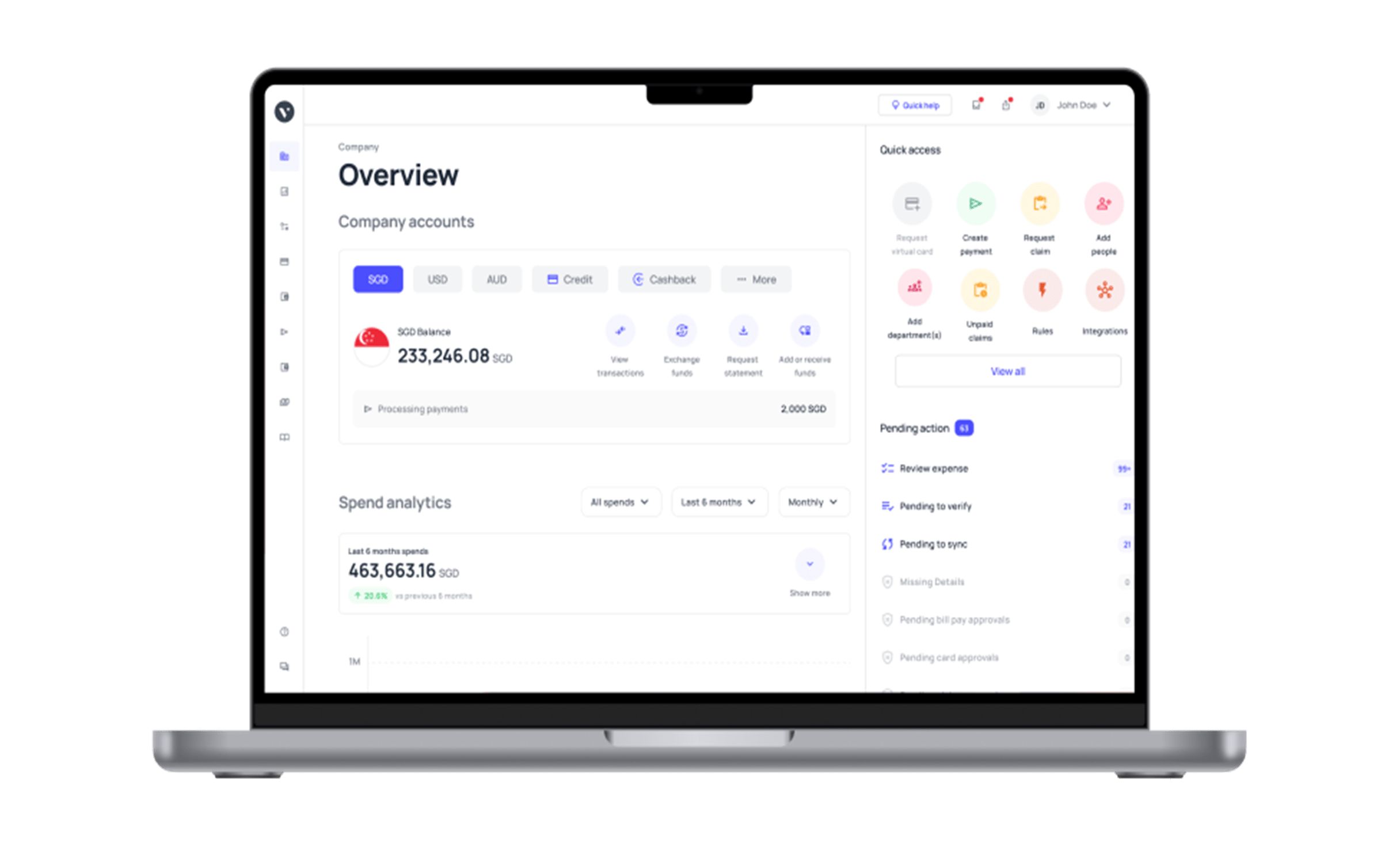

Corporate expense management software from Volopay

Spending hours manually managing business expenses is now a thing of the past. Modern tools of financial control have transformed the way business expense management and development are approached. Volopay’s full-stack corporate expense management software ensures your business is equipped with the perfect set of tools for rapid growth.

Businesses with a diverse range of requirements can benefit from Volopay's tailored expense management solutions. The platform is designed to enable scaling as well as to accommodate ever-evolving business requirements.

Corporate cards to manage expenses

Volopay's corporate cards make expense management very detailed, offering precise merchant control at multiple levels—company-wide and individual card levels. Efficiently manage transactions by customizing restrictions or allowances based on merchant categories and names. Benefit from cards integrated with a centralized system for immediate updates on card activities.

