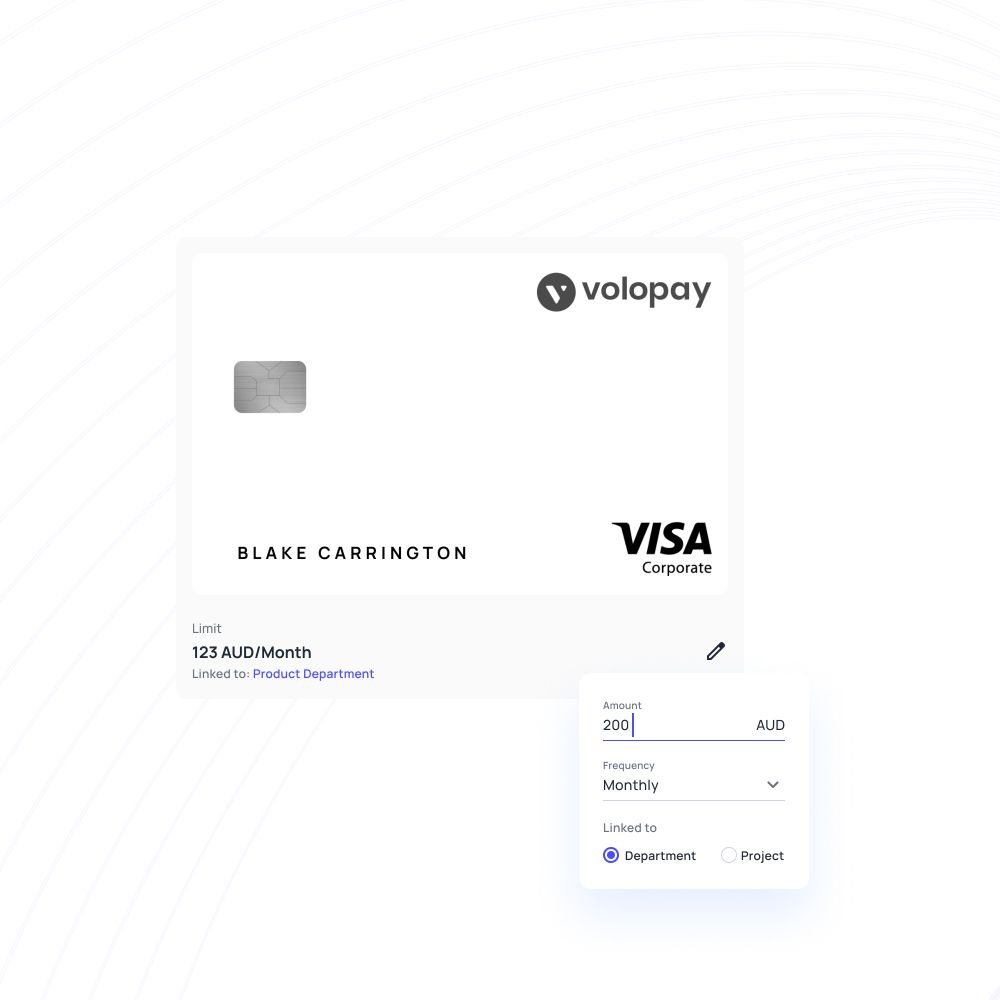

Get business credit card with proactive controls

Get the best credit card for business in Australia — not just convenient but also fully customizable and in your control. Our business credit cards in Australia come equipped with proactive controls.

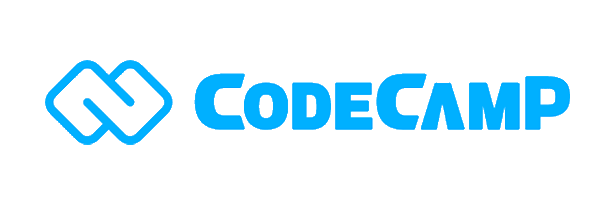

Set your limits. Choose the card owner. Choose the department they belong to. And track all your spending without worrying about reimbursements or lost coins.

Trusted by finance teams at startups to enterprises.

Business credit cards for each employee

Empower each employee of your team with an individual cards. These business credit cards have spending policies and caps that you can customize according to your needs and budgets.

