Expense management cards for employees

Managing business expenses in the United States can be challenging. Expense management cards, a smarter type of corporate card for business expenses, help streamline spending across categories like travel, software, and supplies. Volopay’s solution offers real-time tracking, automatic reporting, and greater control, making financial operations simpler and smarter.

From client meetings to travel costs, these business expense management cards help manage spending efficiently. Say goodbye to manual reimbursements—give your team employee business expense cards with the right settings.

Volopay’s cards offer transparency, customizable limits, and seamless integration with accounting tools. Whether you're a startup or enterprise, enjoy secure transactions, reduced admin work, and 24/7 support—keeping your business agile and compliant.

What are expense management cards?

Expense management cards are prepaid or credit cards for employee purchases, helping finance managers and business owners track and control company spending. With features like automated reporting, real-time transaction tracking, and spending limits, they integrate with software to simplify budgeting and ensure compliance.

With Volopay, you set spending limits, automate reporting, and sync with accounting systems. These cards reduce paperwork, minimize fraud, and enhance transparency, making expense management effortless for US businesses of all sizes.

Key benefits of expense management cards for businesses

Expense management cards offer an all-in-one solution for controlling and streamlining company spending. From day-to-day employee expenses to smaller, ad hoc purchases, company spending management cards replace outdated processes with real-time tracking, better visibility, and improved control. Using employee expense cards can significantly enhance your company's financial management.

Real-time expense tracking

You can monitor spending instantly with expense management cards. You will have real-time insight into the usage of each employee's business expenditure card rather than having to wait for monthly statements.

Improved cash flow

Using company expense cards makes cash flow management much easier. As one of the ways to improve cash flow, you can assign budgets and set spending caps for various groups or projects.

Enhanced spending control

Control spending with customizable limits and restrictions. Set expense limits for each department or employee using expense management cards.

This control makes sure that all purchases stay under budget and reduces the chance of overspending. You may improve financial discipline by controlling where and how the money is spent when you provide employees business expense cards.

Simplified reimbursements

Conventional reimbursement procedures can be annoying and time-consuming. You can do away with the need for laborious reimbursement forms by using business expense management cards.

Charges made with employee expense cards are automatically recorded and verified, helping manage employee expenses, and minimize administrative hassle, as opposed to waiting for employees to submit claims.

Automated expense reporting

You’ll save time with automated reporting. Software that automatically classifies and reports spending is integrated with expenditure management cards. The transaction details are recorded instantly when an employee uses their employee business expense card.

Better budget management

Establishing business expense management cards and purchasing cards facilitates efficient budget distribution across departments. You can allocate funds according to the requirements of the project and keep a careful eye on consumption.

Streamlined approvals process

Using corporate spending management cards speeds up the approval process. You can use preset rules to automate approvals rather than manually evaluating receipts.

Employee expense cards allow your finance staff to verify purchases promptly, cutting down on delays and freeing up time for more strategic financial planning.

Increased financial transparency

You may keep precise, detailed records of all your expenses with the help of expense management cards. Every transaction made by employees using employee business expense cards is recorded with pertinent information.

This degree of openness guarantees that every dollar spent is appropriately accounted for and aids in fostering confidence within your company. You gain clear visibility into spending.

Reduced fraud risk

You’ll minimize fraud with expense management cards. Transactions may be instantly monitored, and questionable activity can be promptly flagged.

An employee business expense card with predetermined limitations and merchant restrictions greatly reduces the possibility of abuse and aids in tighter control over corporate funds.

Faster account reconciliation

Using company expense management cards makes it much simpler to close the books each month. Reconciliation is accelerated by the seamless syncing of employee expense card transactions with your accounting system.

With expense and payroll cards feeding real-time data into your system, you’ll spend less time chasing receipts and more time making informed decisions.

How Volopay’s expense management card streamlines your business expenses

If you’re looking to take full control of company spending, expense management cards for business help you track, manage, and optimize employee expenses through smarter tools like real-time tracking, approvals, and secure controls.

