What is a virtual account, its working and benefits

With digital payments on the rise, virtual accounts have become a popular payment method. Businesses in many different industries are implementing a virtual account online to simplify payments and streamline reconciliations.

Acting as a secure door to your physical bank account, there are many benefits that you can reap by using a virtual account. It’s not rare to find modern banking institutions offering this tool. Understand how virtual accounts work and utilize them to manage your payments better.

What is a virtual account?

A virtual account isn’t that different from a traditional checking bank account, as its main purpose is to make transactions on behalf of your business. However, unlike a traditional account, you don’t have to maintain it and pay monthly fees. This is because virtual accounts cannot be used to store money. Rather, they function as a gateway into your physical bank account.

You can only use your virtual account online. To make payments, you’ll need access to the internet. While you can make payments to any virtual account using multiple payment methods, an internet connection is required for the payment to go through.

How virtual accounts work?

1. Account creation and setup

When you create a virtual account online, it will be linked to your main account. Generating a new account only takes a short process.

Each virtual account you create will have its own uniquely generated account number that you can assign to specific purposes, such as a particular paying customer.

2. Fund segregation and tracking

At its core, a virtual account is a door or gateway into your physical bank account. Due to this, your virtual accounts won’t actually hold any balance.

However, some virtual accounts offer wallet features, which allocate some money from your main account to the particular virtual account for payments.

3. Transaction process

A virtual bank account will draw and receive money through your traditional physical account. Put simply, transactions happen similarly to debit card payments.

If you are paying a vendor, you draw money from your checking or savings account. When you receive a payment, the money will pass by the virtual account into your main account.

4. Real-time transaction monitoring and reconciliation

All payments made through a virtual account online will be automatically recorded as soon as they happen. You’ll never have to worry about not knowing where or how company funds are coming and going.

A virtual account also lets you easily identify which customers have made payments based on their assigned account numbers.

5. API integrations

You’ll have to set up several integrations to use your virtual account effectively. Most financial institutions that provide virtual accounts will have integration capabilities with different APIs, such as payment gateways and accounting systems.

You can make use of these to seamlessly connect all your processes and avoid delays or mismatches.

