Benefits of receipt tracking app for small businesses

Tracking expenses goes a long way towards predicting your future financial status and managing expenses wisely. The foremost step to approach it is starting receipt tracking. Receipt management is a place where even big companies struggle and do their utmost to not get carried away. But with the right accounting tools like receipt tracking apps or spending trackers, it’s achievable.

Only when you track your expenses in real-time, you can identify needless expenses and spend wisely on what you need. Regardless of the size and financial capabilities of your business, it is paramount that you invest time and resources in doing real-time expense management.

What is real-time expense tracking?

Expense tracking is not a monthly or yearly project. To reap the benefits entirely, it should be done in real-time. Real-time expense tracking means you get the data and insights of every money your business spends instantly. Your expenses list grows along with the business. But it doesn't mean that you will be nitpicking over every single detail and handling a humungous load of information.

Real-time tracking apps let you tap into your expense history and pull information associated with it. As the up-to-date data is with you, you can access it anytime, identify the payment source, check for fraudulent activities and save it for later. This data saves your head around the taxation time and audits too.

How does receipt tracking app work?

A receipt tracking app collects receipts automatically or manually, stores them, and keeps track of up-to-the-minute expenses of your business. They offer cloud-based storage solutions to store the records of your day-to-day business payments and grant safe access to a limited number of employees from your company to track those expenses through ocr technology.

A mobile application makes it even easier to upload receipts and access them anytime, anywhere. In short, the receipt tracking app gives you digital receipts, stores them eternally, and lets you access them whenever required.

Why does your business need a receipt tracking app?

In today's fast-paced business world, managing receipts can be overwhelming. Without a receipt tracking app, businesses often struggle with lost receipts, manual data entry errors, and disorganized expense reports.

These issues can lead to inaccurate financial records, compliance problems, and delays in reimbursement, causing significant headaches for business owners. A business receipt tracker solves these problems by offering a streamlined solution for capturing, organizing, and managing receipts.

It ensures that every expense is documented accurately, minimizing the risk of lost receipts and manual entry mistakes. By automating these processes, the receipt tracking app simplifies expense management and reduces administrative burden. This allows businesses to focus more on growth and strategic activities rather than getting bogged down by tedious paperwork.

With real-time tracking and efficient organization, a receipt tracking app for small business teams provides the clarity and control needed to maintain accurate financial records and ensure timely reimbursements.

Benefits of using receipt tracking app for small business

If you are still wondering whether receipt tracking apps are for you or not, read the benefits of this application below. These inputs are from successful small business owners who have used expense trackers for a while.

Reduces paper clutter

A receipt tracking app eliminates the need for physical storage of receipts, drastically reducing paper clutter. By digitizing receipts, you save valuable office space and minimize the risk of losing important documents.

This not only helps in keeping your workspace organized but also ensures that you can easily access and manage your receipts whenever needed. The transition to a digital system streamlines your expense management process and enhances overall efficiency.

Improves organization

A receipt tracking app, for small business especially, enhances organization by allowing you to easily categorize and tag receipts and expenses. With features designed for sorting and managing expenses, you can efficiently group receipts into relevant categories, making it simple to review and track them.

This improved organization helps maintain clear and accessible financial records, reducing the time spent searching for documents and enabling more effective expense management and financial oversight.

Simplifies expense reporting

Expense reporting becomes more straightforward and efficient with a business receipt tracker. You can quickly categorize and upload receipts, making it easier to generate accurate expense reports. The app automates data entry and reporting, eliminating the need to sift through piles of paper.

This streamlined process saves time, reduces errors, and allows for a more organized approach to managing business expenses, ensuring you have detailed and precise reports at your fingertips.

Provides real-time tracking

Real-time tracking is a key feature of a business receipt tracker, allowing you to monitor and manage expenses as they happen. This immediate visibility into your expenses provides better control over your budget and financial planning.

By keeping you updated with real-time data, the app helps you stay on top of your spending, make timely adjustments, and ensure that your financial management is always current and aligned with your business goals.

Increases accuracy

Automated data entry provided by a receipt tracking app significantly reduces the chances of human error. By minimizing discrepancies that often arise from manual entry, a business receipt tracker ensures your financial records are accurate and reliable.

This enhanced accuracy is crucial for maintaining precise expense records, avoiding costly mistakes, and ensuring compliance with financial regulations. With real-time tracking and automated features, you can confidently rely on the app for accurate expense management.