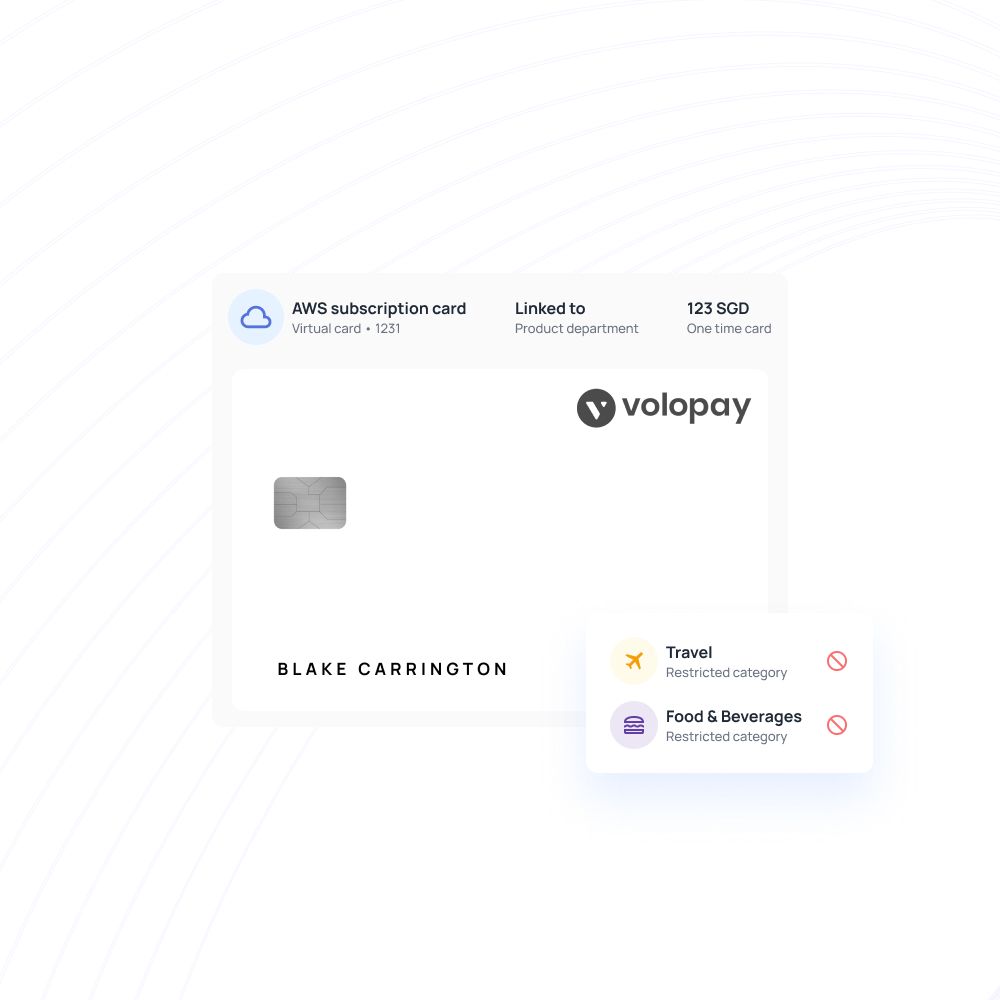

Unlimited set of virtual cards

Create multiple virtual cards, be it vendor-specific, employee-specific, or even department-specific. Assign instantly usable virtual cards to your employees based on their spend requirements. Limits can always be set so that you have control over the spending.

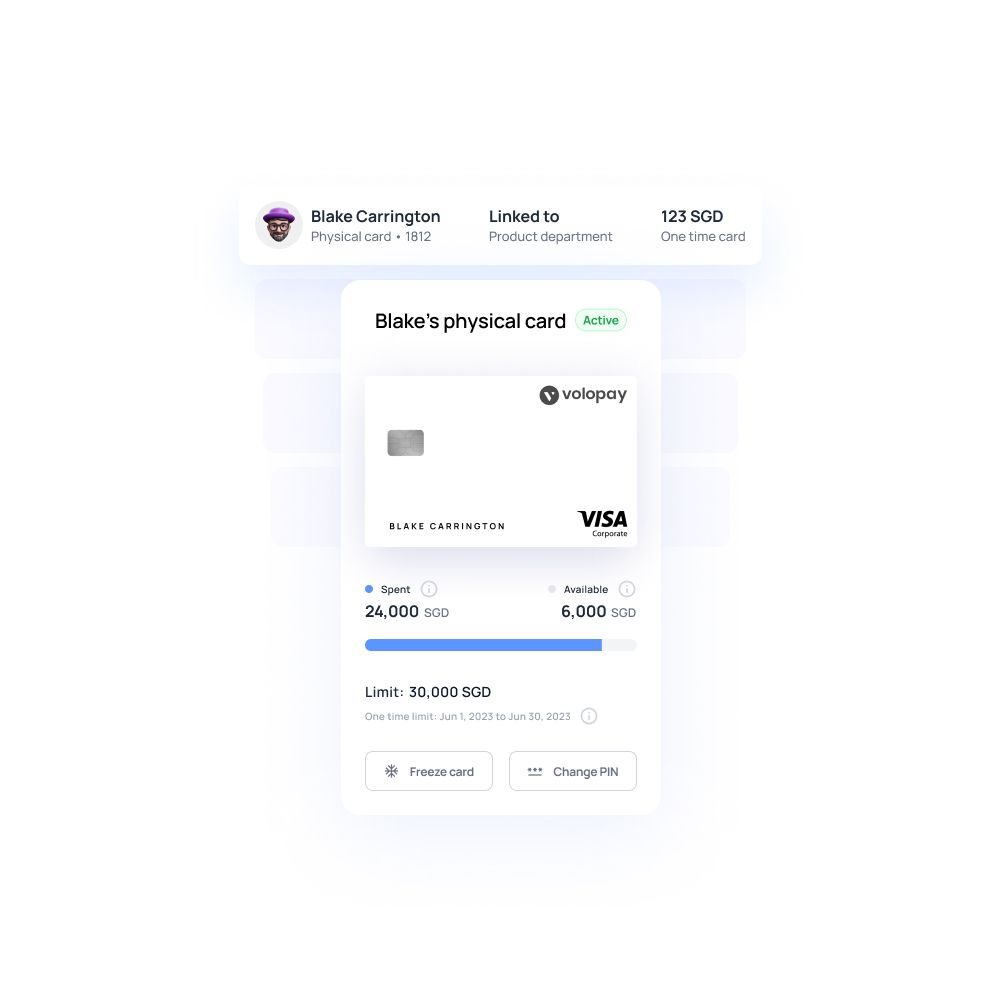

Convenient to use physical cards

Our expense management software Singapore offering allows you to issue physical cards for employees. These cards are compatible with all merchant portals and can also be used for offline expenses. Any payments can be recorded and supplemented with receipts in real time.

