8 types of business expense categories to include in budget

Budgeting holds paramount importance as it decides how much a business is supposed to spend. Without that, you will be clueless on where to invest, how to handle the cash flow and incoming money, and how to avoid useless expenses.

This is why the finance team gives utmost importance to this task and performs it with diligence. They go through the past quarter or year’s spending and try to identify patterns and insights. This is how they estimate the expense categories and their monetary consumption. Without budgeting, there is no regulation in expenses and without that, your financial resources will soon start to exhaust.

What are business expense categories?

If there is one thing without which your business cannot run and go forward, then it is the business expenses you incur every day. Expenses are unavoidable but if you track and categorize them, you will be able to save some through the means of budgeting. To organize the expenses, you need to know the categories your expenses fall into.

To make an effective budget plan, you have to start with making the business expense list. But every business has unique sets of requirements and expenditures.

Common business expenses categories to consider when budgeting

Travel

This is a predominantly employee-related expense where they go on business trips and get the money reimbursed from your company’s account. It does not just include the ticket cost but the meals, coffee, local transport, and room booking charges. Certain companies arrange for transportation facilities for their employee's office commutation.

Office supplies

From pen and notebooks to tissue papers, the company account for every stationery employees uses inside the premises. Even if you have digitized everything, there are still a few items that you might have to stock up like computer spare parts, mugs, first aid supplies. These expenses come under this budget category item.

Employee gifts

Cheerful and satisfied employees are those who are constantly motivated and rewarded. Gifts are an impressive way to express that. This expense includes costs spent on employee refreshment activities like office trips, picnics, shows, etc. It also covers the amount companies spend on sending vocational or festival gifts to their employees. As they are booked/bought in bulk, you can save up a lot through discounts.

Utilities

Whether you work remotely or have an office with walls, you can escape from utility expenses. This includes bills like electricity, rent, internet and telephone charges. These are pretty much going to be around the same range which makes it easy for budgeting. To minimize this, aim at building a properly-functioning remote team.

Consultants and professional services

Both small and large enterprises hire professionals to accomplish services like accounting, marketing, sales, audits, etc. These charges are either monthly or project-based. These charges aren’t a handful but if you hire expert agents or service providers, you will be paying a hefty price. If their services are always in demand in your enterprise, you can hire a full-time team.

Software subscriptions

Software subscriptions are the monthly fee of work-related paid applications your employees use. You can find these across every department. And this is always fixed until you decide to continue using them.

Miscellaneous fees

Any other odd expenses that are less frequent like office maintenance or cleaning services come under the miscellaneous category. It also encompasses certain expenses that are there based on your company’s location, industry, audience, etc. One great example of this is shipping charges.

Payroll

Payroll is something you cannot do away with as you have to provide remuneration to the employees who work for you. Payroll as an expense category includes the wages of employees, additional allowances like overtime, sixth-day pay or performance bonus, taxes, other monetary perks, and payroll service fee if you have outsourced payroll services.

Advertising and marketing costs.

Your business needs the assistance of marketing to represent its best self among the buyers and there is a cost associated with it. These expenses include advertising fees spent on different channels, posters/banners designing cost, referral or affiliate charges, paid backlinks and PR, and finally writing and SEO charges if you don’t have an in-built team.

Taxes. As time goes, you can decide which channel and strategy work best for you and discontinue others.

How to categorize your business expenses?

Once you are aware of the categories, you can start with the categorizing work. Grouping doesn't take much time. Here is how you can do it.

Watch your accounting method: Identify how your business handles accounting, whether it's through manual registers, paper bills and receipts, or electronic systems. Using business expense cards can streamline this process by automatically recording and categorizing transactions.

Find out fixed and variable costs: Once you are done with categorizing, you can further break it down into fixed and variable costs based on the frequency and amount spent. Rent, payroll, and subscription fees are examples of fixed costs. Variable costs include travel expenses, meals, employee perks, and benefits are categorized under variable costs.

Always be up-to-date: Instead of waiting till the month-end, you can do continuous closing and hold up-to-the-minute details of your entire accounting team. This is possible when you have modern bookkeeping systems to do accounting functions. Also, watch closely when there is an overspend in any category.