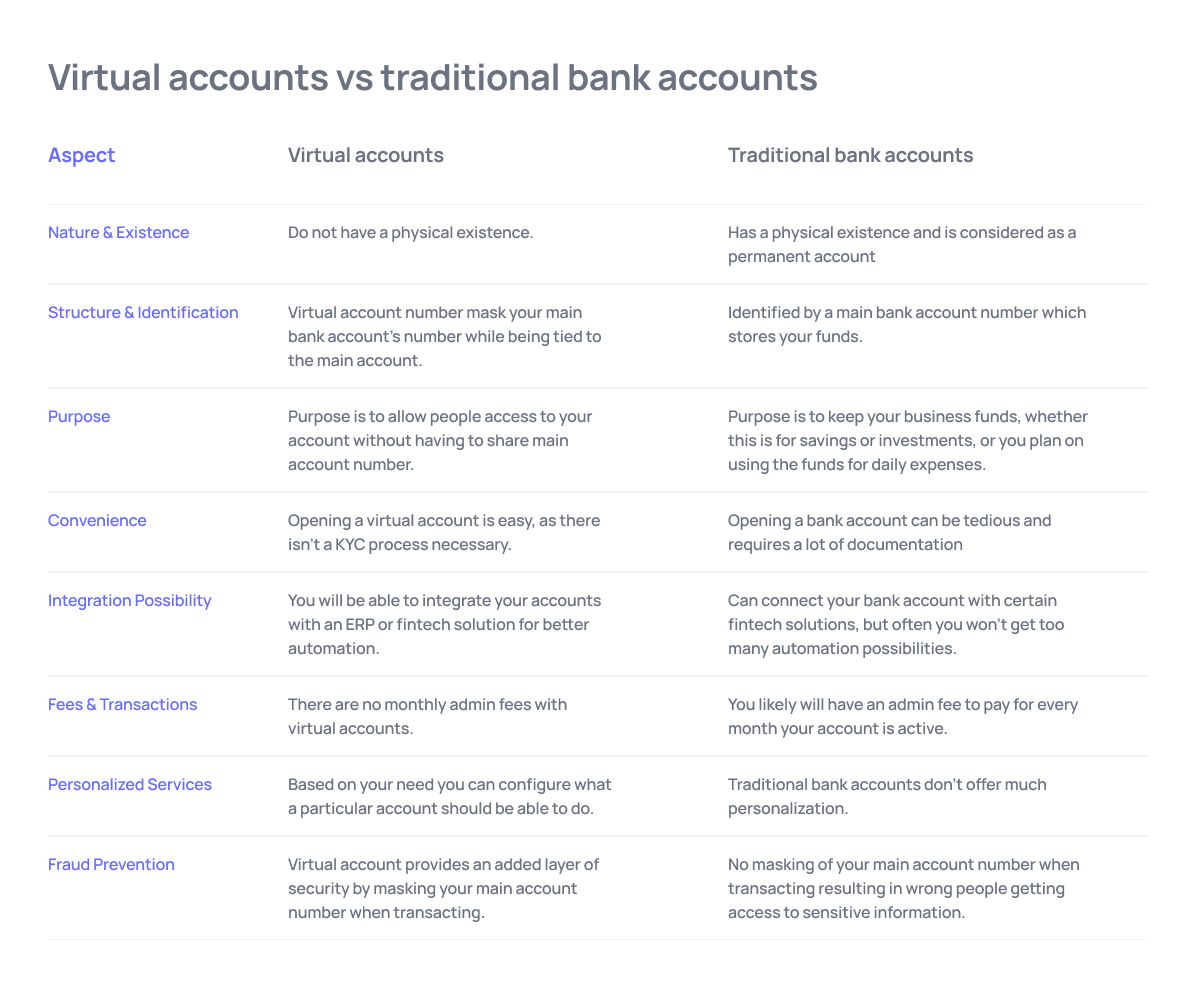

Virtual accounts vs traditional bank accounts — What are the differences?

Often virtual and traditional bank accounts work in tandem to provide the best and most streamlined vendor payment processes for your business.

However, it’s important that you know what their key differences are to make the most of both. Here are some things that set virtual and traditional bank accounts apart.

1. Nature and existence

● Virtual accounts

Virtual accounts are not tied to a physical entity. They cannot be used to store funds long-term and are considered temporary. Often, they must exist alongside a traditional account to funnel the money.

● Traditional bank accounts

When you create a traditional bank account, you’ll have physical access to the funds you store. Sometimes you get a debit card along with it, allowing you to use your money easily.

2. Structure and identification

● Virtual accounts

When creating a virtual account, you will have to link it to a main account. Its identifier is a unique 15-18 digit code that masks your bank account number. A virtual account number example could be 1234-5678-9876-5432.

● Traditional bank accounts

Every traditional bank account is given a unique account number, which is used for transactions. However, as there is only one account number, it could be risky to give out.

3. Purpose

● Virtual accounts

Virtual accounts are essential tools to streamline payments. They don’t function as a fund pool. Rather, you can use them to easily and safely send and receive money with unique transaction identifiers.

● Traditional bank accounts

The main purpose of a traditional bank account is to store money. There are, however, several different types of accounts, all of them with different purposes. These include savings and checking accounts.

4. Accessibility and convenience

● Virtual accounts

It’s equally easy to open and use a virtual account online. Without a KYC process, the entire account opening process can be done online. All you need to use the account is its unique number.

● Traditional bank accounts

A traditional bank account is necessary for businesses, but creating one is not always easy. There is a lot of documentation involved and often takes time. They can also be expensive to maintain.

