Comparing Commonwealth Bank business credit cards

Known as one of the “big four” financial institutions in Australia, Commonwealth Bank has well-established itself in the country since its inception in 1911. As the largest retail bank in Australia, the Commonwealth Bank has diversified its products and services, especially in the credit card payments category.

Commonwealth Bank business credit cards offers a wide variety of features and perks, specifically in the corporate sector, to startups, SMEs, and MNCs

Looking to get business credit cards in Australia? Here we review the features, benefits and compare Commonwealth corporate cards.

Overview of Commonwealth Bank business credit cards

Having a business credit card can help businesses streamline business operations and boost cash flow efficiency easily and cost-effectively. With CommBank business credit cards, employees can keep separate their personal and corporate expenses, thereby introducing a new level of accountability and transparency in business purchases.

Commonwealth Bank offers a variety of business credit cards that offer interest-free days, high credit limits, lower interest rates, and more. Commonwealth Bank credit card offers insurance against travel accidents and fraudulent transactions.

CommBank business credit cards offer great rewards through their CommBank Rewards program and are accepted by over 32 million merchants and vendors worldwide.

Comparing different types of Commonwealth Bank business credit cards

1. CommBank Neo Business Card

As one of the most hassle-free CommBank business credit cards, CommBank Neo Business offers a host of pragmatic benefits to the user. The monthly fee on this card depends on the credit limit set by the user.

You can pay AUD 12 for a AUD 1000 limit, AUD 18 for a AUD 2000 limit, and AUD 22 for a AUD 3000 limit. In months wherein you do not use the card for any expenses and pay your total balance owing in full, you don’t have to pay any monthly fee!

On top of this, the CommBank credit card gives you free additional cardholders at no cost and a 0% p.a. Purchase interest and cash advance rate. Set up a spending cap to keep track of all your business expenses and automatically sync your expense reports with Xero or MYOB. CommBank Neo Business does not permit cash advances and balance transfers.

CommBank also offers personalized CommBank Rewards based on your previous shopping experiences and curates cashback and rebates at similar shopping places.

2. CommBank Low Rate Credit Card

CommBank Low Rate Credit card charges some of the lowest interest rates and other fees without any annual fees at all. That’s right! This Commonwealth Bank credit card helps businesses simplify their administrative and accounting processes at AUD 0 annual fees and additional cardholder fees.

On top of that, CommBank's Low Rate Credit card offers Travel Accident Insurance and Unauthorized Transaction Insurance along with 24/7 international assistance. Users can instantly lock all international payments, and ATM cash withdrawals and set spending limits to safeguard their money against unauthorized expenditure.

With a minimum credit limit of AUD 500, these CommBank business credit cards charge a 14.55% p.a purchase interest rate and cash advance rate and a 5.99% p.a balance transfer rate for the first five months. This Commonwealth Bank credit card offers CommBank rewards customized to your shopping experience and generates similar rewards that you can readily redeem.

3. CommBank Awards Credit Card

If you want to maximize the reward quotient on your business purchases, this Commonwealth Bank credit card is ideal for you. Apart from maintaining a healthy cash flow for smoother business operations, the CommBank Awards Credit card offers 1 Awards point or 0.4 Qantas points for every AUD 1 you spend.

CommBank business credit cards consolidate and simplify your diverse business expenses and help you earn amazing rewards and exclusive access to rich entertainment and privileges through their Commbank Awards program.

Get 24/7 assistance overseas along with transit accidental insurance and unauthorized transaction insurance.

CommBank corporate cards comparison to others, charge a purchase interest rate of 20.74% p.a and a cash advance rate of 21.74% p.a. Pay a pocket-friendly rate of 5.99% p.a. On balance transfers up to the first five months. With a minimum credit limit of AUD 500, users get up to 55 interest-free days for an annual fee of AUD 100.

4. CommBank Interest-free Days Credit Card

Flexible business leaders who desire lower interest rates, more interest-free days, and a better cash flow can greatly benefit from the CommBank Interest-Free Days Credit Card. CommBank eases expense consolidation while providing enhanced control over the spending limit.

With this Commonwealth Bank credit card, you get transit accidental insurance and unauthorized transaction insurance to protect yourself against fraud and travel-related obstacles. These CommBank business credit cards offer a low purchase interest and cash advance rate of 17.57% p.a with a whopping 55 days interest-free period to make cash more accessible.

A low balance transfer rate of 5.99% and annual fees of AUD 60 only is levied on the cardholder.

With a minimum credit limit of AUD 500, unlock maximum rewards with the CommBank Rewards program that modifies its point structure based on your shopping experience to offer discounts and shopping rewards you will love to spend!

5. CommBank Corporate Credit Card

CommBank corporate cards comparison works favorably as opposed to leading corporate credit card facilitators. It is an ideal card program for large companies that deal with a lot of travel, procure-to-pay processes, and other vital business operations. This Commonwealth Bank credit card comes with customizable control for each unique cardholder, making it easier to restrict spending and transaction limits. Users can significantly eliminate tedious reporting processes with the fast, automated reporting feature.

The auto-debit feature to settle outstanding balances allows companies to maintain a healthy amount of credit without paying high-interest fees. On top of that, companies receive complimentary travel accidental insurance of AUD 250,000 for cardholders and unauthorized transaction insurance of up to AUD 150,000 annually.

