Attain spend control with tailored expense management software

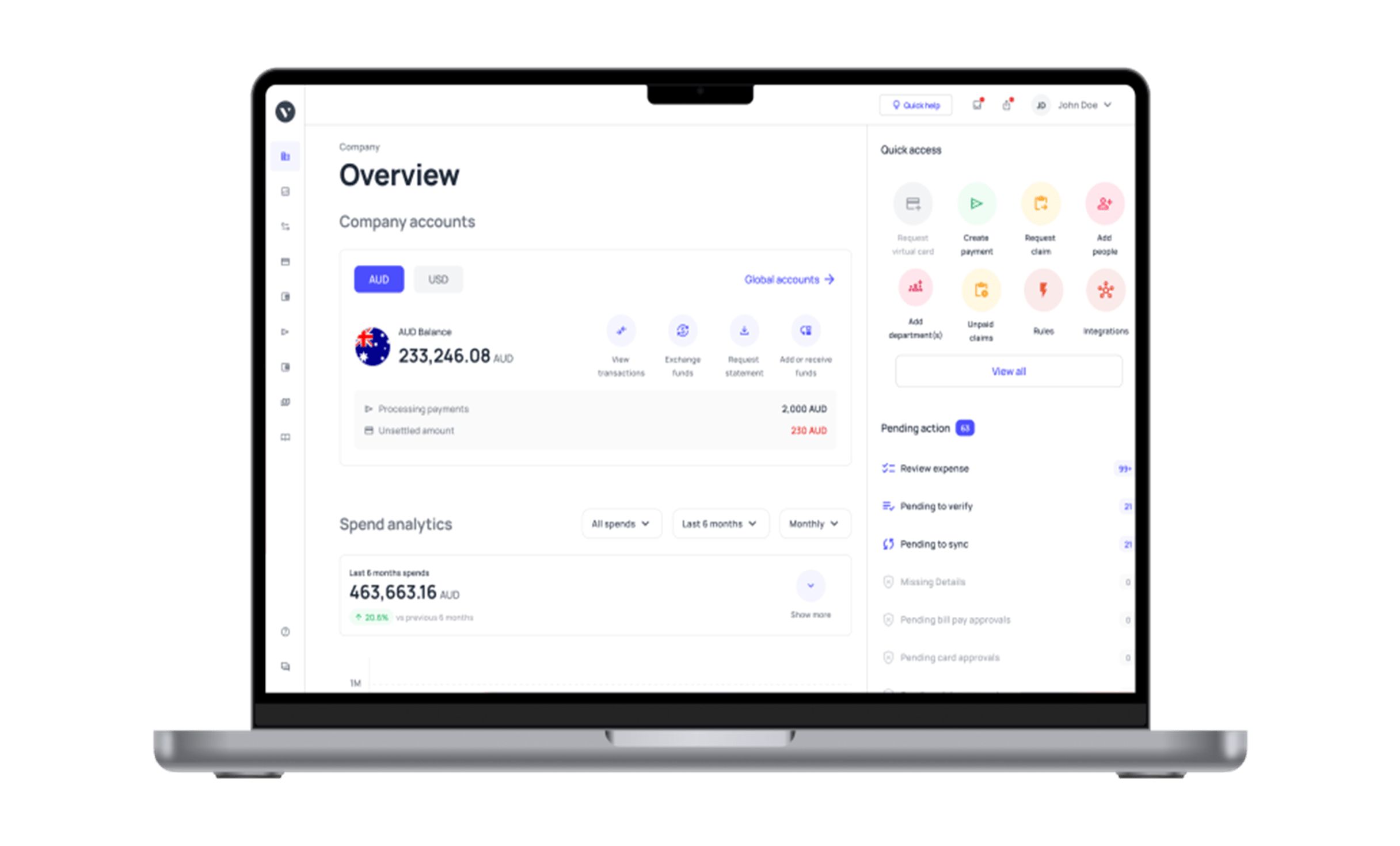

Explore what makes Volopay’s expense management software one of Australia's best financial control platforms. With features designed to automate, simplify, and streamline processes, you can track spending in real-time, effortlessly process reimbursements with a single click, manage subscriptions and so much more.

