Automate vendor payments with the best accounts payable software

Make timely and accurate bill payments easy with Volopay’s AP automation tools. You can verify, approve, process, and pay every invoice on a single platform. No more hassle and late fees!

Trusted by finance teams at startups to enterprises.

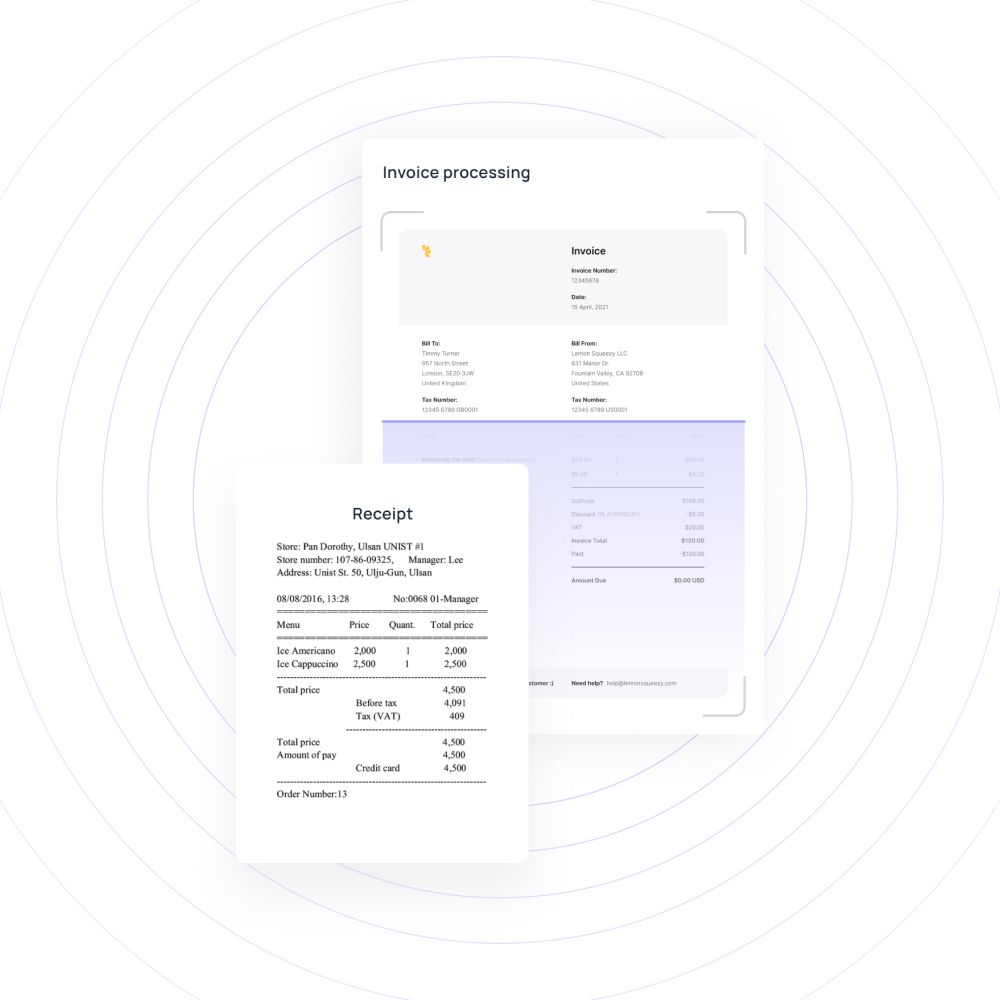

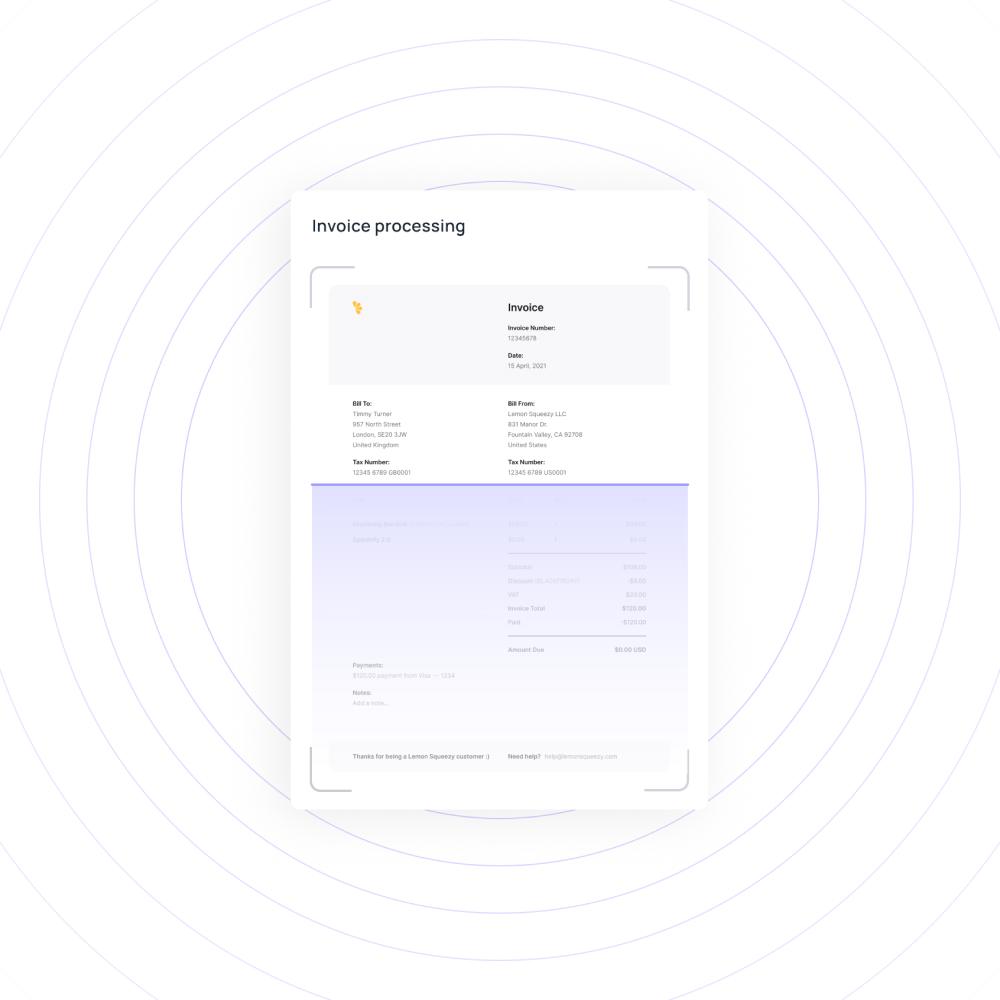

Streamlined invoice processing

Invoice submission on the platform automatically creates a bill for you to process. Use optical character recognition (OCR) technology to scan invoices or upload them in bulk to avoid tedious manual administrative tasks.

