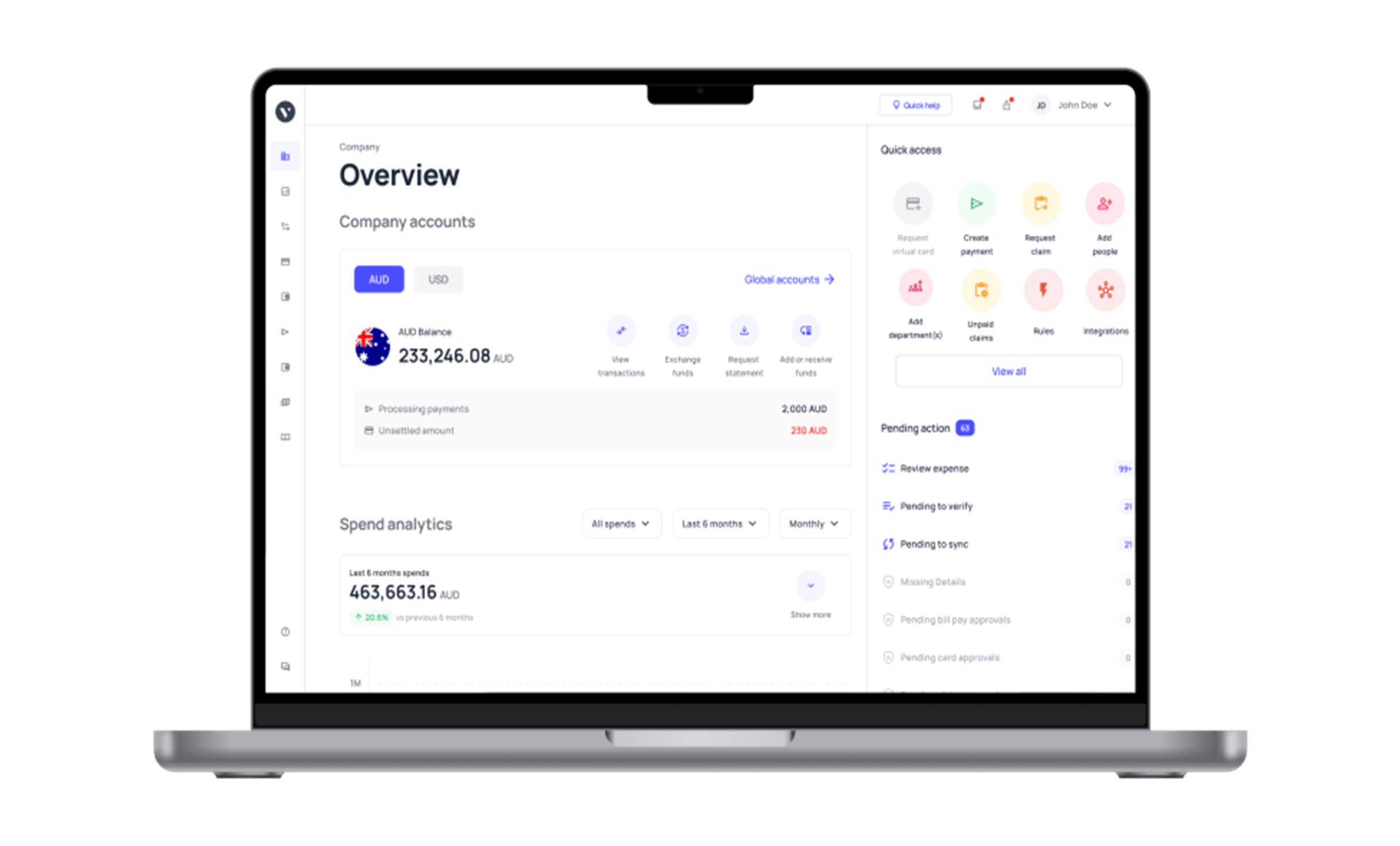

Expand your boundaries with a Volopay business account

Ditch multiple bank accounts & get the best multi-currency business account in Australia to manage all your expenses through a single dashboard.

Open a business account online hassle-free and simplify your domestic and international transactions.

