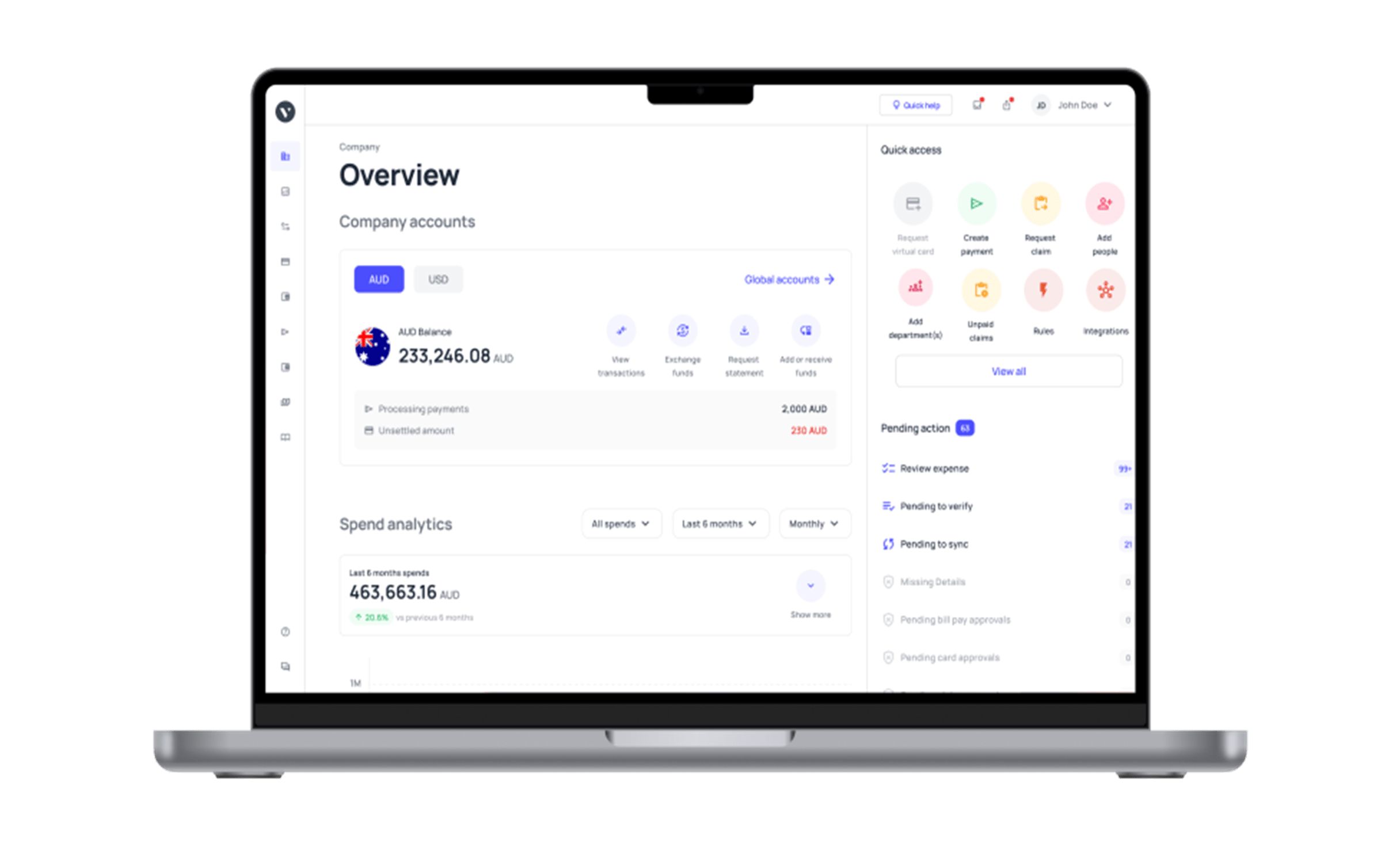

All your business spending visible in real-time

Spend visibility is an essential part of any business expense tracking software. Instead of wasting time on monthly statements, Volopay allows you to get real-time visibility on all your expenses.

