Open banking in Australia - Complete guide

The evolution of technology has opened gates for many convenient and safe banking practices. Earlier, no one could get their hands on data stored by banks as a means of security and confidentiality.

But this regulation of interoperability by fiscal institutions made finance professionals toil hard to carry out even basic financial tasks. This is where the concept of open banking came in.

What is open banking?

In the agile world, businesses must stay always on top of data and adopt modern and automized facilities. Open banking exactly suggests that. Open banking is a safe practice where banks can collaborate with third-party applications in a safe, regulated way and exchange authorized data. This is made possible by API (Application Programming Interface) that forms the bridge between banks and payment/finance applications. This way, customers can safely access their funds through third-party payment solutions and make payments on the go.

In order to help customers get digital banking solutions at their fingertips, open banking is a must. Imagine this scenario to understand open banking in Australia simply. If you have to send money to someone, you don’t have to drop by the bank or get their entire bank account details. You can simply send them through mobile wallets by withdrawing money from your bank account in just a few clicks.

How does open banking work?

CDR (Consumer Data Right) is the principle that governs and controls open banking in Australia. The Australian Competition and Consumer Commission is the regulator of CDR that takes care of verifying and authorizing service providers who are data recipients.

Whereas the Australian Information Commissioner spreads awareness about the rights and obligations of consumers and stakeholders. Together, these commissions mandate compliance and regulatory measures for open banking in Australia.

Who are data holders (DH) in open banking?

One of the involved parties is called the data holder. Data holders are the authority that holds customer data and must transfer it to authorized data recipients upon request.

At first, only four major banks are allowed to transfer data by CDR. Post-July 2021, many other banks and deposit-taking institutions are added to the list of DH.

Who are accredited data recipients (ADRs) in open banking?

Accredited data recipients are those who receive customers' banking data from banks with customers' permission. The Australian Competition and Consumer Commission must accredit a provider to be an ADR.

These accredited providers are granted a CDR brand mark to use on their platforms. This mark helps their customers to identify whether a service is credible to use and receive information from other providers.

In order to be an ADR, a business must have an Australian address and have adequate measures to protect the data they handle.

Data that can be shared in open banking

Personal information of the account holder, like physical address, contact number, and email address.

a) Account data

● Account holder’s name and type - Full name of the account holder and type of account they operate

● Currency - The native currency in which the account is operated

● Date - The account was opened

● Transaction info - Amounts deposited into different merchant accounts

● Account balances - Real-time account balances and history

b) Information about your financial products

Data about the type of accounts and financial products you use, their rates, features, etc. can also be shared through open banking in Australia.

Open banking mechanism explained

To explain in simple terms how open banking happens, it’s because of API. API is a technical term that refers to a program layer that connects two software. It basically allows communication to happen in between.

In this case, API is supposed to let financial applications obtain the above-mentioned information from banks. Every financial institution mostly has its own API developed. Not all data but only the consented information is allowed to be shared. And this is regulated by the banks, consumers, and controlling bodies.

It’s banks' turn to build APIs to support fintech software and make banking convenient for all types of consumers. Once banks develop their API, financial service providers start designing innovative products to suit the data they get access to.

Though open banking in Australia allows data sharing, the process is meant to be strict and stringent, requiring the customer to fulfill the following procedure.

1. Consent

Consent and ongoing consent from the customers' end is a key principle in CDR Open Banking (Consumer Data Right).

The consent is usually obtained in a webpage/portal of the application that requests access to banking data. The consumer holds the entire right to withdraw or alter the consent, and the involved institutions must abide by it.

2. Identity verification

As sensitive and private data is allowed to be shared, customer identity verification is crucial to initiate open banking processes. The application's website or app interface must verify identity as per CDR standards.

3. Confirm data sharing

Customers must check boxes to confirm data sharing every time they give access to their banking data to a third party.

It might seem like an additional task, but this is for the sake of your data protection. Banks request this from you to make sure what kind of data and how long the data must be shared with the third party.

4. Data is successfully transferred

Once you have consented to the data sharing, with the help of API, data is successfully shared with the authorized, third-party service provider. And the service provider will be able to help you access the services you want.

What can open banking do for its stakeholders?

Open banking benefits different parties in different ways.

For financial service providers

Providing convenient services to their customers is the top priority of service providers. This shift in data management from bigger banks to small financial institutions will create more opportunities and scope for them. The change in an oligopolistic economy will give new providers opportunities to cater to the indispensable needs of their customers at reduced engineering costs.

The ability to access such robust, advanced, and convenient applications will improve customer experience. With seamless access to data, they can create novel and innovative financial products that their customers require.

Instead of relying on unauthorized ways to obtain customer data, fintech providers can get accredited and tap into the data pool the authentic way. There is no risk factor associated if they follow mandated regulations and requirements.

For customers

As a customer, you get the utmost control over who gets to access your data, how, when, and for how long. Even if a customer is not aware of what is open banking, they will still decide whether or not to provide access. Open banking paves the way for customers who want to access upgraded financial services, trading apps, or budgeting applications.

Many customers enjoy cutting-edge money management and mobile banking services curated for their convenient usage. These applications require access to your bank balance, spending, and other data to operate.

Open banking acknowledges this need and allows an easy flow of access that fuel the functions above. No one relies on check payments and online banking anymore. It requires more data to make payments and doesn’t happen instantly.

For businesses

Advanced accounting applications are needed more for businesses than regular customers. Also exist the requirement to keep their banking data confidential. Both needs are met when open banking joins hands with their business account providers.