5. Integration and automation possibility

● Virtual accounts

Integrating a virtual account with your main physical bank account is easy. Beyond that, you can also automate transaction categorization and identification for easier reconciliation by using virtual accounts for payments.

● Traditional bank accounts

Modern banking partners and fintech solutions may be able to offer integrations with your accounting software. However, you won’t get as many automation functionalities like transaction categorizations without virtual accounts.

6. Fees and transactions

● Virtual accounts

You don’t have to pay monthly fees for your virtual accounts. For this reason, you can generate as many virtual accounts as you need. Some payment gateways also will allow you to bypass transaction fees.

● Traditional bank accounts

Having too many traditional bank accounts can be costly for your business, as you’ll have to pay monthly admin fees. Not to mention the fees for transactions between different banks or countries.

7. Personalized services

● Virtual accounts

Considering that you can create multiple virtual accounts with ease, you can personalize what type of accounts you want to have and what you need them for. Generate both single and multi-use accounts easily.

● Traditional bank accounts

There are several different types of traditional bank accounts, but beyond picking which one will be the right one for your business, there is not a lot of personalization.

8. Fraud prevention

● Virtual accounts

You can mask your main bank account number by initiating transactions with virtual accounts. Your physical account is inaccessible by external parties this way, reducing the risk of criminal interceptions.

● Traditional bank accounts

A company’s bank account details should be treated as sensitive information. Giving them out to too many people could increase the risk of fraud attempts. You have to take extra precautions to protect your information

Unlock efficiency and control with virtual accounts for your business

What are the types of virtual accounts?

Virtual accounts offer plenty of customization and personalization options. This is why they are considered extremely valuable tools for many different types of finance processes, starting from accounts receivable to temporary projects or events.

Here are some types of virtual bank account customizations depending on your needs and usage.

1. Receivables virtual accounts

Put simply, a receivables virtual account allows you to receive customer payments easily. Traditional accounts receivable requires a long and tedious manual reconciliation process, but you don’t have to waste your time on that when you use virtual accounts.

Each virtual account online number that you generate and assign to a paying customer is unique to them. As a result, you’ll be able to identify the senders of all your incoming money transfers with ease. Platforms that offer integration capabilities will streamline reconciliation even further.

Suggested read: What are the key difference between accounts payable vs accounts receivable

2. Payables virtual accounts

Your vendors will be able to assign you a virtual account number, or VAN, to make quick and accurate payments. While this is useful for your vendors, it’s also a helpful tool for your accounts payable process.

You can pay directly to your vendors by copy-pasting the VAN assigned to you, which will often have the pre-approved amount already entered. Every payment made through a virtual account will be automatically recorded. Payables virtual account online payments can also be buyer-initiated rather than seller-initiated.

3. Escrow virtual accounts

While virtual accounts are commonly attributed to your main bank account, they don’t always have to be created on top of it. Instead, you can create an escrow virtual account. How this works is that the payer will transfer money, where the funds can be temporarily held in the escrow account.

After the agreed-upon conditions have been met, the funds will then be transferred to the recipient. This ensures that no foul play is involved and that both parties fulfill their obligations.

4. Disbursement virtual accounts

Receive payments directly from your customers with virtual accounts. When you use an expense management solution, sometimes you’ll have to move money from your other bank accounts to your fund wallet. Not only is that time-consuming, but you could end up with double the transfer fees.

With a disbursement account, your banking partner can provide you with a virtual account number for your customers. The account number facilitates your customers to pay directly to you, making use of your dedicated wallet.

5. Customer payment virtual accounts

Customer payment virtual accounts are considerably similar to receivables virtual accounts. By issuing your customers unique virtual account numbers, you can simplify the payment process and identify each paying customer in no time.

However, the focus of virtual accounts of this nature is the customer experience. When creating an invoice to send to a customer, a virtual bank account that they can send money to may be attached. You may also offer virtual wallets to temporarily hold customer funds before payment.

