Domestic money transfers in Australia made quick & secure

Have multiple payment channels for different vendors and remittances? Swap out the lengthy procedures with Volopay. Consolidate your diversified expense types through our employee and vendor payment services. Send money locally that reflects in seconds. Track every single dollar that leaves your company with the fastest domestic money transfers in Australia.

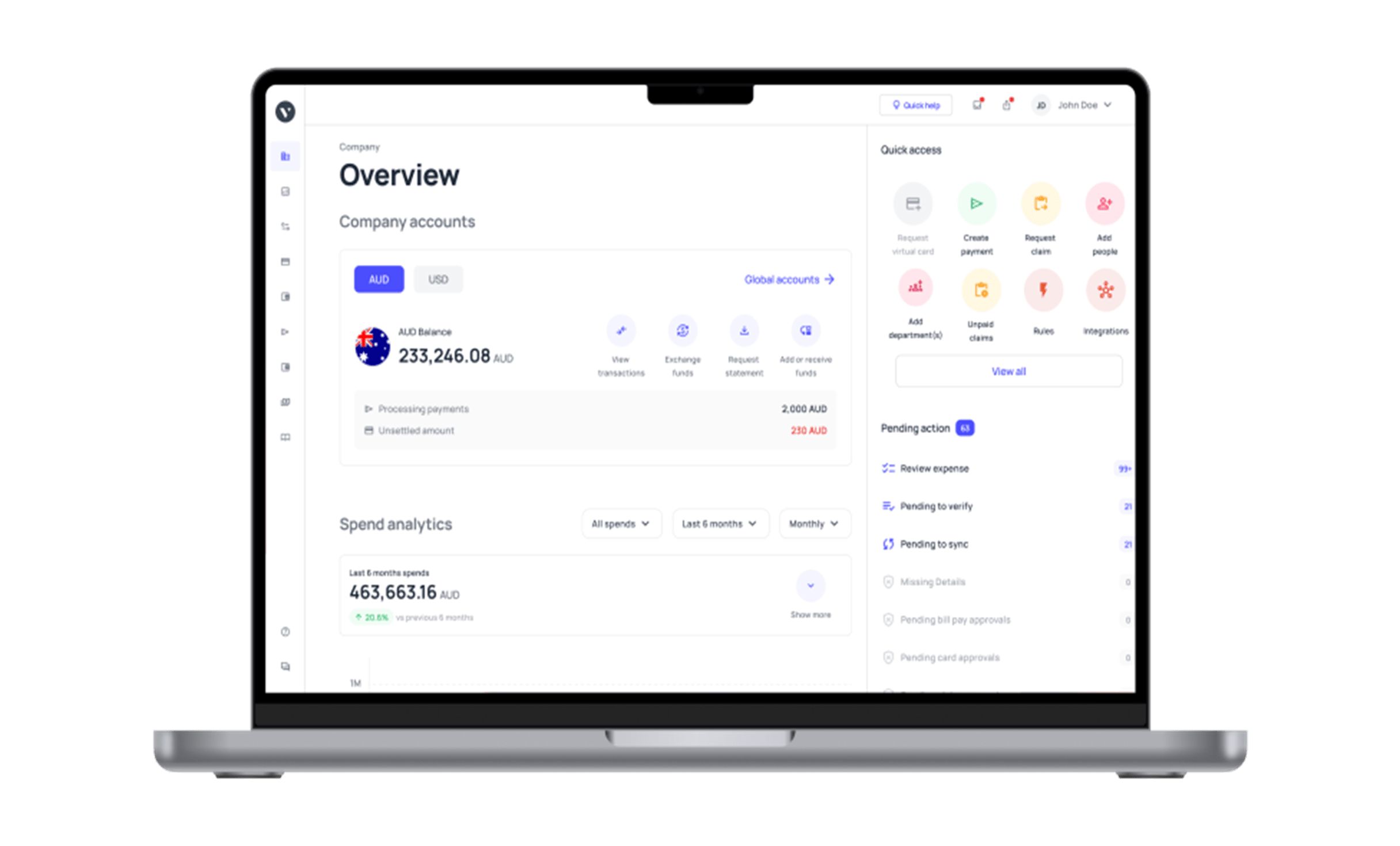

Many expenses, one dashboard

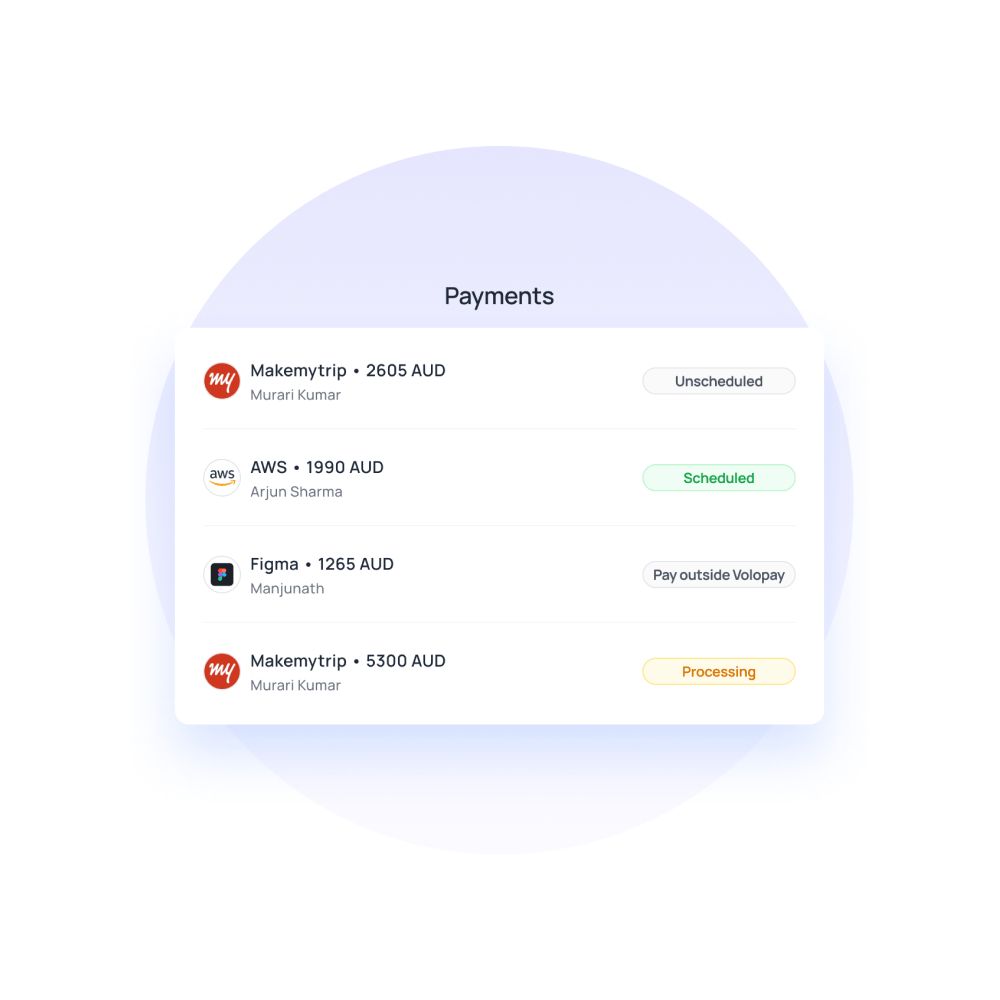

Whether it’s our vendor payment services, reimbursement, or payroll, manage and track all transactions on our intuitive, live dashboard. Get 100% visibility into all domestic money transfers in Australia — know the who, when, where, and why of every spend.

Whether you are in Adelaide or Sydney, access all company invoices and receipts on our unified, centralized location.

Lightning-fast money transfers

Transfer money at the speed of light. Volopay’s employee vendor payment services allow you to pay within Australia in a matter of seconds.

Enjoy zero markups on your local vendor payments and domestic employee payments. No hidden charges, no surcharge. Pay your local merchants and staff and send money within a few clicks.

