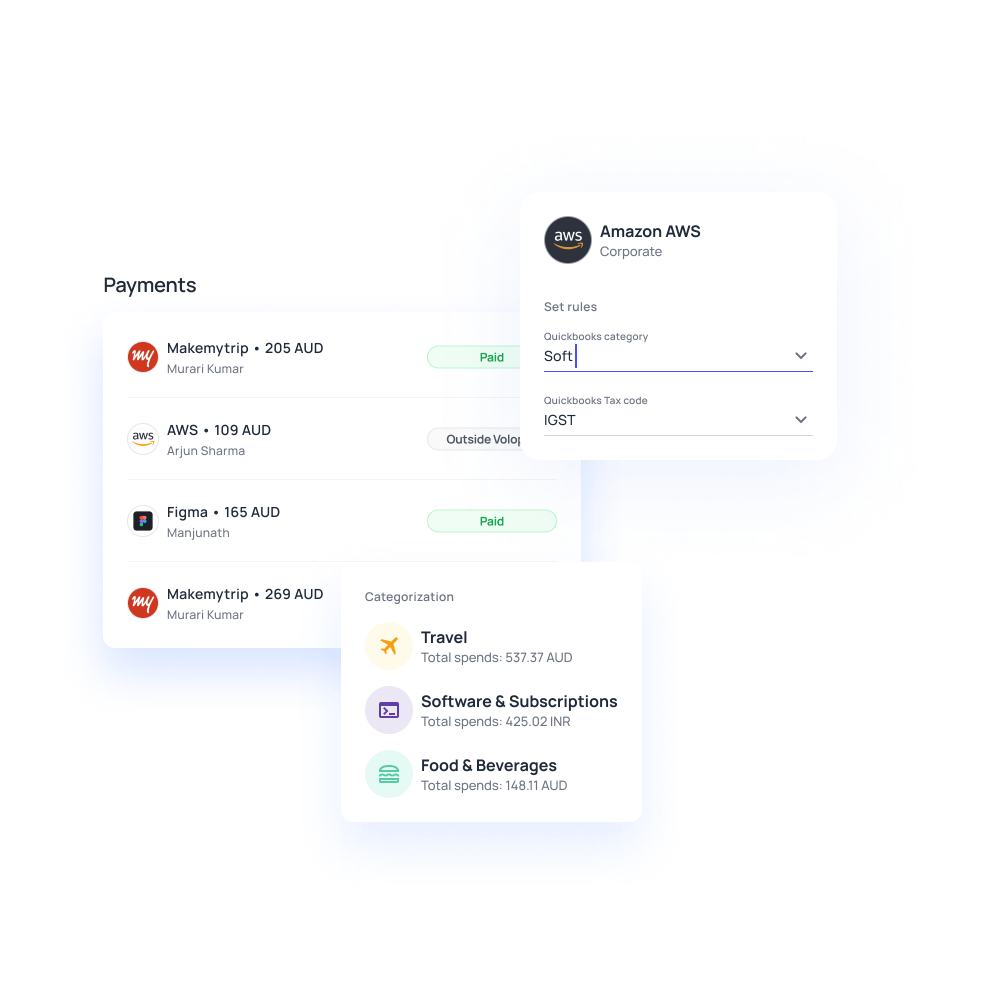

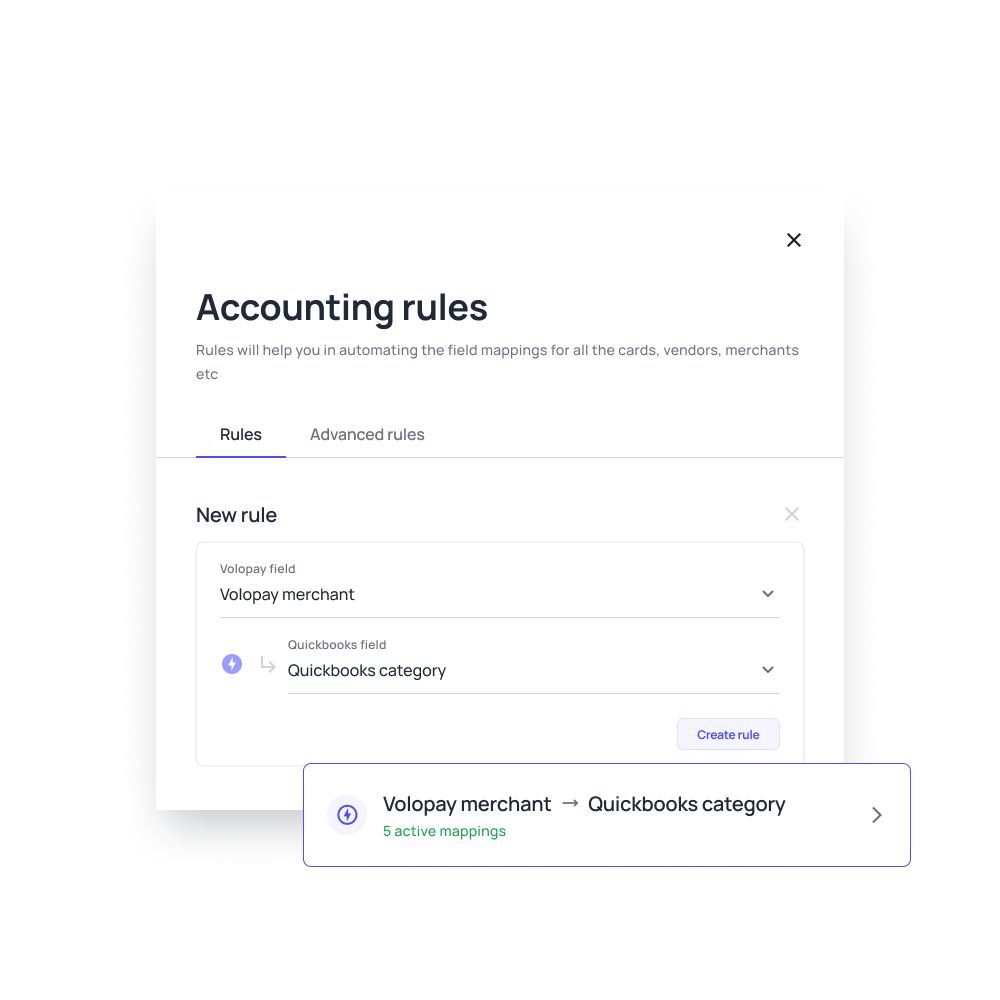

Create custom mapping rules

Want your ledger to appear a certain way? Our Quickbooks integration lets admins create customized mapping rules tailored to your business. Use it to pull, map, and sync information for any department, vendor, user, or card in seconds.

Volopay produces custom expense reports for any payment method, vendor type, or financial period.

