Multi-currency wallet for global businesses

Growing your business internationally can be challenging because of the roadblocks you may face. International transfers, for one, are a hassle to do and can be costly. You run into things like inflated exchange rates, high transaction fees, and delays in transfer processing. Fees related to international transfers may slowly eat away at your business savings, while slow transfers could impact your relationships with international vendors.

With multi-currency wallets, however, growing a global business won’t be a difficult task. Bypass the challenges that come with international transfers by utilizing a multi-currency wallet that enables you to make foreign payments faster and smoother.

Introducing multi-currency wallets by Volopay

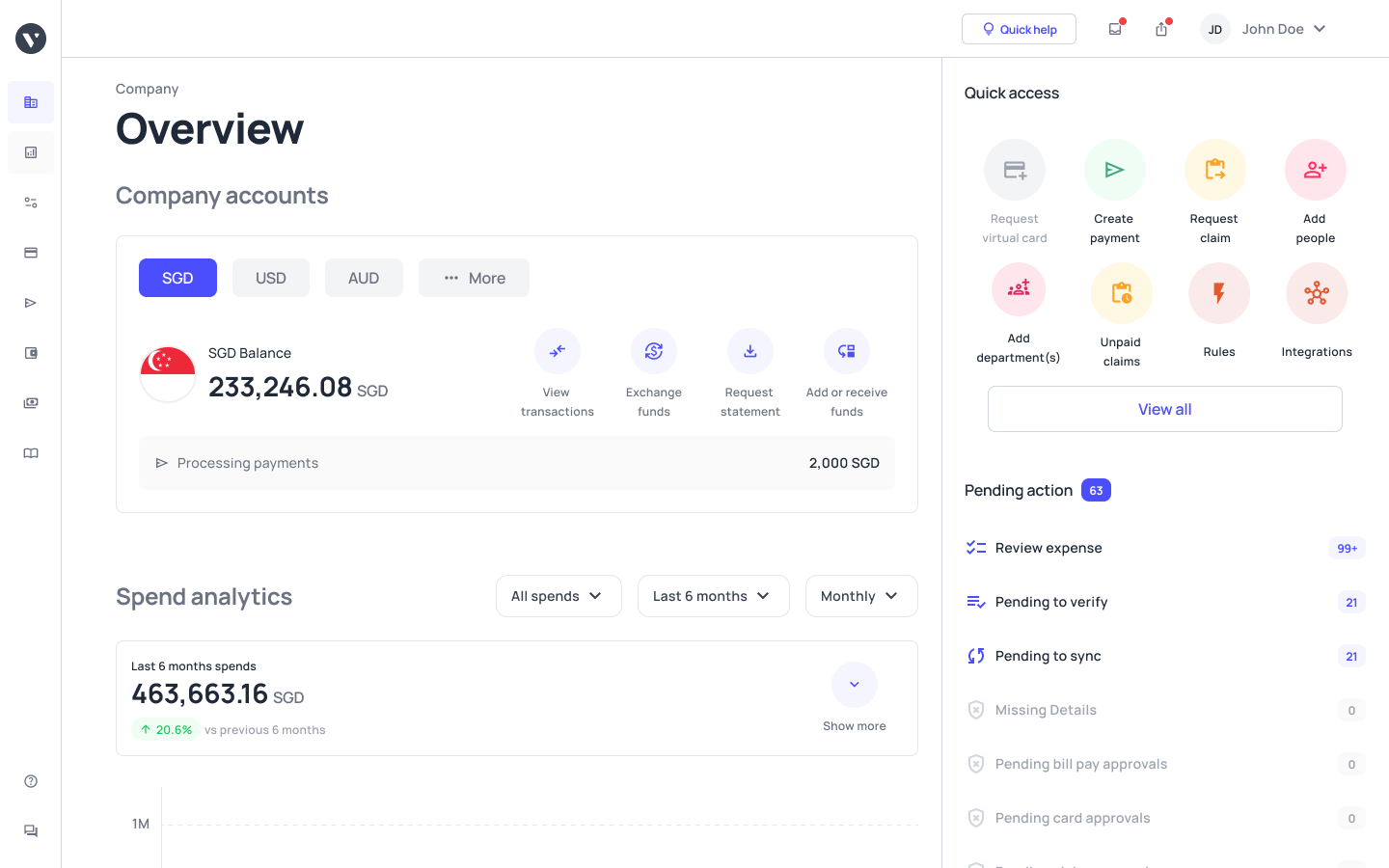

Volopay’s multi-currency wallet allows you to hold money in more than one currency. Having access to this feature will empower your company and help you conduct business and grow internationally.

