Best startup business credit cards in Australia

Credit cards have become an essential part of managing finances within a company. It first started with business owners using their personal credit cards but soon shifted to specific corporate credit cards meant for businesses.

Today there are countless business credit cards in Australia that organizations can get to manage their expenses more efficiently. The best business credit card for startups have many things in common but also have many different things among them.

When choosing a credit card for your company you must consider your priorities and business needs, and decide accordingly.

Importance of business credit cards for startups

1. Keeping personal and business expenses separate

A business credit card helps you keep your personal and business expenses separate.

From a legal and cost-saving standpoint, it also separates and reduces the tax liability as you are a different entity and your business is its unique entity.

2. Improved cash flow

Most organizations need liquid cash in order to carry out daily operations but may face a cash crunch due to delayed or lengthy duration between receiving payments from their clients.

In such cases, a business credit card can help you avoid cash flow gaps and ensure that your business operations continue smoothly.

Read our article on cashflow management to know the effective ways to manage and improve your business cashflow in detail.

3. Access to credit

A business credit card is one of the many financial tools available that give you access to credit that can help you finance your daily business operations.

This could include expenses such as buying new equipment or paying for advertising.

4. Building credit history

Using a business credit card responsibly can help you establish and build your business credit history, which is important when seeking future financing.

When you want a loan for your business in the future, the first thing that a bank or your loan provider will look at is your credit history to check your creditworthiness.

Paying your business credit card bills on time without any delays will help you build a good credit score to receive financing in the future.

Related read: Tips to improve your business credit score

5. Rewards and benefits

Apart from the logical benefits mentioned above, many business credit cards offer rewards to their users.

Some common benefits offered by credit card providers include airline miles, hotel discounts, and other perks that can help you save a lot of money over time.

Some providers even offer cashback and allow you to literally earn money as you spend more.

Top 5 best startup business credit cards in Australia

1. American Express Qantas Business Rewards Card

The American Express Qantas Business Rewards Card offers Qantas Points on all eligible purchases, with no cap on the number of points you can earn.

The card also offers complimentary Qantas Club lounge invitations, travel insurance, and other benefits. The annual fee is $450, and the interest rate is 20.74% p.a.

2. NAB Rewards Business Signature Card

The NAB Rewards Business Signature Card offers NAB Rewards points on eligible purchases, which can be redeemed for travel, merchandise, and other rewards.

The card also offers complimentary travel insurance, concierge service, and other benefits. The annual fee is $175, and the interest rate is 18.50% p.a.

3. American Express Business Explorer Credit Card

The American Express Business Explorer Credit Card offers Membership Rewards points on eligible purchases, which can be redeemed for travel, merchandise, and other rewards.

The card also offers travel insurance, airport lounge access, and other benefits. The annual fee is $395, and the interest rate is 16.99% p.a.

4. NAB Low Rate Business Credit Card

The NAB Low Rate Business Credit Card offers a low ongoing interest rate on purchases and balance transfers. The card also offers up to 55 interest-free days on purchases and a low annual fee of $60.

5. Westpac BusinessChoice Rewards Platinum Credit Card

The Westpac BusinessChoice Rewards Platinum Credit Card offers Altitude Rewards points on eligible purchases, which can be redeemed for travel, merchandise, and other rewards.

The card also offers complimentary travel insurance, airport lounge access, and other benefits. The annual fee is $300, and the interest rate is 20.24% p.a.

Questions to evaluate your credit card requirements

Apart from the general points mentioned above, there are some contextual factors that affect the type of credit card you need. Ask the following questions regarding your business to get a more specific understanding of your financial situation and pinpoint your organizational needs:

● What are my average expenses each month, and what credit limit would I need to suit?

● Am I planning to have a balance on the card month-to-month, or pay it off regularly?

● Do I want a low-fee credit card to keep interest costs down?

● Will it be helpful to earn rewards points on my expenses?

● Would it be helpful to have free insurance included?

● How many of my employees would need a credit card?

