How to open business bank account in Australia?

One of the first things you'll need to do when starting a business is setting up a business bank account for it. All of your financial transactions, profits, accounts payable, employee payroll, and other information will be stored in your corporate bank account.

Whether you require one or not depends on the type of your firm. It is, nonetheless, always prudent to have one. Opening a business bank account is not difficult, even for a tiny company.

What is a business bank account?

Company bank accounts and corporate bank accounts are other names for business bank account. They all have the same meaning, though. A business bank account is a separate account that has been set up specifically for your business. It's where you keep track of your company's finances. You can also use this page to manage your other bills. This could cover anything from payables to payrolls to credit card payments.

Similar to personal accounts, a corporate bank account can be a checking or savings account. It enables you to separate your personal and professional accounts. Additionally, setting up a business bank account comes with a slew of benefits (from the time of opening a business account to using a corporate account), including the option for a multi-currency account that allows businesses to hold and manage different currencies, which is especially useful for international transactions.

Your bank account and bank of choice will be chosen by your requirements. Regardless of how small a company is, it is necessary to open a business bank account. Many banks give additional assistance, including specific incentives, for small company bank accounts. As a result, there's no such thing as opening a business account "too early."

Also, understanding what a business bank account means starts with knowing how it differs from a personal account. Dive into our blog on the difference between personal bank account vs. business bank account to explore these key distinctions.

How does a business bank account work?

Business banking is distinct in that it is specifically designed to assist businesses and corporations in making the best financial decisions possible. As more businesses choose to open a business bank account, the area of business banking is rapidly expanding. The goal is for these financial institutions to assist large and small firms in making better use of their assets and making prudent financial decisions based on their current balances and creditworthiness.

Business banking safeguards your company's status, which is one of the most crucial features. For LLCs and corporations, business bank account serve as proof of their legitimacy.

As a result, banks will offer your business more services. Small-term loans, low-interest credit allowances, spending management advisory, and payroll administration are just a few of the services available. Business banking is also safer and more fraud-resistant.

Related read: What is open banking in Australia?

6 things to consider when opening business account

Opening process and account set up

Long processing time delays and truckloads of paperwork are antiquated procedures. For firms to open business bank account, banking systems today offer highly well-regulated and automated processes. Make a note of which of your selections has the finest method for setting up an Australia business account when deciding where to register a corporate account. Check if you have all of the necessary documents to open the account.

Spend requirements

Many bank accounts have a minimum deposit requirement that must be met before the account can be opened. There may also be a minimum balance that you must maintain to avoid fines. However, this isn't limited to receiving funds. Some banks have a minimum expenditure requirement for accounts, depending on the type of account. If your business is just getting started, choose a bank with fewer requirements and a lower cost.

Accessibility

Business bank account is not only accessible to the individual whose name appears on the documents. Your finance team, accountants, compliance staff, and some employees will need access to bank facilities. It's always a good idea to have a banking system with a powerful and easy-to-use web interface. Make sure they have a mobile app so that staff can access information even when they're on the go.

Additional features and perks

Financial institutions understand how important it is to provide as many benefits to businesses as possible. Business bank account holders have a variety of extra benefits, especially if they open an SME bank account. Accounting integrations and collateral-free corporate cards are just a few examples, as are better interest rates and expenditure analysis capabilities. Examine the advantages and perks that your bank provides to businesses that create an account with them.

Costs

Opening a business account is frequently accompanied by costs. Transaction fees, international currency exchange costs, and even fines for failing to maintain a minimum balance are examples. If you want to run your business with the least amount of collateral feasible, go with a bank that has the best fee offers and the lowest fees. Also, see if your company qualifies for any fee waivers; having a free business bank account is always preferable.

Transaction rules

Many advantages come with a business bank account, and these benefits are based on the assumption that you would use the account. Your business's bank savings account may have deposit limits that must be adhered to. If you choose a business checking account, you may be required to complete a minimum and a maximum number of transactions (or transactional amount). Before picking which accounts to open, carefully review the transaction rules for each option.

