Best business credit cards for rewards in Australia

With the rise in popularity of digital payment methods, it’s no surprise that businesses are following suit with this trend. Rather than using cash, many businesses have started investing in credit cards to make their business expenses.

In fact, businesses are utilizing cards best tailored for them compared to regular personal credit cards. Many businesses are now using the best business credit cards for rewards and other benefits to simplify their business spending processes and save money in the long run.

What are business credit cards with rewards?

Just as personal credit cards are used by individuals to make purchases on credit, business credit cards do the same thing for businesses. Similar to their personal counterparts, you can also get a rewards program and earn points, miles, or cashback with your business credit cards.

If you use your business credit card to book accommodations for an upcoming business trip, for example, you could earn a percentage of that back in airline miles.

The next time you book a plane ticket, you could use your miles to partially—or fully, with enough miles—pay it off.

How do business credit cards with rewards help businesses?

By using your business credit cards to make company expenses, you’ll be able to ensure that you’re keeping company funds and spending completely separate from your personal accounts. But the best business credit cards for rewards do more than just that.

Ultimately, the goal of using a business rewards credit card is to save money by making business expenses that you were always going to make—by making them through your business credit card instead of with other payment methods.

Every time you swipe your card and make business purchases, you’ll earn some points with business credit cards with rewards.

If you use your business credit cards for all your company expenses, you’ll eventually accumulate enough points that you’ll be able to save money on your next purchases by trading in your points.

5 best business credit cards to consider for rewards in Australia in 2025

1. American Express Qantas Business Rewards Card

The American Express Qantas Business Reward card is one of the best business credit cards for rewards in Australia. It’s geared toward businesses to help them track their business expenses while also allowing you to enjoy other perks and rewards.

Its main draw is the competitive rate for earning Qantas points, starting with a bonus that you can get for new users if you spend 3,000 AUD within the first two months. For every dollar spent, you get 1.25 Qantas points.

You’ll be charged an annual fee of 450 AUD for using the American Express Qantas Business Rewards cards, but there are no extra annual card fees for each individual card for up to 99 employee cards.

2. American Express Business Explorer Credit Card

If you want to earn rewards that can be used for other things outside of business travel, another one of the best business credit cards for rewards Australia has to offer is the American Express Business Explorer Credit card.

On the Membership Rewards Gateway program, you’ll earn 2 membership points for every dollar you spend on your card and 1 point per dollar for government payments. There’s also a bonus if you spend 3,000 AUD in the first three months.

Similar to the Qantas Business Rewards card, there are no annual fees for individual cards for up to 99 employee cards. However, your business does get charged 149 AUD per year.

3. NAB Rewards Business Signature Card

NAB boasts a fast and fully online application to help you get started with the NAB Rewards Business Signature card. The NAB Rewards program lets you use your points to travel with Webjet, exchange them for rewards at the NAB Rewards Shop, or redeem them as gift cards.

When you spend over 4,000 AUD within the first four months of getting your card, you’ll get a bonus of 100,000 NAB Rewards points that you can trade for different rewards. For every dollar you spend on your NAB Rewards Business Signature card, you can get 1.25 to 3.75 points depending on your purchase.

Each NAB Rewards Business Signature card comes with an annual fee of 175 AUD.

To know more about NAB business credit card, read Card review - NAB business credit cards

4. Westpac Business Altitude Platinum Card

With Westpac Business Altitude Platinum cards, you’ll have access to rewards programs that allow you to transfer your points to six different frequent flyer programs. For every dollar you spend on domestic merchants, you’ll get 1 reward point. This rate doubles for overseas merchants.

Once you’ve gotten at least 3,000 points, you can redeem your points for business rewards or flight rewards. Your new Business Altitude Platinum card has a 0 annual fee for the first year, which then goes up to 90 AUD per year for every year after.

Keep in mind that the Business Altitude Platinum cards are personal liability cards. This means that the individual cardholder is responsible for the credit repayment.

To know in detail about Westpac business credit cards, check out our article on Card Review - Westpac business credit cards

5. Westpac BusinessChoice Rewards Platinum Card

Unlike the Business Altitude Platinum cards, Westpac’s BusinessChoice Rewards Platinum cards don’t have to be personal liability cards.

As a business, you get to choose who is liable for each card. It’s a good alternative to the Business Altitude Platinum cards if you want to equip employees with business liability cards.

With the BusinessChoice Rewards Platinum cards, you’ll be able to get 0.75 Qantas points per 1.50 AUD you send. It’s a good fit for businesses that do a lot of business travel and frequently need to purchase plane tickets.

There’s an annual fee of 150 AUD for each BusinessChoice Rewards Platinum card you have.

Looking for business cards to manage your expenses?