Gain complete oversight of your expenses

Ensure that all costs remain within your authorized budgets; you may keep an eye on staff spending across projects and departments. You can stop depending on incomplete or delayed data when you issue business expense cards to employees.

Your dashboard instantly displays each swipe made with an employee's expense card, providing you with unprecedented control.

Get detailed expense reports of every expense made

Creating thorough reports for each transaction made with an expense management card is made easier with Volopay. The merchant names, quantities, and purchase categories are automatically recorded on each employee's business expense card.

No more fumbling for receipts or attempting to reconstruct fragments of past expenditures. These reports sync with accounting software, minimizing manual work and errors. Gain insights into spending trends, ensuring compliance, and smarter budgeting for your US business.

Customize expense categories that suit your needs

Expenses such as meals, software subscriptions, travel, and more can be categorized. Tagging transactions guarantees simple reporting and analysis, regardless of whether an employee's business expenditure card is used for office supplies or client meetings.

Employee expenditure card management is made more intelligent with custom categories, which also assist you in finding areas where your company may cut costs.

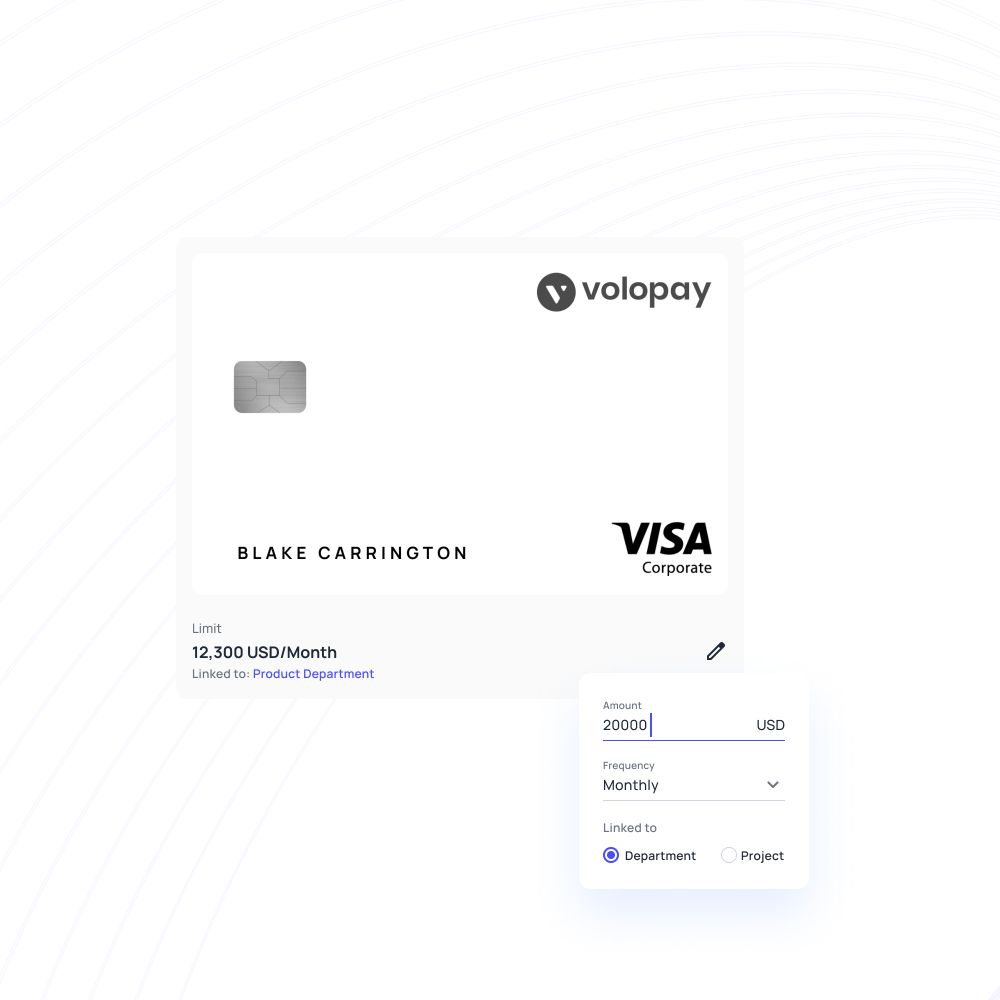

Implement precise spending controls

To avoid overspending, impose strict budget limitations on every expenditure management card. You can set daily, weekly, or monthly restrictions for each employee's business expenditure card with Volopay.