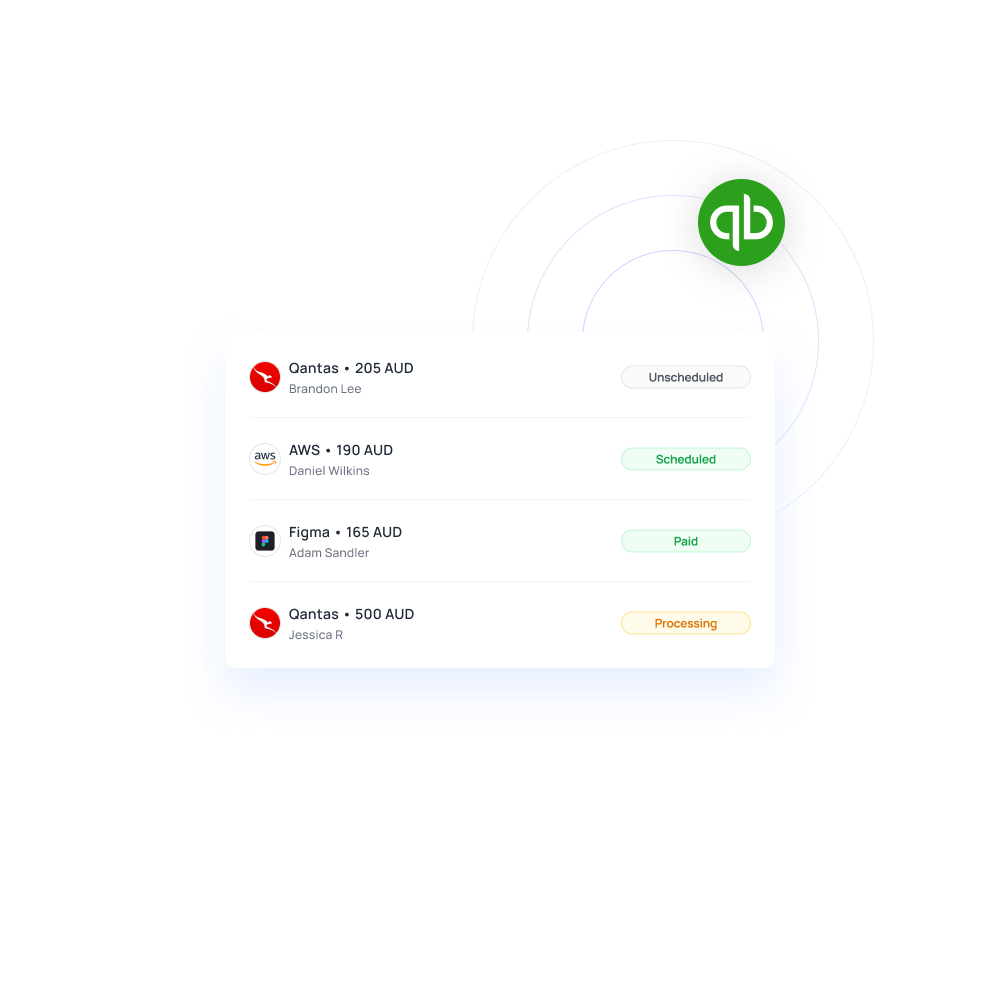

Sync corporate card spending with a click

Say goodbye to manual credit card reconciliation. Integrate Volopay corporate card spends on Quickbooks with our convenient one-click sync.

Map predefined card expense types to feed file transaction codes and automatically produce expense types in expense reports. Build tailored mapping rules for each user to enforce compliance.

