Best fuel cards for businesses in Australia - Top picks for 2025

Businesses, especially logistics, commercial fleets, distributors, and retail service providers, are directly affected by the increasing expenses of fuel. The challenges revolving around fuel expenses are not declining anytime soon. It is because more and more vehicles are being purchased.

Almost all businesses require fuel-powered vehicles to conduct daily operations smoothly. It’s no surprise that many want the best business fuel card Australia has to offer. Those in the logistics, transport, or retail industries may traditionally benefit the most, but there’s no denying that a fuel card for business can make a difference to businesses of all sizes and sectors. .

Vehicles demand fuel to run, and the increased demand for fuel is directly proportional to the increased fuel price.

However, businesses are making efforts to cope with this challenge. This article contains the best fuel cards for small businesses to help them manage their fuel expenses efficiently.

What is a fuel card?

A fuel card functions similarly to a credit card. It makes the payment process simpler for businesses purchasing fuels like petrol, diesel, or gasoline. It also allows businesses to keep track of the money spent on fuel.

Fuel cards for small businesses are a good investment. Just like a business credit card, fuel cards are linked with an account. The charge is deducted from the user’s bank account whenever the fuel card is swiped for making a fuel-related payment.

With the best fuel cards for small businesses, there is no requirement to preserve fuel receipts for tally purposes. Companies can have a single tax statement with all the purchase records and items.

Types of fuel cards

1. Business fuel cards

Several different cards can fall under the business fuel cards categories. Though primarily used to describe cards specifically designed for fuel expenses made by businesses, there are some business credit cards that also serve a similar purpose and can get small businesses fuel rebates.

2. Fleet fuel cards

Fleet fuel cards are not that different from business fuel cards.

However, consistent with its name, fleet fuel cards also target large-scale operations with a fleet of hundreds or thousands of vehicles. These cards are typically used by businesses that refuel thousands of liters each month.

3. All-brand fuel cards

As the name suggests, an all-brand fuel card for business can be used at most if not all fuel station brands across Australia.

While these cards make it easy to refuel anywhere, they typically have a higher monthly fee and fewer deals.

4. Single-brand fuel cards

A single-brand fuel card is designed for one fuel station brand. Shell cards or BP fuel cards are good examples of this type of card in Australia.

Some of these cards may be usable in other fuel stations, but there will be a surcharge.

5. Brand-specific fuel cards

Similar to single-brand business fuel cards, Australia also has brand-specific cards. These are attached to the particular brand in the card name and likely can only be used at those brands. As a trade, businesses can get better deals with them.

How do fuel cards work?

The fuel cards Australia has to offer function similarly to credit cards. When a fuel card is swiped at a fuel station, the total of the transaction is charged to the card.

Rather than directly pulling funds from the cards, however, fuel cards are linked to a bank account or credit card, which will be charged the total monthly bill at the end of the billing period, just like a credit card.

The biggest difference between a fuel card and a credit card is that fuel cards are designed specifically for fuel and vehicle-related purchases. Companies looking to control fuel usage better may want to use the best business fuel card Australia has to offer.

