What is a business credit card and how do business credit cards work?

A long-run business cannot be operated on personal funds. Credit is essential over the years to keep the company in business. Besides the traditional way of getting credit, banks and other financial institutions offer business credit cards for easier and faster transactions.

Keep reading to better understand what is a business credit card, how to get a business credit card, the benefits of a business credit card, and more.

What is a business credit card?

A business credit card, as the name suggests, is specifically designed to help business owners in fluctuating times and also meet basic requirements.

Business credit cards are assigned to business owners who can use them to pay rent, for utilities, pay vendors in some low time, buy equipment or supplies during the high selling season, etc.

Why use a business credit card? This is because it offers higher credit limits, rewards and cashbacks, and advanced spending control and management options.

How does a business credit card work?

Personal credit cards and business credit card work almost the same. Every month you spend with the card, and at the end of every month, you get the bill with the total amount and due and the minimum due amount payment required.

Now, if you pay the business credit card debt in full every month, no interest is charged. However, if you carry the balance to the next month, interest has to be paid. The interest percentage depends on the creditworthiness of your business.

Some credit cards are such that full payment is mandatory every month. This might sound tight, but the benefit of such a card is that its credit limit is way higher than the normal business credit card.

So, if your business has a stable source of income every month, only then should you go for such a business credit card.

Benefits of business credit card

Separate business and personal transactions

The most obvious yet highly needed benefit of a business credit card is the separation of expenses. Business owners can use a business credit card to make all official work-related purchases and keep a separate personal one for private expenses.

This way, nothing is cut down from the personal funds of the owner, and the business also gets a higher spending limit and clear audit trail.

Manage and control business cash flow

Business credit cards come with advanced management features. These are meant to cater to business needs, features like spend control, real-time expense tracking, automatic record creation, sorting, etc.

These features help in managing incoming and outgoing funds and maintaining a stable flow for the operations of the business.

Higher credit limits

As stated before, in comparison to personal credit cards, business credit cards offer higher credit limits. It is pretty simple; business credit cards are designed to tend to the expense needs of corporations and companies.

Business spending is way higher than normal personal expenses. Purchase of equipment, supplies, vendor payments, etc. All these are huge expenses, which is why business credit cards have a higher credit limit.

Easy approval

Another great benefit of a business credit card is the approval system. If you give business credit cards to your employees, all the employee expenses would have to stick to the set limits on the card.

They can easily access the company funds, and expenses under the spending limit will be automatically approved. Anything higher will require approval, which can be done by the managers easily through the card app.

Flexible repayment options

Depending upon the business credit card provider, you can get a repayment option that suits your business review cycle. You may prefer to repay the amount every month, every three months, or pay interest for extended periods, etc.

Negotiate terms with the provider, and you can easily get a flexible repayment option.

Interest-free periods

Some business credit card providers offer extended interest-free periods. This means that the lender gives businesses an interest-free period of more than the official 21 days.

This gives you some extra days to pay off the debt and also make other financing investments before repaying the whole amount.

Track business spends

Speaking of audit trails, business credit cards track, and record all the details of the expenses made through them. Details like time, place, purpose, amount, etc., all get captured and stored in the mobile application connected to the card or advanced management software.

This data can be easily accessed and is sorted automatically. So, auditing becomes a cakewalk for the business. Along with this, further amendments and financial decisions based on expense data can also be made more wisely.

Rewards and cashbacks

One of the greatest advantages of using a business credit card is the rewards and cashbacks features. Many business credit cards offer cashback on certain types of or a certain amount of transactions.

Some offer travel points and VIP lounge access at airports; others give rewards such as a discount on hotel stays, purchasing supplies, etc. So, not only do you get great spending and management features, but you also get extra on-top benefits.

Volopay is a trusted partner for 1000+ business to manage their expenses

How to get a business credit card

Getting a business credit card is pretty simple if you have all the necessary business documents handy and a good credit score. However, here is a brief breakdown of the steps to get a business credit card.

1. Choose the credit card provider

Determine the areas and reasons why your company needs a business credit card. Identify the areas where business credit cards can optimize the process and prove profitable.

According to that list, choose a business credit card provider that offers you all the essential features within your budget limits.

2. Check eligibility

While shortlisting credit card providers, also look for the eligibility criteria, documentation required, and all the other category fulfillment needed. See if it matches your business position, and apply for the business credit card accordingly.