A single bill can easily be split into multiple line items for greater details on your expense tracking. Everything you need to streamline invoice processing is at your fingertips with Volopay’s accounts payable automation software.

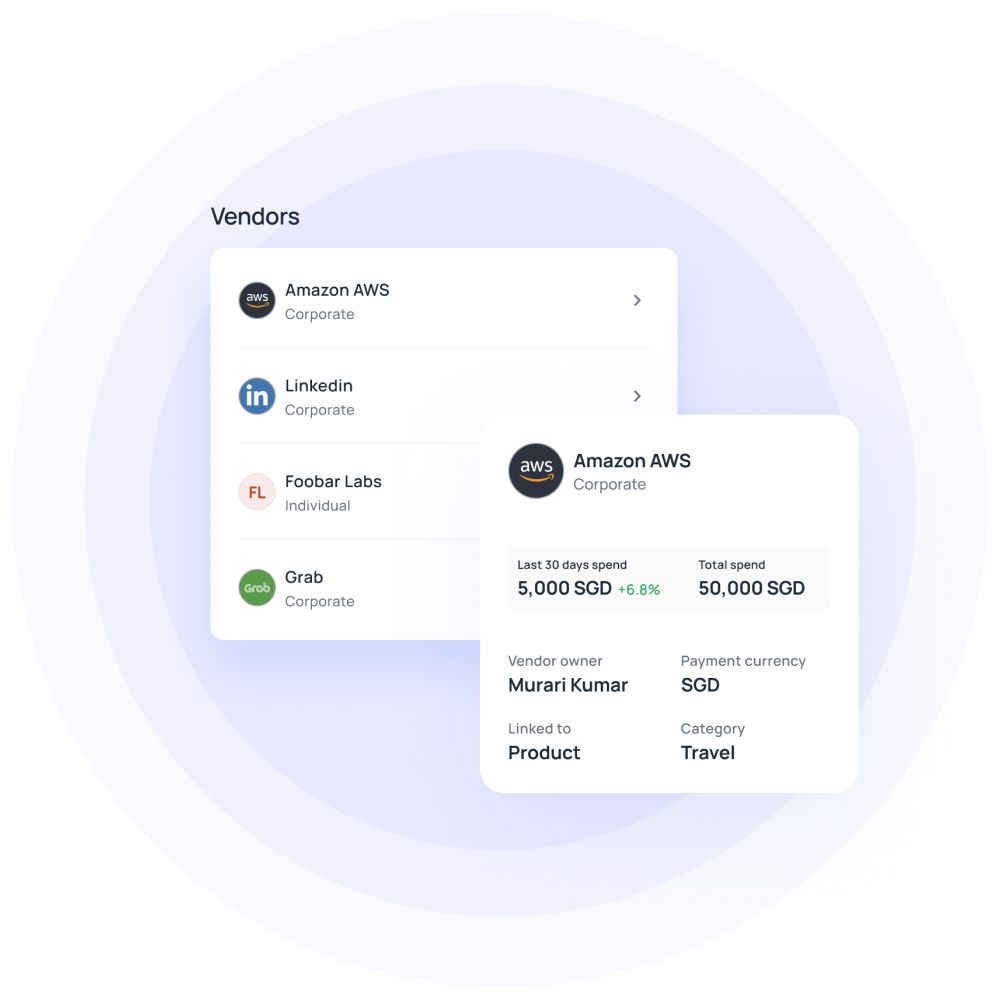

AP automation for efficient vendor management

Create, add, and manage vendors with ease through Volopay’s automated accounts payable software. Each vendor entry can have an appointed owner, promoting accountability. Make the data collection process easy by requesting vendors to complete their details.