What is required to open a business bank account in Australia?

Employer information

To open a business bank account in Australia, you will need your ABN/ACN number handy. You will also need copies of your share certificates, director appointment documents, and company constitution.

Personal identification

The business owner needs to provide personal identification for opening business account in their name. The form of ID will depend on your country of residence and country of operations, but it will need to be a government-issued identification that is not expired.

Copies of the business owners’ passports, birth certificates, Medicare cards, and utility bills should suffice (and will depend on the bank you choose). These need to be provided for every entity having more than 25% holding. Banks in Australia use a point system to approve a corporate account application, and this goes towards the 100-point system.

Business registration documentation

This is the documentation that proves your business entity is registered with the authorities. It could be a tax certificate, an LLC registration document, as well as proof of office space purchase (if your business has an offline office). Your bank will need this to ensure that you are a legitimate business trying to open a corporate account. Your company should be registered under the Corporations Act 2001 (Cth).

You will also need to provide additional documentation depending on what type of company you have. For instance, public companies need to show their listing on the Australian Stock Exchange, as well as register with the Australian Securities and Investments Commission. Trusts require to show their registered investment scheme.

Ownership and partnership agreements

The business bank accounts make room for your business to grow and expand. This includes partnerships. If you share your business with other entities or have entities with a controlling amount of shares, then that legal paperwork is required by your bank. This is purely to ascertain how will be controlling the funds and making authorizations.

Licensing information

Is your company registered? This, of course, is dependent on the industry in which you work and the country in which your headquarters are located. Some licenses are unique and must be obtained after you have established an account. However, some permits must be secured prior to your company's registration. These permits must be given when your company bank account is opened.

Brand and company certifications

Some banks and local laws demand a "doing business as" certificate if your company's registered name and branded name are different. This will be required by your bank, especially if your company has many sub-brands.

Credit score information

Your application will include a credit score if your company has one. If you are creating an account for the first time while starting a business, the credit score of the account owner (the business owner) may be needed.

Related read: Opening a business account in Australia from overseas

Get the best business account for your startups

How to open a business bank account in Australia?

Steps to open business bank account in Australia:

Do your research

Before deciding on a bank, carefully consider all of the available options, advantages, and costs. When opening a corporate bank account, it's critical to conduct your homework on your current status and how you see your company expanding in the future.

Choose the right provider

Research all the options and choose the best business bank account that suits your business needs. It would be ideal if you could get in touch them and see if whatever they have to offer fits your needs.

Decide the type of account you will open

Decide if you'll open a business checking or savings account first (or both). Always consider the interest rates and fees associated with each option.

Gather the required documentation

Make a list of all the essential paperwork once you've decided what kind of account you want. So that there are no surprises or delays once you've filed your application, get them as soon as possible.

Fill out the application

Complete the application fully and accurately. Provide as much information as possible, and be as specific as possible. If your data is right, your bank will process everything more quickly.

Deposit the required amount

As with most accounts (especially savings), there needs to be a nominal deposit made to open the account. Gather the funds for this and write the check that meets these nominal requirements. Many banks in Australia cater to SMEs and have no minimum balance requirements, so look for those!

Activate your bank account

Your task isn't done once you get confirmation that your company account has been opened. It is necessary for you to use it to activate your account. Prepare to use your account by familiarizing yourself with the banking services (both online and offline).

How much does a business bank account cost? Charges & Fee

Administration fee

This is the operative fee your bank charges for owning the account. It might be charged monthly or annually. On average, the range of monthly fees in Australia is between 10-25 AUD. Many services also offer free business bank accounts.

Cash payments

Charges may apply to cash deposits and withdrawals from the account (as well as charges for ATM usage).

Automated payments

Pre-approved payments or recurring transactions may incur fees at some banks. If this is the case, contact your bank.

