Vendor management - Basics, process, and how to automate

Vendor management helps manage two-way relationship between a company and its vendors. When a company starts to scale, its number of suppliers also doubles. This burden falls over the AP team as they struggle to balance the vendor relationships from onboarding to payment.

The only way to harmonize this without wasting a lot of time is by bringing automation into this process. From selecting the right vendor for your business to getting the best value for your money, a comprehensive vendor management system has an answer to everything.

Vendors are the pillars of a successful business. They do not just stop from supplying but also possess the opportunity to form a long-lasting partnership. If you establish a strong foundation here, they can also attract top-grade clients for you. In this way, leveraging vendor management system benefits can significantly enhance your overall operations and relationships.

Basics of vendor management in accounts payable

Post the vendor selection by the purchasing department, they have to be onboarded, and the orders and invoices have to be tracked, and this goes on. If vendor management is accomplished through traditional methods, there are lots of phone calls and unopened, semi-automated emails involved. Any disruption in the process, you will find the relationship with your vendor affected.

You wouldn’t want to interrupt supply chain management. Because, when they reduce the supply, your company’s overall outcome gets impacted.

Delay in email acknowledgments or payments can upset a vendor and risk the supply of goods from them too. Yet, to be able to negotiate for better deals and receive your supply on time, having a successful vendor relationship is crucial.

And this depends on how you handle your vendors’ information and leave no stones unturned in the vendor management and payment solutions. But this can be too much for the AP team to handle if the process is manual. And when you lack a centralized view of vendor data, it’s going to be much harder than you imagine.

The trust factor can be established only when there is a healthy flow of communication between you and your vendor. Having an outstanding vendor payment solution that also supports vendor management is a must for any company that wants to grow its business.

What does vendor management include?

The process of choosing a vendor, purchasing a product/service from them, and maintaining a good relationship as long as it goes is called the vendor management lifecycle. It includes six steps in which a company maintains its relationship with its vendors right from their selection to decommission.

Vendor selection

Selecting the vendor is the first step where you will attend demo sessions with prospective vendors and finalize five to six of them. After checking who can equip you at a better price, your decision-makers will approve them.

Along with pricing and features, other vendor selection criteria a company should consider include client stories, reviews, reputation in the industry, responsiveness, and overall value for money. It’s also important to determine if they can continue to supply even if there is a sudden increase or reduction in the order.

Building a diverse and reliable vendor network can reduce costs for businesses by fostering competition and ensuring access to a range of options, which helps secure better pricing, terms, and reliability over time.

Vendor onboarding

Now that you have selected a vendor, you will move to the next step, which is onboarding their details into your company’s records. Onboarding includes the documentation process and contract signing as well.

Post that, you will add them officially to your vendor list after collecting them from your vendor. It is data like currency, the preferred mode of payment, payment account details, and contact information.

Depending on the size of your company and your vendor, the onboarding process may take up from 2 weeks to 4 months. Here is where you can understand more about their services/products and how they function as a company.

Performance monitoring

Post-onboarding is the period when your vendor will start supplying you with goods. Here is where you will track, analyze and understand their performance, timeliness, and quality of the product and evaluate the KPI based on their delivery. Performance tracking will continue throughout the end of the contract period.

Vendor risk management

Though you might have already done a risk assessment, it is essential to analyze it after you have onboarded them. Vendor profile examination includes law and order involvement against your vendor, data and security breaches they commit (IT breaches by your vendor’s third party suppliers, governance and compliance errors, etc).

So, your job is to analyze the apparent and non-apparent risks before they happen and prevent or mitigate the effects before they could affect your company. Incorporate the consequences of a security breach in the contract beforehand and communicate your company’s standards, when it comes to security and compliance.

Vendor payment process

As the name suggests, this process involves collecting your invoice, carefully verifying the information contained within it, and subsequently initiating the payment for approval by the appropriate parties.

Know how Volopay can help improve your vendor payment process

How to improve your vendor payments process?

Though the vendor payment process might appear like a two-step process, it is still possible to go wrong somewhere.

Here is how you can improve it.