6. Event virtual accounts

Given the flexible nature of virtual accounts, the fact that you can open and close them whenever you need is practical for events or temporary projects. You can generate single-use virtual accounts, which will allow one-off payments to be made easily.

There’s no need to worry about double payments either, as the virtual account will be deemed unusable after the initial payment has been made. After the end, you can also close all the accounts that you made for the event.

What are the main features of a virtual account?

1. Payment monitoring

Monitoring and recording business payments are tedious tasks, especially when you have hundreds of them coming in and going out each month. Virtual account transactions are automatically recorded as soon as they’re made, but that’s not the only feature you get.

With virtual bank account numbers, you can set up unique identifiers for paying customers, making it easy to tell who has paid.

2. Efficient fund management

Processing all your payments through one traditional bank account can get disorganized very quickly, especially when you’re unsure which payments have been made. Using a virtual account simplifies this greatly and makes it much easier to efficiently manage your funds.

Instead of worrying about hundreds of vendor and customer details, you can assign customers with unique virtual accounts and pay your vendors with your virtual wallet.

3. Streamlined reconciliation

Manual payment reconciliation may require you to go through every single entry in your bank account and match them with supporting documents such as payment receipts from customers.

When you have hundreds of paying customers, the process could take you up to a few days. The good news is that by assigning each customer an individual virtual account number, you’ll be able to identify everyone easily—automating your reconciliation process.

Interesting read: What is account reconciliation, its types, and best practices

4. Cost-effectiveness

Maintaining a traditional bank account can get expensive. When you multiply that and have more than one account to manage, you’ll find that the cost of monthly admin fees quickly adds up. To avoid this, utilize virtual accounts instead.

Each virtual account can be directly linked to your main bank account, but they’re generated without any additional costs. You can even create virtual accounts for multiple currencies under one main account this way.

5. Integration capabilities

Choose a banking partner that offers the right integration features for you. If you’re already using an ERP, finance management software, accounting platform, or any other system, creating virtual accounts with banking partners that offer integrations with the aforementioned systems is extremely beneficial.

You can cut down the time it will take for manual data entry and matching. Your records across multiple platforms are guaranteed to be accurate!

6. Fraud prevention

Instead of risking fraud attempts by distributing your main bank account number, virtual accounts allow you to keep that data safe. Generating virtual account numbers helps you keep sensitive information private.

Your main bank account number can be kept on a need-to-know basis internally without having to compromise convenience. Many financial institutions that offer virtual accounts also have industry-standard security measures to prevent fraud.

7. Virtual wallet

Although a virtual bank account cannot be used to hold funds long-term, it’s a good representation of an access method to your traditional account. Virtual wallet APIs, for example, allow your customers to add funds for their transactions with you.

Some virtual account providers also allow you to divide funds in your account neatly by generating multiple wallets for different purposes.

8. Multi-currency support

You can also temporarily hold funds in multi-currency wallets with virtual accounts. While the total funds are ultimately held in your main bank account, using multi-currency functionalities allows you to open a wallet for a particular currency within the main account. This can be used to send or receive funds in that currency, streamlining international business transactions. You won’t have to open a new account for each currency.

9. Transaction reporting

No more manual data collecting to make finance reports. Use virtual accounts to automatically record all your transactions as they happen. Exporting this data only takes a few clicks.

With multiple formats easily available to you, you can access a detailed report of your transactions and export them to various systems you use—such as your ERP or accounting software.

10. Seamless and safe payment experience

As long as you’re connected to the internet, making a payment is easy with a virtual account. All it takes just a few clicks and the payment will be sent in no time.

More importantly, however, is that you’re not compromising any security even with an easy payment method. You can generate one-time payment virtual account numbers to not risk compromising your bank account.

Explore the future of financial management with Volopay

What are the main use cases of a virtual account?

