Key benefits of cloud-based invoice approval

The invoice processing and approval aspect of any accounts payable system are infamous for being hard to manage. Teams often have to go through a lot of back and forth with stakeholders before an invoice can be approved.

At any step of the process, people are responsible for tracking documents down, manually entering data, and obtaining payment approvals, whether over long email threads or in person.

This process becomes even more daunting when exceptions start to arise in the invoices. However, modern technology has an answer for this conundrum - cloud-based invoice approval.

The benefits of cloud-based invoice approval far outweigh the issues that arise with manual invoice approval processes.

The challenges of manual accounts payable processes

1. Lost invoices and delayed invoicing

Growing companies often have to deal with a large, growing number of invoices every day. Consequently, as the number of invoices you deal with grows so will the number of invoice processing and approval issues.

Due to the manual management of accounts payable the risk of human error is high and as a result of an increasing number of invoices this risk becomes even higher.

Paper-based invoices may get misplaced or erroneously recorded, duplicate invoices may go unnoticed and as a result of these cases invoicing altogether can end up getting delayed.

2. Manual follow-ups

Traditional invoice approval processes are highly dependent on follow-ups. Teams often have to go back and forth between a variety of stakeholders and approvers before they can actually get an invoice approved.

This issue can become even more pressing when exception invoices with irregular information come in. Employees have to manually vet such invoices and make sure the approval is granted only once the issues have been resolved.

This whole process is not only time-consuming but can also draw resources away from actual value-generating tasks.

3. Manual reconciliation

Expense reconciliation is the process by which accounts payable departments ensure that general ledger entries are matching with the actual expense made.

Using supporting documents such as receipts and invoices financial controllers of your company will be able to confirm that a recorded expense was actually incurred.

Doing this manually involves a painstaking process of physically checking documents and verifying them against general ledger entries.

This process can take a lot of time and manual effort to complete, not to mention the process is also highly susceptible to human errors and discrepancies.

4. Delayed payments

Before a payment can be made the invoice associated with it must undergo a series of checks and steps. Traditionally, this involves a strenuous process involving multiple steps where invoices are received, processed, and approved for payment.

Not only is this process long and labor intensive, but given the number of manual steps involved, a number of things can go wrong along the way. This will obviously lead to delays in payment that have to be mitigated.

Payment delays not only slow down your process but can negatively impact your cash flow, and vendor relationships and create frustration.

5. Data errors

Manual accounts payable management means your entire process will involve a lot in terms of human effort and intervention. You will need people to receive invoices, process them and get them approved and ready for payment.

Now, the undoubtable obvious fact here is that humans make mistakes and, therefore, there will be errors in your accounts payable process if you manage it manually.

Data entry and expense recording errors are amongst the most common forms of error in the accounts payable process and it becomes even more pressing if you’re managing accounts payable manually.

Benefits of cloud-based invoice approval for businesses

1. Data integrity

Data is critical to the functioning of your company, whether it's for current needs or for evaluating past performance. With paper-based or manual systems it’s likely that you’re dealing with data via piles of documents or excel sheets.

As we know, this is definitely not the most efficient way of ensuring data integrity. Not only is it hard to locate and collate information this way but there is also always the possibility of information getting lost or corrupted.

On the other hand, one of the many benefits of cloud-based invoice approval is data integrity. With cloud-based invoice approval, you can store all your data safely in a cloud and keep it protected forever.

Not only is data integrity maintained this way but by storing data on the cloud you can access them whenever and wherever you want.

2. Automated payments

Manually processing invoices and making required payments typically take a lot of time and labor. Your teams have to physically receive invoices, get approvals and go through a host of other steps before they can make the actual payment.

This process is not just long and time-consuming but it can get even more delayed when there are cases of exception invoices. Cloud-based invoice approval, however, can cut down this resource-heavy process significantly.

In fact, it can automate your entire payment system. With cloud-based invoice approval, you can automate the entire invoice processing system, right from when the invoice is received to when the actual payment is made.

