Card review - NAB business credit cards

National Australia Bank also known as NAB is one of the largest financial institutions in Australia. As the biggest card payments player in the Australian market.

NAB business credit cards offer various useful features and exciting benefits to business owners and are instrumental in streamlining business operations.

Overview of NAB business credit cards

NAB corporate cards and business credit cards offer various benefits, specifically catering to business owners from all industries and varying growth stages.

NAB business credit cards manage and monitor cash flow and maintain a clear distinction between personal and business expenses to ensure a smooth tax season for the business.

NAB corporate cards are essential in managing employee-driven spending by issuing cards with customizable spending limits and merchant blocking to keep track and avoid wasteful expenditure.

With transparent monthly statements for every cardholder, NAB enforces greater accountability and faster accounts payable reconciliation.

NAB business credit cards unlocks access to Visa commercial offers and premium business benefits. NAB business credit card rewards include travel and retail privileges, car rental services, luxury airport lounges access, and lots more.

Looking to get business credit cards in Australia? Here we review the features, benefits and compare NAB business credit cards with Volopay.

Comparing NAB business credit cards

1. NAB business credit card

NAB Business Card allows companies to manage their employee-related business expenses by empowering them with their own NAB corporate cards.

These cards are packed with powerful features to track and manage corporate spending on the go. Enforce greater control by consolidating multiple cards to one card program, setting up credit limits, and generating monthly statements.

NAB business credit card offers complimentary unauthorized transaction insurance and transit accident insurance, as well as access to discounted business services through Visa commercial offers.

NAB business card charges AUD 9 as a monthly fee per card and a 15.50% p.a. purchase interest and cash advance rate. NAB offers up to 35 interest-free days on business transactions with a minimum credit limit of AUD 5,000.

2. NAB purchasing and corporate card

Companies that process a high volume of monthly business purchases can benefit greatly from NAB purchasing and corporate cards.

NAB corporate cards offer a dedicated solo facility for card multiples with customizable spending limits and diligent expense reporting.

Enjoy complimentary authorized transaction insurance to protect the business against fraud and unverified purchases. NAB provides seamless procure-to-pay facilities and T&E expenses worldwide via the Visa network.

NAB charges a cash advance interest rate of 12.65% p.a. on their purchasing and corporate cards.

Suggested read: Westpac business credit cards review

3. NAB low rate business card

Winner of the 2021 money magazine best value business credit card - major bank, NAB low rate business card helps businesses manage corporate spending at competitive rates.

With these NAB business credit cards, customers can make contactless payments through their smartphones and wearable devices.

NAB low-rate business cards also offer complimentary unauthorized transaction Insurance and travel accident insurance along with exclusive access to top-notch services through Visa commercial offers.

NAB low rate business card charges an AUD 60 fee per card and a 13.25% p.a. purchase interest and cash advance rate. Customers can enjoy up to 55 days of interest-free days on all their business payments with a minimum credit card limit of AUD 5,000.

4. NAB rewards business signature card

Enjoy great rewards on business purchases through NAB rewards business signature card. Comparing NAB business credit cards rewards, this card offers significantly higher reward points than other cards.

Earn 1.25 NAB reward points for every AUD 1 spent on regular business purchases, 2.5 points for each dollar spent in leading departments and hardware stores, and a whopping 3.75 points per AUD 1 while traveling overseas.

Users can earn points on payments made to the Australian taxation office, just like regular business transactions.

Customers get access to complimentary NAB corporate cards, unauthorized transaction insurance, and transit accidental insurance to safeguard companies against fraudulent activities.

Business owners using NAB rewards business signature cards can access 24/7 global concierge travel and lifestyle services and various business offerings via Visa commercial offers.

NAB rewards business signature card charges AUD 175 monthly fee per card and an 18.50% p.a. purchase interest rate and 21.74% p.a. cash advance rate.

NAB offers up to 44 interest-free days on business transactions with a minimum credit limit of AUD 5,000.

5. NAB Qantas business signature card

This is one of the best NAB business credit cards that allow businesses to make the most out of their NAB corporate cards. NAB Qantas business signature cards offer the chance to earn Qantas points without sacrificing premium features.

Enjoy a dedicated corporate card facility with customizable credit limits for each cardholder.

Get complimentary unauthorized transaction insurance and transit accidental insurance to protect companies against fraud and travel-related incidents.

Unlock premium round-the-clock concierge service for travel and lifestyle recommendations worldwide. Earn 1 Qantas Point for every AUD 1.50 spent on daily business payments, including transactions made to the Australian taxation office.

Enjoy a free Qantas frequent flyer membership worth AUD 99.50. Redeem your Qantas points to earn great NAB business credit card rewards through vouchers, flight bookings, rebates, and more.

NAB Qantas business signature card charges an AUD 295 monthly fee per card and an 18.50% p.a. purchase interest rate and 21.74% p.a. cash advance rate.

NAB offers up to 44 interest-free days on business transactions with a minimum credit limit of AUD 5,000.

Interesting read: Card review - Commonwealth bank business credit cards

Manage your business payments efficiently with Volopay

NAB corporate cards are a good option; however, it levies a heavy charge on annual fees, interest rates, and more.

If you are looking for a cost-effective corporate card program that simplifies corporate expenses and scales with your company size, then Volopay is the ideal fit.

