How long does international money transfer take?

If your business operates in different regions around the world, you must be familiar with international transfers. Naturally, you would also be familiar with all the hassle and issues of international money transfer time and cost.

Plus, there is no way you can just avoid making any cross-border transactions or eliminate the need for it. So, questions like “how long does international money transfer take?” do not have a correct, accurate answer.

However, various smart tech solutions are readily available and simple to operate to solve these international money transfer time challenges.

How long does it take to transfer money internationally?

1. How long does international bank transfer take?

Usually, international bank transfers take one to five working days. To start the procedure of an international transfer, you first need to gather all the basic essential information like IBAN number, SWIFT number, receiver’s bank account details, etc. These details, along with the money transfer amount specifications, have to be submitted to your bank. Either the bank requires you to be there for the submission physically, or it can be done through the bank’s online mobile app.

Some banks have one more condition attached to the process: requesting the international transfer within the working hours limit. This means that the request for the international transfer must be made before the cut-off time. This cut-off time is different in each bank.

If you submit the details and money for the transfer within the cut-off time, it will be processed either the same day or the latest would be the next working day. Funds from the sender’s bank are deducted on the same day; however, this does not mean the receiver would get it the same day. It might take anywhere between one to five business days.

2. How long does it take for top banks in Australia to transfer?

Again, even in Australia, international money transfer time varies between one to five business days. The transfer time also depends on the technology you use. Naturally, the money transfer would take less time if the technology used is updated and high-tech. In Australia, there are different methods through which businesses can make cross-border transactions.

For example, PayId and Osko are transfer enablers that process payments in almost real-time. Other services include BPAY, which completes the transfers in about one business day, and fintech providers like Volopay, which also complete transfers in one-two working days.

What are the factors that affect transfer time?

Even though there are technologies today that provide almost immediate international transfers, there are still many factors that can cause delays in the transfer time.

Considering these factors, many banks and providers do not promise instant transfers.

1. Security maintenance

The SWIFT transfer network requires the funds to pass through three different banks before showing up in the receipts bank. Additionally, different banks have different fraud protection procedures, which might also take time.

2. Weekends and non-working days

Simply put, international transfers can be late because of holidays and non-working days. If your bank or the recipient’s bank is closed someday between the transfer time, it is natural that the process would come to a halt. It will only continue when the bank operations resume.

3. Errors in payment details

While submitting your request for an international transfer, double-check all the details and information. Many times payments are halted or sent back because maybe the recipient’s bank information was wrong or the SWIFT code was flawed.

4. Currency conversion

The fundamental currency conversion procedure can also sometimes cause delays in the transfer process. You are making payments in a different currency, and the receiver would want it in a different currency.

5. Timezone differences

Your business is based in Australia and has to send payments to a vendor in London. Naturally, the time zones would be different. This means that the bank's working time would vary; the banks in London might not be operating at that time of the day. Hence, this can also create a time lag in international money transfers.