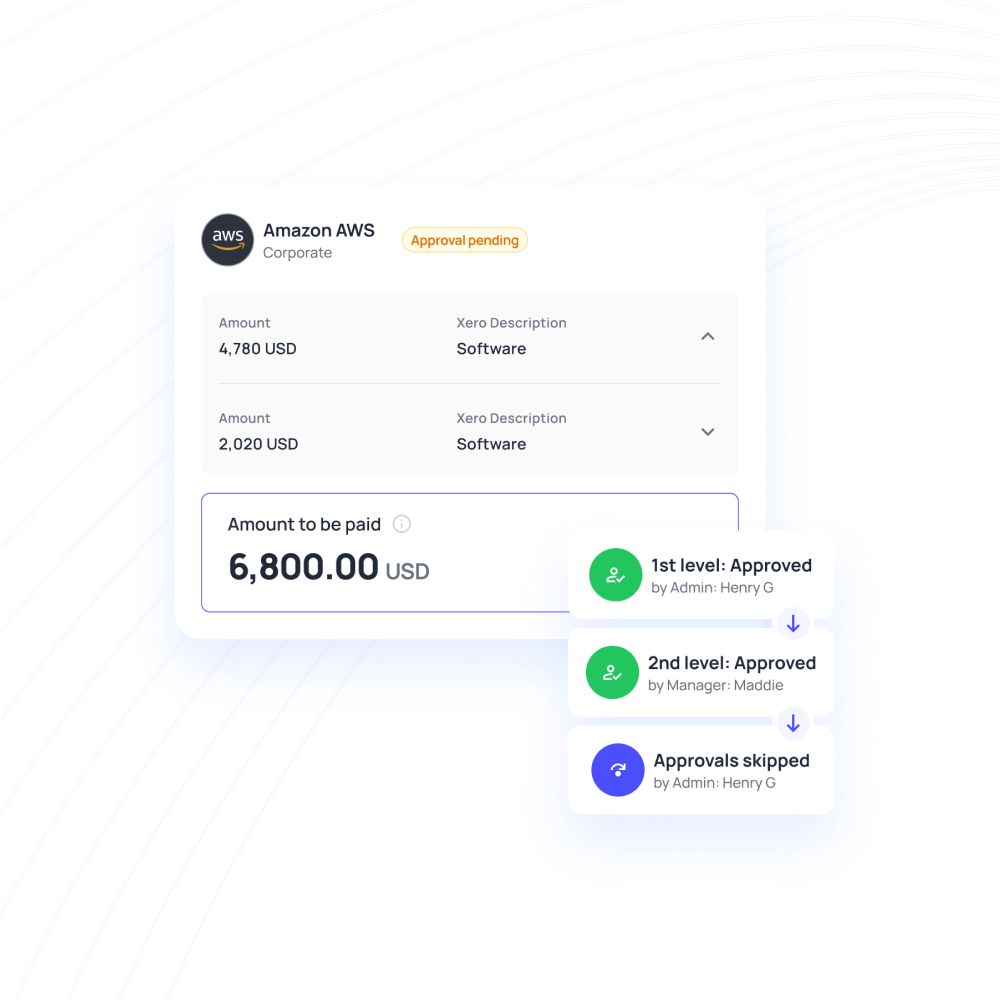

Supports policy compliance

A receipt tracking app helps ensure adherence to company expense policies by enforcing spending limits and guidelines. It provides tools to monitor and review expenses against predefined rules, reducing the risk of non-compliant spending.

This functionality promotes consistent expense management and helps maintain policy adherence, ensuring that all expenses align with company regulations and standards. By automating compliance checks, the app streamlines the expense approval process and reinforces organizational spending controls.