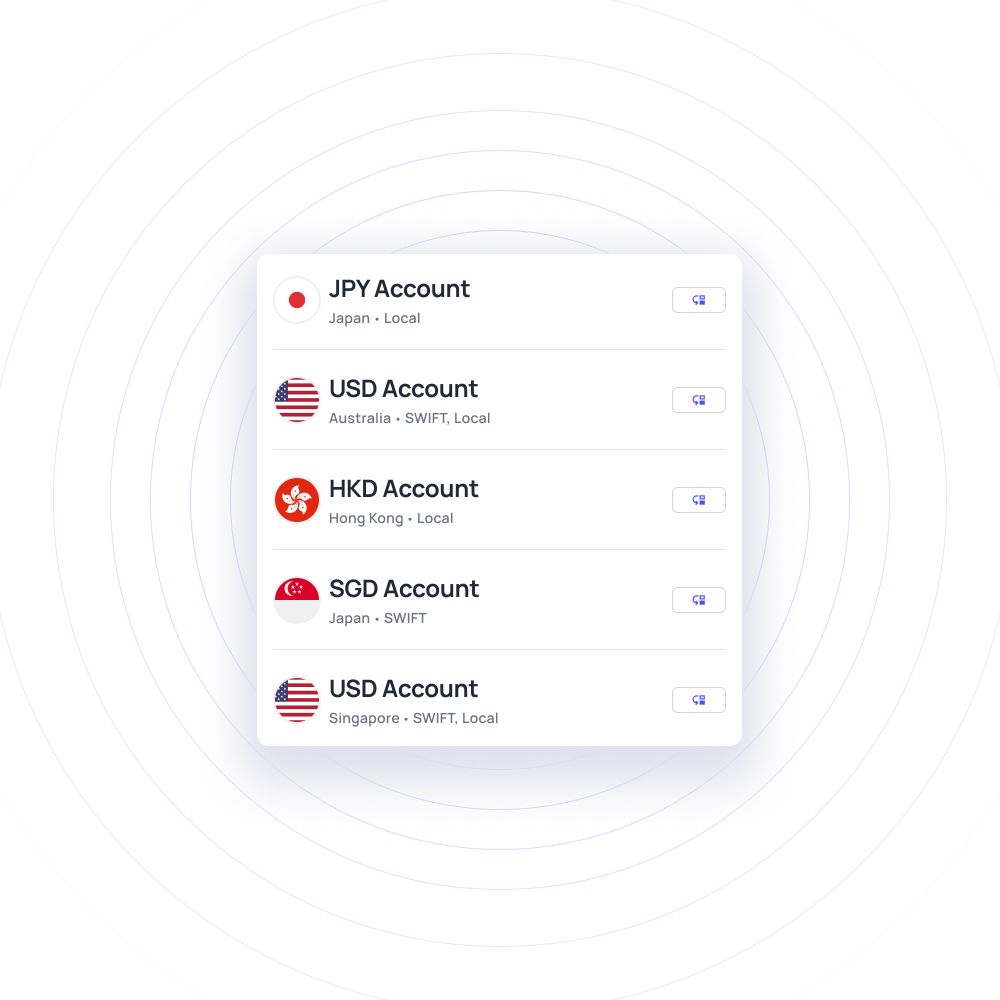

Multi currency business account

Volopay’s multi-currency wallets let you hold money in different currencies. This makes international payments simpler and helps you avoid the high exchange fees that you must bear on other platforms.

Compared to traditional banks, this is a cost-effective way to go about paying vendors abroad.

Faster domestic payments

Making payments locally within Australia is also a breeze when you get a Volopay business account. Fast transactions enable efficiency in business operations and you also get to see all your payment activity in real-time through the platform’s dashboard.

Payments without borders

Sending money to vendors or employees abroad becomes as simple as any other transaction using our business account. You get reduced FX rates when loading your multi-currency wallets, can keep all your payments centralized, and have the ability to send money to 180+ countries.

