Cutting-edge accounting automation software

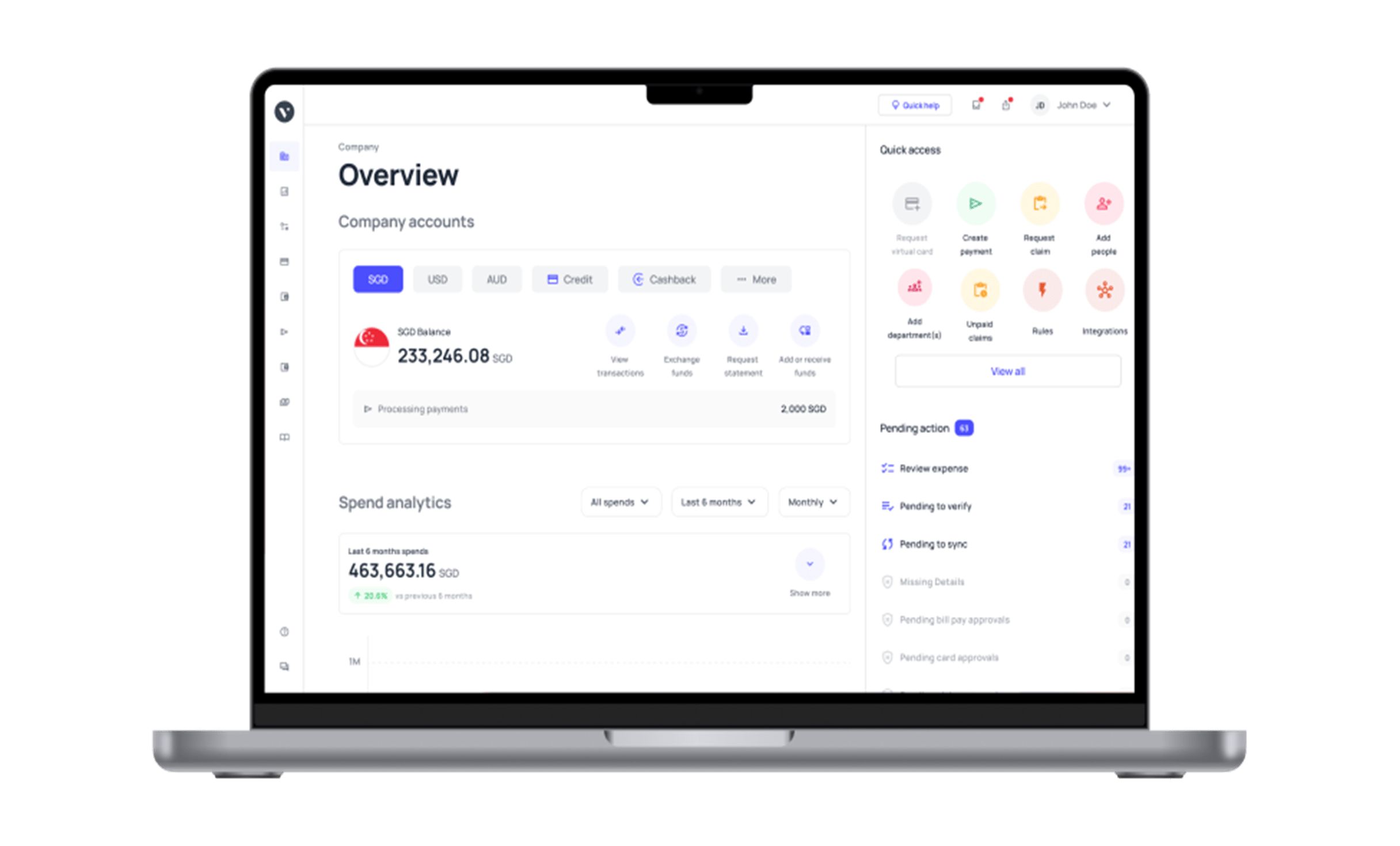

Using Volopay’s system of highly customizable accounting automation tools makes sure your organization is always maximizing efficiency. With real-time updates, instant synchronizations, customizable controls, and more, Volopay guarantees the full package for automation.