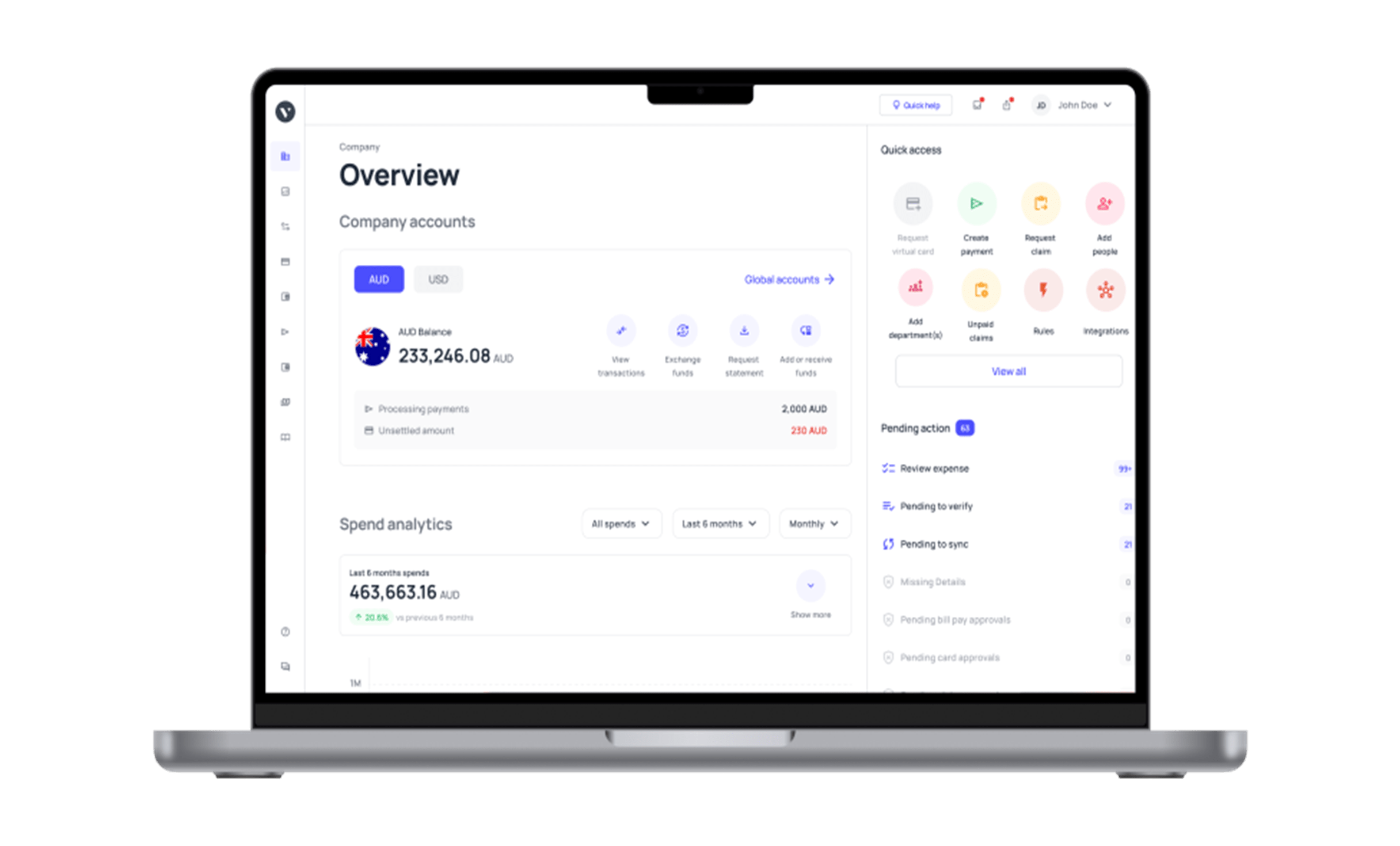

Volopay is a hassle-free spend management software that combines the ease of tracking and reporting expenses with their comprehensive physical and virtual corporate cards.

Businesses can allot physical cards to facilitate seamless corporate travel domestically and overseas with enhanced controls that enable or disable ATM withdrawals, POS (Point of sale) system transactions, and more.

Volopay virtual cards help companies manage multiple SaaS subscriptions effortlessly. With our VISA-powered virtual cards, employees can make recurring and one-time payments.

Thus avoid sharing sensitive information about their business bank accounts. Issue unlimited cards to streamline employee corporate expenses at no additional cost. Make the best choice for your business and choose Vollopay today.

FAQs

Business credit cards offer numerous advantages to Australian businesses by clearly distinguishing between personal and business transactions and simplifying accounting and bookkeeping processes. It also helps businesses maintain a healthy cash flow, easily access funds, and build a good business credit score.

While it is not illegal to use a business credit card for personal use, we strongly advise against it since it can lead to more complications for companies and employees. Employees who fail to pay off their personal use credit on the business credit card can face termination, legal actions, or both.

Yes, businesses can get a business credit card as long as they can show an earnest intention to generate revenue at some point in the future.

Yes, to apply for a business credit card, the applicant must have a valid Australian Business Number (ABN) and also be registered for GST.

Having a corporate credit card program for your business is essential in building your business credit score. When companies pay off their dues in full and on time, it builds their overall creditworthiness in the market and opens doors to lucrative financing opportunities.