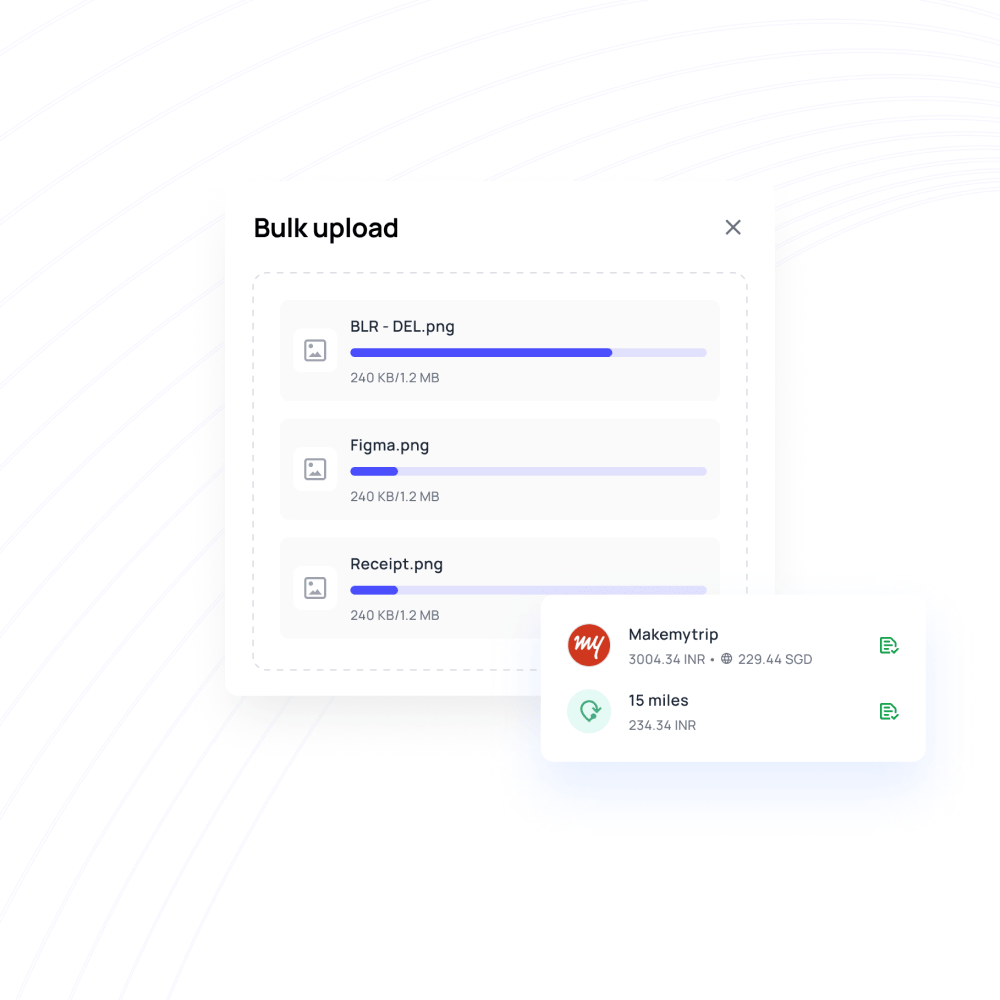

Process out-of-pocket expenses swiftly

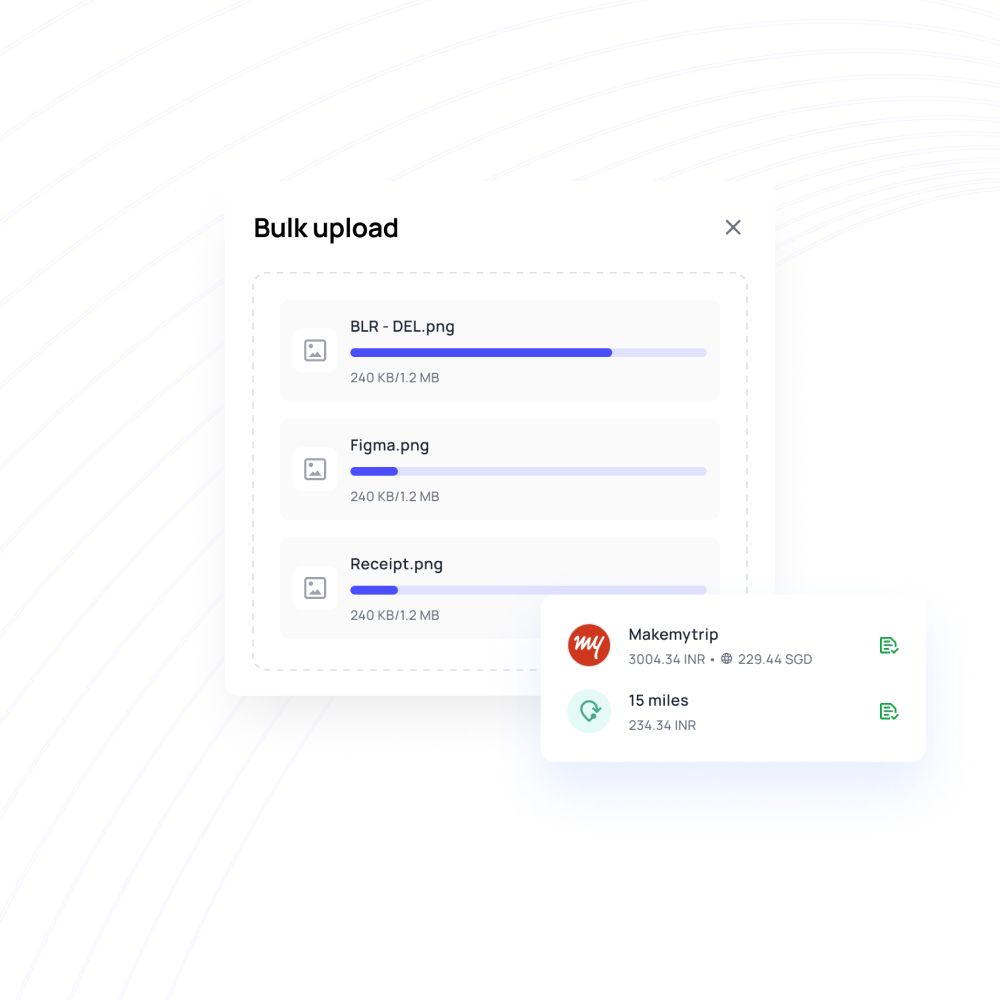

You can process expense claims with the click of a few buttons through our corporate expense management software. Upload receipts effortlessly in bulk, leveraging our Optical Character Recognition (OCR) system to automatically identify reimbursable amounts.

Automate payments and schedule settlements for approved claims, with mileage claims accurately calculated and visually mapped for convenience. Customize mileage rates for different countries as needed.

Virtual cards to ease subscription handling

If you think that the expense management software option won’t let you handle global subscriptions, you’re wrong. Virtual cards make SaaS payments much easier to manage remotely.

Cards can be created for one-time payments, as well as recurring ones. Just load and plug in the card number on the payment portal. These cards track expenses as they happen and can also be reloaded whenever required.

Accounting also becomes quicker with dedicated cards for each subscription.

Effortless expense management at your fingertips!