Engineered to manage operations from initiation to completion, Volopay streamlines every aspect of a business's financial workflow. Embrace the benefits of intuitive automation and effortless integrations in your workflow, without unforeseen obstacles and constant support.

Smart categorization and controls

Users can establish precise and tailored regulations that automatically activate during transaction accounting with the enhanced rules and advanced rules features.

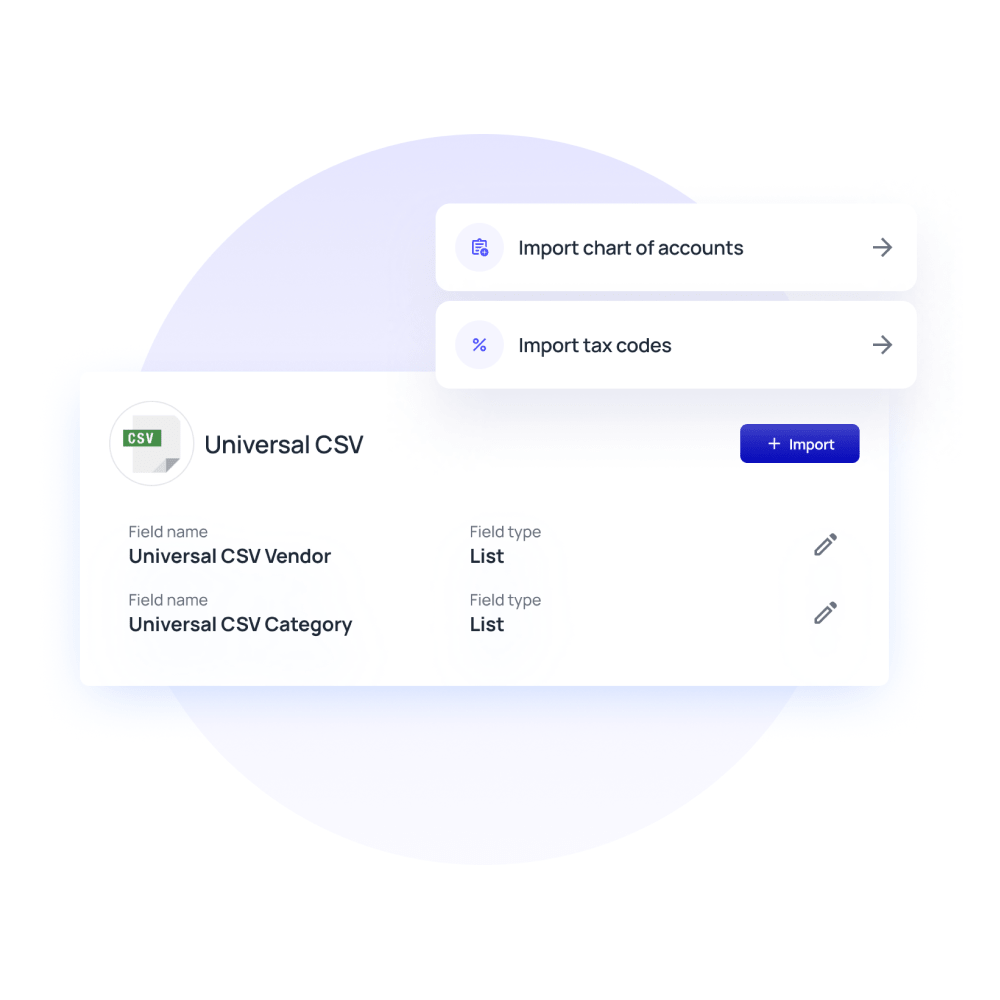

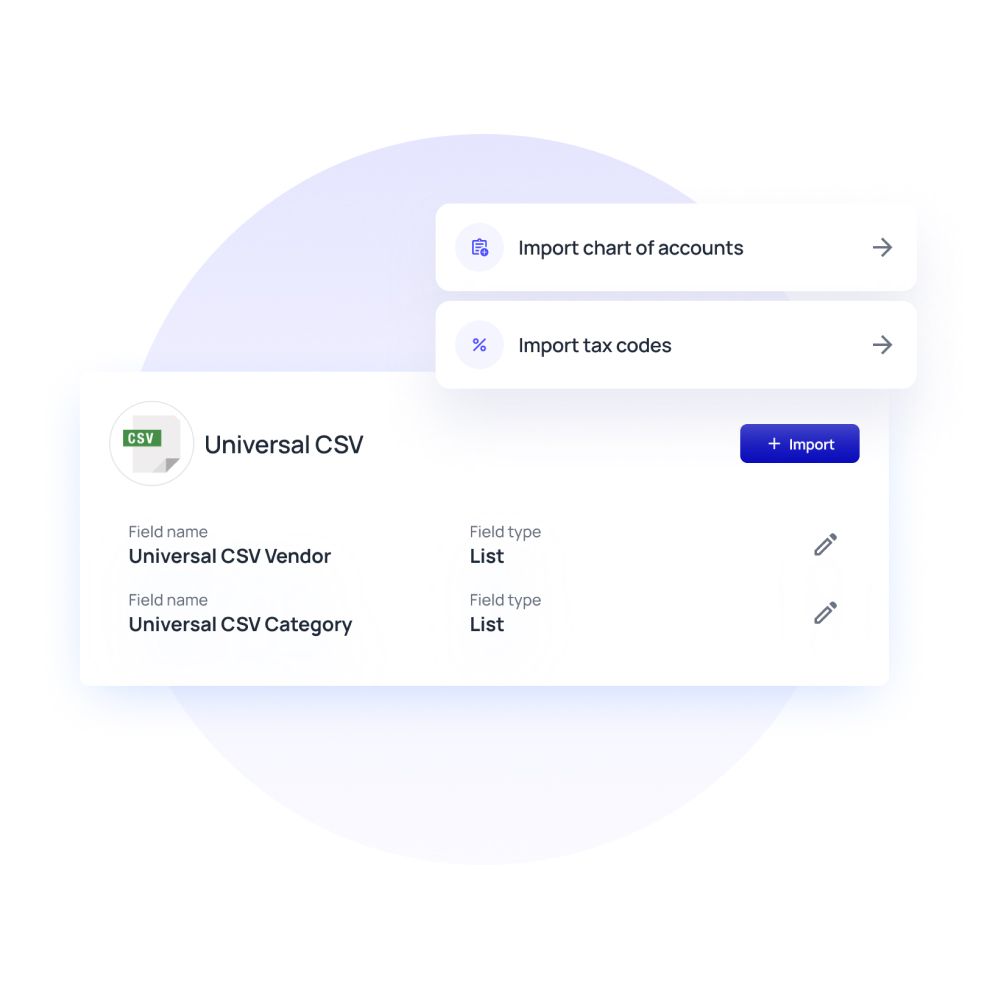

Additionally, the Universal CSV feature provides the capability to generate custom fields tailored to meet the demands of and seamlessly integrate accounting data with virtually any accounting software.

Close accounting books faster than ever

Configure rules and workflows into Volopay which automatically scans and categorizes payments as soon as they are processed. Eliminate time-consuming and repetitive manual accounting that is prone to human error with accounting automation that helps businesses close books 10x faster.

