Corporate cards to streamline expense management

Empower your team with the best corporate card and built-in dynamic controls. Share company funds safely across departments and operations, and manage business expenses anytime, anywhere. Enjoy the benefits of business credit cards with Volopay’s corporate cards.

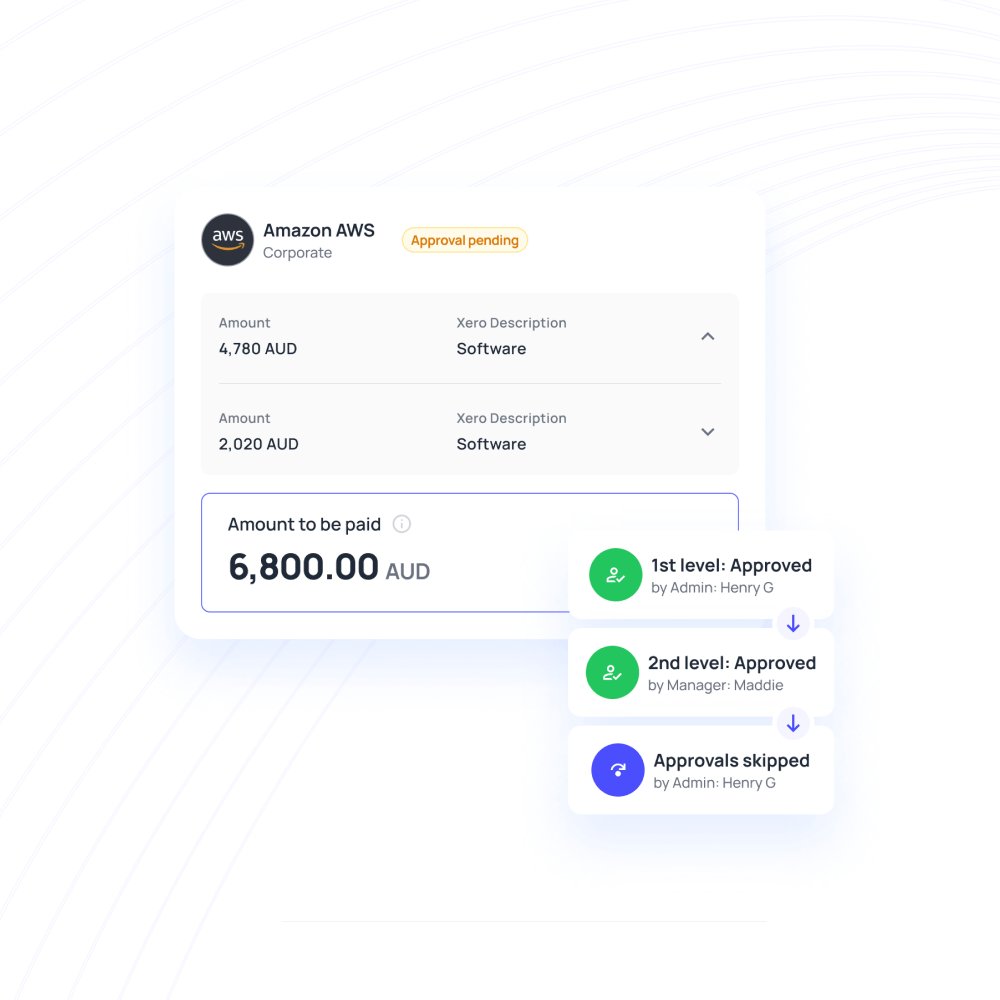

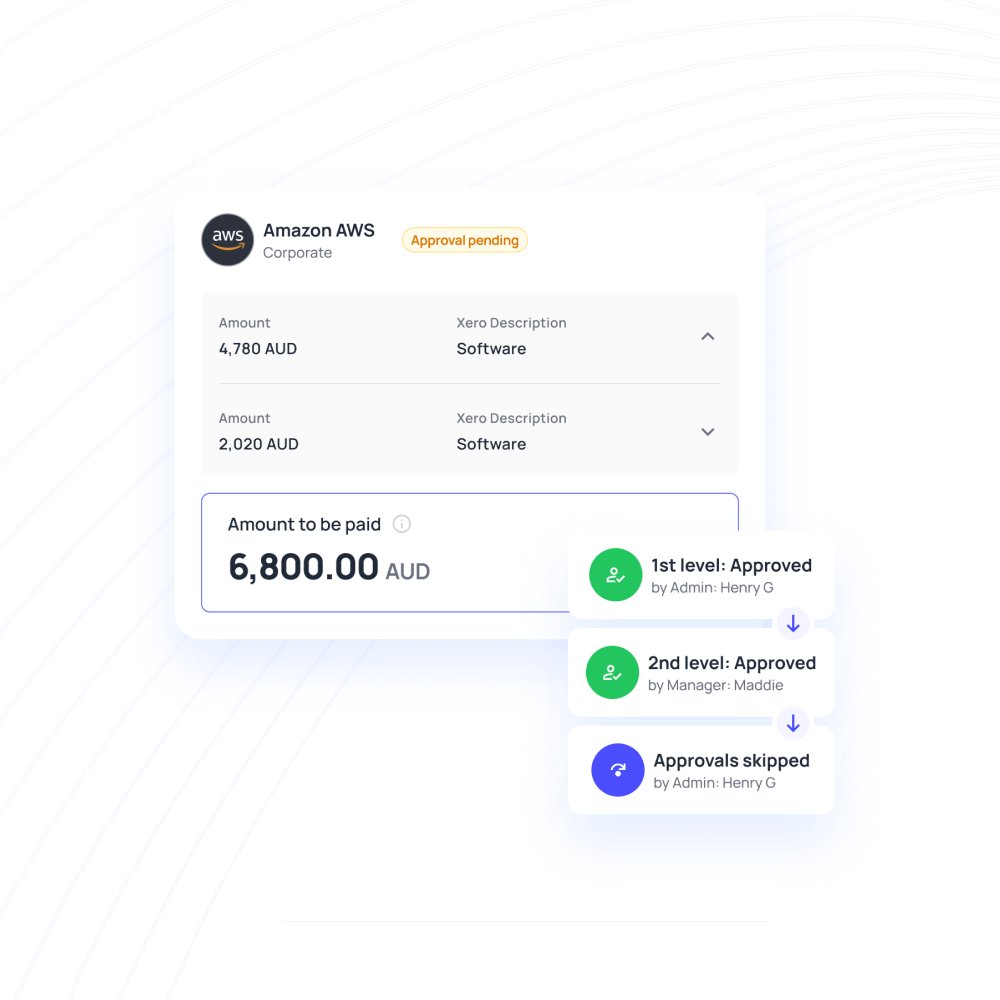

