B2B payments in Australia: A complete guide

Business-to-business (B2B) payments refer to financial transactions between two companies rather than between a company and an end-consumer. These transactions can involve a variety of payment methods, including electronic transfers, credit cards, and paper checks.

B2B, or business-to-business, payments make up a large chunk of a business’ finance operations, as most businesses will not be able to operate at full capacity without purchasing goods and services from their vendors and suppliers. Making B2B payments on time and accurately is important for any business in Australia.

However, the fact is that B2B payments, Australia or international-based, are often complex. This is why it’s crucial for businesses to fully understand what B2B pay processes entail.

Knowing this information allows businesses to figure out what the best B2B Australia payment methods and practices are to achieve better efficiency.

What are B2B payments?

Put simply, B2B payments refer to business-to-business payments and transactions. Unlike B2C, or business-to-consumer, transactions, B2B pay involves two businesses.

One business will act as the vendor or supplier and sell its goods or services to the other business, who will in turn pay money according to the costs of the goods or services purchased.

Due to the large sums usually involved in B2B payments, it’s no surprise that B2B payments Australia businesses engage in are typically more complex than their B2C counterparts.

For one, B2B Australia transactions typically have more steps before the payments can be released. There are more documents that must be reviewed before funds can be transferred securely.

Overview of B2B payments landscape in Australia

1. B2B payments anticipate 10% CAGR growth until 2030

The trend of B2B payments will continue to increase, with the B2B market anticipating to grow at a compound annual growth rate, or CAGR, of 10% until 2030.

The expected market worth of B2B payments by 2030 is around USD 2.1 trillion.

2. Most B2B transactions go digital by 2025

Due to technological growth in the digital space, B2B transactions are expected to mostly go digital as soon as 2025.

The growth in digitization in the last three years has been massive and significant enough that 80% of transactions between businesses are expected to be digital.

3. B2B payments lead virtual card payments by 2026

With the forecast of predominantly digital B2B transactions, virtual cards specifically are predicted to take over the B2B payment market.

Globally, virtual cards are expected to reach USD 6.8 trillion in all transactions by 2026. Many B2B payments, Australia businesses included, are likely to contribute to that.

4. Aussie businesses rely on banks

While there are a number of digital payment solutions cropping up, many Australian businesses still choose to rely on banks.

Bank loans still remain a very popular financing method for B2B payments, given that banks are generally safe and reputable.

5. Almost half of Australian businesses aim to improve payments

Around 46% of Australian businesses accept four or more payment methods, but many are still aiming to improve their payment processes.

The most popular payment methods in Australia are bank transfers, corporate cards, direct debit, and payments made through digital solutions.

6. 12% surge in overdue payments; 47% of B2B sales unpaid

In the last year alone, there has been a 12% surge in overdue B2B Australia payments.

Although trade credit has proven to be useful for many businesses, 47% of B2B sales on trade credit still are unpaid. Offering credit can come with a lot of risks.

7. No change in payment durations in Australia despite policies

There have been some policy developments that aim to cut down payment durations, but despite this, there has been no actual change.

Studies show that when bigger businesses purchase from SMEs, SMEs are still waiting for around 32 to 47 days to get paid.

8. Automated payments enhance experiences for customers and suppliers

Unsurprisingly, many businesses have taken to automate their B2B payments, Australia and international-based, to streamline the process.

Automated payments have proven to be better experiences for both the buyer and the supplier in a B2B transaction. It eliminates confusion and speeds up the process.

9. 70% of finance teams spend 10 hours weekly on manual tasks

Without automation, finance teams must spend longer hours working on accounts payable and B2B payment processes.

70% of finance teams in Australia are reported to still spend 10 hours weekly on manual accounts payable tasks. Processing time could be significantly cut down with automation.

10. About 40% of accountants devote half their time to manual tasks

Similarly, a lack of automation also negatively impacts accountants. About 40% of accountants are still spending half of their work hours on manual tasks.