Best fuel cards for small businesses in Australia in 2025

1. Volopay prepaid cards

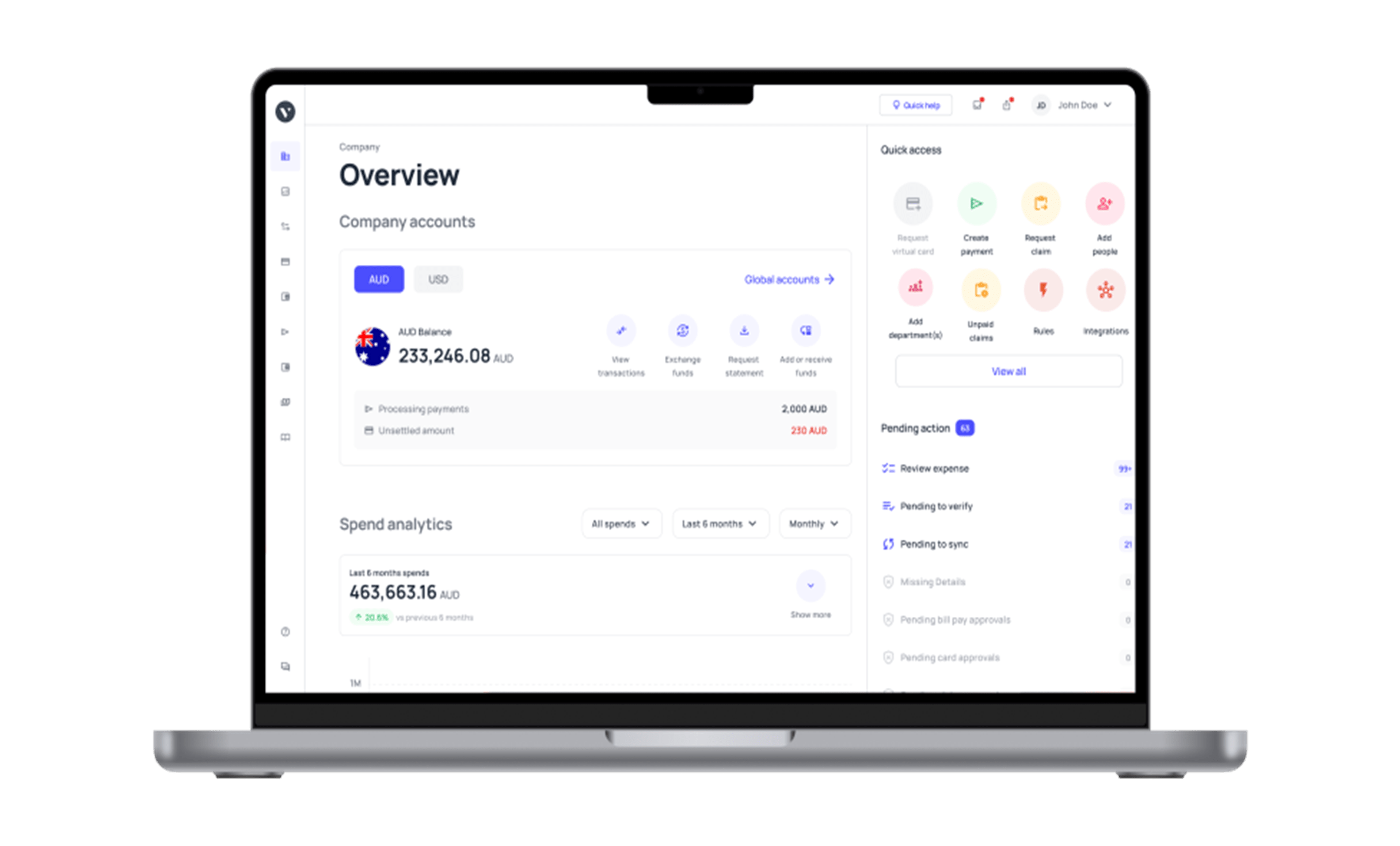

While Volopay doesn’t offer the traditional fuel card for business, its prepaid cards provide a smart alternative for managing transportation-related expenses. From fuel purchases to tolls and maintenance, you can use Volopay’s cards to streamline fleet expense management.

The platform also centralizes expense tracking, making it easier for Australian businesses to manage costs, enforce controls, and improve visibility across all vehicle-related transactions.

● Standout features

Volopay’s prepaid cards are ideal for startups, small businesses, and fast-growing companies that want control without the limitations of a dedicated fuel card. What sets Volopay apart is its flexibility, cards can be issued to employees, drivers, or vehicles, each with customizable rules and spending limits.

Businesses can track every dollar spent in real time, categorize fuel and transport expenses, and eliminate paperwork with mobile receipt capture. Volopay integrates with popular accounting platforms, simplifying reconciliation and reporting, which helps streamline financial operations beyond fuel expenses.

● Fees

To learn more about Volopay’s pricing and plan options, please visit their pricing page.