Tighter control with multi-level approvals

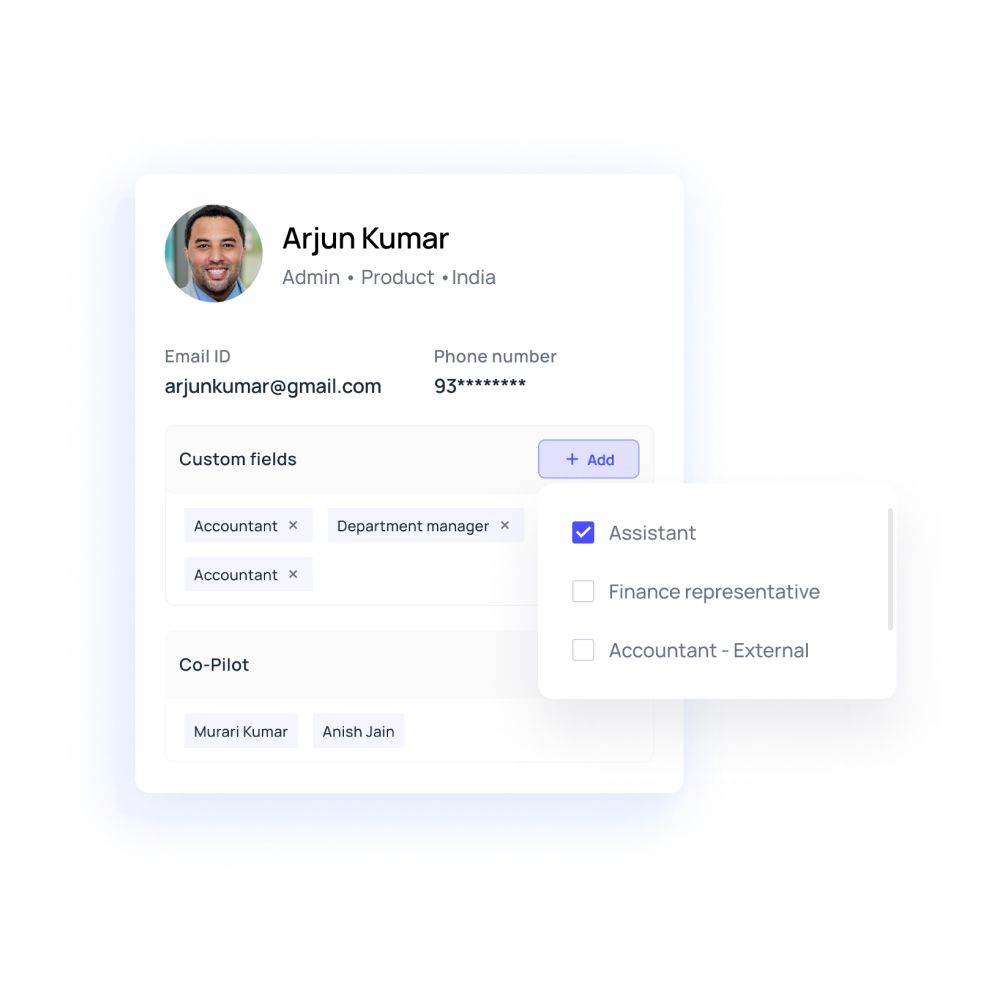

Configure a rule-based, multi-level approval policy right into the platform for all corporate cards. Eliminate unauthorized spending, a risk often associated with corporate credit cards. Instead, with Volopay’s corporate cards, you can tackle this by setting appropriate transaction limits.