On Volopay’s platform, each currency has a separate wallet that can be used to collect, hold, as well as spend money in that particular currency.

You’ll be able to have full access to multiple currencies all in one place without having to change between accounts.

With just a few clicks, you can view all the currencies you hold and use them to make payments, both to local and foreign vendors alike.

When you process your international payments with multi-currency wallets, you don’t need to spend time and money on long international transfers with many fees.

Instead, you can use your multi-currency wallet to transfer money in the same currency as the one your foreign vendor uses.

For example, if you have a vendor that asks for USD payments, you can load up your USD wallet on Volopay’s platform and pay them in USD. No need to convert your funds and pay extra for marked-up conversion rates and intermediary bank transfer fees.

Benefits of multi-currency wallets

No hefty fees

Problem with international transfers is that money from one currency is transferred as money in another currency, meaning that there are a lot of intermediaries in the process.

For one, you’ll have to convert your local currency to a foreign currency when you do an international transfer.

Typically, there will be a markup when you convert your funds for payment. Not to mention that there will be transaction fees at your bank or the receiving bank.

Unlike traditional international transfers, multi-currency wallets don’t come with expensive transfer fees or conversion rate markups.

Even if your business mostly utilizes your local currency, you can still hold money in a foreign currency in your multi-currency wallet and use funds in that wallet to make international payments. There are no additional fees involved. Volopay’s multi-currency wallet offers a $0 transfer fee.

Better global reach

The best thing about having a multi-currency wallet is that you can conduct international business transactions without having to jump through hoops.

Get paid by local and foreign buyers alike and receive funds all on one account in multiple currencies. You won’t have to hesitate to start doing business internationally just because your payments might get delayed through international transfers.

You’ll also be able to form better relationships with foreign buyers by helping them save on foreign exchange markups when paying you. The same applies to foreign vendors.

You don’t have to be limited to only purchasing from local vendors and can instead purchase from anywhere hassle-free. Multi-currency wallets can help you achieve better globally without having to go through all the tedious processes of international transfers.

Leverage conversion rates

Conversion rates fluctuate on a daily basis. What this means for your international transfers is that the money being sent might not be the exact same amount as the money that is received.

On a particularly unlucky day, you might receive a payment that amounts to less than what you imagined, or have to pay a vendor more than you wanted to compensate for the conversion rates.

You don’t have to settle for unfortunate conversion rates with multi-currency accounts. If you receive money in a foreign currency, you don’t have to immediately convert it into your local currency if the rates don’t work in your favor.

Instead, you can hold on to the money in their native currency for as long as you need. Use it to pay other foreign vendors and suppliers or convert it to your local currency when the exchange rate works in your favor.

Ease of transfer

Typically, international transfers involving more than one currency take between 3 to 5 business days. This is caused by your bank having to convert the currency and send it to an intermediary bank before it arrives in the recipient’s bank account.

Multi-currency wallets eliminate that step. You can pay or get paid in foreign currencies without having to figure out complicated logistics.

Allow foreign customers to pay you in their currency, hold the money they send you without converting it to your local currency, and pay your foreign vendors straight away.

You don’t have to worry about conversions whenever a payment is made or received.

Settle invoices faster

Multi-currency wallets don’t only help speed up the payment process, but they also help you with your records.

When doing international transfers, it may be difficult to tell which bank transaction is for which invoice. If you only operate in SGD, for example, but have to send money to vendors that request to be paid in USD, then you’ll have to send the SGD equivalent of your USD bills.

This will make it tough for your accounts payable team to sort out the payments as they’re in two different currencies.

With multi-currency wallets, you can simply pay in the currency requested and have your reports sorted out easily.

How to make use of this feature?