Get immediate notifications whenever your company dollar is being spent. The answer to "who,” "when,” and “where” your money is spent is automatically recorded on your ledger.

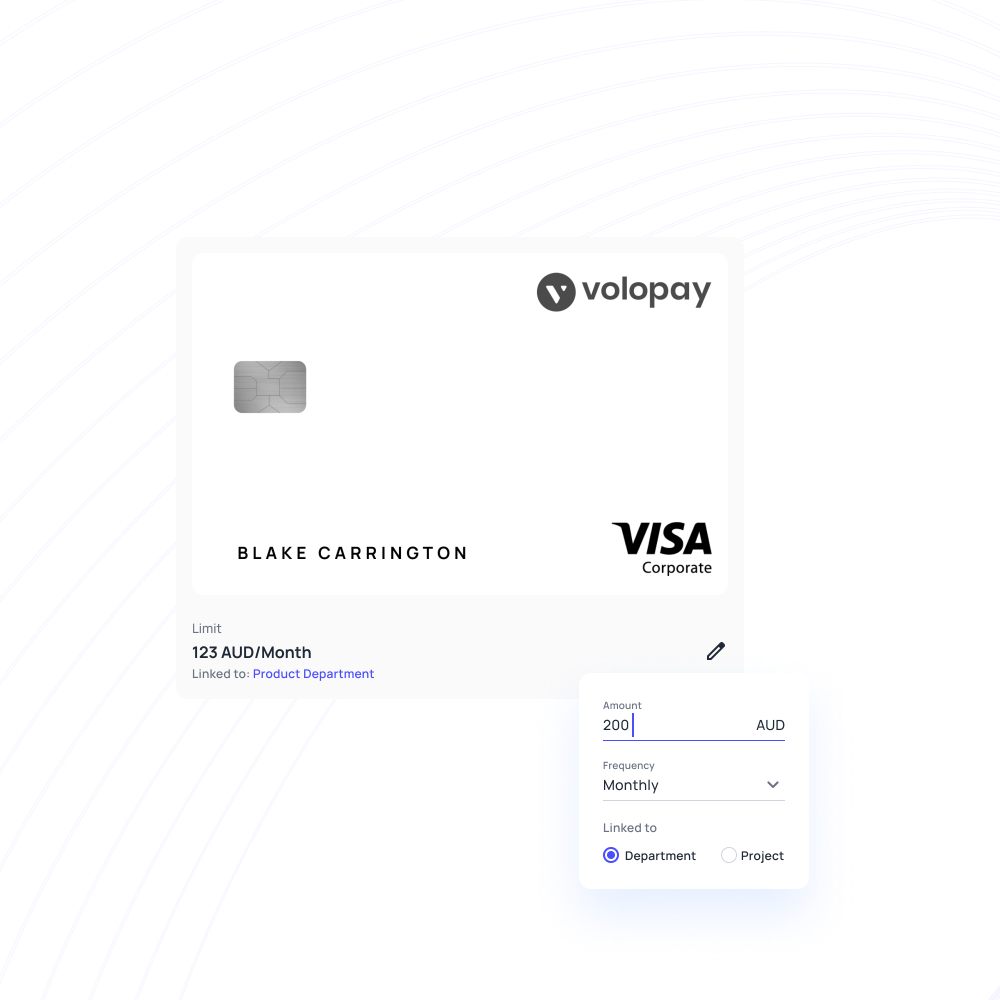

Virtual credit card for business expenses

Unlimited virtual cards can be generated for specific online payments. Create one-time use burner cards or recurring cards to manage your department budget, and to allow your employees access to required company funds.

You can block or freeze cards when they’re no longer needed. You can also use your Volopay business credit card globally.

Avoid the inconvenience of sharing cards by generating as many business credit card instantly for your business as you want, without compromising on safety or control.