For greater control, you can limit merchant types, locations, and amounts. By providing employee expense cards, you can make sure that every dollar spent complies with corporate guidelines and encourage financial responsibility among your staff without having to constantly monitor them.

Reconcile expenses in minutes

Your purchases and receipts are automatically matched when you use Volopay's business expenditure management cards. To expedite the reconciliation process, employees who use expense cards for their jobs can easily upload receipts using the app.

You keep your financial records completely transparent while saving a significant amount of time and minimizing errors, which speeds up and improves month-end closings.

Get access to our 24/7 support

You can rely on Volopay’s 24/7 support for any expense management issues. Whether troubleshooting or navigating the platform, expert assistance ensures seamless operations. Our knowledgeable support staff is available 24/7 in case you or your staff members run into problems with an employee business expenditure card.

You'll always have someone available to assist you in promptly resolving any issues, whether they relate to employee expense cards or payment issues, ensuring that your business continues to function efficiently.

Implement role-based user access controls

Volopay’s expense management cards for business come with powerful role-based access controls. It is possible to grant different types of access to managers, financial teams, and staff based on their roles.

Better job segregation can be achieved by customizing the limitations and approval permissions for each employee's business expense card. You may keep tighter internal controls by managing employee expenditure cards in a more organized and secure manner.

Leverage advanced security measures

Use Volopay's strong security measures to safeguard your business expenditures. Every expense management card is protected by encryption technologies, virtual card production, and real-time fraud detection.

Secure, closely watched transactions are advantageous to employees who use employee business spending cards. Employee expense cards greatly lower the possibility of data breaches or illegal use, guaranteeing that your business's finances are constantly safeguarded to the greatest standards.

Automatically route transaction requests to approvers

You have the option to configure automatic routing for approval when utilizing Volopay's expense management cards. Every transaction performed using an employee business expenditure card initiates a workflow to the assigned approver, eliminating the need for manual follow-ups.

Employee expense card management becomes easy, guaranteeing that all expenditure requests are examined and approved on time. You keep things under control without impeding your teams' capacity to make the necessary investments.

Start streamlining your expenses with Volopay's corporate cards

Steps to configure Volopay’s expense management cards

Choose your card

First, decide which kind of cost management card best suits your company's requirements. Volopay provides versatile alternatives for both physical and virtual employee business expenditure cards.

Managing both kinds from a single platform is simple. Selecting the appropriate employee expense cards enables you to optimize office supplies, software subscriptions, travel costs, and other expenses while guaranteeing that each payment is clearly linked to your company's objectives.

Define card policies & limits

Establish expenditure guidelines based on your operational and financial requirements. You can set daily or monthly limits, merchant category restrictions, and maximum transaction amounts for every cost management card.

You maintain control over the usage of funds and guarantee adherence to your financial plan when you grant employees business expense cards. Establishing explicit guidelines for employee expense cards safeguards your finances and lowers the possibility of overspending.

Configure approval workflows

You establish approval workflows with Volopay, routing requests to approvers. For quick approvals, assign a manager or finance head to each expense management card.

Every transaction made with a business expenditure card issued to an employee will automatically go through the review procedure that has been set up. Establishing guidelines for employee expense card approval lowers errors, guarantees appropriate supervision, and stops illegal transactions in all corporate divisions.

Integrate with accounting systems

To easily sync data, integrate Volopay's platform with your existing accounting program. Business expense management cards streamline bookkeeping and tax filing by automatically transferring expenses into your accounting system.