This shows the importance of automation solutions and how much they can aid in streamlining B2B pay processes.

Types of B2B payments

Although there are some overlaps between the methods of B2C and B2B payments Australia has to offer, it is key for businesses to understand their differences as well.

This is due to a difference in regulation and purpose when it comes to B2B pay. With B2B payments, businesses will prioritize speed, convenience, security, and low costs.

Here are some popular B2B payment types that many Australian businesses use. Each method has its advantages and disadvantages.

1. Cash transactions

Although decreasing in popularity, traditional cash transactions are still viable for B2B payments. For some businesses, there will be cases where this is the preferred B2B pay method.

Cash can be quick to process and has no extra fees, unlike credit or digital transfers. However, too many cash transactions can also negatively affect the business' cash flow.

To know more about effective and improved cash management for your business, visit our blog on How to manage cah flow.

2. Cheque transactions

While this payment method is not as popular anymore in the modern day, businesses still use cheque transactions to clear B2B pay invoices.

Often, this method is considered a safer method of payment as it requires several instances of authorization, but can also take a lot of time and is inconvenient when the business has hundreds of invoices.

3. ACH payments

ACH, or Automated Clearing House, payments are part of a US-based payment system that makes it easier to move money between bank accounts.

They use a routing number and are great for recurring payments. Australian businesses will want to keep in mind that this is only available in the U.S. for entities based there.

4. Wire transfers

Wire transfers are easier to do than cheque transactions, as they allow businesses to transfer funds to suppliers electronically.

Digitally moving funds like this means that the payment can happen faster with less hassle, making it one of the most popular methods of B2B payments Australia has to offer.

5. Digital payment solutions

One downside to traditional wire transfers is that they have a daily cutoff time and must pass through an intermediary bank to be processed.

An alternative that is typically cheaper and faster comes with new digital technology that enables mobile apps are digital wallets. Digital payment solutions can make B2B pay instant.

6. Credit or debit card transactions

Given how popular credit and debit cards are in the modern day, it’s no surprise that many B2B Australia suppliers and vendors have started taking credit or business debit cards as payment methods.

New technology has even introduced one-time use virtual cards for higher safety. Note that credit card payments may incur interest fees.

Related read: How to apply for a corporate credit card in Australia?

7. Card-based payments

Card payments are usually associated with customer-facing businesses rather than B2B pay processes, but plenty of companies have started using this payment method for transactions with other businesses.

So long as there is a payment processor or portal to perform transactions smoothly, card-based payments can be faster to do and are easier to track.

Optimize your payments with Volopay

Advantages of B2B payments for your business

Ensuring that businesses put an emphasis on B2B payments as much as they do the B2C equivalent is important, as it helps to improve several different business processes.

Finding the right methods for B2B pay will improve cash flow, save time, increase efficiency, and many more. Here are some ways B2B payments can make a positive impact.

1. Improved cash flow

A large amount of a business’ cash outflow is made up of B2B payments to vendors and suppliers.

Being able to manage these payments well and in a timely manner will help the organization improve its cash flow. Faster payments, for example, eliminate delays that could incur additional late fees.

2. Increased revenue

Working closely with suppliers is necessary to ensure that business operations remain smooth. By ensuring that all B2B payments are made to suppliers correctly, businesses won’t have to deal with issues in production.

Having the right materials and efficient production processes will lead to better revenue generation in the long run.

3. Access to more markets

Engaging in B2B deals with vendors, suppliers, and other businesses opens new doors. This is because plenty of businesses only operate in the B2B space.

With the right payment methods, a business will be able to access more markets to get the best deals on materials or services from vendors.

4. Time savings

There are many methods of B2B payments Australia has that are geared toward saving as much time as possible. Many modern methods understand the urgency of moving funds quickly.

More importantly, another advantage of paying close attention to the right B2B payment methods is that businesses will also save time tracking and organizing records.

5. Efficiency in the workplace

The last thing a business wants is to be bogged down by issues in the B2B pay process.