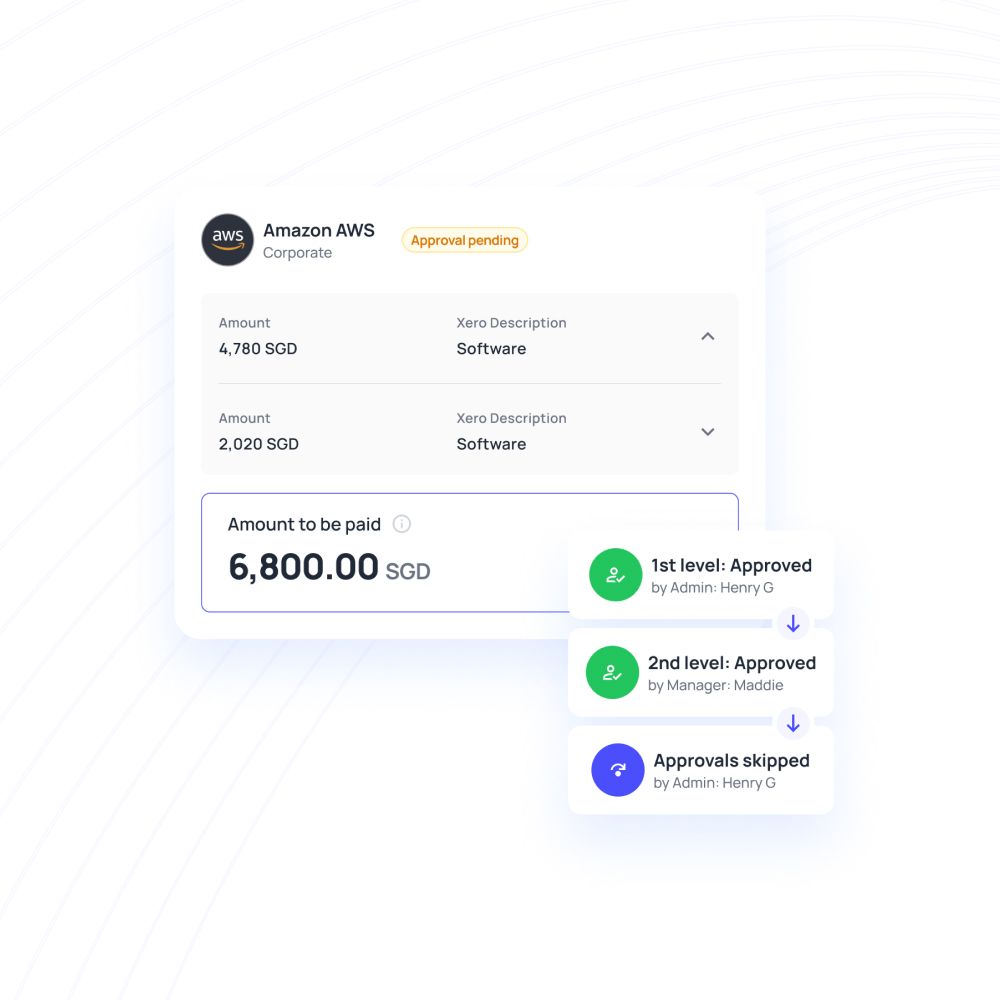

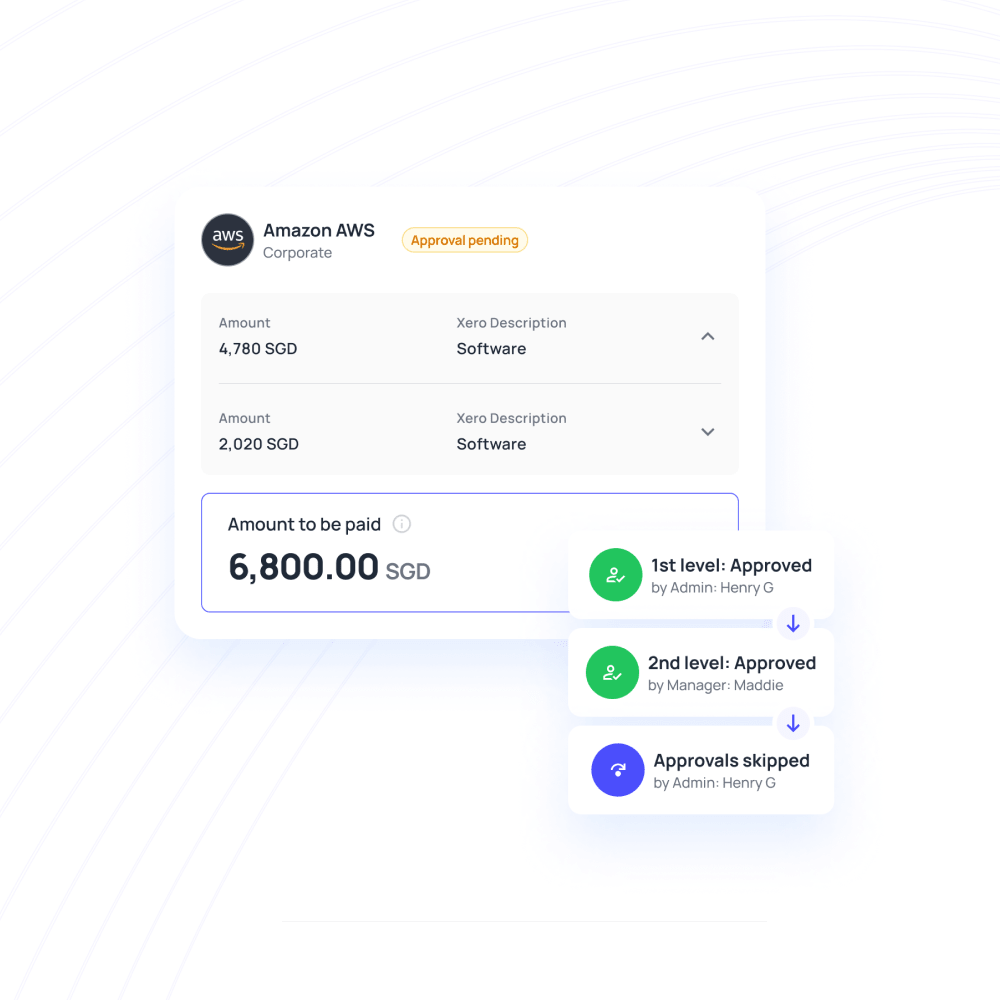

Multi-level approvals with customizations

The most time wasted with corporate expense management is when you’re chasing approvals. Customize approval policies to align with your organization's needs using Volopay's flexible settings. Tailor parameters, workflows, and user roles by department or project, streamlining the approval process for enhanced efficiency.

Auto-decline rules can be set for requests over a certain amount. Additionally, these approvals can take place remotely and instantly, avoiding the wait time.

