Benefits of vendor management system for your business

Managing vendors is tough, especially if you rely on many of them for your company. But every organization knows the importance of building a strong and healthy relationship with them to grow each other’s businesses. As startups scale, they start dealing with more and more vendors, and managing all of them becomes tough, specifically processing their payments.

This is where a vendor management system for payments like Volopay becomes extremely important for your organization. Our platform allows you to create and manage vendor payouts both domestically and internationally, source invoices automatically through email/directly upload them/sync from your accounting software, and also autofill invoice fields using OCR.

What is vendor management?

The operations of every company include a vast number of activities that need to be done to gain business from customers.

There will be instances where certain work must be outsourced to other businesses, also known as vendors or suppliers. This can range anywhere from obtaining raw materials for the products you make to freelancers or consultants for your organization.

Usually, this is not a one-time thing, but rather an ongoing process that requires a lot of coordination. This entire process of dealing with vendors or suppliers is known as vendor management.

What is a vendor management system?

The managing of vendors, especially the payments aspect of it needs to be systematic. Traditionally this was done manually by an accountant or finance team.

Although it got the job done, if you’ve dealt with vendors and processed their payments, you would know that there are always chances of problems occurring in the process; errors in the invoices, invoices going missing cause late payments, and various other issues.

To avoid all of this, companies use a vendor management system to streamline their business and build a better relationship with these suppliers. A robust system also helps consolidate vendor relationships, ensuring that the vendor network reduces costs for businesses through improved coordination and minimized redundancies.

Challenges in vendor management

Choosing the right vendor

Selecting the right vendor for your business operations is a crucial task as it will decide how good your business output will be. If a vendor you choose does not comply with your standards, then it will not be a fruitful business relationship. To avoid this, companies generally try out 2 to 3 different vendors at the same time to see who provides the best service.

Related read: Vendor selection criteria: Choose the right vendor

Vendor reputation risk

As established earlier, choosing the right vendor is very important. But to do that, you’ll inevitably have to go through the process of weeding out the ones who you don’t gel with you and who don’t comply with your standards.

So the risk of ending up with pushed deadlines or business operations facing major roadblocks becomes another issue. This is where a company should do a thorough background check of each vendor they are about to onboard and see how their reputation has been so far. This might help to some degree in gaining confidence regarding their performance.