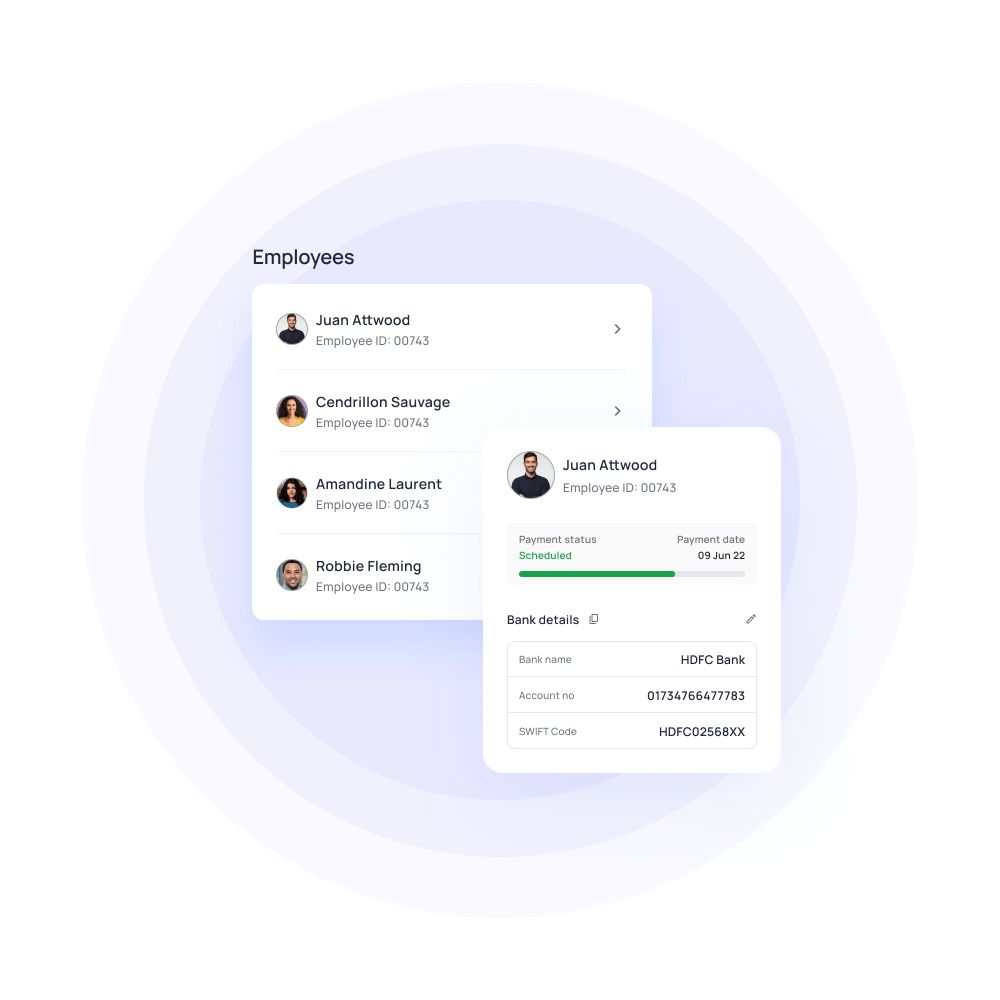

Speeds up reimbursement process

Receipt tracking apps significantly accelerate the reimbursement process by streamlining the submission workflow. Employees can swiftly upload their receipts and monitor their status in real time, leading to faster approvals and payments.

This efficiency reduces delays and administrative burden, ensuring that employees are reimbursed promptly. The app’s automated tracking and notification features keep everyone informed, enhancing the overall speed and reliability of the reimbursement process, which contributes to a smoother financial operation.