Making sure that B2B payments are streamlined and managed properly will help to reduce administrative issues, which can affect other aspects of the business. Allow other processes to become more efficient by making accurate and on-time B2B Australia payments.

6. Cost savings

Making sure that B2B pay is given the attention it deserves allows an organization to save costs.

The finance team will be able to determine the best payment method where fees are concerned. Not to mention that paying on time helps avoid late fees, and early payments can even net supplier discounts.

7. Accurate transaction tracking

Many modern B2B payment methods provide built-in transaction tracking. Using one of these systems allows businesses to ensure that their B2B payments are tracked accurately.

With accurate and good-quality data, businesses are able to gain useful insights and accurately forecast future transactions. Maintaining compliance is also easier with better accuracy.

8. Seamless transition

While there may be a bit of a learning curve, businesses will generally enjoy a seamless transition when adopting B2B payments.

Instead of viewing every transaction as a customer in a B2C model, companies are able to embrace their status as businesses when purchasing goods and services from vendors.

9. Timely adoption

Transitioning into a B2B pay mindset and introducing B2B-specific payment methods can be done in a timely manner.

Businesses won’t have to spend too long to figure out how to use certain payment methods efficiently. Once B2B payments are fully adopted, the company will have an easier time with their supplier transactions.

How to handle cross-border and international B2B payments?

B2B transactions should not be restricted to just domestic transactions with local vendors. Rather, businesses should consider cross-border B2B transactions, which will open doors that enable other business opportunities.

However, as international B2B payments involve some additional steps, it’s important to understand how to handle cross-border payments appropriately.

Global business opportunities

Sometimes purchasing goods or outsourcing services from foreign vendors can be cheaper. It’s important for any company to explore its options to see what the best course of action is.

Don’t miss out on global business opportunities that can be highly beneficial.

International money transfers

A big portion of cross-border B2B payments consists of international money transfers.

This is typically done with the help of multiple banks to get the money transferred internationally from the sender’s account to the receiver’s. Keep in mind the fees and wait times.

Global ACH payments and mediation

While ACH payments are US-based, as the name suggests, global ACH payments have a larger scope.

International ACH transfers are a way to transfer funds from US-based accounts across the border to recipients in other countries. Keep in mind that the sending account must be US-domiciled.

Outsourcing transaction processing

Given the complexities of cross-border B2B pay, businesses may prefer to outsource transaction processing.

There are many payment partners and service providers that offer all-in-one solutions that take care of an organization’s international business payments from end to end.

Platform functions

When picking a platform to assist with international B2B Australia transactions, make sure to look at the overall platform functions.

Options that offer features like supplier portals, payment configurations, and built-in compliance for cross-border transactions are invaluable when trying to easily handle these payments.

Considerations for international transactions

Sending money internationally comes with a lot of considerations, particularly in terms of compliance and local policies.

Businesses must also take into account additional fees and wait times. These factors should be thoroughly researched when making B2B payments.

Understanding B2B payment processes across various industries

B2B payments within online marketplaces

Online marketplace sites can help facilitate B2B transactions that connect buyers with the gig economy, even if these buyers are companies with larger purchases as opposed to individual buyers.

One thing to keep in mind with online marketplaces is that traditional B2B payment processes may not work as well within this space. This is because freelancers will typically want faster and easier payments. Many marketplace sites, however, will provide methods that help facilitate payments.

B2B transactions in the SaaS industry

Most SaaS providers offer services with a subscription plan that requires buyers to make recurring payments. Making these payments can be a hassle, especially for businesses that have multiple SaaS payments to make each month.

Most businesses that operate in the SaaS industry accept payment methods that are geared to make recurring payments easier. Digital payment solutions that provide both SaaS buyers and vendors with fast payment processing. These payments can be made internationally with lower fees.