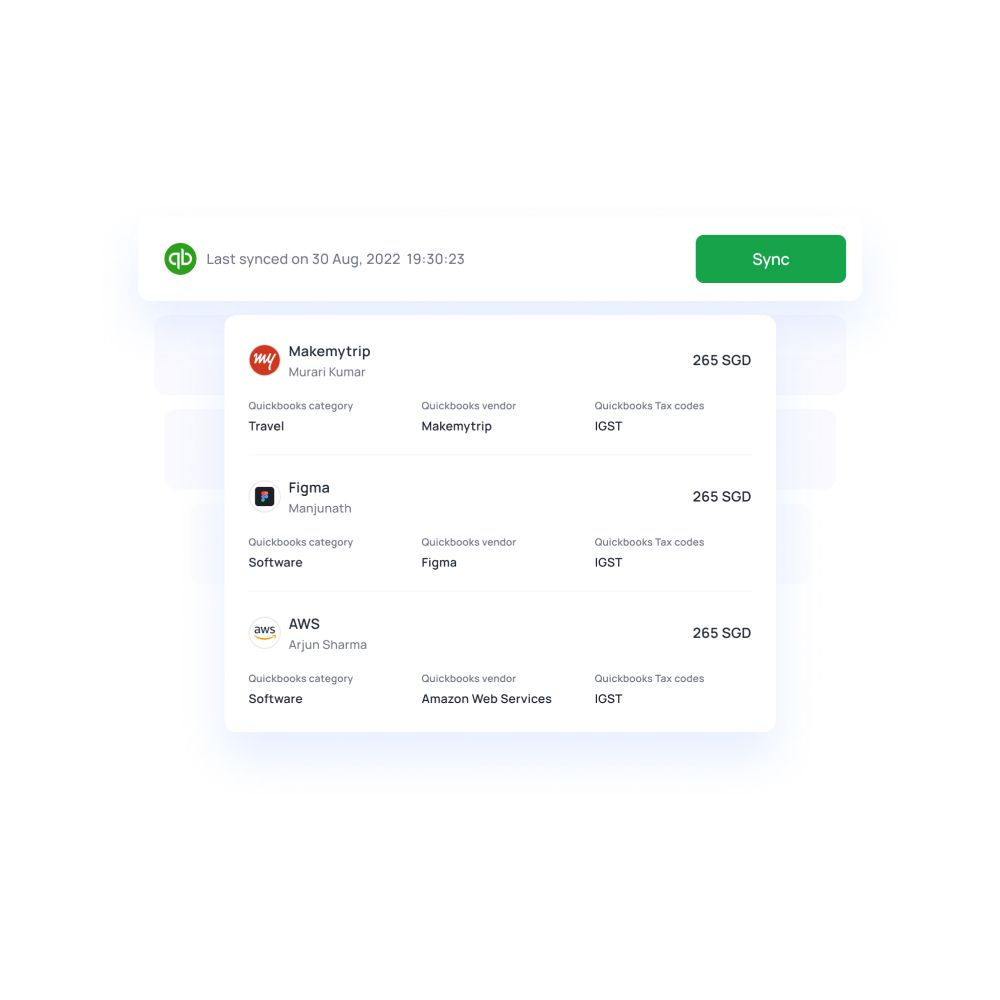

Real-time sync and tracking of spending

Company-wide expense management can now be done from one platform. Live synchronization of expenses lets you track spending as soon as payment takes place, be it from one of the AP accounts, or from a card.

Expenses are tracked instantly and synced to the ledger for better expense reporting. Transparency on payment frequencies and amounts becomes that much more convenient to implement. Use one, unified system to allocate department or project budgets, set up automated payments, and reduce manual data entry with OCR Integration.

