What is procure to pay automation: Comprehensive guide

The market we currently live and work with has truly become competitive. Every single performance metric matters and must be tracked constantly.

Moreover, the cost of doing business has become a constant source of concern for all involved. Finding ways to reduce costs, improve performance metrics and make more money has become harder than ever before.

One route, however, that has surfaced as a source of business acceleration is automation; to be precise, automation of the procure-to-pay (P2P) process.

The traditional procure-to-pay process is infamous for being time and labor-intensive and therefore is not the ideal solution to improving business performance. To improve this process we now have procure to pay automation.

What is procure-to-pay automation?

The procure-to-pay process refers to the means by which organizations identify potential suppliers and vendors, pick the ones that are best suited to organizational needs, place an order for services or goods and then pay for the same.

Automating procure to pay process is a way to streamline this very system. It is designed to bring efficiency to the way vendors are evaluated, selected, and paid using the help of technology.

Procure to pay automation aims to use software to streamline departmental collaboration, eliminate manual tasks, and save money through reduced labor and increased accuracy.

Essentially, it seeks to bring alignment between the functions of the accounts payable and procurement departments. While the accounts payable department pays the bills, the procurement department handles vendors.

These two processes can often become disconnected and lead to inefficiencies in the P2P process. The aim behind procure to pay process automation is to consolidate the functions of these two departments with the help of digitization.

By doing so you can enjoy a host of benefits such as reduced errors and fraud, improved supply chain management, increased visibility into business operations, and better compliance with regulatory bodies.

Why should you consider procure to pay automation for your business?

Automation is a gift that truly gives on giving. With the help of automation businesses across the globe have been able to make their operations far more efficient and streamlined.

Traditional forms of business expense management were plagued with a plethora of issues. Missing invoices, duplicate payments, and poor vendor management are only a few examples.

Now, however, we live in the age of automation. And this particularly applies to the procurement and accounts payable departments.

Automation of accounts payable and procurement processes has come as a saving grace from the nightmares that traditional accounting would bring for accountants and finance teams.

Instead of spending hours doing back and forth, getting approvals, etc., your teams can now work seamlessly with the help of software that can do the manual labor for them.

Therefore, there’s a host of reasons why you should automate procure to pay for your company:

Streamline workflows for the procurement process

Traditionally, workflows in the procurement process were handled manually. This meant a lot of back and forth in getting approvals on requisitions, selecting the right vendors, and so on.

Obviously, such a process would require a lot of time and effort to get the procurement process going smoothly. Now, however, with the help of procurement software connectivity is maintained seamlessly throughout the organization.

With the help of automated connectivity, companies can spend much lesser time and resources on getting requisitions approved, selecting the right suppliers based on data, and producing and sending Purchase Orders (POs) to suppliers.

Reduce invoice processing costs

Processing invoices manually means bad news for your company’s accounting department. It means hours spent sifting through invoices, processing data, getting invoices approved from required stakeholders, and making them ready for payment.

Not only time but money and other resources are also spent heavily on processing invoices manually. Using automation to go paperless can help you save time as well as money.

It can enable your organization to dedicate more time and resources to strategic initiatives, and tasks that generate value, rather than to repetitive, manual tasks that are better handled with the help of automation.

Get complete visibility

Using manual systems to process procure to pay does not do much in terms of enabling complete visibility over operations. It can be hard to track and manage invoices, approvals, requisitions, and so on with manual systems.

Errors and scrupulous accounting often go unnoticed because of paper-based systems. This not only increases the probability of fraud but can also cost you more money and resources in the long run.

A procure to pay automation solution, on the other hand, significantly boosts the degree of visibility you get to exercise over P2P operations, giving both you and your suppliers the power to track the approval status of invoices in real time.

Manage expectations better

With manual systems in place, it can be difficult to set and meet expectations accurately. Delays and errors in getting approvals and processing invoices are pretty much synonymous with paper-based processes.

Thus, it can be difficult to deliver on set timelines for your company if you are using manual procure-to-pay processes. By automating procure to pay processes you can ensure that invoice processing goes straight through, without any delays or glitches.

This way you get to ensure your timelines are met accurately and the expectations vendors, suppliers and other stakeholders have are matched efficiently.

Improve supplier relationships

Supplier or vendor relationships are integral to the procure to pay process. Traditionally, maintaining this relationship would require a ton of communication on behalf of your procurement and accounts payable departments.

This communication is especially difficult to manage if you are still using paper-based systems, vendors will have no idea of the status of their payment unless you communicate it to them manually.

Now, however, you get the facility of using vendor management portals with P2P software. By utilizing such portals your suppliers will be able to know exactly what the status of their invoices are whenever they want.