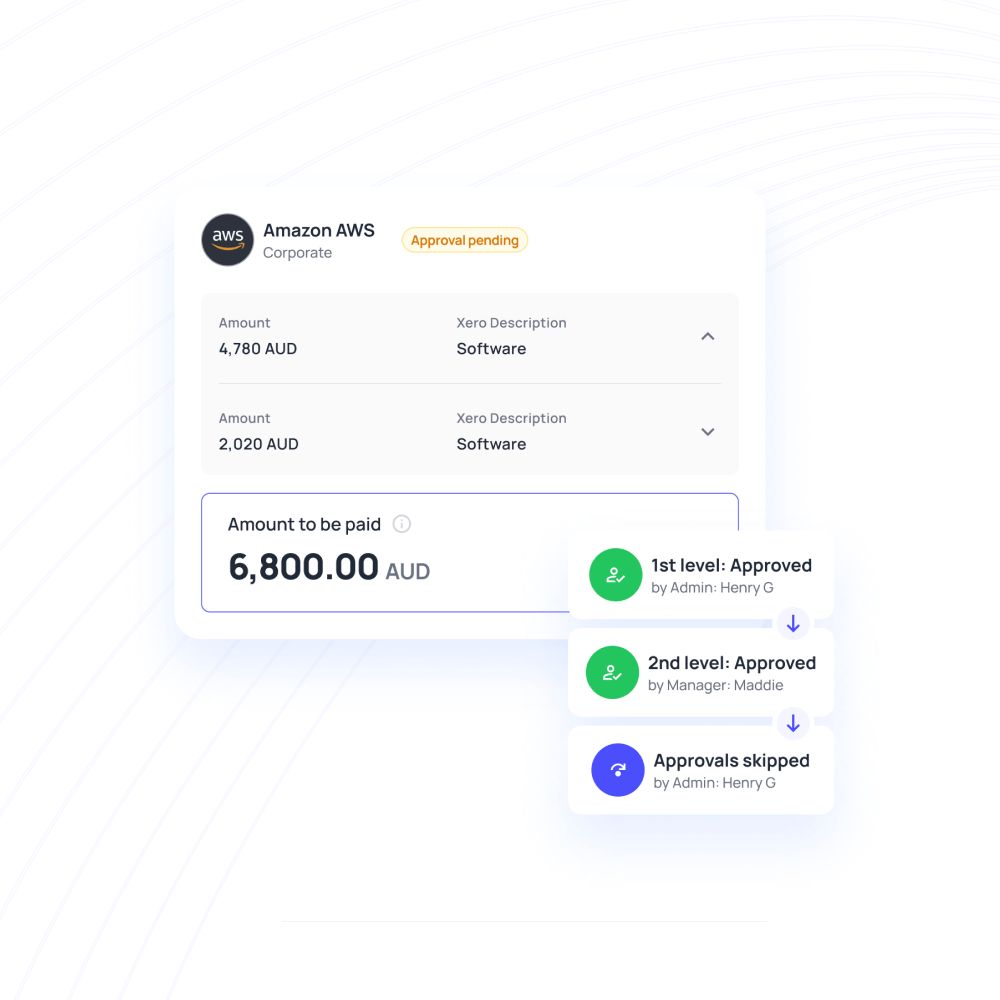

Multi-level approval process

Swap out dodgy expenses for faster verification and greater accountability. Create custom, multi-level approval workflows for every single expense that processes through our system.

Assign multiple approvers on every level and choose from our range of in-built policies such as the maker-checker policy to ensure the maker of an expense is never its sole checker. Wish to create custom policies? Configure company expense policies directly into our system and enforce compliance from the get-go.