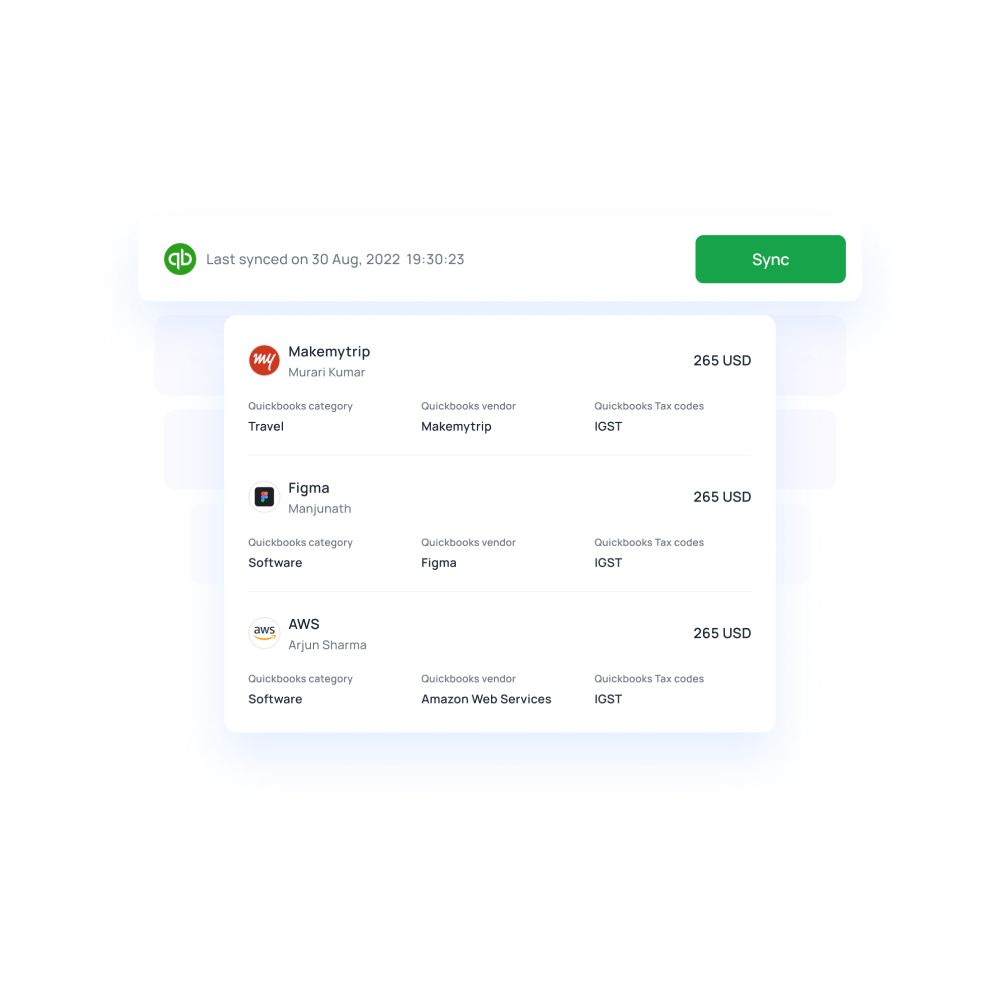

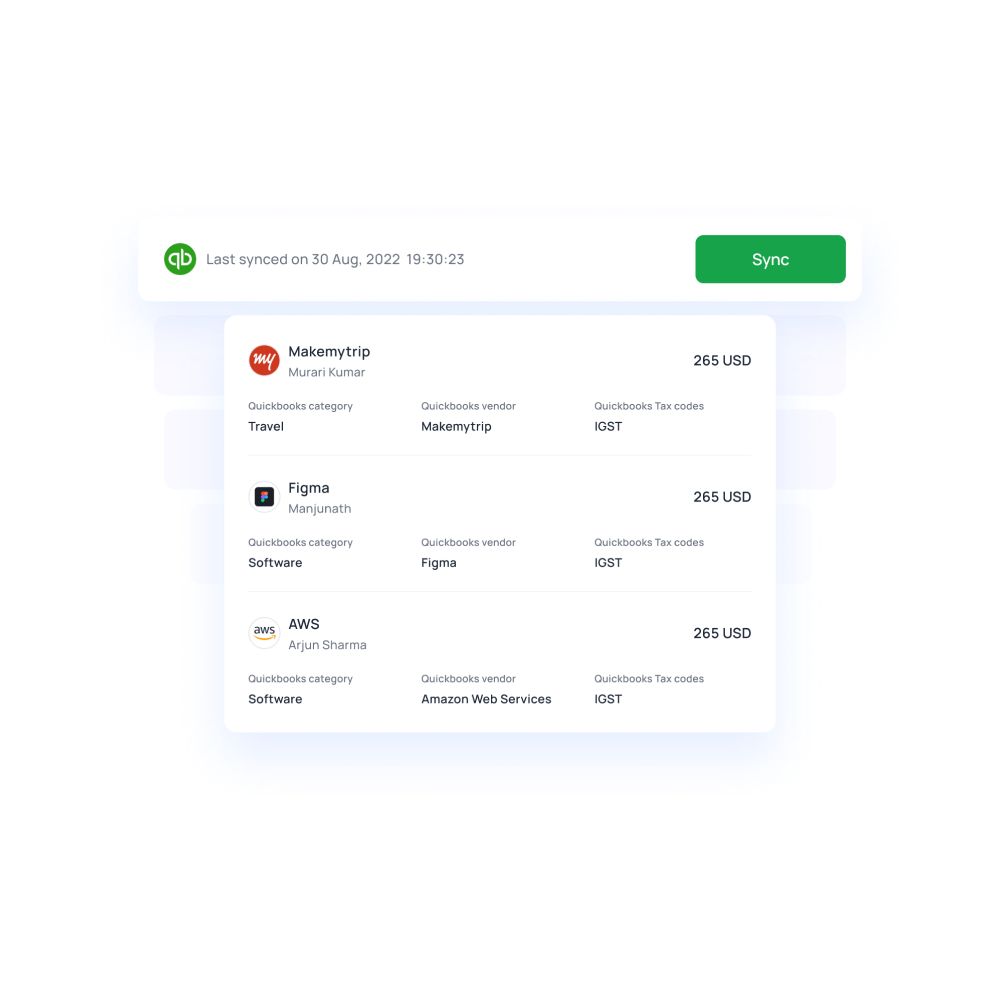

Integrates with accounting software

Receipt tracking apps often integrate seamlessly with accounting software, enabling automatic data synchronization. This integration simplifies financial management by ensuring that all expense data is accurately and promptly reflected in your accounting records.

It eliminates the need for manual data entry and reduces the risk of errors, keeping your financial information up-to-date. The integration also streamlines reporting and reconciliation processes, providing a cohesive view of your financial status and improving overall efficiency.

Privacy and security

You cannot let the receipts lie around as anyone can get hold of your private information or your clients’. This poses a serious threat and your clients wouldn't be pleased about it too.

Receipt tracking software offer secluded, cloud-based storage with limited access facilities and you don’t have to worry about losing them somewhere or data falling into wrong hands.

Simplifies tax & audit processes

Receipts act as the most accepted proof when it comes to taxation or audit. Your auditor can finish the work in no time when they have every receipt of your business expense.

You can either export and share the files with the auditing team or give them temporary access.

Track expenses with real time visibility from Volopay

How is real-time spend tracking helpful?

In this digital era, is your business catching up with the best and advanced mechanisms to stay on top of everything or stuck with outdated and time-consuming methods? You can determine your business agility by answering the above question. Inculcating spend visibility practices is the best way to start. Here is how expense tracking helps your business.