Related read - Benefits of vendor management system for your business

Improved power of negotiations

If your business is unable to pay its invoices on time or give vendors a concrete platform for tracking their payments you’re likely to have weak power in terms of negotiations. Unhappy vendors will never give good terms of negotiations and why would they?

If, instead, you have a good track record of paying vendors in a timely manner and at the same time your suppliers are confident about when their payments will be initiated the case will be different.

In this case, your negotiation power will be much higher and your vendors will be willing to offer better terms that will be beneficial to your business.

Related read - How to negotiate with vendors to optimize costs?

Improved data and analytics for informed decision making

Another big plus point of using procure to pay process automation is the data and analytics services that this software also provides.

You can get access to in-depth metrics on spend behavior and other such aspects without having to process piles of data manually. Furthermore, you can use this data and analytics to make informed decisions for the future of your company.

It can help you identify potential areas of improvement, loss, and changes that can be made to secure as well as enhance your business’s future.

Streamline your procure-to-pay workflow with Volopay

How P2P automation can benefit your organization?

Generally speaking, there are 5 steps involved in the procure to pay process. Here’s how automating them can help your organization:

1. Requisition

A Purchase requisition is an internal document that is used by employees to raise a request for the purchase of the services and goods required by the company.

It contains product-related details such as its price, quantity, and the department and name of the requestor. Typically it involves three stages - purchase request submission, request screening, and manager review.

Automation of the requisition process helps ensure that there is complete control of spending behavior of the company from start to finish. Your finance teams can create catalogs that are predefined with approved suppliers.

Directly from this collection, your company requisitioners can then choose the services or products that they require. This ensures that there is complete visibility over the what and why of purchases being made.

2. Invoice capture

Invoice capture is that step of the process where your company will receive invoices and capture the data for purchases made from suppliers and vendors.

The invoices received typically include details like purchase amounts, the quantity of goods or services purchased, date of purchase, payable by, and so on.

Doing this manually means tracking all the different channels from where invoices can arrive. This can be hard to do and invoices often go missing because of the manual way of invoice capturing.

With the help of automation, however, all invoice types (including PDF, paper, EDI, fax, XML, and email) can be captured automatically into the system.

This means that the entire process of capturing data from invoices can be automated, with the help of technology like Optical Character Recognition (OCR) this software can automatically capture and extract the required information from received invoices.

Processing invoices in this, touchless, fashion means that all your accounts payable team members need to handle are exceptions.

Issues such as missing Purchase Orders, duplicate invoices, and unregistered suppliers are curbed at the very source before they can lead to more work and significant problems down the line.

Suggested read - Benefits of OCR in expense management system

3. Invoice matching

The process by which information on invoices received is compared against supporting documents such as goods receipts, purchase orders, and contracts is what is known as invoice matching.

Invoice matching can take hours to do when done manually. Growing companies receive an increasing workload of invoices every day and matching these invoices against supporting documents is not an easy task.

Not only does it take time but the probability of errors and scrupulous recording is also high when invoice matching is done manually. Instead, if you use procure to pay automation you can have invoice matching done with just the click of a few buttons.

The software automatically extracts data from the invoices received and matches them with POs, contracts, and other supporting documents, thus eliminating the need for paper-based processing.

With the help of technology, more than 80% of all your invoices received can be matched and processed directly.

4. Invoice approval

Once invoices are received and matched with supporting documents the next step is where the invoices must be approved for the payment to go through.

Traditionally, this would involve your procurement department reaching out to stakeholders in the accounts payable department for approvals on payment.

This could take up a lot of time in terms of doing back and forth and constantly reminding stakeholders of approvals.

Automation of the invoice approval process allows for invoices to be electronically routed, therefore reducing the amount of time spent obtaining approvals.

This can help you ensure that company policy is strictly adhered to in the approval process. Sophisticated automation of workflows can even enable multi-entity organizations to have a seamless approval routing process.

5. ERP integration

The last step of the procure to pay process is where details related to purchases and transactions are integrated with your company’s Enterprise Resource Planning software.

This is done to maintain a record of all transactions while also maintaining a concrete audit trail. Doing ERP integration manually means your AP teams have to go through every single transaction and input its data into your ERP software.

On the other hand, with the help of procure to pay process automation software you can seamlessly and automatically integrate all your purchase data into your existing ERP system.

This can help you ensure that complete visibility is gained over the entire P2P process while a concrete audit trail is maintained for every transaction.

Key features to look out for when choosing P2P automation solution

Knowing how effective procure to pay processes can be with the help of automation is only half the battle.

You also need to be able to make informed decisions when it comes to choosing the right software for automating procure to pay process for your business.