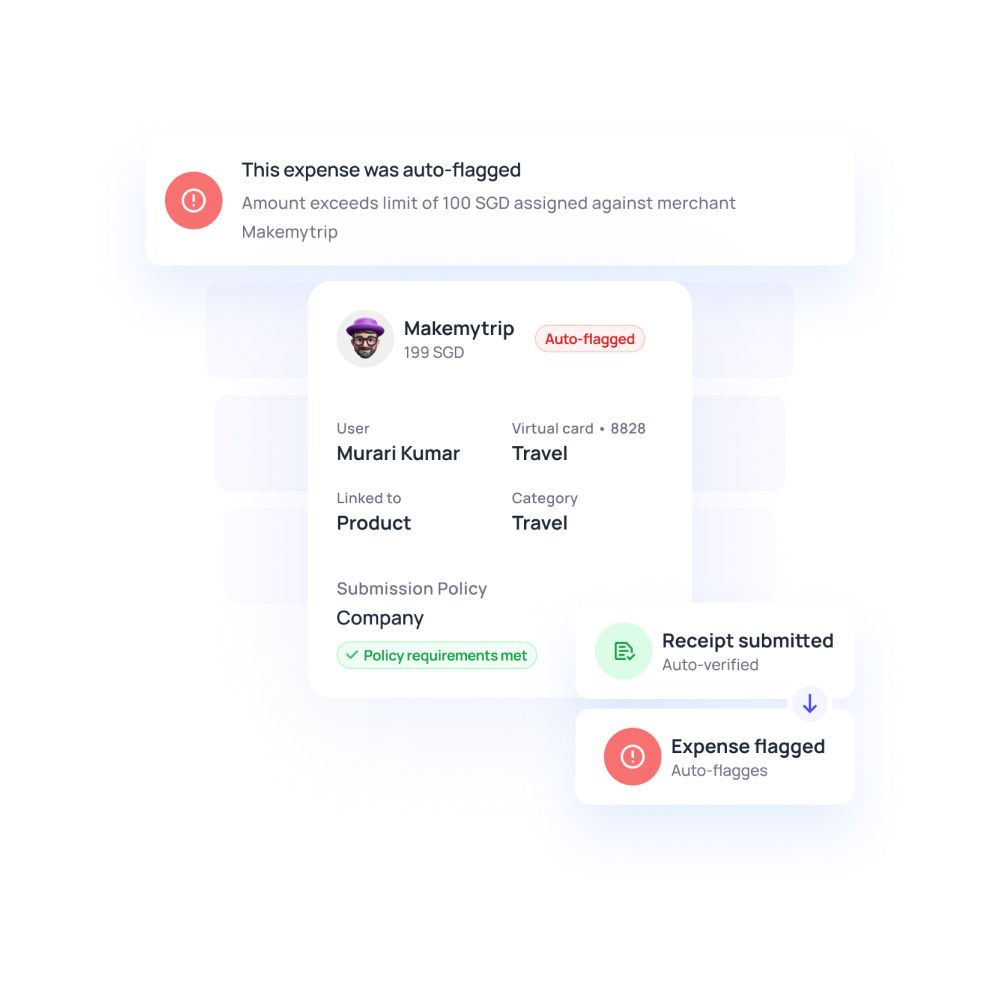

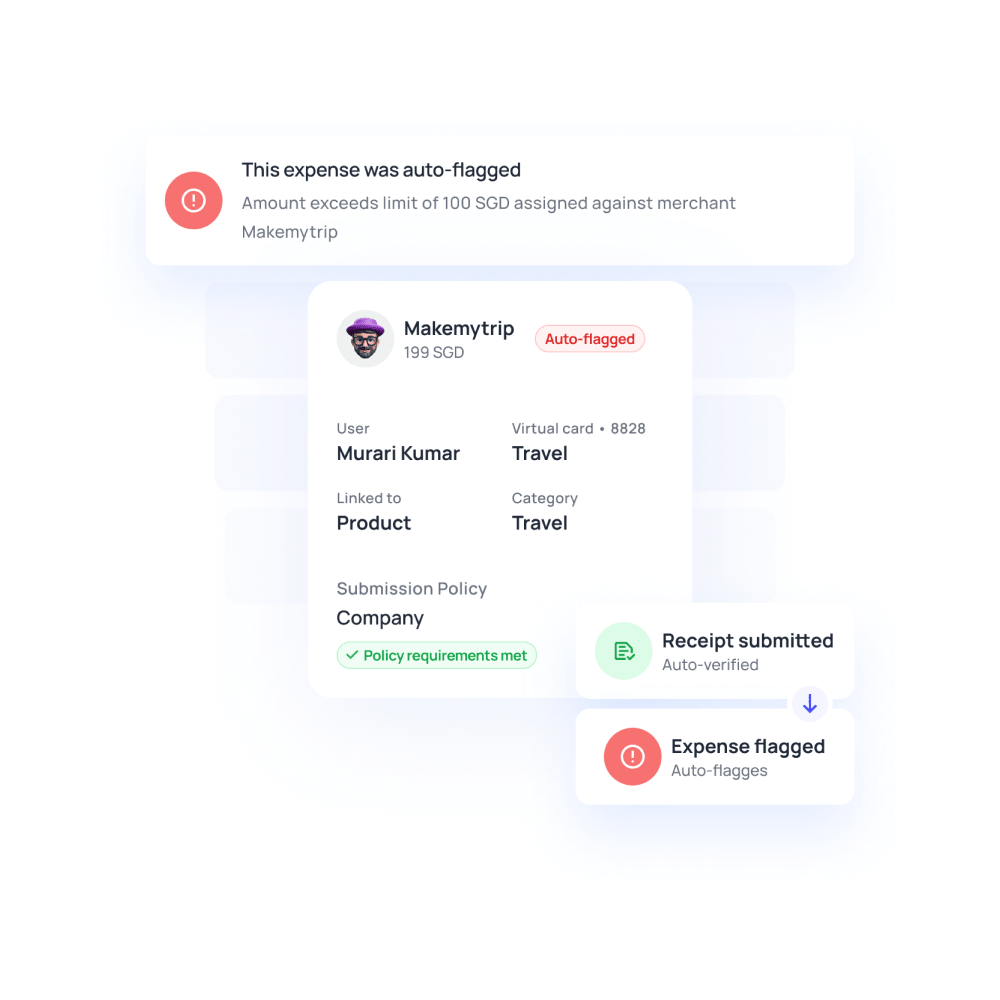

Spending is controlled before it occurs

Fear of overspending is not unfounded in the corporate expense management world. Specific controls and expense policies can let you monitor your spending before it even happens. Company-wide expense policies can be implemented, with customizations for departments and projects. Execute spending control with precision using Volopay's customizable limits and alert systems.

Get real-time alerts for duplicate payments and establish criteria for flagging expenses based on department, amount, category, or merchants, eliminating incorrect payments and enforcing compliance.

Experience hassle-free business expense tracking with Volopay

Implement a smarter spending culture

Better spending management comes with better control and policy awareness. The ability to secure your company funds is made possible by enabling approvers, policies, as well as live-tracking of all expenses.

Additionally, your employees have a degree of accessibility, too. Receipts can be directly uploaded to the platform, reimbursements requested, and mileage reimbursed. Employees can also request funds for cards at any time, from any place.

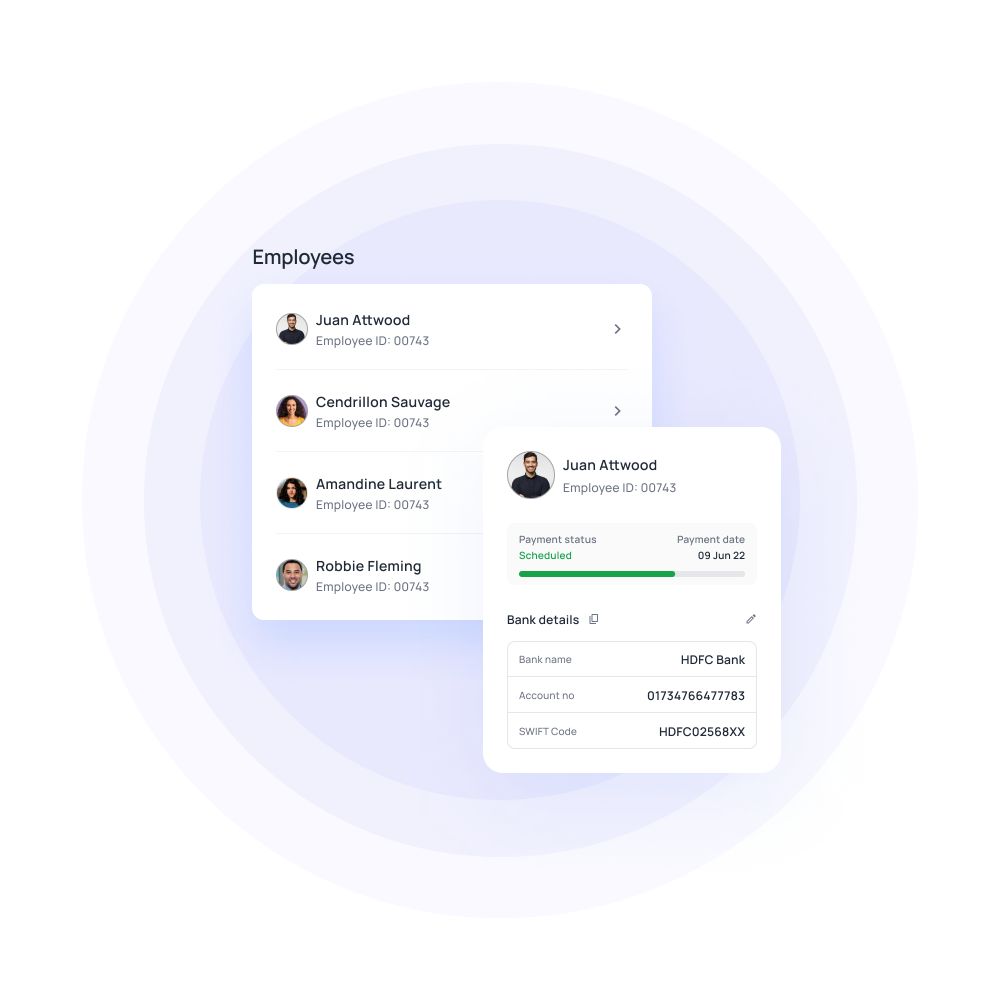

Streamlined payroll management and automation

Making payroll processing easy is a fundamental function of Volopay's integrated tools. Utilize downloadable CSV templates for bulk payment processing, ensuring smooth handling of tax calculations to meet regulatory requirements.

Automate payroll payments with scheduled dates for timely disbursements, minimizing manual intervention.

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

Expense management software benefits

Faster processes

It’ll become harder to keep track of hundreds of paper invoices as your business grows. It’s made even worse when your invoices and physical reports have to cross many desks for approvals.