Fuel your business growth with Volopay business account

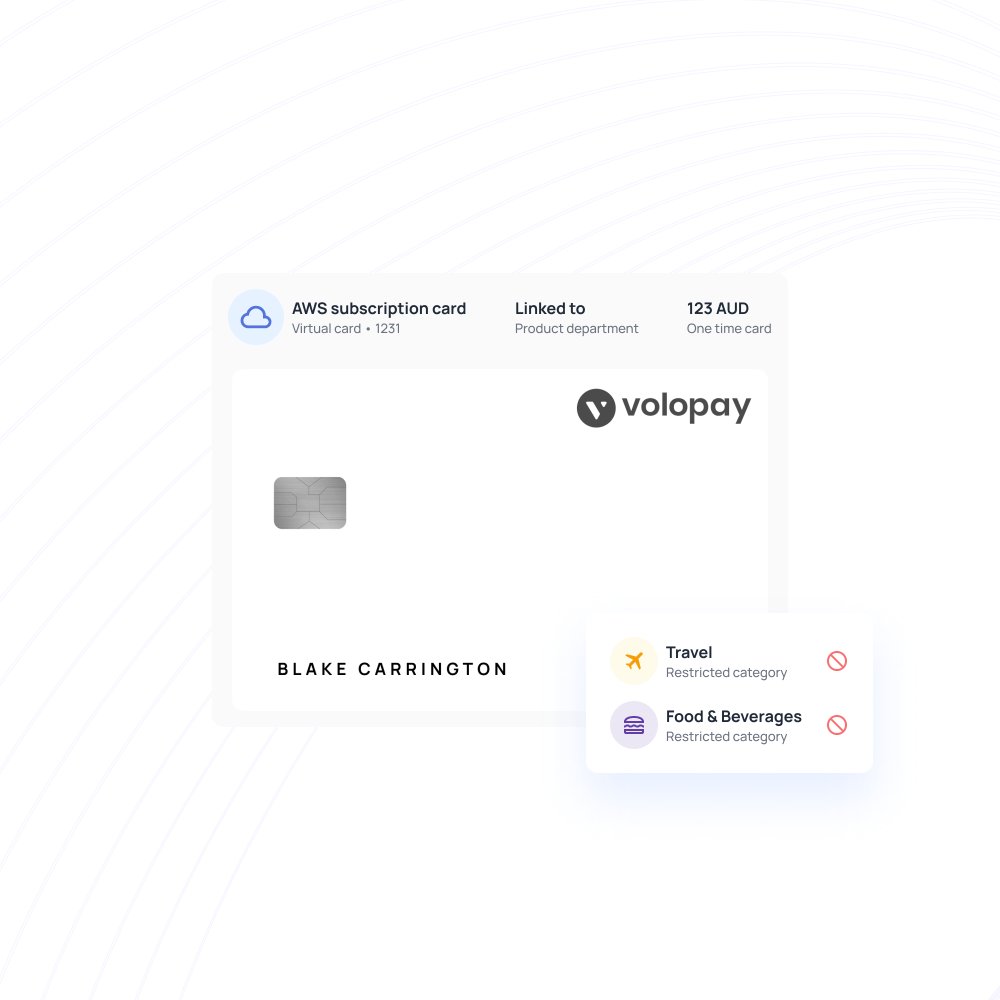

Corporate cards for expense management

Using Volopay’s business account, you get access to corporate cards for expense management that you can issue to each employee.

You can load the cards with specific currencies as per your business account and use them to pay in the local currency of a country to avoid FX charges.

