Reimbursements for employees’ out-of-pocket expenses

Volopay brings to you the reimbursement management Australia businesses are looking for. Instead of racking up large stacks of receipts and claims, employee reimbursement software lets you automate the entire process.

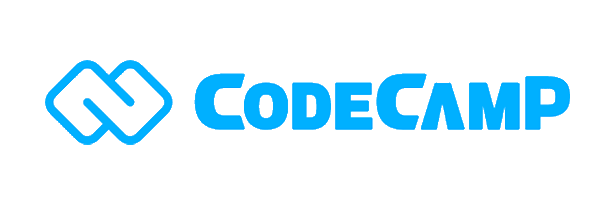

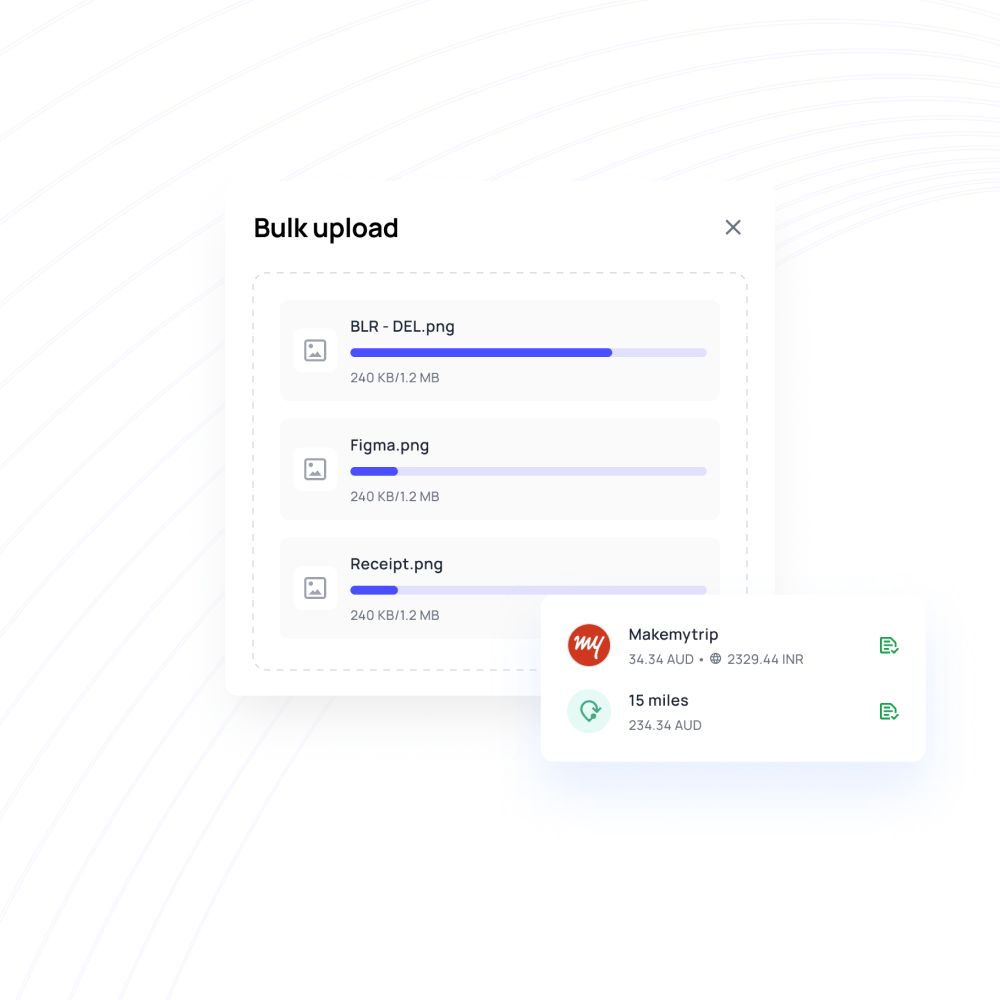

It takes just one click, uploading a receipt, and a quick approval process. Your employees can, then, efficiently manage their business-related spends without waiting for months on a payout.

Trusted by finance teams at startups to enterprises.