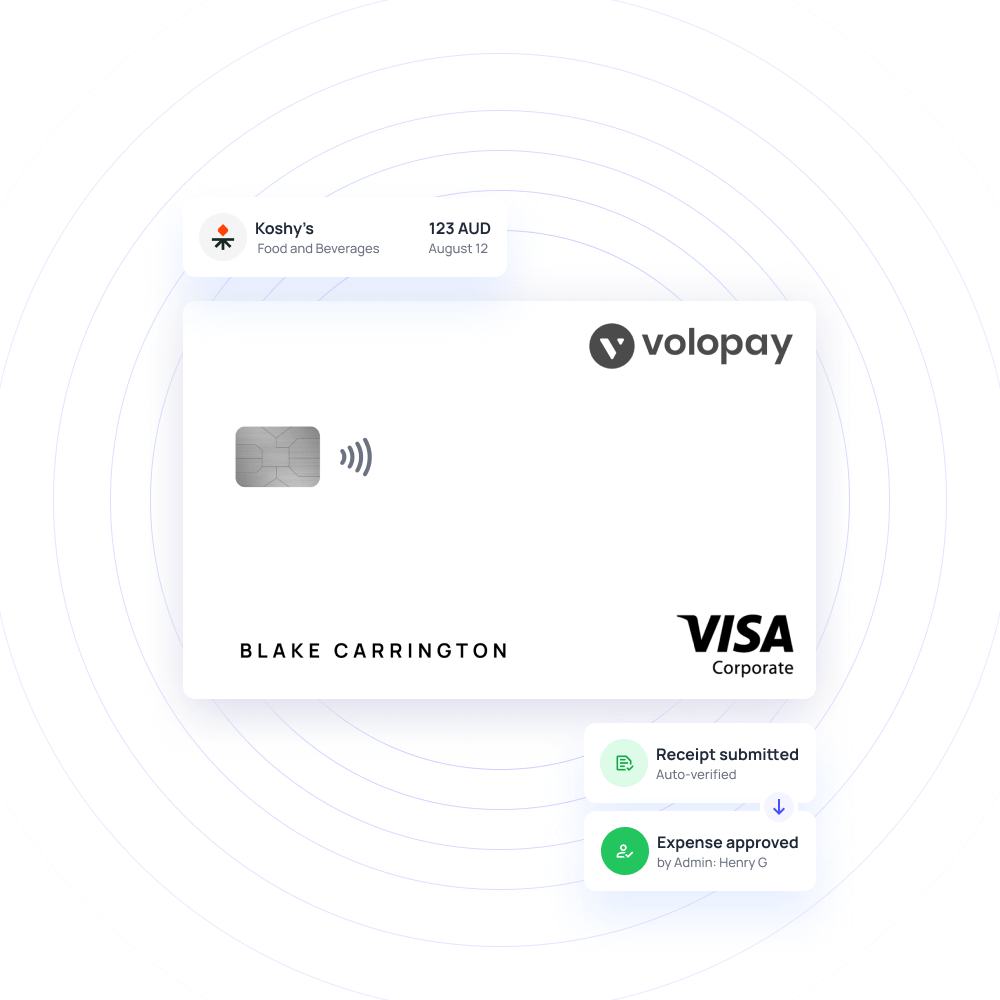

Smart corporate cards for modern businesses

With Volopay’s corporate cards, you can now filter merchants at company, department, project, and card levels. Easily restrict or allow transactions based on merchant category codes and names. You can also issue highly customizable, unlimited virtual cards.

Additionally, all Volopay cards are linked to a centralized software that gives you real-time updates on card use.

Reimburse out-of-pocket expenses

The Volopay platform allows you to effortlessly upload receipts in bulk for claims, utilizing an optical character recognition (OCR) system that scans and recognizes payment details automatically.

Set up auto payments and enable the automatic settlement of all approved claims on specified dates. You can also effortlessly input both the starting and ending locations for mileage claims; the system will automatically calculate the number of miles traveled, coupled with a visual map. Different mileage rates for different countries are also customizable on Volopay.

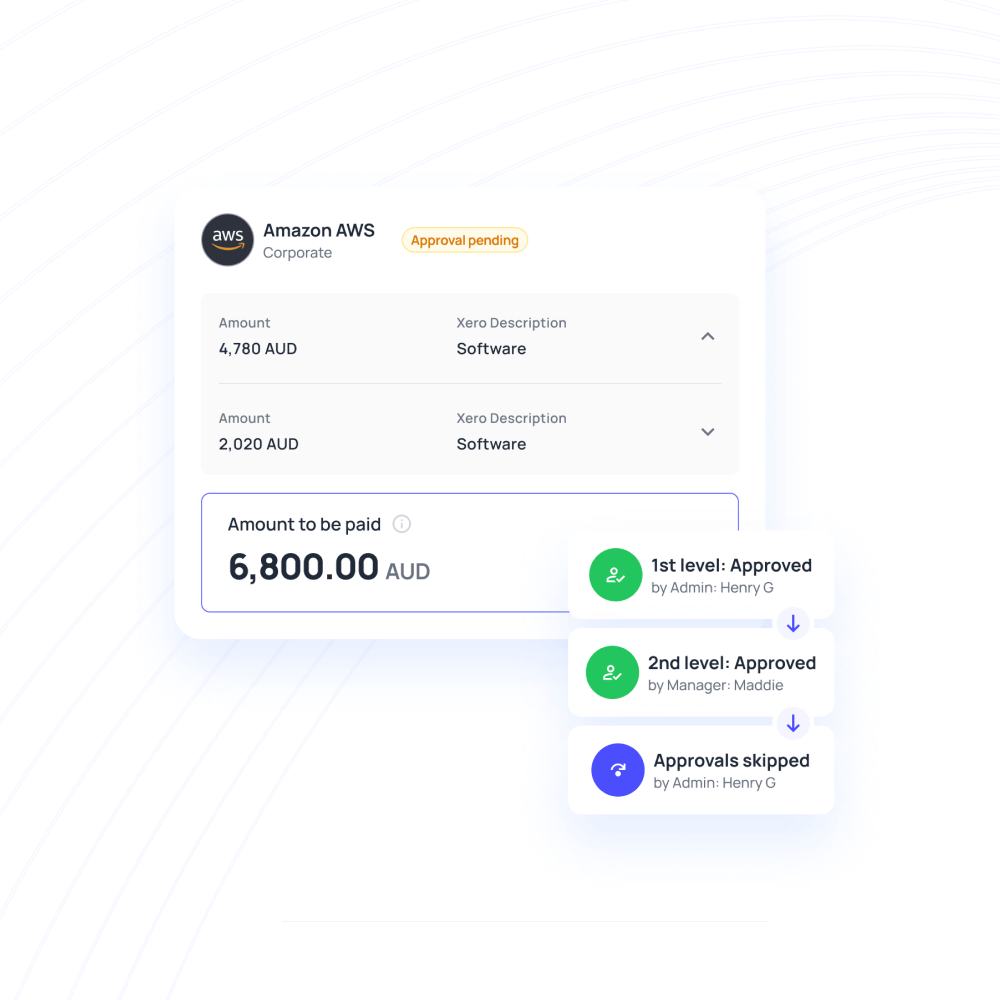

Customizable approval cycles

Set approval policies on a company-wide level. Each parameter on spend policies is highly customizable on Volopay.

Customize your approval workflow according to the department or project needs, set different approvers for different ranges, and customize these user roles as per business requirements.

