Corporate card vs business credit card: A detailed comparison

In Australia’s evolving financial landscape, understanding the difference between a corporate vs business credit card is essential for modern enterprises. Both options provide streamlined alternatives to traditional payments like cash and checks, supporting the country’s move toward digital transactions.

Business and corporate credit cards help companies efficiently manage expenses, track spending, and maintain better control over cash flow. They also offer seamless integration with popular accounting platforms, making financial management easier.

Knowing the key distinctions between corporate vs business credit card options allows Australian businesses to choose the right card that fits their operational needs and supports sustainable growth.

Overview of credit cards for Australian businesses

Why shift from traditional payments?

Traditional payment methods like cash and checks involve manual processes that are time-consuming and prone to errors. Switching to a business or corporate credit card automates expense tracking and simplifies reconciliation, saving you valuable time.

This shift reduces administrative overhead and eliminates risks such as lost receipts or payment delays. By adopting modern payment tools, your business benefits from faster processing, better accuracy, and enhanced financial oversight compared to traditional options.

Defining business and corporate credit cards

Business and corporate credit cards are specialized financial tools designed to manage business expenses with advanced features tailored to different company sizes. A business credit card typically suits small to medium enterprises, providing basic spend controls and individual card management.

In contrast, a corporate credit card caters to larger organisations, offering multi-user access, detailed spend controls, and comprehensive reporting. Knowing the business credit card vs corporate credit card differences helps you pick a solution aligned with your company’s operational complexity and financial management needs.

Key benefits overview

Both business credit cards and corporate credit cards provide benefits that extend beyond basic payment functions. These cards often include rewards programs, such as cashback and points redeemable for travel or office supplies, which help reduce business costs.

Integration with accounting software like Xero, MYOB, or QuickBooks streamlines bookkeeping by automatically syncing transactions, improving accuracy, and saving time. Additionally, these cards enhance financial control through real-time expense tracking, spend limits, and detailed reporting features.

In the business credit card vs corporate credit card comparison, corporate cards usually offer more advanced tools for managing multiple users and departments. Both options help improve cash flow management and provide safer alternatives to cash, reducing the risk of fraud and misuse.

Distinction from personal credit cards

Business and corporate credit cards are purpose-built for company expenses, differing significantly from personal credit cards. They typically offer higher credit limits to support larger purchases and come with restrictions to prevent personal spending.

Unlike personal cards, they include tools for multi-user access, spend monitoring, and compliance with tax regulations. Understanding the business credit card vs corporate credit card distinction ensures you maintain a clear separation between personal and business finances, essential for accounting accuracy and legal compliance.

Alignment with Australia’s digital payment trends

Australia is rapidly embracing digital payments, and both business and corporate credit cards reflect this shift. Features like virtual cards, contactless payments, and mobile wallet compatibility support seamless, secure transactions.

The business credit card vs corporate credit card decision plays a role in choosing tools that fit your business’s digital strategy. Both card types facilitate integration with cloud accounting software and offer automated expense management, helping your business stay competitive and aligned with Australia’s evolving payment ecosystem.

Regulatory context

Australian financial regulations require transparent and accurate business expense reporting, making the use of business and corporate credit cards increasingly important. These cards provide itemised transaction records, GST-compliant invoices, and seamless integration with accounting software to meet tax obligations.

In the business credit card vs corporate credit card comparison, corporate cards often come with enhanced compliance features suitable for larger firms handling complex reporting requirements, ensuring your business meets legal standards with minimal effort.

Understanding business credit cards in Australia

Essential features

Business credit cards come equipped with features tailored to business needs. These include higher credit limits than personal cards, expense tracking, and integration with accounting software like Xero and MYOB.

Many cards offer rewards such as cashback, travel points, and discounts on business services. Spend controls and multiple cardholder options make it easier to manage employee expenses while maintaining oversight. These features simplify bookkeeping and enhance cash flow management.

Eligible applicants

In Australia, eligibility for a corporate vs business credit card varies based on your company’s size and financial profile. Business credit cards are typically available to sole traders, partnerships, and small to medium-sized enterprises (SMEs) with established credit histories.