Why Volopay’s corporate card stands out as the smarter choice

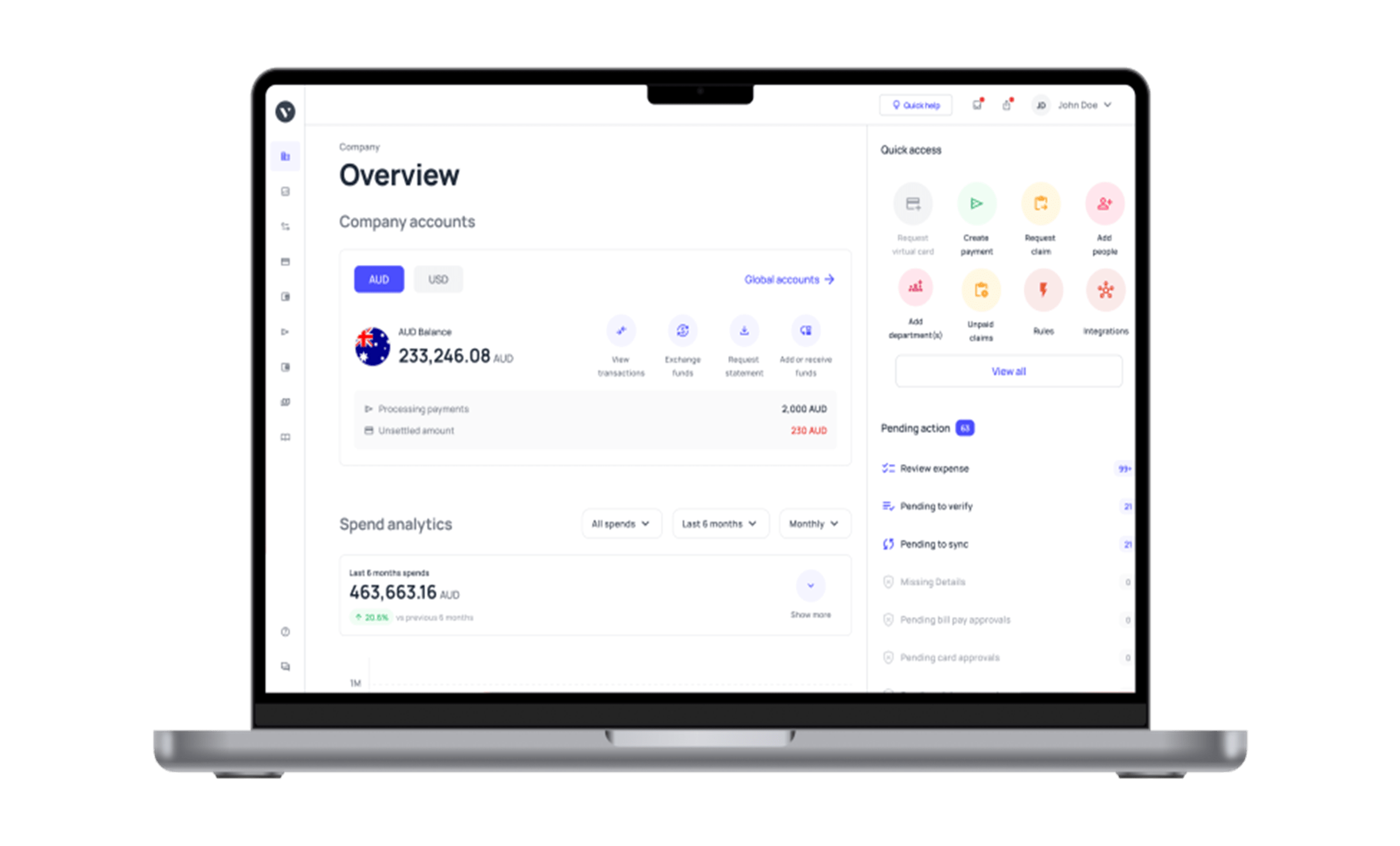

Volopay is a complete expense management ecosystem to track and control business expenses. Along with this platform, we also offer financial tools such as physical and virtual corporate cards for companies to issue for their employees and make managing expenses easier.

Better cash flow & visibility

Every payment made through any of your Volopay corporate cards is recorded in real-time on the platform. This gives you real-time visibility over employee and business expenses at all times.

Easy to use

You can easily issue one physical corporate card from the platform for each employee that you want. You can also create unlimited virtual corporate cards for managing all online expenses.

This allows an employee to make faster decisions and not waste time in getting budget approvals or waiting to get a shared card from their coworkers.

Control expenses

You don’t have to worry about employees overspending using corporate cards as you can set custom spending limits for each card.

This way, no employee would be able to spend more than the limit that has been set on their card effectively controlling expenses.

Security & Compliance

Our physical and virtual cards along with the platform are integrated with high-level security features to ensure the safety and security of your financial data.

We comply with all the financial regulations in the country to ensure you experience one of the best startup business credit cards in Australia.