International money transfers made easy with Volopay

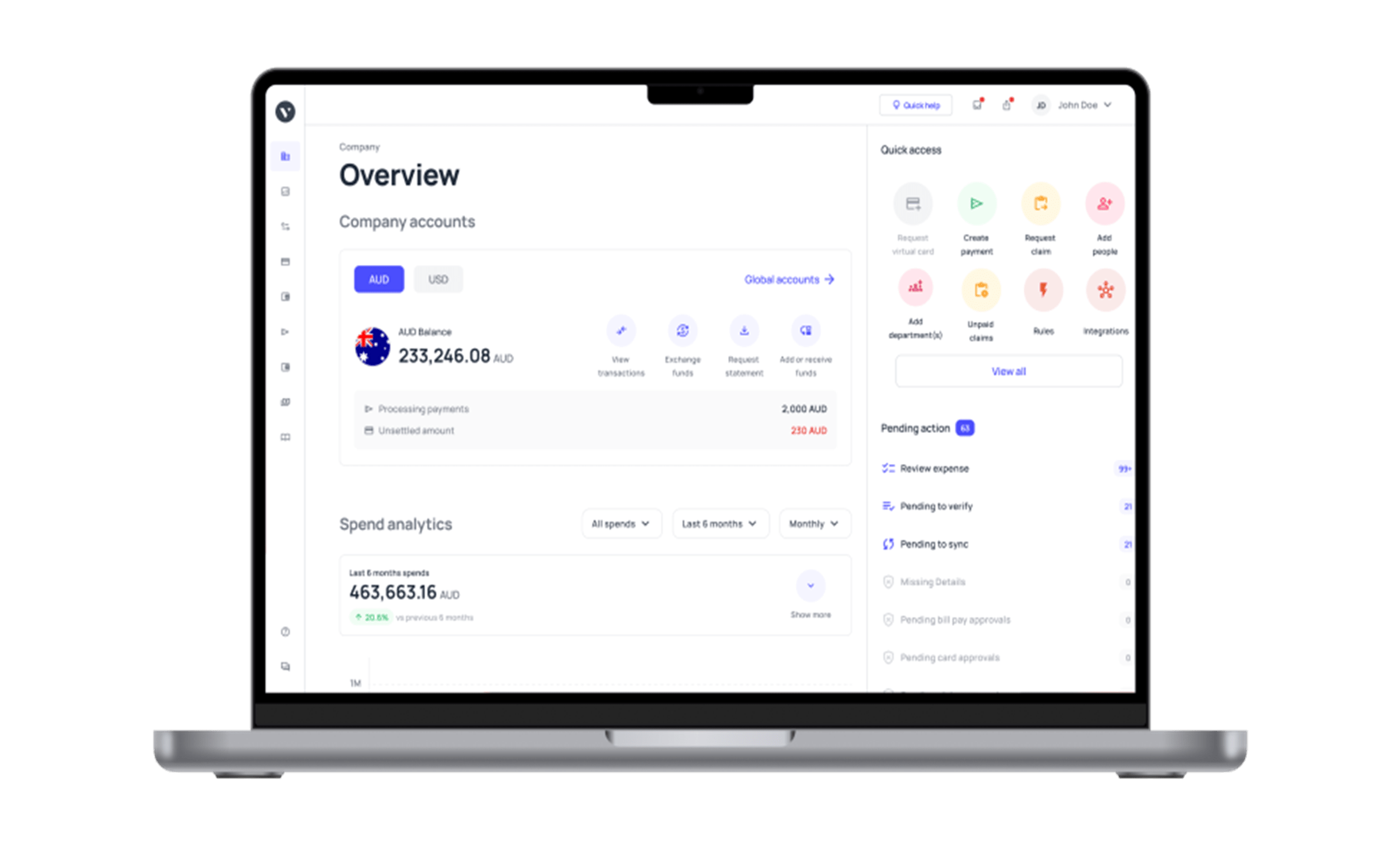

One of the best international money transfer providers in the country is Volopay. You would now ask, why? Volopay is an expense management software that, along with providing financial management solutions, also offers excellent international transfer services.

Cross-border transfers made through Volopay are completed within one–five business days. The process of making an international payment is pretty simple. You just have to select a recipient vendor or employee in the system, enter the amount, and some other details like the SWIFT code and description. Voila! Your transfer is done.

The next tremendous benefit of making transfers through Volopay is that it offers the lowest possible FX rates in the market. You might have been skeptical many a time about expanding to international vendors because of the high interchange rates that the banks charge.

But no more; Volopay solves this issue by charging meager and competitive exchange rates on all international transfers.

Just when you thought it couldn’t get better than this, Volopay also offers real-time tracking of all cross-border transactions. This means you will no more have to sit around for days and wait to know the update on the transfer. The Volopay dashboard gives you a transparent look into the transfer process so you can know the exact whereabouts of your payments.

The international exchange of money is an inevitable part of running a business ins the market. You have to expand to grow. The expansion would require a safe and quick channel for money transfers. Hence, look at the development of your business and choose the right provider.