10 Financial goals for a business in 2025

The need to adapt has never been more pressing

We are all currently living in a world typified by rapid modernization, the rise of digital giants, and an overall shift towards more technology-driven lives.

As a direct consequence of this, most parts of our traditional way of life have found themselves becoming increasingly redundant. These changes are especially relevant for your finance team.

When you’re the manager of a relatively small-scale organization using traditional forms of financial management might seem alright. But, what happens when you’re responsible for managing the finances of a big organization?

Using spreadsheets, paper receipts, manual invoice processing, etc. is error-prone, time and labor-intensive, and not at all efficient, especially when dealing with large amounts of data.

In light of this, it becomes quite logical to believe that traditional forms of financial management do belong to an older generation.

If you are looking to overcome the drawbacks of outdated systems, modernize your operations, or, try to find efficient ways to get the most out of your business you definitely need to revamp your finance team's objectives to suit this era.

How to do this? Let’s find out.

The importance of setting financial goals for your business

It’s important to set financial goals for a business. Often, businesses find it a challenge to sustain themselves when they don’t have proper goals or strategies. Without financial goals, you’ll have a difficult time formulating strategies as you’ll be directionless, which could eventually lead to business closure.

Here are some key reasons why setting up financial goals is important for business:

1. Purpose and direction

Having financial goals will help your business figure out its purpose and direction. When you know what exactly you want your business to achieve, it becomes easier to figure out what path to take. The way your company takes shape also can be highly influenced by your goals, purpose, and direction.

2. Performance evaluation

Setting financial goals for a business gives you something to measure your business performance against. You won’t know exactly how good or bad you’re doing if you don’t have something to strive for. When you have a measurable number, you can see how much you’ve accomplished in a certain time frame.

3. For planning and decision-making

It’s difficult to make plans for your business without concrete goals. If you have financial goals for a business, however, you can use those as an endpoint and work backward to create plans.

Having goals will also help you make decisions based on what goal you’re trying to achieve.

4. Improve investor and stakeholder confidence

Most investors and other business stakeholders will require you to have a plan for your business. When you set financial goals and draft an action plan on how to achieve them, stakeholders will feel like the business is in good hands. It also allows them to have an idea of where your business is at.

5. Resource allocation

When you have goals and a clear vision for your business, it becomes easier to determine what resources should be allocated.

Actively working on achieving financial goals for a business means that you know what to focus your money and resources on, letting you grow your business faster and more efficiently.

6. Budgeting

Financial goals can also influence how much you budget for business expenses, including inventory orders and staff hiring.

Without solid goals, you could even end up overspending, especially when you don’t know what your budget should be based on. Goals let you measure whether you’re under or overshooting with your numbers.

7. To identify areas of improvement

After you make financial goals for a business and reach the time frame you set to accomplish them, you’ll be able to evaluate them regardless of the results. This step in the process will help you identify which areas of your business can be improved and how to improve them.

Types of financial goals for businesses

1. Revenue goals

All businesses should strive for revenue and business growth, therefore meaning that it’s important they have revenue goals. These can be divided into three more subtypes, those being revenue growth, which can be a percentage or a value, sales maximization (regardless of profitability), and market share growth. You can have goals under all three subtypes.

2. Profit goals

Unlike revenue goals, which focus on generating as much money as possible, profit goals specifically aim to increase how much profit your company has after costs have been deducted.

Profit goals can be measured by a certain amount of profit that you’d like to achieve, an increase in profitability rate or margin, and a comparison of market profit margins.

3. Cash flow goals

For small businesses or businesses that are just starting out and are not yet profitable, one of your main goals should be to improve your cash flow.

Setting financial goals related to your business cash flow should be a priority. Achieving it can be done by reducing inventory or minimizing seasonal sales patterns.

4. Investment goals

You’ll want to invest your revenue to grow your business. By setting an investment goal that is SMART, you can employ strategies for different aspects of your business, such as revenue and profit, to meet your investment target. Investment goals can be measured in a set amount or a percentage of your revenue.

5. Debt and financial obligations goals

Financial goals for a business aren’t just about trying to make as much money as possible. As a company, you’ll have debts and financial obligations.

Goals related to them allow you to focus on how much money you want to owe. Depending on whether your profits are high or low, your debt goals may change.

