How to apply for a corporate credit card in Australia?

Business cards function similarly to regular credit cards. They can be used to make credit-based purchases that must be repaid later (over time or by the next billing cycle). They, like the vast majority of credit cards available today, offer valuable rewards for spending money.

On the other hand, corporate credit cards and purchasing cards (P-cards) provide additional tools for tracking spending, issuing employee cards, and other benefits designed to meet the needs of large corporations.

Corporate credit cards are designed for businesses and organizations to provide their employees with a quick and easy way to make work-related purchases. Corporate credit cards are typically restricted to high-level employees such as managers, executives, and frequent business travelers.

These individuals are in charge of overseeing their organization's finances and making critical purchasing decisions. The article has briefly discussed how to get a corporate credit card in Australia.

Difference between corporate credit cards and business credit cards

For their financial needs, businesses use two types of credit cards: corporate credit cards and business credit cards. Despite the fact that both types of cards are used for business-related expenses, there are differences between them.

Corporate credit cards in Australia are typically issued to high-level employees, with the company responsible for paying the balance for significant expenses such as travel and entertainment. It has been found that about 40 percent of corporate credit card holders in Australia receive positive benefits from their cards in terms of net monetary.

The person or business entity registered in the place is responsible for paying the balance on business credit cards, which are typically issued to small businesses or self-employed individuals for more minor expenses such as office supplies and equipment.

Furthermore, corporate credit cards typically have higher credit limits than business credit cards.

How to get a corporate credit card in Australia?

Business registration

The documents include the Certificate of Incorporation or Business Registration Certificate and the Australian Business Number (ABN) or Australian Company Number (ACN).

Financial statements

You must have access to the company's financial statements to evaluate its financial health and creditworthiness over the last two to three years. This includes the Cash Flow Statement, Balance Sheet, and Profit and Loss Statement.

Business credit history

A report on the company's credit history and score is required to assess the company's previous credit behavior.

Business plan

A comprehensive business plan outlining the organization's mission, objectives, and financial projections is essential for start-up businesses.

Identification documents

Passports or driver's licenses are acceptable forms of identification for authorized signatories who will use the corporate credit card on behalf of the organization.

Tax returns

The tax returns for the previous two years are required to evaluate the company's tax compliance and financial stability.

Income documentation

Income documentation from the company, such as invoices, receipts, and bank statements, may be required.

Reference letters

Reference letters from the bank, suppliers, or other business partners may be required to verify the company's creditworthiness.

Legal documents

Legal documents such as the Articles of Association, Shareholder Agreements, and Director Resolutions may be required to verify the applicant's legitimacy.

Things to consider while choosing a corporate credit card for your business

Selecting the best corporate cards for your company is critical for managing cash flow and simplifying expenses. Keep the following factors in mind when choosing a corporate credit card in Australia:

1. Features and benefits

Look for a card with rewards and benefits that complement your company's needs. If you frequently travel for work, look for a credit card that offers travel rewards or discounts.

2. Rates and fees

Consider the interest rate, annual fee, late fee, and other fees associated with the card. Choose a credit card with low fees and competitive rates.

3. Credit limit

Consider the card’s credit limit and whether it meets your business needs. A higher credit limit can make it easier to pay for larger purchases, but it also raises your interest rate.

4. Smooth application

Look for a card that includes online expense tracking and management tools. This can make it easier and faster to reconcile your business expenses.

5. Accepted network

Take into account the accepted network. If you frequently travel abroad, look for a credit card that is accepted everywhere.

6. Customer service

Select a card issuer with dependable customer service. You should be able to contact someone with any problems or questions.

7. Fraud protection

Look for a card issuer with fraud protection and security features to help protect your business from unauthorized transactions.

To summarise, several steps are involved in how to get a corporate credit card in Australia. Businesses must first determine their credit needs to find the best corporate credit card option for their needs.

Financial statements, business information, and personal identification documents are typically submitted as part of the application process for each cardholder. Once approved, businesses can activate and use their corporate credit card.

They should take advantage of any available rewards and benefits. Additionally, businesses should implement clear employee expense policies and use online expense management tools to manage expenses efficiently.

It's critical to carefully read the terms and conditions of the business credit card agreement and stay updated on fees and interest rate changes. Following these steps, Australian companies can apply for and use a business credit card to meet their financial needs.

Manage your business expenses with Volopay corporate cards

Corporate credit cards have no doubt qualified as a business essential. Making business spend and investments the traditional way is not feasible in today’s business environment. You already know what to consider before choosing a corporate card, but the right provider choice is also necessary. Hence, let us introduce you to Volopay!