More control over employee expenses

You spend a considerable amount in reimbursing your employee’s business expenses. But if you have no proof for any of these expenses, you wouldn’t know where the money is exactly spent. What’s worse than this is when there are fraudulent entries by your employees.

Identifying and categorizing employee business travel expenses can be done efficiently when you have a real-time tracking system. This allows your employees to upload their receipts right away through a mobile app. This gets passed towards predefined levels of approvals and only if it passes through, they get their money back.

Insights into duplicate costs

Duplicate invoicing and costs are more prevalent when you process bills manually. This can easily pass off as original and cost your business double the amount of what you owe. When viewed through naked eyes, it can be hard to identify these duplicate payment sources.

However, modern payment systems come with the liberty to pick out duplicate receipts based on their invoice number or any matching information with the original invoice. As the dashboard gives you a more brief view of every processed payment, one can quickly spot duplicate costs and work on the cure.

Reduce fraud risks

Manual calculations cater to errors and misentries. Even a small number change can totally swap the intended entry with something else. And then there are external or internal deceptive activities that are difficult to identify through manual methods.

To avoid risking your hard-earned business money, a real-time expense management application should be there. Fraudulent behaviors account for financial loss as well as hamper trust.

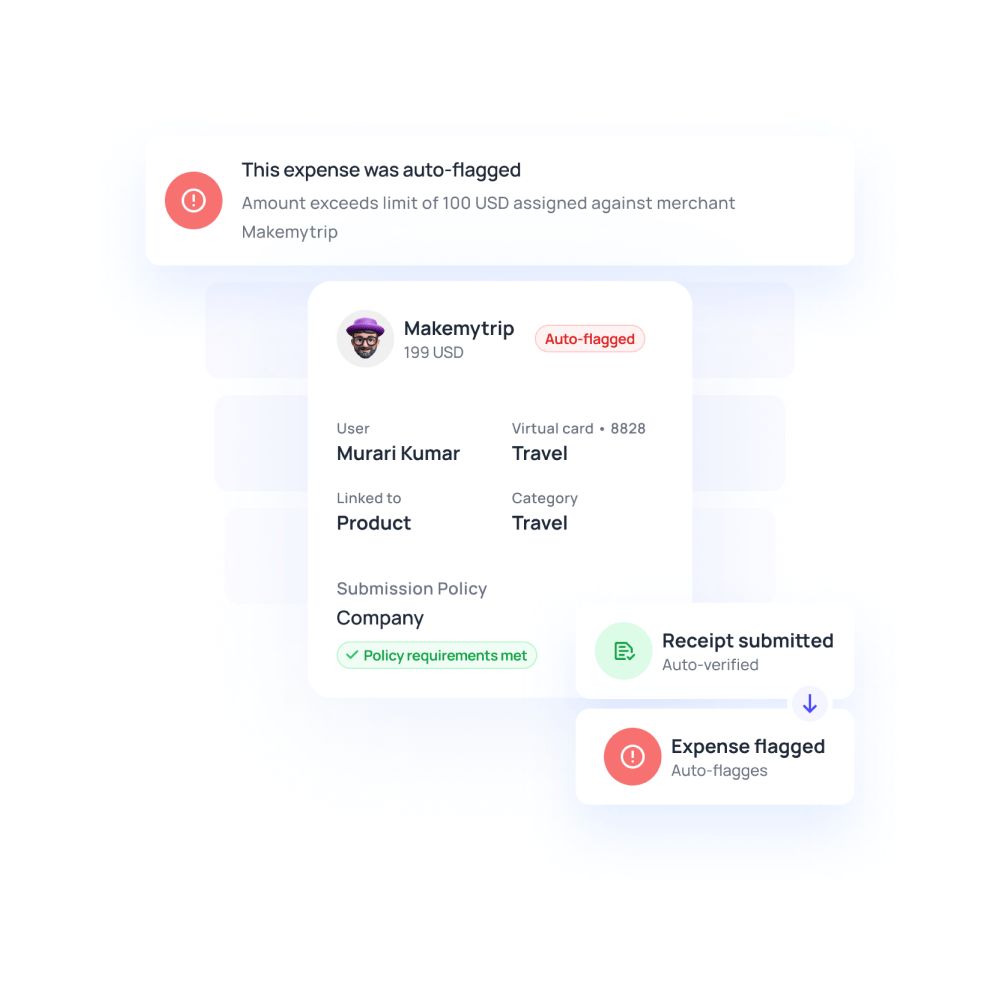

Check into any spend policy violations

Spend policies are a must if you wish to have a close watch over your financial standing. They regulate the debits that go out of our account, set limits on the amount set on each category, and administer travel policies. You are alerted when there is a violation of the spending policies you have established.

With just a few tabs, you can zero in on and find where the thrift has happened. Your expense tracking application makes sure that you adhere to the spending policies formulated based on your financial projections and goals.

