Complete history of credit cards in Australia from the 1900s to 2025

The credit card has, without a doubt, served as an instrumental tool in the world of personal as well as corporate finance.

The history of credit cards has proved this tool to be an extremely potent source of financial support, regardless of the other opinions around it. In Australia, the credit card industry has served as a useful source for consumers and corporate giants.

Overview of the first charge coins in 1900s

The earliest and oldest forms of credit in the history of credit cards in Australia that were recorded in the 19th century were charge coins, also sometimes referred to as charge cards.

These were the first step in the history of credit card processing in Australia. Departmental stores, hotels, petrol companies, and other large merchants would issue charge coins to customers who were regular.

It was for these customers to use charge coins along with store charge accounts. Charge coins would come in all kinds of shapes, sizes, and forms. They would be made out of celluloid or sometimes even metal.

These charge coins would bear the charge account number of the customer alongside the name and logo of the merchant, this was done in order to make imprinting on sales slips easy.

However, given that no other marks of identification were present on charge coins, it was easy to steal these coins and use them for fraudulent transactions.

Charge coins were soon replaced by charge plates, the credit cards’ closest precursor. These plates would come in the shape of rectangular plates made of metal and they were very close to military dog tags in terms of resemblance.

The customer’s address, name, account number, and in some cases even their signature was mentioned on charga-plates. This made fraud harder to commit with such plates, as compared to charging coins.

However, it was still only large merchants that could issue charga-plates and they could be used in the issuing store only.

History and evolution of credit cards in Australia

To understand the evolution of credit cards in Australia we need to take a closer look at the history of credit cards timeline.

To be precise, we need to understand how the credit card has transformed and progressed starting from its earliest variant in the 1900s to the credit card we know today. Here’s a brief history of credit cards:

Charge coins history from the 1900s to 1930

The brief history of credit cards started out first with the introduction of charge coins. As we have already discussed, the earliest form of credit recorded in the 19th century was the charge coins.

These coins included the charge account number of the customer alongside the name and logo of the merchant. While they were effective till a certain point in time they were still susceptible to fraud.

Given their susceptibility to fraud, charge coins were replaced, in the 1930s, by charga-plates. These were military dog tag-style plates that included the customer’s address, name, account number, and signature to help reduce fraud.

Charge cards and credit cards 1940s to 1960s

The first attempt by a bank to issue cards that can be used at more than one merchant store was the Charg-it card developed by banker John Biggins in 1946. It was issued by the Flatbush National Bank of Brooklyn in New York.

Next in line was the first Diners Club card issued in 1950 by Frank McNamara and Ralph Schneider. Made of cardboard, these cards could be used in selective restaurants. This was still not a credit card in essence but a charge card because it didn't offer revolving credit.

Following this, in competition with the Diners Club card, American Express released its entertainment and travel card while the first BankAmericard (later renamed Visa in 1976) was launched by Bank of America launched in Fresno California.

Soon after, in 1965, the Californian credit card system was introduced by the Bank of America across the country. This resulted in the beginning of a national bank card association that allowed the use of BankAmericard (an early version of Visa) nationwide.

Master Charge (later renamed Mastercard in 1979) came into the scene in 1966. It came as cooperation between Northeastern banks that wanted to allow cards issued by each other.

Credit cards come to Australia 1970s

Prior to 1974, the only cards used in Australia were store-issued cards (cards that could be used in the issuing store exclusively),

while only the wealthy had access to a small number of American Express and Diners Club credit cards. However, the history of credit cards in Australia took a major turn in the 1970s.

Via the joint effort of Australian banks, the Bankcard was launched in 1974. By working in tandem with each other these banks developed a card network.

They then proceeded to implement the technology required to enable a nationwide search facility. These banks issued their own, branded, Bankcard and implemented their own customer relations and regulations.

The Bankcard was already a success by 1976. 1,054,000 people held Bankcards and the number of participating merchants was almost 49,000. In 1977 the first ATMs showed up in Australia, and Bankcards could be used nationwide by 1978.

Credit card trends happening after 2020

Almost 68% of Australian adults already had a credit card by the start of 2022. Moreover, the number of credit cards in circulation is around 13 million with AUD 18.5 billion worth of national debt accruing interest.

Credit card trends in Australia after 2020 look something like this:

1. No-interest credit cards

In 2020 these cards were launched where no interest is charged and a flat monthly fee is accrued upon the use of them or a balance is carried over.

These credit cards were introduced as an alternative option to BNPL (Buy now pay later) and combined features of both traditional credit cards and BNPL.

2. Virtual credit cards

With the rise in the use of mobile-based wallets, physical credit cards have given way to virtual ones.

While having a plastic card as well as a digital one is common, instant virtual and virtual-only options are also being offered by some card providers, these include the MONEYME Freestyle Virtual Card, PayPal Rewards Card, and more.

3. Introductory offers

0% interest and bonus point offers have long been popular. A more recent trend that has become popular is credit card perks alongside one-off cashback offers. Since 2021 the interest in cashback has developed as well.

The Cashback Credit Card was launched by American Express – the only major brand in Australia offering dedicated cashback rewards cards.