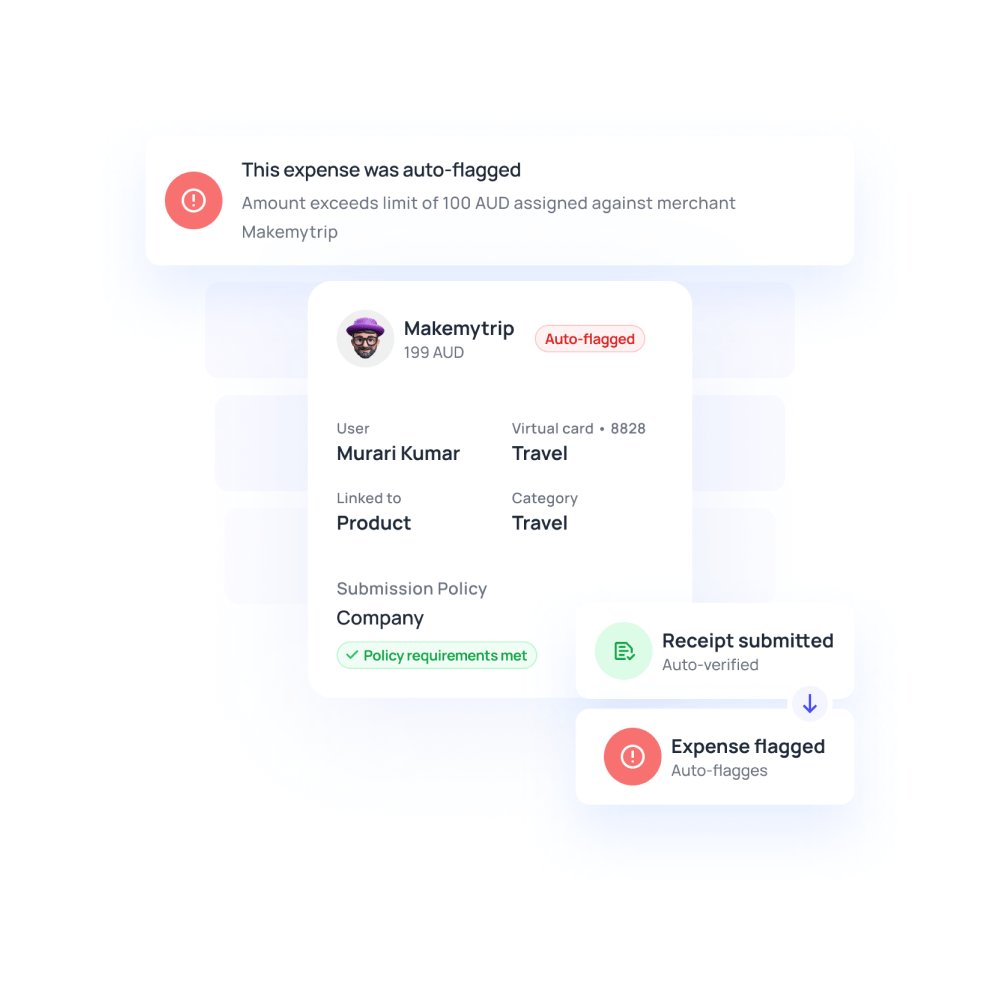

Get robust card management features to change card settings with ease. Establish criteria to flag expenses based on non-compliant amounts or categories and easily make review comments on flagged expenses.

Streamlined expense management

Volopay's corporate cards are the ultimate solution for streamlining your business expense management systems. Say goodbye to the hassles of manual tracking and paperwork.

Our fully equipped corporate card seamlessly integrates with your company's financial systems, automating expense categorization, reporting as well as approvals.

Gain real-time insights into spending patterns with corporate cards, allocate budgets effortlessly, and simplify reimbursement processes. Empower your team with a smarter way to manage expenses.

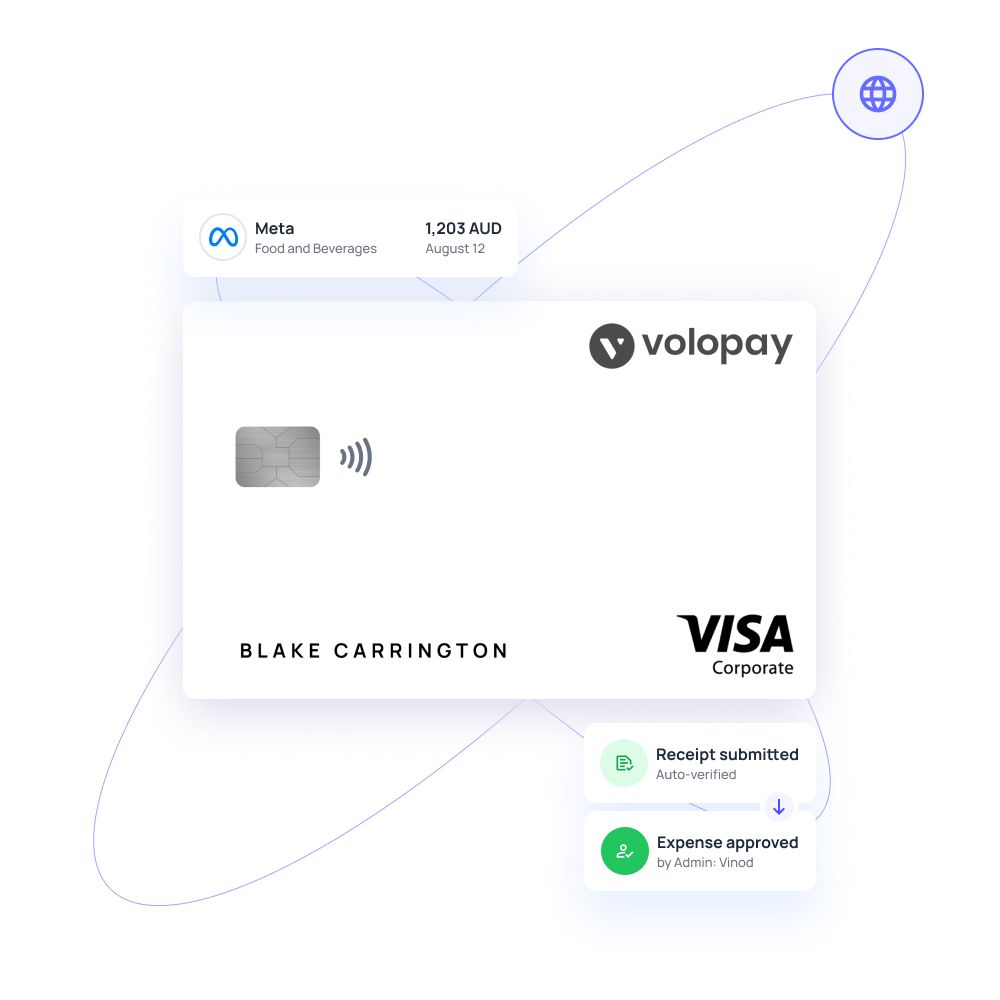

Physical corporate cards for every employee

Order customizable physical cards for all your employees in no time. You have the choice to bulk order personalized employee cards through our platform.