Considered powerful tools for multiple finance processes, virtual accounts are often associated with accounts receivable and payable management. However, given their flexibility, many businesses have begun implementing them for many different reasons.

Here are some ways a virtual bank account for business purchases could prove to be helpful to you and your team.

1. Corporate banking

It’s no surprise that virtual accounts are helpful tools for corporate banking, which is notorious for being complex and time-consuming.

Instead of relying on one disorganized bank account or having to make and manage multiple accounts, open and close virtual accounts as you see fit.

2. Expense management

Without regular reconciliation of your transactions, your bank account can become disorganized. Don’t let this happen when you can utilize virtual accounts to automatically sort your expenses.

Paying your vendors with virtual accounts makes where and how your money is being used easier to track.

3. Receivables management

Tracking customer payments is a tedious task when you have hundreds of them. You want an easy way to identify payments that are sent to your account.

Even when your bank balance increases, you will still have to reconcile each incoming transaction record manually without virtual accounts.

4. Escrow services and fund management

If your vendors only accept payments made directly to their traditional bank accounts, ask if you can make your payments through a virtual account online.

Many offer escrow services and help you ensure that all conditions are met before a payment is received. Every party can feel confident about the transaction.

5. Supplier and vendor management

Making a payment to a supplier’s traditional bank account requires several additional steps. From collecting your vendors’ bank account details to storing them correctly, these payments are a hassle to do.

Virtual accounts eliminate those steps, replacing them with a simple step of copy-pasting the virtual account number to make a vendor payment.

6. International transactions

Virtual bank account numbers allow you to have access to multi-currency wallets. If your business makes a lot of international transactions, virtual accounts are an easy way to do it.

Instead of going to the bank branch, you can send and receive money in multiple currencies digitally.

7. Payables management

Getting a unique virtual account number from your suppliers will simplify the accounts payable process and speed up payments.

Suppliers can even pre-assign you the amount that needs to be paid on a payment portal. You can also use virtual multi-currency wallets to streamline accounts payable.

What is the process of implementing virtual accounts?

There are several key steps that you must follow to ensure that the implementation of virtual accounts goes smoothly in your organization. It’s important you know what they are, allowing you to plan better for it.

Here are some things you want to consider when implementing virtual accounts.

1. Assess needs and objectives

To ensure that the process goes smoothly, you want to set goals first. This way, you’ll have some metrics to measure the success of the implementation.

Do a thorough assessment of your current processes to identify your pain points. You’ll have a better understanding of how using virtual accounts will help, making it easier to find the right virtual account provider.

2. Partnering with financial institutions

Traditionally, a bank is the institution you would be considering to get a virtual bank account. But despite its name, you are not limited to banks. There are a number of financial institutions that can support your finance management needs with virtual accounts.

Conduct your research to find which provider is the right one to help you tackle your pain points.

3. Define virtual account structure

Your banking partner will be able to give you some insights into what structure would suit you best. However, it’s best that you go into the implementation process knowing what the different virtual account types are.

Take another look at your initial assessment to see which would be the right structure for your business. Then, set up the parameters in which your virtual accounts will exist.

4. Integration with existing systems

When you’re researching financial institutions for your virtual accounts, you want to consider integration capabilities as a factor in choosing the right banking partner.

A key ability that you must have is to easily integrate virtual accounts with your accounting software and ERP. Many providers will also be able to help you set it up for future direct sync.

5. Set up access control

You are likely to be given a management dashboard to control all your virtual accounts. Use this to your advantage and make sure that you set it up according to your company policies.

You can determine who has access to manage and generate an account number. Make sure that you utilize the login function to set up access only for specific authorized users.

6. Staff training and onboarding

Virtual accounts can be simple, but when you’re implementing them for the entire organization and making a big change, it’s important that everyone involved has proper training.

Along with assisting your employees during the onboarding process, it’s good practice to host training sessions. This not only helps clarify the purpose and guidelines of virtual accounts but also allows employees to voice queries and issues.

