12 best business bank account to consider in Australia (2025)

Every Australian business should consider opening a business bank account to streamline all finance processes and keep them separate from the owner’s personal finances.

Amongst the business bank accounts available in Australia, choosing the best business bank account for your organization is key to ensuring that your business is well-supported and all your needs are met.

What is a business bank account?

A business bank account or a corporate account is specifically for businesses and is operated under the company name. It is exclusively used to process all business-related transactions. These are almost similar to personal accounts. However, features that can be accessed through a business bank account are much more advanced than those of a personal bank account.

For example, you can make business payments and transactions in international currencies and process bill payments and salary payments. Business bank accounts are available for different business types, like partnerships, sole proprietorships, and limited companies.

12 best business accounts in Australia in 2025

1. Volopay Business Account

● Overview

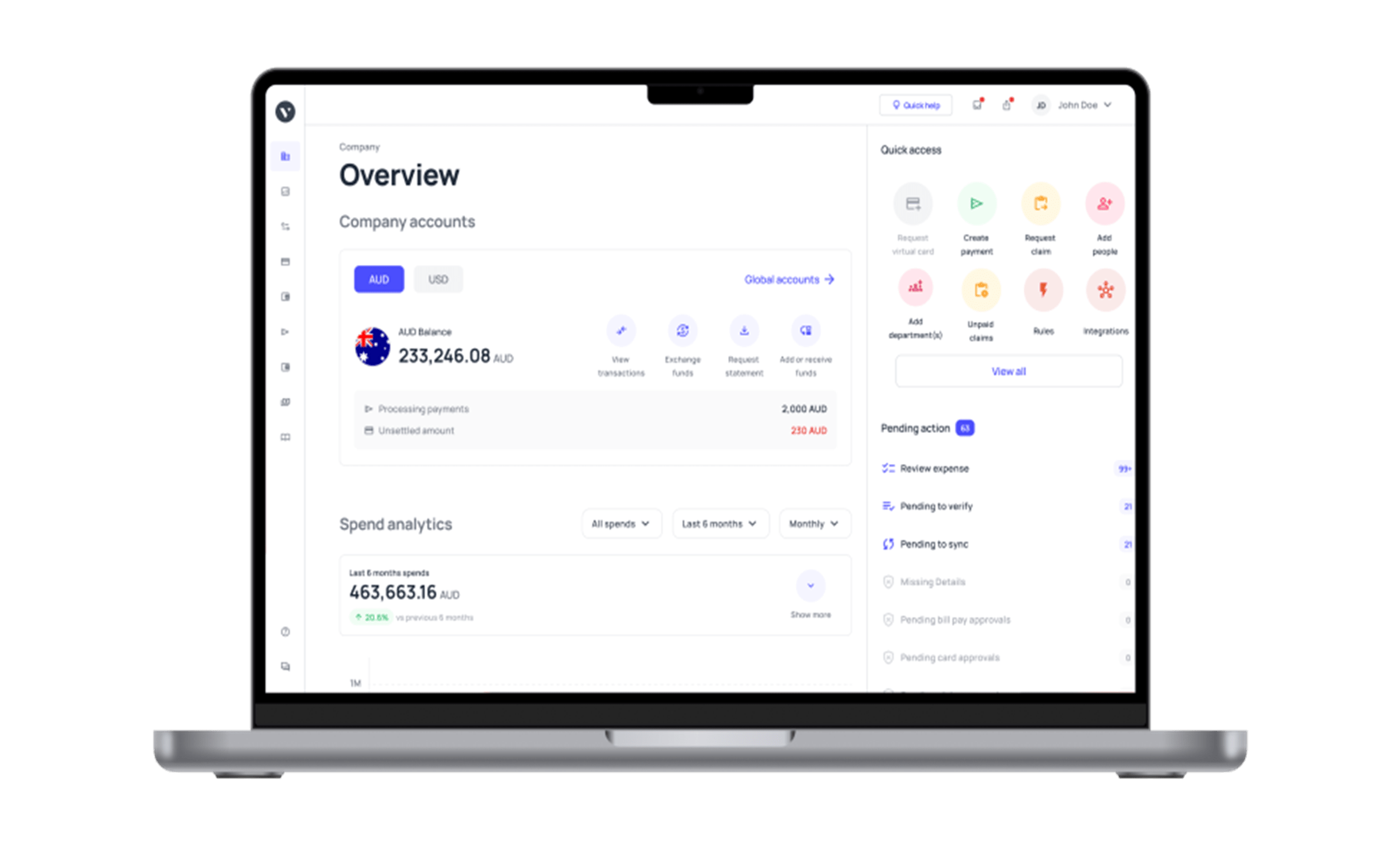

No need to juggle too many accounts and financial tools—Volopay offers the one-stop solution for all your financial needs. With multi-currency wallets, Volopay is the best business account to help you cut back on the hassle of managing your business finances.