Each physical card can be linked to its owner’s appropriate department and any projects the cardholder is involved in. Every transaction made with the card will also be associated with the right department and project.

Be on top of your business expenses with corporate cards

Track expenses in real-time

Experience total transparency in every single expense. With the best corporate card in Australia, your dashboard will tell you exactly what you are paying for.

Just as with any business credit card, with Volopay’s corporate card module, you get advanced analytics, can view insights, and qualify trusted merchants through your dashboard. It takes just a few clicks to link each expense with a department or project.

Reconciliation and compliance simplified

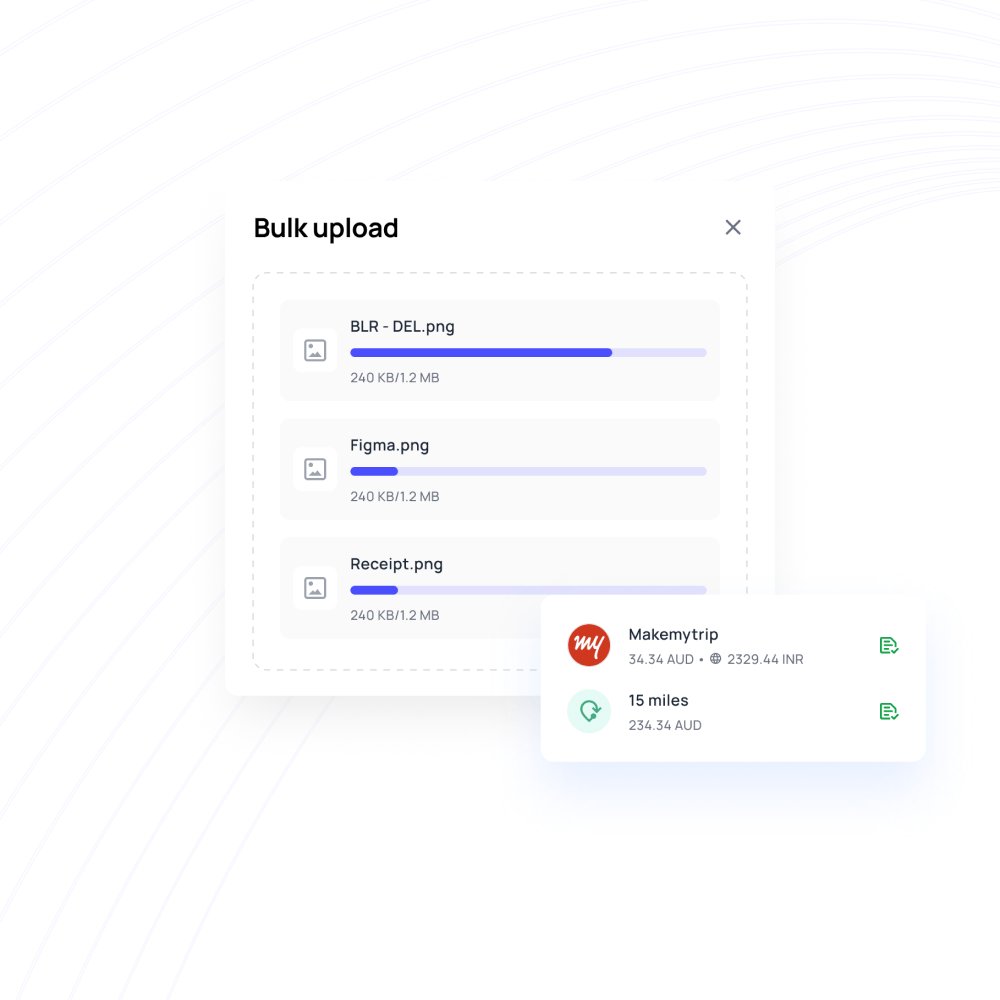

Every dollar that leaves your company can be automatically accounted for through our high-powered web software and mobile application. With corporate cards issued to your team, gain detailed card histories for each transaction.

Enhance compliance by using the customizable merchant category control feature and automating non-compliant category blocks. Conveniently start discussions through comments on flagged expenses, all on the Volopay platform.

Corporate cards for business travel spends

Maximize business travel efficiency with Volopay's corporate debit card. Efficiently cover all your business travel expenses, from flights and accommodations to meals and transportation.

Our corporate cards offer global acceptance, ensuring smooth transactions wherever your team goes. Track and manage expenses in real-time, simplifying reimbursement processes as well.

