What is procurement fraud and how to identify it?

The procurement process cycle is, arguably, one of the most important cycles for any business.

Comprising of multiple levels, some of which can include complicated steps and data exchange, it is also the one most susceptible to fraudulent attacks.

For any hacker or fraud, a procurement process with a complex network is the ideal spot to slide into and escape without reflecting in the accounting books.

Procurement risks are why many companies switch to digitizing their accounts payable.

The presence of procurement fraud prevention technology makes their transaction and purchase order history significantly more fool proof than manual bookkeeping.

What is procurement fraud?

Any kind of intentional deception that occurs in the procedure-to-pay process with vendors can be considered procurement fraud.

This deception leads to some kind of financial loss or gain, either by the buyer or the vendor.

More often than not, these are procurement fraud schemes for individuals within the system to make money outside of the designated contract or employment benefits.

Over the years, procurement fraud schemes have adapted themselves to the systems that maintain vendor and supply information.

For instance, spreadsheets containing purchase order history or invoice details can easily be modified by anybody working against the favor of the company.

These discrepancies between payment and received amounts translate to kickbacks for the employees involved in the fraud.

But these aren’t the only types of procurement fraud. Anything from conflict of interest, to fake purchase orders and invoices, can be considered procurement fraud.

It’s important to understand all how they occur to be able to assess your company’s susceptibility to them.

This blog will not only dive deep into the most commonly seen procurement frauds but also how using an automated expense management system can work as an ideal procurement fraud detection and prevention tool.

Different types of procurement frauds

1. Payoffs and kickbacks

Payoffs is one of the most common types of procurement frauds.

Getting in the way of competitive bidding, they design tenders in such a way that only one supplier can win the bid and benefit from the order.

For this to happen, one or more employees from the purchasing end are involved in securing orders from specific suppliers that they receive kickbacks.

These kickbacks can be in the form of cash, personal discounts, or even prizes.

2. Shell companies

Shell companies are another prevalent form of money laundering and covering fraudulent transactions.

Employees relying on this method usually create a fake company name and credentials and then issue small transactions and purchases in their name.

If there is no way to match transactions to purchase orders, these small amounts can go unnoticed.

3. Bid rigging

Bid rigging occurs when multiple vendors get together to benefit from a supplier’s tender.

They purposely inflate the price of the bid, and whichever vendor wins ends up subcontracting with the largest vendor (or whichever vendor initiates the rig).

As a result, all vendors benefit from deceptively inflating the purchase contract value.

These kinds of procurement fraud schemes happen on a much larger scale, with frequent infractions.

4. Credit card fraud

There are certain procurement risks associated with handing cards to your employees.

Procurement card frauds are extremely common with employees who are generous with swiping their corporate cards.

These can translate as off-book expenses, swiping a corporate card but also claiming reimbursement for the expense, and even utilizing a card for recorded “repeat” transactions of the same invoice.

Related read - How to handle employee misuse of corporate credit cards?

5. Fraudulent invoices

If you have a high volume of invoices then noticing a fraudulent one can be tricky.

Employees that pose procurement risks rely on this to fly under the radar.

This kind of fraud is not necessarily an internal fraud, though. It can also be conducted by a vendor.

While employees involved in fraud might charge to shell companies, fraudulent vendors might invoice for goods/services that have never been delivered.

They can also charge a higher amount than what the goods were sold for.

Related read - 10 common invoice processing errors you can easily avoid

Impact of purchase fraud and corruption on your organization

Financial costs

The biggest loss that a procurement fraud can incur is financial loss.

Between ghost invoices and employees creating shell companies, the amount of money being fed into fraud can cause substantial monetary losses for a company.

But that’s not the only loss. A company that becomes victim to bid-rigging will also suffer losses since the vendor contract price has been inflated on purpose.

Additionally, if an employee receives kickbacks for promoting a specific vendor, that vendor may not be the best choice for a company’s needs.

This can lead to further losses, either through paying a high price or unknowingly compromising on the quality of goods/services being rendered.

Reputation damage

A company that gets involved in procurement fraud will undoubtedly take a hit on its reputation.

This is why many invest in systems for procurement fraud detection and prevention.

They might lose their existing vendors out of fear that the buyer has been disingenuous in their vendor selection process.

Some might fear associating with the fraud. Clients might also pull out of contracts if they think that the company has not been honest in its procurement process.

The public fallout can also cause legal issues, and cause stock prices to drop (if the company is public).

Public health & safety risks

Vendors who participate in procurement fraud are likely to also be cutting corners in other aspects of their goods and services delivery.