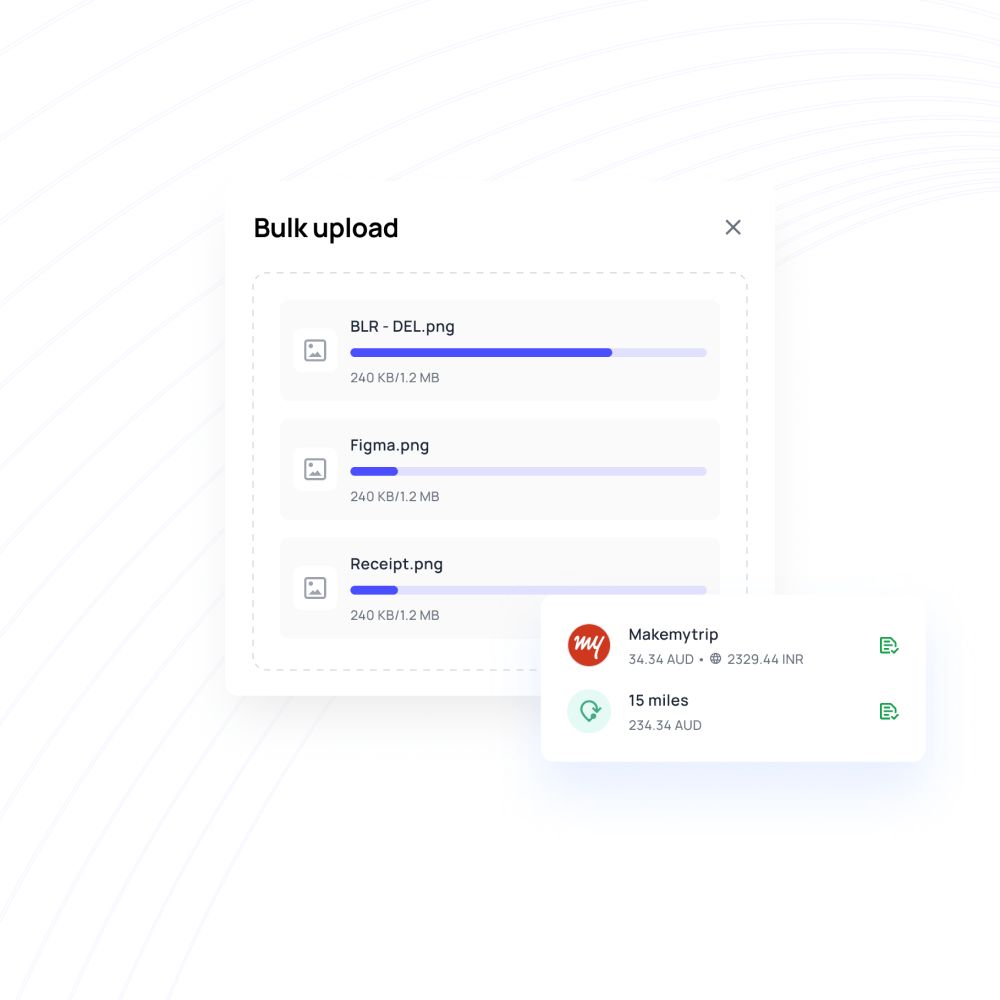

Hassle-free reimbursements

Whether it is local or international reimbursements, Volopay’s system makes it extremely easy for organizations to reimburse employees in the currency that they made an expense.

Finance teams can set up automation to ensure that claims are compliant with the company policy after which they can process bulk reimbursements.