Automate your business expense tacking

Centralized spend management on one platform

Volopay allows company-wide spending management from one central platform. From here you can set up automatic payments, set up department or project-specific budgets, and reduce the burden of manual data entry with our OCR integration feature.

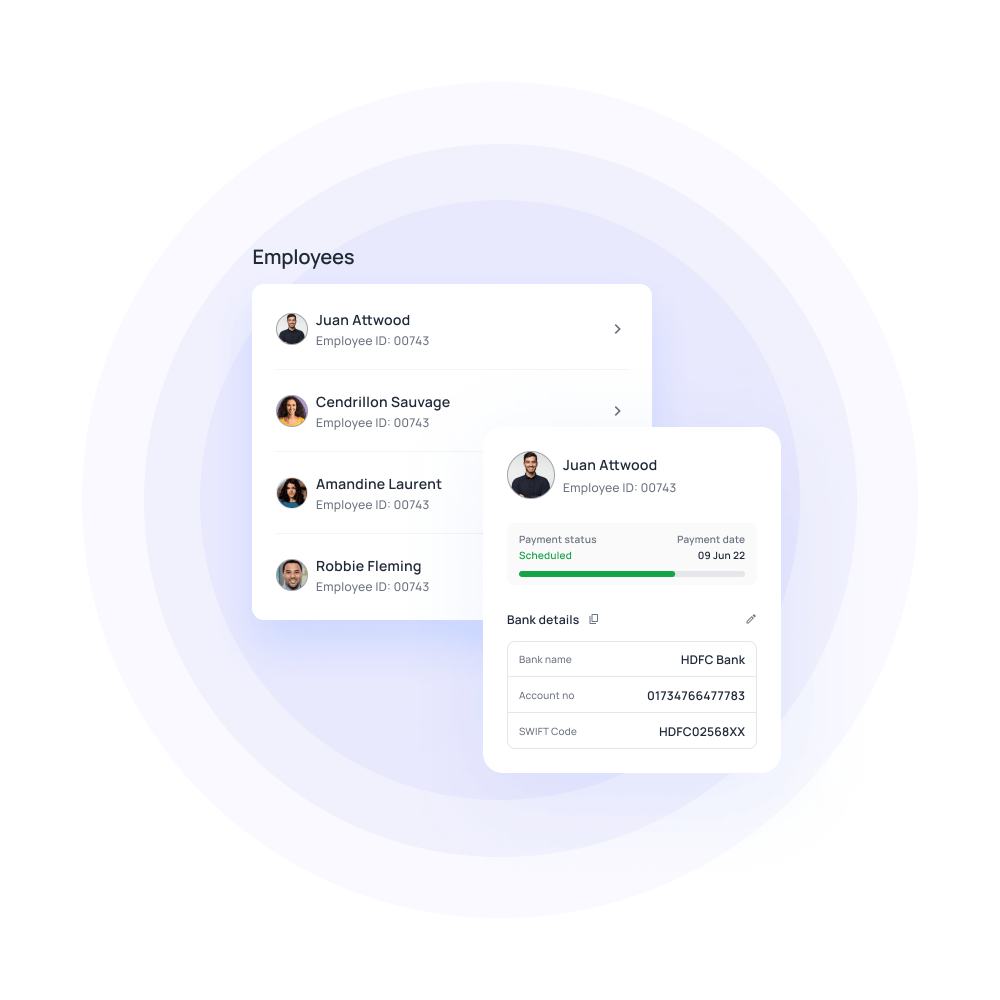

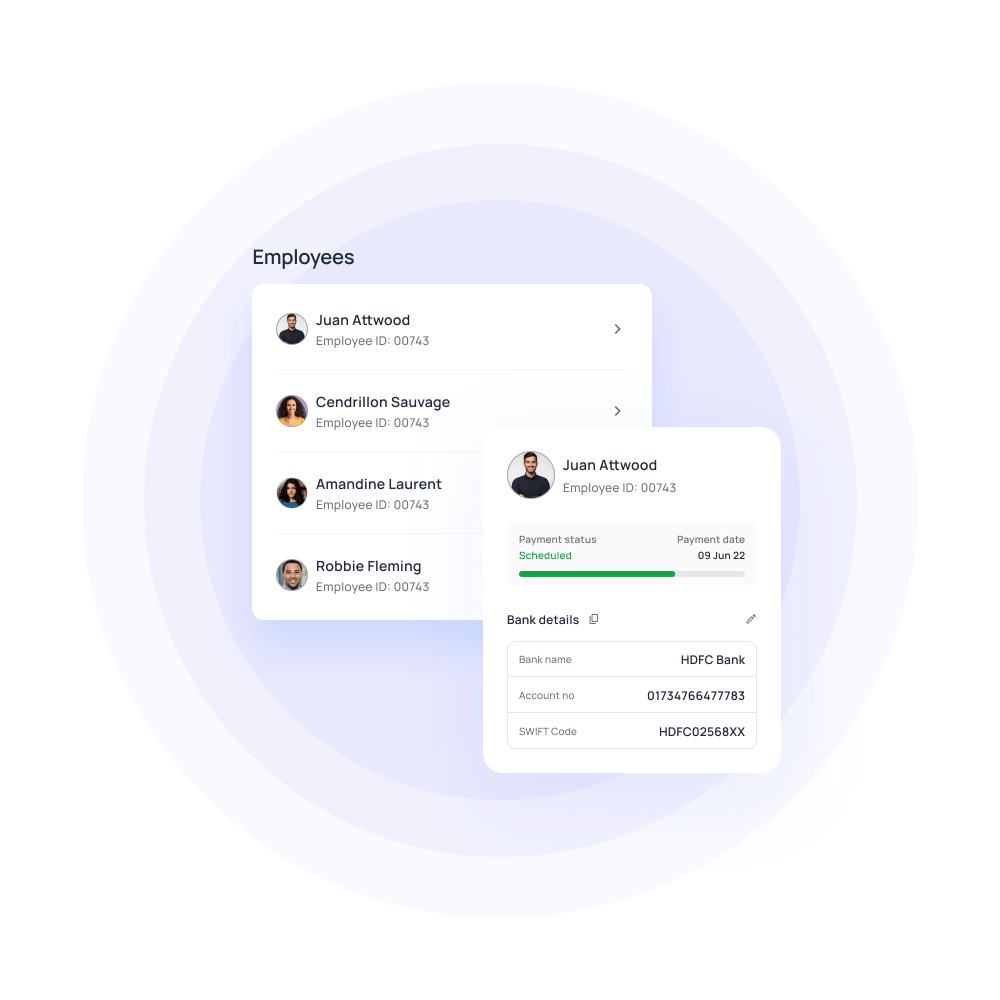

Manage your company’s payroll

To further support expense management tasks Volopay enabled users to easily manage payroll payments and process bulk payments. You can also automate payroll payments by setting a specific payment date, ensuring payments are made on time without manual intervention.

Volopay's expense management solutions are meticulously crafted to empower businesses with greater control, transparency, and efficiency over financial operations. Whether it’s for a budding startup or a multinational corporation, Volopay's platform has been designed to adapt to unique needs and scale rapidly with growth.