Importance of business credit cards for businesses

1. Keeps business and personal transactions separate

The main reason why you want to use a business credit card for your business expenses instead of relying on a personal card is to separate your transactions.

This way, your funds, and credit bills don’t get mixed up. Not only does this make it easier to manage your credit repayments, but it also makes accounting for your business much simpler. It’s best to keep your business card statements strictly only for business expenses.

The good news is that with the best business credit cards, you’ll still have the benefits of a personal credit card—just tailored to businesses.

2. Access to immediate funds

You may have business opportunities that are time-sensitive or payments that you can’t delay. This becomes an issue when you’re still waiting for your customers to settle their invoices before you can make expenses.

With business credit cards, you get access to immediate funds without having to settle on waiting. You can get your credit refreshed by the end of your billing cycle after you make your repayment, meaning that you’ll have more flexibility on when to make payments.

Have access to your credit balance immediately after you activate your business credit card and every month after that.

3. Easy repayment schedules

Many business credit card providers offer flexible billing cycles and a grace period for your repayments. This means that you can take a look at your invoice terms, review when you’re getting a lot of cash inflow, and pick a repayment schedule that makes sense to your business.

While you may be looking for the best business credit cards for rewards, you also want to take advantage of things like a flexible repayment schedule to make business expense management more convenient and efficient.

4. Improves cash flow

Sometimes it’s not enough that you know you have outstanding accounts receivable. You may have cash inflow in two weeks, but that means nothing if you need the cash now. This is where business credit cards come in.

Your business credit card providers may offer higher credit card limits to businesses when compared to personal credit cards. This means that you won’t need to worry about running out of cash when you can utilize your credit limit and make your repayments at a later date once you receive money from your customers.

5. Rewards and benefits

It’s common to get rewards in the form of miles or points on your personal credit cards. Business credit cards with rewards offer the same thing. In fact, some business credit cards come with bigger rewards or better rates, from cashback to airplane miles.

You’ll also be able to find a provider that has a rewards program that suits your business needs amongst the best business credit cards for rewards Australia has to offer. If your employees go on a lot of business trips, for example, you can find a provider with good rates for earning airline miles.

Things to consider while choosing a business credit card

Choose the card for your business needs

The first step to choosing your business rewards credit card is to determine what you need cards for.

If your main use case is for subscription management, for example, then you’ll want a business credit card provider that has the option of virtual cards to help you with creating subscription-specific cards. Choosing the right card for your business starts with knowing what your use cases are.

Application process

While some business credit card providers may require you to go to the bank branch to submit your documents and start your application process, it’s also possible to apply for some business credit cards with a simpler application that can be done online.

You want to consider what kind of application processes are you looking at. The simpler the process is, the more time you could save.

Check rewards applicable to your business

The best business credit cards for rewards are the ones whose rewards can benefit your business the most. While there may seem like many tempting rewards, you want to first see which rewards programs would suit your business best and save you the most money.

Then, you want to make sure that the rewards that you are looking for apply to you.

Interest rates

Generally, it’s always best to make your credit repayments in full to avoid being charged with higher interest rates. There are some business credit cards with rewards that offer interest-free periods so long as you make your repayments in full within a certain timeframe, which you can take advantage of.

You’ll also want to pay close attention to other interest rates like purchase and cash advance interest.

Restrictions & limits on spending

If you need business credit cards to make large amounts of expenses for your day-to-day operations, then you want to make sure that your business credit cards have a high daily usage limit.

On the other hand, however, you also want to get business credit cards that give you control options to manage your spending according to your needs.

Annual fee & other fees

Most of the best business credit cards for rewards will have annual fees.

Some will charge that fee per card, while others may charge it for your business card account with no additional fees for each card.

You may also find some card providers that will waive the first-year annual fee. Make sure that you know what all your business credit card fees are.

Integration with your accounting tool

Instead of manually reconciling your card transactions and taking a long time to close your books, it’s best if you can find business credit cards with a card management system that can be integrated with your accounting tool.

This way, you can directly sync your transaction information and achieve a more streamlined accounting process without compromising any data accuracy.

Why should businesses choose Volopay’s corporate cards?

