Benefits of automated invoice processing for businesses

The manual process of matching receipts to good delivery invoices (GDR) and purchase orders (PO) is a hectic and complex task. It becomes more complicated in the case of matching receipts to PO at the initial level.

Automated invoice processing with digital accounts payable (AP) automation software streamlines and controls the receipt balancing process in a fully automatic system. This touchless step significantly reduces the complexity of manual work.

Modern automated invoice processing solutions are capable of handling even the most complicated invoice matching tasks, saving time and easing the burden on your accounts payable team.

What is automated invoice matching?

The matching of your buyer receipts against related documents like a purchase order or a goods receipt is made simpler with the automated accounts payable invoice matching. An automated invoice matching offers a completely touchless and efficient invoice processing system. The differences in business invoices lead to a hectic and tiring work of examining.

The manual access of invoices comes as a distress to the accountants. Additionally, they need to wait for the approval of all those bills. Automated invoice matching is a great comfort to the managers. This accounts payable solution finds out the discrepancies at the line level itself.

8 benefits of automated invoice processing

Time savings

In the absence of digitization, the manual invoice matching process includes Buyer printing invoices, Buyer invoice approval, Buyer writing checks, Buyer entering invoice data, Supplier sending an invoice, Buyer mails checking to the supplier, Buyer’s data reviewing, and Supplier invoice generation. Additionally, if any kind of discrepancy persists, the chances of conflicts between the purchaser and the seller prior to approval tend to rise. This traditional receipt matching process takes around 25 to 90 days per invoice – that’s when zero error exists in the cycle. By implementing an automated invoice approval workflow, the process is streamlined, significantly reducing processing time. The automated AP solution offers invoice approval within minutes, significantly improving supplier invoice processing. Human intervention is not necessary for this process.

Speed up the process

The manual method of managing and tracking invoices is a complicated task. The automated and standardized solution assists retailers in simplifying operations. It allows you to effectively manage the reconciliation, matching, and payment of supplier receipts and makes a simpler process for the accountants through digital receipts. Plus, the effort and time taken to handle, locate, and identify the value earned on bill-backs and rebates can be minimized. These steps aid in speeding up the invoice matching process.

Reduce data entry errors

An automated invoice matching solution is crucial as it eliminates the necessity of manual work. It also works for lowering the associated errors. The automated AP solution works on the basis of real-time data. In an attempt to match payment orders, invoices, and receipts, it bears on the seller's corporate policies. It is very beneficial in reducing data entry errors. With an automated solution, sellers can explain the stage at which the matching takes place – from a single invoice to handling multiple such invoices at a single time.

The automated system makes it easy to handle complex operations. It eliminates the existing complexities. The rebates and the earning of due bills are calculated automatically. Plus, it also automates the financial position identification. It reduces the existing complications during the calculations.

Easy to track and better visibility

Retailers require real-time, data-driven reporting to assist them to make perceptive conclusions without demanding to authenticate which orders have been assessed and which have not. This accelerated visibility provides retailers with a perfect illustration of their firm’s inside and outside cash flow.

With an automated solution, checks are processed hastily, adding effectiveness and efficacy and demoting man-made jobs. The automated Invoice Matching ensures the receipt procedure is on-target up-to-the-moment as it has the points of setups, involving any checks, bills, and off-invoice deductions. If any discrepancy exists, the automated solution tracks it easily and takes appropriate steps to resolve it effectively.

Reimbursement can be done instantly

The automatic receipt matching solution supports instant reimbursement. In a scenario where an employee bears out-of-pocket expenses or incurs expenses on behalf of the organization, they are reimbursed by the firm. Reimbursement is a kind of compensation paid by a business to its employee, buyer, or third party. Reimbursement of insurance expenses, business expenses, and extra payment of taxes can be taken as illustrations. However, reimbursement does not relate to taxation. Reimbursement can now be done in minutes with the assistance of an automatic receipt matching solution.

Management of multiple receipts

The manual task of managing receipts is a time-consuming process. It becomes tough for the accountants to go through the entire receipts one on one to match and find out the discrepancies. The automatic receipt matching solution makes it easy for the managers to check the receipts and invoices. This automated solution is capable of handling all kinds of complexities.

It can manage more than a single receipt at a time. It aids in the management of multiple receipts within a short duration of time. When the managers attempt to handle multiple receipts manually, the chance of discrepancies rises. These increased discrepancies further lead to conflicts between the buyers and the seller. Well, the automatic receipt matching system provides you the benefit of handling multiple receipts with great efficiency.

Expense reports

The maintenance of expense reports serves as an additional burden for the managers. With automatic receipt management solutions, managers of your organization are free from the extra workload of handling expense reports. This solution is truly a dream-come-true offer for the accountant. Gradually, businesses have shifted their entire focus towards the automatic process. The reason behind it is that manual work increases the possibility of errors. The automatic accounts payable solution provides efficient and error-free expense reports.

Efficiency improvement

In comparison to manual work done by accountants, the automatic receipt matching solution is found to be more effective and efficient. It reduces the chances of errors in the receipts and invoices which means a decrease in the discrepancies. The traditional process of matching receipts manually is now less preferred by organizations. Businesses prefer the automatic AP solution because of its dedicated efficiency.