Smarter decision making

Real-time expense tracking can also play a role in offering valuable financial insights based on your previous spending habits. Your finance team cannot make informed decisions when there is leaky, incorrect, and unrecorded data mass. An expense tracking application rectifies this and becomes their best friend by organizing the data and extending that with useful analytics.

As the expense ranges are usually dynamic based on various factors, your finance team will have to do hard math in figuring out future business spending. Feeding them with precise data can simplify their work and help them make accurate predictions and planning.

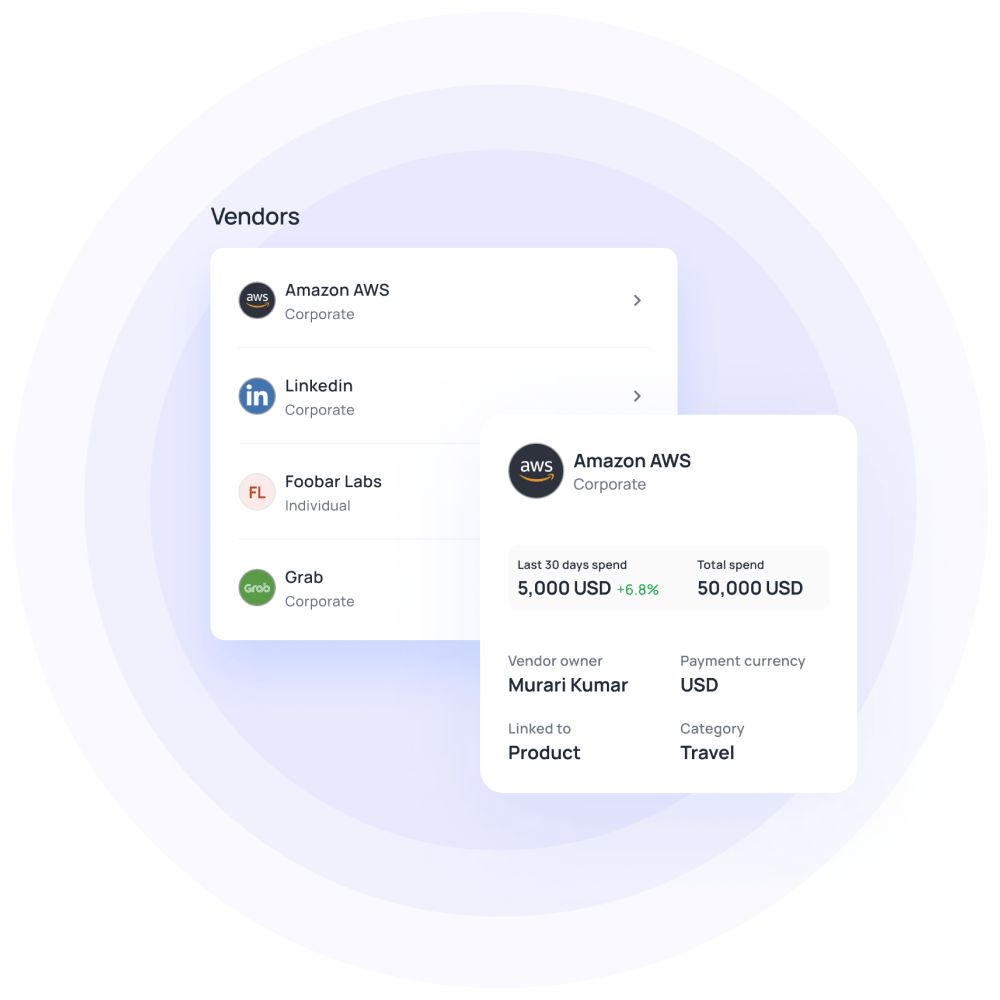

Better supplier evaluation

A substantial share of payments falls under supplier payments. When you have a clear visibility dashboard where you can observe supplier payment trends, you can ensure that they are paid on time.

Additionally, it favors you in identifying whether the initial terms between you and your supplier are still being met. Your relationship with suppliers is equally important to strict adherence to vendor agreements. The ability to look into it comes with umpteen possibilities like saving money, enjoying early payment privileges, etc.

Get real-time expense data with Volopay

From what has been outlined above, a real-time visibility platform should quicken your payment process, provide real-time insights and analytics, and digitize and safeguard your payment information.

Volopay’s finance management platform does more than that and takes control of your entire accounting and banking needs. You can pay your bills and invoices and store receipts for future reference. Furthermore, you can schedule payments in advance and do repetitive payments in an automated manner.

The dashboard shows real-time status and analytics visually for you to catch up on. These are handy when it comes to making budgeting decisions and predictions for the future. Speaking of budgets, Volopay grants budgeting liberties to the admin.

You can create budgets, assign funds respectively, and if you exceed limits, you are alarmed. This way, you can turn your theoretical budget plan into actionable inputs. If you are looking for convenient payment solutions that will smoothly transition your expense management to the digital world, Volopay is the right choice.