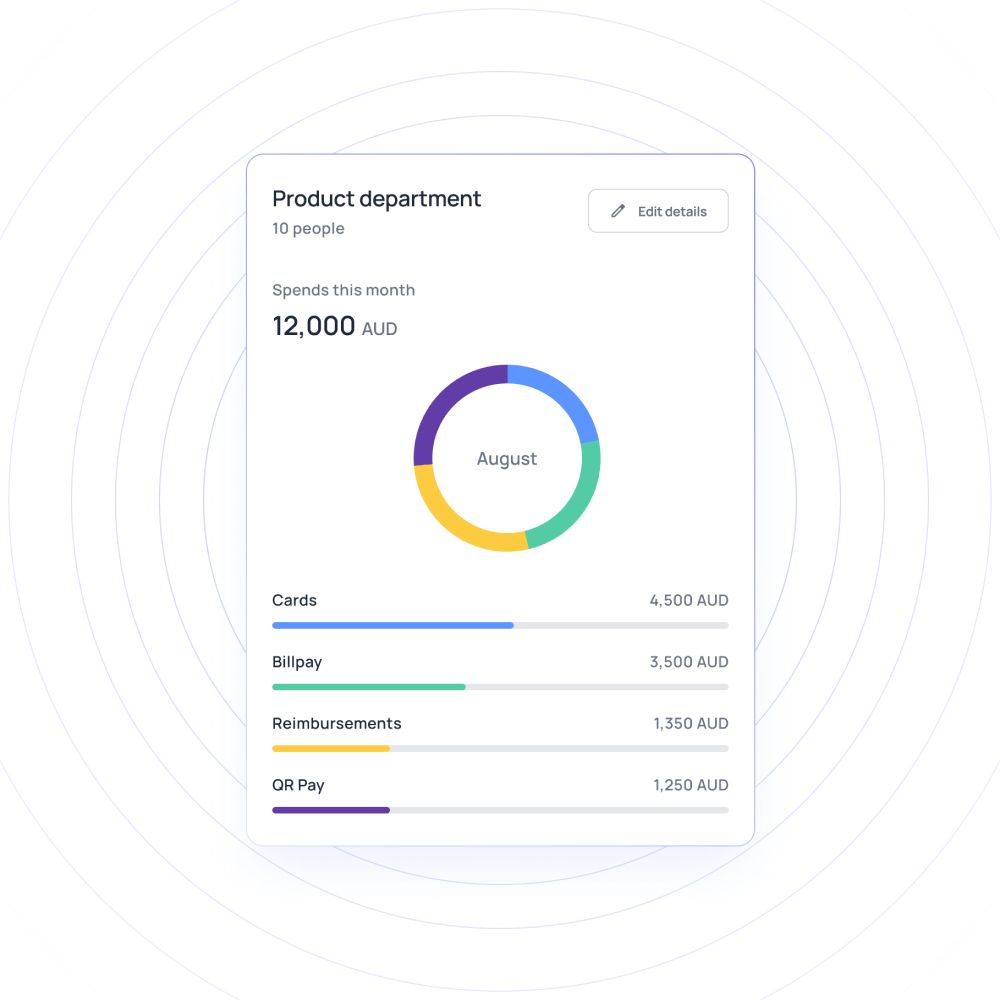

From cards to accounts payable, to even reimbursements – everything is in the same place, as soon as it happens.

Every business expense is visible

The moment you sign up for Volopay, you sign up for the ability to view all the company’s expenditures from a single dashboard, thanks to this intuitive business expense tracking software.

With one click, you have the option to track employee spending, corporate card expenses, as well as your account transactions. Insights are also available at any given time; as are expense reports. Sync every source of spending into one spot for complete spend visibility.

Virtual card spend visibility in real-time

Card spends no longer have to be a mystery when you have an all-in-one expense tracking software. The spend visibility on all your cards – both virtual and physical – is incredibly high with the sync feature.

You can even sort data depending on the employee, the department, the vendor, or the transaction.

Budgets and actuals reconciled

Effective budget forecasting is only possible when there is an existing budget to compare actual spends to. Spend visibility solves this for you. Expense reports can be pulled at any given time, and they give an updated analysis of the company’s expenses.

These make it possible to ensure that all departments are moving according to a set budget, and also help design future budgets. No need for the finance team to repeatedly intervene.