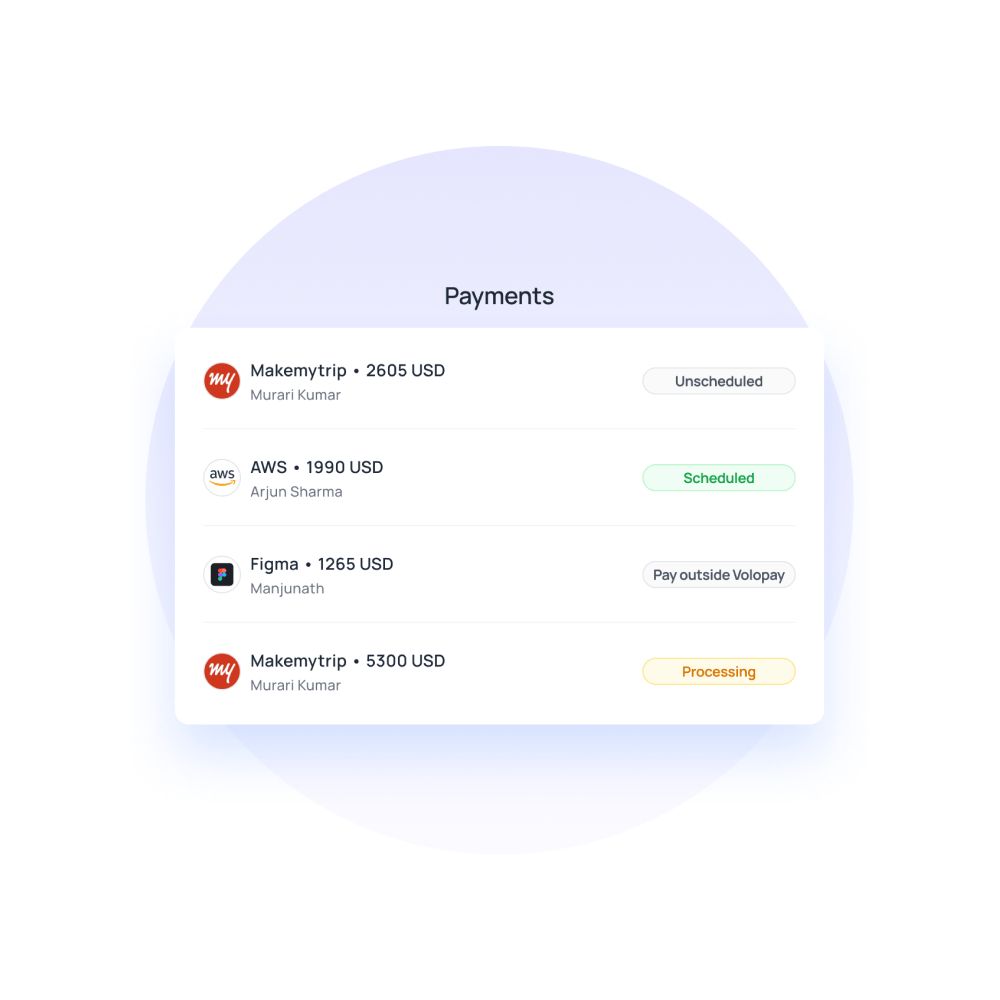

Scheduling payments

In general, accounts payable vendor management software comes with a payment scheduling option. Scheduled payments prior give you enough time to go over them to quicken the approval process.

Reconciliation

It is wise to reconcile manually or automatically through your AP software to align your financial data with your bank statements. Frequent reconciliation brings accuracy to your overall financial system.

Digitize everything

From receiving invoices to sending payments, transfer everything electronically. Digital transformation lets you effectively process the payment and generates a permanent copy of your data.

How to amplify accounts payable in vendor management?