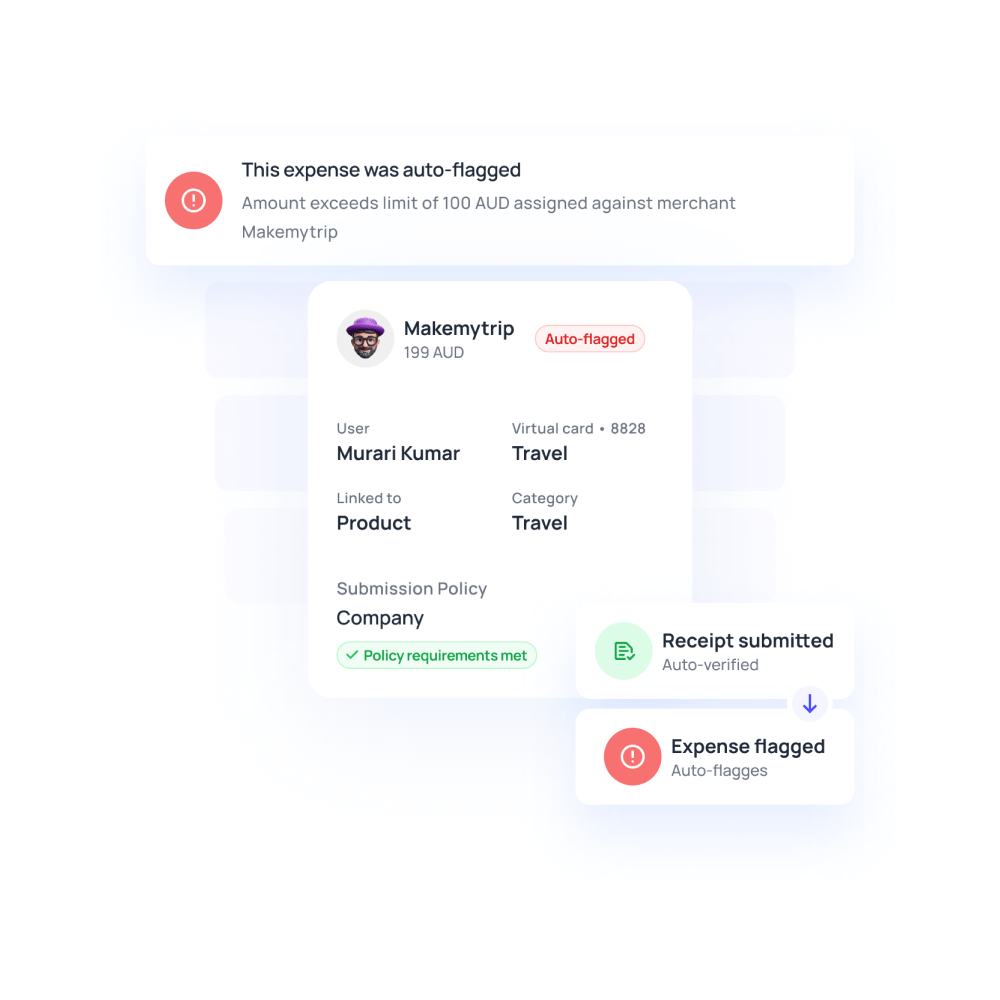

Spend controls to manage expenses

Volopay enables users to set limits for each payment category, offering both flexible as well as non-flexible limiting options. Users also receive alerts and warnings from the system when a duplicate payment is detected, preventing overpayments.

This security feature is further strengthened by the ability to set criteria for flagging expenses based on conditions such as amount, department/project, category, and merchants.

Automate expense tracking and reporting to maximize efficiency

Expense tracking made easy

Expense management software offers a streamlined solution for businesses to track and manage their expenses efficiently. This technology simplifies the otherwise cumbersome process of recording and monitoring expenses, saving valuable time and resources.

Your finance team does not have to spend hours recording and keeping track of expenses manually. Using the software, most of this expense management process is automated.