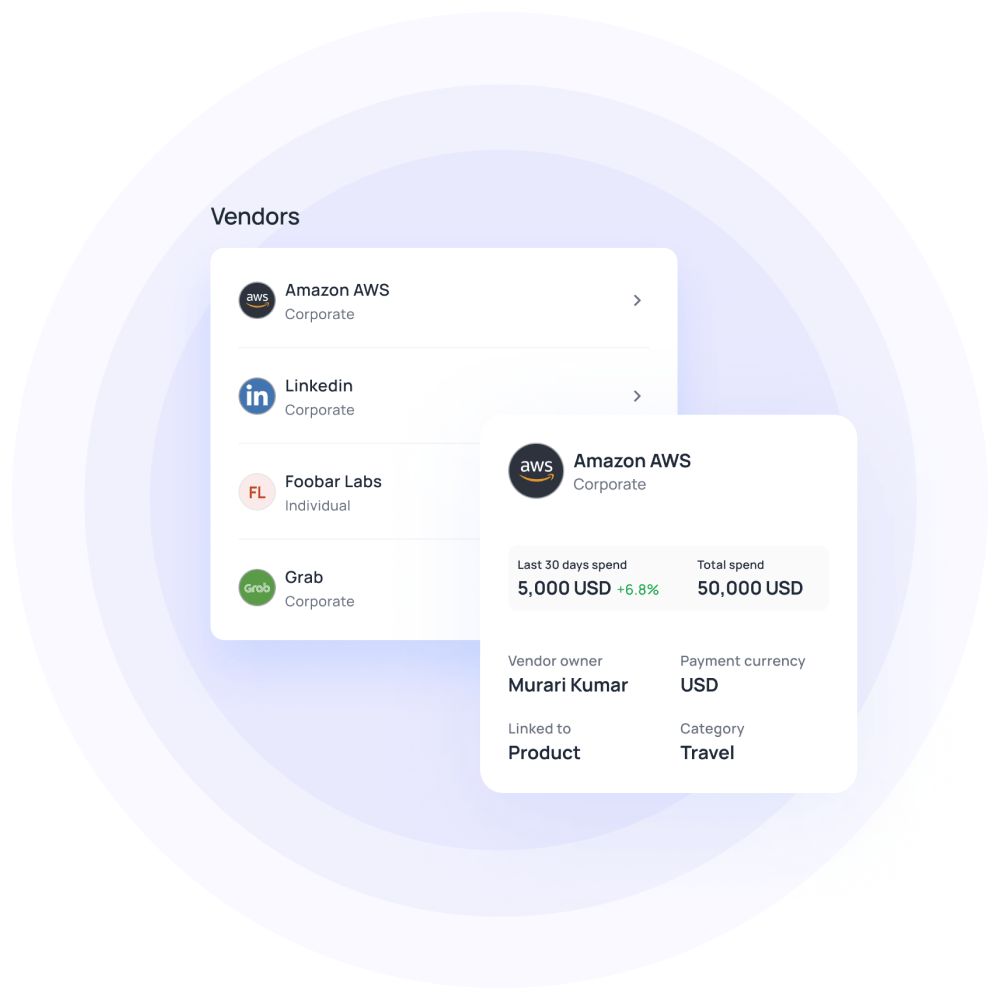

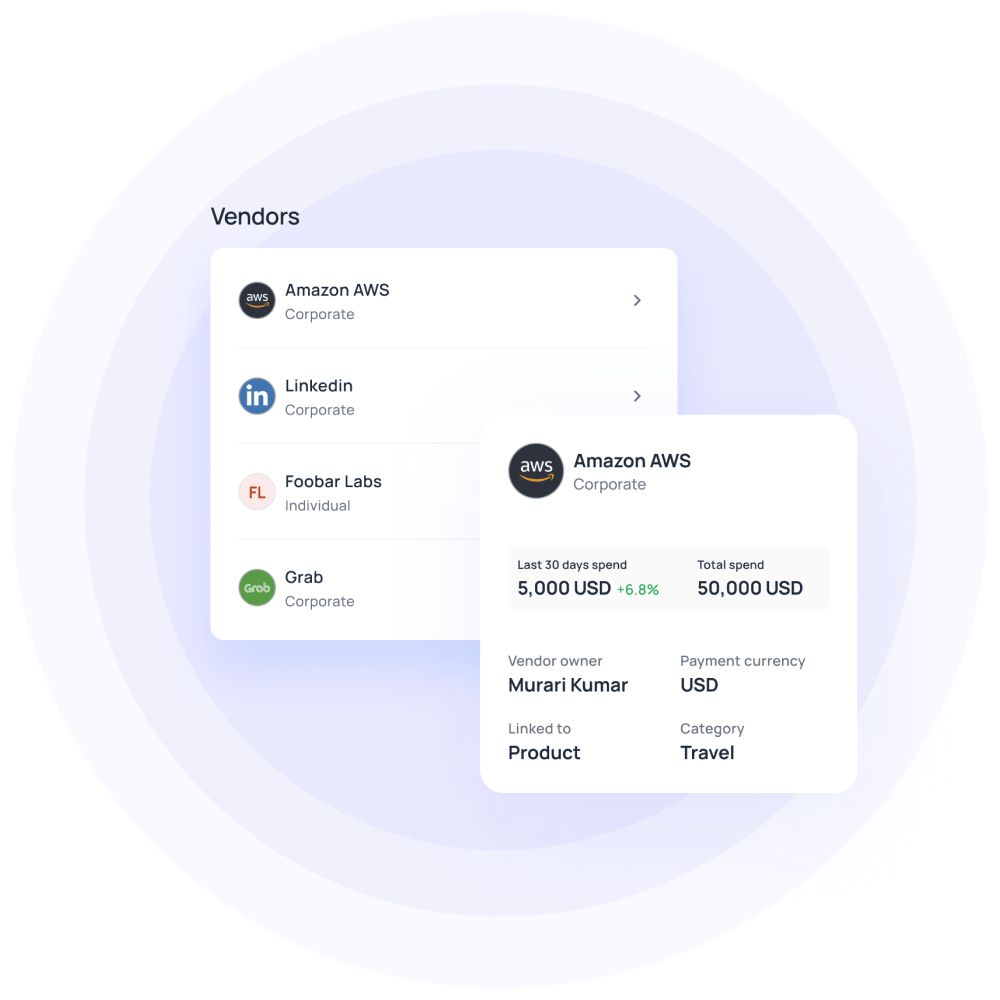

Unorganized vendor management

Managing vendors manually and dealing with them in a decentralized way will at some point cause issues due to a lack of visibility. If you cannot view all your vendor data in one place, the chances of things going wrong are higher. When the opposite is true, and you can easily manage all suppliers and vendors through one platform, it will improve the way your resources are allocated and hence increase efficiency.

Storing vendor information

Storage of data in the traditional method of vendor management which included paper invoices, contracts, and so on is tough to store. With digital tech vendor management systems in place, companies no longer need to worry about safely storing a pile of paper in a physical location as all the data can be easily accessed on the platform you use.

Vendor payment risk

Lastly, another challenge that your organization may face is the different payment terms that certain vendors have. While most would follow the industry standard, there will be suppliers who would ask for a major portion of the final project cost upfront, which can be very risky.

To explore these challenges in greater depth and learn how to effectively navigate them, visit our blog on Common vendor management challenges and their solutions.

Make managing vendors super simple with Volopay

Why is a vendor management system important?

Minimize risks

When dealing with multiple vendors, there’s always a chance that one of them might end up causing a delay in business operations due to late shipping, sending damaged goods, or other issues.

These operational issues impact finances, enabling you to see each vendor's cost implications on the Volopay platform. If you notice irregularities, you can investigate and take precautionary measures to prevent future problems.

Decrease costs

Since you get to see all the vendor payment information within one dashboard, the system allows you to get a comprehensive view of all the financial transactions.

Add to that our platform’s 3-way invoice sourcing capability, you can rest assured that you will never miss an invoice and no vendor will go unpaid leading to late payment fees. All of this together helps reduce your costs.

Optimize performance

An accounts payable automation system like Volopay streamlines vendor coordination by enabling quick vendor payouts for your business.

Build loyal relationships

There is no doubt, that whenever work is done thoroughly and payments are made on time, it helps you in building vendor relationships.

Increase administrative efficiency

Using a tech platform like Volopay significantly drives down the efforts of an admin who has to keep track of all vendor payments. Overall, it increases the work efficiency of any administrative team.