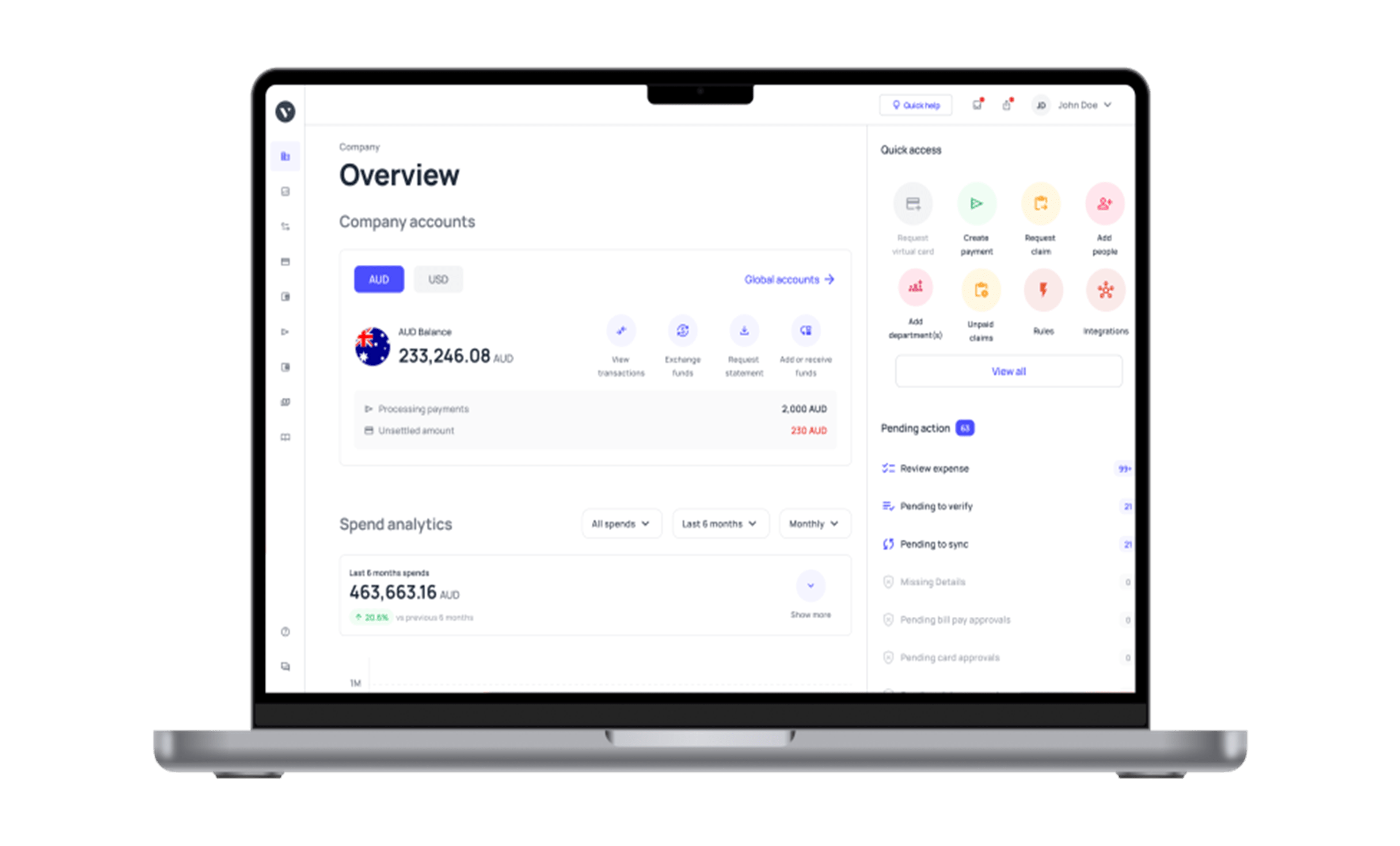

As an all-in-one expense management solution, you can be sure that your business funds are used, tracked, and managed efficiently with Volopay.

Volopay’s business credit cards are some tools that can help you achieve better business spending habits. From in-built spend controls to accounting software integrations, the features you’ll have access to are designed with businesses in mind and will save your business a lot of time and money in the long run.

Highly secured

Prevent fraud attempts by using a secure and easy-to-track payment method. There are no more unauthorized purchases or doctored bills with Volopay’s business credit cards. Freezing or blocking a card is as easy as a few clicks.

Easy approval

Applying for Volopay business credit cards is easy. The entire application process can be done online with minimal documentation. Once you’ve submitted all the required documents, our team will review your application within a week.

High credit limits

Using Volopay’s business credit cards instead of personal credit cards can help you get higher credit limits for your business. The application can be done fully online and there’s no personal guarantee necessary.

Offer employees separate cards

Every employee can get their own card for business expenses. Get rid of card sharing and tedious reimbursements by offering employees individual physical cards and purpose-specific virtual cards. There’s no more confusion over expenses.

Integrate with accounting systems

You can easily integrate your Volopay cards with your existing accounting software and directly sync your data. Closing your books at the end of the month doesn’t have to be complicated—reconcile all your expenses in just a few clicks.

Track spending in real-time

All payments made on your Volopay cards will be automatically recorded in real-time on the dashboard. Track how much money you’ve spent on your cards at any time from anywhere and get the latest updates.