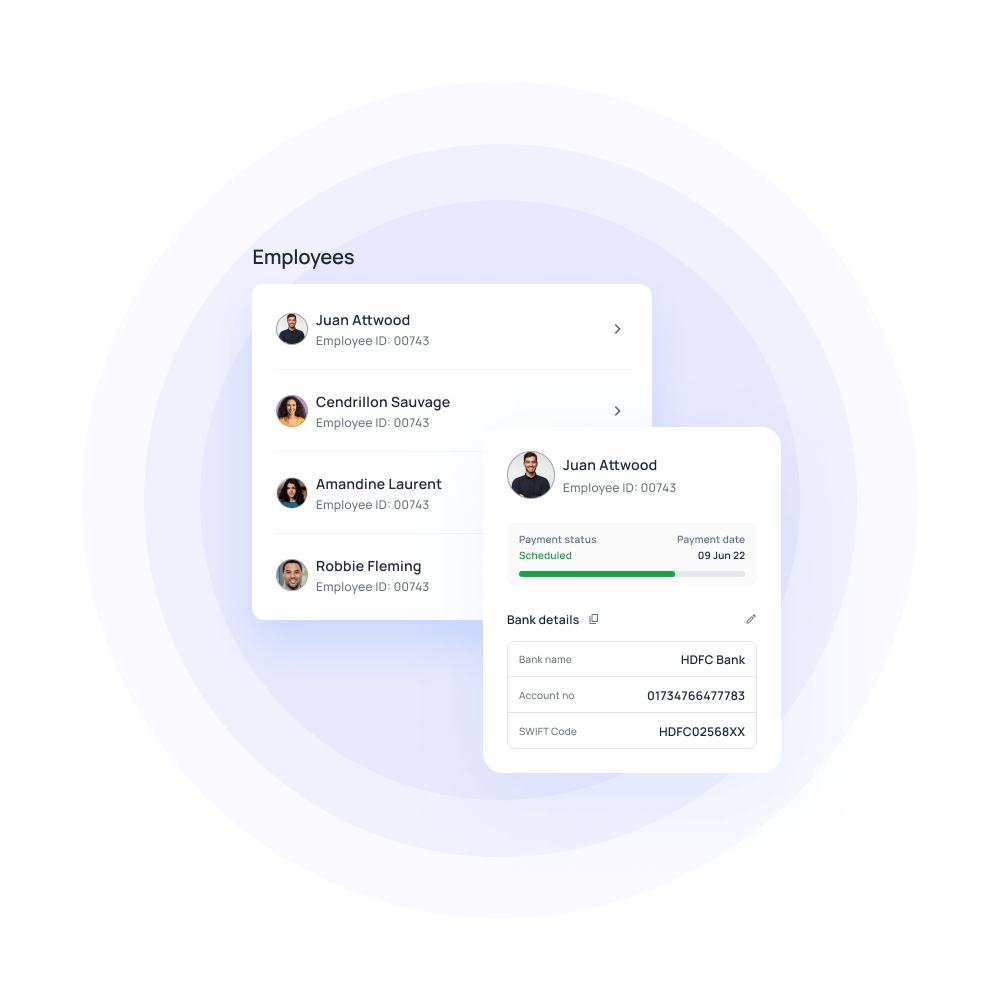

Payroll management

Pay local employees faster and make paying employees abroad even simpler without additional transfer charges. Payroll management features like auto payment dates and bulk payroll payments make sure every employee gets their salary on time.