Streamlined expense tracking

Volopay provides a comprehensive solution for expense tracking, allowing you to effortlessly monitor and manage your expenses. Its intuitive interface enables real-time tracking of expenses, ensuring that your financial records are always accurate.

The app simplifies expense management by consolidating all your expense data into a single platform, helping you stay organized and informed. With Volopay, you gain greater control over your spending and can easily oversee your financial activities with minimal effort.

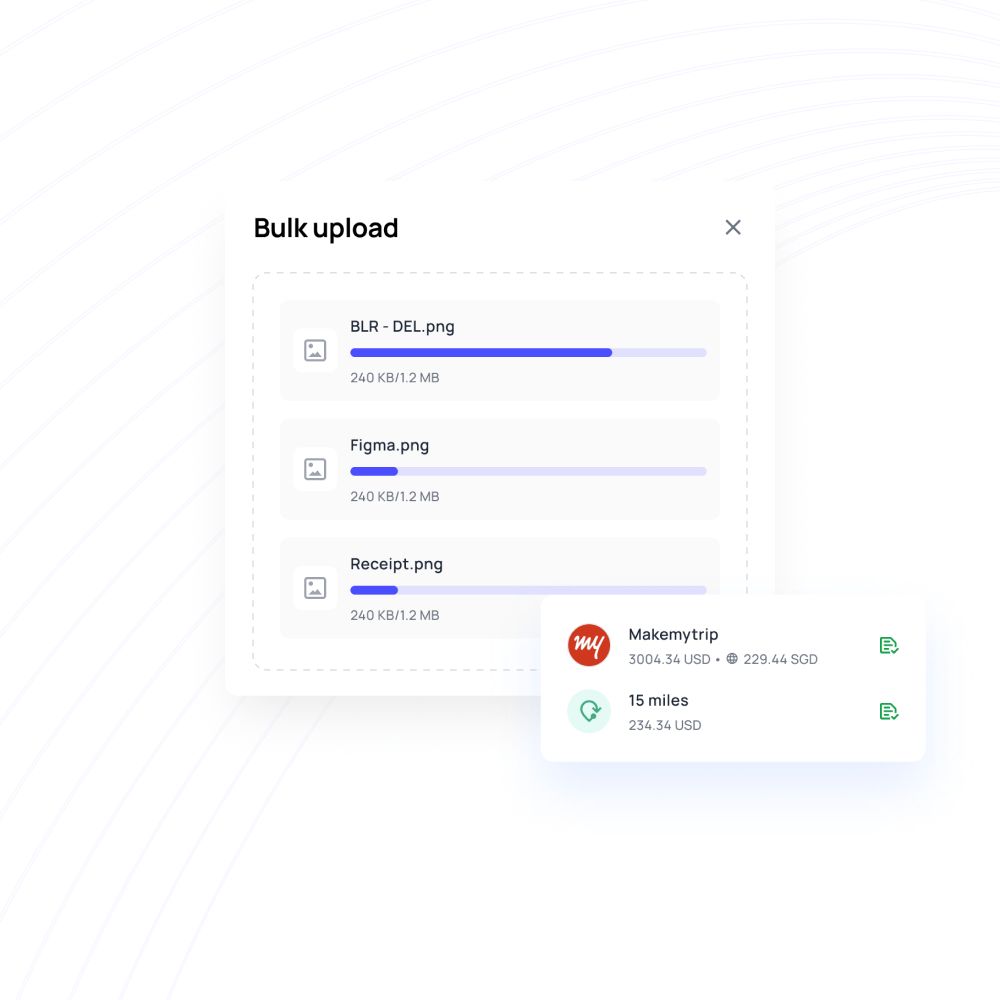

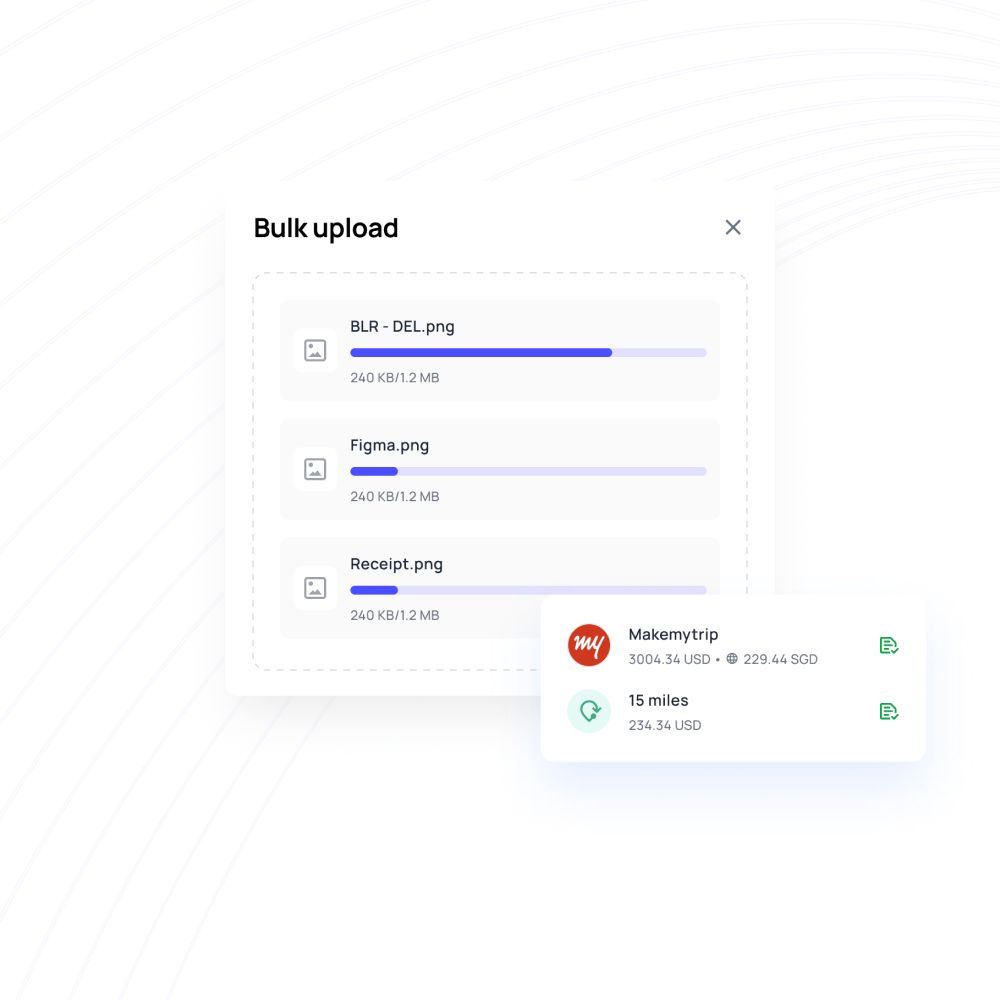

Automated receipt management

Volopay’s automated receipt management eliminates the need for manual data entry. The app captures and processes receipts, reducing administrative tasks and minimizing errors.

This automation streamlines your expense management by ensuring that receipts are accurately recorded and categorized without manual intervention.

By handling receipt management efficiently, Volopay allows you to focus more on strategic activities rather than tedious paperwork, improving overall productivity and accuracy in financial tracking.

Integration with accounting systems

Volopay seamlessly integrates with various accounting systems, ensuring automatic synchronization of expense data. This integration helps maintain consistent and accurate financial records by eliminating the need for manual data entry.

It simplifies the reconciliation process and keeps your accounting information up-to-date. By connecting with your accounting software, Volopay enhances financial management efficiency, providing a cohesive view of your expenses and ensuring that all financial data is accurately reflected across systems.

Customizable spending controls

Volopay offers customizable spending controls that allow you to set and manage spending limits according to your business needs. Tailor spending policies to align with your budgetary requirements and ensure that all expenses remain within approved limits.

This flexibility helps enforce financial discipline, control costs, and prevent overspending. By adjusting spending parameters to fit your organizational needs, you maintain better oversight and compliance with your budget, enhancing overall financial management.