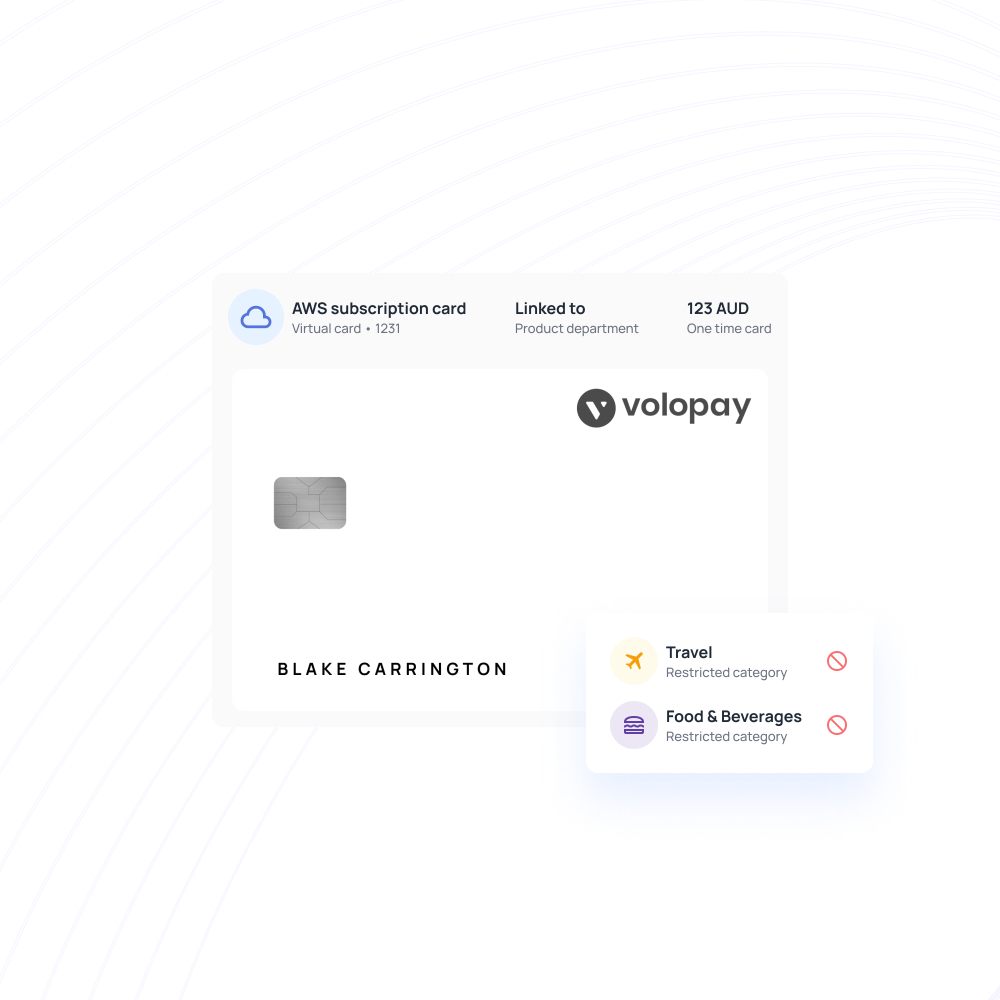

Business credit card with proactive controls

Our credit card for business come with highly customizable, proactive controls that ensure complete control over all company finances.

You can set up controls for where your cards are used, who uses the cards as well as how much can be spent with each card. Control and track every penny spent from your cards easily.

Top-quality premium credit card for business

We believe in providing top quality, premium cards, not just another piece of plastic. With Volopay you can rest assured that that cards you are using are top of the line, fully equipped financial management tools.

You get a premium card that gets activated instantly with all the features a business needs to streamline its spending.