Lenders assess your business’s financial stability, turnover, and creditworthiness before approval. Startups with a solid business plan and personal guarantees may also qualify.

Understanding these eligibility criteria helps you decide if a business credit card suits your company or if a corporate credit card is better for larger operations.

Common use cases

Business credit cards are versatile tools used for everyday business expenses such as office supplies, travel, client entertainment, and utility payments. They help separate business costs from personal spending, simplifying tax reporting and budgeting.

Many businesses also use these cards to manage cash flow by taking advantage of interest-free periods and rewards programs. Compared to a corporate credit card, business cards generally serve smaller-scale expense management needs.

Personal use restrictions

Business credit cards in Australia usually restrict personal spending, ensuring the card is used solely for legitimate business expenses. This separation is critical for tax purposes and accounting accuracy.

Cardholders are expected to maintain clear records and avoid mixing personal and business transactions. Banks may monitor usage to enforce these restrictions, helping you stay compliant with Australian taxation rules.

Interest rate insights

Interest rates on business credit cards vary depending on the provider and your business’s creditworthiness. Generally, rates are competitive but may be higher than corporate credit cards designed for larger firms with stronger financial backing.

Many business credit cards offer interest-free periods on purchases, allowing you to manage short-term cash flow without incurring additional costs. Understanding these rates helps you select a card that balances cost with flexibility.

Tax and BAS benefits

Using a business credit card simplifies tax reporting and Business Activity Statement (BAS) preparation. Detailed transaction records and automatic integration with accounting platforms make tracking GST claims easier and more accurate.

This feature reduces errors and audit risks, ensuring your business stays compliant with the Australian Taxation Office (ATO) requirements. The business credit card vs corporate credit card decision often hinges on how each card supports these tax benefits.

Suitability for startups

Business credit cards are often the best choice for startups and small businesses entering the Australian market. They provide access to credit without the complexity or higher costs of corporate cards.

Startups benefit from straightforward application processes and useful rewards programs that help reduce operating expenses. For rapidly growing businesses, a business credit card offers essential financial flexibility without overwhelming administrative demands.

Application process

Applying for a business credit card in Australia typically involves submitting business financial statements, proof of identity, and a credit history check. Some providers may require personal guarantees from directors or business owners.

The process is generally faster and less complex than for corporate credit cards, making business credit cards accessible to smaller companies and startups. Reviewing the application requirements helps you prepare the necessary documentation for a smooth approval process.

Exploring corporate credit cards in Australia

Core features

Corporate credit cards offer advanced features like customizable spending limits, real-time transaction tracking, and integration with enterprise accounting systems such as Xero, MYOB, and NetSuite. They allow multiple cardholders under a single account, providing visibility and control over company-wide spending.

Enhanced security measures, including fraud detection and multi-level approvals, ensure financial protection. These cards often support multi-currency transactions, ideal for businesses with international operations.

Eligible applicants

When considering corporate vs business credit card eligibility, corporate credit cards are generally available to established medium to large-sized businesses with strong financial histories and stable revenue streams. Applicants usually must provide detailed financial statements, demonstrate consistent cash flow, and meet regulatory requirements.

Unlike business credit cards, corporate cards often require approval from company directors or financial officers. This stricter eligibility reflects the higher credit limits and enhanced features that corporate cards offer to larger businesses.

Common use cases

Corporate credit cards are widely used to streamline employee expenses such as travel, client entertainment, procurement, and project-related costs. They provide a convenient alternative to reimbursement processes by allowing direct spending through company-issued cards.

This simplifies expense management, reduces paperwork, and improves financial transparency. Compared to business credit cards, corporate cards are better suited for businesses with multiple employees needing access to company funds.

Employee benefits

One key advantage of corporate credit cards is empowering employees with controlled spending capabilities. Businesses can assign individual cards with preset limits, reducing the risk of overspending while increasing operational efficiency.

Employees avoid out-of-pocket expenses, improving satisfaction and productivity. Additionally, detailed expense reports generated from card usage facilitate easier reimbursement and audit processes.