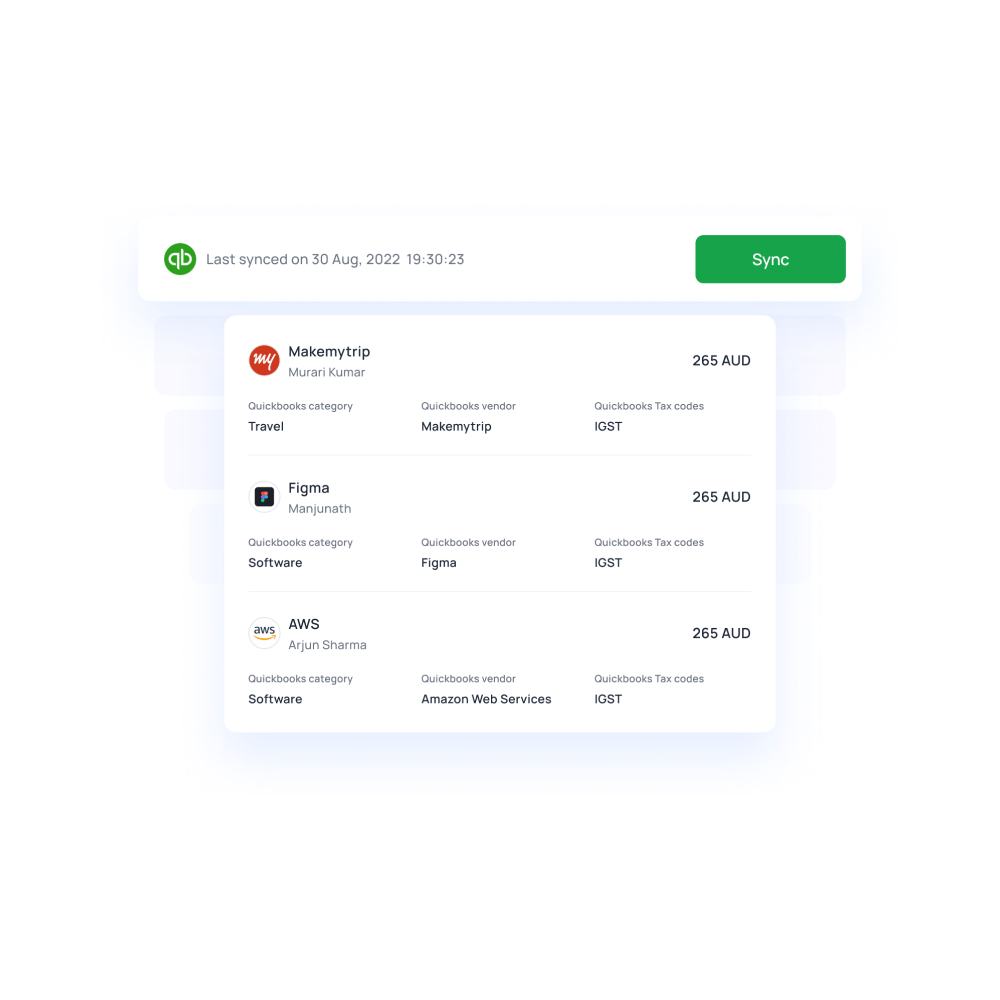

Easy to integrate with other software

Modern expense management software is designed to integrate seamlessly with other business tools and software. This integration streamlines data transfer across platforms, ensuring a cohesive financial ecosystem and reducing manual data handling.

A few examples include expense management systems being able to integrate with accounting systems. Having this type of integration is very necessary as it is a must for businesses to account for all their expenditures.

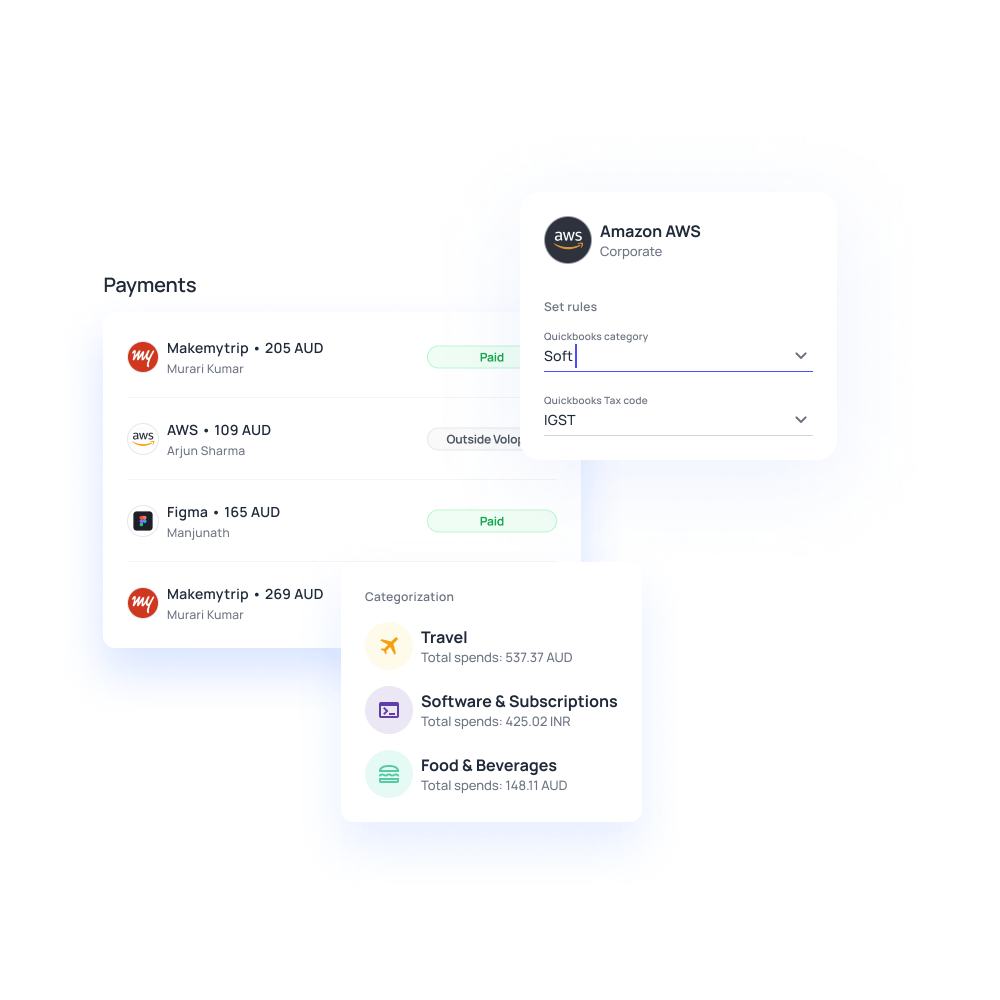

Smooth automated expense reporting

With expense management software, generating expense reports becomes a breeze. The software automatically compiles expenses from various sources, categorizes them, and creates comprehensive reports. This automation reduces errors and ensures that expense reports are generated promptly.