● Features

What makes the Volopay business account stand out from other business bank accounts is that you’re also getting a smart financial tool with your Volopay account.

Get a multi-currency account that allows you to manage business finances both locally and internationally.

Manage your vendors, accounts payable, and daily expenses. Real-time tracking, multi-level approval workflows, and accounting integrations are all helpful features readily available to you.

● Advantages

Streamlined expense management, customizable spending limits, and real-time transaction monitoring. Volopay also has an app for easy access wherever you are.

● Limitations

Volopay has no physical branches, meaning that all your spend management has to be done online. You’ll have to make sure you have the necessary devices and a good internet connection.

● Documents required to apply for business account

You’ll be able to apply for a Volopay account online. Be sure to provide your proof of identity, proof of address, and company registration. You’ll also need your ACN.

● Target audience

Startups, tech companies, and SMEs focusing on efficient expense management and digital financial solutions.

2. ANZ Business Account

● Overview

Aimed to simplify your daily business transactions, you can choose one of the two ANZ business bank accounts depending on which is best suited for your business.

● Fees

Depending on which ANZ business bank account you create, you’ll have a different fee structure. The ANZ Business Essentials account has an AUD 0 monthly service fee, but staff-assisted transactions, cheque transactions, and manual merchant deposits will cost you AUD 2.50 each. The higher tier, the ANZ Business Extra, has a monthly service fee of AUD 10 but allows you 20 free ANZ transactions monthly.

● Features

Get a free ANZ Business Visa Debit card and access to the ANZ app to manage your business finances better. Save time with account reconciliation by linking your ANZ business account with the accounting software you use.

● Advantages

Robust online and mobile banking platforms, personalized lending options, and a wide network of branches. If needed the bank also provides affordable financing options in the form of flexible loans.

● Limitations

You can only hold funds in AUD and overseas transactions will cost you fees that will add up over time.

● Documents required to apply for business account

To apply, you’ll need to be the owner of a business operating in Australia. You will also have to be over the age of 18 and able to provide two forms of ID.

A passport and your driver’s license, for example, would suffice. Your ACN or ABN is needed for verification.

● Target audience

Small to large businesses looking for comprehensive banking solutions and personalized lending options.

3. Commonwealth Bank Business Account

● Overview

Commonwealth Bank offers a suite of business banking products, catering to startups, SMEs, and larger enterprises. The bank has more than 800,000 shareholders and over 52,000 employees. They offer a full range of financial services to help all Australians build and manage their finances, making them one of the best business bank accounts in Australia.

● Features

While assisted transactions net you a fee, you get unlimited access to free electronic transactions. With the CommBank App, you can also manage your business finances from anywhere. Get Smart Alerts to stay on top of your account balance and access business analytics tools and accounting integration easily.

● Advantages

Extensive branch and ATM network, innovative digital banking tools, and customizable business packages. They also provide low-rate credit cards and business debit cards. You can also opt for business loans and specific working capital loans.

● Limitations

International transactions can be expensive, with a 3% fee of your transaction value. Withdrawing money at CommBank ATMs outside of Australia will also cost you AUD 2 each, which will add up.

● Documents required to apply for business account

If you’re new to CommBank, you’ll need to present your ID. Otherwise, you’ll need your ABN or ACN (when applicable). Private companies also need to confirm their directors, owners, and trustees’ details.

● Target audience

Startups, growing SMEs, and larger corporations seeking comprehensive financial solutions.

4. National Australia Bank business account

● Overview

NAB provides a range of business banking solutions, targeting businesses of various sizes and industries. The bank supports more than eight and a half million customers in Australia and overseas across personal accounts, small, medium, and large businesses, private clients, and government and institutional activities.

● Features

Get unlimited electronic transactions regardless of what account plan you’re on. NAB also has banker-assisted transactions, deposits, and cheques that are considerably cheaper than the other major Australian banks. With an NAB business account, you can get seamless accounting integration and a free NAB Visa business debit card.