7. Conduct thorough testing of the account

Once you have your virtual bank account set up, you want to test it thoroughly. It’s a good idea to create a virtual account number example and do some test transactions.

If there is anything that doesn’t work, this would be a good time to identify and resolve it. It’s also important that you’re comfortably familiar with the account before you use it for daily business operations.

8. Gradual rollout

The last thing you want is to overwhelm your team with the implementation of virtual accounts. Make sure that you roll out the virtual account usage gradually and incrementally, as this ensures that your team is comfortable with the virtual bank account before using it on a larger scale. It helps make it less overwhelming for your team when assigning account numbers to customers.

9. Monitor and evaluate

Monitoring your virtual account processes is important even once you’re done with the initial implementation stage. Make sure that you are regularly touching base with your employees and addressing any additional questions they may have.

You also want to review and evaluate how effective your virtual account online payments are. Get feedback from employees and continuously tweak your process to optimize it.

10. Compliance and regulatory considerations

Staying up to date with regulations about virtual accounts is crucial if you’re planning on implementing them. Provide training sessions to your legal, compliance, and finance teams and familiarize them with your virtual accounts.

This will help to ensure that all processes within your virtual bank account comply with regulations. It’s also good practice to include these in your company policies.

You might also be interested to read: How to ensure expense report compliance for your business?

Open a virtual account for seamless financial management and growth

What are the challenges associated with implementing virtual accounts?

Knowing the benefits that you can get from setting up a virtual bank account for business purposes is only the first step. When you implement a payment system with virtual accounts, you’ll have to take some measures to mitigate common challenges that you may encounter.

1. Integration complexity

Integrating a virtual account online with other existing systems in your organization can be a challenge. Without integrations, however, you’ll have a difficult time ensuring that every process you have is in sync with one another.

When you implement virtual accounts for your organization, ensure that your banking partner provides easy integration solutions.

2. Change management

Introducing change to your organization is always daunting, especially when you already have existing payment processes.

While virtual accounts are guaranteed to be more efficient in the long run, reaping the benefits of a virtual bank account will require you to do gradual rollouts and host enough training sessions.

3. Regulatory compliance

Getting a virtual account online is a recent development for a lot of businesses. You must know how to implement a virtual bank account for business and understand what the regulations are.

Make sure that you go with a reputable virtual account banking partner to avoid non-compliance penalties.

4. Migration plan

If you are planning to make the shift from manual processes to using a virtual bank account for business payments, it’s best that you migrate the entire system to suit your new digital account.

While the steps can be complex, setting up individual virtual account numbers for each customer and migrating them is necessary.

5. System reliability

As with every other finance process, reliability is key to ensuring that your virtual account online payments go smoothly. However, you may have trouble if your banking partner's central system is down.

To avoid delaying your processes, it’s important that you open virtual accounts with a banking partner with good customer support.

Increasing adoption of virtual accounts in different industries

The popularity of virtual accounts extends across multiple industries, especially because they’re useful for both businesses and their customers.

Some industries that have seen virtual accounts make a positive impact include, but are not limited to, manufacturing, healthcare, and education.

Most businesses will find that upon implementing virtual accounts, their payment and reconciliation processes will be much more streamlined.

Manufacturing and supply chain

It’s no secret that manufacturing companies and the supply chain industry deal with large transaction volumes with equally large amounts. Their finance teams have to sort out, organize, and manage bank accounts and reconciliations at all times.

With virtual accounts, manufacturing companies can assign each customer a unique VAN to identify them when a payment has been made. It also reduces the risks of sensitive information being leaked.

Healthcare

As an industry that is often associated with large payment volumes and time-sensitive orders, virtual accounts offer a better way to get higher visibility of customer payments in a shorter time.

Allowing customers to automatically generate a virtual account number to send a payment shortens the cycle. With the addition of automated reconciliation, businesses can begin fulfilling their orders faster without having to worry about unfinished transactions.