Consolidate out-of-pocket expenses

There might be multiple situations where your employees are forced to pay out-of-pocket: incidentals, office expenses, client meetings, petty cash, or even mileage. Everything can be reimbursed quickly with the help of Volopay’s employee expense reimbursement software.

With this reimbursement management, Australia businesses have a better handle on making sure their employees are utilizing company funds instead of their own.

Instant reimbursements

The automated expense reimbursement Australia offering lets employees head to their dashboard and request reimbursement immediately.

The system allows timely repayments, as well as the option to settle all repayments on a fixed date for easier reconciliation. Quick approvals and additional detail collection are streamlined with push notifications.

Smooth integration

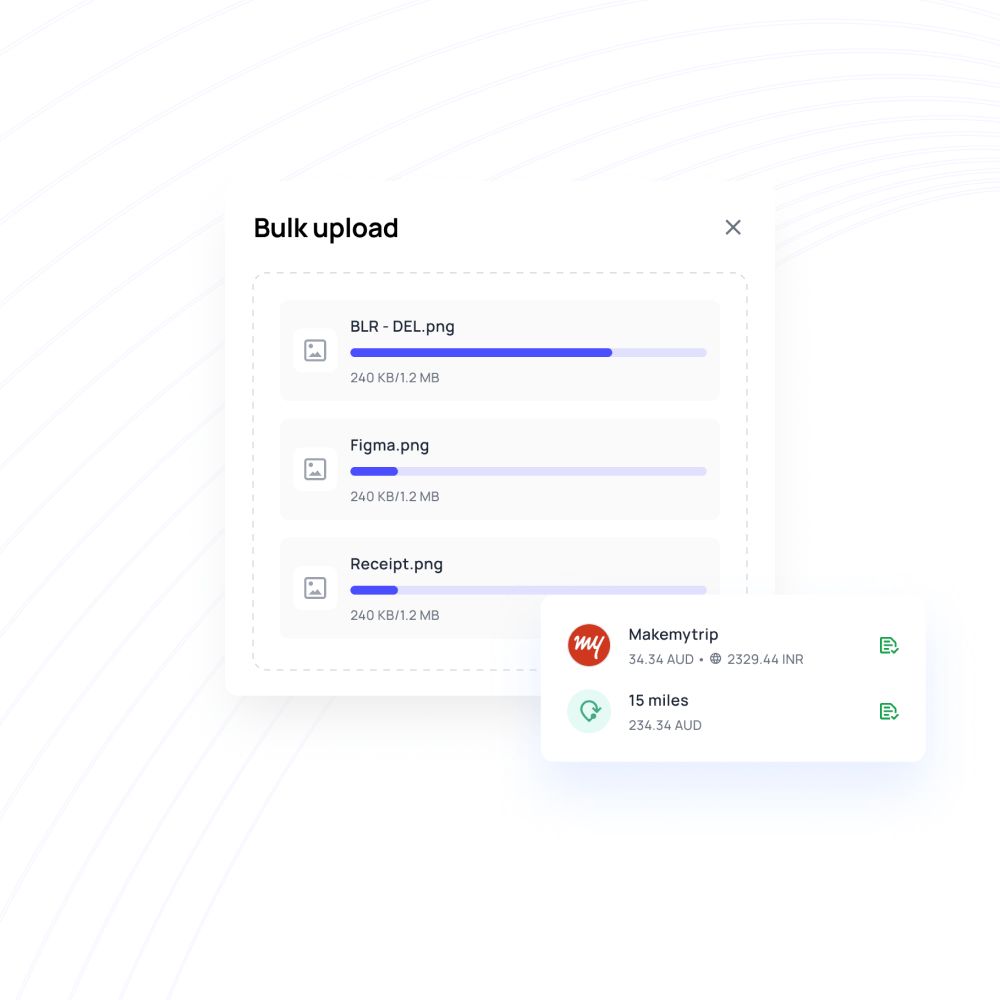

The benefit of integration makes bookkeeping quicker. Companies can sync with their ledgers instantly, and transfer automatically to their accounting system.

Expense-processing costs are greatly reduced, and all out-of-pocket employee expenses are accounted for across platforms.

Full visibility and control

The employee reimbursement software allows you to track every expense claim and reimbursement in real time – both the employee and the admin.