● Advantages

Diverse business loan products, dedicated business support, and competitive interest rates on savings accounts.

● Limitations

Compared to other major banks, NAB offers fewer features. It’s best suited for smaller businesses looking for simple banking.

● Documents required to apply for business account

You need at least two ID documents, which you can choose between an Australian passport, driver’s license, or Medicare card. Present your ABN or ACN and address details for all directors.

● Target audience

SMEs, larger enterprises, and businesses seeking personalized financial solutions.

5. Westpac Business Bank Account

● Overview

Like other Australian banks, Westpac offers two tiers of business bank accounts. Depending on whether you prefer banking online or through a bank branch, one of the two options can be the right choice for your business.

● Features

Manage your bank account online or through the Westpac app. You can set up bank fees to be directly uploaded to your accounting software and temporarily lock your business debit card for up to 15 days without having to go to a bank branch.

● Advantages

Strong digital banking platforms, customized financial solutions, and comprehensive lending options.

● Limitations

Other than the non-electronic banking fees, there is a hefty interest rate of 15.01% if your debit account becomes overdrawn without prior arrangement or approval from the bank. Make sure to always keep a close eye on your balance.

● Documents required to apply for business account

Depending on your business structure, you’ll need different documents. A driver’s license or passport will typically be required for all customers.

Every signatory will have to provide an ID. For companies, you’re required to submit your company registration, ACN, and details of every beneficial owner.

● Target audience

SMEs, larger businesses, and enterprises seeking digital banking innovations and personalized financial services.

6. Suncorp Bank Business Accounts

● Overview

Suncorp Bank provides a variety of business accounts crafted specifically for small to medium enterprises (SMEs). These accounts aim to offer both flexibility and convenience, enabling businesses to handle their finances efficiently. Emphasizing strong customer service and forward-thinking banking solutions, Suncorp has established itself as a dependable option for businesses across Australia.

● Features

The Suncorp Business Account includes essential features such as online banking, a debit card, and no monthly account-keeping fees for businesses with fewer than 10 transactions per month. For those who exceed this limit, there’s a fee of $5 for each additional transaction. Additionally, Suncorp provides tools for budgeting and financial planning, which can be particularly beneficial for new business owners. Customers can also link their accounts to various accounting software, streamlining financial management.

● Advantages

A key benefit of the Suncorp Business Account is the absence of monthly fees for businesses with low transaction volumes, making it a budget-friendly choice for startups and small enterprises. Additionally, the user-friendly online banking platform provided by Suncorp includes features like transaction categorization and spending analysis, which makes it arguably the best business bank account for owners who need to keep a detailed track of their cash flow.

● Limitations

However, there are some limitations to consider. Businesses that frequently exceed the transaction limit may find that the additional fees accumulate quickly. Additionally, Suncorp's branch network is not as extensive as some larger banks, which could limit in-person banking options for customers.

● Documents required to apply for a business account

To open a business account with Suncorp, applicants need to provide identification (such as a driver's license or passport), business registration documents, and details of business ownership, such as ABN or ACN.

● Target audience

This account is ideal for small to medium businesses seeking a cost-effective solution for everyday banking needs, particularly those who do not expect to process a high volume of transactions.

7. Wise Business Account

● Overview

The Wise business account allows you to hold money in 9 different currencies and transact internationally with over 70 countries. Pay local and foreign vendors and employees easily.

● Features and advantages

Wise is a banking alternative that allows you to make local and international payments in just a few clicks. You get a dashboard that you can give your finance team access to in order to help you manage your finances. With an optional debit card at an extra cost of AUD 6, you can also make in-store payments.

● Limitations

Wise only allows you to have one debit card per business account. Keep in mind Wise also isn’t a bank and doesn’t offer overdraft facilities.

● Documents required to apply for business account

If you are a sole trader, a freelancer, a partnership, or a company, you’ll be able to apply for a Wise business account. You can easily sign up online. Documents that you’ll have to submit include your business registration, proof of residence, documentation on who owns the company, as well as the owners’ ID.

8. Heritage Bank Business Accounts

● Overview

Heritage Bank in Australia is a customer-owned bank known for its community focus and personalized service. It offers some of the best business bank accounts in Australia, specifically designed for small businesses and startups, prioritizing accessibility and ease of use. Heritage Bank’s accounts support efficient cash flow management, making them a valuable choice for local enterprises.