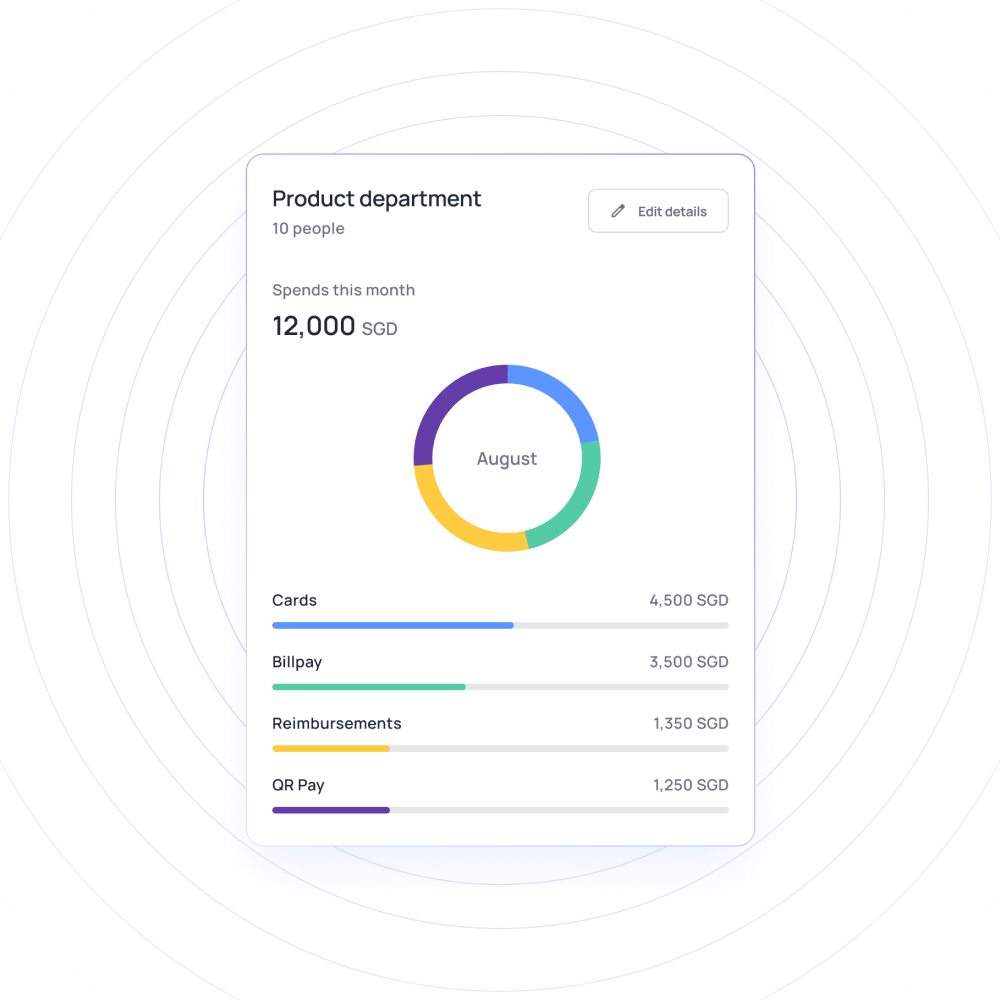

Do everything on a single dashboard, starting from linking vendors with departments and projects to accessing each vendor’s full payment history. Vendor tracking and reconciliation don’t have to be difficult.

Track invoices in real-time

Say goodbye to confusion and unexpected surprises. AP automation with Volopay allows you to easily track where each of your invoices is at, all in real time.

Every stage of your approval process is highly visible to all personnel involved. Between automated duplicate payment flaggings, general ledger syncing, and an easily accessible Bill Pay history, the entire AP process is always highly visible.

Streamline your AP process with Volopay

Access and approve invoices on-the-go

You don’t have to be confined to your office to be able to process your invoices effectively. Take care of your accounts payable from anywhere using Volopay’s mobile application. Access your invoice information and review them easily on the go, enabling faster approvals.

Set automatic notifications to be sent via your mobile app to ensure that you never miss an invoice approval request.

Expense reporting integration

Get the most accurate expense reports in real-time without having to worry about the manual work associated with them. Every payment made will be automatically recorded on your accounts payable software.

Eliminate the need for manual data entry and paper trails. Automated expense entries can be integrated into your finance processes, allowing you to quickly generate reports for all your expenses.