Manual payments or checks

Checking processing and manual deposits can both be expensive. Take a look at these costs ahead of time.

Minimum balance charges

If your savings account falls below the minimum balance threshold, you may be charged a fee. Make sure this price is within your budget, especially if your cash flow is slow.

Overdrafts

Is overdraft protection available on your checking and credit accounts? Is swiping into a negative balance permissible? Recurring payments might easily put you in danger of going into debt. Check your overdraft costs to make sure they aren't too high.

Additional services

Some premium services (such as specialty cards, insurance, upgrades, advisory, and report preparation) can be charged. If you want to open a low-cost or free corporate account, check with your bank to see if such services are required.

International transactions

Exchange rates, receiving bank costs, administrative fees for the wire transfer provider, and other factors come under the international transaction fees. Have an idea of how much it costs to transfer or receive money from another nation (particularly if you frequently pay for it).

5 advantages of setting up a business bank account

The largest and primary benefit of opening a corporate account is to separate your personal and business finances. Your payroll and your household expenses don’t need to be mixed. Everything pertaining to your business is handled separately, and can also be analyzed separately. Credit scores are also separated so that your personal creditworthiness does not have an impact on your business (or vice versa).

Accepting payments to a personal account can be tricky. Sometimes it needs to be an NEFT/SWIFT transfer, or through a payment application. But many of your clients and customers might need to make card payments to you. A corporate account lets you accept debit and credit card payments, which not only expands your market but also makes your customers’ lives easier.

From a brand reputation perspective, having an Australian business account can improve your credibility. Customers are more likely to make payments to an account that is registered as a legitimate business, instead of a personal account. Employees’ salary slips and payroll make their tax filing streamlined. Additionally, all invoices, receipts, and reports can be generated in the name of your business.

Having a corporate bank account creates a very clean money trail for your business. This comes in handy for compliance, audits, and also when applying for loans and investors. Having a no-nonsense record of your company’s payments improves your legitimacy as a business.

A corporate bank account lets you share the account with your partners and employees without having to hand over any personal assets. Everything related to your company’s finance can be easily accessed by authorized people, and you can have a transparent system for efficient business transactions.

Business bank account: When to open it?

Opening a company bank account is never too early. You can open an account as soon as your business has been registered and the appropriate licenses have been received. Some specific permits may even necessitate the creation of such an account. If you're going to form a partnership, you'll also need a business account.

Starting early ensures a clean audit trail from the outset. Many banks have special packages and deals for small businesses, so you don't have to be a unicorn to open one. Just keep in mind that if you want to grow your business, your financial institution should be able to accommodate your needs.