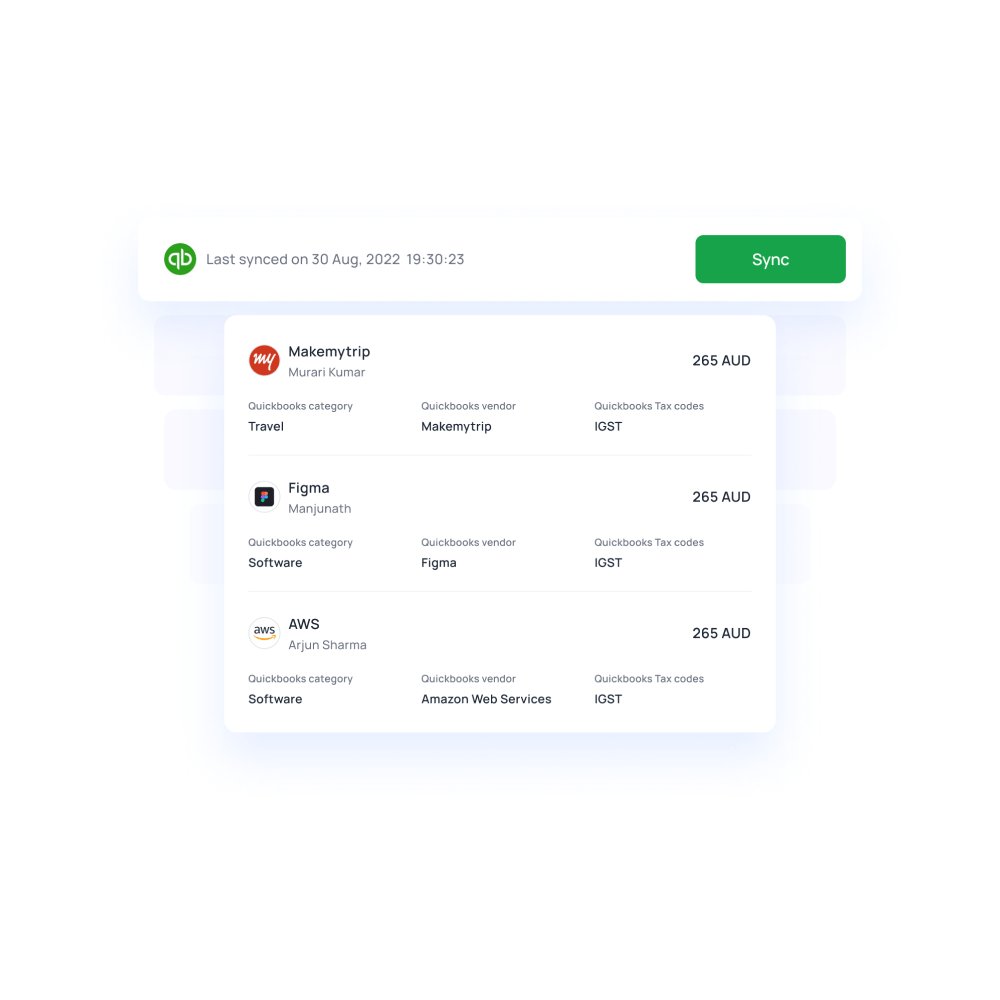

Streamlined accounting

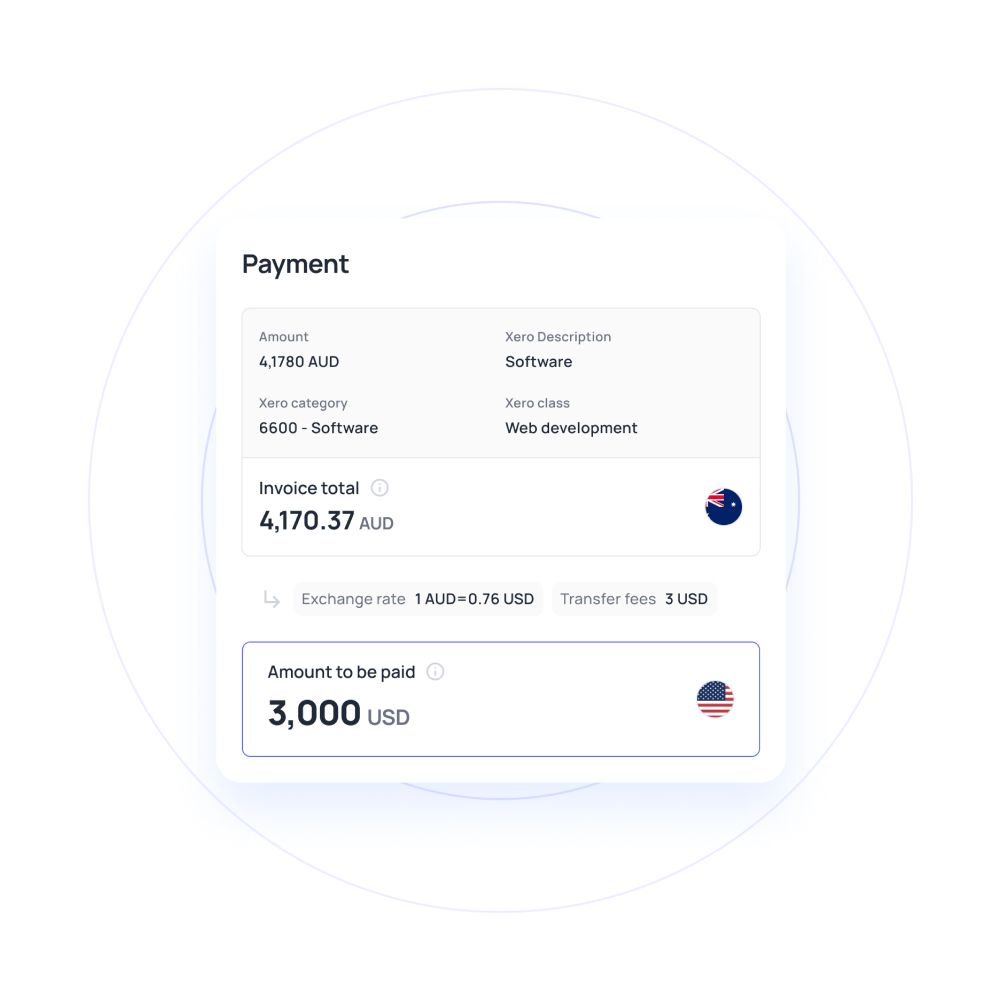

All expenses recorded and payments made through Volopay are extremely easy to sync with your accounting system and ensure uniformity of data across platforms. Advanced rules allow finance managers to make sure that expenses are automatically mapped to the correct categories.