3. Compliance and reconciliation

Ensuring complete compliance and accurate reconciliation with a manual, paper-based system is easier said than done.

There are far too many obstacles in the form of human error, missing documents, duplicate invoices, and so on that inhibit the reconciliation process.

Amongst the benefits of cloud-based invoice approval is also the fact that it can automate reconciliation and therefore make compliance easier.

Your teams no longer need to go through each and every invoice and match them with supporting documents. With automation, this entire process can be taken care of by the software.

Additionally, reconciliation software does not make errors which in turn ensures that your books are always compliance-check ready.

4. Invoice matching

Invoice matching is the process by which invoices are compared with supporting documents (e.g. Purchase Orders) to ensure that information is correct before payment is made.

Doing this manually means your accounts payable teams will have to go through each and every invoice received and compare them physically with supporting documents.

Obviously, this process can take time and there’s always the possibility of individuals making errors. Instead, if you use cloud-based invoice approval software you can automate this entire process.

On this software, invoices are automatically matched against POs and other supporting documents as soon as they are received, without you having to lift a single finger.

5. Maker-checker workflows

Inefficient workflows can have a severe impact on company productivity. They can slow down your approvals process and create unnecessary friction between departments responsible for approvals.

The good news here is that cloud-based invoice approval software come with its own, highly customizable maker-checker workflows that are automatically implemented.

All you have to do is set up the workflow and customize it to the needs and requirements of your organization, the rest is taken care of by the system itself.

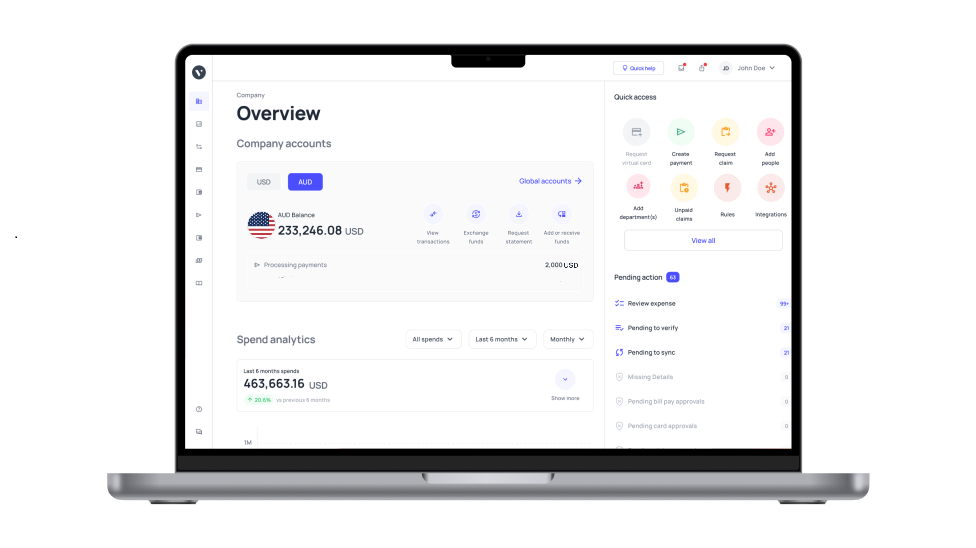

Customize and automate your invoice approvals with Volopay

Volopay is essentially an expense management system that comes with several cloud-based, automation capabilities. Amongst these capabilities, Volopay’s invoice processing and approval features are right up there with the best.

With Volopay you get access to a system that can automate your entire accounts payable process, from the point of receiving an invoice to the point where payment is made.

The system is equipped with AI and ML capabilities that can automate the invoice approval process and even learn the specifics of how you process invoices for your company.

There is no need for manual intervention in the process whatsoever - the system will receive invoices, review and extract data, get approval, record information and make the payment all on its own.

Additionally, you can set up highly customizable maker-checker workflows for the approvals process on Volopay. All you need to do is set up different levels of approvers and the system will automatically reach out to them and obtain approvals.

To sum it all up, Volopay is the ideal solution for not only the invoice approvals process but for automating your entire accounts payable system.