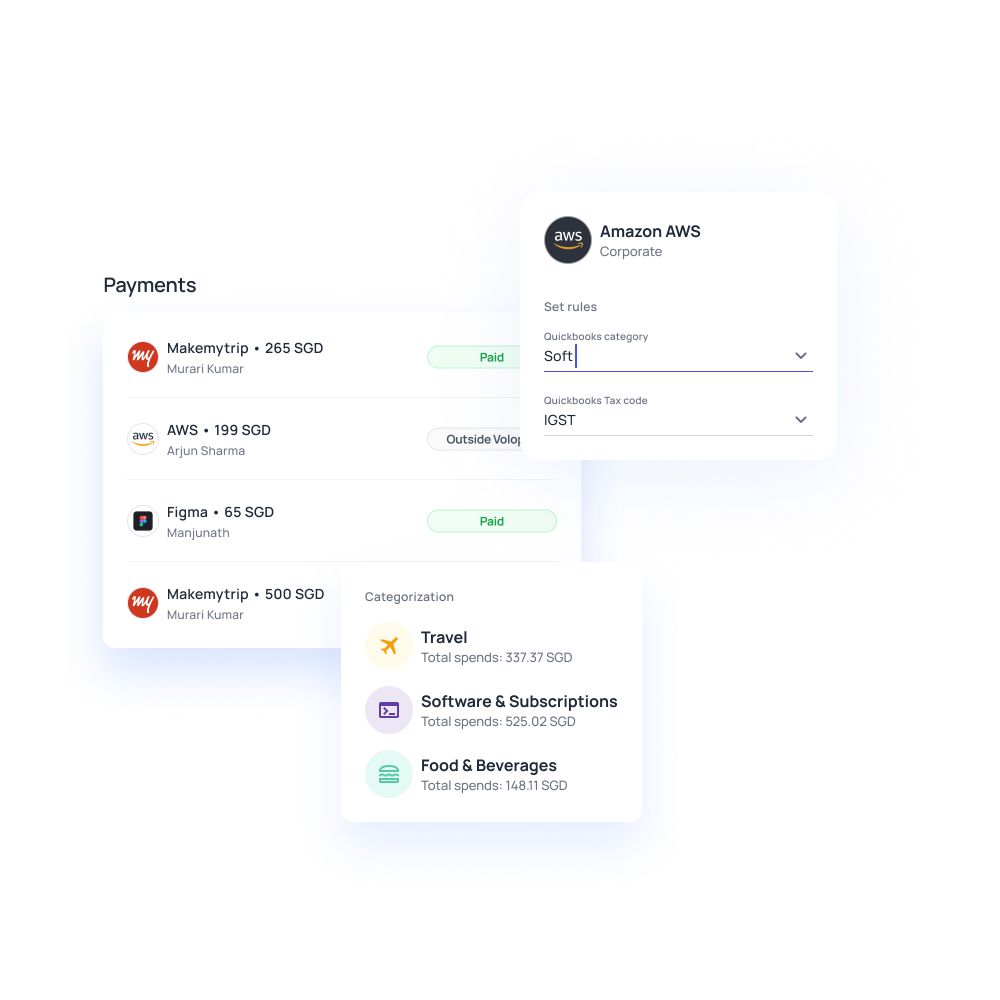

Vendor payments, simplified

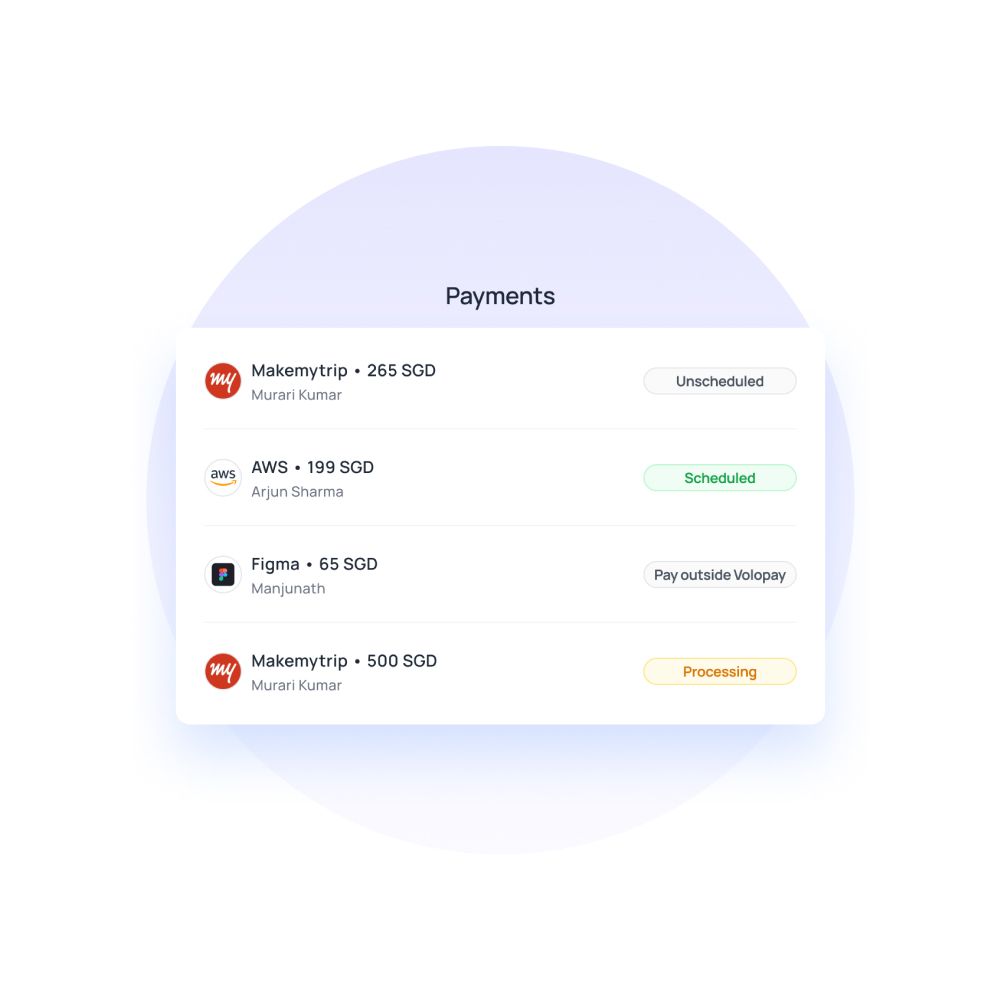

Need to pay a vendor quickly? Make it easy to settle your payments with Volopay bank transfers and virtual cards. Schedule one-time and recurring payments as needed and get alerted when a payment has been made.

Vendors linked to specific projects will automatically use those project’s allocated budgets. If needed, you can also pay outside of Volopay and sync