No matter which currency the payment is made through on Volopay, you can set up automated sync timings to keep your company books up to date.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

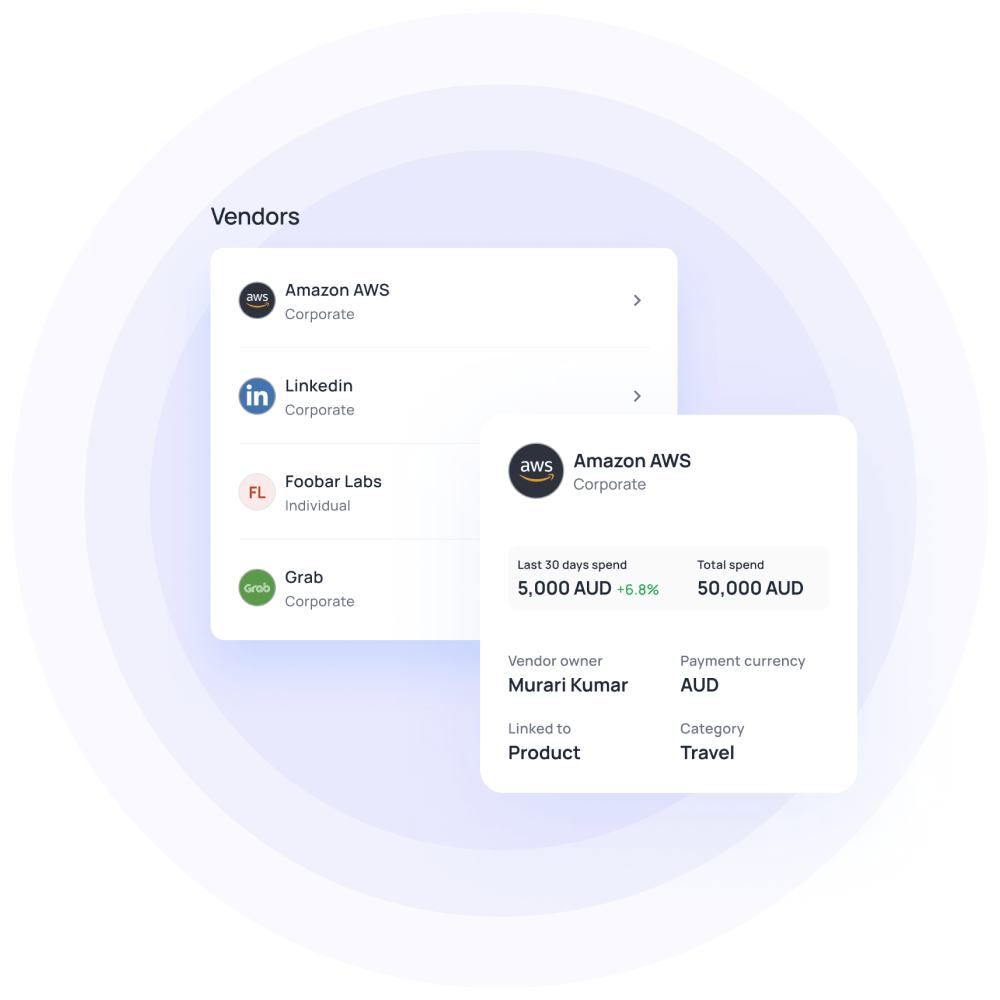

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Unleashing the potential of Volopay's features

Ensure that your employees are consistently complying with the company policies and procedures regarding transactions and payments.

Transactions made through Volopay must be approved before they’re processed.

Never lose track of how, when, and where every penny in your organization is used. Get the best business account Australia has to offer which provides features like real-time updates and alerts on all of your expenses to enhance visibility.

Skip the hassle and effortlessly streamline your workflow by directly syncing all your transaction data, eliminating the need for manual input and saving valuable time. Integrating Volopay with your accounting platform only takes a few clicks.

Simplify your approval workflows by using Volopay’s multi-level approval feature. Approvers can easily get notified to review and approve payment requests.

Get the best business account Australia has to offer for domestic and international transfers, all while maintaining affordability with low costs.

Open business account online in no time at all to ensure that all transactions are made securely. Volopay is committed to your data safety.

Volopay Vs. Business bank account - A detailed comparison

Comparing Volopay with a traditional business bank account reveals key differences in features, flexibility, and efficiency. Below, we have a detailed comparison table to help you choose the best option that suits your business needs.

Considering Volopay over your standard business bank account?

Considering Volopay over your standard business bank account?