3. Share required documents

In compliance with the application, submit the business documents. This can be identity proof of the business owner and stakeholders, revenue turnover, business and tax registration, and any other formalities that can be subjective to every provider.

4. Submit application

Every business credit card provider might have a different application process. Some might conduct the whole process online; some might take the identification step offline or any other alternative process. Read the process instructions carefully and follow them cautiously.

Factors to consider while choosing a business credit card

1. Choose the card that best suits your needs

Choose the business credit card that aligns with all your needs and relieves all the pain points of the business function.

For example, if the business is at the peak season and you are short of supplies, look for a business credit card that can be obtained easily, and you can start making transactions with it immediately.

Or if you have been facing issues paying your vendors because your customers haven’t paid on time, business credit cards can be of great help.

2. Spending restrictions & limits

Before jumping on to any business credit card, carefully go through all the spending restrictions and limitations.

Some providers might have a ceiling on the amount that can be spent in one day; some might have restrictions on the amount of cash withdrawal allowed, and some might not support payments to specific kinds of vendors or international payments. Hence, have an eye for the details and make decisions accordingly.

3. Annual fee & other fees

Apart from the interest rates, there might be other charges applied to the use of a business credit card. These can be annual credit card usage, fees on international transactions, extra charges on certain types of payments, or maybe charges on swiping the card for cash more than four times, late fees, etc.

Look out for any such fees, and choose the one where the least charges are applied because the purpose of the business credit card is to help the business not make it spend extra.

4. Integration with accounting tools

An extremely important feature to look for in a business credit card is integration with accounting tools.

Many business credit card providers offer expense management tools or accounting tools specifically so that all transactions made through the card can be automatically entered into the company’s books. No manual data entry hassle.

5. Interest rates

Another essential thing while deciding on a business credit card is the interest rate. If you can pay the used credit amount in full every month, then no interest is charged.

However, if you are unable to do so and only pay the minimum due amount, the interest cycle starts. The interest rates can vary from 10% per annum to as high as 25% per annum. This depends on the creditworthiness and repayment pattern of your business.

6. Credit limits

The major aim of getting a business credit card is to have access to a good amount of money to fulfill the daily (and some special) needs of the company.

To calculate the amount of credit required, add interest to the repayment calculation just in case you are not able to repay the full amount. There are business credit cards that provide a high amount of credit but at a mandatory interest rate.

7. Application process

You do not want to be stuck in a long, stretched-out process of business credit card application. Hence, whichever providers/credit card companies you shortlist, ensure that the application process is easy and quick.

Identification verification can be done instantly, and the business can start using the credit card immediately after receiving it. If your business has to make any time-sensitive payments, the lengthy process will only delay it.

8. Ensure if any liabilities

Ensure that there are any personal liabilities attached to the business credit card. This means many business credit cards are assured of personal liability, i.e., the person whose name the business crest card is registered that person is responsible for all the transactions made through it.

Hence, before applying for a credit card, find out who is responsible, the business or the person.

9. Rewards & other benefits

One of the most amazing benefits of having a business credit card is the rewards and cashbacks offered with these cards. Rewards like extra travel miles, travel points, lounge access, etc.

Cashbacks on a certain amount of payments, international transfers, 5%-10% cashback, etc.