Load funds in different currencies

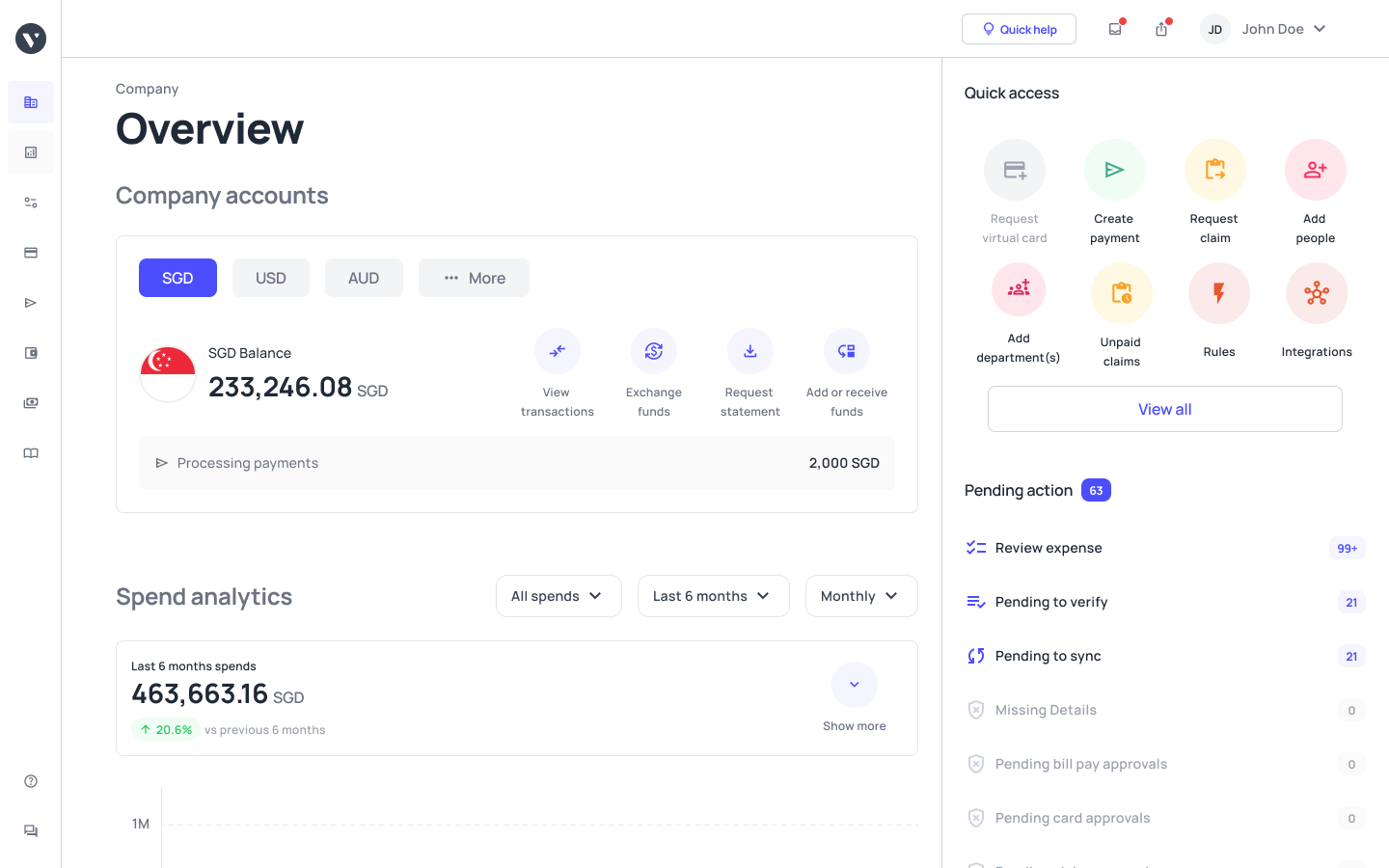

You can view all the different currencies you hold funds in and load your wallet all through one dashboard. Open your Volopay dashboard and view funds in any of the currencies you hold by clicking on the currency account that you want to load.

Click on “Add or receive” and view your account details. Then, transfer money into the currency account where you wish to load your funds.

Receive funds from buyers

Share your account details with your buyers to get them to pay you straight to your multi-currency wallet. When a buyer makes a payment to your account, the money will instantly be loaded into your account with the respective currency.

Exchange funds in currencies

Transfer funds between the different currency accounts easily. When you want to exchange funds in different currencies, all you have to do is click “Exchange” on one of your currency wallets and pick which currency account you want to transfer the funds to.

Bill payments

Your multi-currency wallet can be used to make bill payments to your vendors. This way, you can avoid conversion and foreign exchange markups.