Whether you want to see how much employees spent using their corporate cards, how much was paid to a vendor during a period, or the amount that a particular team has spent, you can do it all with customized reports that you can generate through the platform.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Why should you use an expense management solution?

Minimize fraudulent activity

Small businesses can be at risk of payment fraud from both internal sources, such as employees altering records or processing excess payments, and external parties, such as vendors sending invoices for non-existent goods.

To safeguard your business, it is recommended to implement a comprehensive expense management application. This can assist in identifying fraudulent activity and can provide a protective measure.

Identify spend policy violations

Expense policies are established to regulate expenses related to business operations. However, some employees may intentionally abuse these policies for personal gain and may violate the company policies.

Implementing a transparent payment system can prevent this type of misuse, protecting your company funds and making it clear to employees the consequences of violating policies, whether intentionally or unintentionally.

Scan and capture receipts

Usually employees carry receipts safely till they come back from their business trip and then submit their reimbursement claims. If reimbursements can be done from anywhere, they can have a peaceful trip without safeguarding receipts.

Expense management system lets them do this reimbursement claims in a much easier way by scanning receipts and submitting the claim. This way reimbursements happens seamlessly and employees can focus 110% on their trip.

Identify duplicate expenses

Duplicate payments are instances of the same payment being made twice and these can occur frequently.

With the use of expense management software, it is easy to identify duplicate payments. Also, payments can be automated eliminating the duplication.

Improve supplier evaluation

Maintaining positive relationships with suppliers is important for the ongoing success of your business.

An expense management platform can not only facilitate vendor payments, but also assist in evaluating and selecting vendors. This gives the overview of your vendor.

Real-time policy checks

It’s always difficult for your employees to keep in mind the detailed travel and expense claim policies.

The expense management software is capable enough to process the expenses that align with your company's policy that matches the updated guidelines.

How can Volopay help your business?

Accurate spending reports

Your finance team puts a lot of work into creating spending reports and analysis. If they get all the data they need in-hand, it will be much easier for them to do analysis and make financial decisions.

With Volopay, they can achieve this and can generate more accurate reports whenever needed.

Spend within your business budget

Plan your budgets and spend it wisely by synching them to our expense software. You can set your company budgets and monitor all expenses department-wise in real time.

Volopay gives you better controls to track the spending and limit the overspending to maintain good cashflow.

Expense reporting for employees

It may take up to a day for employees to claim and sort out their expense claims after a trip. They also need to follow-up with other teams to know the status of their claim.

Volopay simplifies all these processes. Employees can simply submit their expense claims and can check the status periodically and get updated.

Expense reporting in one-click

Expense reporting, reimbursements claims are tedious and time consuming for employees who frequently travel. Your employees can submit expense reporting and claims in just one-click and upload scanned receipts right there.

Volopay lets employees to do their claims even when they are travelling through desktop suite or mobile app.

Instant reimbursements

Employee happiness and satisfaction will make the workplace happiest and productive. Tedious tasks like reimbursements should be made easier for employees, so that they can completely focus on their own tasks.

With Volopay, they can submit claim requests instantly and receive payments quicker. Additionally corporate cards further simplifies by providing pre-approved limits to use when required.

Automate expense approvals

Whenever an employee submits a request it automatically gets transferred to the first level of approval. There may be single or double authorization based on upon which the claim may travel and moves to the settlement stage.

Notifications will be sent quickly to the approvers about the request and they can see all the requests in the queue. This way Volopay helps business to automate their expense approvals.

Better compliance and accountability

Accounting is always regulated by governance policies and compliance. It is always required to stay compliant with your tax authoritator’s for hassle-free tax returns.

Volopay helps you stay updated with being compliant if any new changes implemented.

Integrate with accounting software

You can connect Volopay with any accounting software you use. Always safe and encrypted data transfer happens from Volopay to destined application you connect.

No more toggles between tabs is required for your accountants to manually enter data.