Interest rate overview

Corporate credit cards generally offer competitive interest rates, often lower than those on business credit cards, reflecting the financial stability of eligible companies.

Many corporate cards provide interest-free periods on purchases, helping businesses manage cash flow effectively. Understanding interest rate terms is crucial for businesses weighing the business credit card vs corporate credit card options to ensure cost-effectiveness.

Rewards and incentives

Corporate credit cards often include attractive rewards tailored for business needs, such as cashback on office supplies, travel discounts, and loyalty points redeemable for business services. These incentives add significant value, helping reduce operational costs.

Compared to business credit cards, corporate cards typically offer more comprehensive rewards programs, designed to benefit larger spending volumes.

Compliance requirements

Compliance plays a critical role in corporate credit card management. Australian businesses must ensure card usage aligns with internal policies and taxation laws.

Many corporate cards include features supporting audit trails and expense approvals to maintain regulatory compliance. This is especially important for larger companies facing strict reporting requirements.

Employee card management

Managing employee cards is simplified with corporate credit cards through centralized platforms offering spend controls, transaction monitoring, and real-time alerts.

Businesses can easily adjust card limits or suspend cards as needed. This level of control ensures responsible spending and reduces the risk of fraud, making corporate credit cards a secure and scalable solution for Australian businesses.

Get best corporate card for all your business needs

Business vs. corporate credit cards: Key differences

1. Eligibility

● Business credit cards

Business credit cards are generally available to small and medium-sized enterprises (SMEs) or sole traders with a reasonable credit history. They often have less stringent eligibility criteria, making them accessible for startups or businesses in early growth stages.

● Corporate credit cards

Corporate credit cards are tailored for medium to large businesses with established financials, steady revenue, and sometimes require approval from senior management or company directors. This distinction in eligibility reflects the differing target users for each card type.

2. Liability models

● Business credit cards

One of the primary differences lies in liability. Business credit cards typically hold the individual cardholder personally liable for the debt, even if it’s used for business expenses.

● Corporate credit cards

Corporate credit cards, however, place liability on the company rather than the employee. This means businesses can centralize expense responsibility, protecting employees from personal financial risk while maintaining control over company spending.

3. Fees

Fee structures for business and corporate credit cards can vary, but both generally involve annual fees, transaction fees, and possible foreign exchange fees for international purchases.

Corporate credit cards may come with higher fees due to their enhanced features and larger credit limits, but they often provide more value through rewards and management tools.

It’s essential to compare the cost against the benefits when deciding between business vs corporate credit cards.

4. Rewards and perks

● Business credit cards

Business credit cards often offer basic rewards such as cashback on everyday purchases or points redeemable for travel.

● Corporate credit cards

Corporate credit cards, however, tend to provide more comprehensive perks, including enhanced cashback rates, travel benefits, and exclusive business-related offers.

Rewards programs differ significantly between the two card types. These perks can translate to substantial savings for companies with larger spending volumes.

5. Interest rates

● Business credit cards

Business credit cards can have higher rates, reflecting the higher risk associated with smaller businesses or sole traders.

● Corporate credit cards

Corporate credit cards may offer lower interest rates or interest-free periods, given the financial strength of eligible companies.

Interest rates on both card types vary based on the issuer, creditworthiness, and card features. When comparing business credit card vs corporate credit card, understanding interest rate terms is critical for effective cash flow management.

6. User permissions

● Business credit cards

User permissions on business credit cards are generally limited to a single cardholder, occasionally with supplementary cards issued to employees, but without advanced spending controls

● Corporate credit cards

Corporate credit cards excel in this area, offering customizable user permissions where spending limits, categories, and approval workflows can be tailored for each employee. This granular control helps mitigate risks and enforce company policies efficiently.

7. Transaction limits

● Business credit cards

Business credit cards usually come with lower credit limits aligned with smaller business needs.

● Corporate credit cards

Corporate credit cards provide significantly higher credit limits to accommodate large-scale company expenses and multiple users. This scalability in transaction limits is essential for businesses planning growth or managing extensive operational costs.