● Features

Heritage Bank's business accounts feature online banking and mobile banking capabilities, ensuring that business owners can manage their finances conveniently. The accounts offer competitive interest rates of up to 0.25% for linked savings accounts, which can help businesses grow their funds over time. Additionally, there are no monthly fees for accounts with low transaction volumes, making it easier for small businesses to keep costs down. Heritage Bank also provides integration with accounting software, helping streamline financial management and reporting.

● Advantages

A standout feature of Heritage Bank is its emphasis on community support and exceptional customer service. Business owners receive personalized guidance and access to a dedicated banking team familiar with the unique challenges that small businesses face. This high level of support helps foster trust and loyalty, essential for building lasting banking relationships.

● Limitations

However, Heritage Bank may not offer as extensive a range of business accounts as some larger institutions. This could limit options for businesses with more complex financial needs. Additionally, while the bank is known for its customer service, some users may find that the online banking platform could be more robust in terms of features compared to competitors.

● Documents required

To open a business bank account for small business with Heritage Bank, applicants must present identification, business registration documents, and proof of ownership.

● Target audience

Heritage Bank's business accounts are ideal for small to medium-sized enterprises looking for reliable banking solutions with a focus on personalized service and community engagement.

9. St. George Bank Freedom Business Account

● Overview

St. George Bank provides the Freedom Business Account, tailored for businesses seeking a flexible and easy-to-manage banking option. This business bank account for small business meets diverse corporate needs and is especially suited for those with moderate transaction volumes. St. George Bank emphasizes customer service and simplicity, enhancing the banking experience for its clients.

● Features

The Freedom Business Account includes features such as no monthly account fees, unlimited electronic transactions, and access to a comprehensive online banking platform. The account allows businesses to make unlimited transactions, including direct debits and scheduled payments, without incurring extra charges. St. George also provides various tools for managing finances, including the ability to set up alerts for account activity and easy integration with accounting software.

● Advantages

A major advantage of the St. George Freedom Business Account is its no-fee structure, making it a cost-effective choice for businesses that maintain moderate transaction activity. The unlimited transaction capability is especially appealing for businesses that require flexibility in managing their cash flow. Additionally, St. George Bank’s strong reputation and extensive branch network provide added peace of mind for business owners.

● Limitations

However, businesses with high transaction needs may find the account limiting in terms of advanced features compared to premium options. While the online platform is comprehensive, some users may desire more specialized tools for financial management.

● Documents required

To open a Freedom Business Account, businesses need to provide identification, an ABN, and relevant business documentation.

● Target audience

St. George offers some of the best business bank accounts in Australia for small to medium-sized businesses looking for a flexible and cost-effective banking solution without the worry of monthly fees.

10. Airwallex Business Account

● Overview

Airwallex offers a modern banking solution tailored for businesses involved in international transactions and in need of multi-currency accounts. This cutting-edge platform aims to simplify and reduce the cost of cross-border payments, a critical feature in today’s global market. Airwallex provides arguably the best business bank account for businesses with international operations or clients abroad.

● Features

The Airwallex Business Account offers key features like affordable international transfers starting at just 0.6% above the mid-market rate and the option to hold and exchange funds in more than 12 currencies. This flexibility helps businesses manage international transactions efficiently and economically. Airwallex also provides an easy-to-use online platform for seamless account management and activity tracking.

● Advantages

Airwallex is particularly advantageous for businesses engaged in international trade or those with overseas clients, offering significant savings on currency conversion fees. The platform’s robust analytics tools allow business owners to gain insights into their financial operations, enhancing decision-making. Furthermore, the ability to hold multiple currencies helps businesses manage their cash flow more effectively across different markets.

● Limitations

However, the account may not suit businesses that primarily operate locally, as its features are heavily geared toward international transactions. Additionally, businesses that do not require multi-currency capabilities may find the platform's complexity unnecessary for their needs.

● Documents required

To apply for an Airwallex business bank account for small business, businesses must submit identification, business registration documents, and financial statements.

● Target audience

This account is best for businesses involved in international transactions or e-commerce, looking for a cost-effective banking solution that facilitates global commerce.

11. Macquarie Bank Business Account

● Overview

Macquarie Banking and Financial Services is one of Australia’s five major banks, providing comprehensive business accounts such as business transaction accounts, at-call investment accounts, term deposits, trust accounts, and project trust accounts.

With over 30 years of business banking expertise, Macquarie provides financial solutions to meet and support diverse Australian business enterprises.