B2B payments in affiliate and influencer networks

In a way, B2B pay processes associated with affiliate and influencer networks share striking similarities with transactions in the gig economy. Similar to online marketplaces, payments made by companies to affiliates and influencers must also be processed quickly and seamlessly.

However, there may be additional calculations involved in these payments, as many influencers earn a commission rate that is a percentage of the engagement they get. These payments are closely linked with performance analytics.

B2B financial operations in online marketplaces

Given the popularity of online marketplaces, there has also been a rise of marketplaces geared specifically toward B2B transactions, where the products or services offered by freelancers are bought by businesses. This space opens an opportunity for B2B financial services and institutions to provide better payment systems.

Fintech companies may offer credit for buyers and facilitate easily manageable payment portals for sellers. B2B pay operations in these spaces also often offer digital payment support.

B2B payments within the e-commerce sector

With e-commerce businesses, B2B pay processes are also becoming increasingly digital and international. One of the most popular B2B Australia payment methods for online marketplaces is a virtual credit card. One-time-use cards promote better security while being convenient to use.

A lot of B2B payments Australia sees in the e-commerce space allow early payment discounts. Buyers and suppliers can negotiate within the space and make payments digitally once the terms are agreed upon.

B2B payments in the retail sector

Purchases in the retail sector can be facilitated both online and in-store, though it should be noted that online shopping is becoming increasingly common due to its convenience. As a result, more and more retailers need to be able to provide online payment options for their B2B customers.

Another trend with the retail sector is the rise of digital wallets. These payment solutions significantly simplify and streamline the retail purchasing process for businesses and their employees who represent those businesses.

Enhance B2B payment efficiency with Volopay

How to send a cross-border payment?

Often businesses mistake cross-border payments as being identical to domestic ones, especially in terms of sending these payments. But while there are overlaps in the process, international B2B transactions typically have additional steps that businesses must consider.

Here are some factors that finance teams should keep in mind when performing cross-border B2B Australia payments.

Comply with local regulations

Due to cross-border payments involving entities in different countries, it is important to comply with both the sender’s and recipient’s local regulations.

Make sure to do thorough research on what documents and steps are required to send cross-border B2B payments. Australia will have its own set of regulations that Australia-based companies must follow.

Decide transaction type (one-time or recurring)

Depending on the purchase, businesses will have to determine what the transaction type is. If there is an ongoing contract with a vendor where the same purchase is made every month, that would make the transaction recurring.

Some payment processors allow businesses to schedule recurring payments. A purchase could also be a one-time payment.

Verify payment rules

Each country will have its own set of payment rules, all of which must be verified against the B2B payments businesses plan to make. This, however, is extremely time-consuming to do manually.

Finance teams will typically use payment programs or systems to detect these payment rules and automatically verify them.

Use invoice automation tools

Invoice automation tools are helpful regardless of whether those transactions are domestic or cross-border.

When it comes to international transactions, businesses will want to use tools to make them as easy as possible, given the complex nature of cross-border B2B pay. Use these tools to easily process invoices from foreign vendors.

Discover how Volopay simplifies your B2B payments efficiently!

Challenges with B2B payments

Although there are advantages to processing B2B pay well and staying on top of all B2B payments, they are also not without challenges.

As B2B payments make up a large bulk of business transactions, these issues and challenges that businesses face must be addressed quickly to improve the B2B Australian business sphere.

1. Inter-business compatibility issues

A particular business may prefer to do B2B payments with a particular payment method. However, some B2B Australia suppliers may not accept that payment method.

Compatibility issues like this can pose a challenge, as it requires businesses to tweak their payment methods or find new ones.

2. Payment system security concerns

Often transactions that are B2B in nature consist of large sums of money, as businesses are likely to buy in bulk from suppliers.

This means that there is a higher need for payment security, which remains unmet by a lot of payment systems. Many businesses still struggle to implement the right security measures.

3. Handling transaction fees and surcharges

Due to the volume and amount of B2B payments Australia businesses must make, it’s no surprise that the fees associated with them can prove to be a challenge.