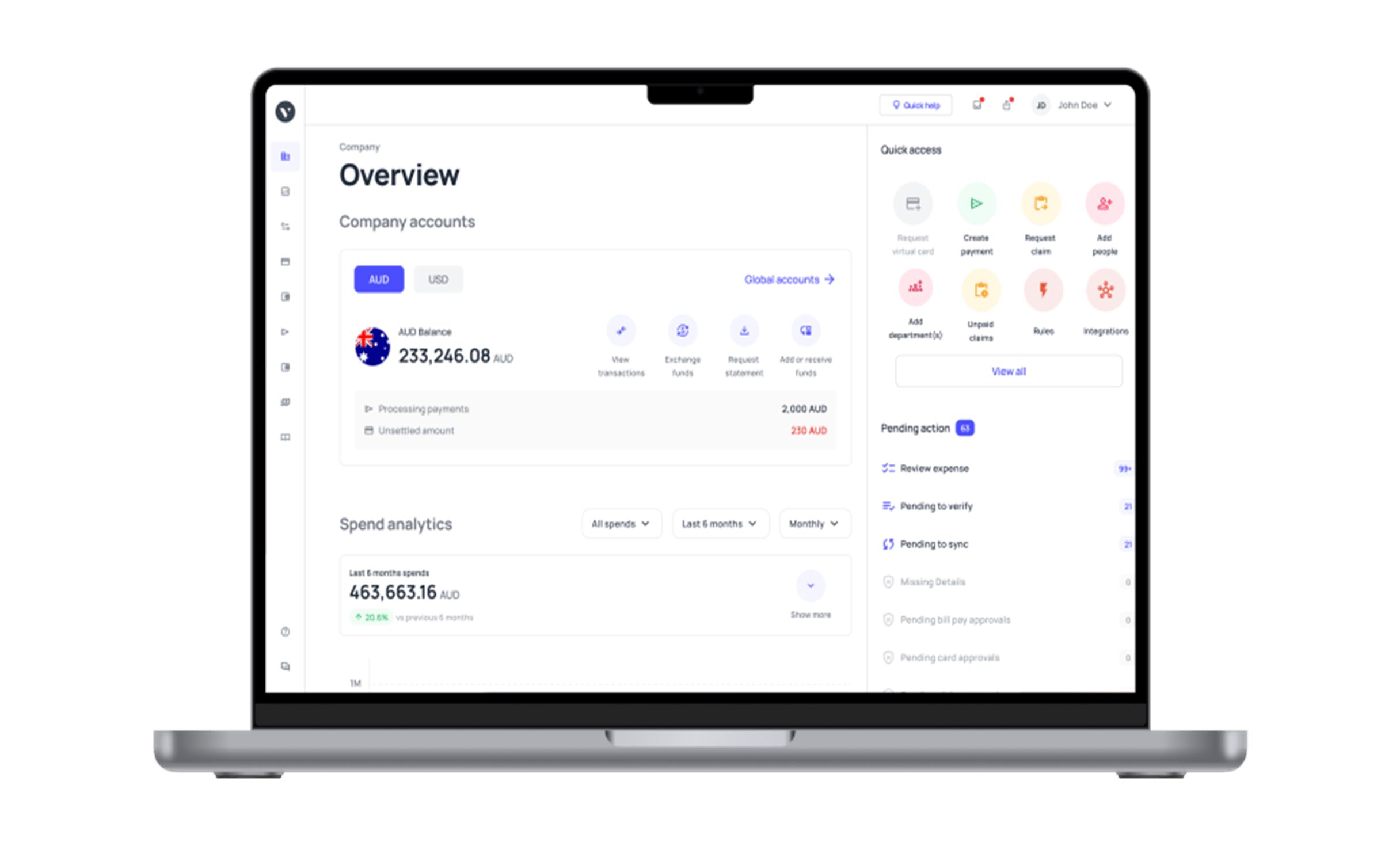

User-friendly dashboard interface

Everything you need to manage your corporate cards is at your fingertips with the Volopay dashboard. Card expense reviewers can flag inappropriate transactions, give comments, and request repayments.

Easily split expenses into multiple line items with different categories to manage expenses down to the details, all on one platform.