Corporate expense management software provides a solution by automating and digitizing expense report submissions and approvals. Everything can be done directly on one platform.

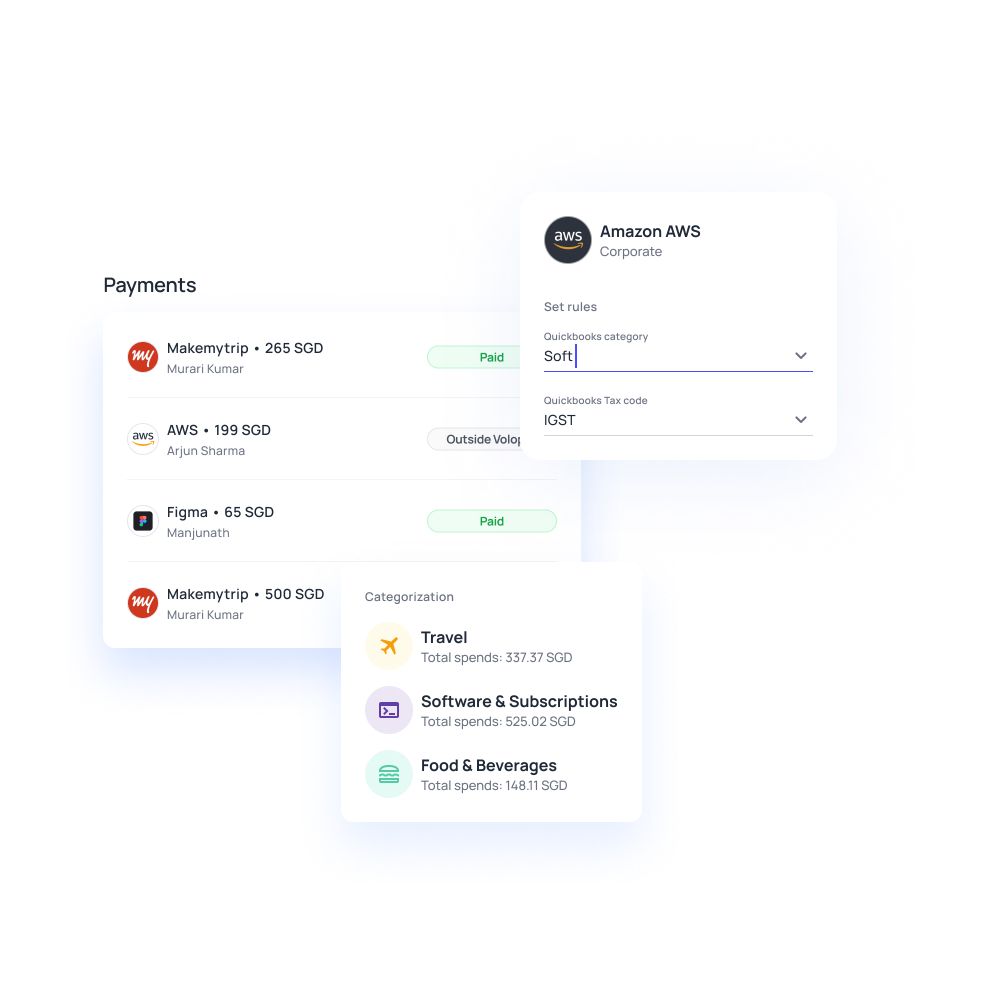

Enhanced reporting

Having better visibility into your company spending in real-time doesn’t just stop there. You can easily consolidate all your expense details into reports, which can then be used to identify trends.

Pinpoint which departments or employees are spending the most and create plans to save more. Corporate expense management software can help you generate reports to better inform your decisions.

Enforced policies

Changes in expense policies are hard to keep up with. Even the best managers might have a tough time enforcing them. The good news is that a corporate expense management software makes it easy to make policy changes that will automatically be applied to the whole company.

With automatic out-of-policy flagging, it’s easier to ensure that your business expenses are within company policies.

Streamlined reimbursements

Employees can easily submit claims while approvers can just as easily review and approve them through corporate expense management software.

With mobile app support, it takes no time at all for employees to submit a claim after making an expense.

Bypass complex reimbursement requirements and satisfy your employees by quickly settling their out-of-pocket expenses.

Fewer manual errors

Decreasing manual touchpoints using automation features reduces the likelihood of errors.

Instead of having your finance team input error-riddled expense reports into spreadsheets, you can rely on your expense management software to flag errors and duplicate entries.

You’ll have better accuracy and a sped-up data entry process when you aren’t dealing with errors.

Improved visibility

View your expenses from anywhere at any time. Not only can you keep track of your business spending in real time, but you’ll also be equipped with a dashboard that presents your information in ways that are visually easy to understand.

Filter key metrics and information you want displayed to get the best visibility possible.

You can make smarter decisions when you have a better view of your expenses.

Get real-time visibility and control over your expenses

Real-time visibility to track and manage business expenses

Allocate resources better

It’s easy to fall into the trap of sticking to what you know. With a lot of expenses to settle, it might feel like you don’t have enough time to analyze your current processes and make changes.

Real-time visibility enables you to take a step back and view what your monthly expenses look like to help you allocate resources better.

Reduce inefficient expenses

The first step to figuring out which expenses are inefficient is by knowing how, when, and where your money is spent. Understanding what your expenses look like at any given time will make inefficient expenses easily visible.

Make yourself aware of what expenses are bleeding your cash flow and cut back on ineffective marketing strategies or unprofitable vendor purchases.

Optimize future spending

Real-time visibility equips you not only with information on how much you’re spending, but also enables you to see what the return on investment on your expenses is.

With a more comprehensive and holistic view, you’ll be able to pinpoint what the most effective strategies are. You can optimize future projects based on the available information.

Streamline your expense management

When you have a high volume of transactions, you’ll spend a lot of time compiling data and making sure that you have complete and accurate information.

Having tools that can help you achieve real-time visibility solves this issue and streamlines your expense management process. Enable better decision-making in less time.

Simplify reimbursement with expense approval workflows

Cut down on the number of reimbursement claims that your finance team has to process by providing your employees with corporate cards with pre-approved limits.

As long as they spend within the pre-approved limit, business expenses are made easier. Your employees don’t have to make out-of-pocket expenses and wait to be reimbursed.

Instead of having to approve every single transaction before they go through, you can set auto-approval policies to save time. When your employees spend under a certain amount, they won’t have to chase down approvers before making payments.

This way, expenses and reimbursements are transparent and controlled without your finance team and other employees wasting time on approvals.

You don’t have to waste your employees’ time chasing down approvers and risk losing paper documents as they cross many desks.