The annual fee for the CommBank corporate credit cards is tiered: AUD 40 per card for the first 50 cards, AUD 32 for each additional card till 500, and AUD 24 per card above 500+ cards issued. There is also an establishment fee of AUD 300, payable when the company starts its corporate cards program and when banks approve the request for an increase in credit limit.

Manage your business payments with Volopay

A thorough Commonwealth Bank business credit cards review reveals certain disadvantages as well. With the higher interest rates and lower credit limits, companies can feel restrictions in terms of flexibility and purchasing power. That’s where Volopay comes in.

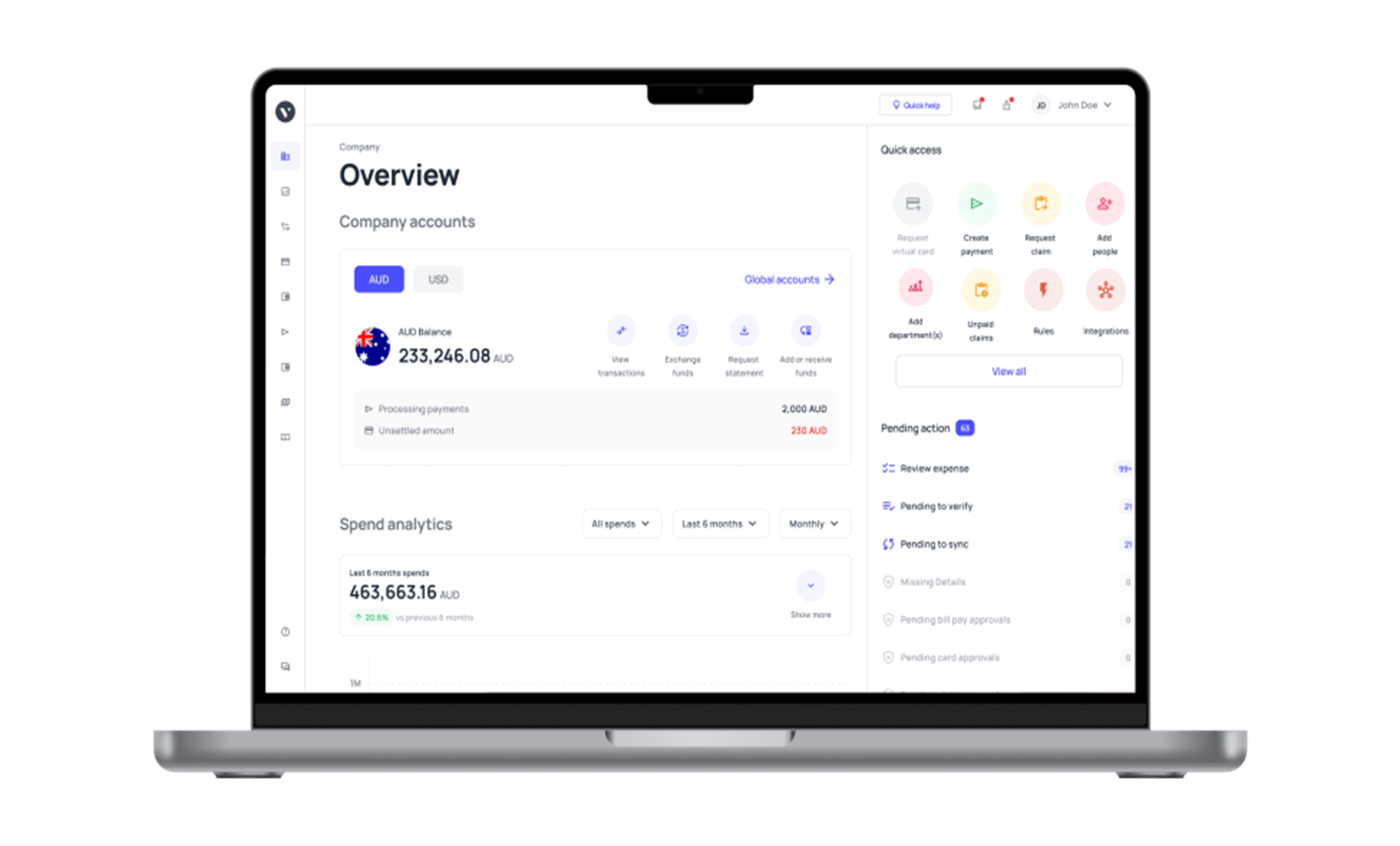

Volopay is a purpose-built expense management software that provides a comprehensive corporate card program.

Consolidate all travel and accounts payable management and enforce greater control over employee spending from a single platform.

Our corporate cards come equipped with credit to allow for rapid scalability and faster growth for businesses. Volopay offer physical and virtual cards to manage company spending across department and functions.

Physical cards can be used by employees while traveling, paying at POS systems, and much more. Virtual cards empower employees with the ability to manage their subscriptions and one-time payments without disclosing sensitive bank account details.

All our cards are VISA-powered and come with advanced security features such as 3DS security and 2 factor authentication. Enforce company-wide control over all your cards with customizable spending limits, expense approval workflows, instant blocking/freezing options, and much more. Experience the best-in-class corporate card program with in-built expense management and reporting – with Volopay.