Smooth ERP integration for financial management

Connect your ERP system to Volopay with ease to boost your financial management processes. Our integrations are tailored to eliminate the need for manual data entry, reduce errors, and ensure real-time visibility into your financial operations.

Whichever ERP system you work with, Volopay's smooth integration facilitates efficient data flow and helps you focus on scaling your business.

Sync data in real-time

Keep your financial records updated at all times with Volopay’s ERP integrations.

All transactions, payments, and expense data are synced in real time with your ERP system. This provides you instant insights and accurate reports for better decision-making.

Automate data syncing

Automate the transfer of financial data between Volopay and your ERP system at periodic intervals based on your preference.

Say goodbye to manual entries and errors, as our system ensures that payments and expense data flow seamlessly between platforms, offering precise records without extra effort.

Secure and encrypted transfers

Using industry-standard encryption and protocols, your financial data remains protected throughout the entire process. Volopay ensures secure data transfers, keeping your sensitive information safe as it moves between systems.

Connect your ERP system effortlessly with Volopay

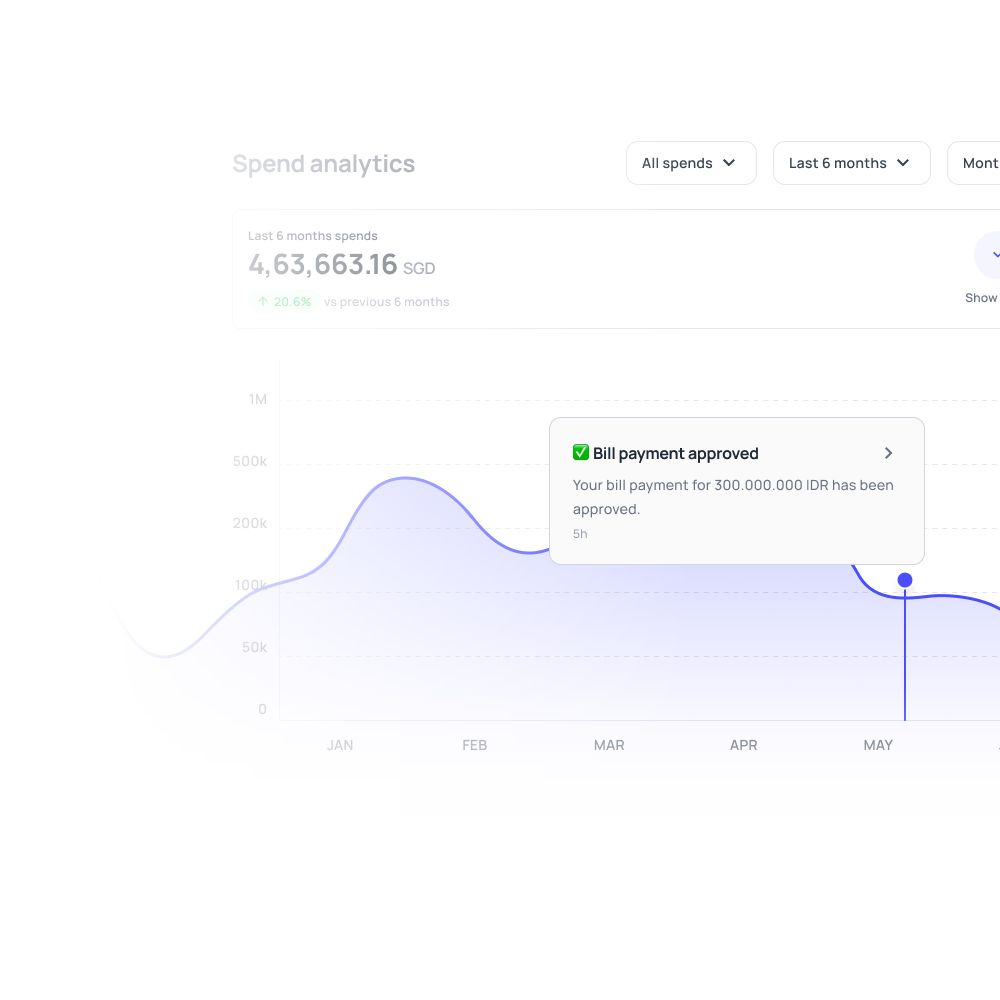

Real-time monitoring and notifications

Access and monitor your integration at any time with proactive tracking through our system and alerts.

Volopay’s comprehensive dashboard gives you visibility into the ERP integration, allowing you to monitor data flow and receive immediate notifications if any issues arise, ensuring continuous and smooth operations.

Tailored workflow integration

Change and customize the integration between Volopay and your ERP system to match your requirements.

Our flexible system supports personalized data mapping and synchronization, ensuring smooth alignment with your internal processes.