Volopay’s business credit card to manage all your business expenses

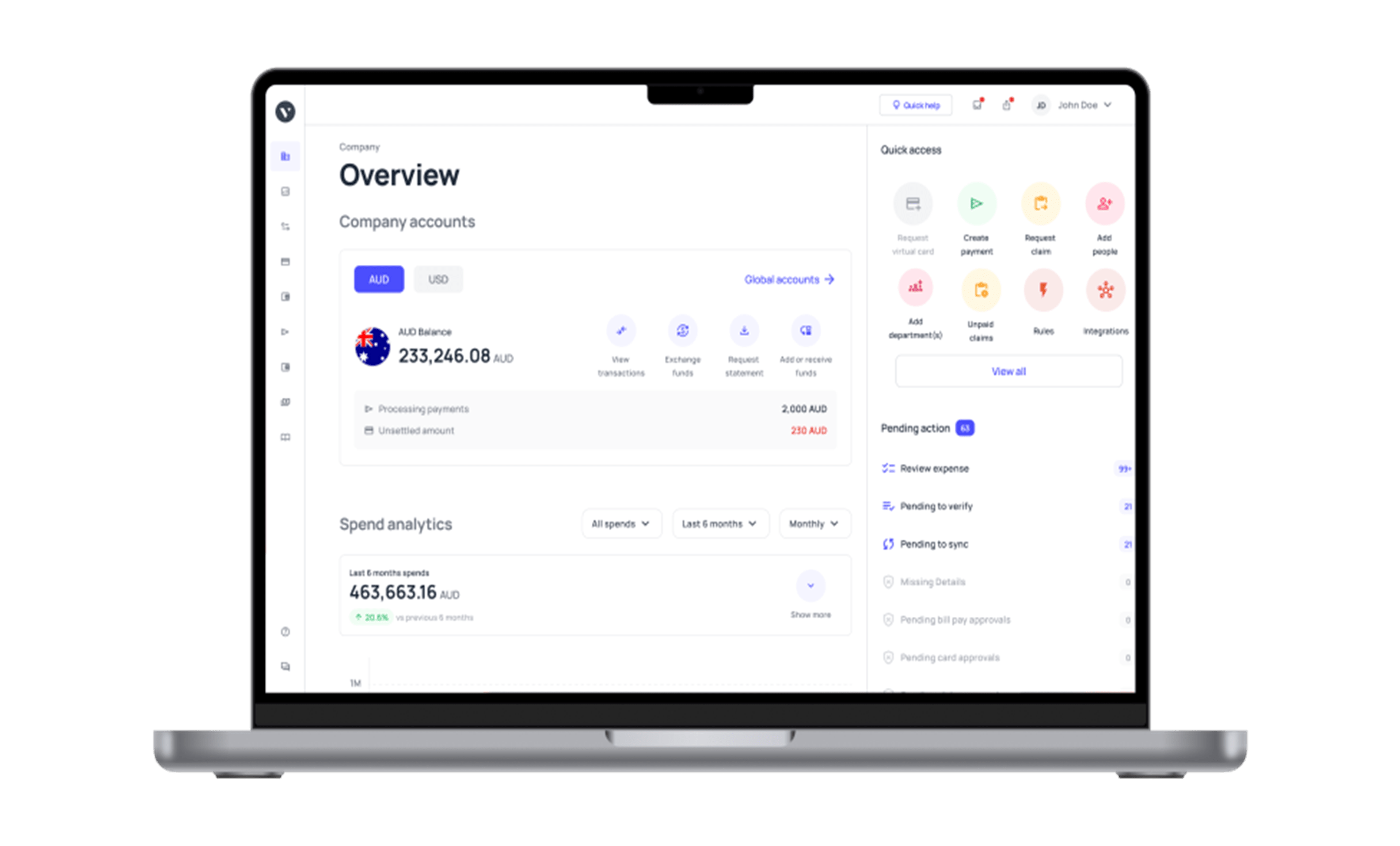

Looking for the right provider that fulfills all your needs within the budget? Let us introduce you to - Volopay! It is an all-in-one expense management platform that provides advanced management tools and the best business cards.

Volopay business credit cards give you the facility to manage expenses, set up multi-level approval policies, designate the cards to particular members, set limit expense amounts, and track all transactions in real-time.

Plus, if you are looking for a card that can help you manage all your business subscriptions, we got you. Volopay offers virtual cards with credit that can be burner cards or recurring cards according to your payment cycle and needs.

Wait, it gets better. All expenses made through Volopay cards are automatically reconciled and integrated with the accounting system. This eliminates the heaviest task of accounting data entry.

Along with this, to avail of Volopay credit, you just have to submit minimal business documentation. No guarantee is required, and the lowest possible interest rate is offered. Being connected with a high-tech management system, Volopay cards make expense management faster and better.

Streamline and manage your business expenses easily with Volopay cards

FAQ's

Yes. Business credit cards optimize business spending, help in expense management, and also provide extra rewards and cashback benefits.

Business credit cards are specially curated to serve business spending needs. These cards have a higher credit limit and advanced management features. Whereas personal credit cards are meant for individual use and, in comparison to business cards, have a lesser credit limit.

To maintain a good credit score and build a worthy reputation for further financial aid, it is advised to keep the credit utilization rate under 30%.

It is best to get a business credit card issued in the company’s name and not to attach it to any personal guarantee.

Lenders do expect a small business to show up with a credit score of at least 160-160. The credit scale is between 101 to 992. Anything above 600 is a good credit score.