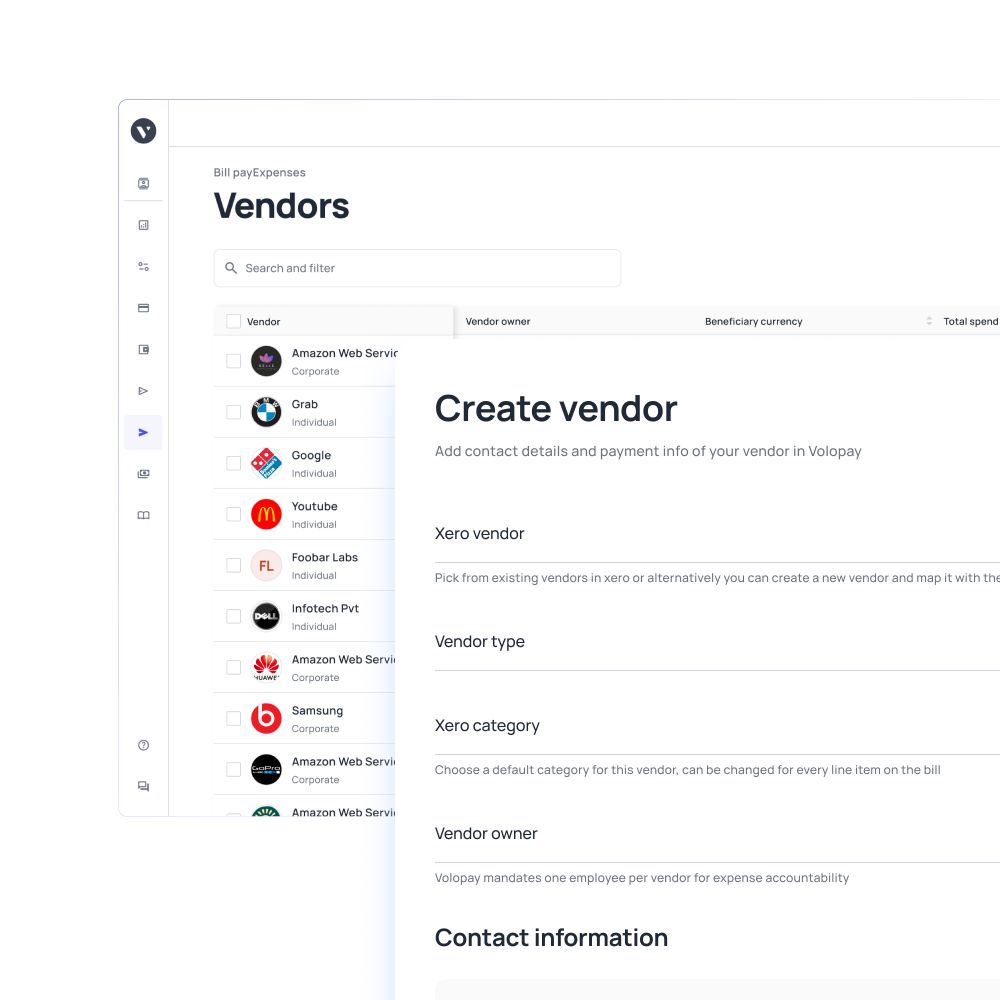

Increase onboarding speed

An extremely simple vendor creation and onboarding process on the Volopay dashboard ensures that work can kick off immediately as soon as the vendor accounts are created.

Benefits of using Volopay for vendor management?