Advanced data mapping

Transferred data will always have proper categorization thanks to our advanced mapping features that enable alignment of fields and data across different systems. This reduces inconsistencies and improves overall data accuracy.

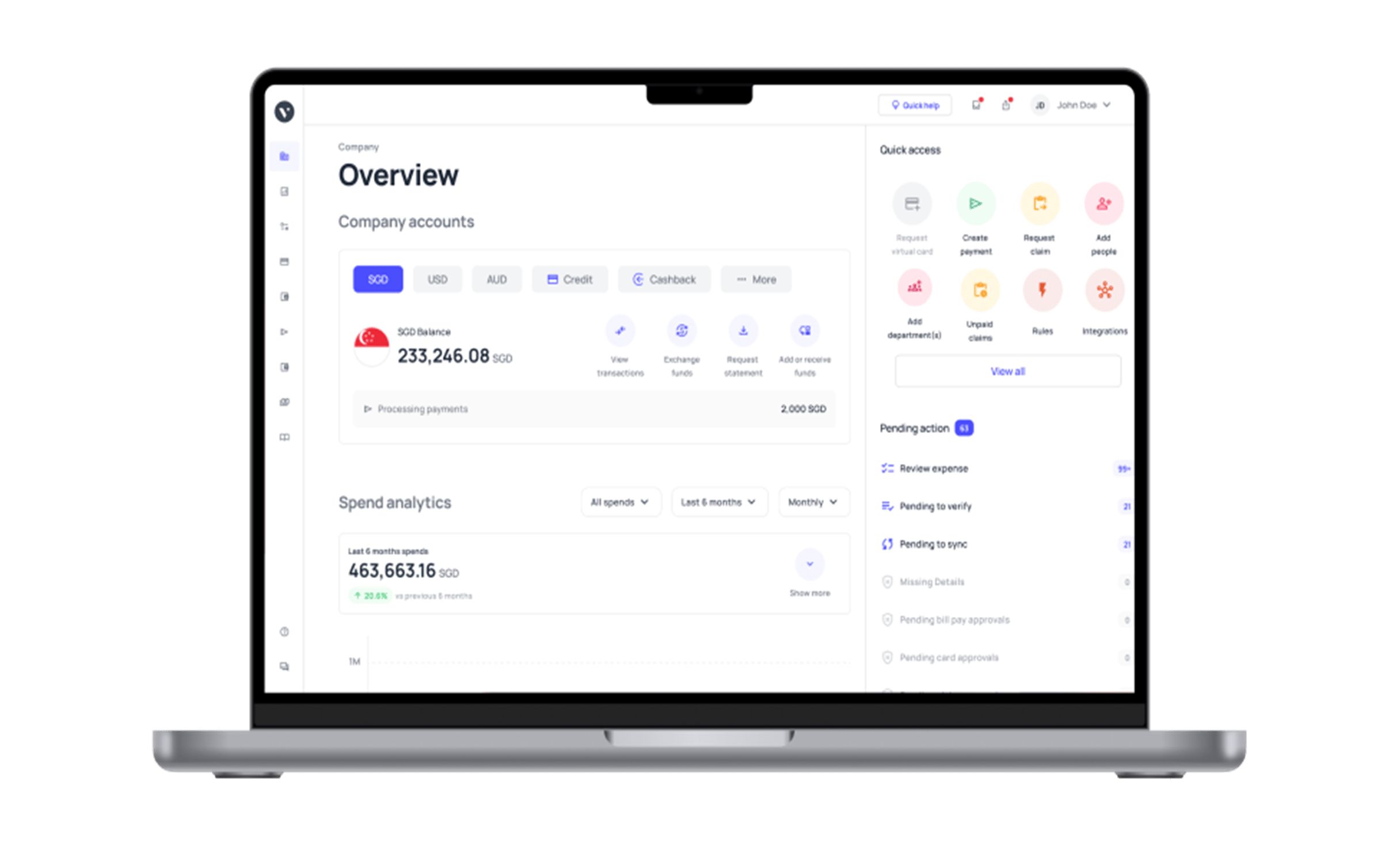

Financial stack for business

No more switching between multiple bank accounts and tools to run your smart business. We have combined great software with every service you are using a bank for, to produce a state-of-the-art financial platform.

Empower your employees with physical and virtual cards

Manage and track every dollar that leaves your company

Open a global account with multi-currency payments

Manage vendors, approve invoices and automate payments

Save hours daily, and close your books faster every month

Integrate with the all the tools and software that you use daily

One platform, endless possibilities: Volopay for diverse industries

Healthcare

Volopay’s integration with business systems streamlines financial workflows for healthcare providers, ensuring precise budget management and regulatory compliance.

This way you can easily track expenses, manage vendor payments, and simplify reporting, all while safeguarding data and enhancing operational efficiency.

Technology

Tech companies tend to have a lot of online payments.