Between handling fees and intermediary bank charges, a lot of B2B pay methods can become expensive. International transactions will also come with more markups and surcharges.

4. Process visibility challenges

It can be difficult to track B2B payment processes at all times.

While companies will have policies that aim to accurately record B2B payments and improve visibility, some transactions can still be missed or processed incorrectly. Businesses must find ways to have the best visibility they can over B2B payment processes.

5. Delays in payments

Many of the methods of B2B payments Australia has to offer are associated with lengthy wait times to process the payments.

Whether that is due to slow processing times with intermediary banks or there are persistent issues, delays in payments will also cause other problems. A delay in supplier delivery, for example, is an unwanted consequence.

Best practices for streamlining B2B payments

With how important B2B payments are, businesses will want to know the best ways to streamline their B2B. Australia has plenty of processors, software providers, and other technology that could help with the process.

Here are some practices, some involving technology and others not, that businesses should implement for a streamlined B2B pay process.

1. Choose a processor wisely for efficiency

With modern-day technology, there’s no shortage of B2B pay processes that businesses can choose from to make payments easier. However, different businesses will need and want different things.

Make sure that thorough research is conducted before picking the right professor for the organization. The right choice can significantly improve the company’s efficiency.

2. Assess methods for time and cost

There are many different methods for B2B payments Australia businesses can use. Which of those methods are the best for a particular business will depend on several factors.

Make sure that each method is assessed thoroughly to find out which ones are the best for time and cost savings.

3. Automate payments with software

Given that most businesses will have to make recurring B2B purchases, it’s a good idea to automate payments. This way, the finance team won’t have to waste time manually inputting the same payments each month.

There are plenty of payment automation software available that allows businesses to quickly and easily schedule, authorize, and release payments.

4. Prioritize secure payment processing

Although it’s expected to focus on speed, security is also a crucial aspect of the B2B payment process.

Make sure to carefully consider whether a particular payment method or system has a reputation for secure payment processing. It is key for any business to protect sensitive information and funds.

5. Prioritize fraud prevention

Well-designed payment processing software will have fraud prevention features to ensure better security. Whenever possible, make sure that there are fraud prevention features or measures in place before transactions are made.

This prevents unauthorized transactions and ensures the safety of sensitive information that the system may be dealing with.

6. Maximize technology usage

Don’t be scared of leveraging technology and maximizing its usage. If there is any part of the B2B pay process that can be made easier by using digital tools, these tools should be used liberally.

As long as there is sufficient understanding of the tools, businesses should maximize their usage whenever possible.

7. Minimize manual processes and checks

One huge bottleneck when it comes to B2B payments is manual work. This can cause significant delays, which is why it’s highly recommended that businesses minimize manual processes.

This is not only applicable to transaction records and authorizations but also to payment methods that are slow and must be done manually.

Volopay for seamless B2B transactions

Factors to consider while choosing a B2B payment method

Some payment methods may seem obviously better than others at first glance. But the truth is what works best for one business may not be applicable for another business. Rather, it’s important for businesses to choose methods that align specifically with their needs.

One of the biggest challenges for B2B Australia businesses face is determining which method to use. However, by understanding the advantages of all the different B2B payment methods and factors to consider when choosing, companies will be able to steer themselves on the right path.

1. Multi-channel payment support

Not all B2B payments (Australia or international) happen on the same platform. Some transactions happen online through payment portals while some others require some sort of face-to-face interaction.

With multi-channel payment support, businesses won’t have to worry about whether or not they have the appropriate payment method regardless of the transaction setting.

2. Diverse payment methods

While it’s great to use a tool that specializes in a particular B2B payment method, it is often more useful for businesses to use a tool that enables diverse payment methods.

A platform that allows both card-based transactions and digital payment solutions, for example, may open up more doors for the company.

3. Global payment capabilities

The best payment methods and processors have features that allow global payments. Having these capabilities allows businesses to easily work with foreign vendors and suppliers.

