How much does it cost to transfer money internationally from Australia?

Any business that grows significantly and starts dealing with vendors or employees outside a country needs to have the operational capability of international money transfers. The cost of carrying out these transactions often depends on the service provider you use and the currency of the business you’re dealing with.

Needless to say, it is a costly affair to send and receive money from Australia due to all the different types of international money transfer fees associated with the process.

What are different ways to transfer money overseas from Australia?

Banks

Banks are probably one of the oldest financial institutions to exist across the world. Not only are they useful for storing money but also facilitate transactions of complex nature even between entities that are in different countries.

You will find that many banks in Australia offer international money transfers as one of their services to their customers.

Payment service providers

Apart from traditional institutions like banks, the 21st century has seen the emergence of many new-age technology-based payment service providers.

These B2B FinTech companies rely on digital infrastructure to help businesses transfer money from Australia to different parts of the world in a much quicker way than traditional banks. Some payment service providers also offer multi-currency accounts to streamline international money transfers by avoiding frequent currency conversions.

Cash or cheque

Apart from legacy banks and modern payment service providers, there are other multinational financial services companies like Western Union & MoneyGram that facilitate international transfers even through cash or cheque payments.

The thing to ensure when choosing such providers is whether your receiver’s location has a branch from such an institution.

List of fees associated with international money transfer

Transfer fees

The sender’s bank fee for international transfers is known as the transfer fee. This might be a fixed amount or a fixed percentage of the amount you are sending from Australia. The transfer fee may also be different depending on the type of account you hold with the bank.

While every bank or service provider charges differently, the average international transfer fee can be anywhere from 2-4% of the total transfer amount.

Intermediary bank fees

Whenever a bank conducts an international transfer, it is most likely taking place through an international network such as SWIFT(Society for Worldwide Interbank Financial Telecommunication).

When money passes through different banks in different countries within this network for the purpose of currency exchange or easy transfers, then they charge a fee to process such payments known as intermediary bank fees.

Recipient bank fees

Once a sender’s payment amount finally reaches the receiver’s bank account, they might also charge a collection fee. This is known as the recipient bank fees.

As the sender, you can gather the fee information from the receiver before the payment so that you can send a little extra money so that even after the fee cuts, the receiver gets the amount that they were supposed to receive.

Exchange rate

The exchange rate is the amount that will cost you to convert money from one currency to another. The rate that banks or service providers use is often the mid-market exchange rate which is an average of all the exchange rates in the market for any currency.

But you will often find many banks and institutions charge higher than the mid-market rate and essentially profit off of the transaction.

How much does it cost to transfer money internationally?

1. Wise

Wise charges a fixed transfer fee and a percentage of the amount you’re transferring depending on the plan you choose with them. They have a $0 receiving fee for certain currencies such as AUD, GBP, EUR, and USD. For currency conversion, they use the mid-market exchange rate.

2. Westpac bank

The transfer fee for sending money in a foreign currency is $10 and $20 when sending in AUD. Westpac bank charges $12 for receiving money internationally. The exchange rate used by the bank is not fixed and may vary depending on the type of transaction and the amount of the transfer.

3. NAB bank

The transfer fee for sending money in a foreign currency is $10 and $30 for transferring in AUD. The money collection fee into their account is $15. The exchange rate is variable and the sender will be asked to confirm the rate at the time of the transaction.

4. ANZ bank

The transfer fee for sending money in a foreign currency for amounts below $10,000 is $12 and $18 if you’re sending in AUD. ANZ bank’s collection fee is $15. The exchange rate is variable and will have to be confirmed at the time of making the transfer.

5. Bendigo bank

Sending money internationally incurs a flat $30 transfer fee when using Bendigo bank. If you’re receiving money in a foreign currency then there is a $10 charge and a $2 charge if you’re receiving it in AUD. The bank uses a buy-and-sell rate to convert your money into another currency.

6. CitiBank

Citibank does not charge any international transfer or receiving fee. When making an online international transfer with CitiBank, you will be shown an exchange rate when confirming the payment.

7. ING direct bank

The international transfer fee for amounts less than $10,000 is $15. There is no transfer fee for amounts greater than $10,000. There are no collection fees for money received in AUD. ING direct bank uses OFX to determine its exchange rates.

8.Bank of Melbourne

The international money transfer fee when sending a foreign currency is $10 and $20 when sending in AUD. Their collection fee is $15 in addition to overseas bank charges. The bank charges a fixed 3% conversion fee to convert currencies.

9. St. George bank

This bank charges $10 per transfer for a foreign currency and $20 for sending money in AUD. The collection fee is $15 in addition to the overseas bank charges. This bank also charges a 3% conversion fee.

10. HSBC Australia

The transfer fee is a flat $20. Their collection fee is $10 if the money is credited to an existing HSBC account. The exchange rate for international transfers is variable.

11. Suncorp bank

The bank fee for international transfers through Suncorp bank is $20. They have a collection fee of $10. They use a buy-and-sell rate instead of the mid-market rate.

12. Bankwest

They have a transfer fee of $15 and a collection fee of $10. Similar to Suncorp bank, Bankwest also uses a buy and sell rate instead of the exchange rate to convert currencies.