Transactions are immediately recorded, sorted, and submitted when employees use their employee business expenditure card. Through this integration, employee expenditure card management will become more accurate and efficient with fewer human data entries.

Set up expense tracking & reporting

You may create real-time reports with Volopay that are filtered by department, vendor, employee, or card usage. Your system receives real-time data from each employee's business expenditure card.

Having thorough information on employee expenditure cards increases financial transparency and gives you the ability to make data-driven decisions that will optimize company operations and budgets.

Assign role-based controls

To control who may issue, utilize, authorize, and review transactions, define user roles. Better internal controls are ensured by Volopay's role-based configuration for cost management cards. Because each employee's business expense card is linked to their user position, management and oversight are made simple.

Maintaining security, reducing risks, and optimizing your cost management procedures are all made possible by managing employee expense cards with defined access levels.

Issue cards to employees

Give your staff members actual or virtual expense management cards after your setup is finished. Volopay makes it simple to issue business spending cards to employees in accordance with departmental or project requirements.

Giving staff expense cards guarantees that they can promptly manage approved charges while adhering to your organization's spending guidelines. You receive total control, and employees get flexibility.

Start making payments

Your staff can begin using the cards for commercial transactions as soon as they are issued. With a Volopay expense management card, each payment is automatically logged, classified, and reported.

Employees can easily pay for travel, subscriptions, and other business expenses using their employee business expense card. Using Volopay to manage employee expense cards guarantees compliance, ease of reconciliation, and real-time monitoring.

Key features of Volopay’s expense management card

You benefit from Volopay’s corporate cards' robust features, including real-time tracking, global acceptance, and advanced security, ensuring efficient and transparent expense management. With their many capabilities, these corporate expense management cards allow you complete control and insight into employee spending.

Instant funds via direct deposit

You can fund Volopay cards instantly with direct deposits, ensuring employees have immediate access to funds for approved expenses.

With Volopay’s expense management cards, you can directly deposit funds into your cards without complex procedures. This feature simplifies fund allocation for your employee business expense card, making it quick and efficient to provide necessary budgets.

Direct deposits eliminate the need for lengthy approvals and ensure your teams have immediate access to the funds they need, empowering better business operations and enabling faster decisions.

Mobile access capability

You can manage expenses on the go with Volopay’s mobile app. With Volopay's mobile access capability, you can maintain control no matter where you are.

Using an easy-to-use mobile app, manage your expense management cards straight from your smartphone.

While administrators can promptly authorize expenses, employees can upload receipts, request additional funds, and check their expense cards for employee transactions.

Even while you're on the go, this mobile-first strategy guarantees effective management of business expenditures.

24x7 customer support

You have access to Volopay’s 24/7 support, which addresses queries promptly. Expert assistance ensures seamless card usage and platform navigation.

Volopay is aware that operations continue after hours. For this reason, they provide round-the-clock customer service for all of your business-related spending management card demands and queries.

The committed staff at Volopay is always available to help if you or your staff members experience any problems with their employee business expense card. Get prompt answers anywhere, at any time, for any question regarding purchases or card declines.

Competitive pricing

Volopay offers expense management cards for business at highly competitive rates.

You can completely optimize your expense management costs while getting premium and comprehensive features that help you control and track spending better.

Instead of paying excessive fees for basic services, Volopay provides you with a cost-effective solution for managing every employee business expense card with no hidden charges. Get enterprise-level service without burdening your budget.

Ease of accessibility

You’ll find Volopay’s platform intuitive, with user-friendly dashboards. The business expense management cards from Volopay are made to be easy to use.

A straightforward and comprehensive dashboard makes online business expenditure management easy for everyone, both you and your staff.

The user-friendly design of each employee business expense card makes it simple to log transactions, request funds, and check balances at any time.

Unlimited reloads

Volopay's expense management cards, in contrast to conventional corporate cards, provide limitless reloads, guaranteeing that you never run out of operating cash.