● Pros

1. Custom spending controls for each card.

2. Real-time tracking and instant alerts.

3. Seamless integration with accounting tools.

● Cons

1. Not accepted at all fuel stations.

2. Lacks pump-level data specific to fuel cards.

2. Fleet cards

● Standout features

Given the popularity of Fleet cards in Australia, the name is almost synonymous with fuel cards. Some people even use fleet and fuel cards interchangeably, but the name-brand Fleet cards are premium fuel cards Australia businesses can use across the country. Unlike single-brand fuel cards, Fleet cards can be used at almost all fuel stations.

What sets Fleet apart is that businesses only need one card for all business vehicle-related expenses. These cards can be used not only for refueling but also for oil changes and vehicle repairs. They are well-suited for companies with larger fleets that want to centralize their vehicle expenses.

● Fees

To explore current fees and charges for the Fleet Card, visit their official pricing page.

● Pros

1. Fleet cards are a good premium option for businesses looking to easily refuel and take care of vehicle expenses from anywhere.

2. Businesses with large fleets can take advantage of the volume-based discounts for cost efficiency.

3. It’s easy to customize and manage Fleet cards according to the company’s business needs.

● Cons

1. Because it’s not brand-specific, businesses get fewer fixed deals on fuel with Fleet cards. Those with smaller fleets may not benefit.

2. Replacing a Fleet card is expensive, costing AUD 15 per replacement card.

3. While there’s a Fleet card mobile app, its only use is to locate fuel stations. They are not made to manage cards.

3. Shell card

● Standout features

Shell cards are some of the most accessible fuel cards Australia has for new businesses. This is because there is no requirement for how long the business has been registered and active. Anyone who has an ABN can apply for Shell cards and save money at Shell fuel stations.

As a popular fuel brand, businesses won’t have difficulties finding Shell stations to refuel at. Using a Shell card at any Shell fuel station nets businesses a fixed discount of 2 cents/liter for regular fuel and 4 cents/liter for premium fuel. Filling up fuel at Shell Coles Express also helps businesses earn Flybuys points.

● Fees

You can find detailed pricing information for the Shell Card on their pricing page.

● Pros

1. New businesses can benefit from Shell cards without a wait time.

2. Get access to the Shell Card Portal to view and manage all the Shell business fuel cards. Australia businesses can order and cancel cards, streamline GST, access transaction reports, and more.

3. Get Shell fuel discounts and earn Flybuys points by using this card.

● Cons

1. Though Shell is widely available in Australia, keep in mind that Shell fuel card users are limited to Shell stations and must work around that.

2. Businesses cannot make manual payments for Shell cards, as Shell only takes bank account or credit card direct debit.

3. New businesses with no credit history get shorter credit terms.

4. WEX Motorpass

● Standout features

If a Fleet card does not do it for businesses looking for multi-brand fuel cards, they may want to look at the WEX Motorpass fuel card for business. Businesses that operate in sectors such as plumbing, electricity, repair, and other sectors with a good number of tradespeople will be able to really benefit from the WEX Motorpass.

When a tradesperson is on the road and going from one job to the other, it’s easiest to refuel at whatever the closest fuel station is. The WEX Motorpass’ ability to refuel at any station helps to ensure that a tradesperson’s daily work goes smoothly.

● Fees

For an overview of WEX Motorpass fees, please check their official pricing page.

● Pros

1. The WEX Motorpass is a flexible premium card that can be used Australia-wide.

2. Card users get a fixed 1-cent/liter discount at all stations that accept WEX Motorpass except for LPG.

3. Customize which WEX Motorpass card type to give drivers, such as a fuel-and-oil-only card or one that allows drivers to buy food and drinks.

● Cons

1. A 1.5% surcharge is applied to all Coles Express purchases.

2. There are a number of negative reviews of WEX Motorpass that are unhappy with their customer support team, so make sure to look into it closely when considering this fuel card.

5. AmpolCard

● Standout features

An AmpolCard is a good choice as the best fuel card for small business. Australia has around 1,900 Ampol fuel stations across the country. Businesses that have a lot of operational vehicles that are constantly on the go will be able to rest easy knowing that they can refuel almost anywhere.

The benefit of the AmpolCard being a brand-specific card, unlike the Fleet card or WEX Motorpoass, is that businesses get fixed discounts at Ampol stations.