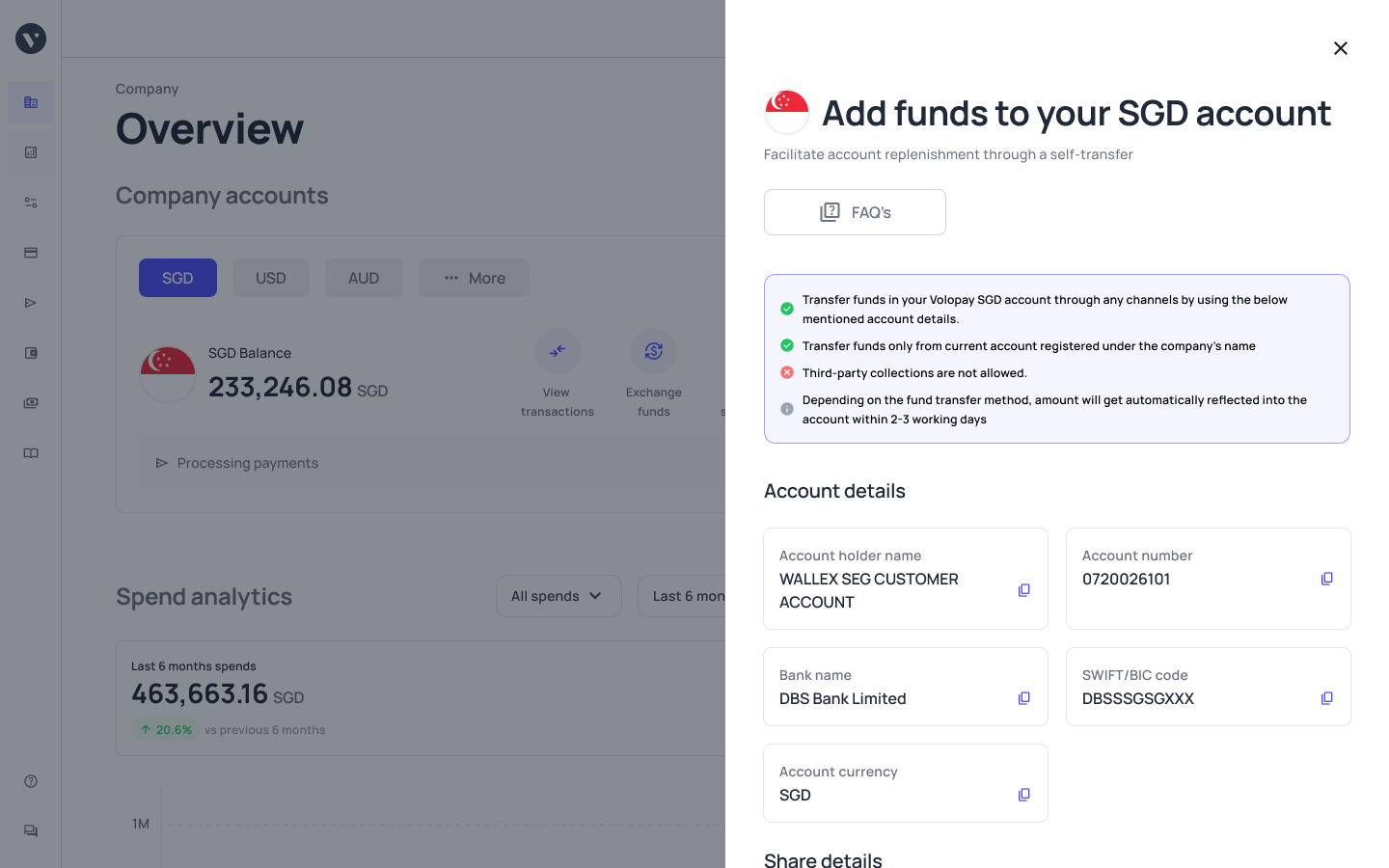

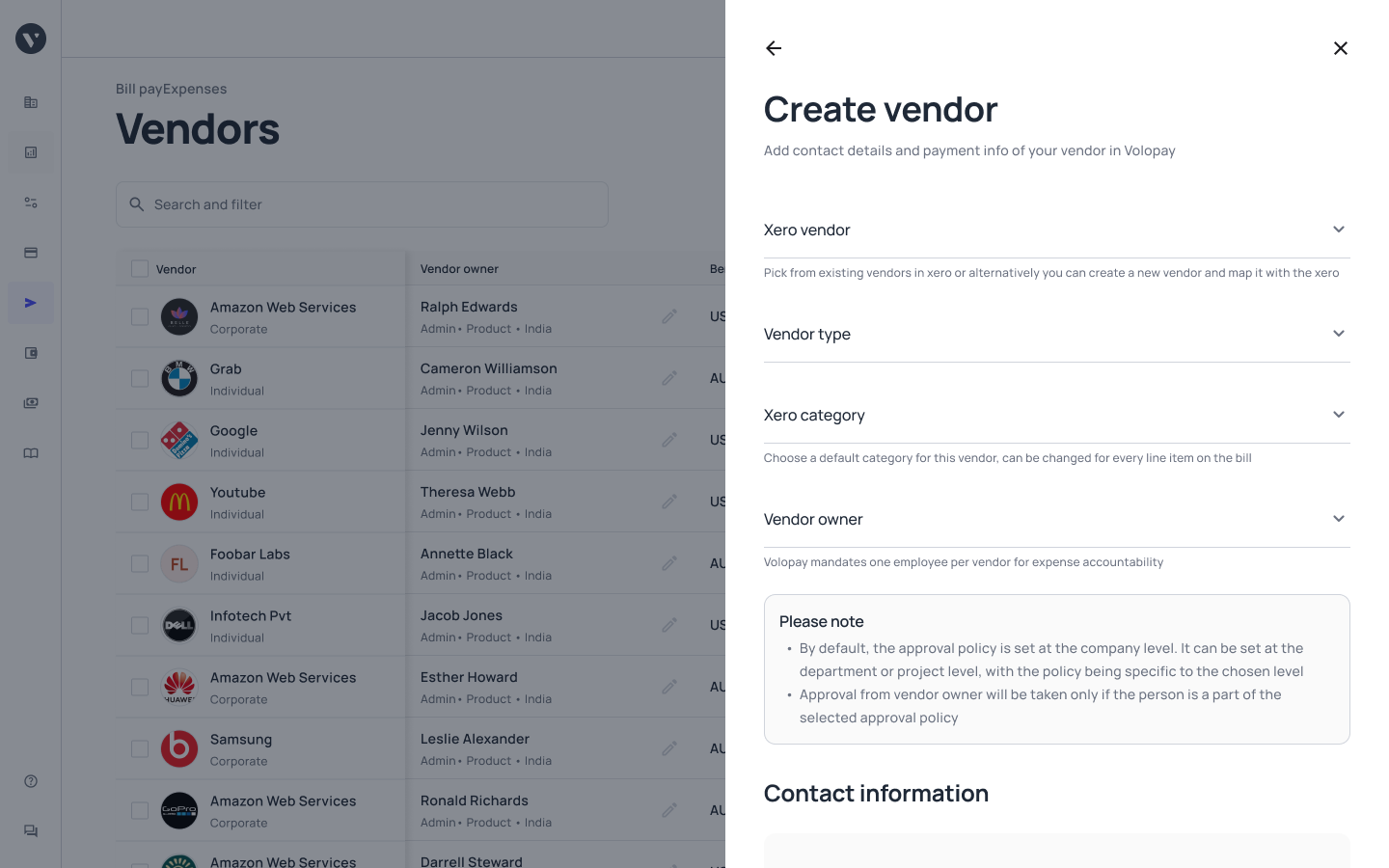

Use the “Bill Pay” section of your Volopay dashboard to make your payment. Go into the “Vendor” section and add a new vendor to the system. Fill out all the necessary vendor data.

Once you’re done, go to the “Payment” tab and create a payment. Fill in all your invoice details, choose which currency you want to pay the vendor in, and process the payment. It will automatically draw funds from the relevant currency wallet.

Who is eligible to make use of multi-currency wallets?

To be eligible for Volopay’s multi-currency wallets, you are required to own a licensed business. If you fulfill that requirement, you can onboard with Volopay to gain access to the multi-currency wallets offered.

Once you have a Volopay account, you will be able to make use of multi-currency wallets regardless of the size of your business.

Whether you’re a small business looking to grow internationally or an enterprise trying to streamline your international payment processes, you’ll be able to utilize Volopay’s multi-currency wallets to help you streamline the way you do business internationally.

Conclusion

Forgo tedious international transfers and start utilizing multi-currency wallets to help grow your business. You no longer have to wait 3-5 business days to get your transfers processed, nor do you have to shell out more money to cover expensive transfer fees.

Expand your business’ global reach and conduct business internationally with ease. Book a demo with Volopay to gain access to your own business multi-currency wallet. Load, hold, and spend in multiple currencies using Volopay’s multi-currency wallets.