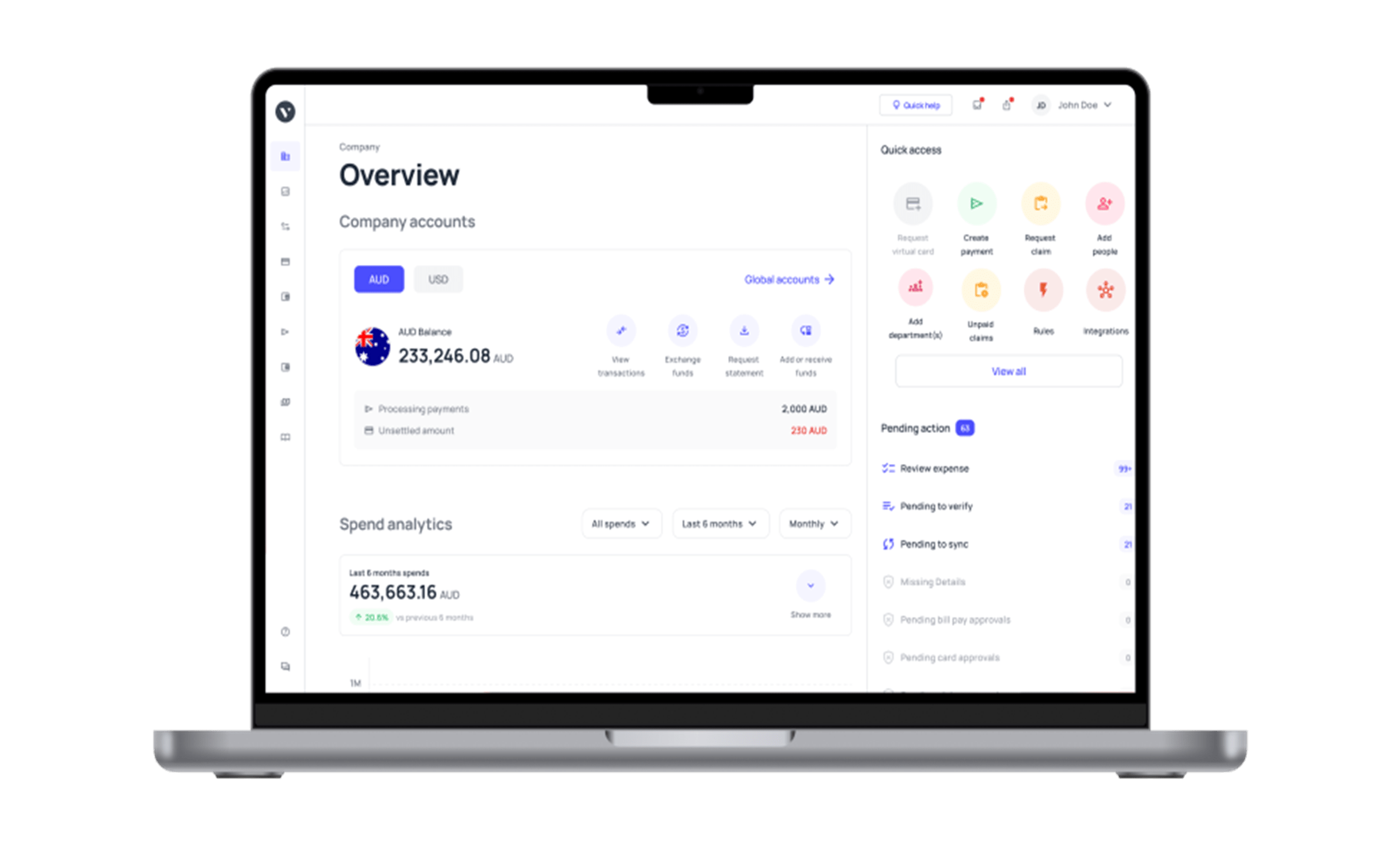

Volopay offers the best corporate cards. The features and services provided by the platform and the corporate cards are unmatched. Real-time expense tracking, direct accounting integration, accurate expense report and analysis, international transaction facility in more than 60 currencies, spend limit restriction, automated expense policy compliance, and much more. Explore the best with Volopay!

Corporate cards to manage your business expense with ease

FAQ's

Business credit cards are designed for small to medium-sized businesses and provide greater flexibility than corporate cards, which are frequently used by larger enterprises for employee costs.

Employees of a corporation are allowed to spend expenses for work-related reasons.

A credit score of 670 or above is usually preferred, though the credit score required for a corporate credit card may vary.

As a corporation, you can apply for a corporate credit card.

Business credit cards are designed for small to medium-sized businesses and provide greater flexibility than corporate cards, which are frequently used by larger enterprises for employee costs.