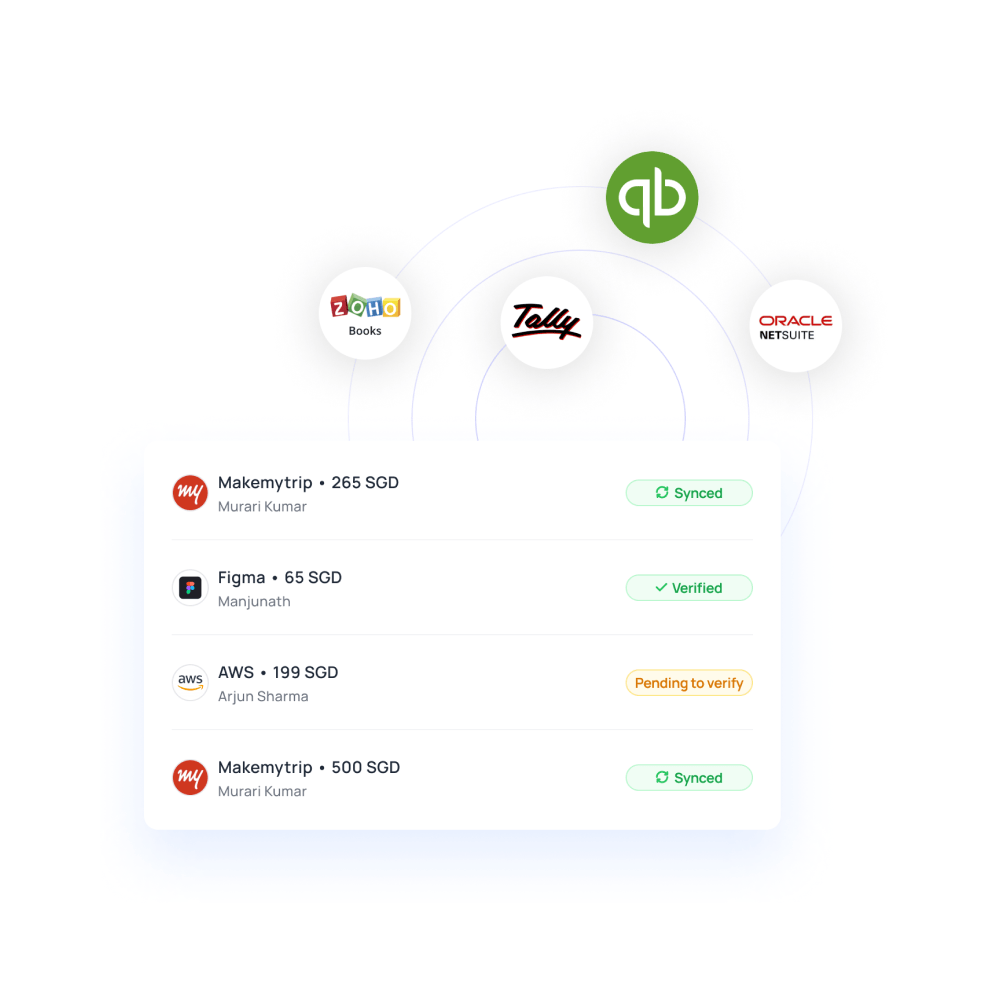

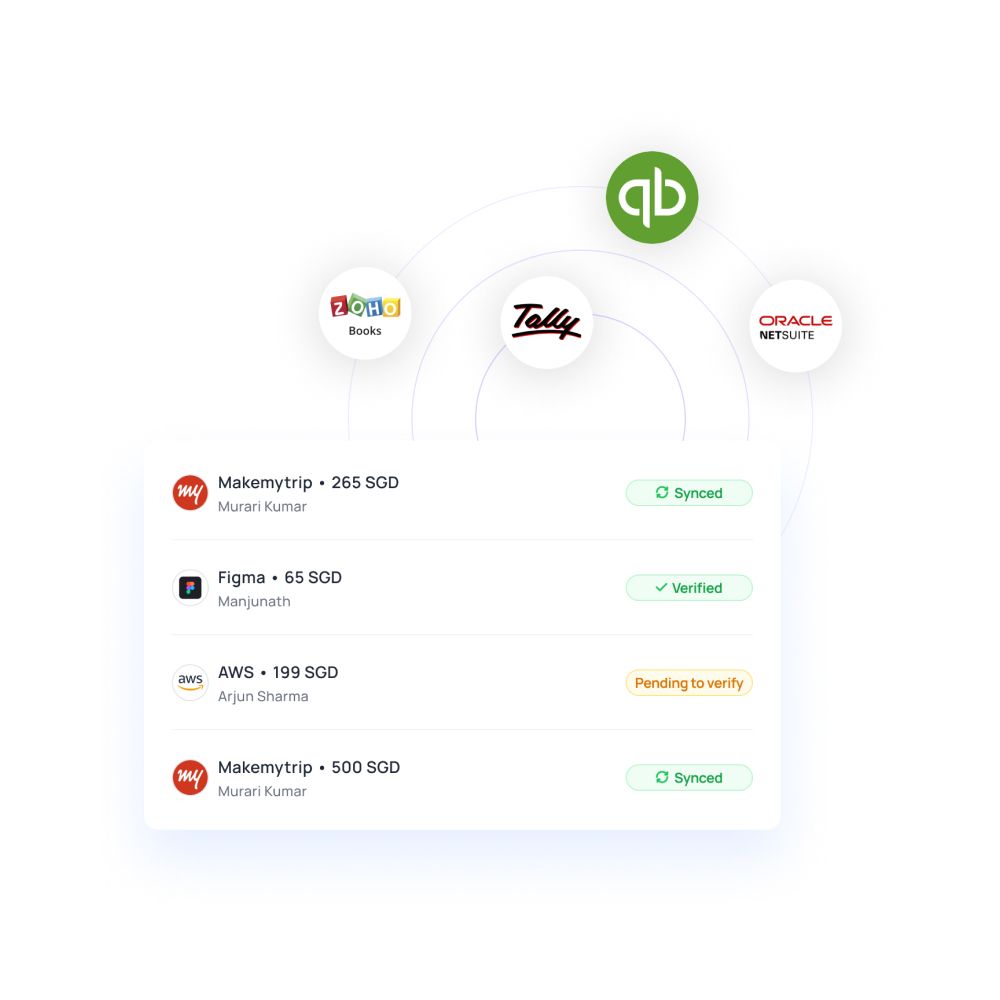

Ensure accuracy and precision with seamless integrations with some of the most widely-used accounting software

Real-time sync with increased visibility

Volopay offers a variety of features to uphold data accuracy across multiple platforms, including real-time sync to update expense reports to your master ledger automatically. We integrate with major accounting automation software such as Xero, Quickbooks, Deskera, and NetSuite.

Changes can be effortlessly monitored through the sync history feature, providing valuable insights into transaction updates over time. Furthermore, direct links to synchronized transactions ensure quick access to comprehensive information as needed.