8. Documentation needs

● Business credit cards

Applying for a business credit card typically requires basic documentation such as identification, proof of income, and business registration details.

● Corporate credit cards

Corporate credit cards demand more comprehensive financial documentation, including audited financial statements, business plans, and director approvals. These additional requirements support the higher credit limits and regulatory compliance expected for corporate cards.

9. Scalability

● Business credit cards

Business credit cards can serve well for smaller setups, but may lack the flexibility and tools needed for long-term growth and multi-user management.

● Corporate credit cards

In terms of scalability, corporate credit cards are designed to grow with your business. They offer features that support expanding teams, multi-location operations, and complex expense management.

The factor of scalability is vital when choosing between business credit card vs a corporate credit card for your Australian business.

Choosing the right card for your Australian business

Here are some more comparison points that can help you make the right decision.

1. Evaluate business size

Your business size plays a crucial role in card selection. Small to medium enterprises often find business credit cards more suitable due to their simpler requirements and flexibility.

Larger companies with multiple departments typically benefit from corporate credit cards that offer advanced features tailored to complex operations.

2. Analyze spending needs

Understanding your business’s spending patterns is vital when deciding between business vs corporate credit cards. If your expenses are moderate and mostly predictable, a business credit card with basic rewards and cashback may suffice.

However, for companies with higher or variable expenses, corporate credit cards offer greater transaction limits and enhanced controls, making them more efficient for managing significant outlays and complex spending needs.

3. Prioritize management tools

Management tools are a key differentiator between business credit card vs corporate credit card options.

Corporate cards often come with integrated expense tracking, employee spending controls, and real-time reporting features. These tools help finance teams maintain transparency and enforce company policies effectively.

4. Assess financial stability

Financial stability impacts both eligibility and card benefits. Businesses with established revenue and solid credit history are more likely to qualify for corporate credit cards with lower interest rates and premium perks.

Smaller or newer businesses might prefer business credit cards, which usually have more lenient eligibility criteria.

5. Ensure accounting integration

Seamless integration with accounting software such as Xero or MYOB simplifies bookkeeping and tax preparation.

Both business and corporate credit cards often support these integrations, but corporate cards may offer more advanced synchronization options that help automate reconciliation and reporting processes.

6. Weigh costs vs. benefits

It’s important to balance fees, interest rates, and rewards against your business’s financial capacity. While corporate credit cards might carry higher fees, their comprehensive perks can deliver significant value for companies with large spending volumes.

Conversely, business credit cards provide a cost-effective option for smaller businesses focused on basic benefits.

7. Review regulatory needs

Compliance with Australian financial regulations is mandatory. Corporate credit cards usually have stricter documentation and reporting requirements to ensure transparency and accountability.

Businesses must evaluate their readiness to meet these regulatory demands before opting for a corporate card.

8. Plan for future growth

Lastly, consider your business’s future growth plans. Corporate credit cards offer scalability and features designed to accommodate expanding teams and increasing expenses.

If you anticipate growth, investing in a corporate card might provide long-term advantages over business credit cards.

Power your business with Volopay corporate cards

Automation in credit card management for Australian businesses

Real-time spend monitoring

Automated systems provide real-time monitoring of credit card transactions, allowing businesses to track expenses instantly. This helps managers identify irregular spending patterns quickly, enhancing budget control and reducing the risk of overspending.

Expense categorization

Automation simplifies the categorization of expenses, a key factor to consider when comparing business vs corporate credit cards.

By automatically sorting transactions into predefined categories such as travel, office supplies, or marketing, these cards reduce manual data entry, streamline bookkeeping, and improve reporting accuracy for businesses of all sizes.

Seamless accounting integration

One of the biggest advantages of automation is seamless integration with accounting software like Xero or MYOB. This integration ensures that all credit card transactions sync automatically with your financial records, reducing reconciliation time and minimizing errors.

Custom spend limits

Automated tools allow businesses to set custom spend limits on each card or for individual employees. This feature is especially useful in managing corporate credit card usage, ensuring spending stays within company policies without constant manual oversight.