It’s also a good card for transport and logistics businesses as it offers discounts for some other items purchased at Ampol stations, such as engine oils.

● Fees

Review all AmpolCard fees and related terms by visiting the AmpolCard pricing page.

● Pros

1. Get a fixed discount of 2 cents/liter on regular fuels and 4 cents/liter on premium fuels at Ampol stations across the country.

2. Businesses can save even more money by linking their Everyday Rewards account and gaining points while swiping the AmpolCard to refuel.

3. AmpolCard seamlessly integrates with Xero and MYOB, two popular accounting software providers.

● Cons

1. AmpolCard offers some extra services and programs, but their fees can add up for businesses with a large fleet.

2. While Ampol stations can be found Australia-wide, businesses looking to be able to use a fuel card to refuel anywhere may want to look at an all-brand fuel card for business instead.

6. 7-Eleven Card

● Standout features

The 7-Eleven fuel cards Australia has to offer, often called 7-Eleven Fuel Passes, are great for businesses on a budget.

Not only do they have low fees, they are also highly customizable. When getting a card, businesses can decide whether they want a card that is registered to the driver and vehicle, just the driver, or just the vehicle.

Businesses can set up their 7-Eleven cards to include other purchases at 7-Eleven stations, such as oils, car wash, and convenience store items. The ability to customize as needed comes in handy for businesses that want to assign different card usage on different occasions.

● Fees

Access detailed 7-Eleven fuel cards Australia pricing and product options on their fuel card pricing page.

● Pros

1. Businesses can get up to 44 payment-free days, though payments are actually due 14 days after the billing statement.

2. Get a minimum ongoing discount of 2 cents/liter at 7-Eleven stations.

3. Each card can be customized according to the business needs and driver requirements before drivers start using it for purchases.

● Cons

1. There are less than 1,000 7-Eleven locations where the card can be used, making the 7-Eleven card’s coverage often limited.

2. Businesses using the 7-Eleven card should note that there are high fees for payments other than with direct debit.

3. Currently, there are no rewards programs associated with this fuel card.

7. BP Plus fuel card

● Standout features

One advantage to using the BP Plus fuel card for business fuel expenses is that businesses can take advantage of the card to earn Qantas Rewards points. Businesses that engage in a lot of travel will highly benefit from this.

However, the points system isn’t the only thing that the BP Plus fuel card offers. As discounts with this card ramp up according to the fuel transaction volume of an organization, those looking to scale may find this card attractive.

Its BP Plus mobile app is also a standout that helps businesses do a number of things, including send receipts and locate fuel stations.

● Fees

For BP Plus fuel card fee structures and plan details, visit the BP Plus pricing page.

● Pros

1. When paired with the BP Plus mobile app, managing vehicle expenses with the BP Plus card is simple and seamless.

2. If a business is registered with the Qantas Business Rewards program, it can use the BP Plus fuel card to earn rewards with Qantas.

3. Get direct accounting integration with Xero.

● Cons

1. BP Plus fuel cards can be expensive for very small businesses, as each card costs AUD 4.95 if a business has 2 or fewer cards.

2. Although there are around 1,400 BP stations across Australia, not all BP locations support the BP Plus app, which is this card’s standout feature.

8. Metro fuel card

● Standout features

The Metro fuel card for business is tailored for Australian businesses that want nationwide access to competitively priced fuel without complex terms. It offers access to over 2,000 fuel sites across Australia, including Metro Petroleum and partner locations.

The card can be used for fuel, lubricants, and vehicle maintenance, with the option to restrict purchases based on product type or dollar amount. Metro’s online platform enables real-time monitoring of fuel expenses per driver or vehicle. Businesses can produce comprehensive reports, access GST-compliant invoices, and evaluate fuel efficiency.

These functionalities are particularly beneficial for small businesses aiming to minimize administrative tasks and optimize vehicle operating costs, making this option one of the best fuel card for small business Australia has to offer. Additional features such as optional PIN protection and spending limits provide enhanced security.

● Fees

To review current pricing details, please visit the Metro Petroleum fuel card pricing page.