If there has been any kind of slacking in the quality, in the government sanctions, or even the components being sub-standard, then it can pose a major health and safety risk for your employees and your customers.

Types of procurement fraud indicators

1. Bid rigging

An honest procurement department will conduct market research before floating any kind of tender.

If the competition is far too slim, or there is a monopoly within the supplier list, then it is likely that there is a risk of fraud.

Examine every vendor’s bid before deciding on the contract awardee. A suspiciously low bid, or a collectively inflated bid, is not worth ignoring.

2. Bribes or kickbacks

Kickbacks are not always the easiest to spot. But a good procurement fraud detection and prevention department will know how to spot one.

However, having an understanding of your employees and their background can make it significantly better to monitor.

If an employee receives a sudden amount of gifts that cannot be explained, it could be a red flag.

Receiving large monetary gains that help them pay off debts and loans (without a paper trail) could also be a sign that your employee might be engaging in deceptive practices.

3. Split purchase orders

Split purchase orders can aid fraudulent parties in staying below a competitive threshold.

Having separate components of the same order contracted or invoiced separately can aid employees in justifying the preference of one vendor over another.

Consequently, multiple invoices can also help cover up unexplained cash payments to a vendor since they’re split into a higher number of intervals and amounts.

For any vendor or procurement employee to suggest a split purchase order when there is no real need is a red flag.

4. Phantom vendors

Conducting a contract audit or due diligence on a vendor should not be a difficult process.

Although more tedious, if there is a clear struggle in verifying records then there is a chance that your vendor is a shell company or a front for money-making.

Verifications can include legitimizing certification, tax return statements, and even a credible client record.

5. False claims

False claims can come from vendors, as well as employees.

If you spot a vendor’s invoice reflecting a higher price than the contract agreement (or not matching the goods or services provided) then this is an error worth flagging.

A repeated error could be indicative of a false contract or deceptive gains. Similarly, having a thorough record of employee budget approvals is good to track business spending.

A credit card statement that is linked to a transaction can debunk fraudulent reimbursement claims in the future.

Best practices to prevent purchase fraud

Set up a hotline

Putting together an anti-fraud department with a dedicated hotline is a must to catch procurement fraud in its early stages.

These departments are trained to look for mismatched information, or suspicious behaviors - either among employees or on the books.

A secure hotline encourages other workers to report any misdeeds or inexplicable actions and trains them in procurement fraud prevention.

It also gives a degree of privacy to whistleblowers as the anti-fraud department works independently. Any ethical misdemeanors can be reported directly to compliance.

Require anti fraud training

Anti-fraud training is a discouraging tactic among employees to not participate in fraudulent activities.

Of course, this covers the legal and technical aspects of what constitutes fraud, how to notice it, and what the consequences are.

But it also creates a culture of trust and transparency.

If you have employees who might turn to fraudulent activities - either due to a low wage, bad departmental relations, or personal debt - then create an environment where they can honestly discuss and solve their issues instead of committing fraud.

Choose vendors carefully and audit vendor lists frequently

Introducing varied competition is a good way to make sure your vendors are giving fair pricing.

Having a large supplier list can make it harder for any kind of bidding rigs to take place.

Moreover, frequently auditing your vendor choices and looking at the competition can encourage them to continue working under agreed terms.

It’s also crucial to conduct due diligence on your chosen vendor. Any history of manipulative business practices or defrauding clients is likely to show up.

Talking to their other clientele, conducting an audit of their finances, and verifying their certifications/licenses will give you a clearer picture of their business decisions.

Rotate and supervise procurement staff

To prevent one employee from committing procurement fraud, it is ideal for your workers to be delegated different tasks within the procurement cycle.

Ensuring that different people are responsible for different stages of procurement makes it harder for an employee to engage in malicious behavior.

If employees are also constantly rotated in these duties, then no one employee can carry forward a fraud attempt from their designated task.

Implementing indicators and analyzing statistics

Spend control systems like policies and approvers can aid departments in pinpointing transactions that exceed an expected limit.

