All about international money transfer regulations in Australia

Growing companies will want to conduct business internationally to scale faster. However, it must be noted that each country will have its own set of international money transfer regulations.

You must be familiar with the rules surrounding sending and receiving money in cross-border transactions within Australia. When you have a good understanding of the rules, fees, and general practices for Australian money transfers across borders, doing international business will come easily.

International money transfer regulations in Australia

While Australia might be considered lax when it comes to international money transfer regulations compared to other countries, there are still several rules and regulations in place to ensure that financial crimes are detected, prevented, and responded to.

The governing body that supervises financial transactions in Australia is called the Australian Transaction Reports and Analysis Centre, otherwise known as AUSTRAC. There is no limit of international money transfer that you can do in Australia, but AUSTRAC requires you to report transfers made above a certain amount. This threshold is AUD 10,000, meaning that you are legally obligated to report incoming or outgoing transfers equal to or higher than AUD 10,000.

Both cash transfer and international wire transfer regulations state that you are required to let AUSTRAC know and complete the report within 10 business days starting from the day the transfer is made.

Either the business involved in the transfer or your payment service provider can make this report. You want to make sure that you get in touch with your payment service provider and iron out the details when you’re making larger transfers of money in Australia to ensure that you comply with Australia’s international money transfer regulations.

Tax implications on overseas remittance

Whether or not you will be taxed when you receive money from overseas in Australia highly depends on several factors, such as the amount and the source of funds. As a general rule, transfers of AUD 10,000 or above will need to be declared to AUSTRAC.

However, when you have paid taxes for your income in another country before you send the money to Australia, you may not have to pay taxes for the amount again. Most business-related transfers will be taxed, whether it is in Australia or in the country where the funds came from.

It is always best to consult with an accounting professional regarding the exact tax rates and implications. You will have to report to AUSTRAC when you make money transfers of AUD 10,000 or higher from Australia to other countries. The ATO may also audit you to determine tax implications on your transfers of large amounts.

It’s recommended that you consult with an accountant or get legal advice about your large transfers to ensure that you comply with the international money transfer regulations in Australia.

Requirements for international money transfer

Generally, your bank or transfer service will help you in preparing for cross-border transactions. However, it doesn’t hurt to be prepared in advance. Regardless of how large your international money transfer amount is, you want to have documents like your ID, the reason for remittance, proven address, Tax File Number, and bank account authentication ready.

For payments of AUD 10,000 or more, international money transfer regulations in Australia state that you are required to declare your transfer.

You will need additional documents, which are required by AUSTRAC to help them detect tax evaders and untracked movements of large sums of money. Here are the documents you’ll need for transfers of AUD 10,000 or more.

1. Certificates that show the address and date of birth of the recipient

One of the concerns about sizeable international money transfers is tax evasion. To combat this, AUSTRAC requires proof of address of the recipient to ensure that the money isn’t being sent overseas to avoid tax.

In some cases, certificates with the date of birth of the recipient to verify their identity can also be required.

2. The reason for making the transfer

While you will also be asked for the reason for the transfer for transactions of less than AUD 10,000, it’s even more important to have this information for transfers of AUD 10,000 or more.

AUSTRAC wants to be sure that large sums of money coming into or going out of the country are made for legitimate purposes.

3. Bank statements for your business’ monthly profits/income and payroll

You will need to provide bank statements detailing your business operations to prove your business is legitimate. Your bank statements will be able to provide evidence of what kind of business you’re doing, as well as what your income and expenses look like regularly.

4. Receipts

If your overseas remittance is being made for real estate or provision purchases made abroad, then you might be asked to show your purchase receipts. This way, AUSTRAC can match and sync the transfer amount with the receipt.

5. Origin of funds being used for the transfer

Considering that international money transfer regulations declare that you have to report large transfers to AUSTRAC to detect and prevent financial crimes, it’s no surprise that money laundering is something that is highlighted.

Providing information about the origin of your funds along with evidence of it will legitimize the transfer and show AUSTRAC that there’s no cause for concern.

What are wire transfer limits and fees?

As per Australia’s international money transfer regulations, there is no actual limit for transferring money into and out of the country.

Some banks might have individual limits on daily transfers that you’ll have to adhere to as their customers, but if your bank doesn’t have a higher limit, you can legally transfer any amount.

However, Australian money transfer regulations state that you are required to report transfers of AUD 10,000 or above to AUSTRAC, which may need additional documentations to be submitted.

The fees for wire transfers depend from bank to bank, although the average fee for sending overseas transfers is AUD 10-30. Receiving overseas remittances usually incurs a fee of AUD 10-15.