● Pros

1. Access to a wide network of Metro and partner stations.

2. Real-time spend tracking and reporting tools.

3. Ability to restrict purchases and set limits.

● Cons

1. Not accepted at major fuel chains like BP or Shell.

2. Limited card features compared to digital-first platforms.

Get the perfect fuel card for your small business

Benefits of fuel cards for small businesses

1. Detailed reporting

It’s no secret that expense reports are tedious and burdensome. Due to the amount of labor that goes into expense reporting, employees may be reluctant to do detailed reports in a timely manner.

With fuel cards, however, transactions will be automatically recorded in real time. Employees will just have to fill out preset fields to complete their fuel expense reports. This also aids the company in streamlining the process by ensuring all necessary details are filled in.

2. Reduced admin costs

Eliminating manual data entry for fuel card transaction records also reduces admin costs. Businesses won’t have to spend long hours on fuel transaction reporting and manually recording expenses.

A faster process turnover time also means that the organization needs less administrative labor. This will cut down the amount of money businesses have to spend on compensating and training employees, especially because fuel cards are not too difficult to use.

3. Easily accessible locations

Many fuel stations in Australia accept at least one fuel card. These cards are easy to use and the locations where they can be used are relatively accessible.

Most companies will not have to go out of their way just to get to a fuel station that will accept fuel cards, especially because that will defeat the purpose of the cards. Aimed to streamline fuel expenses, these cards can be used all over Australia.

4. Protection against fraud

Every transaction gets automatically logged and businesses will get better visibility over their expenses.

If anyone is attempting fraud or lying about fuel card usage, the finance team can immediately spot it and put an end to it.

Unlike corporate cards or prepaid cards, a fuel card for business is also only usable for the purpose of buying fuel. Deliberate card misuse is less likely to occur.

5. Monitoring fuel usage

When all refuel transactions are charged to fuel cards, Australia businesses can easily monitor their fuel usage thanks to their automated transaction updates.

Not only that, but companies can also limit how much is spent on fuel per week.

Any oddity in fuel usage, such as fuel running out in a day or two before another fuel card transaction, will be noted by the finance team and can be addressed accordingly.

6. Efficient expense management

Equipping every employee who needs it with fuel cards is a surefire way to streamline expense management.

Instead of having to manually track how much each employee has spent on fuel, the finance and management teams can simply take a look at the dashboard.

Each individual card can be given its own limit, allowing organizations to manage role-specific expenses with ease, too. Viewing, tracking, and controlling fuel expenses is more efficient with a fuel card for business.

7. Simplified accounting

One huge benefit of using the fuel cards Australia has for businesses is that many card providers offer accounting integration capabilities.

Rather than having to perform manual data entry and stress over bookkeeping, the finance team can directly sync transaction data.

All fuel card purchases are automatically logged. Reconciliation can happen on just a single platform. When paired with the direct sync, accounting records are guaranteed to have improved accuracy with less hassle.

8. Enhanced financial oversight

The first step to maintaining a business’s financial health is by getting a better overview of it. The features that a fuel card for business has are guaranteed to help businesses enhance their visibility over spending.

A stronger financial oversight will lead to more control. Businesses can track their fuel spending patterns accordingly and prevent overspending by setting appropriate spend limits.

Gain enhanced financial awareness and oversight with fuel cards.

Fuel cards vs credit cards vs prepaid cards

When managing fleet expenses, businesses often choose between fuel cards, credit cards, and prepaid cards. Each has distinct features and limitations. Your decision should be based on the type of expenses you manage, the level of control you require, and how much flexibility or automation your business needs.

1. Functionality

● Fuel cards

Fuel cards are designed exclusively for vehicle-related expenses such as fuel, tolls, and servicing. They offer control by allowing businesses to limit card use to specific fuel types, locations, and spending caps. Most are accepted only within a defined network of service stations, making them ideal for businesses with regular, predictable routes.

● Credit cards

Business credit cards are multipurpose tools that allow spending across a wide range of categories, including fuel. They come with a revolving credit line, interest charges if unpaid by the due date, and often offer reward points. While flexible, they lack granular control over how funds are used and can be prone to misuse without tight oversight.