How to automate receipt and invoice matching with Volopay?

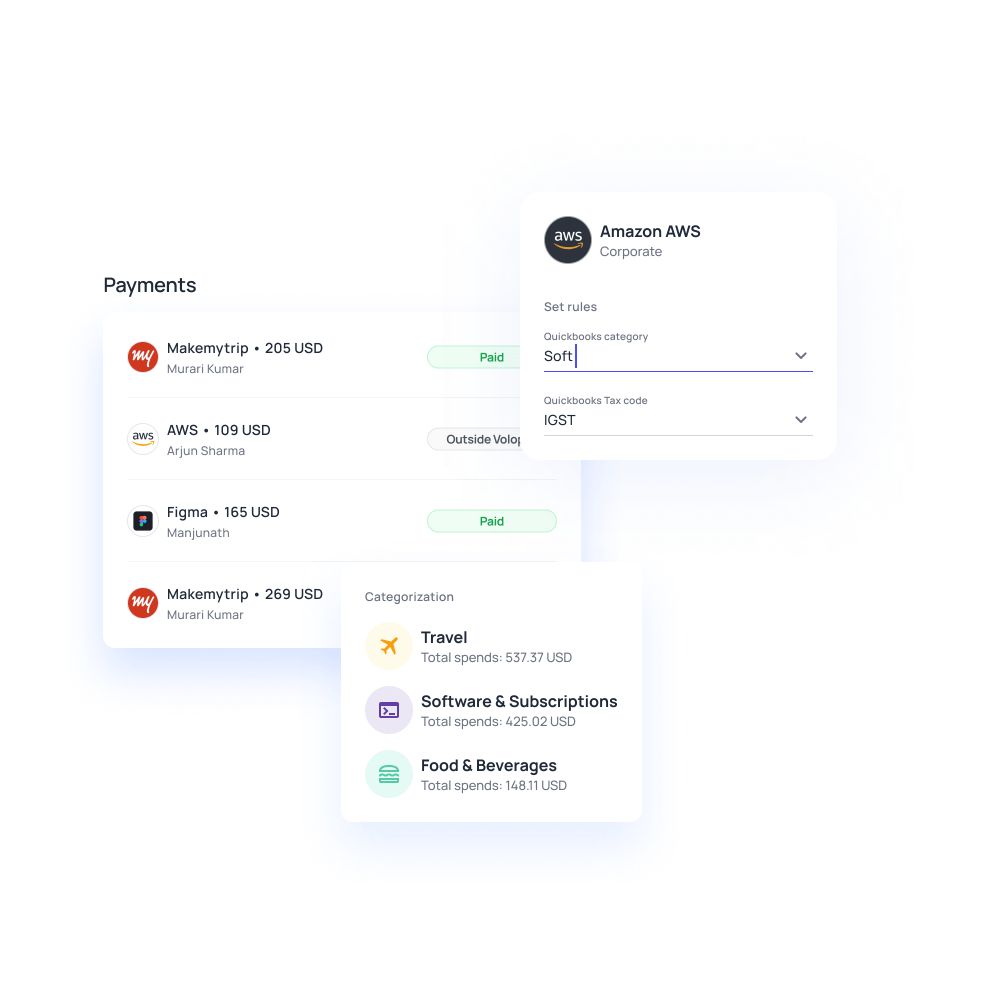

Now that you understand the importance of automated invoice and receipt matching, it’s time to choose a smart software solution to help you automate your business’s matching process. Volopay is an all-in-one spend management platform which can solve all your invoice and receipt matching problems. With our Magic Scan invoice processing, you can simply scan a receipt using our automated OCR technology and automatic receipt scanner. After a simple two-level approval step, receipts are auto-categorized, and ta-da the receipt gets accounted in the integrated accounted software.

Apart from this, we understand how difficult and cumbersome it is you manage all the offline invoices or the invoices that come through mail. Hence we have a feature using which invoices can be taken from all sources and be accounted for automatically. So no more unpaid bills or manual matching.

FAQs

The automatic receipt matching solution takes a few minutes to match depending on the type of your receipts or invoices. Once your receipt is successfully matched, you receive a confirmation notification via email or SMS.

You can manually submit your receipts. The accountants just need to click a picture of the receipts and upload them in the mentioned area given in the dashboard. It also assists you in uploading multiple receipts in the same process. You can also upload receipts or use OCR invoice processing to scan receipts via the app and then it becomes easier for the approval process by admin or manager.

If you are entitled to receive reimbursements under the reimbursement system, you are required to submit an expense summary with any required receipts to the businesses within 30 days after incurring the additional expense of the company. You receive the reimbursed amount within the next 21 working days after the submission of the required receipts.

Virtual card for payments is the same as that of credit card payment, where the AP team will use the virtual card details to process the payment on time. You can use virtual cards to pay monthly bills like subscription costs. Money gets withdrawn from the budget allocated to the particular card, and the transaction is recorded.

Trusted by finance teams at startups to enterprises.