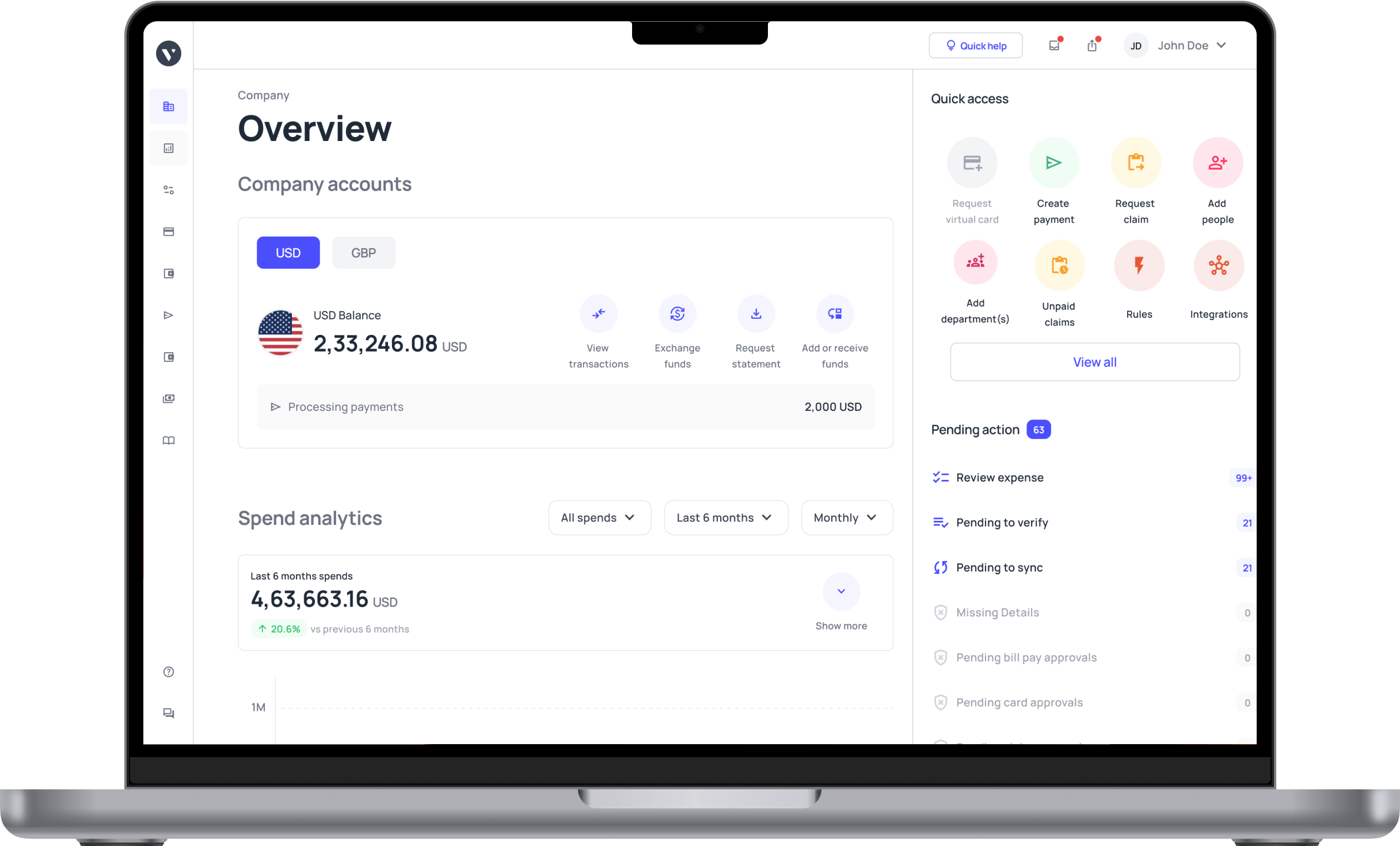

With automated vendor management systems, like Volopay, purchase orders, invoices, and transactions can be examined simultaneously to flag erroneous transactions.

Audit teams, along with the finance department, can also analyze this data to see any recurring discrepancies or compare inventories against purchases.

Minimize the risk of procurement fraud with Volopay

A reliable spend management system allows your company to track and monitor all purchase history. This level of transparency makes it possible to not only pinpoint any fraudulent activity but also discourages fraudulent behavior among employees.

Finance teams can use Volopay to set spend controls. This can be done either by using company-wide policies or by assigning a specific policy relevant to a department or a budget.

Virtual cards can be linked to vendors so that the entire transaction and purchase history for that vendor is easily traceable. Volopay's procurement software also allows you to monitor vendor profiles to help you analyze which budgets are paying a specific vendor.

A digital platform makes it easier for approval processes to be assigned without the extra effort of manual labor. Multi-level approvers can request details, and some transactions over a certain limit can be automatically declined. The administrators are in complete control of every employee’s business-related spending.

Additionally, all transactions can be integrated with your accounting software, for the compliance and legal teams to keep an eye on.