● Prepaid cards

Prepaid cards function like debit cards but must be preloaded with funds before use. They offer flexibility in where they can be used, making them suitable for a variety of business expenses, including fuel.

Businesses can control spending by allocating specific amounts to each card and reloading as needed. However, because they don’t offer automated spend categorization or advanced controls, managing multiple cards manually can become time-consuming. Unlike credit cards, they don't carry the risk of debt, but also don’t provide credit-building benefits.

2. Payment process

● Fuel cards

Most of the business fuel cards Australia has to offer typically operate on either a charge or credit basis. Some require payment in full each month, while others offer short-term credit with a set repayment window.

Transactions are typically limited to specific merchants within a partner network, and itemized statements are issued periodically for reconciliation and tax purposes. No cash is involved, reducing risk of theft or misuse.

● Credit cards

Credit cards enable individuals to make purchases within a pre-approved limit, offering the flexibility to carry a balance if the full amount is not settled by the due date. Interest is applied to any outstanding balances.

Payments can be managed manually or scheduled automatically. They are widely accepted, providing exceptional convenience, but this ease of use can encourage overspending if not managed responsibly.

● Prepaid cards

With prepaid cards, the full amount must be loaded before use. There’s no credit involved, and transactions are settled instantly. Since funds are limited to what’s loaded, overspending isn’t possible.

3. Record-keeping

● Fuel cards

The fuel card for business simplifies expense tracking by automatically generating detailed transaction data. Each purchase is logged with information like driver ID, vehicle registration, fuel type, and location.

These records are consolidated into downloadable reports, which can often be integrated with accounting systems. This reduces paperwork and improves tax-time accuracy, especially for GST claims.

● Credit cards

Credit cards typically provide monthly statements listing transaction amounts, dates, and merchants. However, they lack line-item detail for fuel purchases, which means businesses may need to cross-check receipts manually.

Some cards offer expense management tools or integrations, but these often require third-party add-ons or enterprise-level plans to be truly effective.

● Prepaid cards

Prepaid cards offer basic reporting features, depending on the provider. Most include transaction histories and downloadable CSVs, but few offer the advanced reporting or filters found in fuel card systems.

Businesses relying on prepaid cards may need to manually track driver or vehicle data for each transaction.

4. Credit reporting

● Fuel cards

Most fuel cards Australia has available do not report to commercial credit bureaus, meaning they typically don’t help build a business’s credit history. This can be a drawback for companies aiming to improve their credit profile.

However, the lack of reporting also means missed or delayed payments may not negatively impact credit, offering a bit more flexibility.

● Credit cards

Business credit cards are reported to credit agencies, making them valuable tools for establishing and improving a company’s credit score over time when used responsibly. Timely payments and maintaining low credit utilization can enhance creditworthiness.

On the other hand, late payments or exceeding credit limits can harm it, impacting the company’s ability to secure financing or negotiate favorable terms.

● Prepaid cards

Prepaid cards don’t involve borrowing, so they’re not tied to credit reporting in any way. They won’t help build a credit profile, nor will misusing it hurt it. These cards are purely transactional and operate outside the credit system entirely.

5. Pros

● Fuel cards

Fuel cards offer precise spending control, with restrictions based on fuel type, location, volume, or time of day. They simplify administration with automated reports and GST-compliant invoices.

For businesses managing fleets or frequent travel, they can reduce fraud, streamline expense tracking, and come with discounts or rewards from fuel partners.

● Credit cards

Business credit cards provide unmatched flexibility, allowing purchases across categories beyond just fuel. Many include rewards programs, travel perks, and purchase protections. They also help with cash flow by offering short-term credit and are accepted nearly everywhere, making them practical for both planned and unexpected expenses.

● Prepaid cards

Prepaid cards give businesses budget control by limiting spending to preloaded funds. There’s no risk of interest or debt accumulation.

They’re easy to issue to multiple team members, making them ideal for managing variable or project-based expenses. They also eliminate overspending, since purchases can’t exceed the balance on the card.