Global payment capabilities will open doors to better business opportunities while maintaining that the payments remain hassle-free. It’s also a good idea to look into the time and costs of these payment methods.

4. Competitive pricing

With the variety of payment methods and platforms available in Australia, it’s no surprise that many businesses are looking for which are the cheapest options.

While the cheapest may not always be the best, it’s still good practice to ensure that the pricing is competitive. Compare the fees and surcharges of different payment methods.

5. User-friendly interface

Whether or not a payment platform has a user-friendly interface may not be the immediate make-it-or-break-it factor for most companies. However, keep in mind that confusion over how to use a payment processing system can lead to issues like delayed payments.

Choose a system that is easy to comprehend and use. An intuitive interface can be invaluable.

6. Automated invoicing

Other than making the B2B payments themselves, another major part is the invoicing process.

To make it easier to complete the process from end to end, consider getting payment software that has automated invoicing features. This helps with verifying, matching, and approving invoices, which allows the B2B pay transaction to happen faster.

7. Seamless integration

Most systems that businesses use don’t exist in a vacuum. A B2B pay platform is no different.

Ideally, a company’s B2B payment system of choice should be able to seamlessly integrate with other systems, such as the company’s accounting software. Not only does it minimize data silos, but it also reduces the administrative workload.

How does Volopay assist in the management of B2B payments?