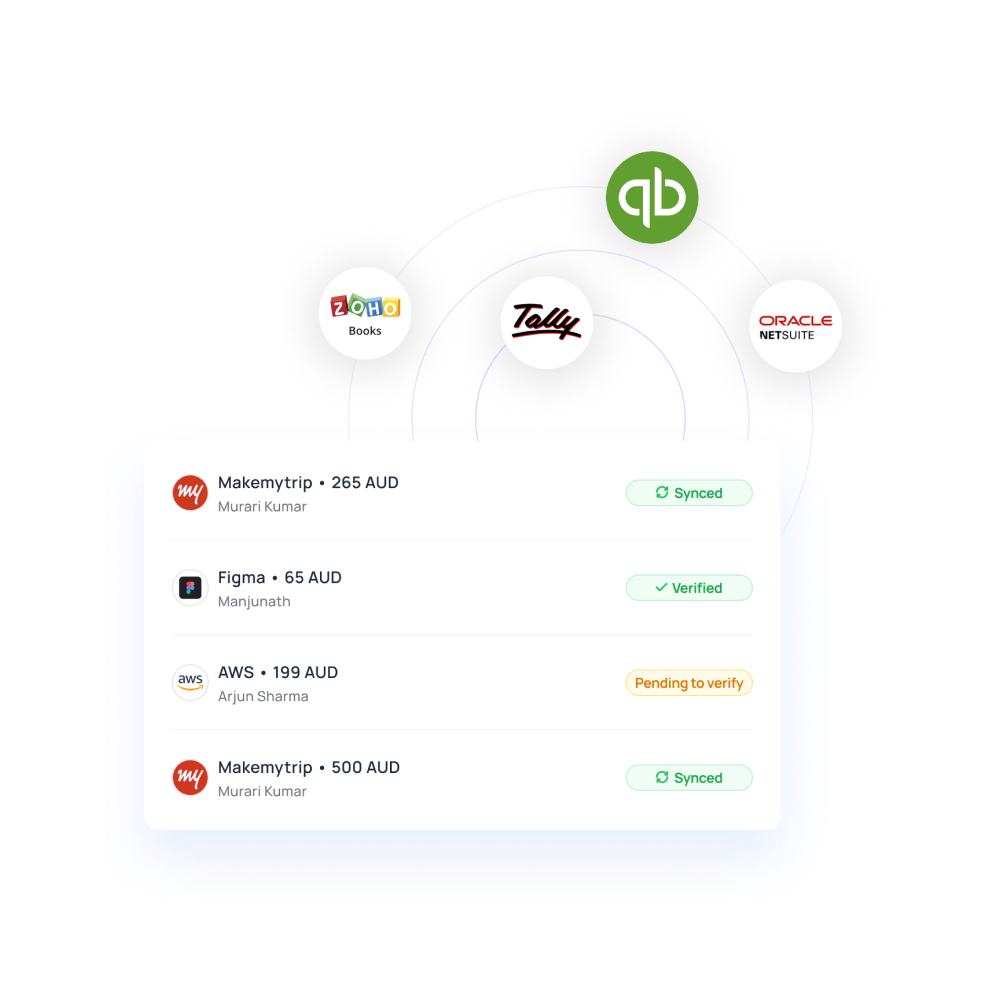

Integrations supported by Volopay

Volopay’s expense management software supports a wide array of integrations, making it a versatile tool for businesses. The software seamlessly connects with various categories of business software:

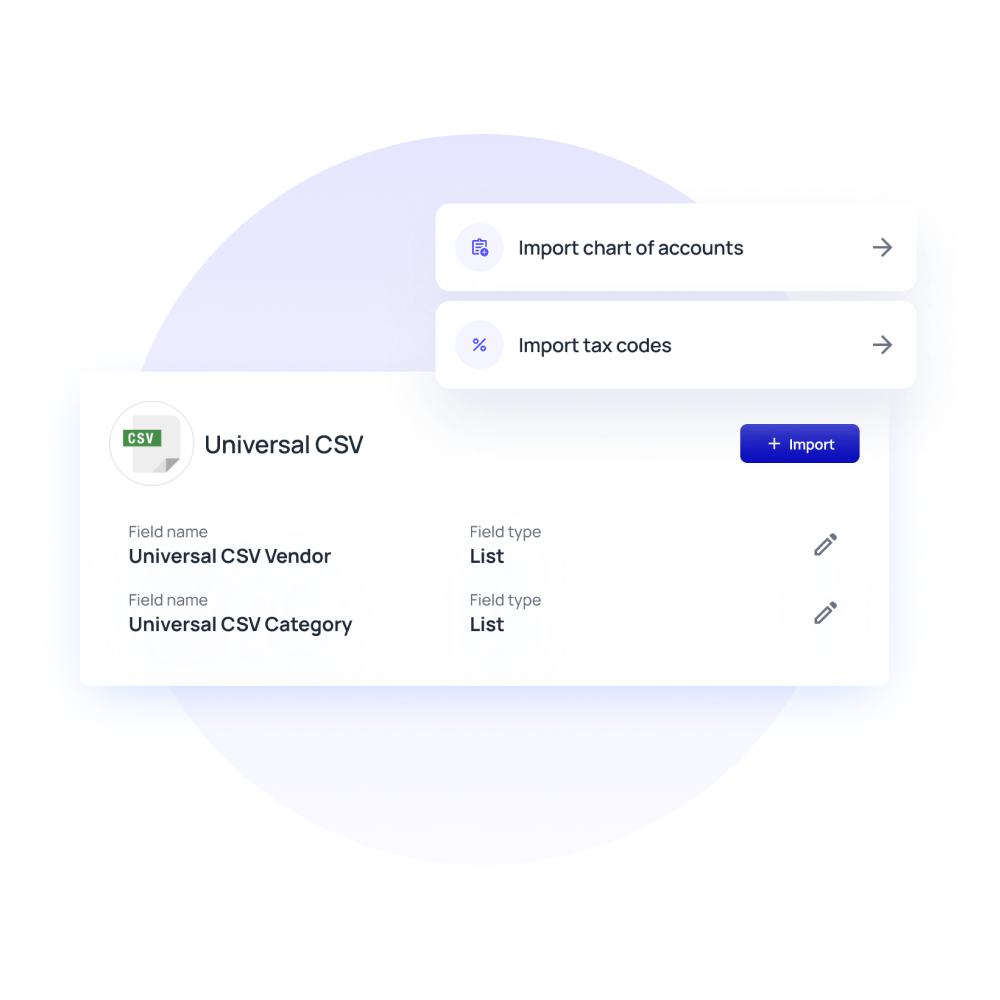

1. Accounting software

Volopay natively integrates with industry-leading accounting software such as Netsuite, Xero, QuickBooks, Tally, MYOB, Deskera, and more ensuring that expense data flows directly into the company's accounting system, reducing manual data entry and minimizing errors.

The platform also has a Universal CSV feature that allows it to integrate with any accounting software even if it does not have a native integration with Volopay.