Automated multi-level approvals can help you digitally route claims and reports for approval. Approvers of each level will be automatically notified. Everything can be done with just a few clicks in a few minutes.

Why choose Volopay’s expense management software for your business?

Simplified claims process

Volopay offers a corporate expense management software that can help you carry out your entire claims process from end to end without hassle. When your employees submit a claim through the Volopay mobile app or web dashboard, it’ll be automatically routed to the designated approvers.

Approvals are easily made on the same expense management software, which can also settle claims.

Process payments quickly

Not only can you make reports and input expense data on Volopay, but you can also make payments straight on the platform.

Collate all your expenses starting from card spending to salary payments and reimbursements and settle all your payments through Volopay.

You get better visibility and control over your spending while speeding up the entire process.

Customizable approval workflows

With tools meant to make your expense management process easier and smoother, Volopay provides flexibility to help you incorporate existing workflows and automate them.

Make use of Volopay corporate expense management software to set multi-level approval workflows and appoint approvers according to your company policies.

With customization, it’s easy to integrate your policies without having to make changes when automating.

Mandatory submission policies

You might spend a lot of time going back and forth to ensure that all expense reports and reimbursement claims have all the necessary information.

Volopay allows you to create mandatory fields according to your expense report and claim submission policies.

Cut back on the time chasing down missing information by notifying employees of which fields still need attention.

Set spending limits

Whether it’s for card payments, monthly vendor payouts, or specific project expenses, you can set spending limits for all your expenses through your dashboard.

In just a few clicks, you’ll be able to easily create one-time spend limits for each specific project or apply monthly limits for individual departments.

Control your expenses better using Volopay’s corporate expense management software.

Get expense overview

Allow department managers, executives, and other administrators in your business to get an overview of all your expenses at all times through Volopay.

All you’ll need to do is open up the dashboard to get detailed information on cards, transactions, and expenses—available to you with just a few clicks. Trade in paper files for a digital overview.

Make expense reporting a breeze with Volopay

Why Volopay?

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about our expense management solution

Volopay brings together the different branches of expense management under the umbrella of one platform. You can manage things like approvals, corporate cards, account payments, expense reimbursements, and accounting automation from the same place.

Multi-level approvals

Different tiers of approvers ensure that no one person is responsible for an expense and that all payments have a good system of checks and balances.

On Volopay, you can assign up to 5 levels of approvers for payments, reimbursement sanctions, policy enforcement, and card reloading. These approvers can also request information or flag inconsistencies before approving so that there is no missing data during the accounting process.

Employee reimbursement

Employees shouldn’t feel hesitant to request funds or claim reimbursements. Instead of letting them get daunted by week-long procedures, allowing them to request reimbursements on the Volopay platforms lets the process be managed much easier.

They just need to upload a receipt and mention the payment details - approvers just have to verify and approve the disbursement of repayment.

Subscription management

SaaS should be helping you, not making your life tougher. Virtual cards can be created for every vendor so that you can allocate funds accurately, and take one look at an expense report to see who was sent how much money.

This also lets you easily manage cross-border vendors, or stop payment for forgotten subscriptions. One-click solutions for seemingly complicated problems.

Real-time visibility

Track it as it happens. Real-time visibility lets admins, accountants and managers observe the flow of company funds as they are occurring.

Instead of shocking expense reports or massive debt, you always have control over how your company’s money is being spent. Know every detail, approve it quickly, or freeze it before it’s too late.

Interested to know more about expense management?

Get to know what is expense management automation, its benefits, process and how to implement automation in your business.

Claiming reimbursement expenses is a painful process for a employee. Learn how to design a expense policy that is employee friendly.

Master the art of business expense management with our comprehensive guide. Learn strategies to optimize costs and boost profitability.

Customer stories

Volopay provides your business with the perfect financial control centre. Don't take our word, let our customers tell you how we empower their organisation.

ParallelDots streamlined their daily expenses and simplified the recording process.

Volopay helped Nexlabs solve the challenges of expense management.

Volopay helped EdgeRed with budget management and spend policies.

They loved Volopay, you will too

Bring Volopay to your business

Get started now

FAQs on expense management

Small businesses manage income and expenses with the help of smart financial and accounting applications. They use customized accounts payable software that schedules and tracks payments, facilitates international transactions, offer cards, do expense reporting, and many more.

If you are constantly bombarded with employee claim requests and have the question ‘How do i keep track of employee expenses’, consider Volopay. Employee expenses is often overlooked, but if not tracked can burn your budgets. Use Volopay reimbursement system to automate and streamline expense reporting or provision corporate cards to each of your employees to further minimize the stress.

Businesses keep track of receipts with the help of corporate expense tracking software. This software facilitates outgoing payments of your business and stores its information within. As soon as the payment gets credited to the receiver, you can access the receipt within this corporate expense tracking system at any point of time. You can also download and access these receipts locally.

Yes. It’s a neat bookkeeping practice to have all the receipts in place as proof for processed payments. Businesses also store invoices, bank statements, or any other payment records and use them while filing taxes. But how do businesses keep track of receipts? It can be a lot for a mid-sized business that handles bundles of payments every day. Implementing an expense management system helps. It can automatically generate receipts once your payment is processed and credited. You can access these receipts at any time within the system and download them for external usage.

Expense reimbursement on Volopay is swifter than traditional expense reimbursement. Employees can put in a request (for mileage or out-of-pocket payments) on the platform. There are options to mention the vendor, the purpose of payment, and attach a receipt. As soon as an approver takes a look, the expense can be approved. The employee is notified instantly and the payment is processed. Approvers can also request more information, which the employee can provide when they receive the notification instead of dealing with weeks of back-and-forth communication.

Volopay physical and virtual cards can be used to make digital payments, by entering the card number into the merchant portal. In the case of recurring payments, the cardholder can have the card information saved on the vendor’s site. So long as the card is funded (either when required or through recurring reloading), the payment will go through. Virtual cards allow you to create vendor-specific cards for one-time payments for better reconciliation and verification. This also helps keep track of forgotten payments and lets you freeze a vendor card to stop a subscription.

Automated expense reporting on the Volopay platform implements the expense policies to make compliance and analysis smoother. Receipt and invoice scanning features allow better management of vendor information. Payments can be set up in advance to avoid late fees, and early payments can earn discounts. With the help of one-click report generation, forecasting and analysis require less data-collection and data-entry work. Expense reporting, then, only requires the more human aspects of financial management instead of redundant menial work.

Expense reports reflect all the information that you filter. The ledgers include information on who has initiated payments, from which account (which wallet or card), as well as which department. Vendor information, invoices, and receipts are all linked to this payment. You can filter information depending on what kind of expense report you wish to generate - but, by default, it is possible to include all this information.