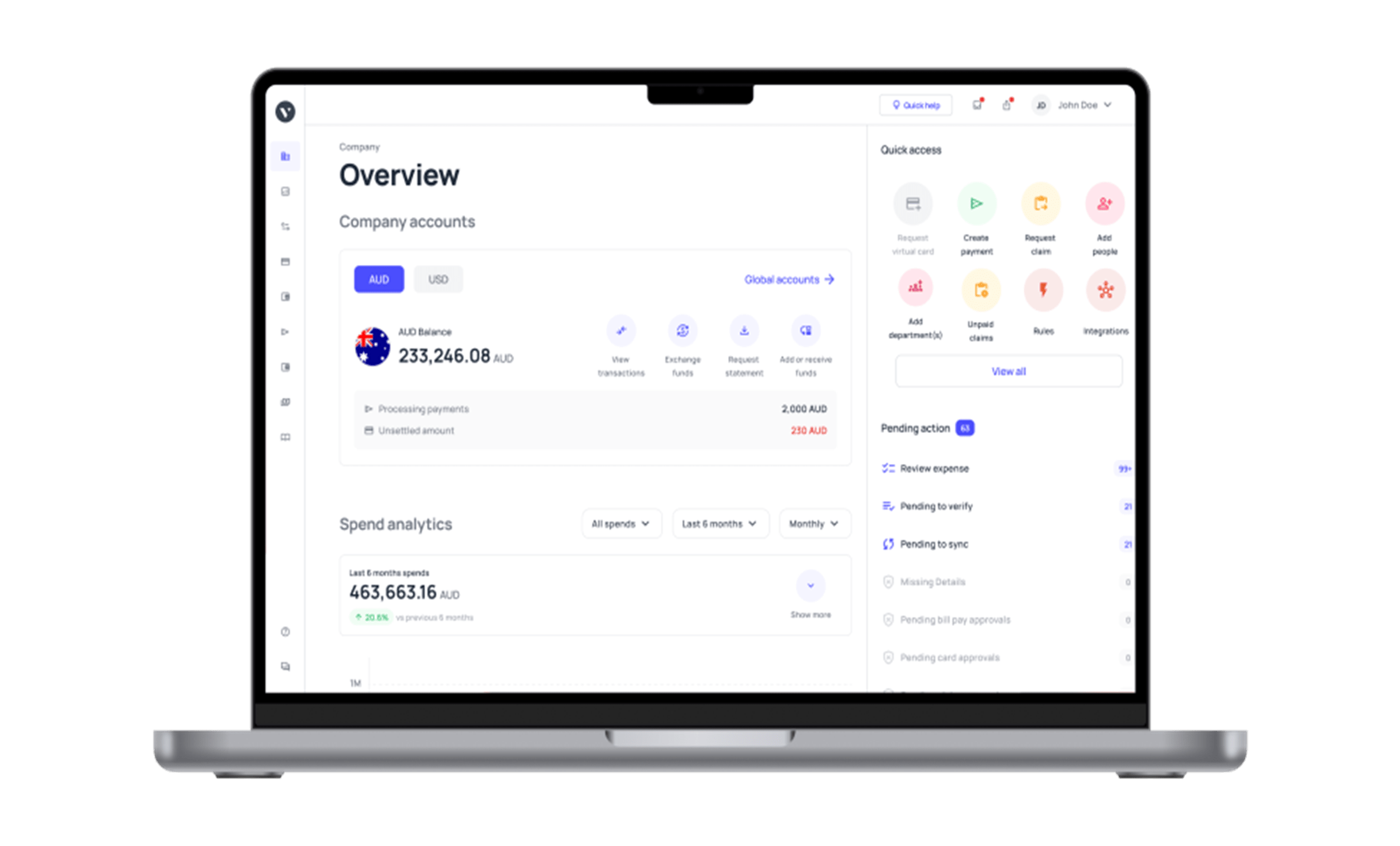

As an all-in-one finance management solution, Volopay offers a number of features and services that your business can benefit from when it’s time to make and manage B2B payments.

From vendor management capabilities to accounting automation to accounting integrations, you’re guaranteed to be assisted every step of the way.

Make your B2B payments, Australia and international transfers, through Volopay. There’s no need to haphazardly manage multiple payment platforms when you can do it all with just one dashboard.

Effortless automation

Say goodbye to long and tedious manual B2B payment-related data entry processes. Using Volopay helps your business to effortlessly automate B2B pay.

Automatically schedule recurring payments, route them through the right approval workflows, and record transactions in real time. You’re guaranteed on-time payments and accurate records hassle-free by automating your processes!

Comprehensive features

Get everything you need for B2B payments with Volopay.

There’s no need to juggle multiple platforms to process your payments when Volopay has a comprehensive set of features that will help you track, record, authorize, and release payments. Volopay is ready to help you every step of the way.

Enhanced security

With ISO and PCI DSS certifications, Volopay is committed to your data and fund security. We implement industry-standard security measures that ensure your business has protection over sensitive information.

With additional features such as user permission controls, two-factor authentication, and payment approvals, getting enhanced security over your B2B Australia payments is easier than ever.

User-friendly interface

You don’t have to be an expert on B2B payments; Australia has platforms like Volopay that make it easy to process and manage your transactions.

With a user-friendly and intuitive interface, there’s no steep learning curve with Volopay. All you require to manage your B2B pay processes are only several clicks away from your dashboard.

High-tech solutions

Volopay is equipped with many of the best technologies, helping businesses access high-tech B2B payment solutions with ease.

With artificial intelligence, optical character recognition, and automation technology, the payment process from start to finish is guaranteed to go smoothly.

You can guarantee that you’ll also get access to newer technology with future Volopay updates.

Cost-effective

Don’t worry about hidden fees—Volopy has none of those. With low transaction fees and FX rates, Volopay is perfect for businesses with many B2B transactions to make.

By eliminating manual administrative tasks, you’re also reducing the processing costs for your B2B payments, You’re guaranteed to reap the benefits of Volopay’s cost-effectiveness.

Seamless experience

All your B2B payments, Australia or international-based, can be easily managed on a single platform. Get a seamless B2B pay experience from end-to-end, starting from receiving your invoice to recording your transaction.

With multiple payment methods available, you can make B2B payments with corporate cards, virtual cards, and digital money transfers seamlessly.

Real-time financial insight

One of the best things about Volopay is that not only are your payments processed in real time, but you also get real-time insights on all your transactions.