Volopay is the best business account in Australia

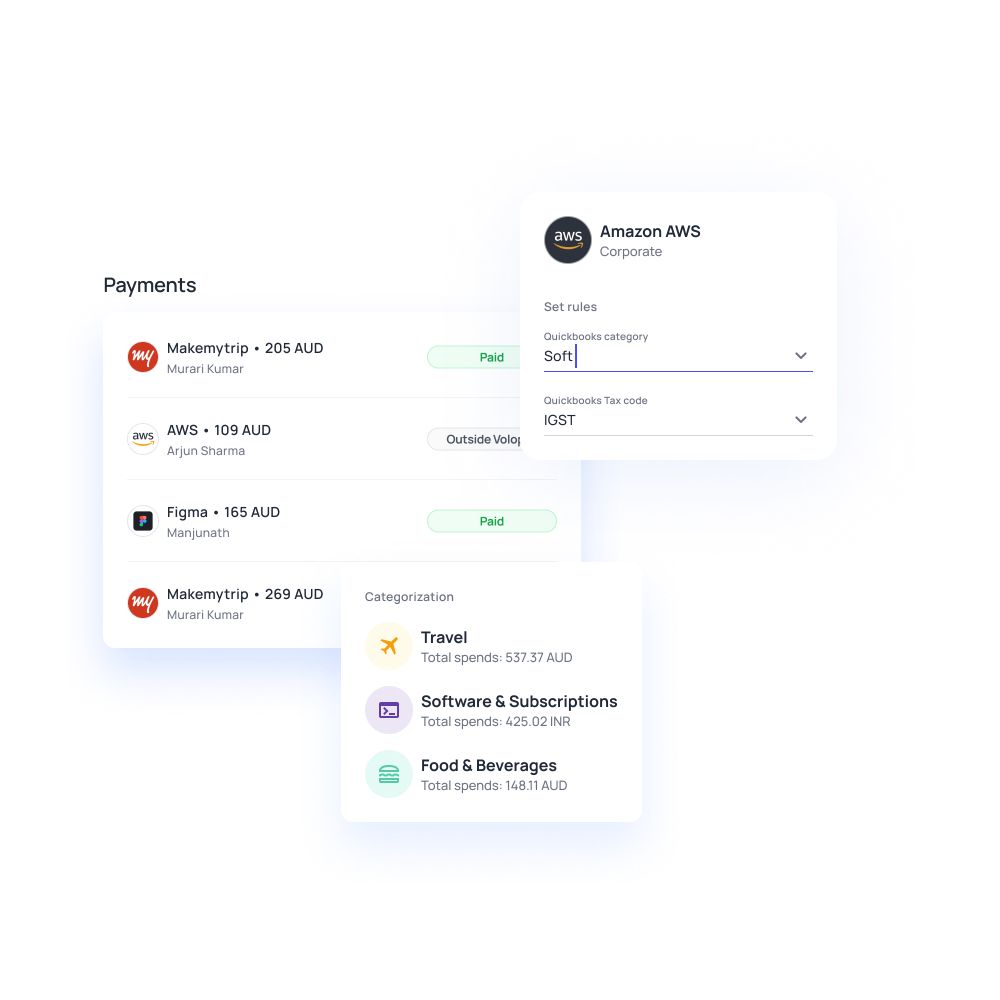

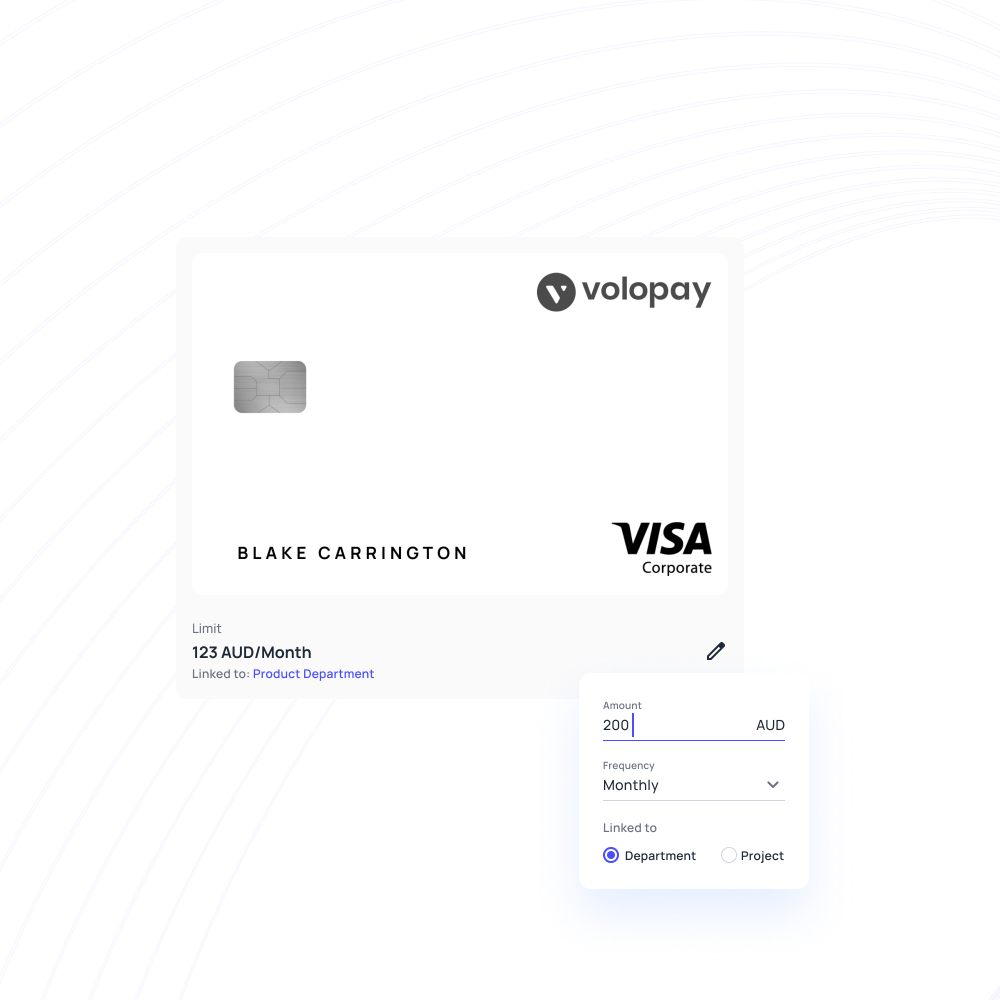

Corporate cards

Instead of giving your employees access to a plethora of debit cards, you can give them corporate cards with Volopay. They are far more secure and protected from fraud.

You can give your employees physical credit cards if they frequently make offline payments - and an unlimited number of virtual cards for online transactions. If your business needs to make SaaS payments, or other recurring payments, these virtual cards can be used for vendor-specific payments.