Hospitality and travel

For a paying customer, travel and hospitality purchases are rarely considered must-haves. Jumping through hoops just to make a payment could change their money. Virtual accounts can eliminate these barriers, helping travel and hospitality businesses increase sales.

Additionally, travel purchases are often time-sensitive. Allowing customers to pay with a virtual account online speeds up the process and helps them guarantee the price and booking.

Non-profit organizations

Virtual accounts are a good way to accept donations, as they are convenient for all parties involved. People who are eager to donate to non-profit organizations can simply copy and paste a virtual account number or use a VA payment gateway and enter the amount they’d like to make a donation for. It takes no time and doesn’t clutter anyone’s bank accounts.

Education

Many of the resources provided by an educational institution are payment-gated. To simplify the interactions between the institution and its students, many institutions are implementing virtual accounts for tuition and other payments.

Each student is provided a unique virtual account number, which will identify them once a payment has been made. With integration capabilities with other systems, the student will immediately be able to access resources upon payment.

Open a virtual account and transform your financial management

Take a look at how Volopay helped BukuWarung with virtual accounts

Managing expenses across different countries is no easy task. BukuWarung is an Indonesian bookkeeping company in the fintech sector, with operations in both Indonesia and its head office in Singapore. With vendors in many different countries, BukuWarung would traditionally have to juggle multiple bank accounts.

Volopay introduced a new, easy, and quick solution for BukuWarung. With just one business bank account, BukuWarung could generate virtual multi-currency wallets and do all their payments with ease—all on a single platform. No stress, no time wasted, and no series of bank accounts to maintain. Volopay is BukuWarung’s gateway to easy payments.

To know more, read - How Volopay helped BukuWarung

How does Volopay virtual account function?

Forgo the long delays and complicated reconciliation processes by implementing Volopay’s virtual bank account for business purposes. Get a digital bank account that you can use for all your payments, both locally and internationally. Equipped with multi-currency wallets for easy international transfers, all your payment needs are met with Volopay. You won’t need to maintain multiple traditional bank accounts.

As a result, businesses can streamline purchases and automate reconciliation without consuming too much time. Simplify your payments and start with Volopay virtual accounts today!

Even better, you can get a virtual account number when you create your Volopay account. When receiving payments from your customers, there’s no need to receive them in one account and transfer them to another. Send them the account number and have customer payments made directly to your Volopay account. Don’t wait for them to send payments to another bank account. Eliminate that extra step of transferring money from one of your accounts to another. Incoming and outgoing transfers can be made with ease, all on the same platform.

With Volopay, you can streamline your processes further by only using one account—the Volopay one. Enable your multi-currency wallets and segregate funds within one account. While they’re all still directly sourced from your main account, you can now temporarily hold money in another currency. When the time comes, initiating international transfers will only take a few clicks.

Volopay’s virtual account works in tandem with many other features on the platform, all of which should be leveraged for smoother payments, expense management, and overall corporate banking experience.

Make expense management a breeze with Volopay

FAQs

VAN is short for virtual account number, which is an account number you can use in place of your bank account number. It offers an added layer of security and can be used as a unique identifier for payments.

Yes. While you can generate unique single-use numbers, you can also avoid the hassle of settling recurring payments by giving your customers an individual multi-use virtual account number. It will be an identifier for every payment from that particular customer.

Yes. Businesses can benefit hugely from using virtual accounts to manage their finances. Whether it’s for sending or receiving them, using a virtual bank account helps you streamline payments and makes reconciliation easier to do.

Do your research to find the right banking partner for your business. Once you find a virtual account plan that suits you, you’ll be required to fill out a form with your business and bank details. As a physical KYC isn’t required, the entire process can be done online.

No. A debit card requires a fund pool to draw money from for transactions. Unlike traditional bank accounts that you can link a debit card to, virtual accounts don’t have a physical result. As a result, no debit card is issued.