You may refill employee expenditure cards promptly and without limitations, regardless of whether you need to top them up every day, every week, or every month.

This flexibility gives you real control over your company's spending and allows you to continue running your business smoothly without worrying about funding delays.

International acceptance

With Volopay's internationally recognized expense management cards, you may easily scale your business without any boundaries.

Employee expense cards are trusted and accepted by millions of retailers globally, whether you're paying domestically or overseas.

With no payment barriers, this international acceptance function guarantees that you, alongwith your entire team can effortlessly handle all of your company expenses while traveling abroad, paying vendors, and subscribing to online services.

Enhanced transcation security

You’ll secure transactions with Volopay’s encryption, fraud detection, and instant card-freezing. When it comes to Volopay's business spending management cards, security is paramount.

Take advantage of features like spending caps, merchant restrictions, real-time transaction alerts, and the power to immediately freeze any employee's business expense card.

You can handle your company's cash with confidence using sophisticated encryption and fraud monitoring, free from constant worry about security lapses or illegal use.

Integration with payroll module

Simplify your financial operations with seamless integration between Volopay’s expense management cards and your payroll system.

By linking expense reporting and payroll, you can manage reimbursements, allowances, and employee benefits easily through a single platform.

This integration ensures all of your expense cards for employees are tied directly to employee compensation when necessary, making salary adjustments and compliance checks much more efficient.

How does Volopay’s expense management card work?

You can streamline spending with Volopay’s cards through automated tracking, approvals, and reconciliations, ensuring efficiency and transparency.

A payment is made

The payment is made immediately when you or your employees use Volopay's expense management cards to make a transaction.

Your employee business expenditure card guarantees quick and safe transactions for anything from office supplies to software subscriptions to business travel.

You can make sure every payment complies with your business's spending policy because each card has pre-established spending limitations and category restrictions, which lowers the possibility of fraudulent purchases.

Receipts are uploaded

You have employees upload receipts via Volopay’s app or platform. Digital uploads simplify record-keeping, ensuring complete compliance and easy auditing.

Users are prompted to upload receipts via Volopay's desktop or mobile platform as soon as they make a purchase using your employee expense cards.

Your staff can maintain compliance without the trouble of gathering and submitting paper receipts later, thanks to this quick and easy-to-use tool. Every uploaded receipt is instantly linked to the appropriate expense.

Receipt is matched & validated against policies

You benefit from Volopay’s automated receipt matching and validation against policies. This matching procedure verifies the date, merchant, and payment amount. A disparity is flagged for evaluation by the system.

Every employee business expense card transaction should go through this validation process to increase accuracy and guard against fraudulent claims. This reduces errors, ensures accuracy, and speeds up expense processing.

It also provides a clear audit trail, making your business audit-ready and financial reviews and reporting more efficient.

Request is routed to the appropriate approver

You streamline approvals with Volopay’s automated routing to designated approvers. The expense request is sent to the designated approver in accordance with your company's protocol upon receipt validation.

The business expense management cards from Volopay make it simple to establish multi-level approval procedures. The appropriate person is informed immediately, whether that be the CEO, the finance head, or the direct manager.

Delays are eliminated by this automatic routing, which also guarantees that every employee expense card transaction is examined promptly.

Request is approved/rejected

You rely on Volopay’s platform for approvers to review requests, approving or rejecting with feedback. Before determining whether to accept or deny the expense, the approver might then examine the transaction and receipt that match.

Volopay's user-friendly dashboard makes decision-making simple by offering a comprehensive perspective.

An expense may be denied with justification if not covered by your policy. This ensures purchases made with cost management cards are legitimate and no fraudulent claims go undetected.

Transaction is recorded

You sync approved transactions with accounting tools like QuickBooks or Xero integration via Volopay.

Human error is reduced, and manual data entry is no longer necessary thanks to this automation.

Your general ledger receives precise real-time adjustments for each payment made using employee business expenditure cards.