6. Cons

● Fuel cards

Fuel cards are usually tied to specific fuel networks, which can limit driver convenience, especially in remote areas. Fees can include monthly charges, transaction fees, or surcharges for off-network use.

Some cards also lack broader purchase flexibility, making them less useful for non-fuel-related business expenses.

● Credit cards

Business credit cards pose the risk of accumulating debt if balances are not paid in full. High interest rates can add to the financial burden, and missed payments may adversely affect the company’s credit score.

Additionally, without stringent internal controls, these cards are more susceptible to misuse or unauthorized expenditures across unrelated expense categories.

● Prepaid cards

While prepaid cards offer spending control, they often lack robust reporting features and don’t support credit building. Manual effort may be required to categorize and reconcile transactions.

Reloading cards frequently can be time-consuming, especially when managing multiple users. Some cards also come with fees for inactivity, loading, or ATM use.

7. Convenience

● Fuel cards

The fuel card for business can be highly convenient for organizations with vehicle fleets. Drivers don’t need to pay out of pocket or submit reimbursement claims, and employers can manage spending from a central dashboard.

However, limitations in where the card can be used can create issues if a driver is outside the partner network.

● Credit cards

Credit cards are widely accepted and easy to use for a broad range of expenses. They simplify payments for both recurring and one-off purchases.

Many offer mobile apps, instant alerts, and virtual cards, increasing accessibility. That said, without usage limits per category, it can be difficult to separate and control specific spending types.

● Prepaid cards

Prepaid cards offer straightforward use and easy distribution to employees or contractors. Because funds are preloaded, there’s no risk of overspending or interest charges.

However, some cards may require manual top-ups or replacement when balances run low, which can add friction to the process if not monitored closely.

Streamline fleet expenses with Volopay

Key considerations while choosing a fuel card for your business

1. Fuel station network

Not every fuel card for business can be used in all fuel stations in Australia.

It’s important to consider how big the card’s fuel station network is, as well as whether or not the stations that the business frequents are in the network.

2. Security measures

Make sure that whichever is the fuel card provider of choice has the necessary security measures to protect company funds.

Built-in spend control features, for example, can help limit monthly spending. Compromised fuel cards should also be easy to lock.

3. Fee structure

The best business fuel card Australia has to offer is likely not free. Make sure to research each fuel card provider’s fees.

These could be annual fees, new card fees, transaction fees, and more. Examine the fee structures in detail to avoid hidden fees.

4. Acceptance rate

The last thing any organization wants is to swipe a fuel card only to have it rejected by the system.

Look up customer testimonials to determine whether or not the best fuel card for small business Australia has to offer has a high acceptance rate.

5. Payment flexibility

As most fuel cards are post-paid and charged to the business monthly, it’s a good idea to look for a card provider with flexible payment options.

This could be alternative payment methods or even flexible and customizable payment dates.

6. Discounts and savings

Many fuel cards have deals that allow businesses to save some money at fuel stations.

In fact, using one of the many fuel cards Australia has can be better than paying in cash. See how much the business can save in fuel card discounts.

7. Reporting capabilities

Businesses want fuel cards to streamline their operations, whether that is on-field or for reporting purposes. For this reason, it is crucial to look at a fuel card’s reporting capabilities.

Automated reporting makes it easier for the finance team and other employees.

8. Interest-free periods

Get a fuel card for business that has a sufficient interest-free period for payments.

Some fuel cards may only give businesses a week or two to make payments before they start charging interest fees, though others may have longer periods.

9. Loyalty programs

Some of the best business fuel cards Australia has to offer have loyalty programs that help businesses save even more money.

By spending a certain amount or making a certain number of transactions per month, for example, businesses can get cashback on their fuel cards.

Simplified fleet expense management with Volopay

Managing transportation expenses across multiple platforms and cards can be cumbersome. Hence, to simplify your expense management systems, we recommend Volopay, a platform that offers an all-inclusive solution without the hassle of complications.

Experience the convenience of streamlined transportation expense tracking and management with Volopay and its unique set of features.