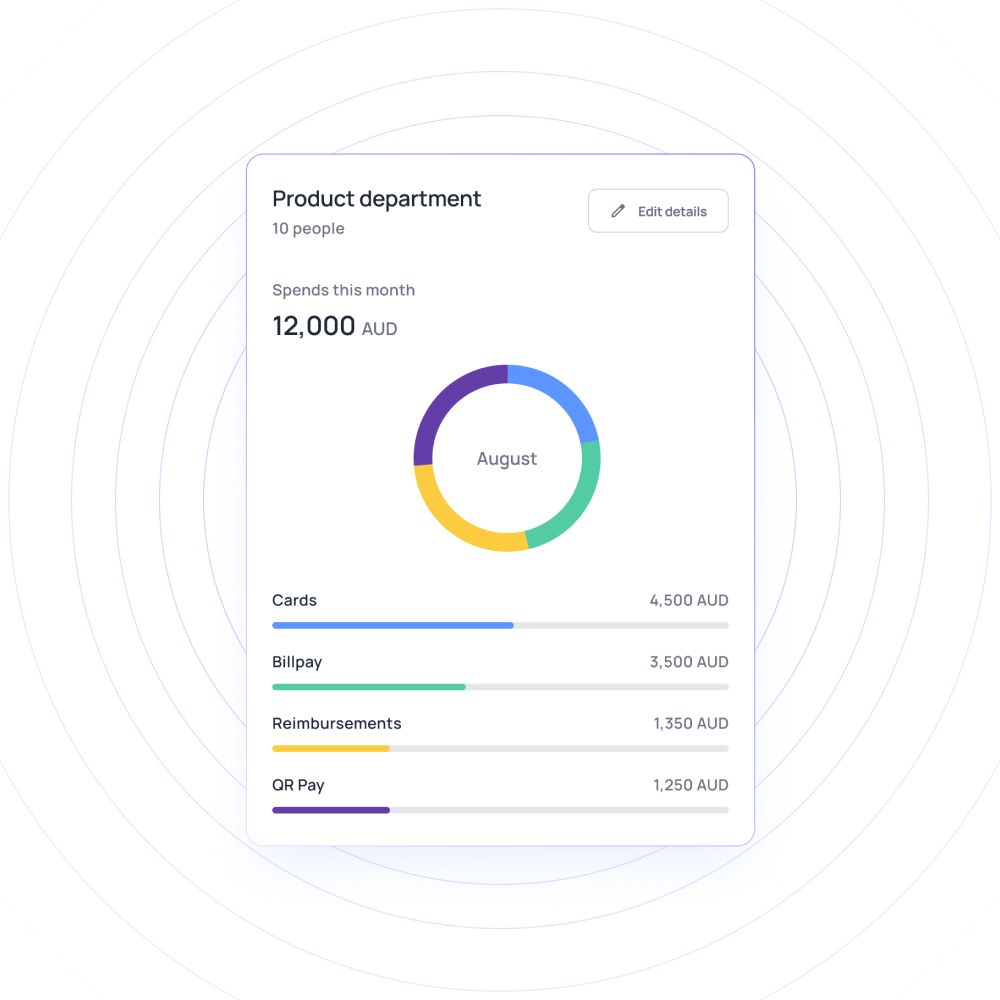

Real-time tracking for better insights

With Volopay business credit card for business expenses, tracking happens in real time.

Purchases made from our cards are recorded instantly, as soon as charges are incurred, so no more waiting till the end of the month. This means you get immediate insights into where your money is being spent and how it is being spent.