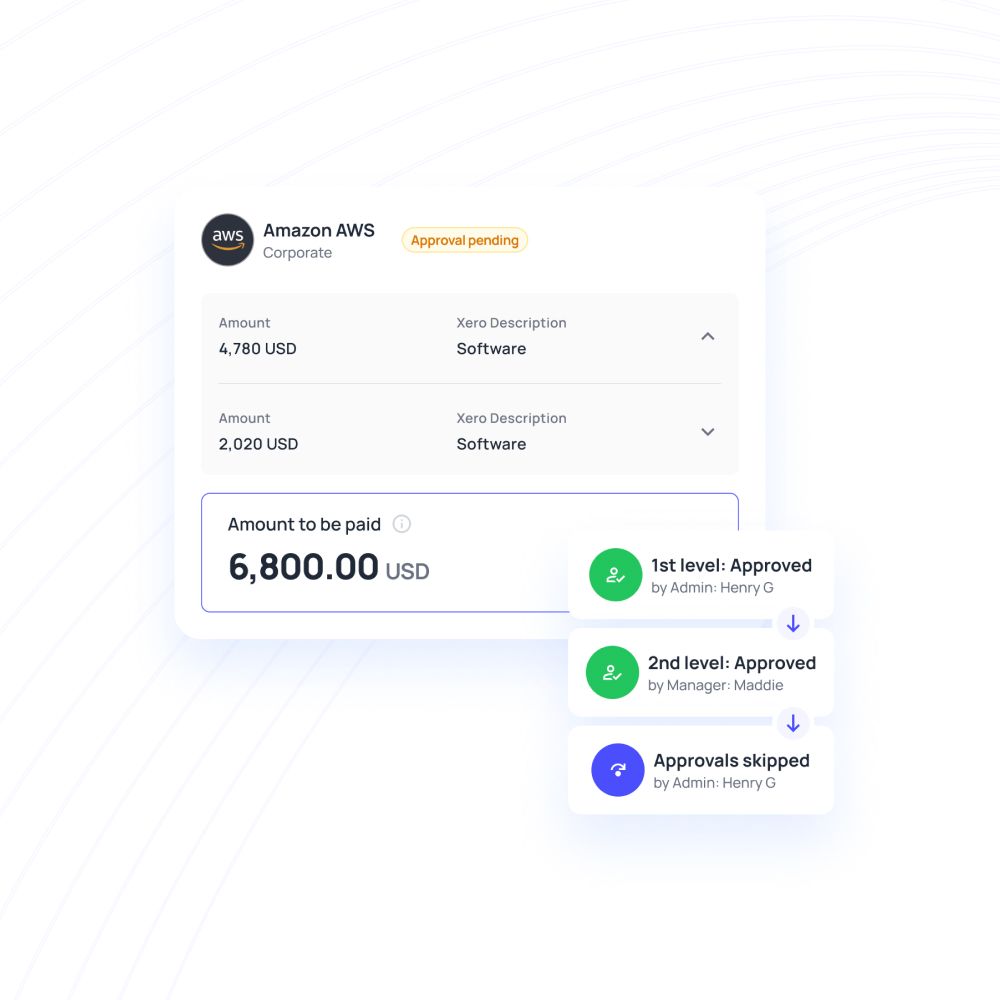

Workflows are instructions that tell the software how and when a payment should be processed and who can approve it.

Customizing workflows to suit the unique needs of your vendors is very important for improving vendor management relationships and can help streamline the process, ultimately saving you an ample amount of time.

While having a vendor payment solution is mandatory, upgrading that with cutting-edge technological solutions can up your game totally.

The presence of artificial intelligence (AI) can automate even the most basic data input tasks by identifying the characters and auto-filling the data in various software applications.

Offering multiple means of payment like a credit card, check, online applications, etc, shows that you value your vendors.

Vendors should be given the flexibility to choose the mode of payment in which they want to receive the money for their supplies. Invest in a robust accounts payable software with flexible vendor billing processes.

Accounts payable vendor workflow

As stated above, accounts payable vendor workflow refers to the series of steps that occur from the moment a vendor submits an invoice until they are paid.

Setting up custom workflows for invoice processing can be challenging, but with automation software, you can establish these processes once for future payments.

By implementing the right rules, you can expedite payments and maintain strong vendor relationships, while also eliminating bottlenecks that delay invoice processing for days.

Automate your vendor payment process today!

Why is vendor management solution necessary?

Vendor data storage

You will need a reliable storage platform to hold and monitor the information about your vendors.

Proper storage medium selection becomes vital if the company size is quite big.

Constant supply flow

When you have multiple invoices to handle manually, one or two might get delayed or missed eventually.

Such inevitable delays can cause you late fees and affect your future supply chain.

Saves you money

When you pay early, you can save money by availing of early payment discounts.

And if you maintain a clean track of record by paying on time, you get better chances at negotiating for deals with your suppliers.

Ability to track vendor performance

When you have a centralized dashboard with vendor details, you can easily track their KPIs based on their performance.

Tracking vendor performance is essential for identifying when a vendor’s performance is not meeting established expectations.

Establishes good vendor relationships

Processing vendor payments on time and not messing up the order-payment process can keep you in their good books.

Having best payment practices can earn you excellent references, and your vendor will be ready to help you out when you are in a fix.

How Volopay helps in vendor management?