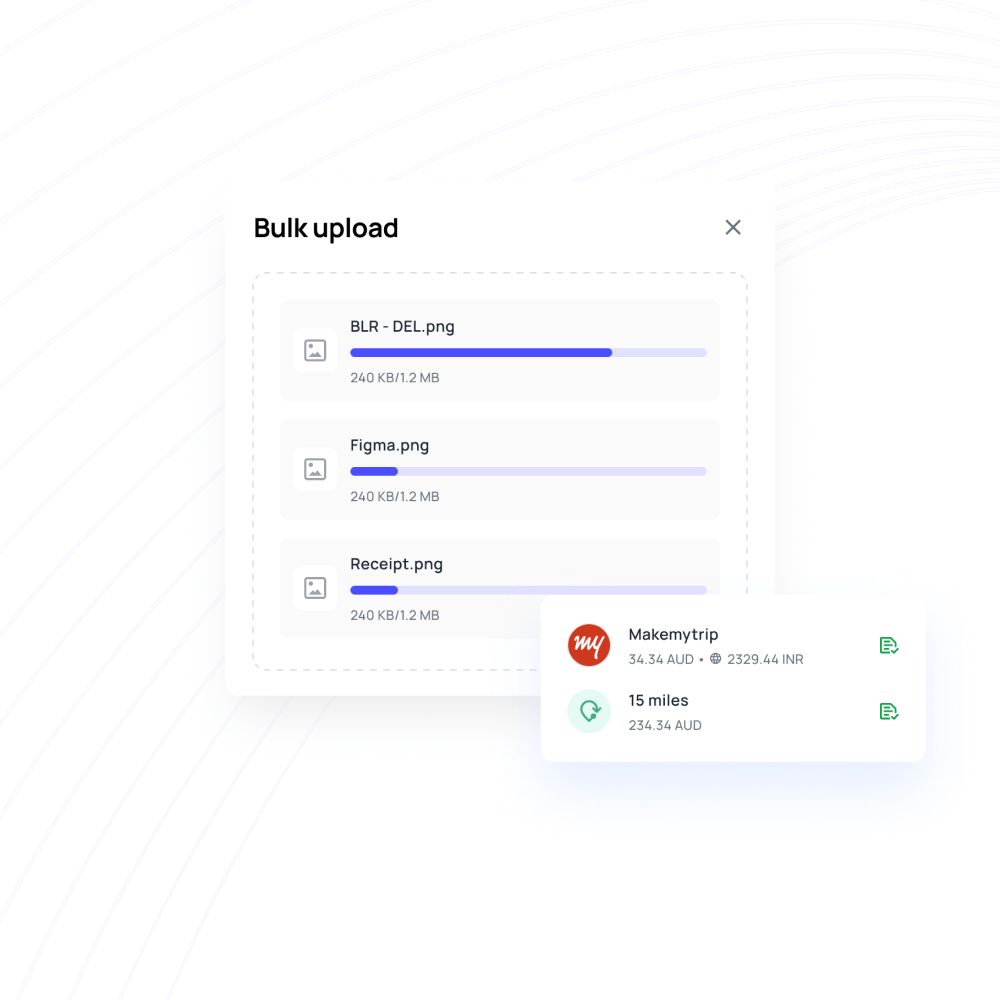

Easy reimbursement reconciliation

Our seamless two-way sync with Quickbooks eliminates the need to feed reimbursement information in the accounting software line-by-line.

Simply review and reconcile out-of-pocket employee expenses and mileage reimbursement. Volopay streamlines all your expenses and integrates their accounting in a few simple steps.