Fraud detection systems

Advanced fraud detection systems integrated into automated credit card management solutions help identify suspicious transactions in real time. These systems provide alerts to prevent fraudulent activity, offering peace of mind for Australian businesses.

Multi-currency transactions

For businesses that operate internationally, automation supports multi-currency transactions. This capability allows smooth handling of expenses across different currencies, helping manage foreign exchange risks efficiently.

Automated approvals

Automation enables streamlined approval workflows, where transactions can be automatically routed to the right managers for approval based on predefined rules. This reduces delays and improves compliance with internal spending policies.

Receipt management

Digital receipt management is a key feature of automation, allowing employees to upload receipts directly through mobile apps. This ensures all expenses are properly documented and linked to transactions, simplifying audits and tax reporting.

Industry applications of credit cards in Australia

1. Technology startups

Technology startups in Australia benefit from credit cards by simplifying expense tracking during rapid growth phases. These cards help manage costs such as software subscriptions, equipment purchases, and travel, while integration with accounting platforms makes bookkeeping easier. Automation features reduce administrative burden, letting startups focus on innovation.

2. Manufacturing

Manufacturers rely on credit cards to streamline procurement and operational expenses. Using business or corporate credit cards helps manage purchases of raw materials, machinery maintenance, and vendor payments. The ability to set spending limits and track expenses in real-time helps control budgets and improve financial oversight.

3. Retail and e-commerce

Retailers and e-commerce businesses use credit cards to handle inventory purchases, marketing campaigns, and shipping costs. Business credit cards offer rewards and cashback that can offset frequent expenses, while corporate credit cards facilitate better management of multiple employee cards and spending controls.

4. Healthcare

Healthcare providers leverage credit cards to manage clinic expenses, medical supplies, and professional development costs. With compliance requirements often strict, automated expense tracking and receipt management simplify auditing and tax reporting, ensuring smoother financial operations.

5. Tourism and hospitality

In tourism and hospitality, credit cards support daily operational costs such as bookings, supplier payments, and travel expenses. These cards also help businesses offer employee cards with controlled spending limits, making it easier to manage staff expenses across multiple locations.

6. Freelancers and consultants

For freelancers and consultants, business credit cards provide a straightforward way to separate business and personal expenses. They help track client-related costs like travel, software, and office supplies, while also offering rewards programs that add value to frequent spending.

7. Construction

Construction companies use credit cards to handle site expenses, equipment rentals, and subcontractor payments. The ability to monitor transactions in real-time and enforce spending limits ensures projects stay within budget, while integration with accounting software streamlines financial management.