All-round reporting across the company

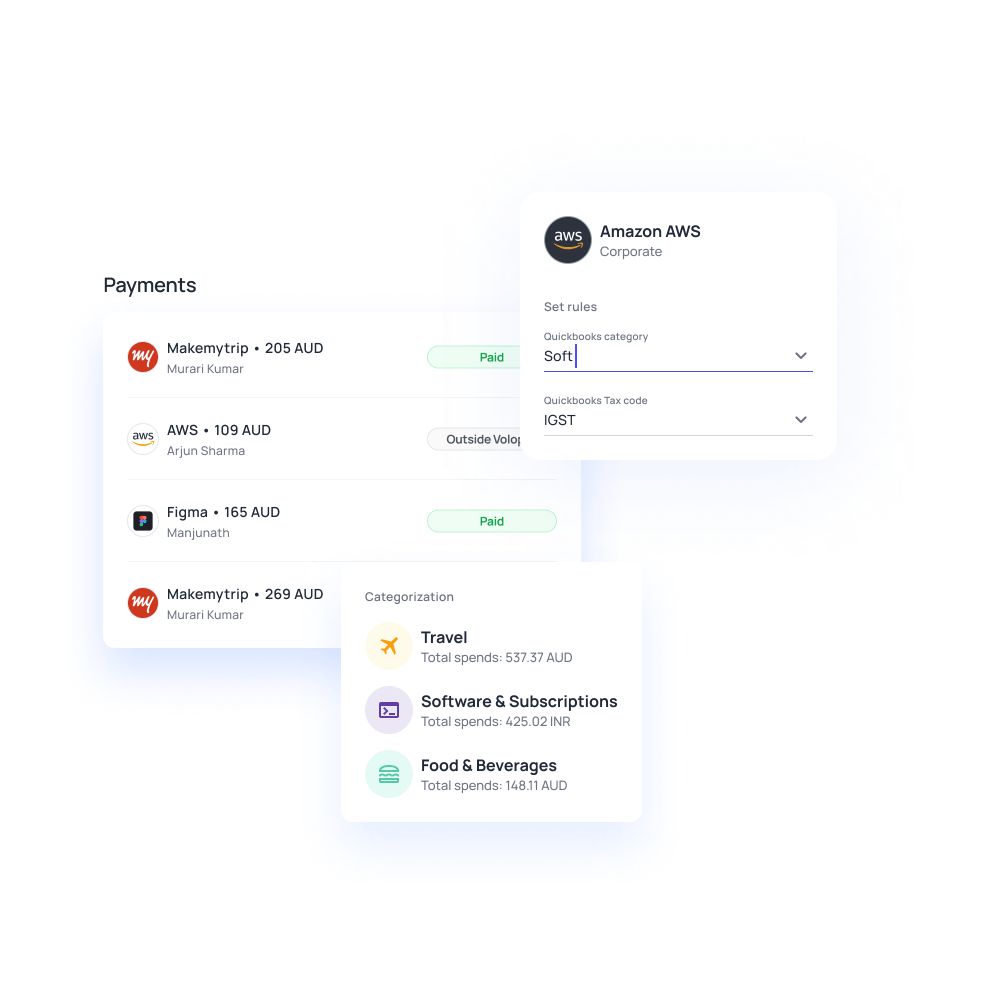

Volopay’s expense tacking software enables a smooth reporting mechanism for company-wide spending. It is possible to get a detail report for every single expense made by your employees or departments.

This can be a purchase order, a vendor invoice, subscriptions, transfers, and even the company cards. Reconciliation is automatic thanks to the total spend visibility provided by the platform. If you integrate your accounting software, then closing books is quicker, too.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our expense tracking software

An all-rounded approach to managing all your expenses. Volopay brings together every aspect of your expense management into one spot – from cards to bills, and reimbursements to accounting.

Employee physical cards

Equip your employees with smart physical corporate cards to give them better access to company funds. Say goodbye to the hassle of reimbursements.

Instead, send funds to card instantaneously, and track all expenditure as it happens. Proactive spend controls let you decide the card budget and approval workflow.

Virtual cards

Manage remote vendor payment and SaaS subscription better. Generate unlimited virtual cards instantly so that online spending is no longer a headache.

Enabled for international transactions, these virtual cards make it possible for your business to grow globally without the worry of duplicate payments or lost receipts.