Volopay’s virtual payment tools and ability to integrate with ERP systems helps tech companies automate expense tracking, software subscriptions, and project-related costs.

Construction

Manage complex budgets and project-related expenses.

Volopay’s ERP integration helps construction companies manage vendor payments, labor costs, and material purchases with real-time visibility and accurate financial forecasting.

Hospitality

Business in the the hospitality industry can take advantage of Volopay by automating expense tracking, vendor payments, and operational costs.

Simplify reconciliation and get real-time cash flow insights, allowing you to focus on delivering outstanding guest experiences.

Logistics

Logistics businesses can benefits from using Volopay for its seamless ERP integration to streamline expense tracking, fuel costs, and vendor payments.

Enhance the management of intricate supply chains with automated data flow and real-time financial insights.

Retail

Retail businesses can automate vendor payments, manage inventory costs, and track daily expenses.

Volopay helps them gain greater control over cash flow and ensures real-time financial reporting to boost profitability.

Volopay's flexible solutions for all business sizes

Small businesses

Small businesses can leverage Volopay to automate expense management, reduce manual data entry, and ensure accurate financial records.

Real-time data sync between other business tools helps small teams streamline their operations without needing complex systems.

Fast-growing startups

Volopay’s scalable system is the perfect partner for scaling businesses with expanding needs.It will help growing companies automate expense tracking, vendor payments, and reporting, so that they can focus on expanding while maintaining financial accuracy and control across different departments.

Enterprises

With completely customizable workflows and real-time insights, enterprises can efficiently optimize global operations.

They benefit from Volopay’s advanced ERP integration, simplifying complex financial workflows, managing high transaction volumes, and ensuring compliance.

Automated accounting. Incredible integrations.

Volopay effortlessly syncs with your existing accounting software. Our integrations result in faster reconciliation and offer custom checks to sort and verify transactions. Easily export expense reports or choose from a customizable template for hassle-free integration.

Advantages of choosing Volopay

Improved accuracy of data transfers

Volopay’s ERP integrations eliminate manual data entry, reducing the risk of human error.

With real-time syncing, all financial data is captured accurately, ensuring reliable records you can trust.

Increased operational efficiency

By automating the transfer of data and expense tracking, Volopay reduces your financial workload, giving your team more time to focus on strategic tasks. This accelerates processes and enhances productivity across departments.

Enhanced decision-making

With access to financial data in real-time, businesses can make well-informed decisions by understanding the situation at hand.

Whether you're tracking expenses, monitoring cash flow, or forecasting, Volopay’s system provides the insights needed to stay ahead.

Seamless system integration

Volopay can natively integrate with many accounting tools and can also effortlessly integrate with other existing ERP systems.

Our solution ensures smooth financial data flow between systems, creating a cohesive financial ecosystem with minimal disruption to your operations.

Consistently rated at the top

We have been consistently rated at the top as a leader in AP automation, expense management, and procurement by our customers.

We are committed to provide modern financial solutions to startups and enterprises with the best customer experience and smooth implementation across your organization ensuring compliance and productivity.

Learn more about Volopay

Make way for more clarity, and less confusion. Volopay is a comprehensive spend management solution that incorporates and integrates with corporate cards, bill payments, vendor payments, and accounting automation, all on a singular centralized platform.

Corporate cards

A single business card disrupting the cash flow? Equip your teams with Volopay corporate cards. VISA-protected cards with built-in advance controls and customized expense policy for enhanced compliance. Enable multi-level approval systems to verify fund requests in real-time.

Virtual cards

Generate unlimited virtual cards for one-time expenses or recurring SaaS subscriptions and vendor payments. Automate subscription payments and eliminate the prospect of late payment penalties. Proactive controls let you easily block or freeze cards to protect against fraud and online threats.

Vendor payouts

Settle invoices on the go – pay local and international vendors from a single business account. Automate domestic and global payments through our multi-currency account at super low FX charges.

Automate accounting

The age of paper-based accounting is over. Accounting automation instantly records transactions as they happen. Collate invoices, purchase orders, and receipts with relevant transactions for smoother reconciliation and auditing. Volopay beautifully integrates with your accounting software with custom checks and automation triggers for a truly hassle-free experience.

Bring Volopay to your business

Get started now

FAQs on integration

Any data transferred back and forth between Volopay and your ERP system is encrypted with industry-standard protocols to safeguard all sensitive financial information.

Yes, Volopay provides customizable integration workflows, allowing you to adjust data syncing and mapping processes to fit your specific business needs. This ensures smooth alignment with your operations.

Yes, in addition to ERP integrations, Volopay can connect with various third-party applications, enabling a more comprehensive financial management system tailored to your business ecosystem.

Yes, Volopay offers dedicated customer support to assist with any integration-related issues. Our customer success team helps you with setup, troubleshooting, and optimizing your ERP integration.