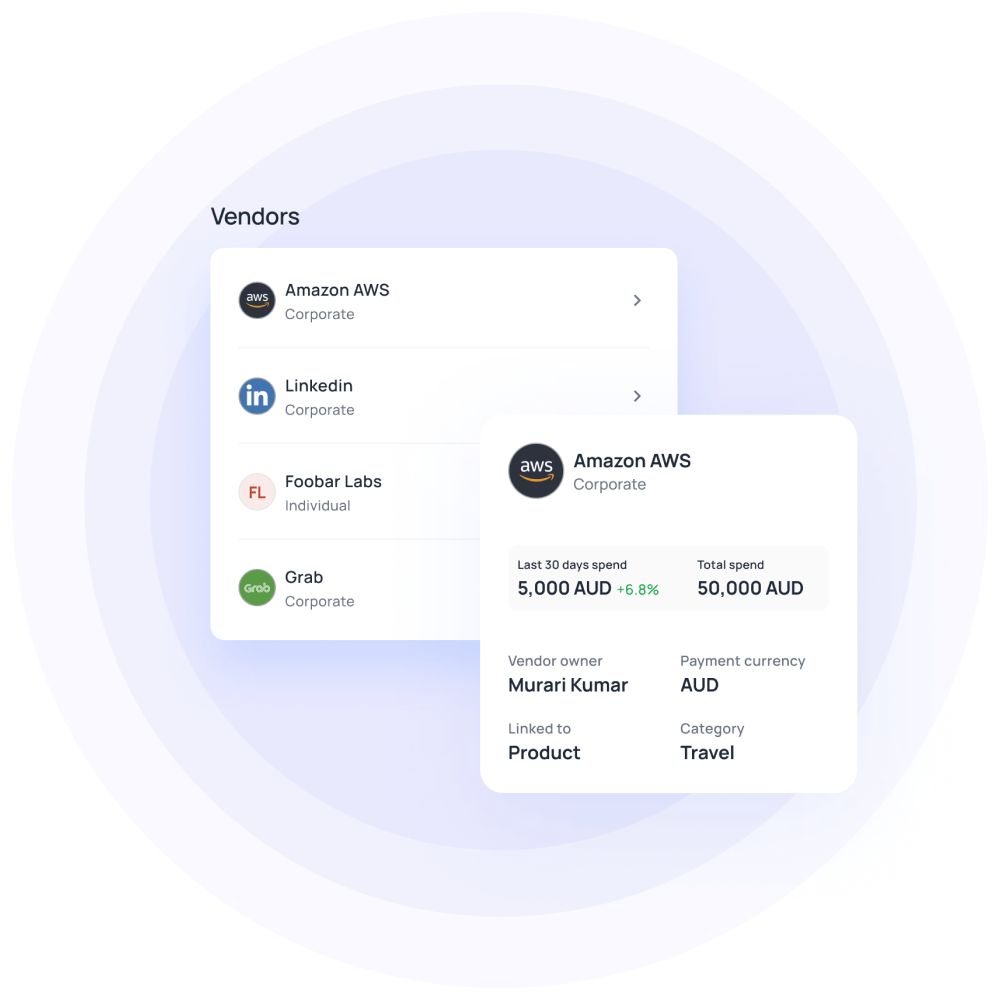

Vendor management

Manage your vendor network from the Volopay dashboard for the quickest payment process. Enjoy hassle-free vendor payment services: add and remove vendors, request payment details easily, link vendors to specific departments or projects, and even assign users to specific vendors for quicker approval processes.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Consistently rated at the top

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our domestic money transfers

Volopay offers a host of services to ensure a smoother end-to-end accounts payable process. Experience a seamless blend of invoice processing, reimbursement, corporate cards, approvals, and integrated accounting automation on a unified platform.

Global business account

Open a global multi-currency business account and hold money in all major currencies. Enjoy super-low FX charges than other traditional banks. Volopay charges A$0 remittance fees for hassle-free global payments.