Business payments, automated with corporate cards

How Volopay powers Australian business transactions

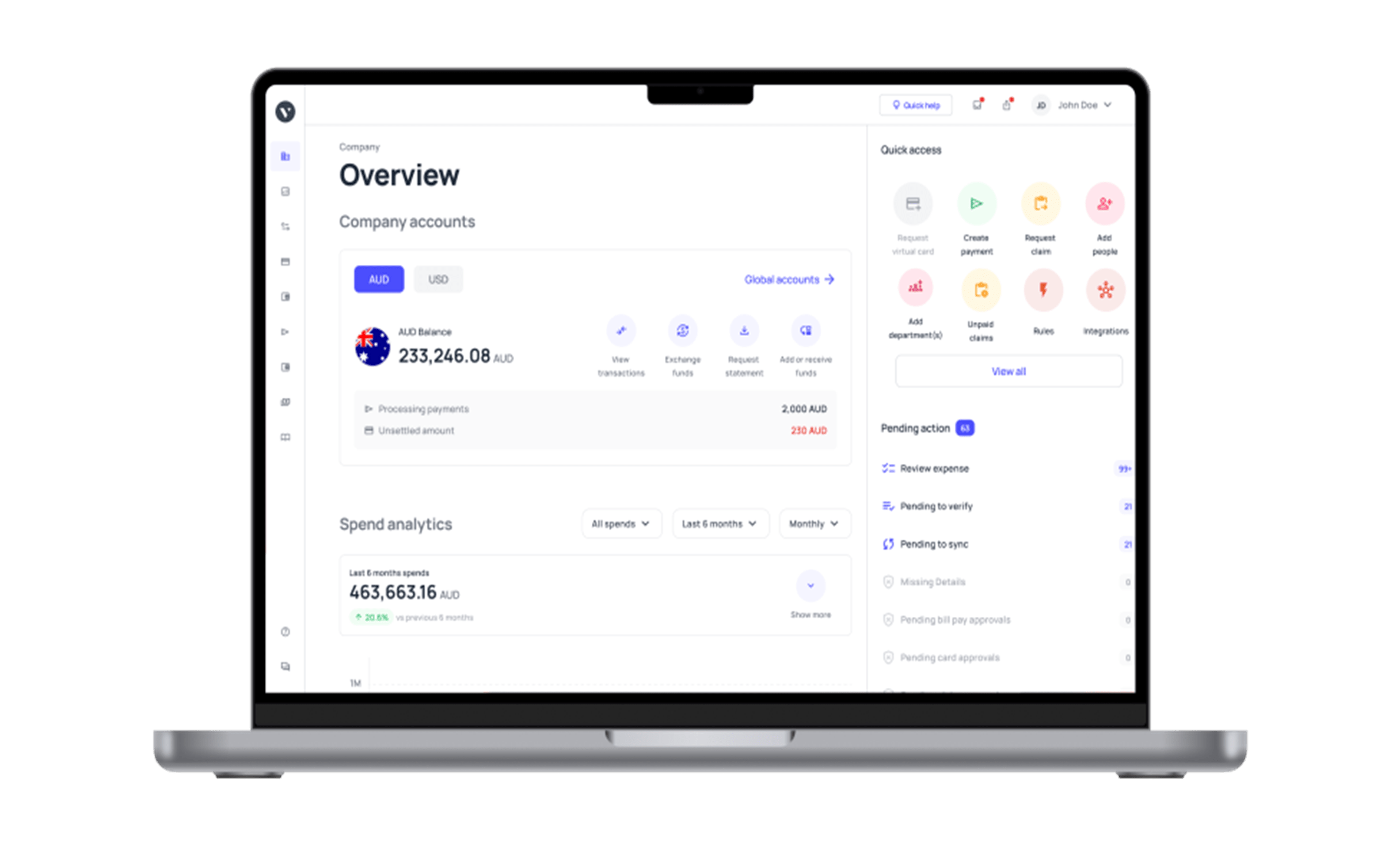

All-in-one expense platform

Volopay’s platform manages all business transactions in one centralized location, eliminating the need for multiple tools. This simplifies expense tracking and approval processes, reducing administrative time and errors. Businesses can easily monitor spending, control budgets, and enforce company policies, improving overall expense management.

Unlimited virtual cards

One of Volopay’s standout features is the ability to generate unlimited virtual cards. These secure, single-use corporate cards are perfect for online purchases and subscription payments, reducing fraud risk. Virtual cards offer flexibility and control, empowering businesses to manage different projects or departments with dedicated cards.

Real-time analytics

With real-time spend visibility, Volopay allows businesses to track expenses as they happen. This instant access to data enhances budgeting accuracy and helps identify potential overspending early, ensuring better cash flow management and financial decision-making.

Seamless integrations

Volopay integrates smoothly with popular accounting platforms like Xero, MYOB, QuickBooks, and NetSuite. This integration streamlines bookkeeping by automatically syncing transaction data, saving time and minimizing reconciliation errors for Australian businesses.

Global transaction support

Supporting multi-currency transactions, Volopay corporate cards enable businesses to make payments worldwide with ease. This feature is ideal for companies expanding their operations or dealing with international suppliers and clients.

No personal liability

Unlike personal credit cards, Volopay corporate cards relieve employees from personal liability, ensuring business expenses stay separate from personal finances. This clear distinction protects both the company and its employees.

One card for all spends - Automate with Volopay!

FAQ's

No corporate credit cards have more high-tech features and higher loan amounts than business credit cards.

Corporate cards offer more robust spend controls and financial management features in comparison to business cards.

Business owners and employees of small and large businesses can use corporate credit cards to manage their business expenses.