Cross-border transaction for your business with Volopay

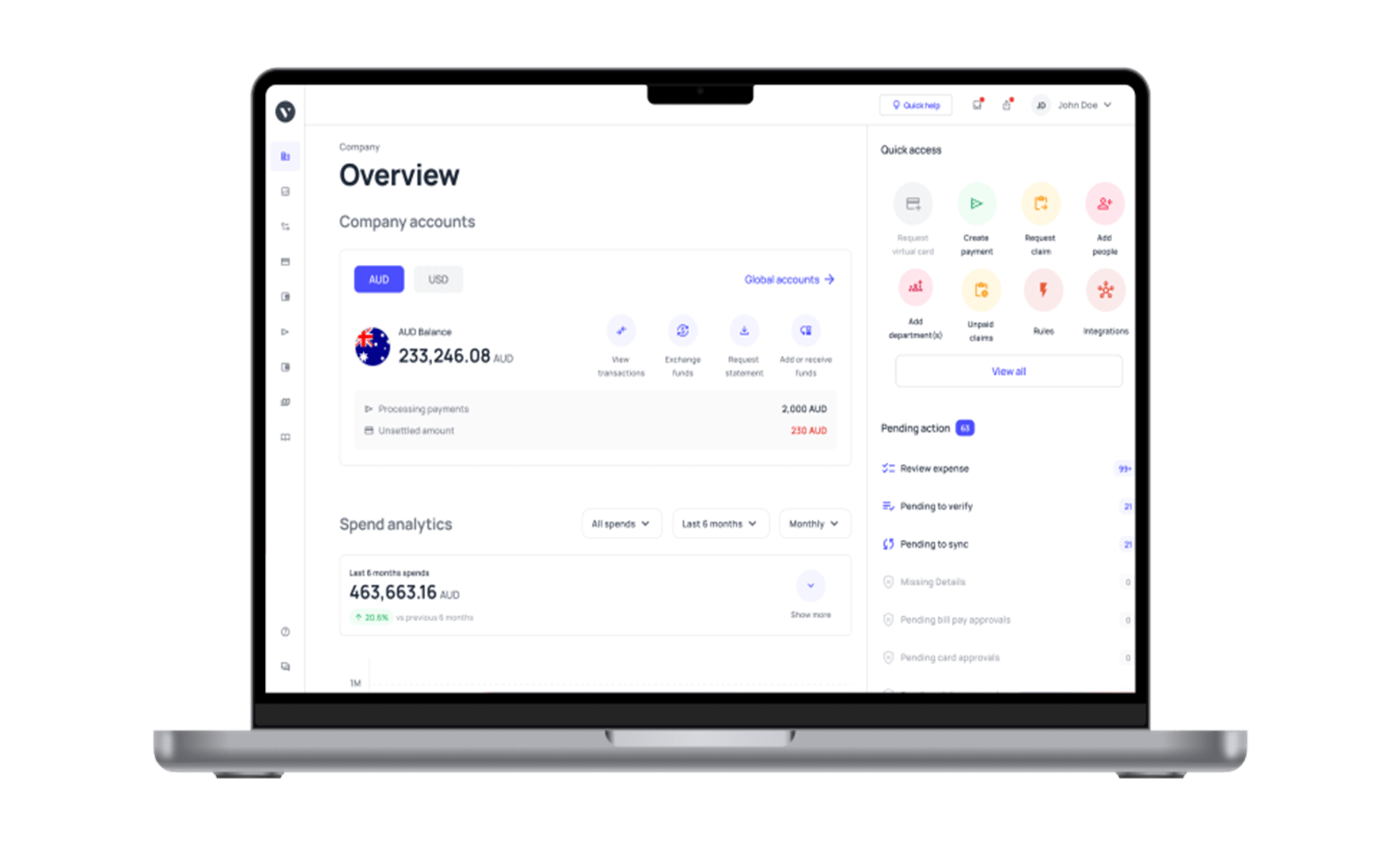

Volopay is an all-in-one expense management ecosystem to help companies manage all their payments and money transfers. Using Volopay for your international transfers from Australia is a much better option than relying on traditional banks thanks to our multicurrency wallets.

Volopay’s multicurrency wallet lets you send and hold money in over 60+ currencies across 100 countries. So if you are in Australia and want to send money to the USA, then you can simply open a USD currency wallet using your Volopay account.

Now you can load this USD wallet with the money you want to transfer and use it whenever you want to make payments to a vendor in the USA. So whenever you send money using this USD wallet, it essentially acts as a local transfer from your USD account to another USD account.

This is beneficial for businesses as you save the FX fees that would have otherwise been charged for each transaction you process from a bank or other financial institution.

Volopay lowers your cost of international money transfers by providing the lowest markup fees. We also ensure that you get the mid-market rate when loading a foreign currency wallet; you will be able to see the exchange rate before you load any wallet.

So depending on your business use case, you can easily hold money in multiple wallets within Volopay and use them to make international payments without losing a lot of money on different types of money transfer fees.

Transfer money internationally with Volopay

FAQs

The transfer of money from one country to another and the conversion from one currency to another requires certain infrastructure to be in place for the process to be carried out smoothly. To maintain and run this service efficiently, banks charge individuals and businesses a certain amount known as transfer fees.

If the money you receive from Australia is a form of income and you are a citizen or resident of Australia, then you must declare the amount on your Australian Tax Return and pay taxes accordingly.

Australia has many payment service providers from legacy banks to new and modern FinTech companies. Some of the traditional banks include Westpac bank, NAB bank, ANZ bank, Commonwealth bank, Bendigo bank, CitiBank, ING direct bank, Bank of Melbourne, St George bank, HSBC Australia, and many more. Modern FinTech solutions include Wise/TransferWise, Volopay, Weel, etc.