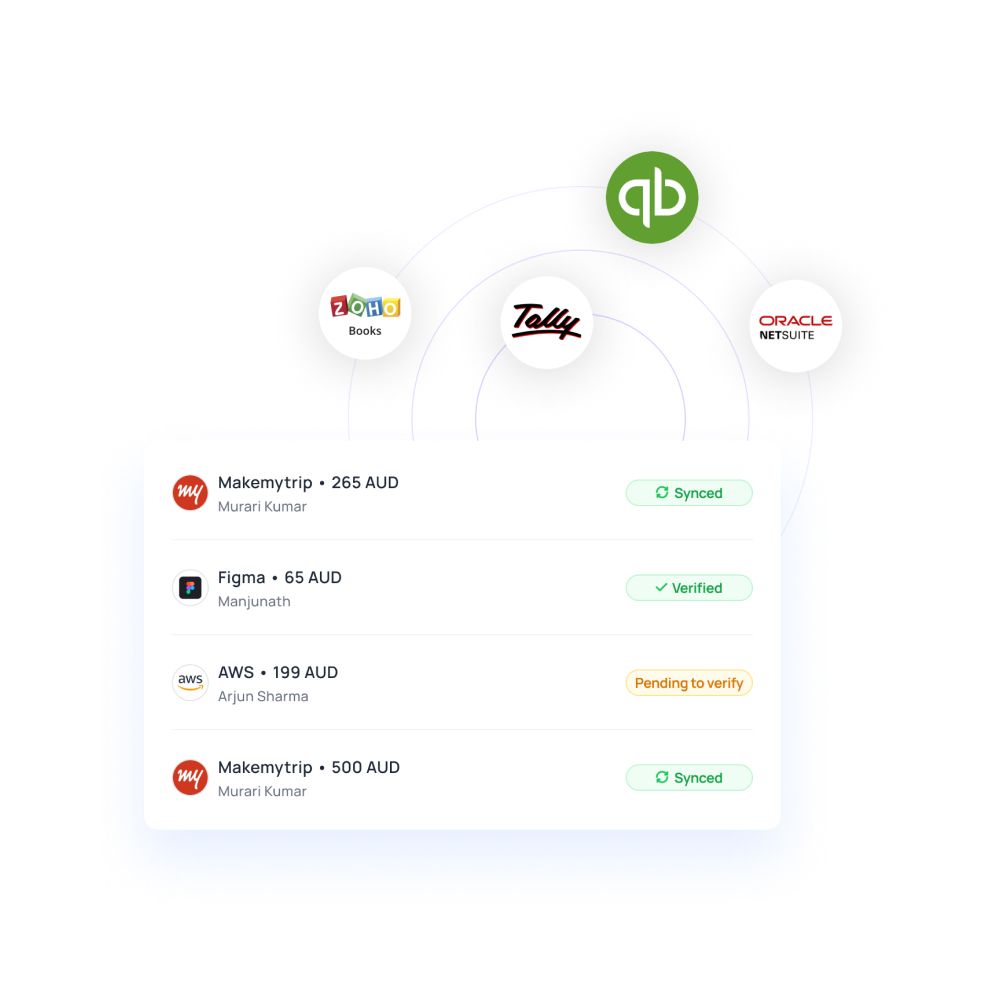

Integrate with accounting software

Even if you choose an excellent banking plan, there are high chances that it may not come with accounting integrations. The automation of accounting has become vital for businesses and having to externally download data only makes the process more cumbersome.

Volopay allows you to integrate your accounting software directly with the portal so that data is transferred directly without manual entry. Volopay also integrates with some HR software that manages payments, such as payroll facilities.