Custom spending limits per card

With Volopay, you can set precise spending limits on each card issued. Whether you need to control daily fuel expenses or restrict spending to specific categories, Volopay’s flexible control features help prevent misuse and promote accountability.

Limits can be updated instantly, allowing your finance team to adapt to real-time business needs and budgets, a feature that puts the platform amongst some of the best business fuel card Australia has available.

Assign cards to drivers/vehicles

Volopay allows you to issue cards tied to specific drivers or vehicles, making it easier to track expenses across your fleet. This setup eliminates confusion over who spent what and simplifies reconciliations.

Assigning cards at this level provides a direct line of visibility into usage patterns, helping you manage cost and performance by driver or vehicle.

Real-time fleet expense tracking

Volopay offers real-time tracking of all card transactions, enabling you to monitor fleet expenses as they occur. No more waiting for end-of-month statements or chasing down receipts.

With real-time visibility, you can quickly flag any irregularities or policy breaches, keeping your fleet’s fuel and travel spending under control at all times.

Mobile receipt upload feature

Drivers can instantly upload receipts using the Volopay mobile app, eliminating the hassle of paper receipts and reducing manual entry.

Each transaction on the fuel card for business can be matched with a photo of the receipt in real time, helping you maintain accurate records. This feature also streamlines audit processes and ensures all documentation is stored securely in one place.

Advanced card security features

Volopay cards are equipped with enterprise-level security features, including instant freezing, transaction controls, and multi-level approval workflows.

If a card is lost or misused, you can disable it immediately. These safeguards reduce fraud risk and ensure spending stays within company policies, giving you complete control over every dollar spent.

Accounting software integration available

Volopay integrates with leading accounting tools like Xero, QuickBooks, MYOB, and NetSuite. All transaction data syncs automatically, including custom fields like GST and cost centers.

This eliminates manual entry, reduces reconciliation errors, and speeds up month-end close. You get a smoother finance workflow while keeping your books accurate and up to date.

Supports multiple currencies globally

Volopay’s multi-currency support provides an effective solution for cross-border fleet operations. Businesses can issue cards in local currencies to eliminate conversion fees and streamline reporting processes.

This functionality is particularly advantageous for organizations managing international logistics or travel needs. All expenses, irrespective of currency, are consolidated on a unified dashboard, enabling efficient oversight and management.

Centralized expense dashboard

Volopay provides a centralized dashboard that aggregates all transportation-related expenses in one place. You can filter by driver, card, vehicle, or vendor to get the insights you need.

This level of visibility helps you make faster decisions, control budgets, and optimize spending without switching between platforms or digging through spreadsheets.

Ultimate alternative

Volopay is more than just a fuel card for business, it’s an all-in-one expense management solution. For businesses seeking better control, visibility, and automation across transportation costs, it stands out as the ultimate alternative.

From custom limits to accounting sync, Volopay replaces outdated, fragmented systems with a modern, streamlined approach to managing your fleet expenses.

Keep your fuel expenses under check with Volopay

FAQs

Some fuel cards Australia offers work only at major fuel networks, while others are accepted at independent or regional stations. Always review the provider’s coverage list to ensure access in rural or remote areas.

Even with just a few vehicles, fuel cards simplify tracking, reduce paperwork, and offer better oversight of fuel spending. Small businesses can gain significant value from automated controls and consolidated reporting.

Yes, one account can manage multiple cards, each linked to specific drivers or vehicles. This setup makes it easier to track spending per user and organize expenses for your entire fleet.

Yes. When cards are assigned to specific users or vehicles, you can monitor individual fuel consumption through itemized statements, which help optimize routes, flag unusual activity, and manage costs better.

Volopay is well-suited for small teams. It combines spend control, easy card assignment, and real-time visibility, allowing smaller businesses to manage fleet expenses efficiently without needing multiple tools or platforms.

Volopay's prepaid cards can be tied to specific drivers or vehicles, so each transaction is automatically tagged. This ensures accurate reporting, clearer accountability, and smoother reconciliation for your transport-related purchases.

Yes, Volopay cards can be used for other vehicle-related costs like tolls, car washes, or parking. Spend rules can be customized, so cards are limited to only approved merchant categories.