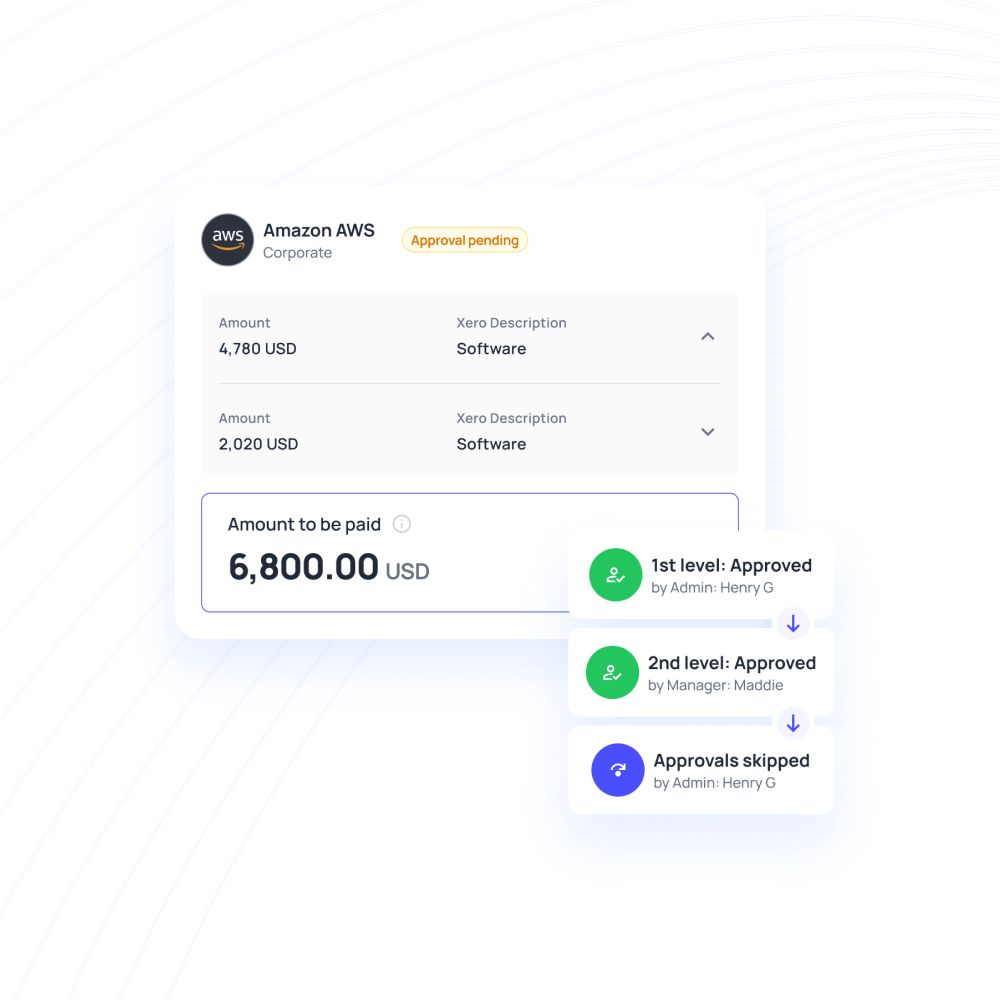

Set multi-level approvals

When making vendor payouts using Volopay, you get the ability to create multi-level approval workflows to ensure that all major stakeholders are aware of expenses being made and no payment is going out without their permission.

For example, you can create an approval workflow where any payment above $500 through the money transfer feature on Volopay must be approved by the team manager first and then the finance head of the company.

Accounting triggers for vendors

The ‘Triggers’ feature will be loved by your accounts team. Accountants can set specific triggers for each vendor expense and assign default accounting values to be filled in for every payment.

By doing this, every payment made to that vendor will automatically have those accounting fields auto-filled in the expenses tab and it’ll be easier for the accountant to sync all of them to their accounting software.