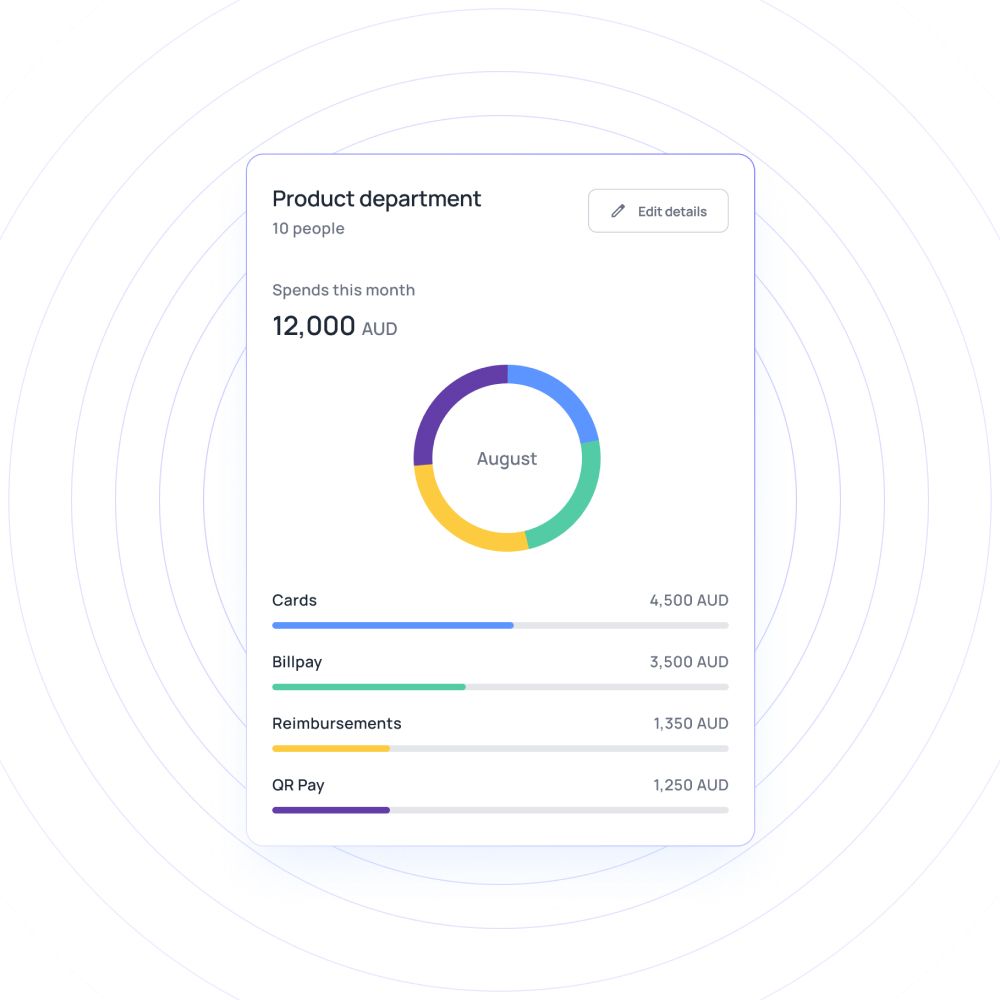

Transparency on spending

Since Volopay is software, everything takes place in real-time. If an employee requests reimbursements, pays a vendor or swipes a card - all data is updated as these transactions take place.

The ability to give all your employees accounts also means that multiple people can access this information, analyze data, and generate reports in a collaborative and streamlined manner. Volopay also has a mobile app so that employees can view their accounts on the move.