As soon as a claim is submitted, both parties receive push notifications and real-time updates of the approval process to avoid any kinds of delay in reimbursement.

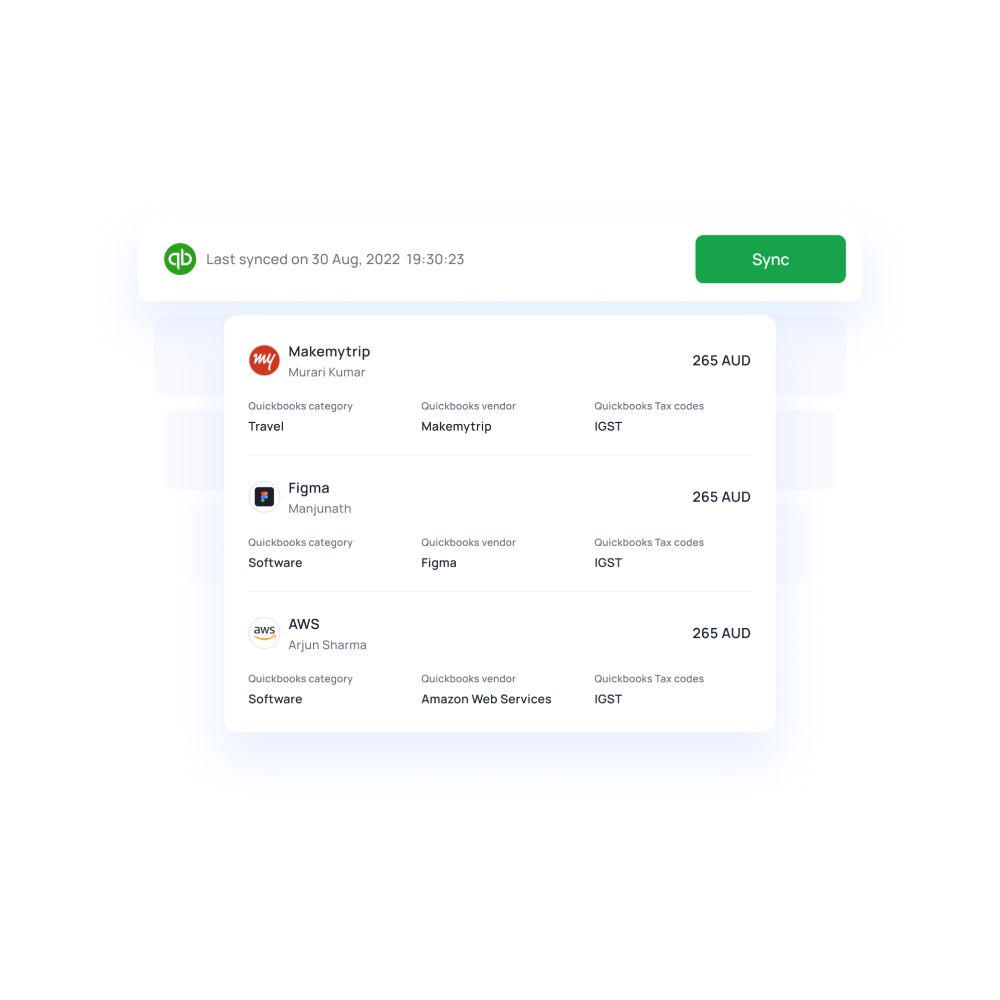

Policy compliances and checks reinforced

With employee expense reimbursement software, finance departments can ensure that expense policies are met, even with out-of-pocket expenditures. Claim policies make sure that duplicate claims are recognized to prevent double payments; limits let admins set flexible or non-flexible claim limits depending on expense categories.

This way only the claims that fit the policy are submitted for approval. Moreover, you can set mandatory fields for employees so that there is no delay in the approval workflow, and information is correctly routed to the line of approvers.

Advanced multi-level approval queues

The employee expense reimbursement software lets admins design a custom approval workflow. This helps to automatically route claims to the approval line.

These approval queues also account for absences so that reimbursements are not left on hold for long periods of time. Any of the approvers can also request additional information from employees to ensure that the expense is compliant with policy.