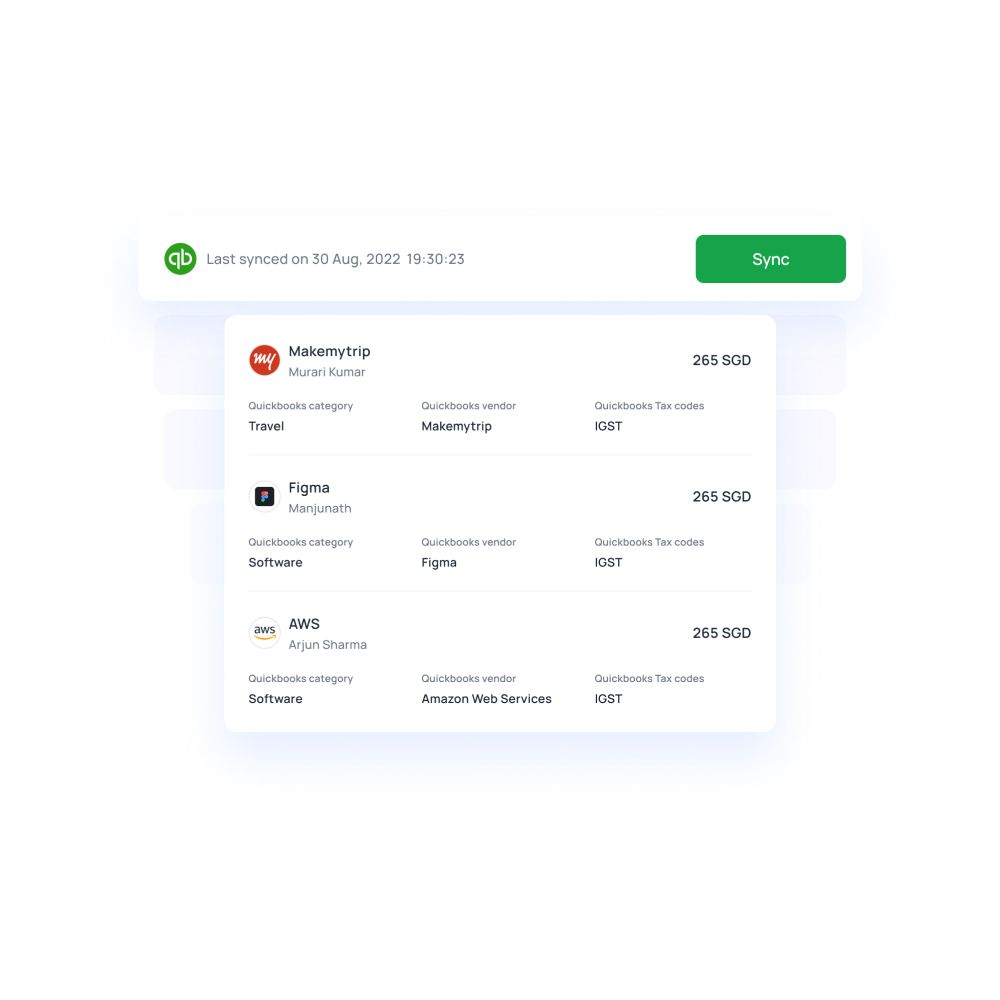

Prepare & export expenses easily

Integration rules can be customized to suit specific requirements and specifications. Enjoy uninterrupted bill payment processes and seamless, regular synchronization with real-time updates. Access the accounting inbox through a consolidated dashboard and label transactions by automating categorizations.

Create extensive expense reports at the click of a button, export them, and instantly sync them to your accounting automation software.