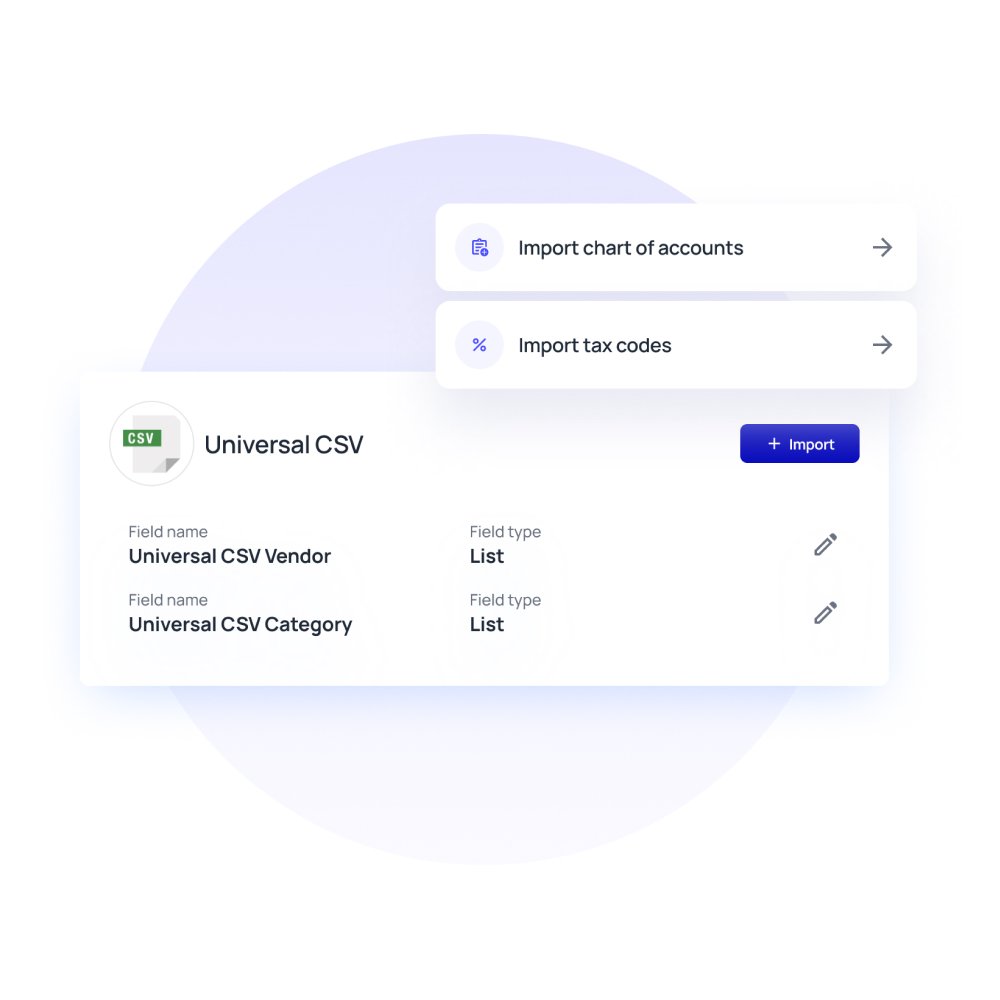

Automate categorizations

With Quickbooks integration, seamlessly import your chart of accounts onto the Volopay platform. Save hundreds of hours’ worth of boring, manual work with auto-categorizations.

Set accounting triggers for vendors, users, cards, and GL tax codes, and mapping rules for expense types – let our software do the rest!

Export expense reports in seconds

Skip feeding in every single transaction by hand. Volopay’s accounting inbox lets you filter and identify unsorted transactions. Program unique expense policy rules for effortless compliance and faster verification, and export expense reports individually or in bulk to your

Quickbooks account in a fraction of a second. Auto-categorize expenses as soon as they happen, using our smart Triggers feature.