Each payment made through Volopay is automatically recorded on your dashboard, allowing the built-in analytics features to use the most recent data. Easily identify patterns to make better-informed decisions.

Vendor and invoice management

Centralize all your vendor, payment, and invoice management on a single platform. It’s easy to add vendors to the built-in database on your Volopay account.

All information like vendor name, address, and bank details is easily accessible. Your vendors will be able to send invoices directly, eliminating the need for manual data entry during invoice processing.

Multi-currency capability

Gain access to multi-currency wallets with your Volopay account. Instead of having to pay high fees and FX markups for international B2B Australia transactions, you can load, hold, and spend in a number of major currencies.

Save B2B payment costs and make transactions easy. Volopay multi-currency wallets are hassle-free.

Conclusion

B2B payment processes are complex, but there are a number of ways businesses can mitigate the complexities.

With the rise of modern-day technology and digitization, it’s even easier for Australian businesses to find the right tools to assist them in making vendor and supplier payments. However, beyond anything else, it’s crucial to first understand how B2B pay works and what payment methods can be used for B2B Australia transactions.

Businesses must grasp that B2B payments are fundamentally different from their B2C counterparts because corporate buyers have different needs from the average consumer. With B2B payments, speed is often of the essence, but so are security and convenience. Considering that B2B payments typically deal with large sums of money, they must be facilitated with the right payment methods.

It’s important that businesses have not only the right tools but also processes for their B2B payments. Pick payment methods that are both secure and efficient to streamline B2B payments, Australia or international-based.

A faster and more efficient B2B payment process means that businesses can ensure that their operations remain smooth, costs are held down, and administrative workload is reduced to a minimum.

Streamline your B2B payments with Volopay

FAQs

Yes, namely the requirement to include the ABN or GST registration number on invoices. Generally, B2B payments in Australia must comply with all the applicable existing tax requirements.

This depends on what the payment method is and what payment service your business is using. However, there will generally be a processing fee for most electronic or digital payments.

These can be a small percentage of the payment or a flat fee. International transactions may also be subjected to FX markups and have additional or different fees than the domestic processing fees.

Technology allows Australian businesses to streamline B2B payments in many ways, namely by automating various processes.

Instead of manually having to create, authorize, and settle B2B payments, Australia businesses can use modern tools to automate scheduling, recording, and tracking the transactions. Finance teams won’t have to spend lengthy amounts of time processing B2B payments each month.

Volopay works closely with licensed partners in Australia, ensuring that all payments are made in compliance with Australian regulatory requirements.

Our platform also has features that ensure all payments are approved accordingly before they are made, along with GST fields to fill out when creating payment requests. Any suspicious B2B transactions will be flagged for additional review.

Yes. Volopay offers multi-currency wallets that enable easy B2B payments for Australian businesses. All B2B Australia and international payments will be recorded automatically.

Multi-currency and international transaction features can be found on the Volopay dashboard, making it easy to access all payments in a single platform.

Volopay is ISO and PCI DSS-certified, meaning that it has all the industry-standard required security measures. All our data is stored in a secure remote server, with encryptions to prevent data breaches.

The Volopay system also offers built-in controls and approval workflows to ensure that every payment is approved and authorized accordingly.

Companies of all sizes and operating in all industries will be able to benefit from using Volopay.

While it’s easy to assume that only larger businesses and enterprises with hundreds or thousands of B2B transactions can benefit from automating payments, small and mid-sized corporations will be able to improve efficiency and enforce compliance with ease with Volopay.

Yes, Volopay offers easy accounting integrations. Every transaction will appear on a built-in ledger and systems like Xero, Quickbooks, and MYOB all can be directly synced with your Volopay dashboard.

All it takes are a few clicks to get this done. The customer support team will also be able to assist in setting up integrations.

Yes. Volopay has a dedicated customer support team that is always happy to assist your business. Once onboarded, the team will walk you through the Volopay platform and provide training on how to make B2B payments Australia.