your transaction afterward. Categorize all payments regardless of whether they were made in or outside of Volopay.

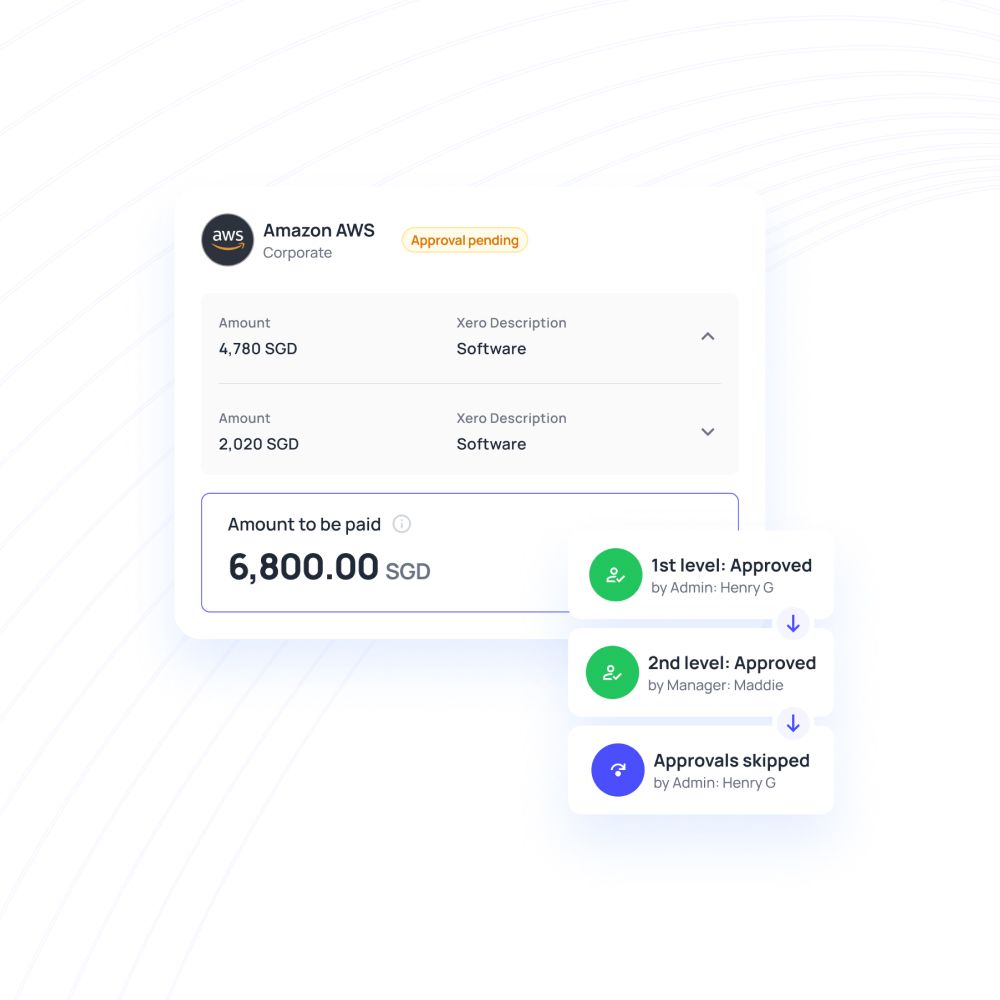

Multi-level approvals for all processes

Good accounts payable software comes with maker-checker capabilities. Payments made to vendors go through multi-level approval systems, and the workflows are designed by you. Multiple people are responsible for verifying a payment before any money is deducted from your account.