International money transfer with Volopay

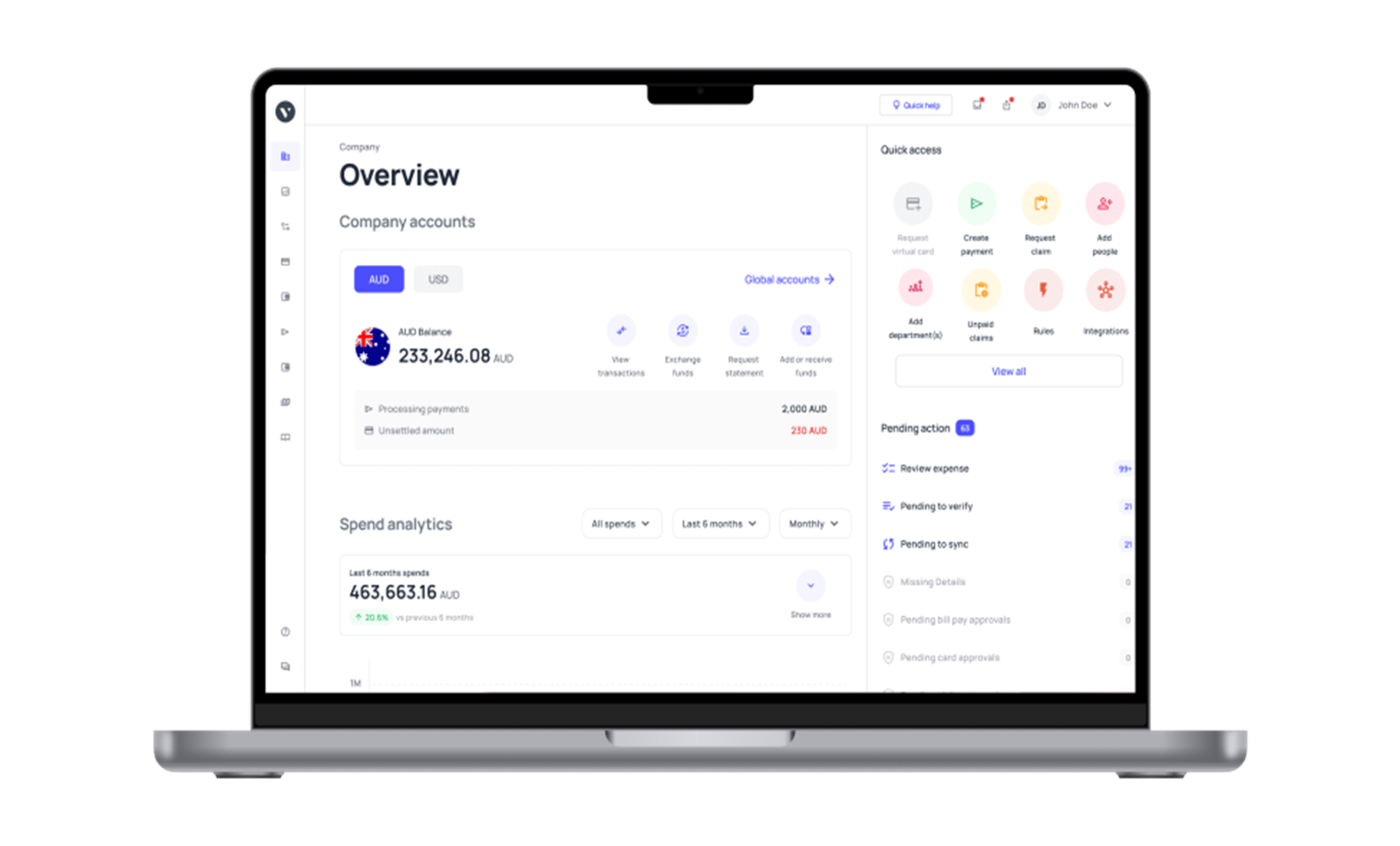

Regardless of how large your transfer is, you’ll want two things: to always comply with the international money transfer regulations and a payment service provider that makes transfers easy for you. Volopay can be the latter for you.

With features that enable you to easily make both domestic and international transfers through our platform, you can enjoy low fees and payments without delays. Everything can be done on a single dashboard.

Create, approve, and send your payment in no time at all. Even international money transfers don’t have to go through long delays. Automate your payments and allow yourself to focus on other aspects of your business—like ensuring that you comply with Australian money transfer regulations.

Do hassle-free international money transfer with Volopay

FAQ's

There is no limit to how much money you can legally send overseas. Australian international money transfer regulations require that you report any cross-border transfers of AUD 10,000 or higher to AUSTRAC.

Yes. Transfers must be reported to AUSTRAC through an international funds transfer instruction (IFTI) report within 10 business days of when the transaction occurred.

No. The limit of international money transfer before it has to be declared to AUSTRAC is AUD 10,000. When your transfer is equivalent to or more than AUD 10,000, you will then have to declare it to AUSTRAC.

That being said, certain transfer methods might also require you to report to AUSTRAC even if the amount is less than AUD 8,000.

Australia’s international money transfer regulations regarding taxes are mostly applicable to receiving remittances from overseas instead of the other way around. You will be taxed for incoming transfers of AUD 10,000 or more. However, it’s best to consult with an accountant about the actual tax rates.

Failure to report transactions of AUD 10,000 or more is considered a violation of the regulations. You will likely have to face penalties such as fines for not complying with this rule.

Transfers made involving an international fund transfer instruction, or IFTI, must be reported to AUSTRAC within 10 business days of when the international fund transfer instruction is sent or received.