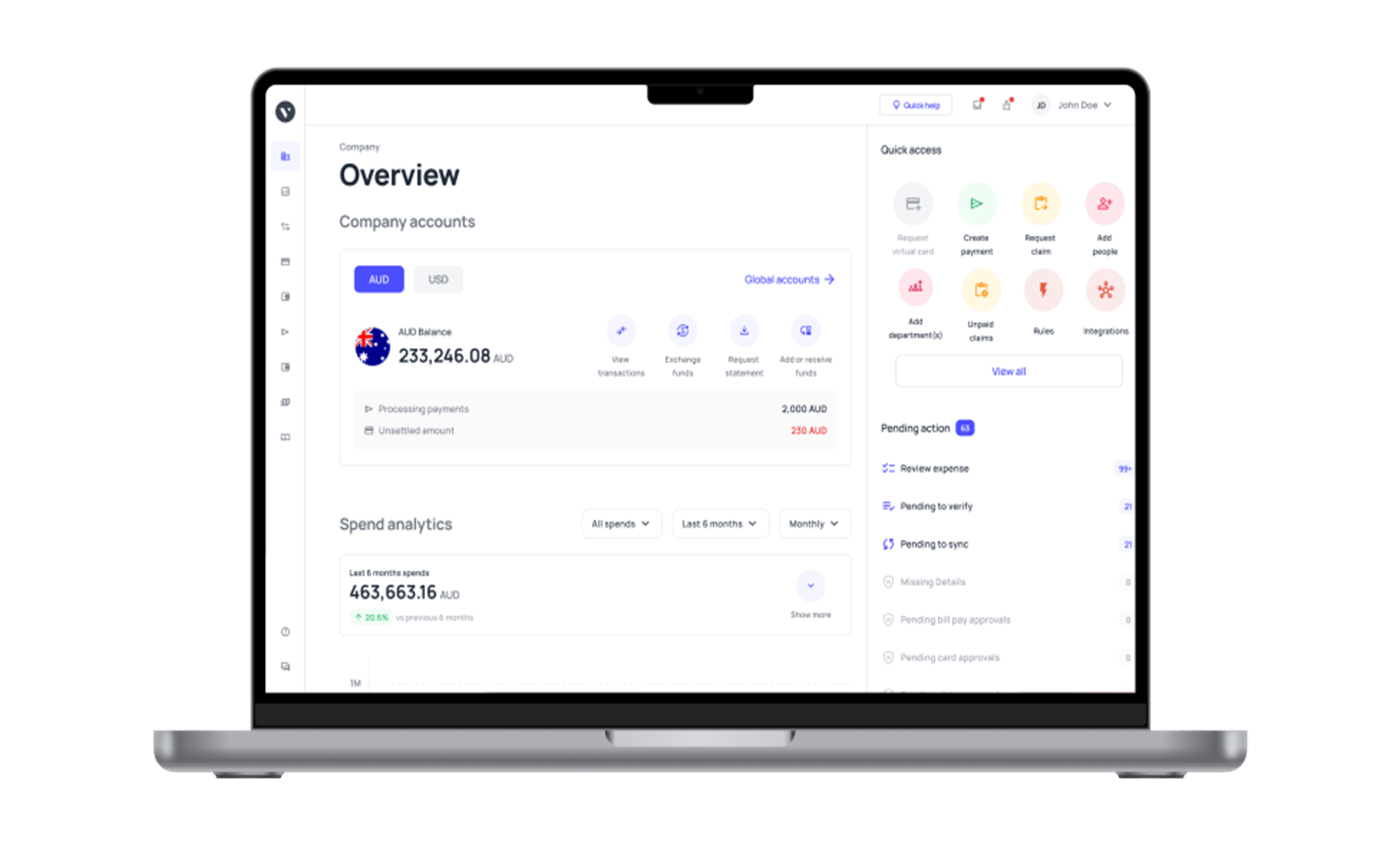

Businesses in Australia can make instant business payments, analyze their spending, make budgets, integrate their accounts receivable with eCommerce apps, and do many other things with open banking.

Many cloud-based fintech service providers in Australia provide the above services at a nominal cost. Only open banking has made it possible to simplify business accounting and financing. Now they can save time and money, manage their accounts more efficiently, and reduce the manpower needed. They can also expand their search and find more tailor-made products and services for their business.

Money management is another aspect that where a business owner must have a better hold of. It can be actualized with the help of open banking in Australia.

Open banking has changed how customers handle sensitive financial data

In the years to come, we can see some major paradigm shifts happening with the way financial products are built and broadcasted. Customers will still hold the ultimate responsibility and switch while having more options to strategize their finances.

Not just the big names but every small business operating in the finance sector will get to develop groundbreaking applications with resources available at ease.

In a short period of time, open banking in Australia has revolutionized and replaced many traditional aspects of banking. This is expected to stay the course leaving positive outcomes for everyone.

FAQs

Open banking in Australia is very safe as it is regulated by Consumer Data Rights federal legislation. It mandates the compliance measures involved parties must follow to practice open banking. Only accredited data recipients and holders are allowed to use API to do open banking. Hence, open banking in Australia is extremely safe.

Ever since 2020, when the CDR was initially launched, banks in Australia kept joining their list of data holders. Right now, their list has over 80+ participants. Banks like Bank Australia Limited, Credit Union Australia Limited, HSBC, IMB, PayPal, etc.

Open banking payments work for businesses and consumers to make quick payments through third-party applications. It lets you make payments without even knowing the bank account number or branch details. This is quicker, easier, and more secure than other modes of payments, and you can always get the status of your ongoing, made, and scheduled payments.