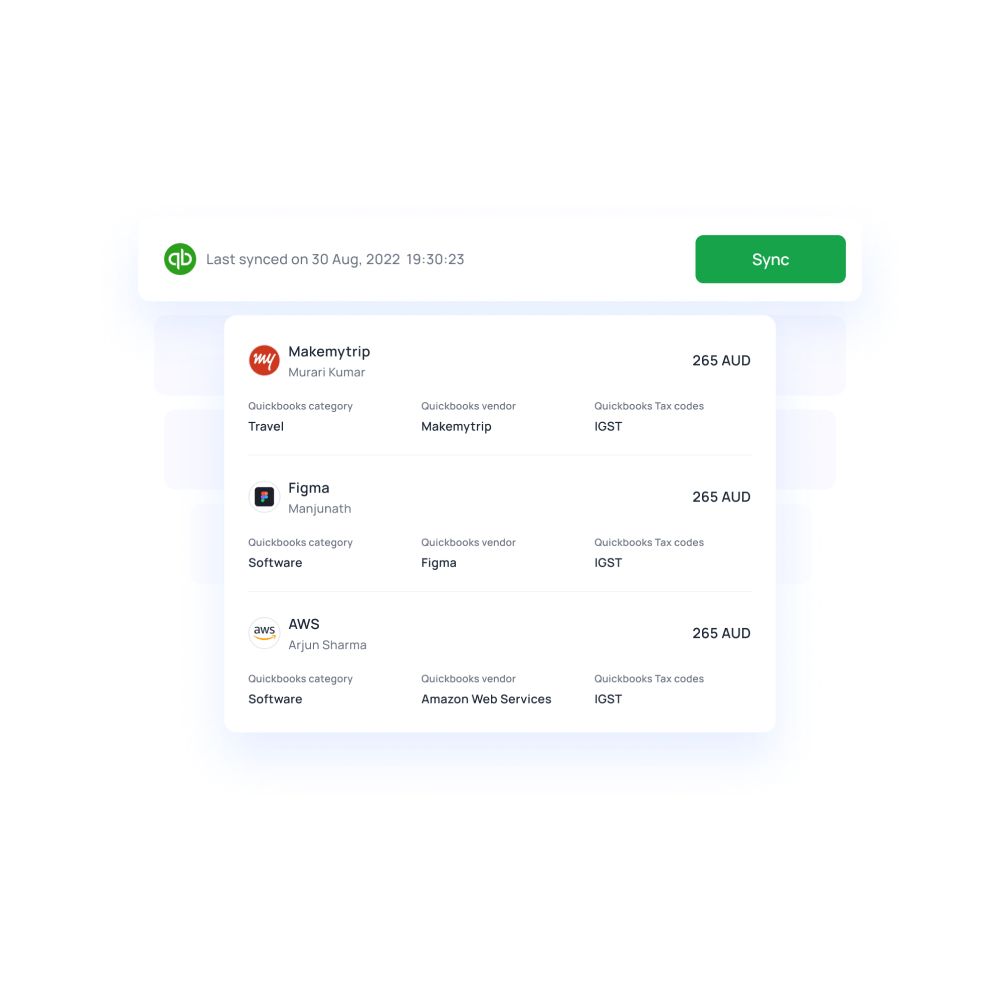

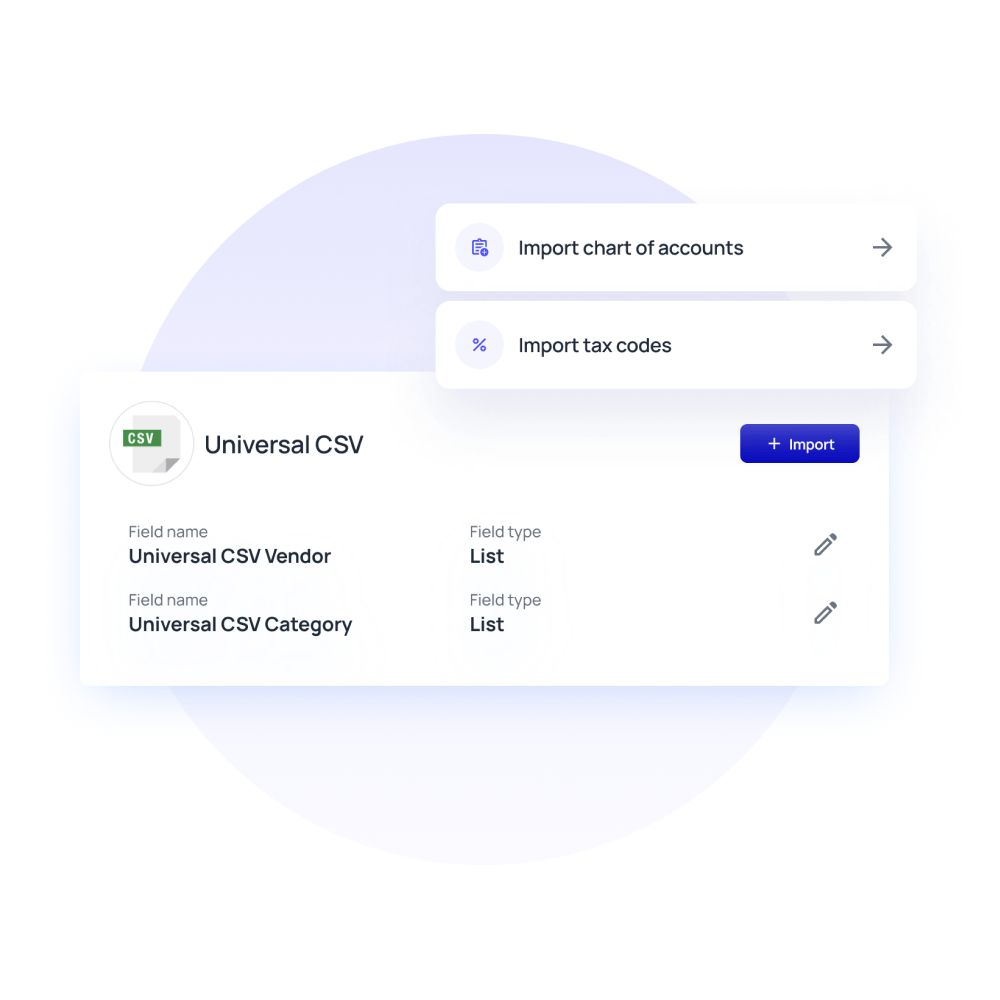

Automate accounting

You can sync your expense management software with your accounting software to ensure quick bookkeeping. Volopay can sync with Xero, Quickbooks, Netsuite, Deskera, and so many more accounting software integrations.

Just set it up, and let your ledger automatically update your books for all reconciliation and compliance.

Bring Volopay to your business

Get started now

FAQs on real-time visibility

You will need an automatic reimbursement tool with built-in filters and customised workflows to make sure an expense report is accurate. The time required for hand cross-checking each expense report that managers receive is insufficient. Your company may have major issues if your employees submit phoney receipts or dishonest expense reports.

But how may reimbursement be automated?

The automatic and clever reimbursement management system that Volopay has in place will keep fraudulent and misleading reports out. Managers have more authority and information to make decisions because it only permits permissible business expenses that are within the proper limitations to be passed through.

Any expense, vendor payments, remittances, and subscription payments you do on the Volopay platform follow expense and approval policies along with multi-level approval workflows that let's you, the admins, to be on top of every spend and transaction.

It allows you to verify, approve or deny transactions thereby ensuring you track every dollar that leaves the company. Expense reports are available at any time and provide a current overview of the company's expenses.

Yes, all your business financial data, employee information, and funds are absolutely safe. The Australian Securities and Investments Commission (ASIC) regulates our operational partners through an Australian Financial Services License. All your data is stored in cloud curbing fraud and no company information is accessible to anyone else other than yourself.

Your financial data is highly encrypted and supported by bank-grade security, protocols, local guidelines and regulations. One of our major values is customer privacy, and your information is kept safe with us.