Any expenses that need further review can be discussed straight on your Volopay platform. Use the comment feature and hold conversations before approving payments.

Supercharge your AP process with our advanced software solution

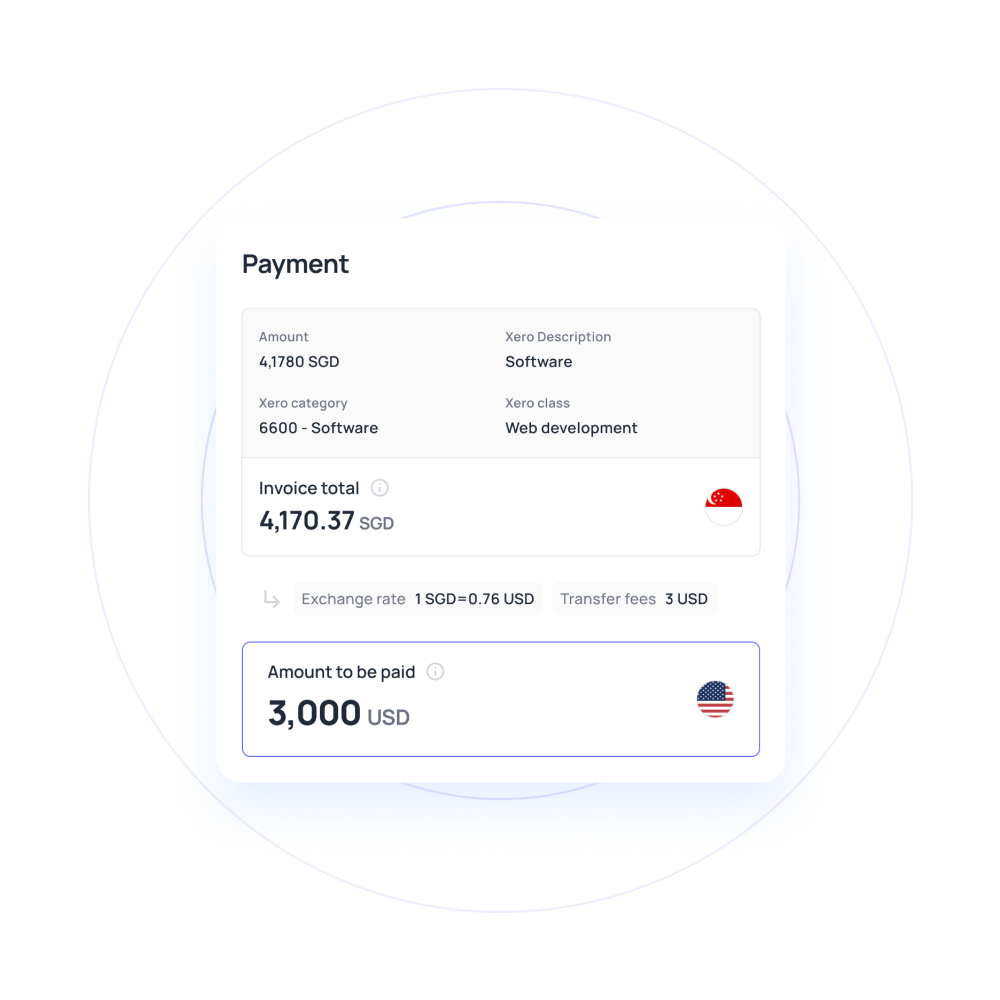

FX charges at low, affordable rates

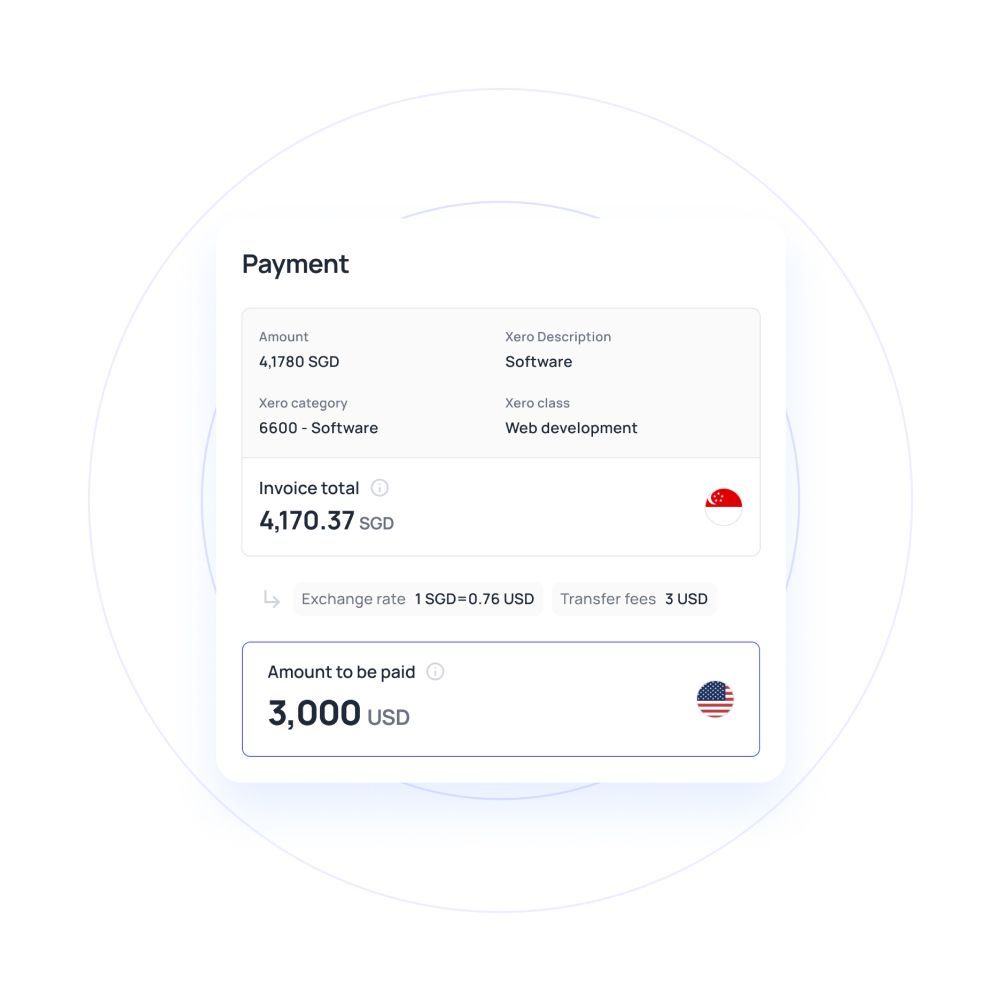

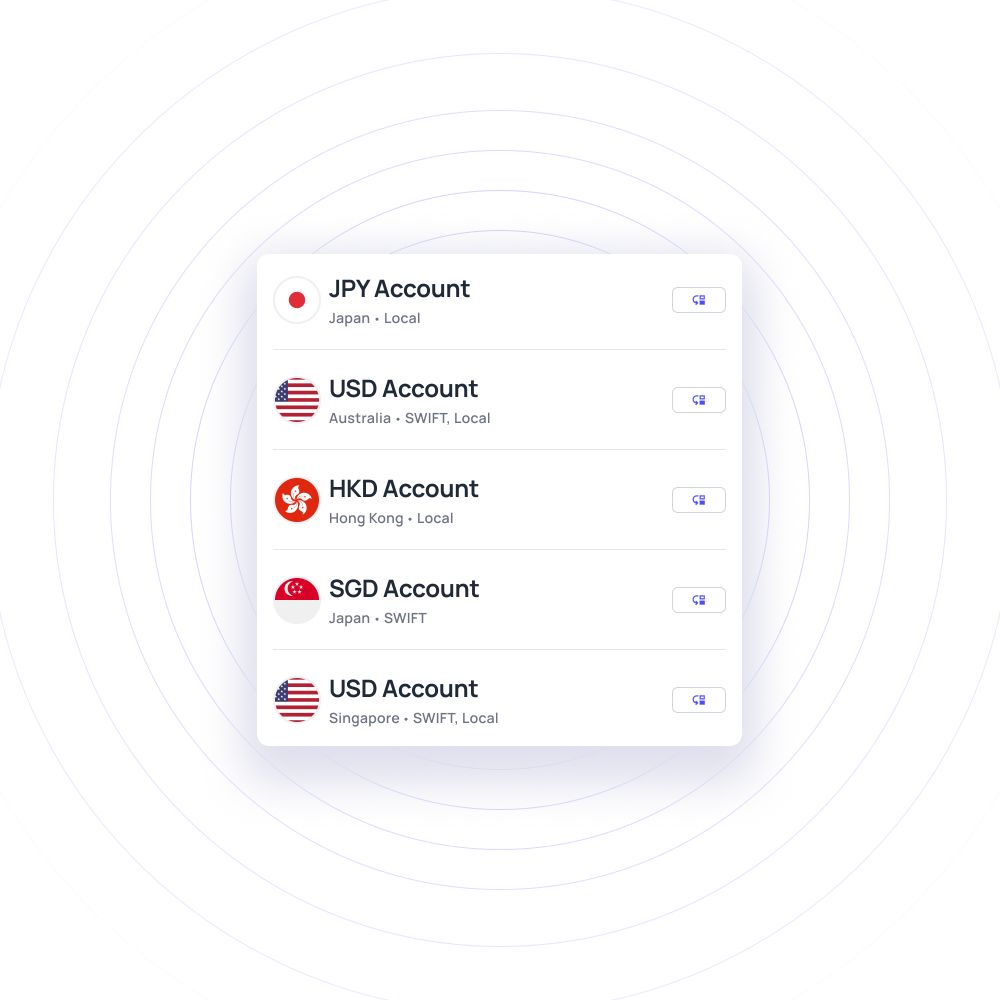

International transactions are effortless when you’re using accounts payable automation software. With Volopay, you can make cross-border payments to vendors and employees in over 130 countries.

We support multi-currency wallets so that you can manage your funds easily. Get low FX rates and competitive transfer fees to facilitate international payments.