● Features

Macquarie business banking offers a high-interest business savings account that can be opened instantly online and requires no payment. The business transaction account is designed for everyday operations, allowing businesses to monitor payments through DEFT, EFT, and batch payments.

Additionally, Macquarie provides investment accounts with an efficient opening process and specialized accounts for managing client funds, contract funding, and subcontractor payments.

● Advantages

The digital application process allows qualified businesses to open an account quickly. It integrates with accounting software for efficient financial management. The business savings account offers an interest rate of 4.65% p.a. on balances up to $1,000,000 and 24/7 access to funds.

Moreover, the at-call investment account has no minimum deposit requirement, and term deposits ensure an early edge from $5,000 with business terms ranging from 30 days to 24 months.

● Limitations

Macquarie does not support foreign currency transactions, so you may need a third party to convert currency. It operates exclusively in AUD, and the Macquarie business savings account cannot be linked to a debit card.

● Documents required to apply for business account

To get started with a Macquarie business banking account, the required information depends on the type of account owner. The details vary based on the business structures— company (domestic private/proprietary, domestic listed public, and domestic unlisted public), individual, sole trader, partnership, trust, and incorporated associations. Credentials commonly requested include an ABN, ACN, or TIN and identification such as an Australian driver’s license or passport.

● Target audience

Macquarie is suited for small to large corporations across diverse industries, such as accounting, healthcare, insurance, legal, real estate, technology, and more, offering effective financial solutions.

12. Bendigo Bank Business Account

● Overview

Bendigo business accounts provide solutions for transactions, savings, trust, and deposits that help to achieve financial goals. Bendigo Bank offers everyday and basic accounts to support the seamless functioning of business ventures in Australia.

● Features

The everyday account is designed for regular transactions, while the basic account is for businesses with limited transactions. The former has a monthly service fee of $15, whereas the latter operates on usage-based pricing.

A minimum balance of $1 is required to open a transaction account. You can access your money with a debit Mastercard and manage your card via e-banking or the Bendigo Bank App.

● Advantages

These accounts are specialized, flexible, and easy to use with minimum transaction charges in Australia. They have multi-factor authentication to verify users, and payments can be made using your smartphone.

● Limitations

Ease of transactions is only available within Australia; international transactions may give rise to additional charges. Also, the e-banking services may take extra time.

● Documents required to apply for business account

When opening a non-individual business account with Bendigo Bank, the required identification documents vary depending on the entity type.

You must provide an ABN, ACN, or ARBN if you are a sole trader, company, or foreign company. All documents provided must be either the original or a certified copy of the original.

● Target audience

Bendigo business accounts are suited for SMEs and organizations requiring specialized accounts.

Enjoy hassle-free business transactions!

Business bank accounts versus personal bank accounts

When you open a business bank account, you’re establishing a separate entity to manage your company’s finances. This helps you keep your personal and business transactions distinct, which is crucial for accounting, tax purposes, and legal protection.

With the best business bank accounts in Australia, you can also access specialized services like merchant controls, payroll processing, and business credit cards.

On the other hand, a personal bank account is designed for your individual financial needs. You use it to manage your day-to-day expenses, savings, and personal transactions. Unlike a business account, a personal account doesn’t come with business-related services.

By using the best bank for business account, you ensure that your business has a professional appearance, making it easier to track business expenses and income, which is essential for financial clarity and credibility.

Related read- Understanding the difference between personal bank account vs. business bank account

Special considerations for small businesses

When it comes to a business bank account for small business, you should look for the best small business bank account to cater to the unique challenges that require customized financial strategies.

Why do small businesses need tailored banking solutions?

Small businesses often operate on a limited budget and need efficient cash flow management. They require the best bank for business accounts to fulfill these specific needs, ensuring funds are accessible and transactions are cost-effective.

Traditional bank accounts may not always meet the flexible requirements of small businesses. They often impose higher fees, limit free transactions, and lack integrated digital solutions, which are crucial for modern business operations.

Key features small businesses should look for in a business account

When choosing the best small business bank account for your business, consider those that rank among the best business bank accounts in Australia. Prioritize accounts with low monthly fees to manage costs efficiently.

Look for options that offer you free transactions both locally and internationally, reducing your transactional expenses significantly. Additionally, consider a multi-currency account that allows you to hold and transact in multiple currencies, which can further minimize your transactional expenses.