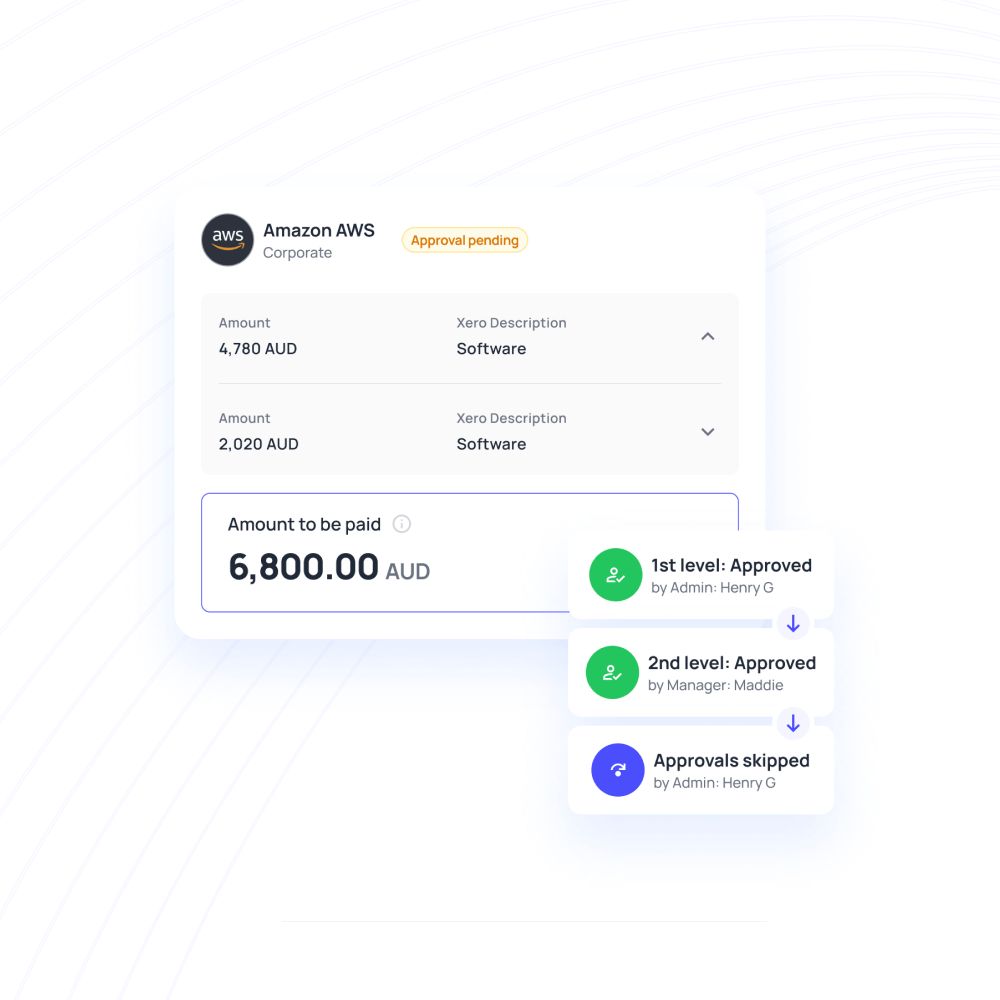

Advanced mapping rules to enhance data accuracy

The ability to set up mapping rules lets you create smart triggers, automatically categorizing and labeling transactions for precise accounting.

Set up rules for which vendor, card, payment owner, or merchant you want to be categorized under which label, and let the system do the rest.

Take advantage of QuickBooks’ full potential

QuickBooks’ range of smart accounting features can be made doubly powerful by connecting your Volopay account.

Set up a two-way sync with our native integration to take advantage of up-to-date records, simplified reconciliation, and accurate expense reporting.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Automated Accounting. Incredible Integrations.

Volopay is a purpose-built expense management software with best-in-class integrations for seamless accounting. Our platform integrates and adapts itself to your existing accounting processes for outstanding performance and unmatched convenience.

Generate customized transaction fields, payment reconciliation, and export expense reports within seconds.

Bring Volopay to your business

Get started now

FAQ on Quickbooks integration

Quickbooks integration with Volopay facilitates faster reconciliation by automatically exporting all expense data from our platform to the accounting system. To do this, click on the “Accounting” tab and sign in with your Quickbooks account.

After doing this, you can easily import all Chart of Accounts and Vendors with our system with our one-click sync feature.

From corporate credit card expenses to reimbursement and vendor payouts, you can manage all your accounts payable from a unified payment and integrate it all on to Quickbooks with real-time updates.

Volopay delivers all information to your accounting system necessary for a smoother auditing process. Information may include bills, invoices, or receipts attached to the transaction along with vendor details, date and time of payment, and more.

Volopay’s fastest integration along with real-time, one-click sync with Quickbooks sets it apart from the rest. Expenses get recorded as soon as they occur on our live dashboard.

You can choose to club multiple expense reports and export them to your Quickbooks account in bulk or choose to share them as soon as the payment is made – Volopay adds the choice of effortless convenience in your hands.

Volopay’s customer support team is here for you to provide assistance of any kind in setting up your Quickbooks integration. A dedicated account manager will help you set up the system and assist you in the entire process. We take pride in helping our clients achieve satisfaction swiftly and efficiently.