2. HR and payroll systems

Salary payments are a type of expense that a company needs to bare. Organizations often use specific HRMS(human resource management system) platforms to make these payments.

Volopay's integration with HR and payroll systems facilitates smooth payroll and reimbursement processes. The software can sync with platforms like Talenox, ensuring timely reimbursements and accurate payroll deductions.

3. Travel management platforms

Volopay simplifies expense booking and tracking for business trips with its integration with TruTrip, a leading travel and booking platform in South Asia.

You can easily use this integration to make bookings through TruTrip and directly pay from your Volopay account balance.

Approval policies to streamline your process

Pre-approval policy

By proactively managing employee expenses, you can save time on request raising and approvals.

Implementing pre-approval policies allows you to approve certain expenses before they occur. This requires employees to share expense reports before business trips, and limits the expenditure.

Multi-level approval policy

This policy is well-suited for small businesses that want to verify details before settling claims or credit requests.

It allows for the creation of up to five levels of approvers based on the severity of the expense, and there is no requirement to use the same number of approvers for all expenses.

Auto approval policy

Some expenses do not require approval at all and can be directly settled through payment under a pre-approval policy.

To set up this policy, you can specify categories, spending amounts, authorized individuals or departments, and a duration for which the expenses can be automatically approved.

How to get started with Volopay expense management software?

Getting started with Volopay's expense management software is a straightforward process:

1. Sign-up process

Visit our website and sign up for an account. Provide the necessary information about your business, and choose the plan that suits your needs.

2. Onboarding and implementation support

Once registered, the team reaches out to you and provides onboarding support to help you set up the software according to your business requirements.

We assist in configuring integrations, customizing expense categories, and implementing your approval workflows.

3. Adding funds and users

Once you are onboarded and ready to use the platform, you can add the necessary funds to your Volopay account. You can then add your employees to the platform by inviting them via their company email.

Once users have been onboarded, you can start assigning them corporate cards and also set their budgets according to your plans.

4. Ongoing support

Your company will be assigned a customer success representative to address any queries or issues that may arise during your usage of the software. Regular updates and improvements are made to enhance the user experience.

Implementing expense management software like Volopay can significantly improve a business's financial processes, save time, and enhance transparency, ultimately contributing to increased efficiency and better financial decision-making.

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our expense management solution

Volopay is the leading expense management software Australia has that offers seamless integration of approval workflows, bill payments, corporate cards, reimbursements, and automated accounting onto a unified platform.

Multi-level approvals

Allow for efficient and accurate expense policy compliance through in-built policy features that establish sleek approval workflows to manage employee reimbursements, Bill Pay, and card fund requests.

Volopay offers an additional layer of security through our multi-level approval policy, maker-checker policy, and more.

Employee reimbursement

Remove the inconvenience of the paper-based reimbursement process. Volopay’s OCR technology digitally scans, captures, and categorizes receipt images for quicker reimbursement processing.

Approvers can approve and reject expense claims or request more information within our expense management software. Pay your employees instantly or schedule month-end payments, the choice is all yours.

Subscription management

Streamline your subscriptions on a centralized platform. Create burner cards for one-time and recurring subscriptions to avoid unnecessary costs and late fees.

Assign virtual cards for each subscription and manage them all on our online expense management software.

Real-time visibility

Streamline your accounts payable process with a live expense tracking dashboard with real-time updates. Get insights into your spend metrics to keep track of your company’s monthly expense patterns.

Design an automated expense reporting system to get accurate knowledge of the where, when, and why of every expense. Improve accountability with clear visibility into the spender details for each transaction.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

ParallelDots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

They loved Volopay, you will too

Bring Volopay to your business

Get started now

FAQs on expense management

Expense management is important for businesses because it helps them to effectively control and monitor their spending in order to achieve their financial goals.

It enables businesses to accurately track and analyze their expenses, identify areas for cost savings, and make informed decisions about how to allocate their resources. This can help businesses to improve their profitability and financial stability, as well as ensure that they are meeting their legal and regulatory requirements.

Expense management also helps businesses to better manage their cash flow and avoid overspending, which can prevent financial problems and support long-term growth and success.

Software for employee reimbursement is essential to manage employee spending and expenses. Employee expense reports from across the organisation will be collected and kept up to date using this programme. Depending on the kind of expense, you can either pre-approve the claims or set up approval workflows.

So, from submitting the expense reports to approving the payment, you automate every stage of the reimbursement procedure.

A subscription management system is an online, automated platform that manages the regular, monthly payments of subscriptions for your business. Most SaaS platforms have recurring monthly fees that should be paid on time at the conclusion of each billing cycle. Services may be halted or discontinued if the payment is not made on time.

When your business has multiple business subscriptions, a subscription management software is useful. With the help of subscription management softwares like Volopay , you can easily schedule and manage online SaaS subscription payments.

By using employee reimbursement software you can easily automate reimbursements. This software will compile cost data and pertinent receipts for use as documentation. Since the application itself automatically sends and notifies the various level of approvers, no one needs to go to the approvers manually.

Employees may always keep track of the request's status. The accounts team will release the requested monies to the employees after approvers have given their approval. A great example of such software is Volopay.

You need to use employee reimbursement software for seamless reimbursements. For example, on Volopay employees can submit reimbursement requests and receive payment for their business expenses.

After a work trip, an employee might sign into the programme used for employee reimbursement, complete the claim form, and attach receipts. When determining if a cost is appropriate, approvers can send it on to the payment section for repayment. And this team will deposit the funds into the employee's salary account after authenticating the request.

An online programme that tracks and records employee expenses and handles claim requests submitted by employees is referred to as a reimbursement tool. Employees can submit online expense claims for authorised out-of-pocket expenses to supervisors for approval using an employee reimbursement programme.

The accounting division will handle this after it has been approved, and the employee will receive their money back. The business can automate reimbursements and keep track of employee spending with the aid of the reimbursement tool.