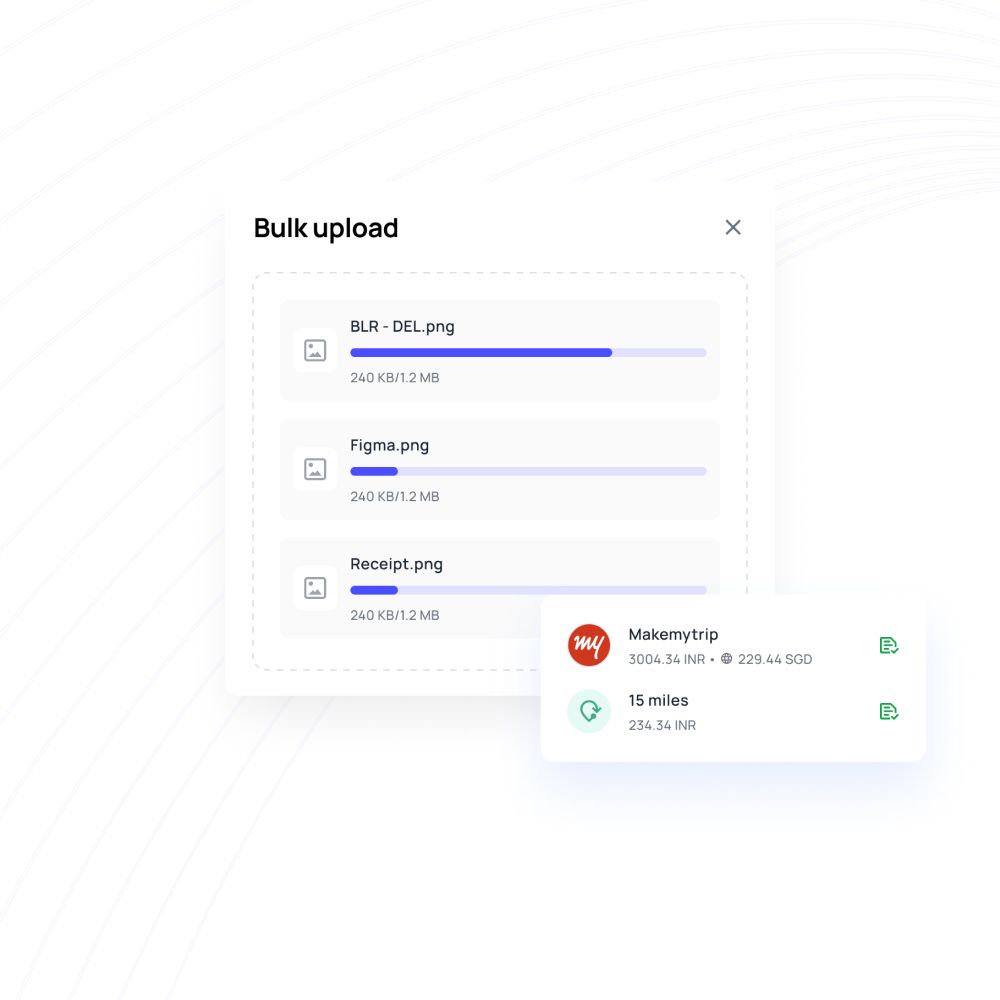

Faster expense and receipt reconciliation

Put an end to chasing paper-based receipts and emailed invoices. Reconciling expenses is more convenient than ever with accounting software for accounts payable.

Users can synchronize card transactions as well as Bill pay transfers for expense reports. Designed to streamline expense reconciliation, Volopay's transfer fee sync feature ensures comprehensive monitoring by directly synchronizing transfer fees with bill payments.

Furthermore, unmatched efficiency is provided through ongoing synchronization for bill payments, as transactions are automatically synced with accounting software upon bill generation, eliminating the necessity for manual intervention.

Import chart of accounts for auto-categorizations

Automate categorizations for any vendor, category, user, department, project card, and tax code by importing your chart of accounts. Set up automatic triggers so that all transactions are automatically sorted according to your accounting needs.

Once you’ve set mapping rules and algorithms for every accounting field, Volopay will automatically classify, tag, and sync all future transactions to the general ledger.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our accounting automation

Volopay is an all-inclusive accounting software for accounts payable that integrates approvals, corporate cards, bill payments, expense reimbursements, and accounting automation into one streamlined platform.

Corporate cards

Allow each member of your team to have their own corporate card for easier expense monitoring. To ensure maximum transparency and accountability, create spending policies and multi-level permission for fund requests within the platform.

Virtual cards

Create unlimited virtual cards to pay for single-use and recurring payments. Use virtual cards for managing software subscription and save money by identifying unused and duplicate subscriptions. Block and freeze cards in case of fraudulent activities and safeguard company funds.

Vendor payouts

Settling invoices through different payment methods is a complicated process. Switch to Volopay’s multi currency business bank account that lets your process domestic and international payments to both local and global vendors. Make cross-border B2B vendor payouts across 130+ countries at jaw-droppingly low FX charges.

Bring Volopay to your business

Get started now

FAQs on accounting automation

Volopay aids in the efficiency of time-consuming accounting by automating the entire process. You can quickly view ledgers and expense reports using the primary dashboard, and all transactions are logged in real time. In addition, all line-item data contains transaction-specific information connected to it (like invoices, receipts, and statements).

Data can be synced in both directions with any accounting integration you enable. This means that changes made in your expense management system are updated in your accounting system, but any modifications made in the accounting system are likewise updated in the expense management system.

We strictly adhere to all international and local data protection standards. Our systems and fund-storage mechanisms meet the Singapore financial regulations and legal standards of security. All data is saved in the cloud and accessible only through the dashboard. You may also add an extra layer of security by restricting access to sensitive data to only specific people.

Yes, when you generate a bill on Volopay, you can attach the invoice to it. The bill is then added to the automation cycle when the information are automatically filled in. Receipts and transaction data are connected to it as and when it is paid. When you set up accounting triggers, the tax codes and reconciliation information are immediately included, and it syncs with your accounting software. The entire procedure can be automated from start to finish.

Multi-currency transactions may certainly be handled by accounting automation software. Whether you're making an international transfer or using one of your multi-currency wallets, all of the information is transformed into data that your accounting software of choice can easily process.