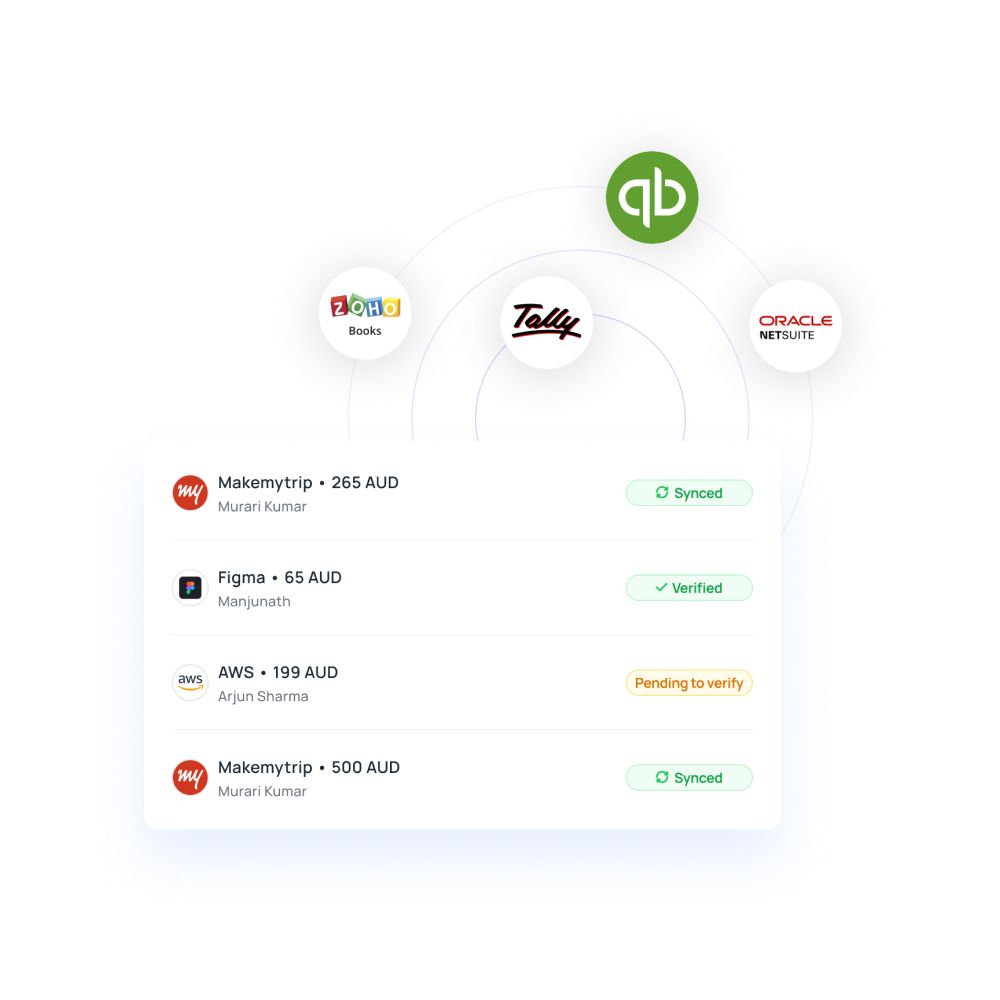

Prepare & export expenses easily

No need to sweat over bookkeeping anymore. With Volopay’s instant approval business credit card in Australia, sync all expenses to Xero, MYOB, Quickbooks, NetSuite, and more.

Never miss a single transaction or worry about compliance. All integrations are two-way, ensuring that data is current and real-time, meaning you don’t have to chase employees or break your neck over spreadsheets ever again.