Ensure the account provides you with robust online and mobile banking functionalities, allowing you to access and manage your funds conveniently from anywhere.

Further, integrating your bank account with accounting software is crucial for seamless bookkeeping, accurate financial reporting, automating processes, and enhancing your financial management capabilities.

These features collectively simplify your operations, and support your business’s financial health.

By selecting the best bank for business account that meets these criteria, you can optimize your business’s day-to-day financial activities.

Why should businesses have a business bank account?

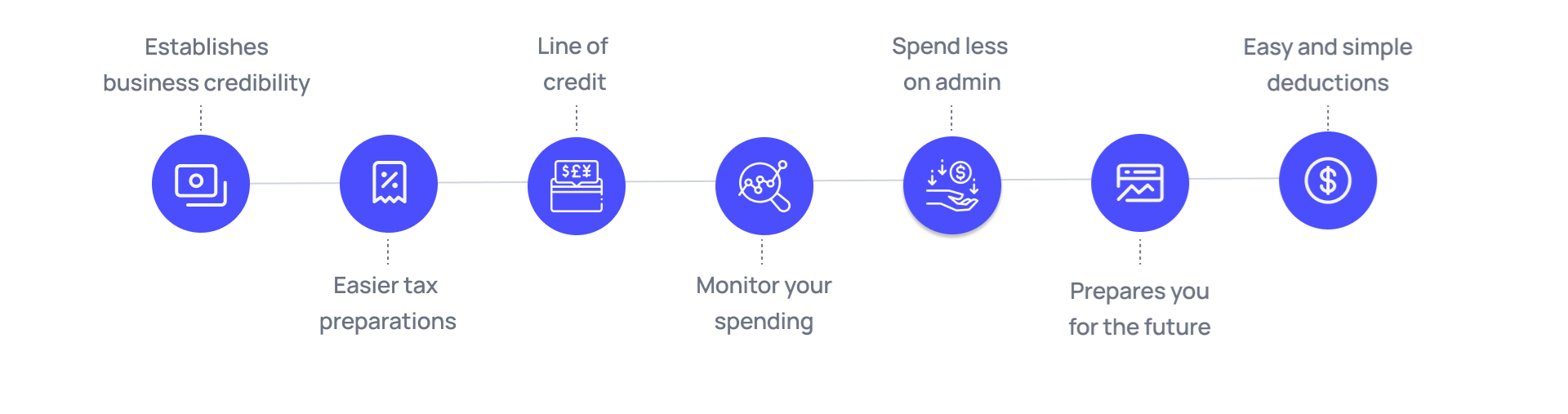

1. Establishes business credibility

Using personal finances to pay for expenses related to your business is considered to be unprofessional practice in the business sector. Your business might come across, to clients, as insincere or hastily operated.

Having a business bank account at your disposal, especially one from the best business bank accounts in Australia, can help avoid this impression.

When you use a business bank account to manage your company’s finances it exudes a sense of credibility, both amongst your employees as well as your clients or customers.

2. Easier tax preparations

A business bank account is also a necessary instrument that can make tax preparation easier for your company. The first thing a business bank account does is that it helps you keep all business expenses and incomes logged in one place.

By doing so you help out your accounting teams a lot because all they need to do is link your business bank account with a tax preparation software that can handle most of the hard work.

3. Line of credit

Having access to a line of credit and at the same time maintaining a good credit score are two very important functions of running a business.

By getting a business bank account you can establish functional relationships with the associated bank.

This can help you obtain an easy, flexible line of credit when you require it. Additionally, a business bank account also makes it easier for you to track and improve your credit standing.

4. Monitor your spending

With a business bank account at your disposal, you can track and manage all your company’s expenditures.

Business bank accounts often come equipped with expense management software that helps you monitor all your business spending from one comprehensive platform. This software updates expense records in real-time so that you get an accurate overview of how company finances are being utilized.

5. Spend less time and money on admin

The best business bank accounts always help business owners cut down on the time and money they spend on administrative tasks such as data entry, expense reporting, and expense reconciliation.

The software that these bank accounts come equipped with helps to consolidate all your financial data into one uniform platform. This makes it much easier for accounting and finance teams to carry out administrative tasks.

6. Prepares you for the future

The primary function of a business bank account is to help keep your personal and business finance separate. By doing so these accounts prepare and protect you from any legal obligations in the future, for example, debt liability.

They also consolidate all your financial data and provide in-depth insights and reports on company spending. Using these reports and data you can map projections for the future of your company and plan accordingly.