4. Credit card debt

Credit card debt has somewhat followed a trend going downward since 2020. An analysis by Finder shows the average credit card balance to be AUD 2721 in January 2022, while in December 2019 it was AUD 3392.

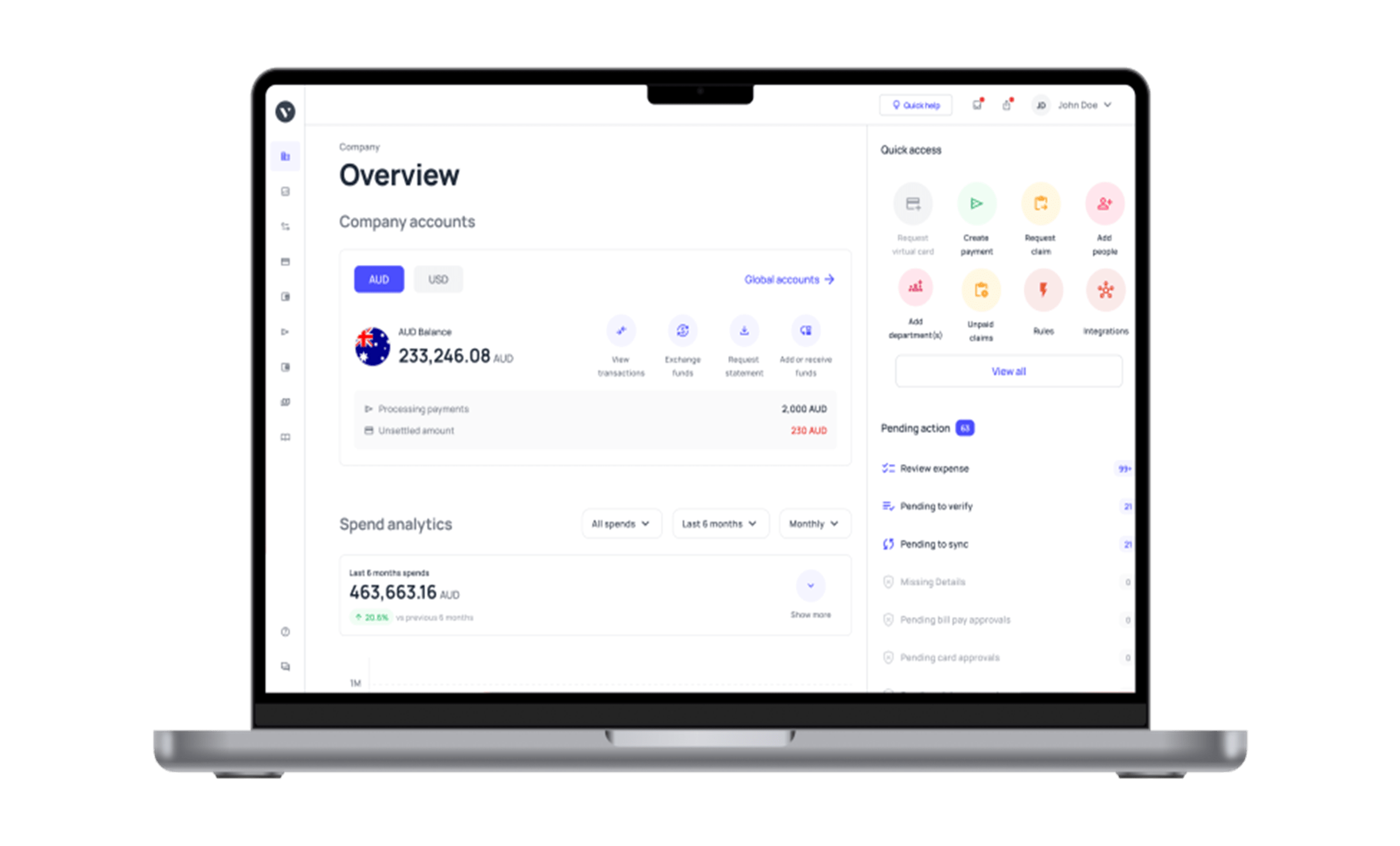

How is Volopay revolutionizing business expenses with corporate cards?

With the rise in the use of corporate credit cards, there has also been a surge in the number of credit card providers making the service available in the market.

Out of the many options that may be available one of the most exciting ones is provided by Volopay. Here’s why:

Physical and virtual cards

Volopay lets you issue both physical as well as virtual cards to your employees. The rise in digitization only means the importance of virtual cards will increase.

Customizations, ease-of-usage as well expense management tools that allow personalized control are all reasons why you should move to a corporate card that offers both physical as well as virtual options.

Issue unlimited corporate cards

What’s more is that Volopay lets you issue an unlimited number of virtual cards, completely free of charge. This can help you avoid the high costs that usually come with card issuing.

You can also use these virtual cards to manage subscriptions for all your teams, you can assign dedicated cards to each department and set automated controls on the cards that help take the burden of regular payment management off of your employees shoulders.

Real-time expense tracking

Last, but definitely not least, all payments you make via Volopay cards are tracked, reconciled, and integrated into your accounting software in real-time, making expense management faster and easier than ever before.

Flag unauthorized transactions, control payments, and set dedicated budgets for all major spending using Volopay corporate cards in Australia!