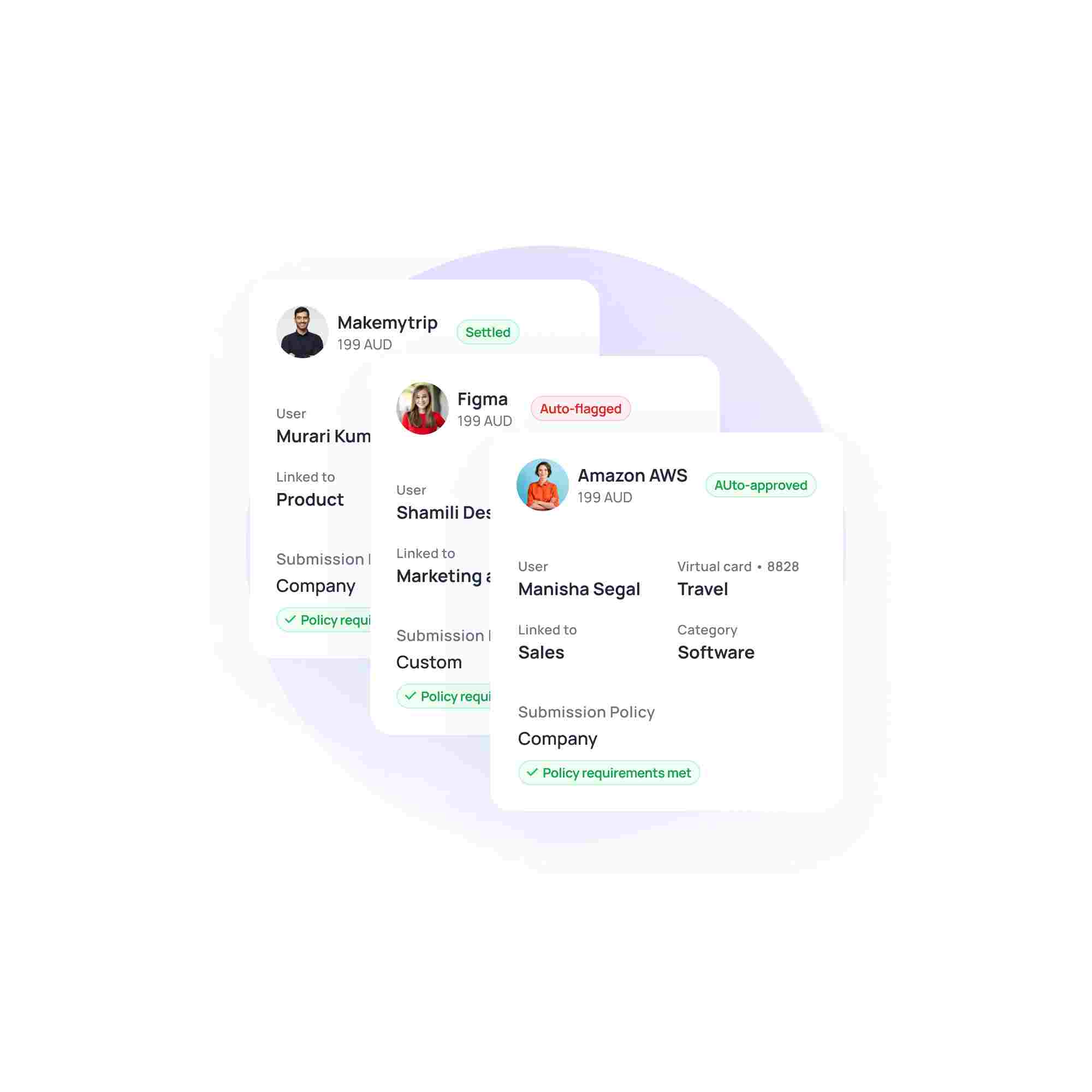

Streamlined expense reporting

At Volopay we’ve developed a platform that makes expense reporting as easy and efficient as it can get. Gone are the days of manually creating expense reports.

With Volopay employees can submit expense reports and corresponding documentation without delay, and managers can quickly and easily review and approve claims as notifications come in.

Custom controls to enforce spend limits

Controlling and enforcing spending limits is essential to protecting your company’s finances. That’s why the Volopay credit card for businesses in Australia come equipped with customizable spend control tools.

As an additional layer of spend limit protection, you only have to load the cards with the amount that is needed to be spent.