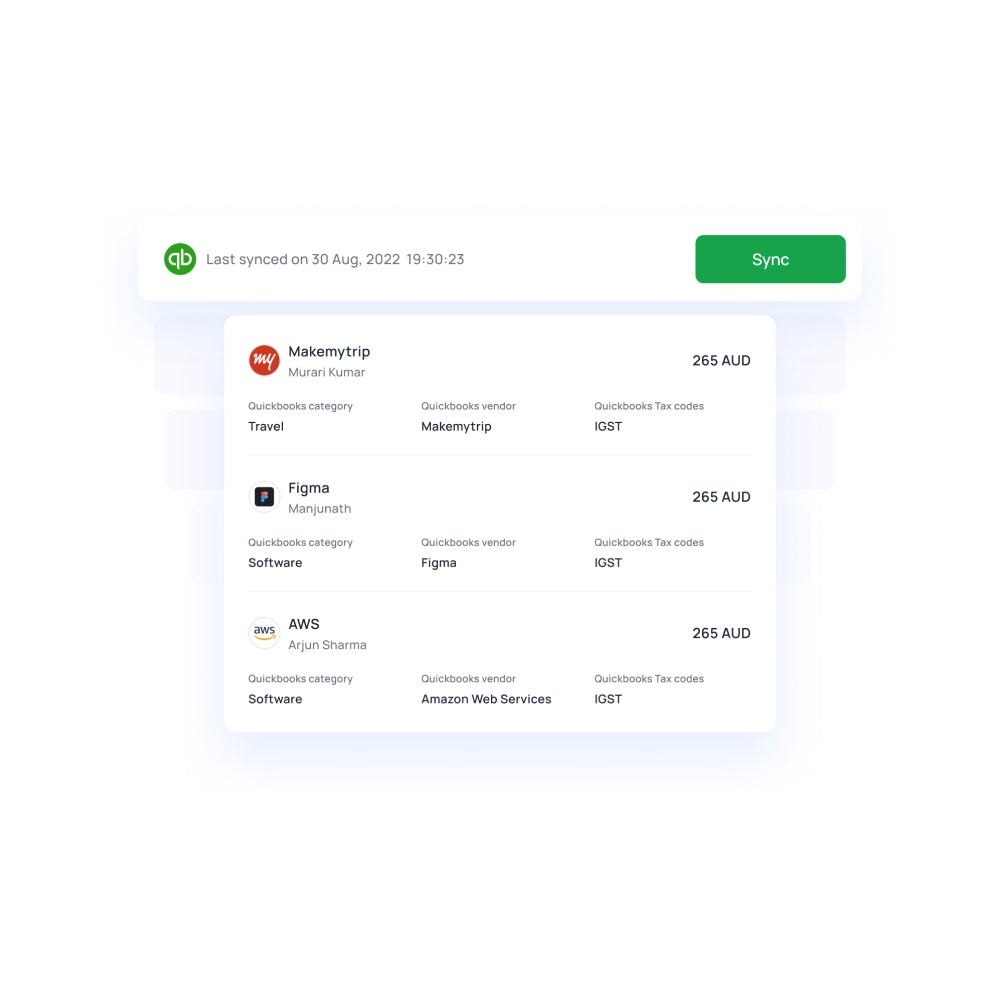

Accounting automation

Experience the world’s fastest accounting integrations at your fingertips. Close books in record time with automated accounting. Volopay seamlessly integrates with leading accounting software - Xero, Quickbooks, NetSuite, Deskera, and MYOB.

Vendor payouts

Pay vendors wherever they are with Volopay. Enjoy local and cross-border B2B payments with non-SWIFT and SWIFT options. Generate invoices, schedule payments, and automate processing with our Bill Pay feature.

Pay on time, every time. Receive early payment discounts from vendors on the Volopay platform.

Bring Volopay to your business

Get started now

FAQs on domestic money transfer

No, SWIFT is not used for domestic payments. It is a payment network that facilitates transfer of funds between banks across the globe.

Yes, it is possible to transfer money between business accounts. You can do so either from the bank directly or via an expense management software like Volopay.

The time it takes to transfer money domestically in Australia varies from bank to bank. However, with an expense management software like Volopay you can transfer funds, both domestically and internationally, within seconds.

Volopay’s live dashboard tracks every single money transfer made for maximum visibility and easier reconciliation. Instead of going through various payment channels and reconciling expenses arbitrarily, Volopay collates all necessary information into every single transaction (bills, invoices, or receipts) to track and categorize expenses in a more streamlined manner.

When businesses grow with unbridled ambition, why should their expense management be any different? Volopay offers unlimited transactions for all domestic money transfers. Make payments in bulk or pay as soon as you receive an invoice, enjoy super-fast payments with no processing fees charged by us.

Paying through Volopay is 100% safe. Volopay does not have access to your funds in e-wallet, we are simply an all-in-one medium through which you can manage your end-to-end accounts payable process. To safeguard your business capital, you can top up your e-wallet which acts like an escrow account.

Additionally, we issue VISA corporate cards that are super secure as the money in your account or e-wallet cannot be directly accessed using these cards.