Comprehensive reporting

Volopay’s comprehensive reporting features enable you to generate detailed expense reports and gain valuable insights. Analyze expense data, track spending trends, and identify patterns to make informed financial decisions.

The robust reporting tools provide clarity on your financial status, helping you assess performance and plan strategically. With detailed and customizable reports, you can better understand your expenses, manage budgets more effectively, and drive data-informed decisions to optimize your financial health.

FAQs

Automation reduces manual data entry, minimizes errors, and speeds up receipt processing. It enhances expense management by providing real-time updates and accurate financial records with minimal manual intervention.

A receipt tracking app streamlines reimbursement by allowing employees to quickly upload receipts and track their status. This leads to faster approvals and payments, reducing delays and administrative workload.

Receipt tracking apps use encryption, secure cloud storage, and access controls to protect sensitive financial data. These measures ensure that your information is safe from unauthorized access and potential breaches.

Integrations with accounting software enable automatic synchronization of expense data, reducing manual entry and errors. This ensures accurate and up-to-date financial records, streamlining bookkeeping and financial management processes.

Receipt tracking apps reduce errors and fraud by automating data entry, enforcing spending policies, and providing real-time tracking. This minimizes manual errors and helps detect and prevent fraudulent activities.

Yes, receipt tracking apps provide detailed expense data and trends that assist businesses in forecasting and budgeting. Accurate financial insights help plan future expenditures and manage budgets more effectively.

Receipt tracking apps facilitate compliance by maintaining organized, accurate records and providing easy access to documentation. This ensures that businesses can efficiently meet financial regulations and undergo audits with minimal hassle.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started free