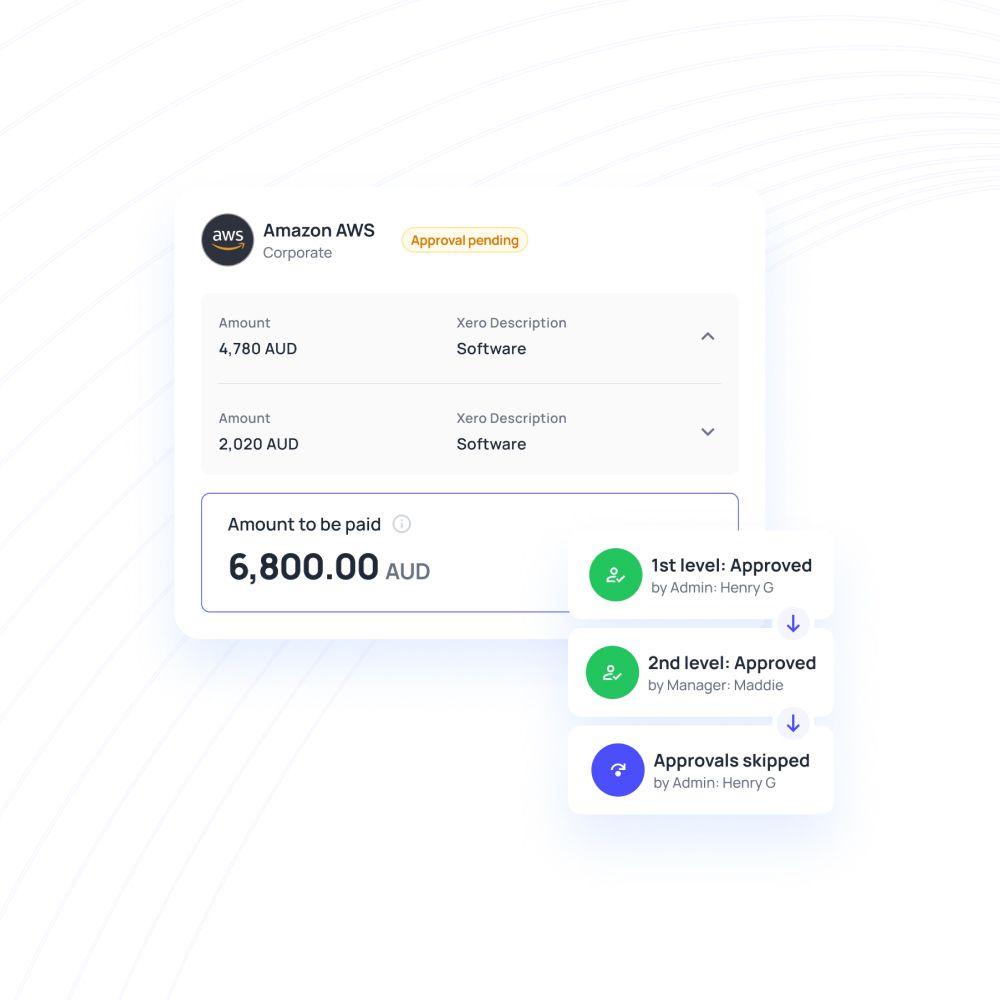

Multi-level approval workflows

Any fund request made on Volopay goes through a specified approvals flow according the the budget that card falls under. The approval policies are customisable and you can set multiple tiers or levels of approvers in your approval policy, any one of the users in the tier limit can approve the expenses, payments & reimbursements.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