Centralized platform for speedy claims

Volopay offers a single place to track everything, including reimbursement claims. Monitor the approval status of your reimbursement claims through the mobile app. OCR (optical character recognition) technology allows you to upload pictures of receipts, which the system automatically scans and translates to text for quicker claiming.

The app also allows you to track other aspects of your product module: from bill payments and card transactions to reimbursement settlement notifications and account balance status, everything related to your company’s and team’s finances in a single spot.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Learn more about our employee expense reimbursement software

Volopay has it all in one place – advanced invoice management, state-of-the-art accounting integrations, flexible corporate cards, and an employee expense reimbursement software. One place for all your financial needs.

Multi-level approvals

Don’t want to rely on late paybacks? That’s where we’ve upgraded approval workflows in our expense reimbursement software, Australia teams! Multi-tier approvals and quick syncs allow minimal delays, while ensuring that all data is reconciled swiftly and within policy range.

Real-time visibility

No more confusion or discrepancies. Your expense reporting system can be designed for you to know every detail about every transaction - as and when it happens.

Know where every penny of your business goes, why, and when it does. Real-time expense reporting and reconciliation makes closing books so much swifter.

Corporate travel

Corporate travel just got a whole lot more manageable. Volopay offers an integration with TruTrip for you to be able to make all corporate travel bookings – flights, concierge, hotels, taxis – directly through your accounts payable wallet.

The expense reimbursement software Australia offering lets employees make claims for money and mileage spent on business travels.

Accounting automation

A secure and intuitive accounting structure allows you to close books faster. Integrate your accounting software with your Volopay account so that all transactions get synced in real-time, and you don’t have to waste time with line-data entry. The two-way integration keeps all your information updated.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Volopay helped BukuWarung in managing their expenses across different countries

Volopay helped Deputy smoothly integrate with an accounting system

Using Volopay, AdCombo eliminated the hurdles of cash flow management

Bring Volopay to your business

Get started now

FAQs on employee reimbursement

Technically it is not possible to reimburse an employee without a receipt. However, using reimbursement softwares like Volopay you can reimburse your employee as long as they have a photo of the receipt, even if they don't have the physical receipt.

An online programme that tracks and records employee expenses and handles claim requests submitted by employees is referred to as a reimbursement tool. Employees can submit online expense claims for authorised out-of-pocket expenses to supervisors for approval using an employee reimbursement programme.

The accounting division will handle this after it has been approved, and the employee will receive their money back. The business can automate reimbursements and keep track of employee spending with the aid of the reimbursement tool.

By using employee reimbursement software you can easily automate reimbursements. This software will compile cost data and pertinent receipts for use as documentation.

Since the application itself automatically sends and notifies the various level of approvers, no one needs to go to the approvers manually. Employees may always keep track of the request's status.

The accounts team will release the requested monies to the employees after approvers have given their approval. A great example of such software is Volopay.

When you make a claim, it has to be substantiated with receipts, details, and vendor information. This allows approvers to recognise duplicate claims and decline them before any money gets deducted. A thorough claims history also prevents duplication of claims.

The employee expense reimbursement software is set up with an approval process. An employee can head to the claims section and start a claim with the click of a button. They have to provide details on the vendor, the amount, and attach a receipt for the payment.

Once submitted, this goes through an approval line. As soon as the final approval is received, the money gets transferred to the employee’s bank account.

Yes, all claims can be reviewed in expense report and the ledger with the help of a filter. If you are an admin or approver, you can also see the claims history in your notifications and alerts log.

You just need to upload the receipt, and the employee reimbursement software logs it as valid or invalid. If the approver requests for additional information, then you have the option to add further details on line items.

However, the claim system allows you to simply add a single receipt along with just the total expenditure.

You need to use employee reimbursement software for seamless reimbursements. For example, on Volopay employees can submit reimbursement requests and receive payment for their business expenses. After a work trip, an employee might sign into the programme used for employee reimbursement, complete the claim form, and attach receipts.

When determining if a cost is appropriate, approvers can send it on to the payment section for repayment. And this team will deposit the funds into the employee's salary account after authenticating the request.

You can keep track of employee expenses by using expense management softwares like Volopay. On Volopay you can issue cards to your employees to make expenses and then track all those expenses on one comprehensive dashboard, in real time.