6. Return on investment (ROI) goals

Return on investment, or ROI, goals are a type of investment goal with a focus on how much you’ll get compared to how much you invested.

For example, one of your ROI goals can be a 15% return on capital employed in the span of 3 years. Coming up with a plan is easier when you have a target.

What should be the financial goals for a business in 2025?

As we are in 2025 there are a whole lot of new, exciting improvements that have graced the finance world.

The faster your finance team can sync with and adapt to these novel changes the better your business performance will be in the foreseeable future.

Here’s a look at some of the financial goals for a business and the objectives that your finance team can incorporate into its systems:

1. Increase confidence in forecasts

No matter how you look at it, being able to have a comprehensive, accurate, and constructive business performance forecast can come as a huge boost to your finance goals.

However, formulating a truly effective forecast is easier said than done. Traditionally, performing a financial forecast would mean hours of labor and extensive digging for your finance team.

It would involve manually compiling financial performance reports of past years, meticulously scrutinizing the numbers, crunching these numbers, establishing performance estimates, and then estimating an approximate forecast for the coming year.

Not only is this process time-consuming and labor-intensive it is also prone to errors caused by misplaced data, incorrect calculations, or basic human negligence.

Therefore, they don’t really exude confidence. Your objective for the coming year should be to change this.

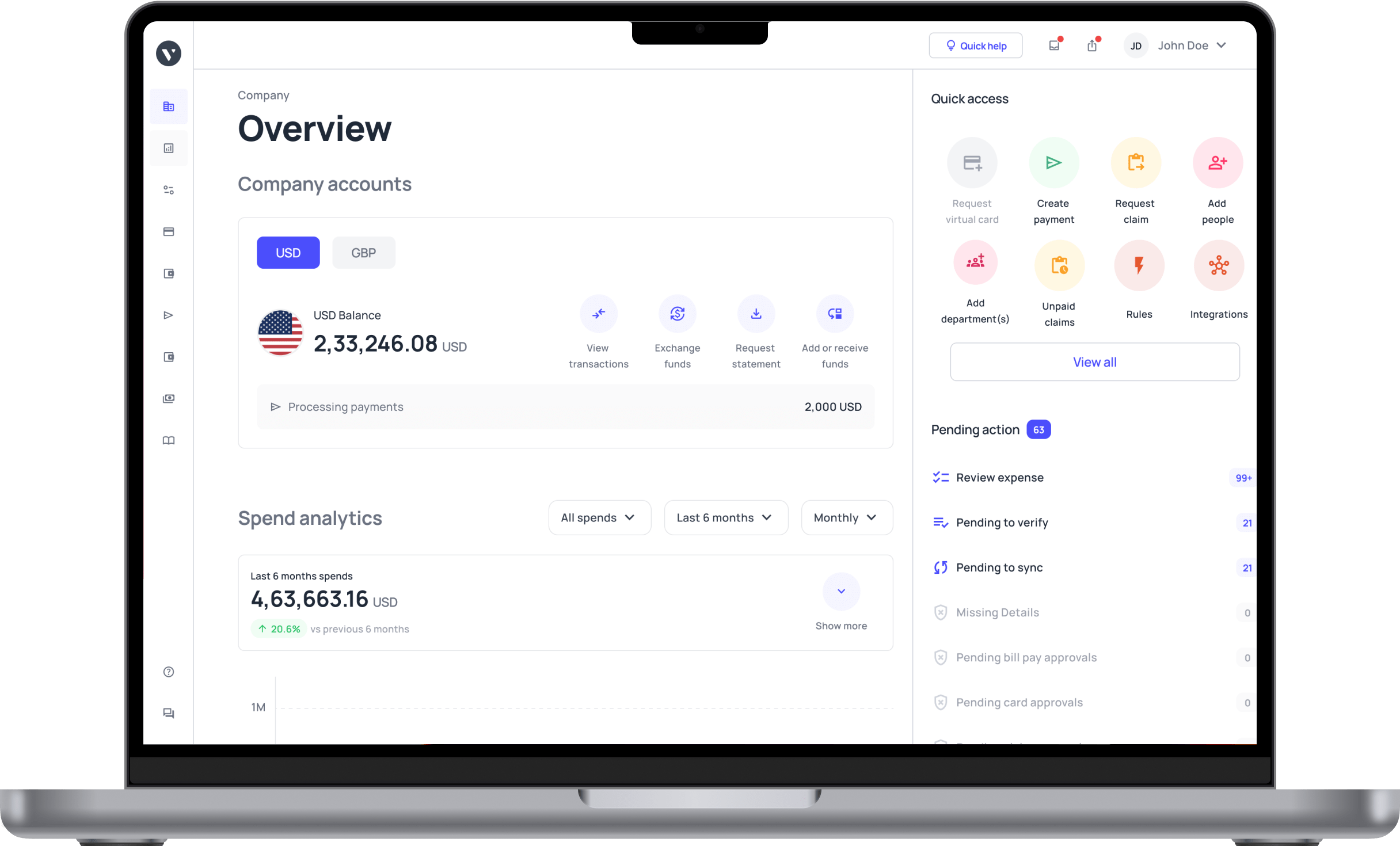

By adopting expense management platforms, like Volopay, you can automate nearly all of these steps. Expenses are recorded in real-time, reports are created by the software itself, and data is never lost.

2. Aim for data in real-time

Our world is operating faster every day. As digitization continues to expand its influence on our lives the need for up-to-date data and immediate action has never been greater. The same applies to your business’s financial performance.

Gone are the days when waiting months to compile expenses was okay. Now, the need of the hour is real-time data.

If you want to be ahead of, or at least on par with, your competition, you need to introduce modern data-tracking tools to your finance team. Not sure how to do this? Volopay’s your best friend.

The system’s software is capable of tracking, notifying, and logging any and every expense your company or an employee makes in real-time. The software’s automated features ensure this data is error-free, air-tight, and recorded as and when they are made.

3. Reduce the amount of friction

While maintaining control over finances is a necessity, too much control can lead to difficult procedures for employees to follow. The best example of this can be seen in the way a company card is used.

Traditionally, if a situation arises where an employee needs to make a purchase using the company card they will have to manually submit a purchase request to the finance team, or sometimes even the CEO.