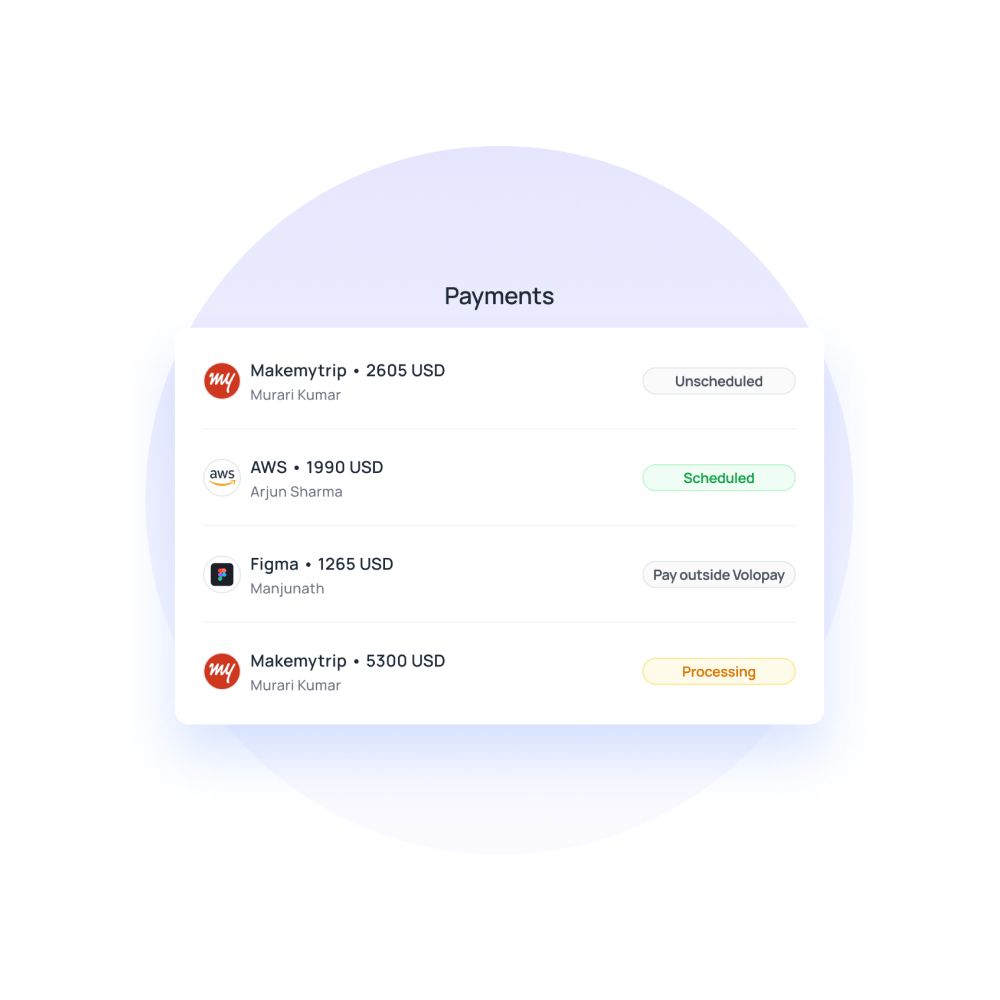

Set and manage vendor payments

Once you create a vendor on Volopay, it becomes incredibly simple to carry out all their payments regularly without having to re-enter all their data every time a payment needs to be made.

This streamlined process not only saves time but also reduces the risk of errors, allowing you to focus on more critical business activities, strengthen and maintain positive relationships with your vendors.

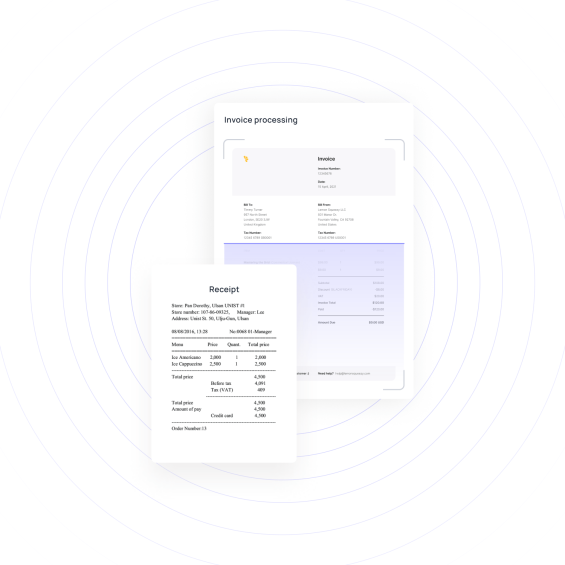

Manage outstanding invoices

The 3-way invoice sourcing lets you pull invoices from email, accounting software, or upload directly to Volopay, ensuring you never miss vendor payments.