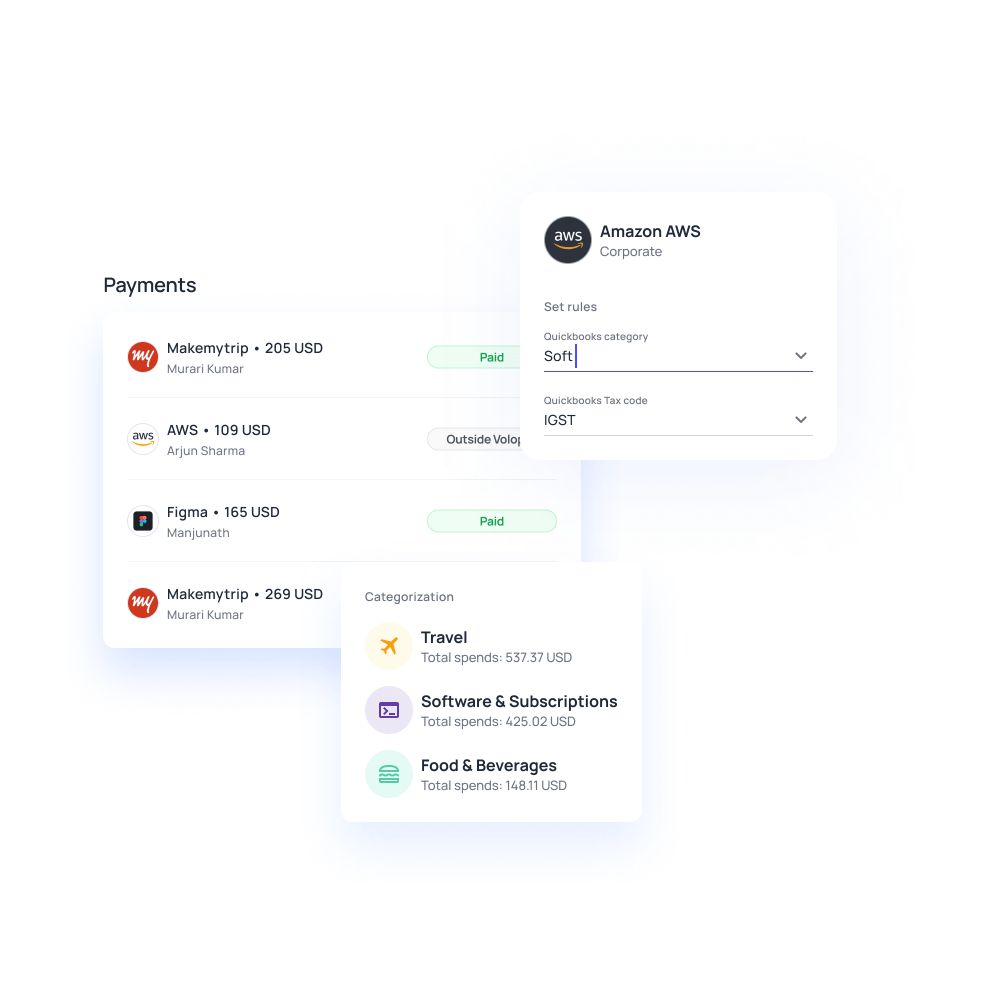

Group common expenses: Instead of noting down two common expenses separately, you can group them together and put them under the same category. Volopay's expense management software has auto-categorization features that automatically do the grouping. If there are two different expenses like the Google ads fee and the Television ad campaign cost, they can be labeled together as marketing expenses. This is how you can avoid too much detail in your budgeting and keep it simple.

Be informed on what costs cannot be counted as business expenses: Costs like penalties, charity, and political contributions, and networking expenses cannot be written off under any expense category.

Customize your expense categories with Volopay

Expense categorization can turn chaotic at any moment if you go through registers and color code expenses with markers. You can always accomplish a lot more than what’s possible with the help of technology. Volopay gives you the technological edge and makes expense management and categorization a breeze. Volopay’s expense management cards provide the flexibility and control your company needs—no matter what stage you're at.

Also, every payment including vendor invoices can be automized till finishing off the transaction. In the main interface, you can see the payments options along with their receipts. Here it is automatically categorized and you can see the label right there.

You can preset the categories and customize them according to your expense nature. You can customize and add as many categories as possible and set budgets for them.

Along with categorizing expenses, you can also add budgets to each category and it highlights and alerts the admin if there is a surpass in the budget. Automatic integrations take this to another level as every expense gets synced to other accounting applications the very moment it happens.

Real-time expense management and budgeting are both possible with Volopay and also real-time financial insights keep you always updated about how much is spent on each category.

FAQs

Volopay expense management software shows every transaction that happened through both bill pay and cards and shows the status of the payment along with its receipt and other information. You can apply filters and view payment entries based on the status, category, time, etc.

Expense workflow is the flow of events that happens between the payment initiation and syncing with the GL. Once the payment is initiated, it has to be approved if necessary and then reviewed, verified and synced with the GL either one by one or all together by choosing the sync option.

Under the transactions folder, you can see the transactions pending to be synced. You can either select all and do bulk syncing which will take only a few minutes. Or you can choose only the reviewed ones and sync them.

Incomplete expenses are the ones that have pending information which needs to be filled. It is highlighted in the dashboard through blue dots which can be clicked on and filled in to proceed further.

Trusted by finance teams at startups to enterprises.