Make secure and convenient business payments with corporate cards

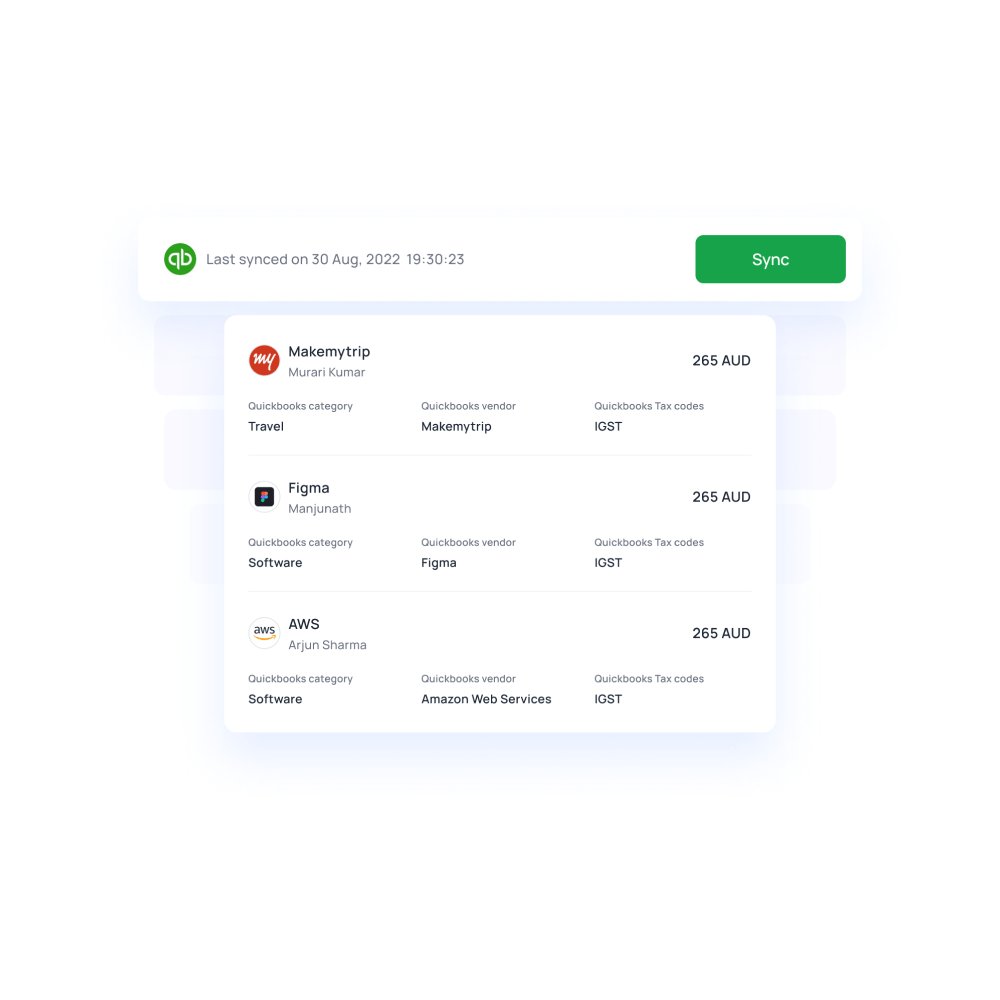

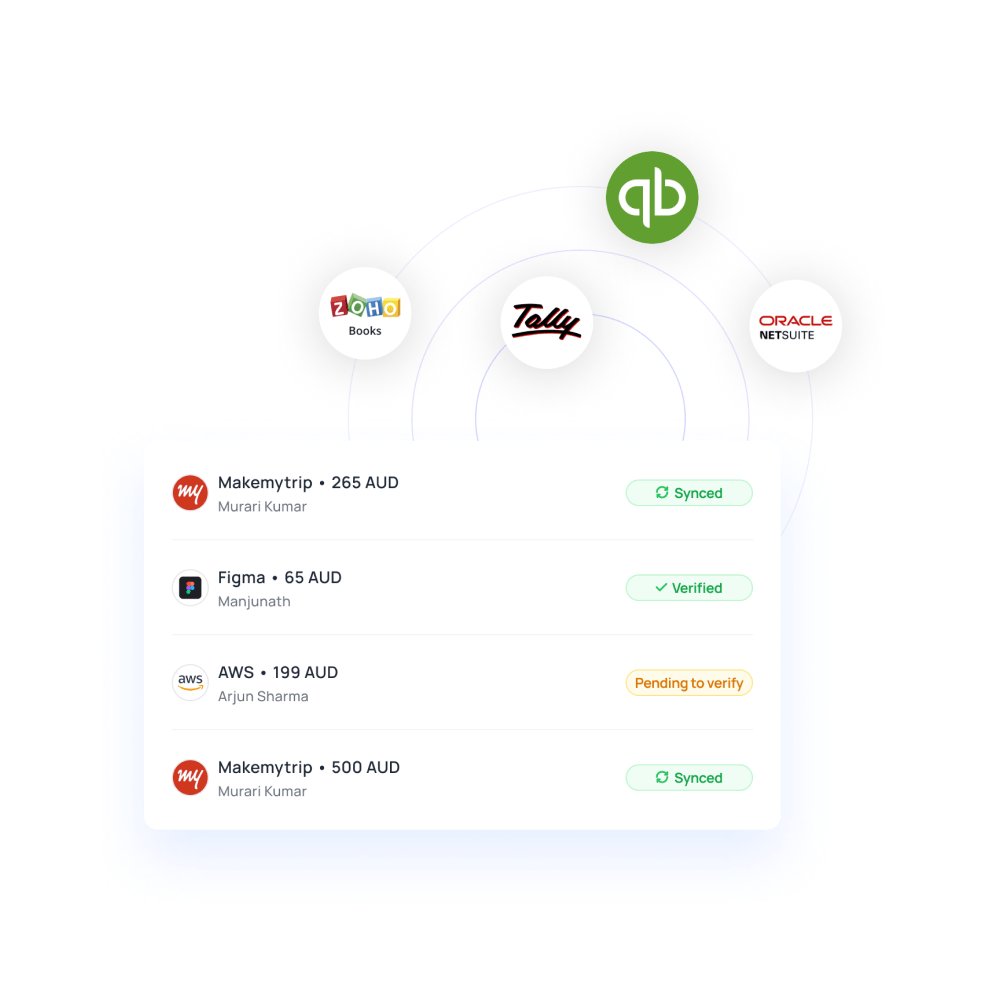

Integrate accounting systems easily

Integrate Volopay's corporate prepaid card and expenses with your accounting systems for a streamlined financial experience. Volopay effortlessly syncs transactions, eliminating manual data entry.

Customize advanced rules to set automated accounting triggers for corporate cards and easily split expense line items for a smoother accounting process.

Corporate cards for seamless payments

Make payments easy with corporate cards. All it takes is a swipe or tap of your cards to make business expenses.

Get alerts of every successful card transaction and stay up to date. With an easy-to-use interface, managing your payments takes no time or effort at all.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Why should your business opt for corporate card program?

1. Seamless reimbursement

Employees who frequently travel often find the reimbursement process to be inconvenient and time-consuming. However, corporate card can simplify this process for both employees and their employers. Employees do not need to use their own money or hold onto receipts.

Additionally, corporate credit card allow employees to access funds quickly, enabling them to book tickets in advance and potentially save money on travel costs.

2. Hassle-free business travel

If employees have to pay for business travel out of their own pocket, it can cause delays due to less funds. They also have to keep track of all receipts and expenses until they return and submit them for reimbursement.

Corporate cards with credits eliminate these issues and allow employees to travel with peace of mind. They don't have to worry about managing expenses and can focus fully on their trip.