1. Automated reminders for approvals

Approvals make up a vital part of the procure to pay process. Before a purchase can be made the purchase requisition must be verified and approved by the required stakeholders in the accounts payable department.

If this process is slow then your procure to pay process will be sent off the rails at the very start. Ideally, you should be looking for a procure to pay process automation software that is able to detect the need for approvals and automatically send reminders.

2. Analytics on spend behavior

In order to make informed decisions for your business you need to have accurate data on past performance at hand. Now you can gather this data manually but that would take hours of manual labor.

Instead, you should get a procure to pay automation software that can get the data and analytic information for you. The best P2P automation software out there is the one that gives you in-depth knowledge of how your spend behavior has been.

3. Workflow based on rules

Irregular and inconsistent workflows can really set your procure to pay process off of its pace. The automation software you choose must be equipped to handle this.

Preferably, you should get a P2P automation software that comes with customizable workflows that can be made to function according to rules that you can set as per your organizational requirements.

4. Centralized storage

The procure to pay automation software that you choose should also be equipped to handle all the data that you work with. It should be fitted with centralized, cloud storage facilities that let you access your data from whenever you require it.

Leverage the benefits of P2P automation with Volopay

While choosing the right software fit for your company’s procure to pay process automation system can be hard, there are some formidable options out there that make a great case for themselves.

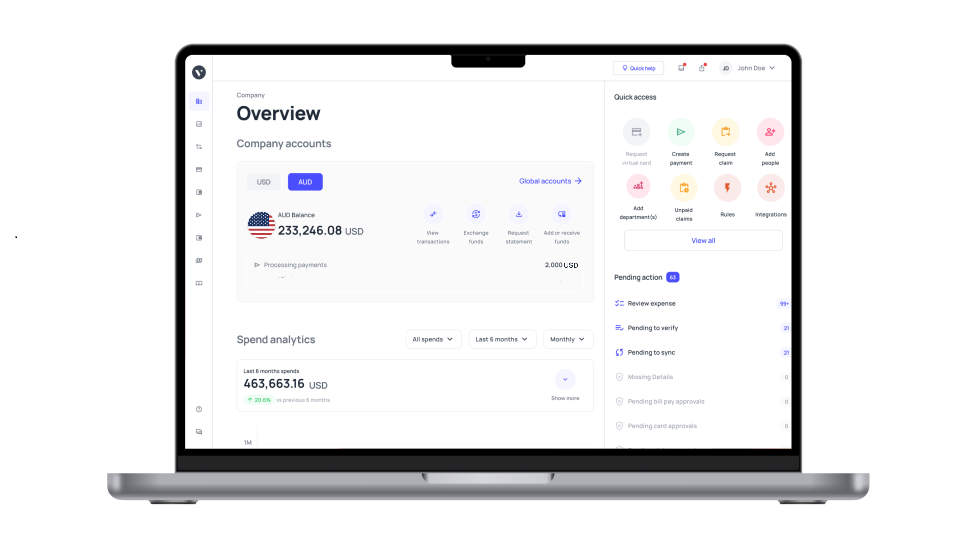

Out of these Volopay is definitely one whose case is quite convincing. Given below are some tools of the procure to pay process that can benefit greatly when automated with the help of Volopay:

Invoice capture, matching, and processing

Volopay is a complete accounts payable and expense management solution. It is capable of managing invoices from the point of receipt or capture to their actual processing.

Volopay can receive invoices from all forms of channels, capture the data on it with the help of OCR capabilities, match it with existing purchase orders or other supporting documents as well as make the payment to the vendor or supplier.

This streamlined approach not only enhances efficiency but also complements the Volopay procurement software in ensuring that all invoice-related activities are synchronized.

Automated approval workflows

Volopay comes equipped with highly customizable, rule-based approval workflows. You can customize these workflows to fit the approval workflow system of your organization.

All you need to do is set up the workflow and let Volopay handle the rest. The system will automatically send reminders to stakeholders without you having to lift a single finger.

ERP and accounting integrations

Volopay is capable of syncing seamlessly with any accounting or ERP system you are using. You can set up accounting triggers and let the system do the integration for you.

Corporate cards

Another huge plus point of working with Volopay is the corporate card feature, especially the virtual cards. You can set up an unlimited number of virtual cards on Volopay.

In fact, you can create dedicated cards for each vendor or supplier in your catalog. This can cut out a lot of the back and forth that is typically required in a procure to pay process.

Cloud storage facilities

All of your accounting data is stored safely on Volopay with bank-grade security. In fact, all your information is secured with the help of cloud storage.

This means that your data is kept in a highly secure place but also that you can access this data whenever you want and wherever you are. This accessibility in an intake-to-procure software is crucial for businesses as it provides real-time insights and data availability.