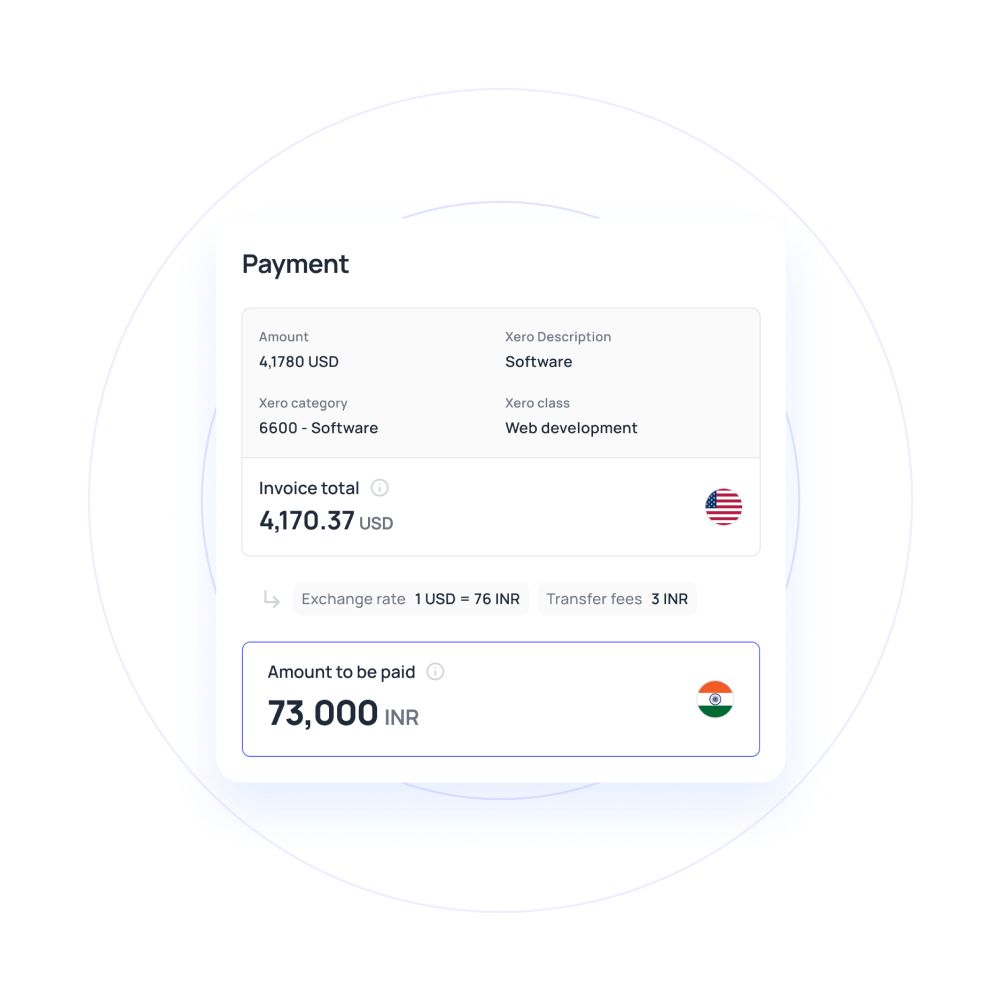

Cross border B2B payments

Thanks to our robust financial infrastructure, you can easily make domestic and international transactions at the lowest rates which are completed within a day at max.

Streamline vendor management for your business with Volopay

As a vendor management system, Volopay helps you carry out the fastest vendor payouts at the lowest rates. This helps builds trust and creates strong vendor relationships.

Easy invoice processing, real-time payment tracking, approval workflows, and automation of accounting tasks, make vendor management a breeze for your business.

Related pages

Identify essential features like integration capabilities, risk assessment, and automated payments to ensure a VMS meets your needs.

Learn effective strategies for vendor negotiation to secure better terms, improve relationships, and enhance your business’s overall profitability.

Discover the fundamentals of vendor management, the key processes involved, and how to automate tasks for improved efficiency and collaboration.

Trusted by finance teams at startups to enterprises.