7. Easy and simple deductions

Deductions at tax time become especially easy and simple if you have been using a business bank account to manage your company finances. This is because these bank accounts ensure your personal and your business finances are always kept separate.

Additionally, if your business expenses are to legally count as tax deductions you need to prove to tax authorities that your business is legitimate and not just a hobby. Getting a business bank account gives major evidence in proving the same.

Related read: Opening a business account in Australia from overseas

Say no to multiple bank accounts!

What are the key features to look out for in business bank accounts?

1. Multi-employee allowance

Businesses often require multiple individuals to access and manage the company's finances. A business bank account that allows for multiple employees to have varying levels of access can streamline financial operations.

The best business bank accounts in Australia often permit different permission levels, enabling designated employees to make transactions, view account details, or initiate payments, enhancing efficiency and control within the organization.

The account should let an admin and a few managers handle the responsibility of assigning roles to employees. These roles will determine the level of access and authority that an employee has for using the business account.

2. Corporate cards

Corporate cards associated with business accounts provide a structured way to manage employee spending. These cards offer features like predefined spending limits, expense categorization, and centralized oversight.

They streamline expense reporting and reimbursement processes, while also enabling businesses to monitor and control expenditures, enhancing accountability and financial tracking.

Issuing and giving corporate cards to each employee is a great way to replace petty cash and make employee spending more efficient.

It leads to better monitoring and control as compared to hard cash. Budgets can be tracked remotely and disbursing additional funds when an employee needs it becomes much easier.

3. Online portal

An intuitive and comprehensive online banking portal is crucial for efficient account management. It should offer a user-friendly interface with features like account balance tracking, transaction history, fund transfers, bill payments, and statement downloads.

A robust online portal simplifies daily financial tasks, allowing businesses to manage their accounts conveniently from anywhere at any time.

This should be a major factor to look out for as many companies today work remotely with employees spread across different parts of the world. So making sure that the finance team gets access and uses the business account wherever they are is very important.

4. Mobile support

Everyone spends more time on their mobile phones more than ever before. Using apps, communicating with colleagues, and performing various other business functions.

In today's dynamic business environment, mobile support for banking operations is indispensable. The best business bank accounts in Australia typically offer robust mobile banking features to meet these needs.

A mobile banking app that mirrors the functionalities of the online portal enables businesses to access accounts on the go. This includes functionalities such as instant transaction notifications, mobile check deposits, fund transfers, and approvals for pending transactions, providing flexibility and convenience to manage finances remotely.

It helps both the employees to manage available funds and also the managers to monitor how their team is spending budgets.

5. Accounting integrations

Accounting is an extremely important step for any business at the end of a financial period. However, this can be a tedious process if the right systems and processes are not followed.

To make things easier business accounts often have the ability to integrate their platforms with common and popular accounting software available in the market.

Integrations with accounting software, such as Xero, QuickBooks, or MYOB, enhance efficiency by automating financial data synchronization. This integration eliminates the need for manual entry of transactions, reducing errors and ensuring accurate financial records. It streamlines reconciliations, simplifies tax filings, and enables better financial analysis and decision-making.

How to choose the best business bank account in Australia

1. Monthly fee

When you are deciding which is the best bank for a business account you have to consider the monthly fees that you will have to pay.

While it might seem like a small cost at first the monthly fees of your business bank account can add up to a pretty big amount.

2. International fee

International fees and costs are an especially important factor to consider if your company works with a lot of international clientele.

Different costs like international transaction fees, foreign ATM charges, and foreign surcharges are all important costs to consider as they can all add up.

3. Account limits

You should also consider the limitations that these accounts come with.

You need to check whether there are any transaction limits, spending limits, cost caps, and so on, especially when evaluating the best business bank accounts in Australia.

Account limitations are important to consider because they will determine how fluidly you will be able to use the account.

4. Online usability

With everything going online nowadays your bank account too must have online usability. Online usability has become an almost compulsory requirement given how digital and borderless our world has become.

It would be a bonus if your business bank account was also cloud-enabled.

5. Reviews

While it may be difficult to gauge the impact of a bank account provider at first you can, however, form an opinion based on the experience of others. This is where reviews come in, both online and offline.

Make sure you do your market research on reviews and the reputation of the chosen provider.

6. Overdraft facility

Having an overdraft facility at your disposal can be a lifesaver when you find yourself in difficult financial situations. Not all business bank account providers come with an overdraft facility.