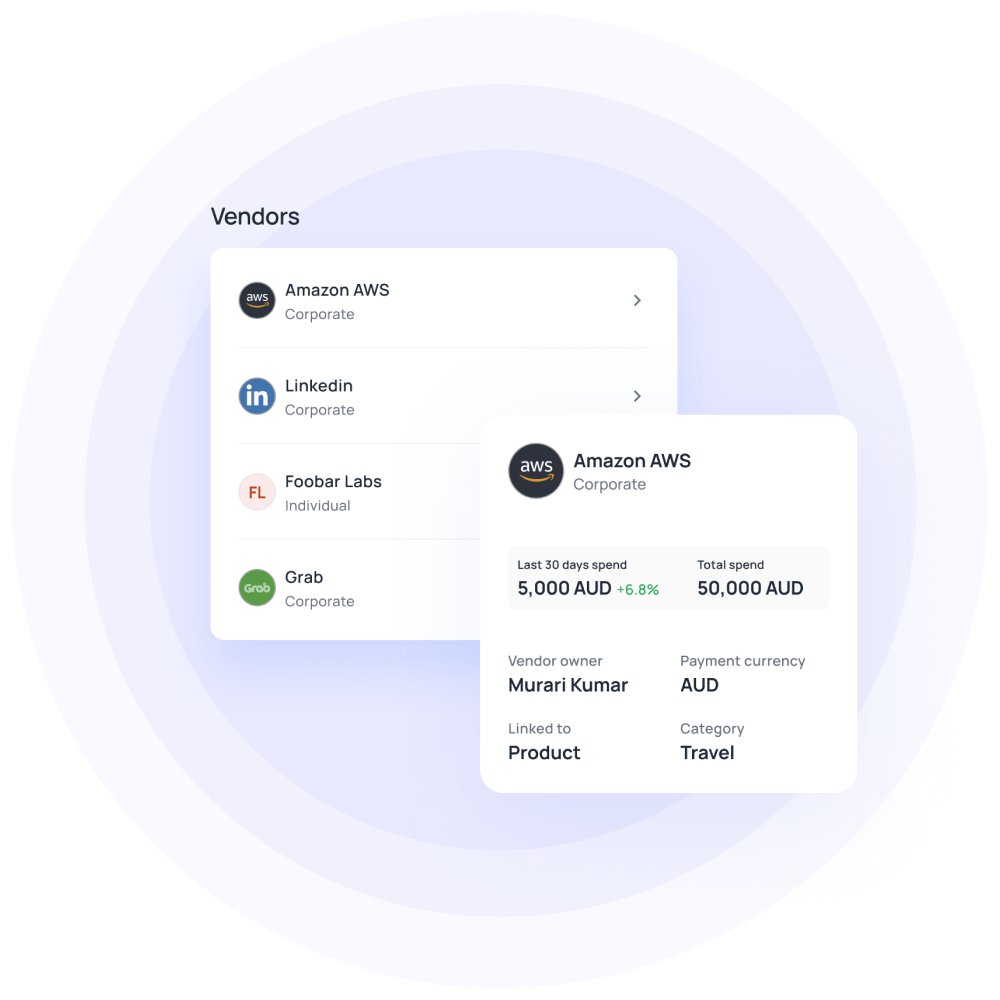

3. Manage vendors easily

A large portion of your business funds go towards paying vendors. If you want to organize and track these payments, corporate credit cards can be useful. Each vendor can be assigned their own card, which can be used to make payments on a regular basis.

You can also tag each vendor with the relevant department. This makes it easier and more accurate to track vendor payments by department.

4. Fewer instances of expense fraud

Expense fraud can take many forms, such as unauthorized spending, fake bills, and double-submitting the same expense report.

To protect your company's finances, it's important to have a transparent system that tracks expenses and makes the data accessible to finance team and all relevant parties.This helps finance teams to stay vigilant and prevent misuse and fraud.

Why businesses prefer Volopay

At Volopay, we understand that every business has unique needs when it comes to managing finances. Here's how our features align perfectly with what businesses look for when choosing a reliable spend management solution.

Consistently rated at the top

Volopay takes pride in being consistently recognized as a top performer on G2. Our G2 badges are a testament to the outstanding value and satisfaction we deliver to our users.

These recognition demonstrates our commitment to offering cutting-edge financial solutions and outstanding customer support, which positions us as a reliable option for companies all around the world.

Learn more about our corporate cards

Use a single dashboard to manage all your business cards along with business-wide visibility on spends in real-time.

Physical cards

Is using a single business credit card for all expenses creating a bottleneck situation for your company? Streamline your cash flow with a smarter spending option. Entrust your team with sleek physical corporate cards for effortless payments. Set customized expense rules on every card per your policy and we’ll help you enforce them.