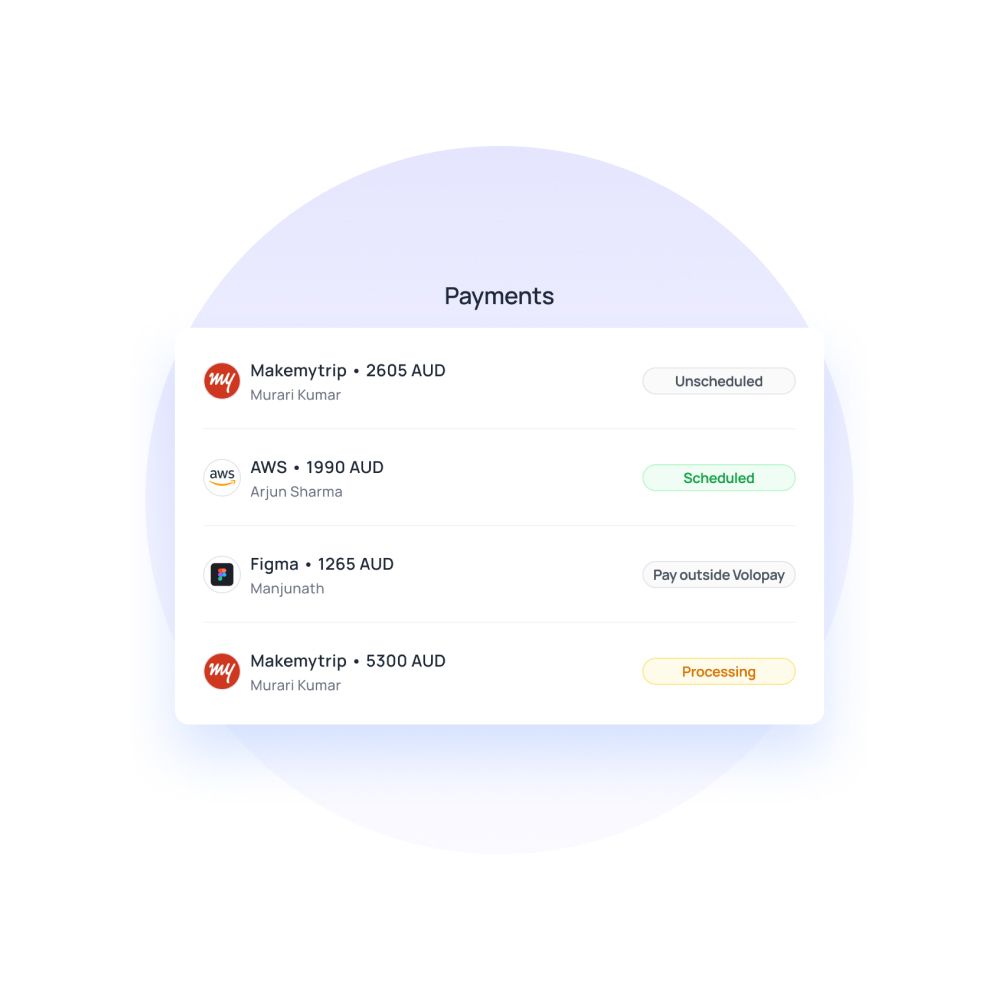

Bill Pay

Volopay’s Bill Pay features work better than a bank account. A centralized location for all your finances, it eliminates the need for multiple bank accounts in different locations. Regardless of where your company is located or how many branches it has, your business can access an eagle-eye view of all its funds from a singular interface.

Moreover, the Bill Pay feature allows you to make a variety of payments at the lowest possible fees. International transactions occur at competitive exchange rates, with significantly lower charges compared to wire transfers (and lesser time!). Your company policies can be assigned to transactions to manage accounts payable in compliance with audit requirements. Budgets can be applied to different departments. It is a one-stop shop for your business banking needs.

FAQs

On the surface, they function the same way. But a corporate account has functionalities specific to a business, unlike a traditional bank account. A corporate account can have offerings such as debit cards for employees, more lucrative interest rates, and payroll processing services. The balance requirements and fees are also, overall, better for your business.

The purpose of opening a business bank account in Australia is to have all your business-related transactions in one place. It separates all personal and business payments. Additionally, business accounts have certain benefits that do not apply to personal accounts (benefits that depend on the bank you choose).

No, opening a business bank account will not affect your personal credit score. However, if you avail of credit facilities, then your business credit score will be calculated separately.

A credit score is not typically required to open a business bank account in Australia. However, it's always a good idea to check with the institution directly to find out their specific requirements.

Yes, an ABN/ACN is required to open a business account in Australia.

Yes, it is possible to open a business bank account online in Australia. Many banks and financial institutions offer online applications for business accounts, which typically require the submission of basic information and documentation, such as the company's ABN (Australian Business Number), ACN (Australian Company Number), and proof of your identity and authorized signatories. Once the application is approved, the bank will typically provide access to online banking services and other account features.

The stricter regulations with increase in compliance checks and other procedures making it more difficult for businesses to open bank accounts

The time it takes for a business bank account to be approved in Australia may vary depending on the bank and the type of business. In general, the process can take anywhere from a few days to a few weeks. The bank will review your application and may request additional information or clarification before approving the account. Factors that can affect the approval time include the completeness and accuracy of the information provided, the type of your business and its financial history, and the bank's own internal processes and policies.

The process of setting up your Volopay account is fairly quick and simple. Once you’ve signed up for a plan and provided your documentation (KYB documentation for verification purposes), you will be invited to create an administrative account. You can get started immediately after that.

Business checking accounts do not, but a business savings account does earn interest. The interest rate depends on the bank you use, and the tier of the account you open.

Volopay is not a bank. It is a spend management platform that allows you to access a requested credit line, create physical & virtual corporate cards, and handle all your SWIFT & non-SWIFT payable transactions. Your funds are stored in an account with ANZ. Volopay is the software that you use to access and utilize your funds, while also managing them without the need for multiple accounts in multiple countries.

Extremely so. Volopay does not keep your money in its own pocket. Your funds are stored in a bank, which is in compliance with ASIC (Australian Securities & Investments Commission). Your data is protected with bank-grade security encryption and access protocols.

Volopay only charges a subscription fee for its software, and there is a range of plans to choose from. If you opt for a credit line with Volopay, there is a nominal fee for that. All transactional fees (such as currency conversion, administration fees, bank markup fees) are charged by banks, depending on the country to which the payment is being made and the country in which your business is located. This fee is not charged by Volopay.

Trusted by finance teams at startups to enterprises.