Make sure you gauge the need for an overdraft facility for your business and then opt for a provider accordingly.

7. Customer support

Getting to work with a business bank account, especially a new one, can be difficult without the right amount of customer support from the provider.

Not only during the implementation but throughout the time you use a business bank account issues will come up and to solve them you will need help in the form of customer support.

Choosing one of the best business bank accounts in Australia often means better access to responsive customer service.

8. Other credit features

Banks also provide other credit features such as flexible lines of credit, loans, and so on. Start by assessing your present or future need for credit facilities and make your choice based on your findings and financial situation.

If you want a safe bet, however, going with a bank account provider that does provide credit facilities is always a good option.

How to manage your business bank account

1. Separate finances

Keep personal and business finances separate by using the best business bank accounts in Australia exclusively for business transactions to maintain clear records and simplify your tax preparation.

2. Track your transactions

Regularly monitor your account for any unauthorized transactions or errors. Use accounting software that syncs with your bank account for accurate record-keeping.

3. Budgeting and forecasting

Create a budget to manage cash flow effectively. Forecast future expenses and revenues within your business to plan accordingly.

4. Optimize cash flow

Ensure timely invoicing and follow up on your overdue payments. Negotiate favorable payment terms with your suppliers and vendors.

5. Maintain a reserve

Keep a buffer of funds in your savings account for emergencies or unexpected expenses.

6. Reconcile regularly

Regularly reconcile your bank statements with your business records to ensure accuracy.

7. Utilize online tools

Take advantage of online banking tools offered by the best bank for business account for efficient account management.

Set up alerts for low balances, large transactions, or upcoming bills.

8. Understand fees and terms

Be aware of the fees associated with your business bank account for small business and how to minimize them.

Understand the terms and conditions of your bank account to avoid unnecessary charges.

Why should businesses choose Volopay business accounts?

If you are looking for a business bank account provider in Australia that is both feature-rich and at the same time well reputed then Volopay is your best bet.

Volopay provides one of the best Australian business bank accounts that can help improve the global reach of your business.

You can use Volopay business accounts to hold and spend money in multiple different currencies at the same time. Volopay’s multicurrency business accounts also offer a 0$ transfer fee, meaning you won’t be paying any extra SWIFT or processing fees.

Volopay business accounts also come with corporate cards. You can use these cards to streamline and control business spending easily. In fact, you can issue an unlimited number of virtual cards completely free of cost.

Australia has plenty in terms of business bank account providers. Different providers come at different price ranges with differing levels of service and features offered.

It is difficult to outline one single bank account provider as the best solution for all businesses. The best solution will always differ according to business goals, requirements, and preferences.

Make sure you do thorough research before making a choice.

Fuel your business growth with Volopay

FAQ's

Opening a Volopay business bank account is easy. Once you select a plan and provide all the necessary documents, you can create an administrative account and start using it immediately.

• Corporate cards, both virtual and physical

• Direct accounting integration

• Invoice management

• Subscription management

• International money transfer

• Multi-currency digital wallet and many more

When you consider the best bank for business account, it should typically include enhanced security measures like multi-factor authentication, fraud detection systems, and transaction monitoring to protect your business funds.

Yes, you can have multiple business bank accounts to manage different aspects of your business finances, such as operations, payroll, and savings.

The best business bank accounts in Australia let you integrate your business bank account with accounting software, which involves setting up a connection that allows automated synchronization of financial transactions and data for seamless bookkeeping.

Online banking offers benefits such as 24/7 access to account information, convenient fund transfers, bill payments, and detailed transaction histories, enhancing your business’s financial management efficiency.

You can receive assistance by contacting your bank’s customer service, accessing online banking support resources, or consulting with a dedicated business banking advisor.

Yes, many banks offer business account options with minimal initial deposit requirements, making it accessible for startups and small businesses with limited funds.

Yes, the best small business bank account allows you to manage payroll efficiently by facilitating direct deposits to employees’ accounts and handling related transactions.

Business bank accounts provide options such as international wire transfers, foreign currency accounts, and global payment platforms to facilitate international transactions seamlessly.

Yes, some banks offer a specialized business bank account for small businesses tailored to startups, featuring lower fees, flexible transaction limits, and additional support services to meet startup needs.

To select the best bank account, consider factors like low fees, free transaction limits, robust online banking features, integration with accounting software, and personalized customer support tailored to small business needs.