Top 9 Reasons for delay in bank transfers

Businesses nowadays have to do things extremely fast to keep up with the competition and grow without lagging behind. In a fast-paced business environment, you need all facets to move quickly.

But often, the finances of a company, specifically payments tend to be slow causing business operations to come to a halt. Delay in bank transfers is one of the major culprits behind slow financial transactions. But have you wondered what causes bank transfer delays?

Reasons why bank transfers gets delayed

1. Global events and natural disasters

If there happens to be some natural disasters or global events, it might hamper the global payment infrastructure and cause delays in payments. There’s nothing you can really do in such a situation as it is out of your control.

2. Bank holidays

The bank you’re transferring through or the receiving bank might have holidays in between the time you made a payment. This is another reason that can cause delays in online bank transfers as well as offline payments.

3. Different time zone and bank cutoffs

When transferring money internationally, the different time zones of a country can affect the speed of payments. There might be instances when you processed a payment on your end within time but the receiver’s bank has stopped processing incoming transactions for the day.

4. Weekend delays

Many banks across the world do not operate on weekends. So if you have processed a payment on Thursday or Friday, it is likely that the payment may take longer to reach the receiver than 2-3 days.

5. Different currencies

Depending on the country that you are in and the country of the receiver, there might be delays due to the time taken in the currency conversion process.

6. Missing paperwork

Banks often ask for supporting documents when making international transfers to verify their legitimacy and detect if there’s anything fishy about it. Insufficient documents provided to support the transaction can also lead to bank transfer delays.

7. Incorrect payment details

If you accidentally give the wrong payment details, then errors might occur while making the payment, or worse it may go to someone else other than the receiver. Dealing with and sorting out such a situation is another cause for delays in bank transfers.

8. Fraud prevention procedures

When dealing with international transfers many banks and payment networks have strict fraud prevention measures put in place. This ensures the safety of money but causes delays in transfers. The SWIFT network for example demands every transfer give the details of up to 3 correspondent banks.

9. Specific network payments

While online SWIFT payments are generally pretty fast, the time taken by offline SWIFT payments varies. They can take anywhere from 24-48 hours, and go all the way up to five business days depending on various factors including other forms of delays.

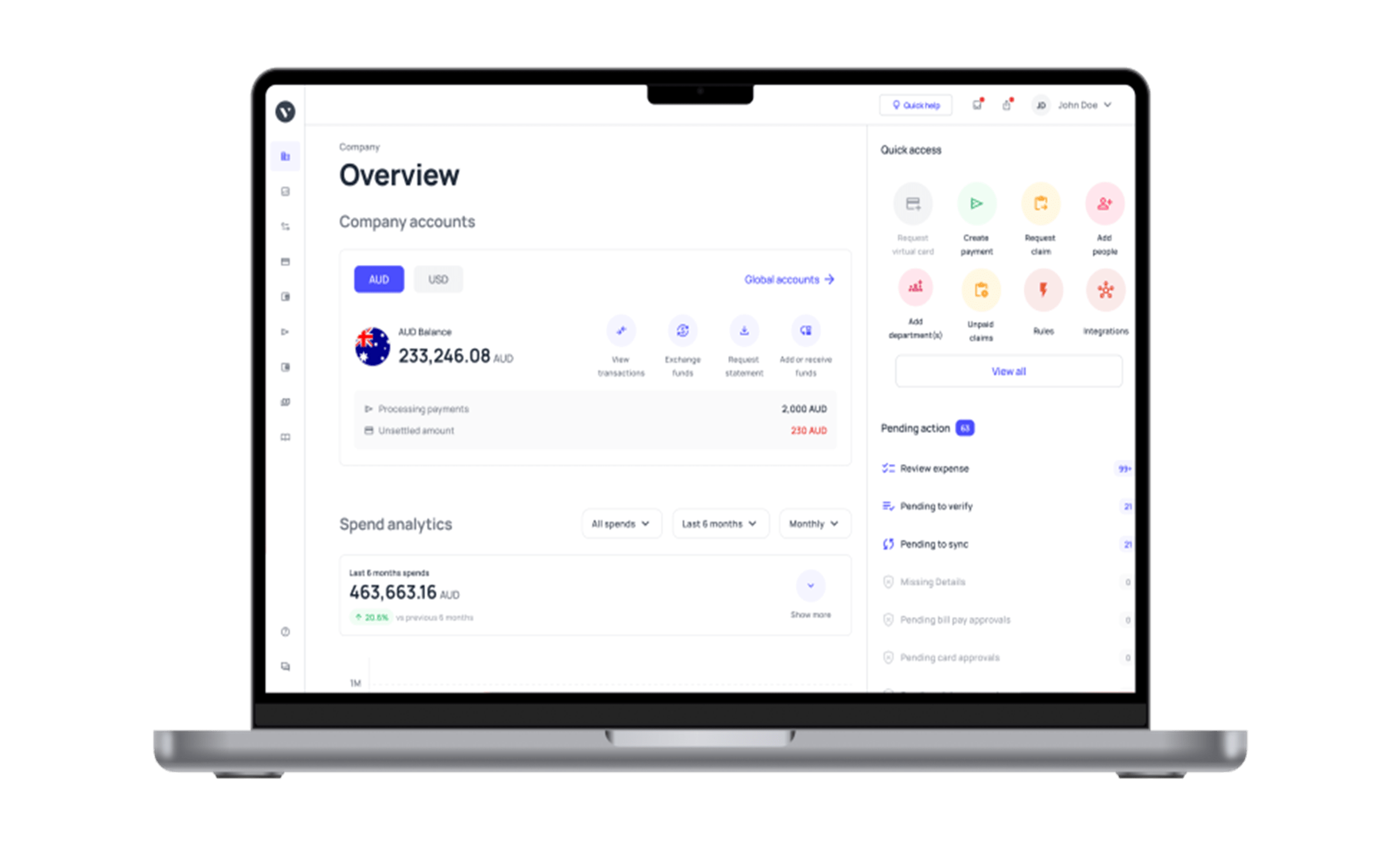

Multicurrency bank accounts for your business with Volopay

Volopay is a complete expense management ecosystem and also a payment service provider for businesses to make local and international payments. As a new-age business, Volopay is built on a modern digital payment infrastructure that lets its users make fast international wire transfers within minutes.

Using Volopay you can set up multi-currency accounts that let you make payments internationally extremely quickly without having to face the usual delay in bank transfers for traditional banks.

You get access to hold and send money in 60+ different currencies and across 100+ countries. Each currency wallet lets you hold and send money to vendors in different currencies without incurring FX charges for every transaction.

So let’s say you are a business in Australia, you can essentially create a USD wallet, load money into it through your bank account, and use it to make payments in the USA to avoid FX fees for all those transactions.

The payments on our platform give you the option to make transfers through the SWIFT network or a non-SWIFT method. While the SWIFT transfers ensure accurate tracking the non-SWIFT method is extremely fast and much more economical.

FAQs

Yes, there may be many different banks that are not open on Saturdays and Sundays. This can make a money transfer take longer to process than usual. To avoid this, try to make payments within the first 3 days of the week.

There can be many reasons why international money transfers take time to be processed such as bank holidays, weekend delays, currency conversion delays, fraud detection & prevention measures, slow international bank networks, global events, and natural disasters among many other reasons.

An online SWIFT transfer is preferred by most businesses nowadays because it takes only a few minutes. The offline process may take a little more time. The SWIFT network is used to make payments in modern payment service providers like Volopay.