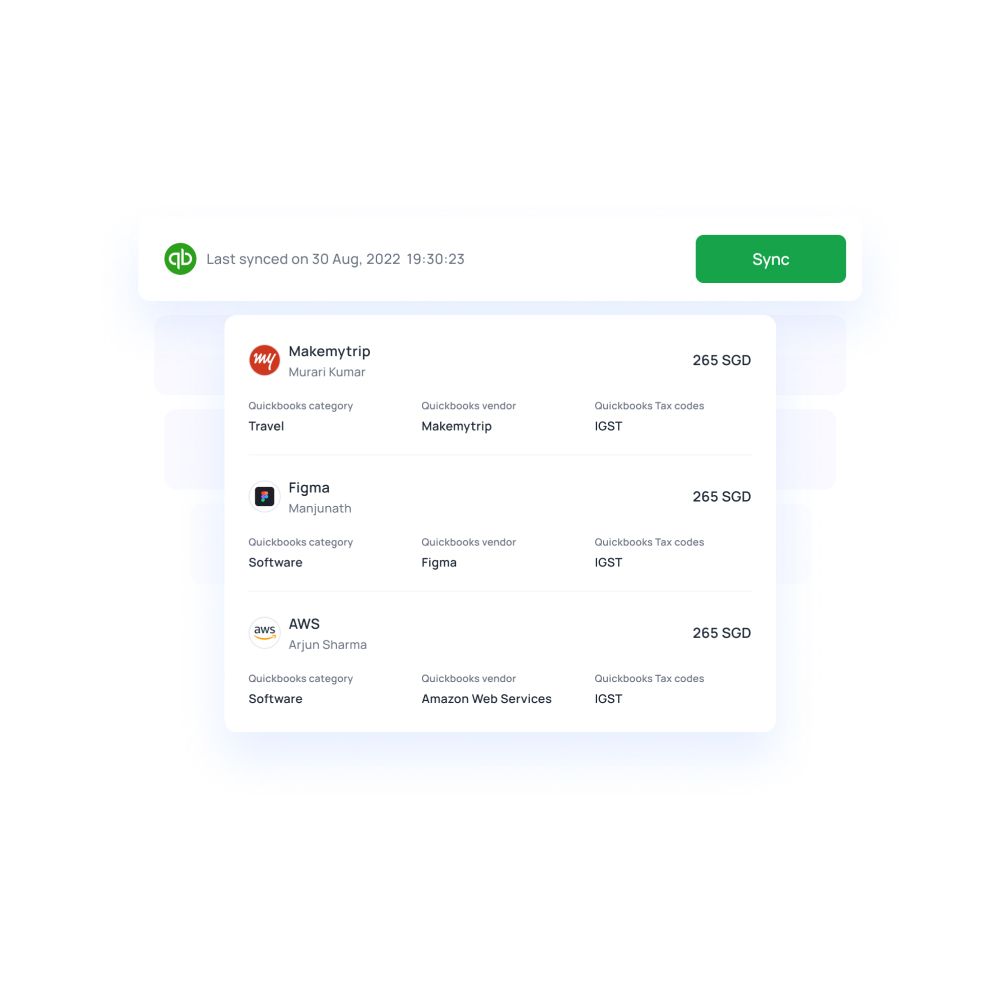

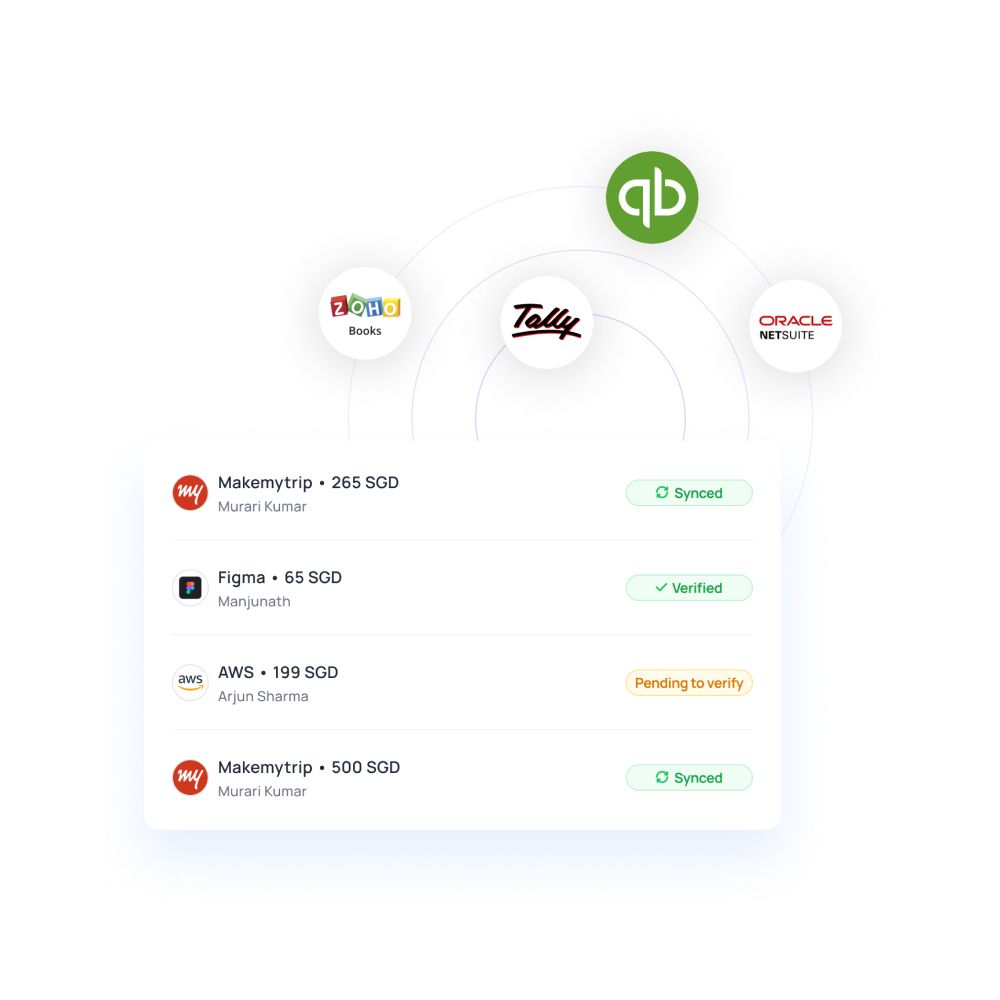

Accounting integrations easily automated

You can integrate your accounting software to sync seamlessly with the Volopay platform. That way, all the recorded expenses get transferred automatically to your accounting system for better reconciliation.

Closing books becomes faster when you can set up accounting triggers, create advanced rules, and easily categorize expenses. With direct transaction sync and the ability to attach receipts to every transaction record, you’re guaranteed to close your books hassle-free.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Unlocking efficiency, savings, and confidence with AP software

Streamlined workflow

No more wasting your time fumbling around in confusion. Accounts payable software is the right tool for you to streamline all your workflows. All invoices can be processed and approved on a single platform.

Reduced manual labor

Make work easier for your accounts payable department. Eliminating the need for administrative tasks like data entry means that your employees won’t have to bear the brunt of manual work. Allow them to focus on other things that require attention.

Regulatory compliance

Accounts payable automation tools like Volopay will flag any suspicious activities and notify you.

Add the enhanced accuracy that you’ll achieve through automation and you’ll find there’s no need to worry about not complying with the regulations.

Faster invoice processing

No one wants to spend too much time processing invoices, especially when this could lead to late payments.

An AP automation platform will help eliminate time-consuming manual data entry, ensuring that all your payments are made on time.