Once a request is submitted the expense approving authority will have to vet the expense, approve it and then hand over the card, if the expense even is approved. This system has been the root cause behind a lot of friction across companies.

To overcome this the best approach is to avail the services of corporate card providers. Volopay’s corporate card, for example, can be issued as both physical prepaid card and virtual cards.

These corporate cards come equipped with tools that let your finance team set spend limits, verify expenses, track spending in real-time, and set custom parameters for auto-approval.

4. Create easy spending processes

The easier spending processes in your company are the faster, more efficient your operations will be. The same goes for your approval workflows and payment methods.

Setting easier spending processes that work well with approvals and payment methods is definitely one that should be a part of your finance team objectives for the year 2025.

The need for faster, more efficient spending is a marker of this era. Purchase requirements can arise unexpectedly and frequently and must be satisfied within a particular timeframe.

Having to submit a formal request and then waiting for it to be approved, if it is, can be detrimental to your ability to meet these needs in time. Therefore, creating a spending process that is fast, easy, and secure should fit into your finance goals.

Additionally, how efficient your spending is will also depend on how easy your approval and payment systems are.

There is no use in having an easy spending system if the approval of the expense and subsequent payment of the amount is slow and tedious. Spend management software, again, is a great way of helping you balance these elements.

5. Faster book closing

Month-end book closing has long been the cause behind many nightmares for finance teams. Consolidating and integrating data from a whole array of different sources can be an arduous task.

The primary obstacle here is reconciling the data from the many systems they come from. However, this is where automation earns its bread.

Accounting automation software, e.g. Volopay, eradicates the need to manually enter data. No matter how many sources of expenditure there are if they are all conducted on one unified platform that is capable of managing book closing without errors, then the need to enter the same manually into your books goes out the window.

This is especially pertinent as you continue scaling a business, the numbers will continue to grow but the effort needed to manage the same will not, and neither will the time taken to close books.

6. Accurate accounting

Maintaining accurate financial records is one of the most important tasks of a finance team. Having accounts that are up-to-date and audit-ready can save your company a lot of time, money, and legal trouble.

However, ensuring your company’s accounts are accurate and air-tight is easier said than done.

Your finance team is expected to manage records quickly while ensuring they’re detailed, reliable, and error-free. Doing all this manually—and in real time—is both challenging and unsustainable.