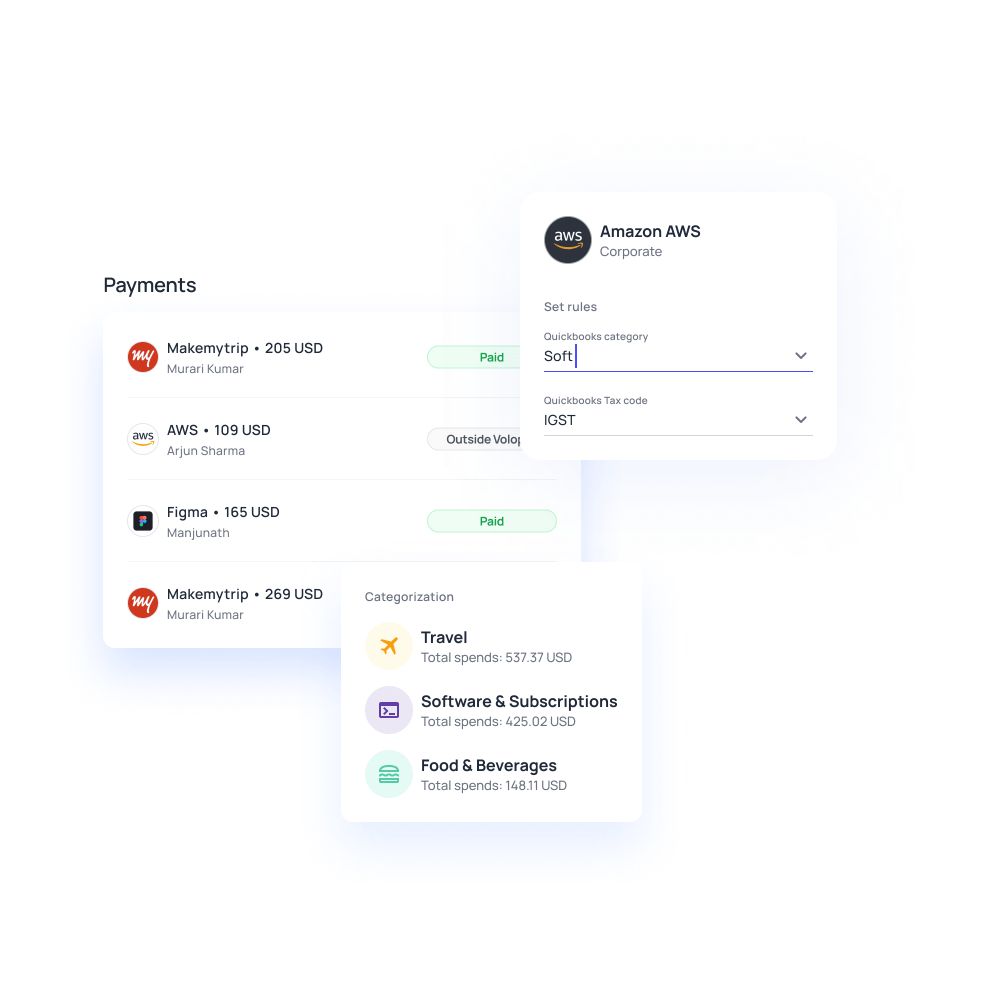

Volopay's vendor management system features an all-in-one dashboard that enhances visibility and control over your vendors and their data. You can view processed, scheduled, pending, and paid invoices, along with vendor details, payment dates, amounts, and receipts.

You can also easily add or remove vendors and access their contact information. Categorize your vendors into individual beneficiaries and corporate types based on their needs.

Set custom rules and workflows to accommodate their payment requirements, including multi-level approvals for specific payments. With Volopay, you can enjoy early payment benefits and schedule payments in advance, setting it apart from competitors.

Trusted by finance teams at startups to enterprises.

FAQs

On the grounds of low price and clear visibility over data, Volopay is one of the best accounts payable software with vendor management for your business. With its ideally created bill pay software, you can manage vendor payments all in one go. You are also getting the ability to customize workflows at the best price in the market.

Yes. Vendor management is a part of procurement though both mean different contexts. Vendor procurement is the process of minimizing buying costs while procuring good quality supplies after a rigorous comparison of multiple vendors, their prices, quality, and quantity. Whereas vendor management means maintaining a relationship where a supplier and a company are both considered equal, all while analyzing and mitigating vendor risks.

Before payment initiation, this happens.

- Verification of the invoice by the purchasing department (sender, amount, quantity, and other parameters)

- Check the same with the concerned team about the goods received and their condition.

- Finding the payment due date

- Keying in the data into the AP software and scheduling the payment

- Sending it for approval

- Decision-maker approves it and payment wires on the scheduled date and time.

Supplier payment management becomes effortless when there is powerful automation software to rescue. Supplier payments can be managed accurately by automating the vendor payment process and scheduling payments before the due date.

Bring Volopay to your business

Get started free

Related pages

Explore key features to consider when choosing a vendor management system to streamline operations and strengthen vendor relationships.

Discover common vendor management challenges and solutions to optimize processes and improve relationships and operational efficiency.

Learn effective strategies for vendor negotiation to secure favorable terms, build strong partnerships, and enhance value for your business.