Reduced paper usage

It’s no surprise that many businesses have taken up sustainability initiatives in recent times. By automating your accounts payable, you’ll easily and significantly reduce the amount of paper used. It reduces your costs, too!

Detailed transaction logs

Get detailed logs and records of all your transactions with accounts payable software. With your entire process easily managed you a single platform, all your data will be stored in one place for easy access.

Discover the benefits of streamlined processes and improved efficiency

Step-by-step process of using an AP software

Onboarding and setup

Get started with your accounts payable approval software by onboarding your staff onto the platform.

While it’s easy to use, you want to make sure that you give the appropriate training necessary to your employees and get the platform set up.

Invoice receipt and capture

Once the initial setup is done, you can process every invoice through your accounts payable automation software.

Upon receiving an invoice, take advantage of optical character recognition (OCR) and scan each invoice to capture its data. This will be automatically recorded in your system.

Invoice verification and approval

Just because you’ve captured your invoice data it doesn’t mean that you can make a payment right away.

Verify your invoices, perform 3-way matching, and get them approved to ensure they contain no discrepancies before sending them forward to process.

Invoice processing

Knowing that your invoices are accurate and verified, you can start processing them to prepare for payment. This will include reviewing each invoice’s terms to see when the due date is.

You can schedule payments in advance during this stage.

Payment processing

No accounts payable process is complete without settling the bill you owe.

Once you know that your invoices are ready to be paid, create your payments and allow your accounts payable software to automatically process it. You’ll get notified when they have been successfully sent.

Reporting and analytics

The good news is that each invoice and payment you process will be automatically logged and recorded in real-time with an AP automation tool.

Make sure that you take advantage of these features and quickly generate reports and get data analytics as needed.

Vendor management

You’ll have much more than just one invoice to process per month. In the same vein, you’ll also have multiple vendors.

Make sure that you are managing your vendor information to ensure that you have all the correct data on your accounts payable software.

Archiving and compliance

Make sure that you have an archive of all your invoice and accounts payable records.

An AP automation platform will aid you in the process by automatically logging and storing your information. Everything will be ready for the audit season!

Learn more about Volopay

We’re a one-stop shop for all your expense management needs. Need a card? Need to manage reimbursements? Need approval systems? Need accounting made better? It’s all in one place.

Invoice management

Manage invoices with sleek, modern software. Make payments in any country, to any vendor, with the help of better invoice verification and payment syncing. Invoices can be manually uploaded, sent through email attachments, or even transferred from accounting. OCR technology makes the process quicker.

Vendor Payouts

Zero hassle vendor payouts through Volopay corporate cards and Bill Pay dashboard. Easily manage wallets in different currencies, and make payments all over the world. On-time, cheaper, and recorded in real-time for easier reporting. Nothing flies under the radar, and everything is reconciled faster.

Explore more about accounts payable automation

Get to know what proforma invoice is, its benefits for businesses and how to create one for your business.

Choose from the list of ideal payment methods that are flexible, scalable, and secure for making business payments.

Know how to seamlessly manage B2B payments with features like Virtual cards, and multi-currency digital wallets from Volopay.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

Volopay helped BukuWarung in managing their expenses across different countries.

Volopay helped Deputy smoothly integrate with an accounting system.

Using Volopay, AdCombo eliminated the hurdles of cash flow management.

Bring Volopay to your business

Get started now

FAQs on accounts payable

To save time and money, always look for an accounts payable automation software that helps you set up and auto-schedule payments on the go. An ideal AP automation software must offer fluid integrations with leading accounting systems as well as top-notch security. Choose an accounts payable software such as Volopay that can effortlessly customize to your existing approval processes, payment methods and workflows.

Volopay is an all-in-one accounts payable automation software that digitizes your invoices onto the platform while streamlining other AP processes such as approval workflows and payment procedures. From invoice generation to payment, you can automate all processes through our unified dashboard.

Yes, automatic Bill Pay is a great idea for businesses that deal with a large volume of invoices on the daily. AP automation software like Volopay take away the stress of manual payments, helping you process invoices on time and foster healthier relationships with your vendors.

Automated accounts payable facilitates vendor invoice management by digitizing vendor invoices and uploading it in your account database for faster tracking, managing and payments across local and international suppliers. With an automated invoice management software like Volopay, companies can easily collate, approve, and audit invoices on the go, all through one convenient location.

In order to minimize bad data or fraud, Volopay allows you to use two-way and three-way matching verification systems for your accounts payable transactions. Invoices and bills (and receipts, if needed) can all be matched to each other to ensure everything is in order. If you’d like, POs can also be attached as supplementary documents for the fourth level of verification.

Volopay allows you to make every constituent process of the accounts payable process much quicker, making the overall process more efficient. You can capture invoice data, set up payments, set approval lists, and automate expense reporting. Moreover, using cards allows you to make FX transactions at lower rates. Not only is your system improved, but it is also more cost-effective. Above all, having a well-oiled accounts payable system also positively affects your vendor relationships.

Volopay integrates with global leaders in accounting software. We have integration options with Xero, Netsuite, Deskera, Quickbooks, MYOB, and more. If you don’t use any of this accounting software, then there is also the option to create templates that match your software requirements and export the files.

Yes, Volopay’s software has OCR (optical character recognition) technology implemented into it. Any invoice uploaded to the system automatically has the line data entered into the report without needing to manually transfer from the receipt image/file to the data fields. If your receive invoices directly to your accounting software, you can integrate it with Volopay so that it captures the data from there. Alternatively, if you receive invoices as email attachments, these can be auto-forwarded to Volopay for automatic upload.

Vendor payment initiated from our platform is a lot quicker and no-nonsense than wire transfers through banks. Domestic payments and non-SWIFT payments (from locally held accounts) are processed within a few hours. International payments generated through the SWIFT network might take a little longer - up to 2 working days depending on the vendor’s country and bank. You can set up advance payments to avoid any last-minute hassles.

Yes! You can make international payments very easily through Volpay, even outside Singapore. You have the option of activating a multi-currency wallet, which lets you hold funds across different currencies other than SGD. Additionally, our corporate cards are enabled for international payments. Utilizing these options will give you much lower FX rates and remittance fees, and you can send money to over 130 countries.