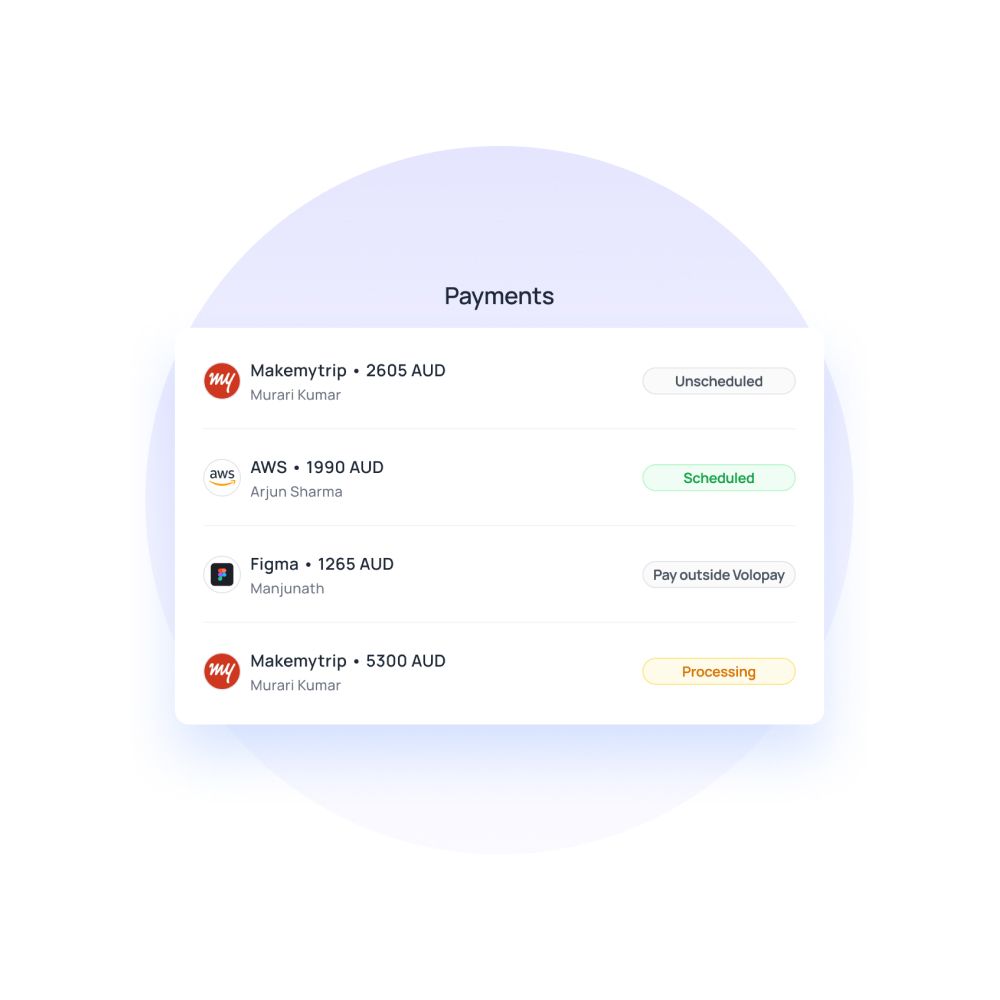

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily.

Eligibility to get a credit card for your business

Different providers will require different things from your business. While not all providers require you to be a licensed or incorporated business to get a card, some other providers solely provide corporate cards. It’s also worth noting that independent business owners, sole proprietors, and freelancers are personally liable for their cards.

The good news with applying for instant business credit card under a company name is that you won’t be liable for your business card expenses. You also don’t have to submit your personal credit score to apply for a credit card for business. With Volopay, you’ll keep separate credit scores for your personal and business uses.

To get a credit card for your business, you want to ensure that your business has a good credit history. If your business is still in its early days and in the growing stage, start small and grow your credit score parallel to your business.

Why should you choose Volopay cards?

Separate business transactions

Credit card for businesses are designed specifically so that business owners are able to keep their personal and business transactions separated.

Manage expenses easily

With the Volopay card management dashboard and its features, managing expenses and transactions is as easy as clicking a few buttons.

Auto payment for cash management

Improve your cash flow management with Volopay’s automatic payment feature. You can simply set up payments and let the system manage the rest.

Spend everywhere

Business credit cards work like bank cards that are tailormade for businesses. They can be used anywhere, from POS machines to online marketplaces.

No hidden fees

With the Volopay credit card for business you no longer have to worry about hidden fees or sudden mark ups in transaction fees.

No personal liability

Volopay business credit cards in Australia are extremely safe to use and come with no requirements to commit personal security for the business owner.

Easy to use

Managing and using your Volopay credit card for business is easy to do with the help of our comprehensive card management dashboard.

Secure & compliant

Our cards come equipped with bank grade security and the necessary tools to help you keep your finances compliant and secure easily.

Control over cards

With admin control, you can set spending limits on each card and designate approvers for any exceptions, giving you a high level of control over spending amounts.

Yes, you can get a credit card by submitting your ABN along with other supporting documents.

Yes, you can. Once you sign up for Volopay, you have the option to apply for our business card credit line. The process is a short one — simply provide the required information, and our credit team will do a quick check of your company’s financial history before approving a credit line. Your dedicated account manager and our customer service team will guide you through the process.

Businesses that sign up with Volopay have the option to apply for business credit from within the dashboard. While there are certain requirements to meet, the process is much smoother and more flexible compared to a traditional bank or business loan provider. In addition to the credit line, all Volopay clients are also eligible for our business debit cards.

Before you choose a credit card for business you need to weigh your options and see which provider suits your requirements the best. For example, check for pricing, features provided and compatibility.

On Volopay, for example, you can get a business credit card within a few days. Virtual cards, for example, can be created instantly.

You should get a business credit card for your company and not use personal credit card because this will help you keep company and personal finances separate.

No, having a a registered LLC or corporation is not always compulsory for obtaining a business credit card.

Yes, your credit score will be checked before providing a credit card for your business.

If you have a suitable credit score (between 600-622) your business will most likely qualify for a credit card.

A business credit card, like a consumer credit card, does carry an interest charge if the balance is not repaid in full each billing cycle.