Ensuring peak security for your business account

Licensed partners

For the highest quality of product and service through Volopay’s business account, Australia licensed organizations have partnered with us. We only partner with licensed reputable companies in the Australian financial sector.

Trust and safety

Volopay is committed to keeping your information safe. As a reputable business account provider used by businesses across the Asia-Pacific region, you can guarantee that we have the utmost care for your data.

Security and privacy

Open business account online without worrying about your privacy. Your data is securely stored on a remote server and have industry-standard encryptions and additional security features like two-factor authentication.

ISO & PCI DSS compliant

With ISO and PCI DSS certificates under our belt, Volopay has all the industry-standard security measures. You can confidently rely on our commitment to adhering to the ISO and PCI DSS standards.

How to get started with Volopay business account?

1. Simple signup process for non-banking financial solutions

There’s no need to visit a bank branch to get started with a business account. Manage your finances hassle-free with Volopay. The signup and application processes can be done fully online from anywhere for your convenience.

2. Documentation requirements and guidance

Business account opening requirements don’t have to be difficult. We only require a couple of documents, such as your business registration document and director ID, to process your application.

Our team will be happy to guide you to ensure that all goes smoothly.

3. Smooth onboarding experience

Once we’ve reviewed and accepted your application, you can get users onboarded immediately. The process is simple to do. All you need is to send employees email invites to get them to join the platform. Employees can begin using it after a short KYC.

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our business accounts

You now have the option to use a single dashboard to manage all approvals, accounts, bills, reimbursements, accounting, and cards.

Domestic money transfers

The accounts payable platform is usable by any employee that you approve. Set up advance payments for vendors, fast track your payroll, and also add money to your corporate cards for domestic use.

Local money transfers at the drop of a hat and reported in real-time for better control and approval.

International money transfers

Your foreign payments are easy to manage as your domestic ones. With the help of your Bill Pay dashboard, you can quickly send money to anywhere in the world.

All payments get recorded in the ledger so that you know exactly when, where, and how much you’ve spent.

Global business account

Go truly global. Don’t just pay international vendors. Create a multi currency account to hold money in different currencies and pay vendors and employees without the long-drawn processes and fees associated with a classic wire transfer.

We have some of the lowest FX rates in the industry, as well as support for more than 180 currencies.

Accounting automation

Stop accounting in an old-fashioned way. Accounting automation makes it possible for every transaction to be synced and reconciled as and when it happens. A quick swipe of a card, or a major transfer.

Everything is neatly reported, documented, and accounted for with the help of integrations with your favorite accounting software.

Accounts payable

A single place for you to manage all your dues. Create vendors, add them to the system, and maintain a precise list of payment and invoice histories.

The tech-driven bill payment platform stores all payments, POs, invoices, and receipts in the same spot for easy reconciliation and accounting.

Setting up advance recurring payments also makes it easier to avoid late fees.

Bring Volopay to your business

Open account now

FAQs about Volopay's business account services

No. Some institutions have a balance requirement to open a business bank account online. Australia has a number of banks that require this to get started.

But with Volopay, there is no minimum balance requirement to open a business account.

There are different requirements to open business account. Australia has providers that require you to visit a bank branch, but you will also find providers like Volopay that allow you to apply online.

You can guarantee your payment security with a Volopay business account. Australia has industry-standard security measures and regulations, which Volopay is committed to meet.

We do everything we can to keep your transaction data safe.

You can make both domestic and international bank transfers through your Volopay business account. Volopay also offers physical and virtual corporate cards that you can use to make payments online and in-store.

Yes. You’ll get a mobile app that you can use when you sign up for a Volopay business account. Australia is increasingly becoming more digital, so mobile accessibility is important to us. Manage your account from anywhere.

Unlike a traditional business bank account Australia has to offer, Volopay does not limit you. Instead, we offer the flexibility to set your own spending limits to manage your finances accordingly.

Volopay stores your data in a remote server and has industry-standard encryptions. We are also ISO and PCI DSS compliant, ensuring that we perform all the necessary steps to keep your financial information secure.

Yes, you can make international payments with your Volopay account. We offer both SWIFT and non-SWIFT international transfer methods, as well as physical and virtual cards that can be used globally.

As a modern fintech solution for businesses, Volopay is more than just a business account. You can get a business bank account Australia has to offer, but with Volopay, you get tools to manage your finance processes.