That’s where management accounting becomes essential. It equips your team with systems and techniques that enhance accuracy, streamline reporting, and support better decision-making across the organization.

As we enter the new year, it may be time to upgrade to a smarter, more automated accounting system, one that brings speed, precision, and control to your financial operations without added stress.

Preferably, via an expense management system that comes equipped with accounting automation capabilities. Volopay’s automated accounting services can be the perfect place for you to start.

7. Make cohesive financial systems a priority

Constructing and prioritizing cohesive financial systems is more of a principle than an actual objective. The more complicated and diverse your financial systems are the harder it will be for your employees to work with them.

Instead, if you move to an all-in-one expense management service like Volopay this issue is no longer relevant.

Having one unified system that handles your company card, expense reimbursement, accounting, credit lines, etc. means there will be fewer systems and processes your teams will have to learn to operate.

8. Fast and factual reporting to the team

Lastly, a key objective your finance team should look to achieve in 2025 is streamlining its reporting processes. Finance teams need data to work. The faster your teams can get their hands on data the sooner they can act on it.

Accurate financial reports play an important role in analyzing the current status of funds, sources of revenue, and expense routes.

These reports are important to making business decisions. Therefore, you should aim to adopt systems that enable efficient reporting that is also informative and comprehensive.

Moreover, if you really want to stay ahead of the curve, you should ideally perform your reporting through an expense management platform.

9. Be on top of cash flow management

Many industries are finding themselves shrinking. As a result, business cash flow has gotten tighter for many. In 2025, it is essential for businesses to stay on top of their cash flow to ensure that they can keep going.

It’s a good idea to seek funds, but more importantly, you should have a plan for your finances.

One solution to consider when making plans is alternative financing, which can give you more flexibility and comes with ease that applying for bank loans doesn’t always have.

10. Preserve & save capital

One thing to keep in mind when conducting business in 2025 is your capital. You want to try and save your capital as best as you can.

Think twice when considering risky investments and avoid ones that have lower chances of paying off. It’s best to steer clear of volatility.

Reevaluate regularly and adjust your plans for capital preservation whenever needed. You want to be sure that you have capital on hand to deploy when necessary.

A step-by-step guide to setting financial goals for your business

Assess your current financial situation

Before you begin setting financial goals for a business, you want to review its current financial situation first.

To do this, look at existing financial statements and KPIs. It’s a good idea to conduct a SWOT analysis to further better understand your company’s position in the market before you set your goals.

Identify long-term and short-term financial goals

Not all goals are made equal. There are some financial goals for a business that will take years to achieve, while others can be accomplished in just one or two quarters.

It’s important that you have a balance of both long-term and short-term goals that align with each other.

Conduct an action plan to achieve your goals

The next step is to conduct an action plan and break down what your new goals entail so that you can achieve them.

At this stage, you want to ensure that you are assigning responsibilities to the right people. You may also need to establish new KPIs for your action plan.

Setting SMART goals

Once you have identified both long and short-term goals, you want to set financial goals for a business that follow the SMART format. This means that your financial goals need to be specific, measurable, achievable, relevant, and time-bound. This allows you to determine how far your progress toward each goal is.

Track and measure the progress

It’s important that you continuously review your action plan once it is set in motion.

Check in with your employees to see where everyone is at and conduct periodic performance reviews. You should also regularly analyze your KPIs and see if everything is working according to plan or if any adjustments are needed.

Overcome the challenges and setbacks

While setting financial goals for a business will help you align your daily business activities, trying to achieve your goals isn’t without challenges.

You want to be sure that you’re ready for potential setbacks by staying flexible and resilient. Diversify your revenue stream and ensure you have contingency funds to prepare.

How to adapt, improvise and overcome ever-evolving business finance needs?

Over time, the way a finance team goes about its job has been constantly evolving. As the world continues to develop so will the techniques and systems that govern financial management.

Above everything else, the one skill that is going to help you and your teams navigate this continuous state of growth is adaptability.

Therefore, the best asset you can acquire to set yourself up for current and future developments is a system that is capable of being tweaked and updated. And, of course, what tool takes updates better than software.

Expense management platforms are specially tailored to fit this requirement. So, the primary objective you should set yourself for this new year should be to acquire software that simplifies your finances.