Your business cost management cards will be a part of a smooth financial environment if they are integrated with top accounting software.

All transactions are promptly reconciled

At the end of each financial cycle, Volopay helps you easily reconcile all of your expenses. You reconcile your transactions effortlessly with Volopay’s smart automation, matching your records to statements.

Reconciliation is a speedy and stress-free process because all of your employee expense card transactions are pre-validated and matched for your accounts.

Your monthly business financial close will be accurate and seamless because everything is recorded and arranged, saving you the trouble of manually verifying each entry or pursuing staff for missing information.

Detailed report is created for your analysis

Finally, Volopay’s reporting module creates detailed expense reports based on all transactions done through your expense management cards. You can analyze spending patterns, department-wise costs, merchant-specific purchases, and much more.

With real-time analytics, you gain valuable insights into how your employee business expense cards are used and can make strategic financial decisions that strengthen your company’s budgeting and spending controls.

You receive Volopay’s detailed expense reports, categorizing transactions for analysis. These insights help track budgets and make data-driven decisions.

Volopay: The expense management card program that every business needs

When it comes to managing business expenses effectively, Volopay’s expense management cards provide the flexibility and control your company needs—no matter what stage you're at.

Whether you're a startup finding your footing, a small business scaling steadily, or a larger enterprise expanding globally, our expense management cards for business are designed to meet your unique needs while ensuring complete oversight and security.

1. Startups

● Easy-to-use interface for quicker employee adoption

As a startup, you need solutions that don’t slow you down. Volopay’s expense management cards offer an intuitive and simple interface, making it easy for your employees to adapt quickly. With minimal training needed, every employee business expense card user can confidently manage their spending from day one without any technical hurdles.

● Quick setup procedure

Time is crucial in a startup. Volopay’s quick setup process ensures your expense cards for employees are up and running in no time. You can easily issue cards, define policies, and integrate with your accounting systems, allowing you to focus more on growth initiatives and less on administrative back-end tasks.

● Minimal administrative burden

Startups often operate with lean teams. Our expense management cards for business minimize the administrative burden on your finance teams. Automated receipt matching, real-time tracking, and seamless integrations ensure that you spend less time chasing expenses and more time driving innovation and strategic growth.

2. Small-sized businesses

● Increased visibility over employee spending

As a small business, gaining complete visibility into your team’s spending habits is vital. Volopay’s expense management cards let you monitor every transaction, set limits, and prevent budget overruns. With every employee business expense card transaction recorded in real-time, you’re always in control without micromanaging.

● Scalability potential for evolving needs

Your business might be small today, but you have big plans. Volopay’s expense management cards for business scale with you. As your operations grow, you can add more users, issue new cards, and implement advanced features, ensuring that your expense management evolves seamlessly alongside your company’s expansion.

● Automation adaptability for increasing spending

Managing rising spend manually can slow your momentum. Volopay’s automated features—like receipt capture, approval workflows, and reconciliation—grow with your business. With expense cards for employees, you can manage increasing volumes without additional workload, freeing your team to focus on delivering better results.

3. Medium-to-large sized businesses

● Advanced analytics for comprehensive reporting

For medium to large businesses, data is critical. Volopay’s expense management cards provide advanced analytics and comprehensive reporting tools. Track trends, identify cost-saving opportunities, and optimize department-level budgets with data-driven insights, giving you a competitive edge in strategic financial planning.

● Customizable workflows for diverse teams

Larger teams often mean complex expense workflows. With Volopay’s expense management cards for business, you can create customizable approval workflows that match your organizational structure.

Whether it’s marketing, sales, or operations, every employee business expense card transaction flows through the correct channels seamlessly.

● Worldwide acceptance during global outreach scaling

As your company expands internationally, your expense cards for employees need to work everywhere. Volopay offers worldwide acceptance, supporting multiple currencies and international merchants.

Whether your team travels frequently or you’re setting up new offices abroad, Volopay ensures that managing global expenses is simple, secure, and compliant.

Bring Volopay to your business

Get started now