Yes, with Volopay, every virtual card you create and physical card you use, you can set precise spend controls to prevent any out-of-policy transactions and ensure expense policy compliance. Set spending rules, and any transactions that don't follow them will be declined immediately by your corporate virtual cards.

Take this up a notch by setting up multiple approvers and creating an approval workflow to ensure your expenses and transactions are in check. Approve or deny when needed, and get an overview of the who, what, when, and how of every spend that occurs.

Yes, with the use of ledger structure and accounting triggers, our expense management software can automatically categorise items like vendors, transaction type, tags, and tax codes. Create custom mapping rules for all of your essential accounting fields, merchants, departments, and more. Simply import your chart of accounts, and we'll categorise and sync everything in your ledger for you.

Business can track receipts either manually or online. They may physically count receipts, which is very inefficient, or they can use digital solutions like Volopay's remibursement software to automate receipt tracking.

Smart financial and accounting software helps small businesses manage their revenue and expenses. They employ specialised accounts payable software that performs expenditure reporting, offers cards, facilitates foreign transactions, schedules and records payments, and much more.

Consider using Volopay if you are regularly receiving requests for employee claims and are looking to upgrade accounting systems. Employee expenses are frequently disregarded, but if not monitored, they can blow your budget. To simplify and streamline expenditure reporting, use the Volopay reimbursement system.

You can also reduce stress by giving each of your employees a corporate card.

You can track your business expenses and transaction with the help of expense tracking software like Volopay. You can issue cards, make payments and track expenses and transactions all in real time.

Yes, savings receipts is important for reimbursement, tax and other administractive purposes. Luckily, retaining the physical receipt is no longer needed because you can store them all digitally on platforms like Volopay.