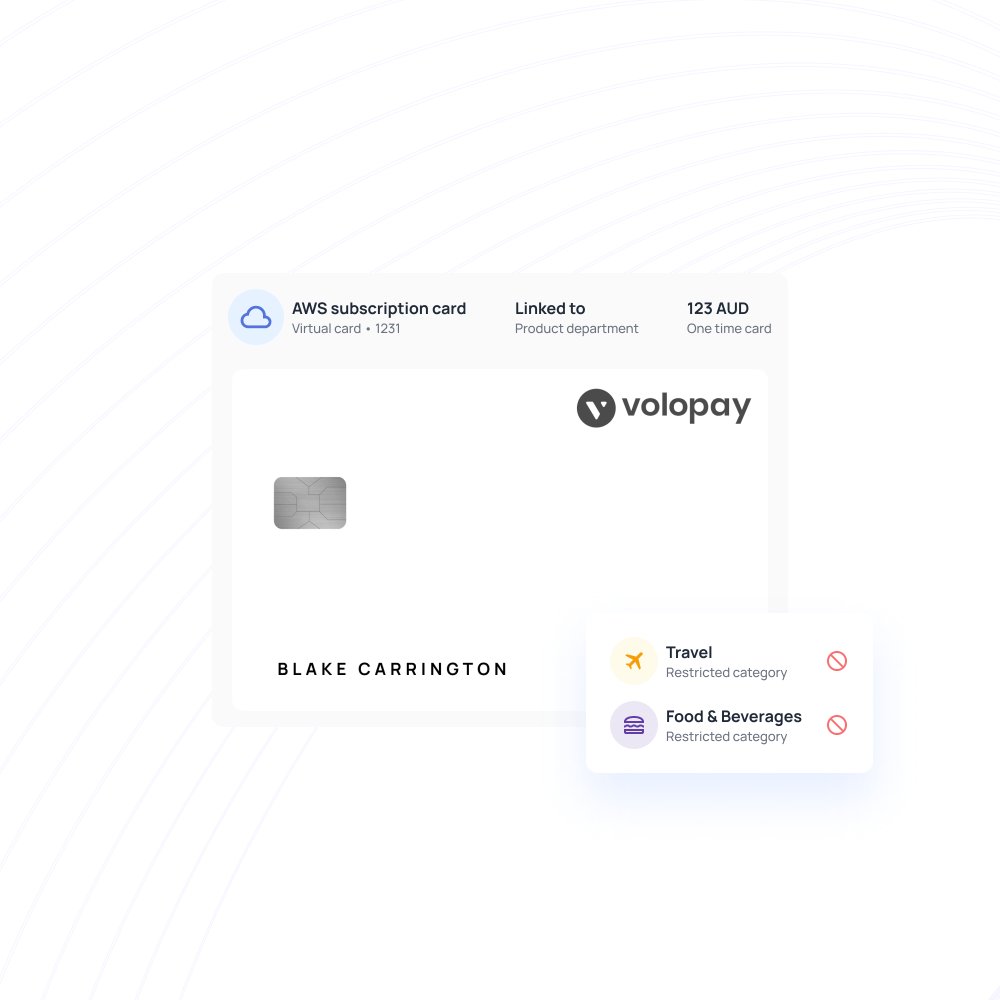

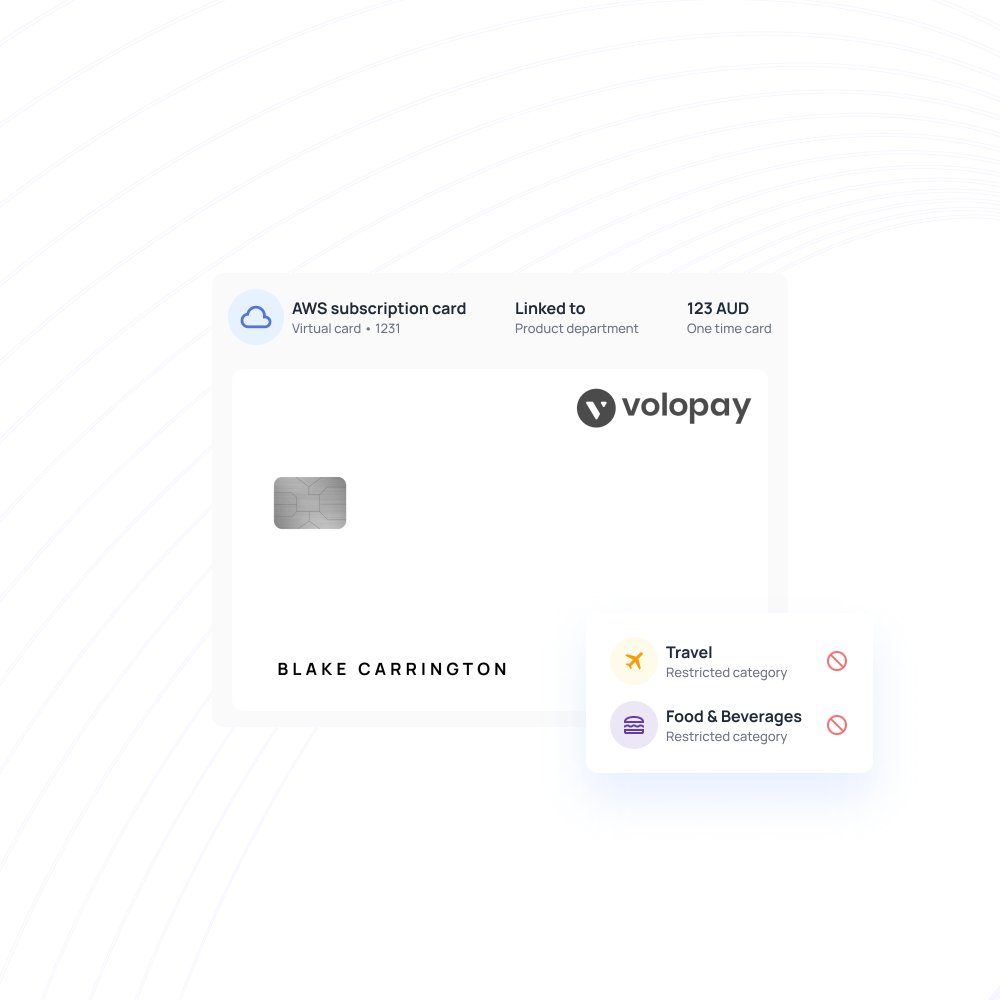

Virtual cards

Generate instant virtual corporate cards for one-time and recurring payments. Set up the recurring frequency and expiry dates to automate all your subscription payments.

Get the highest protection against fraud by allowing you to block or freeze your virtual cards to protect your funds against online threats.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Paralleldots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

Know more about corporate cards

Know more about the requirements, things to consider and how to get corporate credit card for your business.

Know more about the major differences between business and corporate credit card and choose the right one for your business.

Know more about the importance of corporate credit card and how it can streamline your business expenses.

Bring Volopay to your business

Get started now

FAQs on corporate cards

A corporate credit card is also one of the business credit card which helps employees to make all work related expenses. These corporate cards are often used to cover expenses related to business travel, office supplies, and other costs incurred while performing their job duties.

The difference between corporate credit cards and business cards is the bearer of payment & fees liability. The liability for corporate credit card falls upon the company whereas with a business card the primary cardholder is held liable.

Any company that has to make regular expenditures can qualify for and benefit from corporate cards. To qualify for Volopay corporate cards, for example, a company needs to meet certain eligibility requirements related to business type, company size thresholds, and activity expected.

No, instead of the user's credit score, corporate credit cards affect the credit score for the business entity it is connected to. Corporate cards can also help boost the credit score of an individual indirectly by helping them avoid business expenditures from their personal cards to keep credit utilization rate at a minimum.

Yes, you can obtain a credit card issued under your company's name. Banks or other financial platforms like Volopay offer different types of credit cards that can easily be issued under the name of your company.

Based on your choice of credit card, the issuing bank or financial platform may proceed to scrutinize business as well as personal credit score for eligibility.